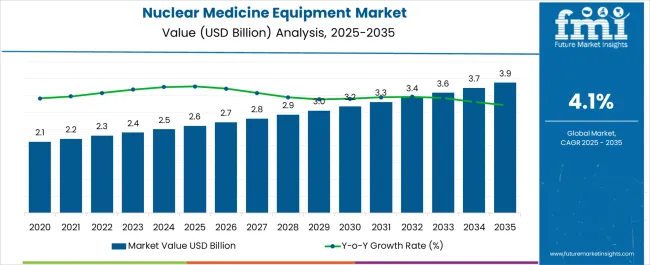

The Nuclear Medicine Equipment Market is estimated to be valued at USD 2.6 billion in 2025 and is projected to reach USD 3.9 billion by 2035, registering a compound annual growth rate (CAGR) of 4.1% over the forecast period.

| Metric | Value |

|---|---|

| Nuclear Medicine Equipment Market Estimated Value in (2025 E) | USD 2.6 billion |

| Nuclear Medicine Equipment Market Forecast Value in (2035 F) | USD 3.9 billion |

| Forecast CAGR (2025 to 2035) | 4.1% |

The nuclear medicine equipment market is expanding steadily due to technological innovations in imaging modalities, increasing burden of chronic diseases, and higher precision demand in diagnostics. Rising incidence of cancer, cardiovascular, and neurological disorders is intensifying the need for early and accurate imaging techniques, supporting wider clinical adoption of nuclear-based modalities.

Equipment upgrades incorporating hybrid technologies and AI-assisted analytics are improving patient outcomes and operational efficiency. Government-led investments in molecular imaging infrastructure, along with training support for radiology professionals, are strengthening the ecosystem for nuclear medicine utilization.

Additionally, growing awareness of radiopharmaceutical applications and expanded access to reimbursement policies are creating a favorable environment for both public and private healthcare institutions. Forward momentum is anticipated from the integration of digital platforms, remote diagnostics, and radiotracer innovation aimed at improving clinical workflows and real-time diagnostics.

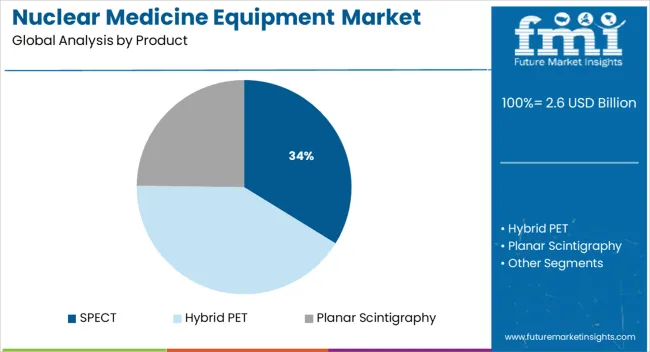

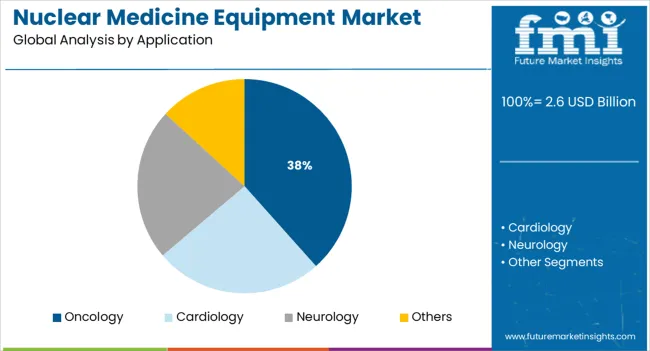

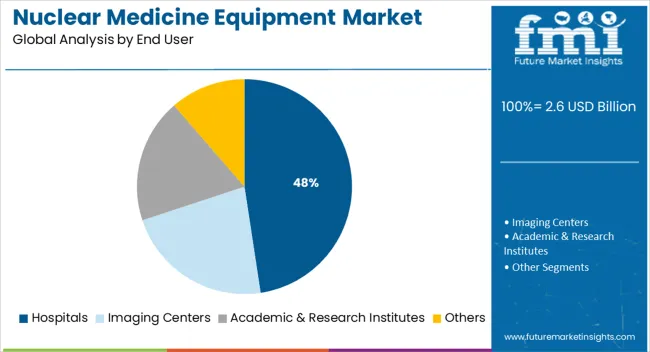

The market is segmented by Product, Application, and End User and region. By Product, the market is divided into SPECT, Hybrid PET, and Planar Scintigraphy. In terms of Application, the market is classified into Oncology, Cardiology, Neurology, and Others. Based on End User, the market is segmented into Hospitals, Imaging Centers, Academic & Research Institutes, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

SPECT is projected to hold 33.8% of the total revenue in the nuclear medicine equipment market by 2025, making it the leading product segment. This dominance is attributed to the widespread clinical use of SPECT systems in cardiac, bone, and brain imaging due to their affordability and operational simplicity.

Ongoing hardware refinements such as solid-state detectors and multi-head configurations have improved image resolution and scan time, enhancing diagnostic accuracy. Hospitals and imaging centers continue to prioritize SPECT for routine nuclear scans, given its lower cost structure and compatibility with widely available radiopharmaceuticals.

The technology’s role in functional imaging for chronic and degenerative diseases further supports its broad adoption across developed and emerging healthcare markets.

Oncology is anticipated to account for 38.4% of the market revenue in 2025, emerging as the largest application segment. The segment’s leadership is driven by the rising global cancer burden and the growing reliance on nuclear imaging for tumor localization, staging, and therapy planning.

Innovations in hybrid imaging especially PET/CT and SPECT/CT have enhanced tumor visualization and treatment response monitoring. Clinical guidelines increasingly recommend nuclear imaging in oncology workflows, further boosting equipment demand.

Additionally, expanded access to radiotracers specific to oncology diagnostics has elevated precision imaging standards. As personalized medicine and theranostics continue to evolve, nuclear medicine equipment is becoming central to oncology-focused diagnostic strategies.

Hospitals are expected to represent 47.6% of the nuclear medicine equipment market revenue in 2025, establishing them as the leading end user segment. This position is sustained by their role as centralized diagnostic hubs equipped with advanced imaging infrastructure and trained radiologists.

Hospitals are more likely to invest in high-cost imaging modalities such as PET-CT and SPECT-CT due to higher patient volumes and access to funding. The integration of nuclear medicine with other diagnostic and therapeutic services within hospital settings enhances patient management workflows.

Furthermore, large-scale public hospitals and academic medical centers are actively involved in nuclear imaging research and clinical trials, accelerating the deployment of next-generation imaging systems. These structural and functional advantages solidify hospitals’ lead in nuclear medicine equipment utilization.

Nuclear medicine equipment’s primary market is North America. The United States is one of the main radioisotope consumer markets in North America, and Canada is one of the primary manufacturers of Tc-99m.

The robust growth of the healthcare sector in the United States, rising cancer incidences, a growing geriatric population, and an increase in product launches leading to increased use of radioisotopes, as well as increased initiatives and investments in advanced cancer treatment, are expected to drive market growth.

The hospital sector will account for the largest nuclear medicine equipment market share during the forecast period 2025-2035, owing to increased healthcare spending by emerging global economies and the presence of highly established and sophisticated healthcare infrastructure in developed nations.

Furthermore, the rise in lifestyle conditions such as cardiovascular disease and cancer has increased the target patient population as well as the need for early identification and treatment by hospitals worldwide.

Because of the rise in lifestyle diseases, governmental and corporate organisations have increased their investment in Research Centers, making this the fastest growing sector with a CAGR of 4.8%. The market for nuclear medical equipment is expanding.

As per nuclear medicine equipment market study, the nuclear medicine's success can be ascribed to the fact that it supplies a unique and non-invasive approach to information at the molecular and cellular level that is unique and cannot be replicated by other imaging technologies.

It also aids in the early detection of sickness and is one of the market's most favourable drivers, as public awareness of chronic diseases grows. Increased diagnostic nuclear medicine procedures around the world will help to propel the demand for nuclear medicine equipment forward in the coming years.

According to supporting data, the usage of radiopharmaceuticals in diagnostics is increasing at a rate of over 10% per year over the world. Reduced funding for medical imaging, a lack of cost-effectiveness statistics and evidence to prove that nuclear medicine improves patient outcomes, and a dearth of anatomic and molecular imaging training among physicians and radiologists are all likely to slow the nuclear medicine equipment market expansion.

The adoption of nuclear medicine equipment has been rising at a rapid rate, which is both stimulating and boosting the market for nuclear medical equipment. Furthermore, the growing awareness of the necessity of early disease diagnosis, as well as the high acceptance of nuclear medicine equipment by end users, leads the nuclear medicine equipment market to have a high adoption rate among the patients.

Increased investment in diagnostic imaging centre renovations, as well as the development of new radiotracers, will additionally fuel demand for nuclear medicine equipment. The constant development of new and upgraded goods is also having a significant impact on the nuclear medicine equipment market size.

Through the emerging trends in the nuclear medicine equipment market, a long-term product pipeline, rising disease incidence among the ageing population, and increased demand for nuclear medical operations are all contributing to the said market growth.

While the prohibitive cost of nuclear medicine equipment and reduced half-life radiopharmaceuticals, as well as a lack of effective data and proof that nuclear medicine improves patient outcomes, are projected to stymie the target market's growth throughout the forecast period. Furthermore, the introduction of new and sophisticated goods is boosting the sales of nuclear medicine equipment.

Nuclear imaging system advancements are expected to boost product demand for nuclear medicine equipment. Nuclear imaging technologies such as PET and SPECT have advanced to the point where they can now be employed in fields other than oncology, cardiology, and neurology.

For example, the introduction of SPECT detectors based on cadmium zinc telluride has aided in the simultaneous viewing of physiological and anatomical systems. During the forecast period, this will drive global demand for nuclear medicine equipment.

In developing regions, a lack of research facilities and funding is expected to stifle the nuclear medicine equipment market growth.

Because of a lack of adequate funding in developing countries, even basic nuclear medicine equipment like as phantoms is becoming scarce. It has also slowed the expansion of medical research centres and radiation-protection technology.

Furthermore, the average cost of patient healthcare in poor countries is 1000 times lower than in affluent countries like the United States. As a result, hospitals have little motivation to invest in costly nuclear medicine equipment. This is reducing the market opportunities for sales of nuclear medicine equipment.

The market for nuclear medicine equipment is expected to be fuelled by an increase in the prevalence of the target patient population.

Cancer alone claimed the lives of approximately 10 million people globally, according to the World Health Organization (WHO). Both the developed and developing worlds are expected to see a rise in cancer cases.

It is expected that one out of every nine Indians will develop cancer at some point in their lives. Heart disease is the leading cause of death worldwide, accounting for 16 percent of all deaths. Early detection increases the odds of survival dramatically, and nuclear medicine equipment plays a critical part in this. This has led to a rapid rise in the adoption of nuclear medicine equipment.

During the projection period 2024 to 2029, the hospital sector will account for the biggest nuclear medicine equipment market share, owing to rising healthcare spending by emerging global economies and the presence of highly established and advanced healthcare infrastructure in developed countries.

Furthermore, the rise in lifestyle disorders such as cardiovascular disease and cancer has led in an increase in the target patient population and a demand for early detection and treatment by hospitals around the world.

As a result of the increase in lifestyle illnesses, governmental and private entities have boosted their investment in Research Centers, making this area the fastest expanding with a CAGR of 4.8 percent. The nuclear medicine equipment market opportunities are on the rise.

The SPECT segment was forecasted to dominate the said market in 2024, and it is expected to continue to do so with a CAGR of 4.7 percent over the forecast period. This is because it is used in a wide range of applications and is also quite inexpensive. Another aspect driving the segment's rise is the surge in technical advancement.

In the category, innovation has resulted in the creation of digital SPECT, which supplies more image detail and sensitivity. Because of its ability to generate 3D images and correct full-body scans, the Hybrid PET segment is expected to increase at the fastest rate during the forecast period. SPECT segment leads the nuclear medicine equipment market with the projected CAGR of 4.92% by 2035.

North America is a significant regional segment due to the rapid rise of nuclear medicine in the United States because of technical advancements. Furthermore, North America's supremacy is due to the quick release of new radiopharmaceuticals for diagnostics and therapies.

During the projected period, Asia Pacific, on the other hand, is expected to increase at the fastest rate. In the Asia Pacific, Japan has the largest consumer nuclear medicine equipment market.

The practise of nuclear medicine in Japan has advanced significantly in recent years, with a significant increase in the frequency of hybrid SPECT/CT exams. Furthermore, rising demand for Alzheimer's and Parkinson's disease treatment and diagnostics in China and India is fuelling the Asia Pacific sales of nuclear medicine equipment.

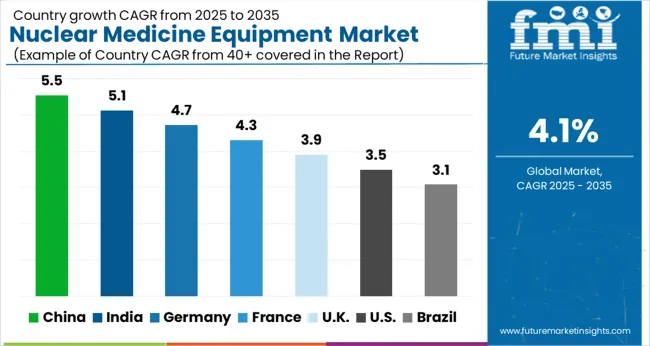

| Regions | CAGR (2025 to 2035) |

|---|---|

| China | 5.5% |

| India | 5.1% |

| Germany | 4.7% |

| France | 4.3% |

| UK | 3.9% |

| USA | 3.5% |

| Brazil | 3.1% |

To increase their market share, key players in the worldwide are focusing on new product launches. Product launches, product approvals, and other organic growth tactics such as patents and events are being prioritised by several companies.

Acquisitions, as well as partnerships and collaborations, were seen as inorganic growth tactics in the target market. These initiatives have paved the road for market players to expand their business and client base and change the nuclear medicine equipment market outlook.

The global nuclear medicine equipment market is estimated to be valued at USD 2.6 billion in 2025.

The market size for the nuclear medicine equipment market is projected to reach USD 3.9 billion by 2035.

The nuclear medicine equipment market is expected to grow at a 4.1% CAGR between 2025 and 2035.

The key product types in nuclear medicine equipment market are spect, _hybrid spect, _standalone spect, hybrid pet and planar scintigraphy.

In terms of application, oncology segment to command 38.4% share in the nuclear medicine equipment market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Nuclear Medicine Shielded Equipment Market Size and Share Forecast Outlook 2025 to 2035

Nuclear Engineering Service Market Size and Share Forecast Outlook 2025 to 2035

Nuclear Energy Consulting Service Market Size and Share Forecast Outlook 2025 to 2035

Nuclear Powered Merchant Vessel Market Size and Share Forecast Outlook 2025 to 2035

Nuclear Robots Market Size and Share Forecast Outlook 2025 to 2035

Nuclear Imaging Devices Market Size and Share Forecast Outlook 2025 to 2035

Nuclear Export Inhibitor Drugs Market

Global Nuclear Imaging Equipment Market Insights – Trends & Forecast 2024-2034

Antinuclear Antibody Test Market

Therapeutic Nuclear Medicine Market Analysis – Size, Share & Forecast 2024-2034

Filling and Dispensing System for Nuclear Medicine Market Size and Share Forecast Outlook 2025 to 2035

Plant life Extensions (PLEX) and Plant Life Management (PLIM) for Nuclear Reactors Market

Medicine Cabinets Market Size and Share Forecast Outlook 2025 to 2035

Global Medicine Blister Market Analysis – Growth & Forecast 2025 to 2035

Telemedicine Carts Market Size and Share Forecast Outlook 2025 to 2035

Telemedicine Equipment Market Size and Share Forecast Outlook 2025 to 2035

Photomedicine Market

Glass Medicine Bottles Market

5G Telemedicine Platform Market Size and Share Forecast Outlook 2025 to 2035

The Sports Medicine Market Is Segmented by Product, Application and End User from 2025 To 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA