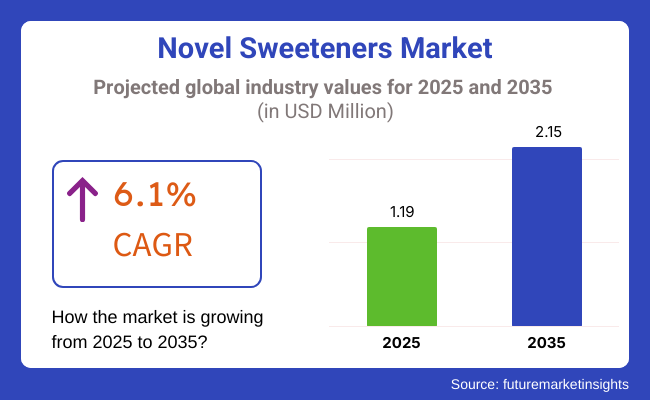

The novel sweeteners market is expected to witness an unparalleled growth with USD 1.19 billion in 2025. The net value of this industry is estimated to grow consistently by a CAGR of 6.1% in the period 2025 to 2035. The industry is anticipated to stand at USD 2.15 billion by 2035.

In a very short span of time, these unique sweeteners such as stevia, monk fruit, allulose, and rare sugars, are being widely accepted as promising alternatives to refined sugar and artificial sweeteners. Consumers are increasingly anxious about their weight, increased blood sugar level and others, along with the increased use of sugar, and are preferring sweeteners that are the most natural, low-calorie, and functional, but still deliver the same degree of sweetness without hurting health.

The aforementioned transition in consumer choices is one of the prominent factors for driving the industry forward. The development of the sector emerges mainly from the burgeoning use of these sweeteners in the food and beverage markets.

Plants in the sector, to keep up with the industry reality, are blending in these sweeteners in a varied range of goods like bread, sugar-free candies, yogurt, and fizzy drinks, calling for less sugar and clean-label formulations. The upsurge in the number of ketogenic, diabetic-friendly, and plant-based diet practitioners also assists in pushing the industry higher.

The industry expansion is also backed by government support for the promotion of honest sweeteners and sugar reduction campaigns set in various countries. Food companies have been urged by the government and health agencies to decrease the amount of sugar in their products therefore they substitute them with the escape-and sometimes-fundamental with the help of these sweeteners.

Available technologies for extraction and formulation improvements such as taste, stability, and solubility of these sweeters are making them more attractive for large-scale production. Owing to such efforts, the industry is bound to face some challenges like higher costs of production as well as the low level of knowledge among consumers on the gains and the application of sweeteners that are novel have.

The perception of taste and the aftertaste which is related to some natural sweeteners being used in manufacturing, are additional hurdles in view of those producers who are dreaming to use some other alternatives to sugar.

The need for functional and fortification food products along with the escalating number of research and development activities is paving the way for the establishment of blends of sweeteners that are newer and closer to sugar in flavor and texture. Furthermore, the direct-to-consumer e-commerce model and the subsequent growth of this channel are allowing the introduction of these sweeteners to a much wider customer base which, in turn, is driving their industry growth.

Explore FMI!

Book a free demo

The industry is growing rapidly because of the factors such as increased consumer knowledge regarding the health hazards of sugar intake. Low-calorie and natural sweeteners like stevia, monk fruit, allulose, and tagatose are becoming popular as substitutes for artificial sweeteners and normal sugar.

In the food and beverages industry, these sweeteners have extensive applications in drinks, bakery foods, milk, and sweets to sustain sweetness at a lowered intake of calories. The pharmaceutical industry also applies these sweeteners in the form of medicines and syrups for improved patient compliance.

Dietary supplements utilize these sweeteners in protein powders, meal replacement foods, and functional foods, while consumers also demand low-glycemic and keto-compliant products. Sweeteners are applied in oral care products and cosmetics in personal care. With increasing emphasis on natural, plant-based, and sustainable sweetening options, producers are developing to optimize taste, stability, and cost, determining the future of sugar substitutes.

Between 2020 and 2024, the industry saw incredible growth as people stepped up demand for healthier sweeteners over the classic sugar. Natural and low-calorie sweeteners like stevia and monk fruit extracts were ruling the industry in this period with people becoming health-conscious and aiming to decrease the consumption of sugar.

Food and drink companies were swift to reformulate products with these sweeteners to address increasing demand for low-sugar and clean-label products. Taste acceptability and regulatory approval were roadblocks, however, to more extensive use throughout their tenure in office.

Through the 2025 to 2035 period ahead, novel sweetener industry size is projected to expand and be strong as technology innovation and research develop new sweetening products with the taste and functionality of sugar. Technological advancement in fermentation technology and bioconversion will result in these sweeteners with better taste profiles and economic benefits, hence more appealing for mass application.

Increased focus on natural ingredients and sustainability will tend to promote the use of plant-based and natural sweeteners. Government agencies are expected to define better regulations, easing industry introduction of new products. In spite of such advancements, factors like consumer acceptance and competition from well-established sweeteners can impact the rate of industry growth.

Comparative Market Shift Analysis 2020 to 2024 vs. 2025 to 2035

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Growing demand for natural and low-calorie sweeteners due to growing health awareness. | Increased focus on sustainable and plant-based sweeteners with improved taste profiles. |

| Food and beverage reformulation with stevia, monk fruit, and erythritol. | Improved-tasting bioconversion and fermentation-derived sweeteners with cost savings. |

| Complicated regulatory clearances for the launch of these sweeteners. | Simplified regulatory processes for quicker industry entry of these sweeteners. |

| Taste incompatibility issues and consumer reservations regarding taste disparities. | Overcoming taste issues using improved formulations and natural flavor blocking technologies. |

| Emergence of plant extraction and chemical synthesis for making natural sweeteners. | Precision fermentation and enzyme-assisted processes to enhance molecular structure for improved taste. |

| Early pioneering of plant origins but with restrictive large-scale cultivation. | Large-scale production of genetically engineered sweeteners with reduced environment footprint. |

The industry is gaining ground owing to the surging request of people for healthier corticosterone substitutes in food and drinks. Nevertheless, the firmness of compulsory regulatory approvals and labeling requirements gives rise to compliance issues. Enterprises have to respect the global food safety regulations, attain necessary certificates, and offer clear product information to assure the consumer's confidence.

Supply chain vulnerabilities, including dearth in raw material and production scalability, affect the industry's stability. Based on the statement, the utilization of sweeteners that come from natural and fermentation sources might be influenced by climate change, agricultural risks, and geopolitical factors. Companies should allocate funds for multiplicity sourcing plans and the implementation of new production technologies to curb the disruption of supply chain.

Consumer approval is still a challenge-As taste perception, digest digestive tolerances and the doubts of synthetic processing affect purchasing decisions. With the help of educating the clients about the advantages of newly developed sweeteners like low glycemic impact and sustainability manufacturers can significantly improve their sales and industry share.

Rising competition from established sugar alternatives, including stevia, monk fruit, and allulose, adds pricing pressures and differentiation challenges. Companies should concentrate on the innovation of products, improving the quality of the product, and marketing strategies orienteering on the health benefits, and functionality in addition, to the taste enhancement to keep their position in the industry.

Economic hardships and the changing trend in diets can result in diminished income on the part of consumers who opt for premium sugar substitutes. To bear the consequences of the economic situation over the long term, businesses must assure the public that they are pursuing low cost, sustainability focus, and the incorporation of e-commerce and retail partnerships for distribution networks.

By 2025, demand for stevia extracts is predicted to account for the largest industry share of all, valued at USD 563.5 million, or 47.3% industry share. Stevia, a zero-calorie/low-glycaemic sweetener derived from the leaves of the Stevia rebaudiana plant, can be used in diabetic-friendly and functional food applications. With demand for natural sugar alternatives showing no signs of slowing, stevia-based sweeteners are expected to generate USD 125.3 million in incremental sales by 2025.

Stevia is rapidly on the rise in Asia Pacific and Latin America, the areas where health-focused consumers and government policies have already successfully thrust sugar reduction efforts into the arms of manufacturers. Major industry players like Cargill and PureCircle are also investing heavily in flavour improvement and selection of extraction operations to expand their product offerings in line with rising demand from consumers.

Tagatose, one of a group of low-calorie rare sugars, is increasingly being used as a natural substitute for sucrose, particularly in baked goods, cereals, and dairy products. It has a lower industry share, but demand is growing also due to the prebiotic benefits and low glycaemic index.

Südzucker and Bonumose, for example, are developing methods of producing it more cheaply to improve its commercial viability. Due to increasing consumer demand for gut-friendly, sugar-free options, the tagatose industry is set to experience significant growth.

In 2025, the food and beverages segment is expected to have the highest share of 78.2% of the total in the organic butter market at USD 931.7 million. Stevia extracts and tagatose are extensively utilized in carbonated drinks, dairy products, baked products, and confectioneries.

It's a way to offer food brands like Nestlé, PepsiCo, and The Coca-Cola Company a way to meet consumer demand for healthier alternatives and so that the products are reformulated with low-calorie sweeteners. As consumers increasingly scrutinize ingredient lists, the clean-label movement is also accelerating the use of plant-based sweeteners. The increasing popularity of functional beverages and sugar-free snacks also ensures many more stevia and tagatose-based formulations.

The pharma segment, in particular, is projected to hold 21.8% of the industry share valued at USD 259.6 million by 2025. These sweeteners are now being used in sugarless syrups, chewable tablets, and diabetic formulations. Stevia and tagatose are popular choices for being low glycaemic and good for one’s digestive health.

Pharma behemoths such as Pfizer, GlaxoSmithKline, and Johnson & Johnson are investing in natural sweeteners for use in dietary supplements and functional health products. The Need for Sugar-Free Drugs Due to the rising population suffering from diabetes and the increasing demand for sugarless medications, the demand for sugar substitutes in formulations is likely to grow.

The disruptive evolution by means of alternative sweeteners for mature sugar will progress globally from now until 2025; as the world focuses on health and wellness, the food, beverage, and pharmaceutical industries will be models of change.

| Countries | CAGR (2025 to 2035) |

|---|---|

| USA | 6.5% |

| UK | 5.8% |

| France | 5.2% |

| Germany | 5.5% |

| Italy | 4.9% |

| South Korea | 6.1% |

| Japan | 5.7% |

| China | 7.2% |

| Australia | 5.3% |

| New Zealand | 4.8% |

As growth is anticipated to occur at a healthy rate, the USA industry is booming with mounting consumer interest in low-calorie and plant-based sweeteners for sugar. Upscale players PureCircle and Cargill are leading with innovation by launching stevia- and monk fruit-based sweeteners.

FDA approval of these sweeteners also favors industry penetration. The movement toward naturals in the beverage, dairy, and bakery categories drives growth, with manufacturers investing in research for flavor profile optimization and formulation versatility.

The competitive marketplace is dynamic, with established and emergent players plowing into product differentiation and clean labeling. Players like Whole Foods and Walmart are expanding on-shelf locations for alternative sweeteners, fueling consumer access. On the other hand, partnerships between beverage and food players and ingredient manufacturers power new products, causing industry growth to continue.

The pioneer in sugar reduction legislation, the UK industry is experiencing steady growth, and food manufacturers are submitting for these sweeteners. Industry leaders such as Tate & Lyle are at the forefront of the development of allulose and stevia-sweetener alternatives that are good not only for the health-conscious consumer segment but also for diabetics. Sugar reduction picking up pace in soft drinks and confectionery drives demand, with high-street supermarket chains retailing better-for-you options.

Consumer concern over artificial sweetener side effects has driven demand for natural sweeteners. Internet sales have driven these sweetener sales, making it possible for smaller industry players to get into the business. The success of the UK's vegan and functional food markets offers additional opportunities, with consumers looking for better-for-you ingredients in everyday products.

France's industry is progressing step by step as a result of a health-focused consumer base and strict food legislation. French companies like Roquette are investing in plant-based sweeteners to maintain clean-label concepts.

Confectionery and bakery firms are some of the leading driving forces, with the need for sugar replacements in chocolates and pastries rising. The soft drink industry is also adopting these sweeteners to satisfy the country's increased need for less-sugar beverages.

The industry also experiences robust growth in sports and nutritional diet apps, where meal replacements and protein bars contain natural sweeteners such as stevia and erythritol. French organic food culture also supports the use of these sweeteners since consumers look for sustainable and low-processed foods.

Germany's aggressive sugar reduction measures and growing demand for natural ingredients put it at the forefront of the industry. Beneo is among the firms targeting prebiotic-based sweeteners, targeting diabetic and health-conscious consumers. Growth is driven by the development of functional beverages and dairy alternatives as companies utilize sweeteners with additional health benefits.

Germany's food industry prefers transparency, encouraging brands to formulate clean-label, plant-based sweeteners. Retail and online channels offer consumers easy access to these sweeteners because high R&D investment continues to drive product performance enhancement in flavor and functionality. Increasing use of keto and low-carb diets continues to drive demand for alternative sweeteners.

Since Mediterranean diets are becoming more susceptible to lower sugar intake, the Italian industry for these sweeteners is picking up pace. Eridania and other companies that have recently ventured into the natural sweetener industry are looking to tap into this industry. Confectioneries and bakeries use stevia and monk fruit to experience true flavor but with less sugar.

The rising demand for specialty coffee and craft drinks also drives the sweetener consumption. Italian producers are committing to R&D efforts to produce natural sugar substitutes that boost conventional recipes. The nation's tourism industry also drives market growth, with health-oriented travelers looking for low-calorie sweetening solutions.

With a sharp interest in health-oriented dietary and functional food trends, South Korea's industry is growing fast. Major players like CJ CheilJedang are investing heavily in fermentation-based sweeteners and K-health trends. The rapid growth of South Korea in adopting sugar substitutes as an ingredient for dairy foods as well as for convenient food mirrors demands for health-oriented food types.

Internet retailing has also been a principal force for accessibility, with global brands entering the markets via e-channels. Government marketing campaigns to cut sugar consumption push demand even higher, with South Korea becoming a chief growth center in Asia for these sweeteners.

Japan's industry is in good shape because of a growing population that increasingly seeks healthier sweeteners as opposed to conventional table sugar. Industry leaders like Morita Kagaku Kogyo hold sway over fermentation-based sweeteners, while old players include monk fruit and stevia in mainstream offerings. Functional food lines like probiotic yogurts and energy drinks are leading growth drivers.

Japan's cuisine focuses on quality and accuracy, stressing manufacturers to enhance taste and texture in sweeteners. Convenience store chains introduce these sweeteners into ready-to-consume foods, widening consumer reach. Demand for diabetic food further facilitates industry growth.

With its industry geared up for explosive expansion, China's government-led drives to lower sugar and expanding middle-class food demand for healthier alternatives are at its back. Plant sweeteners are the target of domestic players such as Layn Corporation, and international companies shore up their foothold by partnering with domestic food companies.

The growing use of sugar substitutes in traditional Chinese medicine and herbal drinks indicates consumer acceptability. Online shopping and cross-border shopping drive industry penetration as China becomes a new industry for these sweeteners.

Australia's industry is seeing sustained growth, driven by mounting fears of obesity and government initiatives to cut down on sugar. The industry is led by brands such as Natvia, which have stevia-based products that are widely used in beverages, snacks, and dairy alternatives. Clean-label demand drives the industry, with consumers insisting on minimally processed and natural sweeteners.

The growth in café culture and sugar-free coffee and dessert consumption also fuels industry expansion. Digital platforms deliver a major boost, with direct-to-consumer websites creating a brand presence. The growing interest in sports nutrition and wellness foods offers additional momentum.

New Zealand's industry is growing steadily, supported by strong consumer awareness of organic and natural food. Healthier Choice, among others, targets new sugar substitutes, with a base of target consumers being health-conscious consumers and food manufacturers. They are applied in the dairy sector in yogurt and protein-fortified beverages.

The growth of specialty foods and eco-friendly packaging is consistent with the nation's health-consciousness and environmentalism. The demand for lower-sugar products in the retail industry also favors growth, making New Zealand a desirable industry.

The industry is rapidly growing at present. It will continue to do so due to the increasing demand from consumers for low-calorie and natural sugar alternatives as well as functional sugar substitutes. Companies are now working harder to create better and more innovative products for health-conscious consumers who are cutting down their sugar intake without compromising the quality of taste.

Market-leading organizations include Tate & Lyle, Cargill, Ingredion, PureCircle (an Ingredion subsidiary), and GLG Life Tech Corporation. Startup companies and niche providers are also on their way. These new entrants are five-star plant-based and fermentation process- newly-derived sugars to counter contribution towards growing trends in the clean label.

The industry, indeed, now includes both novel and natural ones such as stevia and allulose as monk fruit extract, tagatose, and rare sugars. These sweeteners have been introduced to functional food applications in beverages, dairy products, and baked products such as glycemic and keto solutions.

The biotechnology, enzymatic conversion, and precision fermentation sciences are improving the aspects of taste profile, scalability, and cost-effectiveness in this industry. The regulatory approvals, along with a considerable increase in R&D investments, are favorably accelerating the commercialization of next-generation sugar alternatives.

The key strategies to outcompete others include patented formulations, collaborations with food and beverage manufacturers, and sustainable sourcing initiatives. The companies are also focusing on enlarging production capabilities, improving their taste-masking technologies, and optimizing pricing strategies to capture a significant industry share.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Tate & Lyle PLC | 18-22% |

| Cargill, Incorporated | 14-18% |

| Ingredion Incorporated | 10-14% |

| PureCircle (a subsidiary of Ingredion) | 8-12% |

| GLG Life Tech Corporation | 6-10% |

| Other Players (Combined) | 25-35% |

| Company Name | Key Offerings & Market Focus |

|---|---|

| Tate & Lyle PLC | Offers allulose, stevia, and monk fruit-based sweeteners, focusing on sugar reduction in beverages, dairy, and bakery applications. |

| Cargill, Incorporated | Leading supplier of stevia-based (Truvia), erythritol, and allulose sweeteners, investing in fermentation-based production for sustainable solutions. |

| Ingredion Incorporated | Provides monk fruit, stevia, and rare sugars, with a focus on clean-label and customized sweetening solutions. |

| PureCircle (Ingredion) | A pioneer in high-purity stevia extracts and blends, emphasizing taste improvement through proprietary Reb M and Reb D formulations. |

| GLG Life Tech Corporation | It specializes in natural, plant-based sweeteners, including stevia and monk fruit, and focuses on cost-effective, high-purity extraction. |

Key Company Insights

Tate & Lyle (18-22%)

As a leading company for sugar alternatives, Tate & Lyle has mooted its allulose and stevia product lines and has partnered with food manufacturers to construct low-calorie formulations.

Cargill (14-18%)

Big players in the industry have Truvia (stevia) and EverSweet (fermented stevia blends); Cargill is working on an enzymatic modification to improve taste profiles.

Ingredion (10-14%)

Strengthening its clean-label sweetener segment, Ingredion concentrates on monk fruit and rare sugar innovation for functional food applications.

PureCircle (8-12%)

Through bioconversion technology, the next-generation stevia product innovator PureCircle heightens taste-and-sweetness enhancement without bitterness.

GLG Life Tech (6-10%)

The largest competitor in the Asian and North American markets for bulk stevia production as well as sustainable sourcing initiatives.

The industry is expected to generate USD 1.19 billion in revenue by 2025.

The industry is projected to reach USD 2.15 billion by 2035, growing at a CAGR of 6.1%.

Key players include Tate & Lyle PLC, Cargill, Incorporated, Ingredion Incorporated, PureCircle (a subsidiary of Ingredion), GLG Life Tech Corporation, Sweegen, ADM (Archer Daniels Midland), Roquette Frères, BioNeutra Global Corporation, and Stevia First Corporation.

North America and Europe, driven by increasing consumer preference for sugar reduction, clean-label products, and regulatory support for natural sweeteners.

Stevia-based sweeteners dominate due to their natural origin, zero-calorie properties, and extensive use in beverages, dairy, and bakery products.

By product type, the industry is classified as stevia extracts, tagatose and trehalose.

By end use, the industry is classified as food and beverages, pharmaceuticals, direct sales, baby snacks and others.

By application, the industry is classified as Bakery Products, Sweet Spreads, Confectionary and Chewing Gums, Beverages, Dairy Products and Others.

By region, the industry is divided as North America, Latin America, Europe, East Asia, South Asia, Oceania, Middle East and Africa.

Feed Attractants Market Analysis by Composition, Functionality, Livestock, Packaging Type and Sales Channel Through 2035

Dairy Protein Crisps Market Flavor, Packaging, Application and Distribution Channel Through 2025 to 2035

Bouillon Cube Market Analysis by Type and Distribution Channel Through 2035

Food Fortification Market Analysis by Type, Process and Application Through 2035

Fermented Feed Market Analysis by Product Type, Livestock and Fermentation Process Through 2035

Bone and Joint Health Supplement Market Analysis by Product Type, Form and Sale Channels Through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.