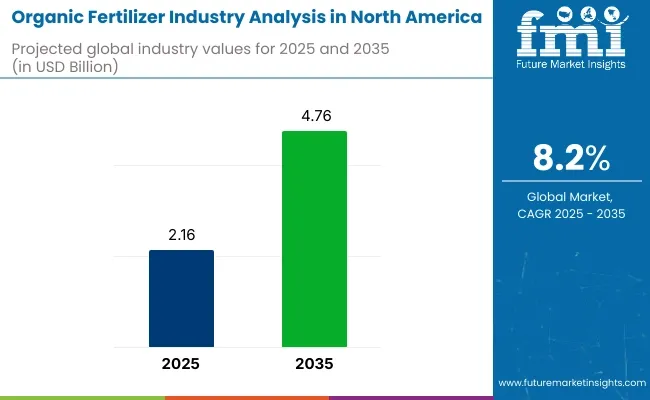

The North America organic fertilizer industry is estimated to generate a market size of USD 2.16 billion in 2025 and is expected to reach USD 4.76 billion by 2035, reflecting a compound annual growth rate (CAGR) of 8.2% during the forecast period.

The growth of this market is primarily driven by the increasing demand for sustainable farming practices, growing awareness of the environmental impact of synthetic fertilizers, and the rising consumer preference for organic produce. Organic fertilizers, derived from natural sources such as compost, manure, and plant-based materials, are gaining traction due to their ability to improve soil health, enhance plant growth, and reduce environmental pollution.

A key driver of the organic fertilizer industry's growth is the increasing shift towards sustainable and eco-friendly farming practices. As concerns about soil degradation and the environmental impact of chemical fertilizers continue to rise, farmers are turning to organic alternatives to improve soil fertility and long-term productivity. This trend is supported by governmental initiatives and regulations that promote the use of organic inputs in agriculture, as well as incentives for farmers to adopt sustainable practices.

In addition to sustainability, the growing demand for organic food is another significant factor driving the market. As consumers become more health-conscious and demand chemical-free products, the need for organic farming practices, including the use of organic fertilizers, is on the rise. Organic fertilizers not only support the production of organic crops but also meet the increasing regulatory standards for organic food certification.

On June 7, 2025, New York lawmakers introduced legislation proposing a five-year moratorium on the use of biosolid fertilizers-treated sewage sludge-on farmland. This move follows incidents in New Scotland, where residents experienced water contamination and health issues attributed to biosolid application, including high levels of E. coli and the presence of PFAS ("forever chemicals").

| Attribute | Value |

|---|---|

| Market Size in 2025 | USD 2.16 billion |

| Market Size in 2035 | USD 4.76 billion |

| CAGR (2025 to 2035) | 8.2% |

The bill mandates comprehensive testing of biosolids for PFAS and analysis of affected soils and groundwater, aiming to assess the long-term impact and determine whether a permanent ban is necessary. The proposed legislation has garnered support from the Northeast Organic Farming Association and several dairy farmers. This was reported by the Times Union.

As the North America organic fertilizer industry continues to grow, ongoing advancements in product formulations and production techniques are expected to expand the range of available solutions. This will further drive market adoption, catering to the diverse needs of farmers and contributing to the ongoing shift towards sustainable agriculture in the region.

The North America organic fertilizer industry is projected to grow steadily from 2025 to 2035. Key segments driving this growth include cereals & grains, accounting for 38% market share, and dry fertilizer, accounting for 65% of the form segment market share. These segments are driven by the increasing demand for sustainable agricultural practices and eco-friendly farming solutions.

Cereals & grains are projected to account for 38% of the crop type market share in 2025. This segment is experiencing growth due to the high demand for staple foods such as wheat, corn, and rice, which require consistent fertilization to achieve optimal yields.

Organic fertilizers are increasingly being adopted in the cultivation of these crops to promote soil health, reduce environmental impact, and meet consumer demand for chemical-free produce. The shift towards sustainable farming practices and the growing awareness of the benefits of organic farming are driving the adoption of organic fertilizers in cereal and grain production.

The demand for organic cereals and grains is further supported by government incentives and subsidies aimed at promoting organic farming practices. Additionally, the increasing consumer preference for organic food products is encouraging farmers to transition towards organic cultivation methods. As a result, the cereals & grains segment is expected to continue its dominance in the North America organic fertilizer industry, driven by the need for sustainable and eco-friendly agricultural practices.

Dry fertilizer is expected to hold 65% of the form segment market share in 2025. This growth is attributed to the advantages offered by dry fertilizers, including their long shelf life, ease of application, and suitability for large-scale agricultural use.

Dry fertilizers are preferred by farmers for their convenience and effectiveness in delivering essential nutrients to crops. The increasing adoption of dry organic fertilizers is driven by their ability to improve soil fertility, enhance crop yield, and support sustainable farming practices.

The demand for dry organic fertilizers is further fueled by the growing awareness of the environmental impact of synthetic fertilizers and the need for eco-friendly alternatives. Manufacturers are focusing on developing innovative dry fertilizer formulations that offer improved nutrient release and better compatibility with various crops. As the trend towards sustainable agriculture continues to rise, the dry fertilizer segment is poised for significant growth in the North America organic fertilizer industry.

Organic Fertilizer Revenue in North America to Expand Over 2.2X through 2035

North America's organic fertilizer industry revenue is predicted to expand over 2.2X through 2035, amid a 4.7% rise in expected CAGR compared to the historical one. This is due to the adoption of precision farming techniques, which drives the demand for organic fertilizers.

Organic fertilizer sales are also set to rise due to rapid population growth, increasing food demand, and surging environmental concerns. By 2035, the total industry revenue is set to reach USD 4,415.8 million.

Organic Fertilizer Consumption Remains High in the United States

As per the latest analysis, the United States is expected to remain the happy hunting ground for organic fertilizer manufacturers during the forecast period. It will likely hold around 55.7% of the North America organic fertilizer industry share in 2035. This is attributed to the following factors:

Cereals and Grains Segment Creating Significant Opportunities

As per the report, the cereals & grains segment will likely retain its dominance across North America, creating substantial growth opportunities for manufacturers.

It is expected to account for a volume share of about 47.3% in 2025. This segment focuses on catering organic fertilizers to cereal and grain cultivation, encompassing staples like wheat, rice, and corn.

Tailored formulations address the specific nutritional needs of these crops, enhancing soil fertility and promoting sustainable practices.

The organic fertilizers within this category contribute to robust growth, improved yields, and the overall health of cereal and grain crops, aligning with the growing demand for organic options in North America’s agriculture sector.

On the other hand, the oilseed & pulses segment is anticipated to expand at a higher CAGR of 7.1% during the forecast period. This can be attributed to the growing trend towards organic fertilization in the cultivation of oil-rich crops, aligning with the region's evolving agricultural preferences.

In the assessment period, the sustainable fertilizer industry in North America is expected to register strong growth, totaling a valuation of USD 4,415.8 million by 2035. This is due to a combination of several factors, including the rising usage of organic fertilizers in many applications and the demand for sustainable farming.

The increasing popularity of sustainable farming practices is emerging as a key factor driving sales of organic fertilizers across North America. Rising awareness among farmers and consumers about the environmental impact of conventional agriculture is leading to a surge in the adoption of organic fertilizers.

With a growing emphasis on sustainable and eco-friendly agricultural solutions, organic fertilizers offer a compelling opportunity. Farmers are increasingly recognizing the importance of soil health and long-term sustainability, aligning with the principles of organic farming.

The demand for organic fertilizers is escalating in the cultivation of cereals, grains, oilseeds, pulses, fruits, and vegetables. Regulatory support for sustainable farming practices, coupled with initiatives promoting organic agriculture, creates a favorable landscape for the expansion of the natural fertilizer industry in North America.

The increasing popularity of home gardening across North America is expected to uplift the demand for organic fertilizers. Home gardeners are willing to pay a premium for natural fertilizers to ensure their food is safe and healthy.

The opportunity lies not only in meeting current demand but also in anticipating and contributing to the evolving landscape of environmentally conscious and sustainable agriculture.

As such, investing in research and development for innovative organic fertilizer formulations can enhance competitiveness and cater to the increasing demand for sustainable farming solutions.

Rising Preference for Organic Foods Fueling Demand for Organic Fertilizers

Demand for organic fertilizers in North America is set to grow rapidly, primarily propelled by the increasing preference for organic foods. As consumers become more health-conscious and environmentally aware, there is a significant shift toward organic produce.

The changing consumer behavior is driving a surge in demand for organic fertilizers, which are instrumental in cultivating organic cereals, grains, oilseeds, pulses, fruits, and vegetables. Seaweed-based organic fertilizers, such as those derived from kelp, are gaining popularity due to their nutrient-rich composition and sustainable sourcing.

The rising adoption of organic farming practices to meet stringent organic certification standards is contributing to the demand for organic fertilizers across the agricultural landscape.

This trend aligns with the broader movement towards sustainable and eco-friendly agriculture, reflecting a harmonious balance between consumer preferences, health consciousness, and environmental sustainability in North America’s industry.

Adoption of Precision Farming Techniques Propelling Organic Fertilizer Sales

The widespread adoption of precision farming techniques in North America is anticipated to fuel sales of organic fertilizers. Precision farming involves using advanced technologies such as GPS-guided machinery, sensors, and data analytics to optimize farming practices.

As farmers increasingly embrace precision farming, there is a growing need for organic fertilizers that complement these high-tech agricultural methods. Precision farming allows for more targeted and efficient application of fertilizers, and organic options, such as seaweed-based fertilizers or microbial formulations, align with the precision farming ethos.

Farmers utilizing precision techniques seek organic fertilizers with specific nutrient content tailored to the needs of different crops, promoting sustainable and environmentally friendly practices.

This trend is exemplified by the rising adoption of microorganism-based fertilizers, which enhance soil health and improve nutrient absorption by plants in a precise manner.

The demand for organic fertilizers is further fueled by the desire to achieve optimal yields and minimize environmental impact. This will likely foster the growth of the organic fertilizer industry in North America through 2035.

Rising Population and Growing Need for Sustainable Agriculture Spurring Growth

The escalating population is a pivotal driver propelling the demand for sustainable agriculture. This, in turn, will likely foster the growth of North America’s organic fertilizer industry during the assessment period.

As the world population continues to surge, the imperative for sustainable and eco-friendly agricultural practices intensifies. Organic fertilizers, sourced from plant-based materials, animal by-products, minerals, or microorganisms, serve as a key solution for sustainable farming.

With rising awareness about environmental conservation and the adverse impacts of chemical fertilizers, farmers and agricultural communities are increasingly shifting towards organic alternatives. For instance, the demand for seaweed-based fertilizers is witnessing an upswing due to their nutrient-rich composition and eco-friendly characteristics.

The organic fertilizer options promote soil health, reduce environmental degradation, and enhance crop productivity.

The organic fertilizer industry in North America is poised to capitalize on this trend, with more and more farmers adopting sustainable agricultural practices to meet the food demands of a growing population while minimizing their ecological footprint.

Availability of Synthetic Alternatives

The organic fertilizer industry in North America faces a significant constraint due to the availability of synthetic alternatives. Though widely criticized for environmental and health concerns, the conventional use of synthetic fertilizers continues to persist as a major competitor.

Farmers often opt for synthetic options due to factors like cost-effectiveness and immediate results. Established practices and habits within the agriculture sector challenge the widespread adoption of organic fertilizers.

The presence of synthetic alternatives can impede the organic fertilizer industry's growth potential. This is because various farmers may prioritize conventional methods over transitioning to organic solutions.

To overcome this restraint, strategic awareness campaigns, government incentives, and education programs are essential to emphasize the long-term benefits of organic fertilizers, both for agricultural sustainability and environmental well-being.

Collaborative efforts across stakeholders can mitigate this restraint and promote a shift towards more environmentally friendly and sustainable farming practices.

Short Shelf Life and Storage Issues Hinder Organic Fertilizer Adoption

The organic fertilizers sector in North America encounters a significant constraint attributed to the short shelf life and storage challenges associated with these products.

Unlike synthetic fertilizers, organic alternatives often have a limited shelf life due to their natural composition, susceptibility to microbial activity, and potential nutrient degradation.

Farmers face difficulties in maintaining the quality of organic fertilizers over extended periods, leading to concerns about efficacy and nutrient retention. Storage issues arise from the need for specific conditions to preserve the biological activity of organic fertilizers, such as temperature control and protection from moisture.

Farmers may opt for synthetic fertilizers with longer shelf lives and simpler storage requirements. Advancements in organic fertilizer formulation, packaging, and storage technologies are crucial to address this constraint.

Innovations that enhance stability and prolong shelf life can contribute to overcoming this restraint. They can promote the acceptance of organic fertilizers among farmers and foster sustainable agricultural practices.

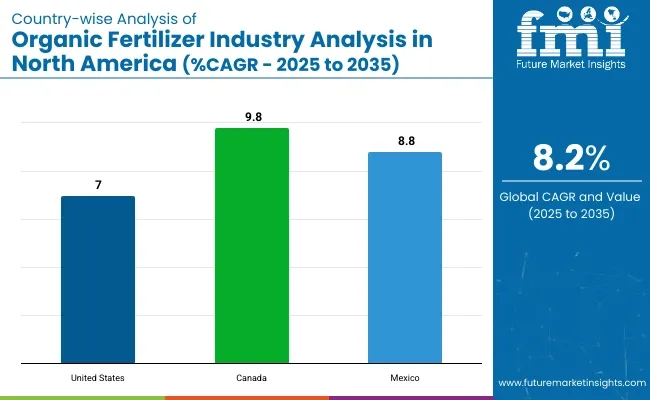

The table below shows the estimated growth rates of the top countries in North America. Canada and Mexico are expected to record high CAGRs of 9.8% and 8.8%, respectively, through 2035. On the other hand, the United States will likely retain its dominance across North America.

| Countries | Projected Organic Fertilizer Industry CAGR (2025 to 2035) |

|---|---|

| United States | 7.0% |

| Canada | 9.8% |

| Mexico | 8.8% |

The United States is expected to remain at the epicenter of organic fertilizer industry growth during the assessment period. It will likely exhibit a CAGR of 7.0% CAGR through 2035, driven by factors like:

The United States is witnessing the adoption of organic farming practices, propelled by supportive government initiatives and subsidies for farmers. This is expected to drive demand for organic fertilizers in the nation through 2035.

Farmers in the United States are shifting their preference toward organic fertilizers as they become aware of the harmful effects of chemical fertilizers. This will further boost sales of organic fertilizers during the next ten years.

The table below highlights the organic fertilizer industry revenue in prominent regions. Midwest, The Prairie Provinces, and Central Canada are expected to remain the top three consumers of organic fertilizers across North America, with expected valuations of USD 1,540.0 million, USD 940.1 million, and USD 363.7 million, respectively, in 2035.

| Regions | Organic Fertilizer Industry Revenue (2035) |

|---|---|

| Midwest | USD 1,540.0 million |

| The Prairie Provinces | USD 940.1 million |

| Central Canada | USD 363.7 million |

| Southeast | USD 317.3 million |

| West | USD 239.1 million |

The table below shows the estimated growth rates of the top three regions. Central Canada, The Prairie Provinces, and Northern Mexico are set to record higher CAGRs of 10.9%, 10.4%, and 10.0%, respectively, through 2035.

| Regions | Projected Organic Fertilizer Industry CAGR (2025 to 2035) |

|---|---|

| Central Canada | 10.9% |

| The Prairie Provinces | 10.4% |

| Northern Mexico | 10.0% |

| The Atlantic Provinces | 10.0% |

| Gulf Coast | 8.6% |

The Midwest United States organic fertilizer industry size is projected to reach USD 1,540.0 million by 2035. Demand for organic fertilizers in the region will likely increase at a CAGR of 6.8% during the assessment period.

Sales of organic fertilizers in Prairie Provinces are projected to soar at a CAGR of around 10.4% during the assessment period. Total valuation in the region is anticipated to reach USD 940.1 million by 2035.

The organic fertilizer industry in North America is fragmented, with leading players accounting for about 20% to 25% of the share.

Yara International ASA, The Scotts Miracle-Gro Company, Fertoz Limited, Tessenderlo Group, Sigma AgriScience, LLC, Verdesian Life Sciences LLC, Bio Green Fertilization Redefined, American Plant Food Corporation, True Organic Products Inc., Sustane Natural Fertilizer Inc., Purely Organics LLC, California Organic Fertilizers Inc., Nurture Growth Bio-Fertilizer Inc., GreenTechnologies, LLC, EnviroKure, Inc., The Fairfax Companies LLC, Quasar Energy Group, Wilbur-Ellis Holdings, Inc., Den Ouden Groep, and Central Iowa Organic Fertilizer are the leading manufacturers of organic fertilizers listed in the report.

Key organic fertilizer companies in the region are rigorously investing in research and development to develop bio-based fertilizers as well as increase their production capacities.

Similarly, the industry is witnessing mergers, facility expansions, partnerships, acquisitions, and collaborations as players look to expand their presence in the region.

Recent Developments in North America Organic Fertilizer Industry

| Report Attributes | Details |

|---|---|

| Current Total Market Size (2025) | USD 2.16 billion |

| Projected Market Size (2035) | USD 4.76 billion |

| CAGR (2025 to 2035) | 8.2% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD billion for dollar sales |

| Sources Analyzed (Segment 1) | Plant-based (Molasses, Seaweed, Soybean Meal, Legume Cover Meal, Cottonseed Meal, Corn Gluten Meal, Green Manure, Others), Animal-based (Fish Emulsion, Bone Meal & Blood Meal, Urea, Manure, Milk, Others), Mineral, Microorganism, Others |

| Crop Types Analyzed (Segment 2) | Cereals & Grains, Oilseed & Pulses, Fruits & Vegetables, Others |

| Forms Analyzed (Segment 3) | Dry Fertilizer, Liquid Fertilizer |

| Nutrient Content Analyzed (Segment 4) | Up to 20%, 20% to 40%, 40% to 60%, Above 60% |

| Applications Analyzed (Segment 5) | Farming, Gardening |

| Regions Covered | United States, Canada, Mexico |

| Countries Covered | United States, Northeast, Southeast, Southwest, Midwest, West, Canada (The Atlantic Provinces, Central Canada, The Prairie Provinces, The West Coast, The Northern Territories), Mexico (Baja California, Northern Mexico, Central Mexico, Gulf Coast) |

| Key Players influencing the Organic Fertilizer Industry | Yara International ASA, The Scotts Miracle-Gro Company, Fertoz Limited, Tessenderlo Group, Sigma AgriScience, LLC, Verdesian Life Sciences LLC, Bio Green Fertilization Redefined, American Plant Food Corporation, True Organic Products Inc., Sustane Natural Fertilizer Inc., Purely Organics LLC, California Organic Fertilizers Inc., Nurture Growth Bio-Fertilizer Inc., GreenTechnologies, LLC, EnviroKure, Inc., The Fairfax Companies LLC, Quasar Energy Group, Wilbur-Ellis Holdings, Inc., Den Ouden Groep, Central Iowa Organic Fertilizer |

| Additional Attributes | dollar sales, CAGR trends, source-based demand, crop type segmentation, form-based preferences, nutrient content distribution, application share, competitor dollar sales & market share, regional adoption trends |

The North America industry value is set to reachUSD 2.16 billion in 2025.

Organic fertilizer demand in the region is expected to rise at 8.2% CAGR.

North America organic fertilizer industry size is set to reach USD 4.76 billion by 2035.

The liquid fertilizer segment is expected to lead the industry during the forecast period.

Gardening segment is expected to dominate the North America industry.

The United States is set to dominate North America’s industry.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Demand for Organic Fertilizer in North America Size and Share Forecast Outlook 2025 to 2035

Industry Analysis of Paper Bag in North America Size and Share Forecast Outlook 2025 to 2035

Snowplow Industry Analysis in North America Size and Share Forecast Outlook 2025 to 2035

Toilet Seat Industry Analysis in North America Size and Share Forecast Outlook 2025 to 2035

Cosmetic Jar Industry Analysis in North America Size and Share Forecast Outlook 2025 to 2035

Carbon Steel Industry Analysis in North America Forecast & Analysis: 2025 to 2035

North America Booklet Label Market Growth – Trends & Forecast 2023-2033

Injectable Drug Industry Analysis in North America Forecast Outlook 2025 to 2035

North America Cement Packaging Industry Analysis – Trends & Forecast 2024-2034

Palletizing Robot Industry Analysis in North America Size and Share Forecast Outlook 2025 to 2035

Potassium Formate Industry Analysis in North America - Size, Share & Forecast 2025 to 2035

North America Vertical Turbine Pump Market Analysis & Forecast by Head, Material Type, Stages, Power Rating, End-use, and Region Through 2035

Luxury Interior Fabric Industry Analysis in North America and Europe Growth, Trends and Forecast from 2025 to 2035

Home Healthcare Software Industry Analysis in North America Size and Share Forecast Outlook 2025 to 2035

Hardware Asset Management Industry Analysis in North America Forecast Outlook 2025 to 2035

Yoga & Meditation Product Industry analysis in North America Size and Share Forecast Outlook 2025 to 2035

Medium Voltage Transformer Industry Analysis in North America Size and Share Forecast Outlook 2025 to 2035

Walk-In Cooler and Freezer Market Growth – Trends & Forecast 2024-2034

Yoga and Meditation Service Industry Analysis in North Americat Growth – Demand & Forecast 2025 to 2035

Fountain Dispenser Equipment Industry Analysis in North America Growth, Trends and Forecast from 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA