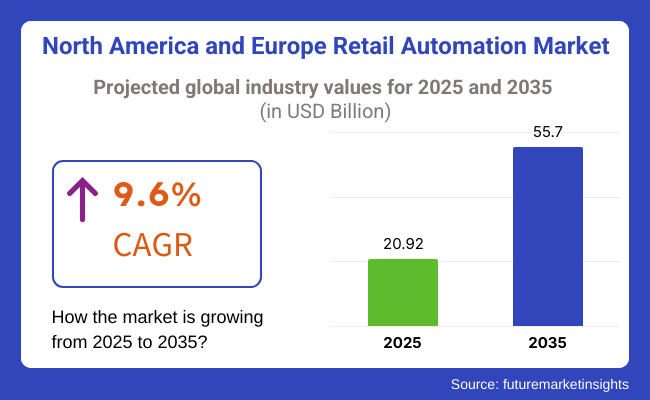

The North America and Europe retail automation market value is projected to be USD 20.92 billion in 2025 and USD 55.7 billion in 2035. This growth is driven by rapid progress of retail technology, increasing adoption of e-commerce, and customer experience expectations. The rapid deployment of automation technologies in the retail sector is one of the key indicators of sustained industry growth over the next ten years.

It means the implementation of AI-driven self-checkout technologies, robotic process automation, intelligent shelves, and automated inventory solutions for optimizing operations, reducing workforce expenses, and increasing customer satisfaction.

As digital transformation reshapes retailing, enterprises are investing in automation solutions to automate processes, minimize human involvement and make seamless shopping experiences. Automated solutions are most visible in North America and Europe in relation to supermarkets, convenience stores and big-box retail chains.

Several drivers are propelling the retail automation industry forward. The growing demand for seamless shopping has led to the widespread use of self-checkout kiosks, contactless payment systems, and cashier-less shops. And robotic automation as well as AI-powered analytics are enabling significant advancements in inventory management while reducing losses and cost associated with stock shortages or overstock.

E-commerce behemoths and physical retailers alike are turning to automation to streamline fulfillment, last-mile delivery and supply chain. Industry trends such as the rise of IoT based smart stores and growing implementation of personalized digital marketing techniques are also driving industry growth.

Although the retail automation market is an industry with solid growth prospects, there are numerous challenges with it. Some of the primary hurdles, especially for mid-size and small retailers, are high implementation costs and difficulty reaching scalable levels of automation with the current retail infrastructure. In addition, data privacy and cyber issues are threats as retailers process enormous amounts of customer data via automated systems. In addition to this, concerns surrounding automation taking over jobs remain a long-standing issue and that is why companies are forced to balance technological evolution with the workers’ capacity to adapt.

The economic future of the industry is sustained on continuous development in AI, IoT, and also machine learning. Retailing is likely to be transformed by technologies such as intelligent checkout counters, autonomous delivery services, and blockchain-based visibility into supply chains.

The use of robots in warehouses and logistics is increasing the efficiency of processes and real-time data analytics is helping with predictive stock management. As consumer preferences continue to lean toward speed and convenience, retailers investing in automation technologies will find themselves ahead with their ability to dictate the future of the retail sector in North America and Europe.

Driven by their durability, flexibility, and cost-effectiveness, the PE Valves segment is expected to represent 57% of the retail automation industry share in 2025[40]. About 43% of the self-checkout, vending kiosks, and point-of-sale terminals use PE (Polyethylene) valves; due to some of the wear and high turnover in the industry, they are easy to put into automation systems.

Significant retailers like Walmart, Tesco, and Carrefour are planning to invest in automatic checkout and inventory management solutions where PE valves have wide applications in fluid handling and pneumatic systems. PE component demand is expected to grow in the industry based on the emergence of smart retail solutions and automation driven by AI.

Prediction on PP Valves with 43% industry Share in 2025 - Polypropylene (PP) valves are more commuted while being a piece of automated dispensing systems and robotics-powered logistics that provide goodwill to the PP valves segment by 2025. Polypropylene (PP) valves are a popular material, are very tolerable toward chemicals, are lighter in weight, and have low cost, making them a better choice for the distribution center for ASRS application and retail warehouse automation.

As contactless shopping experiences and robotic fulfillment centers are becoming mainstream, leading brands like Amazon, Kroger, and Aldi are beginning to incorporate components based on PP valves into their automated retail ecosystems. This won’t be the last as retailers are investing more on systems that fuse automation to increase operational efficiency and convenience for shoppers.

With the retail industry in North America and Europe moving quickly from service to automation, both PE and PP valves will continue to be vital materials, fuelling advancements in self-service technology and robotic outlets.

The bags segment in 2025 is expected to account for a retail automation industry share of 55% due to the widespread use of evaluating bags in the retail automation bags segment automated checkout systems, self-service kiosks, and retail packaging automation. Bags are favored for bulk buying, grocery shopping, and e-commerce packaging, and retailers are zeroing in on using sustainable and recyclable materials to meet environmental regulations in North America and Europe.

The world's largest retailers like Walmart, Tesco and Carrefour are pouring billions of dollars into automated bagging technology to speed up the self-checkout process. Moreover, the trend of using biodegradable and compostable bags is growing as governments are enacting policies to reduce plastic use, encouraging eco-friendly packaging.

The pouches segment in the automated retail industry is projected to hold a 45% share in 2025 due to the demand for flexible and lightweight packaging. Pouches provide tidy storage, prolonged shelf life, and increased portability, which makes them perfect for vending machines, grab-and-go areas, and e-commerce packaging solutions.

Logistics and automatic pouch-filling and sealing machine retailers like Aldi, Lidl, and Amazon Go are implementing automation in operation and packaging. Additionally, there has been an increase in demand for reusable and resealable pouches, particularly within the food and beverage, personal care, and pharmaceutical industries. With the growth of retail automation in North America and Europe, both bags and pouches will remain front and center for improving operational efficiency, sustainability, and consumer convenience.

The industry is growing at a rapid pace fueled by innovations in AI, IoT, and cloud-based technology. Hypermarkets and supermarkets are spending on self-checkout counters, intelligent shelves, and artificial intelligence-based inventory management to make operations more efficient. Convenience stores focus on low-cost automation options such as smart vending machines and electronic price tags.

E-commerce warehouses emphasize robotic fulfillment centers, automated storage, and AI-driven demand forecasting for effortless logistics. Department stores embrace personalized digital signage, RFID tracking, and customer analytics to improve the shopping experience.

Specialty retailers are introducing virtual try-on, automated checkout, and AI-powered chatbots for customer interaction. As retailers are faced with increased labor costs and shifting consumer needs, automation becomes the key to enhancing efficiency, lowering operational costs, and offering better customer experiences in physical as well as digital retail environments.

Contract & Deals Analysis

| Company | Contract Value (USD Million) |

|---|---|

| NCR Corporation | Approximately USD 60 - USD 70 |

| Diebold Nixdorf | Approximately USD 50 - USD 60 |

| Toshiba Global Commerce Solutions | Approximately USD 55 - USD 65 |

| Fujitsu | Approximately USD 45 - USD 55 |

| Honeywell | Approximately USD 65 - USD 75 |

In 2024, the industry recorded tremendous growth fueled by digital technology adoption as a means to automate operations and improve customers' experiences. Major deals and strategic partnerships have been won by NCR Corporation, Diebold Nixdorf, Toshiba Global Commerce Solutions, Fujitsu, and Honeywell in this industry. These advances reflect the determination of the industry to drive retail environments with pioneering automation technologies, that guarantee effortless functionality and competitiveness in an ever-changing digital world.

During the period 2020 to 2024, the industry in North America and Europe developed robustly, driven by AI-powered solutions, altered customer behavior, and building contactless shopping. Cashier-less stores and self-checkout amenities using AI vision, RFID, and biometric identification were introduced by retailers to help consumers shop easily.

Operational efficiency was boosted with AI-driven demand forecasting, real-time pricing, and smart inventory management. Warehousing, logistics, and fulfillment automation accelerated with the COVID-19 pandemic utilizing robot picking and drone delivery. AI-driven waste management and energy-saving systems lowered the carbon footprint.

The barriers were high expenditures, cybersecurity threats, and privacy issues with data, but improved cloud automation and blockchain-encrypted transactions enhanced the uptake. During 2025 to 2035, robotics fueled by AI, hyper-personalized retail, and autonomous deliveries will revolutionize retail automation.

Smart shelves with IoT sensors, cashier less checkout based on facial recognition, and shopping assistants powered by AI will provide improved customer experiences. Blockchain payments, cryptocurrency usage, and biometric authentication will enable frictionless and secure payments.

AI- and quantum computing-driven predictive analytics will revolutionize supply chain management, reducing stockouts and optimizing inventory. Autonomous drone- and self-driving van-powered delivery systems will enable lightning-fast fulfillment. Sustainability will be the focus of future trends as autonomous stores, zero-waste buildings, and carbon-neutral warehouses redefine sustainable retail. Cybersecurity will be fortified by quantum encryption and AI-powered threat detection.

Comparative Market Shift Analysis 2020 to 2024 vs. 2025 to 2035

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Contactless checkout, intelligent payment systems | AI-fueled, hyper-personalized shopping experiences |

| Automated self-checkout, intelligent inventory tracking | Autonomous stores that are fully autonomous with AI-empowered retail assistants |

| Energy-efficient automation, sustainable packaging | Waste reduction using AI, smart zero-carbon retail stores |

| Smart shelves via IoT, robot-based fulfillment | Decision-making based on AI, quantum computing supply chains |

| Cloud storage for data, AI fraud prevention | Quantum encryption, blockchain-based secure transactions |

| Spread of automated checkouts | Expansion of autonomous delivery networks at a national level |

| E-commerce boom, faster checkout solution demand | Customer insights powered by AI, autonomous fulfillment solutions |

The industry is flourishing the self-checkout systems, AI-driven analytics, and smart inventory management due to the high demand. On the other hand, high startup infrastructure costs for automation are the financial obstacles involved. It is the responsibility of retailers to ensure the profitable automation of equipment by weighing it against cost factors.

Cybersecurity has become a hot topic for automated retail systems that are based on cloud computing, IoT, and AI-driven processes. Information breaches, computer hacks, and system failures are some of the factors that can put customer data at risk and affect business operations. The deployment of robust encryption, real-time monitoring, and compliance with data protection laws are among the strategies that can help mitigate security risks.

The regulatory environment in North America and Europe is a barrier to the automation of the services. Stricter labor regulations, privacy legislation, and industry compliance frameworks are not uniform across the regions, thus making businesses navigate through the changing legal systems. Businesses must comply with the requirements of the GDPR, consumer rights regulations, and ethical AI guidelines in order to have a smoother entry into the industry.

Retail automation technologies are being held back by supply chain shortages due to semiconductor shortages and hardware production delays. This reliance on external suppliers and the volatility of material prices can lead to more expenses. Diversifying supplier networks and the pursuit of local manufacturing are both measures that retailers and tech providers could implement in order to alleviate the supply risks.

The reduction of manual labor through automation also lifts social and operational risks posed by the displacement of workforce. Employee and labor union resistance aganst automation may slow down its implementation. Retailers must invest in workforce reskilling programs, hybrid automation models, and employee engagement strategies to help workers adapt and preserve operational efficiency.

The companies should make the cybersecurity, regulatory compliance, and supply chain robustness the main focus for their long-term success. The incorporation of AI in customer experience growth, green automation technologies, and the seamless connection between humans and machines will be the main aspects of a competitive edge in the retail automation field in North America and Europe.

| Country | CAGR (%) |

|---|---|

| USA | 9.5% |

| Canada | 9.2% |

| Mexico | 9% |

| UK | 9.1% |

| Germany | 9.3% |

| France | 9.2% |

Retail automation in the United States is advancing at a fast rate, driven by AI-capable technologies, rising labor costs, and demands for frictionless shopping. Retailers are adopting self-checkout kiosks, AI-capable inventory systems, and cashier-less stores to improve efficiency and enhance customer experiences.

Cloud-based retail management, robot warehouse automation, and smart checkout solutions are rewriting the rules. AI-capable personalization and autonomous delivery solutions are also revolutionizing retail.

Amazon, Walmart, and NCR Corporation spend on smart analytics, fraud detection, and real-time inventory management to streamline operations and boost customer satisfaction.

Canadian retail automation is on the rise as e-commerce growth accelerates, digital transformation intensifies, and frictionless retail experiences become crucial. Retailers are adopting contactless payments, automated checkouts, and AI-driven customer analytics to improve efficiency.

Energy-efficient automation solutions and sustainability are key motivators. Robot fulfillment centers and intelligent warehouses also revolutionize supply chains.

Shopify, Loblaw Companies, and Lightspeed invest in AI-based recommendation engines, smart pricing, and automated store operations to meet evolving consumer demands.

Mexico's retail automation is expanding due to the rising penetration of smartphones, growing demand for intelligent payment technology, and construction of retail infrastructure. Retailers are adopting AI-based point-of-sale (POS) devices, mobile payment checkout counters, and RFID inventory tracking.

Digital payments and Omni channel retailing drive automation programs in supermarkets, convenience stores, and department stores. Intelligent kiosks and automated vending solutions are transforming shopping experiences in cities.

Femsa, Soriana, and OXXO are implementing AI-driven sales forecasting, automated inventory tracking, and self-service retail to fuel customer engagement and efficiency.

UK retail automation is shifting with smart retail initiatives, AI-driven shopping solutions, and increasing demand for contactless interactions. Retailers employ self-service kiosks, automated fulfillment warehouses, and AI-driven fraud detection to optimize operations.

Omni channel retail and smart checkout technologies make consumer life more convenient. AI-driven demand planning, one-to-one marketing, and voice commerce are revolutionizing retail.

Tesco, Ocado, and Marks & Spencer invest in AI-based automated inventory management, cashier-less stores, and robot-powered fulfillment to bring efficiency.

German retail automation is on the rise with smart retail solutions, AI-powered pricing, and autonomous shopping. Retailers focus on automated customer care, self-checkout, and real-time demand analysis.

Cloud-based retail management, automated replenishment, and AI-driven logistics optimization improve supply chains. Intelligent vending and automatic stores are also becoming popular.

Aldi, Lidl, and Metro AG are investing in RFID-based inventory management, self-service checkouts, and AI-driven insights to drive digital transformation.

French retail automation is on the rise as customers' expectations for convenient shopping keep growing. AI-powered merchandising and digital retail initiatives backed by the government fuel digital retail growth. Retailers implement contactless payments, cashier less stores, and AI-powered pricing to remain competitive.

Intelligent inventory management, automated warehouses, and AI-facilitated supply chain analysis enhance retail effectiveness. Customized digital marketing and self-optimizing recommendation algorithms further improve customer engagement.

Carrefour, Auchan, and Casino Group invest in AI-powered demand planning, self-checkout solutions, and automation-enabled customer experiences to optimize operations.

The industry is growing buoyantly due to the need for streamlining operations, enhanced efficiency, and digital transformation for improving customer experience. Adoption of AI-powered checkout solutions, Smart inventory management systems, and Automated fulfillment technology are key drivers of the industry. Retailers invest in self-service kiosks, robotic warehouses, and analytics powered by artificial intelligence (AI) to optimize performance and enhance customer engagement.

Key technology companies, solution automation providers, and innovative startups are leading the industry toward a higher stage of retail automation. Key Players in The Industry Are: Zebra Technologies, NCR Corporation, Toshiba Global Commerce Solutions, Honeywell International Inc., and Diebold Nixdorf.

These businesses use broad distribution networks, strong brand value, and continuous innovation to stay ahead of the game. Frictionless checkout, cloud-based retail management, and AI-powered demand forecasting are other areas of focus for emerging players.

Some of the growth drivers for the retail automation industry are machine learning advancements, increasing labor costs, and the growing requirement for a seamless Omni channel shopping experience. Companies are working on areas such as expanding product portfolios, applying AI to retail workflows, and improving cybersecurity for digital retail spaces.

When defining the dynamics of competition, strategic implications include the competitiveness of prices, the scalability of technology, and, of course, the ultimate goal of automating as much as possible both in a brick-and-mortar store and through e-commerce. As consumers turn elsewhere, brands need data-driven insights, personalized customer interactions, and improvements in operational efficiency to stand out in an era of automation-redesigned retail.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Zebra Technologies | 20-25% |

| NCR Corporation | 15-20% |

| Toshiba Global Commerce Solutions | 12-16% |

| Honeywell International Inc. | 10-14% |

| Diebold Nixdorf | 6-10% |

| Other Companies (combined) | 30-40% |

| Company Name | Key Offerings/Activities |

|---|---|

| Zebra Technologies | Provides AI-based inventory management and RFID-based automation solutions. |

| NCR Corporation | Helps in self-checkout kiosks, point-of-sale (POS) automation, and digital payment systems. |

| Toshiba Global Commerce Solutions | It specializes in cloud retail automation, smart checkout, and digital retail solutions. |

| Honeywell International Inc. | Provides AI-driven customer analytics and automated retail workflow management. |

| Diebold Nixdorf | Providers of self-service banking and retail automation solutions, including smart cash management |

Strategic Outlook of Key Companies

Zebra Technologies (20-25%)

Zebra has established its leadership position in the retail automation industry with innovations in RFID-based tracking, AI-enabled inventory solutions, and intelligent scanning technologies that empower retailers to enhance overall efficiency.

NCR Corporation (15-20%)

NCR is disrupting retail with leading self-service kiosks, mobile POS solutions, and integrated cloud-enabled checkout technologies.

Toshiba Global Commerce Solutions (12-16%)

Via cloud computing, smart checkout systems, and real-time analytics, Toshiba is modernizing retail automation and ushering in a new era of seamless customer experience.

Honeywell International Inc. (10-14%)

Honeywell is streamlining retail environments through its AI-based analytics, automated order processing, and workflow management solutions for retailers.

Diebold Nixdorf (6-10%)

Diebold Nixdorf is leading the way in self-service retail automation with smart cash management and intelligent checkout systems for more efficient transactions.

Other Key Players (30-40% Combined)

The market is divided into North America, further sub-segmented into the United States, Canada, and other countries, and Europe, segmented into Spain, France, the United Kingdom, and others.

The industry includes unattended terminals that function without direct human intervention and human-operated terminals that require manual operation.

The industry covers currency counters, barcode readers, bill printers, cash counters, cash registers, card readers, self-checkout systems, weight scales, kiosks/vending machines, and others.

Table 1: Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Market Value (US$ Million) Forecast by Operator Type, 2018 to 2033

Table 3: Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 4: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 5: North America Market Value (US$ Million) Forecast by Operator Type, 2018 to 2033

Table 6: North America Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 7: Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 8: Europe Market Value (US$ Million) Forecast by Operator Type, 2018 to 2033

Table 9: Europe Market Value (US$ Million) Forecast by Product, 2018 to 2033

Figure 1: Market Value (US$ Million) by Operator Type, 2023 to 2033

Figure 2: Market Value (US$ Million) by Product, 2023 to 2033

Figure 3: Market Value (US$ Million) by Region, 2023 to 2033

Figure 4: Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 5: Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 6: Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 7: Market Value (US$ Million) Analysis by Operator Type, 2018 to 2033

Figure 8: Market Value Share (%) and BPS Analysis by Operator Type, 2023 to 2033

Figure 9: Market Y-o-Y Growth (%) Projections by Operator Type, 2023 to 2033

Figure 10: Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 11: Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 12: Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 13: Market Attractiveness by Operator Type, 2023 to 2033

Figure 14: Market Attractiveness by Product, 2023 to 2033

Figure 15: Market Attractiveness by Region, 2023 to 2033

Figure 16: North America Market Value (US$ Million) by Operator Type, 2023 to 2033

Figure 17: North America Market Value (US$ Million) by Product, 2023 to 2033

Figure 18: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 19: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 20: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 21: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 22: North America Market Value (US$ Million) Analysis by Operator Type, 2018 to 2033

Figure 23: North America Market Value Share (%) and BPS Analysis by Operator Type, 2023 to 2033

Figure 24: North America Market Y-o-Y Growth (%) Projections by Operator Type, 2023 to 2033

Figure 25: North America Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 26: North America Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 27: North America Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 28: North America Market Attractiveness by Operator Type, 2023 to 2033

Figure 29: North America Market Attractiveness by Product, 2023 to 2033

Figure 30: North America Market Attractiveness by Country, 2023 to 2033

Figure 31: Europe Market Value (US$ Million) by Operator Type, 2023 to 2033

Figure 32: Europe Market Value (US$ Million) by Product, 2023 to 2033

Figure 33: Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 34: Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 35: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 36: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 37: Europe Market Value (US$ Million) Analysis by Operator Type, 2018 to 2033

Figure 38: Europe Market Value Share (%) and BPS Analysis by Operator Type, 2023 to 2033

Figure 39: Europe Market Y-o-Y Growth (%) Projections by Operator Type, 2023 to 2033

Figure 40: Europe Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 41: Europe Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 42: Europe Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 43: Europe Market Attractiveness by Operator Type, 2023 to 2033

Figure 44: Europe Market Attractiveness by Product, 2023 to 2033

Figure 45: Europe Market Attractiveness by Country, 2023 to 2033

The industry is expected to generate USD 20.92 billion in revenue by 2025.

The industry is projected to reach USD 55.70 billion by 2035, growing at a CAGR of 9.6%.

Key players include Zebra Technologies, NCR Corporation, Toshiba Global Commerce Solutions, Honeywell International Inc., Diebold Nixdorf, Amazon Go (Amazon Just Walk Out), SAP SE, Fujitsu Limited, IBM Corporation, and Blue Yonder.

The United States and Germany, due to the rapid adoption of AI-powered retail solutions, increased investments in cashier-less stores, and rising demand for smart inventory management.

Self-checkout and AI-powered POS (Point-of-Sale) systems dominate due to their ability to reduce checkout times, enhance customer experience, and improve operational efficiency.

Explore Similar Insights

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA