The global Non-Woven Fabric industry is experiencing significant growth due to increasing demand for lightweight, durable, and cost-effective fabric solutions across healthcare, automotive, construction, and personal care sectors. Advances in material technology, sustainability initiatives, and the adoption of high-performance non-woven textiles are reshaping the competitive landscape.

Market growth is driven by rising demand for eco-friendly, disposable, and reusable fabric applications, regulatory support for sustainable materials, and innovations in biodegradable and smart textiles. As cost-efficiency and quality become priorities, manufacturers are investing in advanced fiber processing, sustainable raw materials, and automation technologies.

Market Leaders & Competitive Landscape

Explore FMI!

Book a free demo

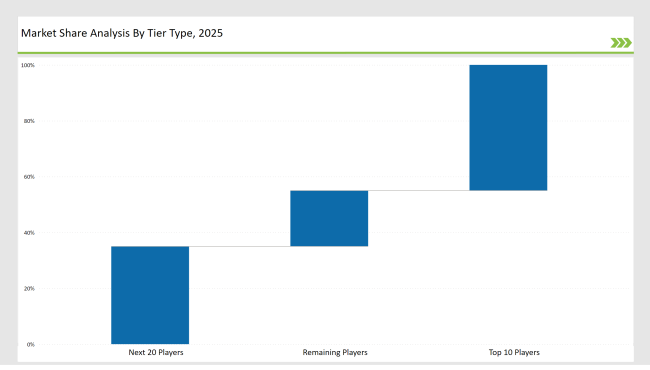

Global Market Share by Key Players (2025)

| Category | Market Share (%) |

|---|---|

| Top 3 (Berry Global, Freudenberg, Ahlstrom-Munksjö) | 18% |

| Rest of Top 5 (Kimberly-Clark, DuPont) | 15% |

| Next 5 of Top 10 | 12% |

The demand for high-quality non-woven fabrics is increasing across multiple industries:

Manufacturers are focusing on innovative solutions to meet evolving market needs:

Year-on-Year Leaders

To stay competitive in the non-woven fabric industry, suppliers should focus on:

| Tier Type | Example of Key Players |

|---|---|

| Tier 1 | Berry Global, Freudenberg, Ahlstrom-Munksjö |

| Tier 2 | Kimberly-Clark, DuPont, Glatfelter |

| Tier 3 | TWE Group, Johns Manville, Suominen |

| Manufacturer | Latest Developments |

|---|---|

| Berry Global | Launched high-durability, sustainable non-wovens (March 2024) |

| Freudenberg | Expanded advanced filtration non-wovens (July 2023) |

| Ahlstrom-Munksjö | Developed biodegradable medical fabrics (October 2023) |

| Kimberly-Clark | Innovated in ultra-soft, breathable non-woven textiles (February 2024) |

| DuPont | Introduced high-protection non-woven materials (May 2024) |

The Non-Woven Fabric industry is transitioning toward sustainability, efficiency, and advanced material innovations. Key players are emphasizing:

The industry is expected to advance in:

Rising demand for lightweight, durable, and sustainable fabric solutions.

Berry Global, Freudenberg, Ahlstrom-Munksjö, Kimberly-Clark, and DuPont.

Biodegradable non-wovens, smart textiles, and advanced filtration materials.

Asia-Pacific, North America, and Europe.

Companies are investing in biodegradable fibers, recycled materials, and eco-friendly manufacturing processes.

Nitrogen Flushing Machine Market Report – Trends, Size & Forecast 2025-2035

Pan Liner Market Insights – Demand, Growth & Industry Trends 2025-2035

Perfume Filling Machine Market Report – Trends, Demand & Industry Forecast 2025-2035

Molded Pulp Packaging Machines Market Analysis - Growth & Forecast 2025 to 2035

Packaging Tensioner Market Analysis - Growth & Forecast 2025 to 2035

Packaging Films Market Analysis by Product Type, Material Type and End Use Through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.