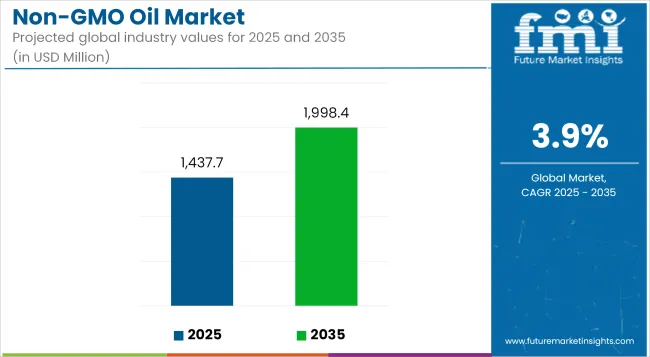

According to recent market analysis, non-GMO oil industry revenues stood at USD 1,437.7 million in 2025 and are forecast to reach USD 1,998.4 million by 2035, reflecting a CAGR of 3.9%.

| Attributes | Description |

|---|---|

| Estimated Size (2025E) | USD 1,437.7 million |

| Projected Value (2035F) | USD 1,998.4 million |

| Value-based CAGR (2025 to 2035) | 3.9% |

The market has benefited from increasing consumer preference for cleaner labels, plant-derived oils, and sustainable agricultural practices. As the food and beverage industry intensifies its focus on traceable and non-bioengineered ingredients, non-GMO oils have witnessed growing traction in both developed and emerging economies.

Growth in the market has been primarily influenced by rising demand in processed food, bakery, infant nutrition, and nutraceutical formulations that avoid genetically modified content. Key consumer groups have shown growing intolerance or skepticism towards GMOs, further reinforcing industry investments in non-GMO-certified raw material sourcing.

Despite this positive momentum, the market faces constraints in the form of high raw material sourcing costs, certification overheads, and limited supply-chain infrastructure, particularly in geographies with dominant GMO cultivation. Major players are focusing on expanding organic and non-GMO verticals, upgrading processing facilities, and obtaining regulatory and third-party certifications to solidify trust and drive sales through retail and institutional channels.

Over the coming decade, the non-GMO oil market is expected to diversify across new oil types, with opportunities emerging in sunflower, safflower, and canola oils. By 2025, soybean oil is anticipated to maintain its dominance due to established supply chains and affordability. However, by 2035, specialty oils are likely to gain higher adoption due to enhanced nutritional attributes and alignment with clean-label product development.

E-commerce and direct-to-consumer distribution models are projected to gain share, driven by consumers seeking transparency and health-centric brands. Regulatory clarity, technological intervention in non-GMO breeding, and growing institutional procurement are expected to be pivotal in scaling this niche but increasingly influential market.

The below table presents a comparative assessment of the variation in CAGR over six months for the base year (2024) and current year (2025) for the global Non-GMO Oil market. This analysis reveals crucial shifts in performance and indicates revenue realization patterns, thus providing stakeholders with a better vision of the growth trajectory over the year. The first half of the year, or H1, spans from January to June. The second half, H2, includes the months from July to December.

| Particular | Value CAGR |

|---|---|

| H1 (2024 to 2034) | 2.2% |

| H2 (2024 to 2034) | 2.9% |

| H1 (2025 to 2035) | 3.2% |

| H2 (2025 to 2035) | 3.9% |

In the first half (H1) of the decade from 2025 to 2035, the business is predicted to surge at a CAGR of 2.2%, followed by a slightly higher growth rate of 2.9% in the second half (H2) of the same decade. Moving into the subsequent period, from H1 2025 to H2 2035, the CAGR is projected to increase slightly to 3.2% in the first half and remain relatively moderate at 3.9% in the second half.

The infant nutrition segment is expected to account for 12.6% of the global non-GMO oil market in 2025. This segment plays a strategic role as demand intensifies for clean-label, allergen-safe, and non-GMO-certified ingredients in early-life formulations.

Driven by evolving parental preferences, particularly across North America and Europe, non-GMO oils such as high-oleic sunflower, canola, and soybean are increasingly being used in infant formulas, cereals, and toddler-specific nutritional products.

Regulatory alignment with agencies such as the European Food Safety Authority (EFSA) and USA Food and Drug Administration (FDA) mandates heightened scrutiny of GMO content in pediatric nutrition, thereby accelerating non-GMO ingredient adoption.

Major brands like Danone and Nestlé have introduced or reformulated products to exclude GMOs, thereby creating demand consistency for non-GMO oils sourced through identity preservation (IP) programs. Furthermore, formulators prefer non-GMO oils for their stability, light flavor, and suitability in DHA/ARA-enhanced blends without triggering labeling liabilities.

Despite relatively higher input costs and limited origin-certified sources in Latin America and Asia, specialized nutrition formulators are increasingly securing non-GMO oil through contract farming and integrated supplier networks. This segment is expected to see further growth through increased awareness of early nutrition quality and expanded non-GMO labeling compliance globally.

Retail-based private label offerings are estimated to hold 17.3% of the market in 2025. This segment is strategically vital as mass-market retailers intensify their focus on health-conscious consumer segments by introducing affordable non-GMO oil options under their own brands.

Retail giants such as Aldi, Kroger, and Carrefour have expanded shelf space for private label non-GMO oils, especially soybean, sunflower, and canola variants, driven by increasing demand for traceable and ethically produced culinary oils.

The Non-GMO Project Verified certification has become a key purchase driver, with retail chains capitalizing on consumer trust associated with third-party assurance. Store-brand positioning enables cost competitiveness without compromising on clean-label claims.

Technological integration in labeling and QR-code transparency tools has further enhanced consumer confidence. In Western Europe and North America, private label penetration has reached saturation levels in organic and natural grocery segments, making non-GMO oils a next-tier differentiation strategy.

Growth in this segment is supported by strategic partnerships with mid-sized crushers and refiners in Eastern Europe and Canada that maintain GMO-free production zones. The segment is forecasted to exhibit stable momentum through 2030, with innovations such as glass bottle packaging, cold-pressed variants, and sustainable farming narratives strengthening private label brand equity.

Rising Consumer Demand for Clean Label Products

The request for clean label products is the main factor affecting the Non-GMO oil market. Nowadays consumers prefer to see food labeling more transparent and want to have no artificial ingredients, preservatives, and GMO in the products. This trend has especially gained the attraction of millennials and people who are same as them whipped for a fit, healthy diet. Producers start the move.

They change the recipes of their products in order to meet these customer preferences, which causes the increase of the amount of Non-GMO oils in the market. In addition to this, brands develop marketing campaigns that emphasize their commitment to clean label. This causes the interest of the consumer to continue to grow.

The growth of this segment is also due to a greater number of people who want to actively include non-GMO oils into their healthy lifestyle.

The rise of plant-based diets is another key trend influencing the Non-GMO oil market.

The growth of the plant-based diet is a significant trend affecting the Non-GMO oil market. The increasing number of people choosing vegetarian and vegan lifestyles is the main reason why the demand for plant-based oils has been on the rise. Non-GMO oils like canola and olive oils are usually preferred because of their health advantages and the large number of ways they can be used in cooking.

This trend is strengthened by an uphill trend of research that has consistently revealed that plant-based diets are highly beneficial to people. The manufacturers are taking the opportunity of this trend by advocating their Non-GMO oils as the required ingredients in a healthy, plant-based diet.

The above mention trend has also increased the popularity of plant-based food products, such as meat alternatives, and dairy substitutes, which further drives the demand for Non-GMO oils in food preparation and cooking.

Sustainability and ethical sourcing are becoming increasingly important to consumers

Sustainability and ethical sourcing have gained traction among consumers and are now affecting their choices of products in the Non-GMO oil market. Consumers are more often looking for products that come in kin with their personal value of ecological sustainability and responsible sourcing as the consciousness about environmental problems is spreading among them.

Adopting organic oils over certain foods is likely to be the consumers' choice because they believe that these products are produced without the use of pesticides that are known to negatively affect biodiversity and ecosystems. To conform to this trend, retailers are choosing sustainable methods of production and are sourcing their raw materials from responsible suppliers.

This approach provides a double benefit since the company's green posture not only draws attention to consumers who care about the environment but also increases their loyalty and trust. Due to the ever-increasing demand for sustainable products, the Non-GMO oil market is foreseen to be in an advantageous position where more consumers will choose oils that are in line with their ethical choice.

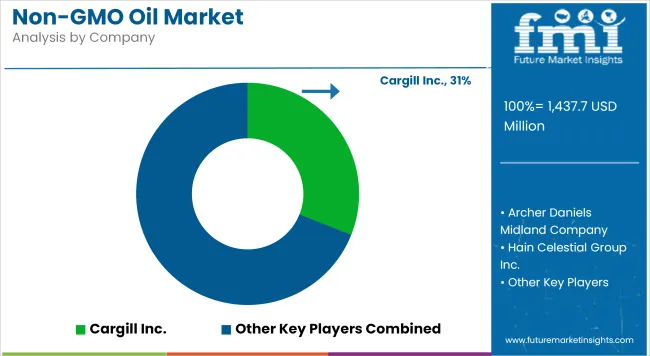

The world Non-GMO oil market is made up of many companies that are arranged into different categories according to how actively they participate in the market, how much they generate revenue, and what they excel at.

Tier 1 companies are the top ones in the Non-GMO oil market, and that is why they are the main players in the Non-GMO oil sector. They hold a significant global presence and have extensive revenue streams. For example, Cargill Inc., Chosen Foods LLC, and Spectrum Organic Products, LLC have made them believe and gain leadership by offering many different types of Non-GMO oils such as canola, olive, and specialty oils.

The companies use modern manufacturing techniques and a comprehensive supply chain to fulfill the specifications of the client, international standards, and quality of the product. Their known strong brand and producer of advanced products lead them to continue to be the first in the market.

Tier 2 companies are powerful in specific areas of the geography and are those companies that have a focused product offer of the Non-GMO oil market. Companies like Jedward International, Inc. and Pleasant Valley Oil concentrate on small, or niche, markets, producing Non-GMO oils of top quality that are requested by local consumers. These companies are frequently engaged in strategic partnerships and collaborations in order to broaden their market presence and to add new links to their distribution network. . With the focus on particular geographic areas or product categories, Tier 2 companies are capable of competing with larger firms on their own, while at the same time serving their clientele in an exclusive way.

The following table shows the estimated growth rates of the top five territories. These countries are set to exhibit high consumption through 2035.

| Countries | CAGR 2025 to 2035 |

|---|---|

| USA | 2.6% |

| Germany | 3.2% |

| China | 4.5% |

| Japan | 5.5% |

| India | 6.6% |

The United States is one of the world's biggest markets for Non-GMO oils due to the fact that more and more consumers are opting for health-focused and organic products. The interest in Non-GMO oils, mainly canola and olive oil, has increased significantly due to consumers' knowledge of the possible health hazards that can be caused by genetically modified organisms.

This is the USA market that offers a variety of products from both famous brands and new sellers that are trying to win back market share. Non-GMO options are being prioritized more often by the retailers which cause that to happen. Therefore a higher number of them is found in supermarkets and health food stores.

The e-commerce channel shows a huge potential in getting people to access non-GMO oils which ancestors way more growth for the market. The Non-GMO oil this changes it trends after clean label's hiking it growth in the USA considerably by the next couple of years.

Germany is among the major players in the European Non-GMO oil industry, and more than anything else, it pushes the idea of organic and natural products. As part of the health and sustainability commitment, the German consumers constantly turn to Non-GMO oils. The market is characterized by the fact that consumers are quite knowledgeable about food labelling and ingredient sourcing, which leads to the increased demand for clean label products.

In keeping with this trend, German manufacturers are now producing a wide range of Non-GMO oils, like canola and sunflower oil, which are mostly certified organic. The distribution of Non-GMO oils in Germany is secured by a high number of shops, including those selling health food, supermarkets, and online stores. The Non-GMO oil market is bound to flourish since the consumers are more inclined to choose sustainable products, therefore, slowly but surely, the number of people consuming Non-GMO oils is rising.

Lesser-known health and nutrition issues among consumers are being addressed as India turns to Non-GMO oils becoming a substantial market for it. The citizens of India are now more aware of the specifics of their food, which results in wanting more natural and organic products in the market, i.e. Non-GMO oils.

Consumers who prefer healthy diets are not only using traditional oils such as mustard oil and groundnut oil but also adding Non-GMO such as canola and sunflower oils to the dietary pattern. The sector is populated by local and international businesses and one of the many scopes of companies is to instruct the public on the benefits of Non-GMO oils.

Besides, the entry of new retail forms and e-commerce platforms is multiplying the availability of Non-GMO oils throughout the country. As a result of the ever-stronger focus on eating healthier, the market for Non-GMO oils in India will evoke a spectacular jump, especially in terms of the rising demand from consumers, a fundamental shift towards clean label products, and other factors.

The advancement in the Non-GMO oil market is attributed to the continuously increasing demand of health-conscious consumers for more natural and healthier options. The top players like Cargill Inc., Chosen Foods LLC, and Spectrum Organic Products, LLC are leading the way in this competitive environment by utilizing their enormous product catalogs and the highly recognized brands to grab a slice of the market.

These firms are implementing strategies such as advertising and product innovations to set themselves apart from their rivals and satisfy the changing customer preferences that are more focused on health.

Apart from the well-known firms, a couple of small and local companies are entering the Non-GMO oil market with their own power by creating niche markets and selling unique products. Such businesses very often highlight their commitment to both the sustainability and the ethical sourcing path, thus in this way, appealing to those environmentally conscious consumers.

The competition has further been intensified with the new companies that are recognizing the trend of clean label products and the fact that GMOs are related with certain health issues that are known to more people.

The global industry is estimated at a value of USD 1,437.7 million in 2025.

Sales increased at 4.6% CAGR between 2020 and 2024.

The Asia Pacific territory is projected to hold a significant revenue share over the forecast period.

The industry is projected to grow at a forecast CAGR of 3.9% from 2025 to 2035.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Oilfield Scale Inhibitor Market Size and Share Forecast Outlook 2025 to 2035

Oil-in-Water Anionic Emulsifier Market Size and Share Forecast Outlook 2025 to 2035

Oil and Gas Field Services Market Size and Share Forecast Outlook 2025 to 2035

Oil Control Shampoo Market Size and Share Forecast Outlook 2025 to 2035

Oil Expellers Market Size and Share Forecast Outlook 2025 to 2035

Oilfield Stimulation Chemicals Market Size and Share Forecast Outlook 2025 to 2035

Oiler Kits Market Size and Share Forecast Outlook 2025 to 2035

Oil Pressure Sensor Market Size and Share Forecast Outlook 2025 to 2035

Oil Filled Power Transformer Market Size and Share Forecast Outlook 2025 to 2035

Oily Skin Control Products Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Oil Immersed Shunt Reactor Market Size and Share Forecast Outlook 2025 to 2035

Oil Country Tubular Goods Market Size and Share Forecast Outlook 2025 to 2035

Oil Filled Distribution Transformer Market Size and Share Forecast Outlook 2025 to 2035

Oilfield Communications Market Size and Share Forecast Outlook 2025 to 2035

Oil & Gas Electrification Market Size and Share Forecast Outlook 2025 to 2035

Oil and Gas Accumulator Market Size and Share Forecast Outlook 2025 to 2035

Oil Based Electric Drive Unit (EDU) Market Size and Share Forecast Outlook 2025 to 2035

Oil & Gas Infrastructure Market Size and Share Forecast Outlook 2025 to 2035

Oil & Gas Analytics Market Size and Share Forecast Outlook 2025 to 2035

Oil Storage Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA