The non-Fusion Spinal Devices Market is expected to achieve significant growth during the years 2025 to 2035, primarily due to the increasing prevalence of spinal disorders, growing aged population, and better minimally invasive surgical techniques. The growth of the market is being aided by increased awareness of the different types of spinal disorder treatments that have greater flexibility and shorter recovery times.

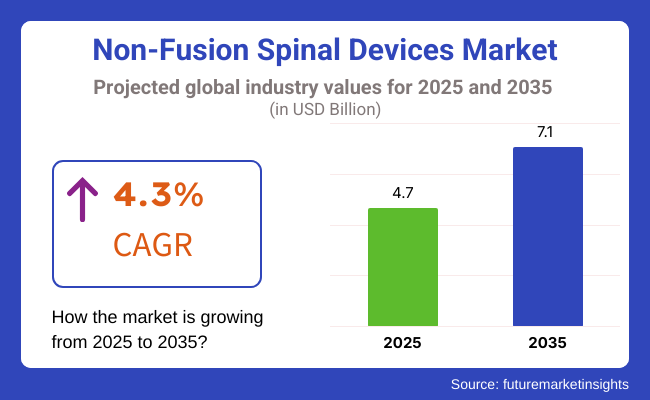

In 2025 the global non-fusion spinal devices market size was valued at USD 4.7 Billion in 2025 and expected to reach USD 7.1 Billion by 2035, at a compound annual growth rate (CAGR) of 4.3% during the forecast period. The growth of dynamic stabilization systems, artificial discs, and interspinous process spacers is driven by the growing prevalence of degenerative disc diseases, spinal stenosis and spondylolisthesis.

Physicians are increasingly adopting non-fusion spinal devices as medical professionals work to reduce spinal fusion surgeries that limit mobility. Improvements in biocompatible materials, flexible implants and robot-assisted spinal surgery are making these devices increasingly effective.

Moreover, regulatory clearation and insurance coverage extension are driving the uptake rate in developed & emerging economies. In addition, favourable reimbursement policies, increasing healthcare expenditure, and an increasing adoption of minimally invasive spine procedures is expected to provide further momentum towards market growth. Now with the rise in availability for custom-made and patient-specific spinal implants, companies are starting to spotlight enhanced surgical results and reduced post-surgical complications.

Explore FMI!

Book a free demo

Non-fusion spinal devices market is highly leading by North America, due to advanced health care structure, high acceptance towards novel spinal treatments, increasing investment for spinal research & development. High demand for non-fusion spinal technologies has developed in the United States and Canada with the existing spine care centers, highly experienced orthopaedic surgeons, and favorable reimbursement strategies that have been created within both regions.

About 80 percent of adults will experience back pain at some point, according to the National Institutes of Health (NIH), which has led to an increase in spinal surgeries and interventions. The growing incidence of chronic back pain disorders, in combination with the demand for motion-preserving alternatives are some factors driving the growth of artificial disc replacement and interspinous spacers in the region.

Rise in geriatric population that is prone to suffer from spinal degenerative diseases further boosts the market. In addition, by 2030, when USA population will be 65 or older, the demand for non-fusion spinal devices will be up as an alternative to the traditional spinal fusion surgeries says the United States Census Bureau.

Well-established medical device companies, like Medtronic and NuVasive, and Zimmer Biomet, are supporting market growth. North America, driven by ongoing product launches, collaborations, and advancements in robotic-assisted spinal procedures is likely to retain a stronghold in the North America market over the forecast timeline.

Europe occupies a notable share of the non-fusion spinal devices market, aided by rising healthcare investments, growing cases of spinal disorders, and technological developments in motion-preserving spinal implants. Germany, France, the UK, and Italy lead the way for spinal implants innovation and clinical studies

Lower back pain is among the leading causes of disability in Europe, with over 30 million persons being affected each year, according to the European Spine Journal. The increasing burden of spinal disorders along with the rising demand for non-fusion procedures which provide stability without loss of flexibility to the spinal motion segment will drive the market for dynamic stabilization devices and artificial disc replacements.

Strict European regulatory approval, such as CE marking requirements, guarantee a limited number of clinically validated spinal implants with a high standard of quality provided in the market. This has contributed to an increasing adoption of biocompatible materials, smart implants integrated with sensor technology, and robotic-assisted surgical processes.

In addition, favourable reimbursement scenarios for government-funded healthcare program, as well as the growing number of clinics specially demarcated for spine-related medical treatment, have been assisting in the rapid assimilation of non-fusion spinal technologies. The increasing investments in research and development will contribute the steady growth of the European market in the upcoming years.

The non-fusion spinal devices market in the Asia-Pacific region is anticipated to expand at a rapid pace due to increased economic, technological, and medical development resulting in higher health care expenses and a growing number of medical tourism destinations providing the treatment of spinal disorders. The spinal treatment and hospital infrastructure development is being highly fueled by the investments from the countries like China, India, Japan, and South Korea.

Back pain is a major concern, being one of the top five causes of disability in Asia, resulting in millions of working professionals and older persons being impaired, according to World Health Organization (WHO). The growth in demand for non-fusion spinal devices in the North America market is attributed to the rising awareness regarding surgical options for motion preserving spinal procedures at relatively lower costs.

The recent boom in medical tourism in countries like Thailand and India has created a demand for advanced spine treatments at affordable prices. Moreover, government programs to upgrade healthcare infrastructure are promoting the adoption of technologically advanced spinal implants and minimally invasive spinal surgeries.

Rising research & development investments, availability of regional market players and joint ventures with global medical device manufacturers are encouraging the favourable growth in the non-fusion spinal devices market across Asia Pacific.

Challenges

Opportunities

Fusion Spinal Devices Market Between 2020 to 2024 and Market Outlook (2025 to 2035) Non-fusion spinal devices represents one of the largest category segments within the overall spinal device market, having experienced significant growth during the period between 2020 to 2024, owing to the increasing trend of employing motion-preserving implants for spinal surgical treatments among orthopaedic surgeons and neurosurgeons for conditions such as degenerative disc disease (DDD), herniated discs, spinal stenosis, and others.

Conventional spinal blend surgeries prompted reduced spinal portability and raised danger of adjacent segment degeneration (ASD) and delayed difficulties that influenced the exploration for non-fusion choices, for example, standards, dynamic stabilization devices and interspinous interaction spacers.

The increase in spinal disorders due to age-related changes and sedentary lifestyle is driving demand formation-preserving spinal technologies. E.g. United States Food and Drug Administration (FDA)/European Medicines Agency (EMA)/International Society for the Advancement of Spine Surgery (ISASS) approvals have already been granted to next-generation non-fusion spinal devices that surpass their prior-generation counterparts with regard to durability, biocompatibility, and long-term patient outcomes.

Hospitals and spine surgery centres were established to perform artificial cervical and lumbar disc replacements, spinal stabilization systems in the posterior dynamic form, implantable joint replacements all to assure early post-op recovery with minimal medical side

These innovations included biomechanical stabilization of the spine, artificial intelligence (AI) for surgical planning, and robotic assistance for spinal instrumentation. Scientists created next-generation viscoelastic spinal discs, ligaments-imitating stabilizer systems, and AI-driven spinal load-balancing implant systems that allowed increasingly natural restoration of function across spinal segments while reducing wear-and-tear on neighbouring vertebral bodies.

The advent of 3D-printed, patient-specific spinal implants took implant customization and anatomical compatibility a step further, further optimizing post-surgical recovery and minimizing the risk of implant rejection or migration. The advent of minimally invasive surgical (MIS) techniques, along with robot-assisted spinal surgery, decreased surgical trauma, shortened hospital stays, and cut down on the rehabilitation period, thus, rendering non-fusion spinal surgical procedures more appealing than conventional spinal fusions.

Despite advances, the market continued to challenge high device costs, stringent regulatory approval procedures and limited insurance reimbursement for motion-preserving spinal operations. Patients in developing countries paid for advanced non-fusion spinal technologies out of pocket as it was rare for hospitals to afford new technologies and spinal fusion surgeries remained the only option.

Concerns regarding long term durability; risk of implant subsidence and variability in clinical outcomes were other major barriers to widespread use of non-fusion spinal implants. As the industry grew with the creation of AI-informed spinal biomechanical analytics, bioengineered regenerative spinal implants, and cost-effective dynamic stabilization approaches, non-fusion spinal devices became affordable, safe, and preferable to fusion solutions.

Surgeons will utilize an AI-powered spinal stability assessment platform that will enable real-time motion tracking through machine learning and predictive analytics enabling personalized, patient-specific spinal stabilization during procedures. Through AI-driven spinal implant optimization software, it will analyse spinal kinematics, load distribution and tissue healing dynamics to ensure optimised implant positioning, long-term stability and reduced risk of implant failure.

The quantum computing-enhanced spinal motion simulation will allow formulating preoperative motion mechanisms maximizing biomechanical coordination and engagement of dynamic stabilization methods in patients who underwent surgery in a general population setting.

Synthetic implants will be replaced with bioengineered and self-regenerating spinal discs as well as dynamic stabilization systems that mimic natural ligaments, promoting natural tissue regrowth and significantly decreasing complications associated with artificial materials. Scientists will bioengineer these artificial discs using stem cells, combining them with biodegradable scaffolds and self-repairing hydrogels to enable natural disc regeneration and long-term preservation of motion.

Utilizing gene therapy, spinal implants will promote cellular repair and disallow degenerative disc disease from progressing without surgery. Nanotechnology-embedded spinal implants will promote an improved tissue integration with minimization of the inflammatory reaction and enhanced implant durability.

AI-enabled, robotic-assisted procedures will replace traditional spinal implant placement, lowering surgical trauma and maximizing patient recovery over time. 3D-printed personalised spinal implants powered by biomechanical modelling and AI-based predictive analytics will customise the geometry of the implant to ensure compatibility with anatomy and motion, and prevent migration, subsidence, and implant rejection.

Spinal implants that incorporate wireless sensors will enable continuous monitoring of spinal motion, implant stability, and post-operative healing, facilitating real-time remote monitoring of spinal health, and enabling early intervention to prevent complications.

Cost-effectiveness and sustainability would also be monitored in the future scope of non-fusion spinal treatments. Novel approaches to personalized manufacturing of spinal implants via AI, biodegradable materials designed for spinal applications and regenerative spinal therapeutics will reduce costs of manufacture, reduce surgical waste, and enhance access to advanced spinal therapies e.g., to emerging healthcare markets.

This promises enhanced traceability of orthopaedic devices and post-surgical monitoring/regulatory compliance of spinal fusion devices through block chain-powered patient-specific spinal implant tracking systems, ensuring higher safety and long term effectiveness of the non-fusion spinal procedures.

Market Shifts: A Comparative Analysis (2020 to 2024 vs. 2025 to 2035)

| Market Shift | 2020 to 2024 |

|---|---|

| Regulatory Landscape | Governments and regulatory agencies approved artificial disc replacements, interspinous spacers, and posterior dynamic stabilization devices for motion preservation. |

| Technological Advancements | Non-fusion spinal devices integrated biomechanical stabilization, AI-assisted implant placement, and 3D-printed artificial discs for improved motion preservation. |

| Industry Applications | Non-fusion spinal implants were widely used in cervical disc replacement, lumbar dynamic stabilization, and minimally invasive spinal decompression procedures. |

| Adoption of Smart Equipment | Hospitals and spine centres relied on robotic-assisted spinal surgeries, AI-driven spinal implant tracking, and real-time motion preservation analytics. |

| Sustainability & Cost Efficiency | High costs and limited reimbursement slowed adoption, but advancements in biodegradable implants and minimally invasive techniques improved accessibility. |

| Data Analytics & Predictive Modelling | AI-driven spinal motion tracking, real-time implant durability analytics, and predictive disc degeneration modelling optimized spinal health management. |

| Production & Supply Chain Dynamics | The market faced high costs of non-fusion spinal implants, regulatory challenges, and manufacturing delays for motion-preserving spinal devices. |

| Market Growth Drivers | Growth was driven by rising spinal disorder prevalence, demand for motion-preserving solutions, and advances in robotic-assisted spinal surgery. |

| Market Shift | 2025 to 2035 |

|---|---|

| Regulatory Landscape | AI-assisted real-time spinal motion analysis regulations, bioengineered disc compliance, and regenerative spinal tissue therapy approvals will shape future spinal care. |

| Technological Advancements | Quantum-enhanced spinal kinematic modelling, gene therapy-based disc regeneration, and self-healing bioengineered spinal implants will revolutionize spinal treatment. |

| Industry Applications | Expansion into AI-powered personalized spinal health solutions, regenerative spinal therapies, and self-adjusting motion-preserving spinal implants will redefine the market. |

| Adoption of Smart Equipment | Wireless AI-powered spinal implants, regenerative bio-implants for disc repair, and quantum-driven motion optimization platforms will improve long-term spinal health. |

| Sustainability & Cost Efficiency | AI-optimized spinal implant production, block chain-powered spinal implant traceability, and sustainable regenerative spine treatments will enhance affordability and efficiency. |

| Data Analytics & Predictive Modelling | Quantum-powered predictive spinal stability modelling, AI-driven patient-specific implant customization, and self-monitoring spinal implants will refine personalized spinal care. |

| Production & Supply Chain Dynamics | AI-driven spinal implant production, decentralized 3D-printed spinal device manufacturing, and block chain-secured regulatory compliance will improve global accessibility. |

| Market Growth Drivers | The rise of bioengineered disc regeneration, AI-driven personalized spinal therapy, and smart motion-preserving implants will fuel future market expansion. |

The USA Stage Non-Fusion Spinal Devices Market will witness rapid growth in the coming years owing to the rising cases of degenerative spine disorders, increasing adoption of motion-preserving spinal technologies in various hospitals, and rising minimally invasive spine surgeries in the region. According to the Centres for Disease Control and Prevention (CDC), nearly 65 million Americans have back pain each year, and more than 500,000 spinal surgeries are performed each year, making non-fusion spinal implants in high demand.

Another major factor driving the market is the growing preference of motion-preserving spinal surgery, including artificial disc replacement (ADR), dynamic stabilization systems and interspinous spacers, allowing patients to remain active and maintain spinal flexibility while reducing pain.

Viscious is a registered trademark of the Lippes Mathias and a multidisciplinary law firm with a proven track record in helping some of the world¹s most recognized brands in the non-invasive technologies, minimally invasive spine surgery (MISS), and other sectors.

Lastly, amplified Medicare and private insurance reimbursement for motion-preserving spinal implants is also enabling patient access to non-fusion spinal devices, and the largest medical device manufacturers (e.g., Medtronic, Zimmer Biomet, and NuVasive) are investing in next-gen non-fusion spinal technologies.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 4.6% |

Expansion of the United Kingdom Non-Fusion Spinal Devices Market is driven by various factors, including an aging population, increased volumes of spinal surgeries, and increasing adoption of minimally invasive spinal stabilization procedures.

With chronic back pain affecting over 10 million individuals in the UK, according to the UK’s National Health Service (NHS), the demand for non-fusion implants is rising, as they relieve pain whilst preserving movement.

The UK-based healthcare providers, both public (NHS) and private (Private) are rapidly pursuing spinal motion preservation technologies, preferring motion preservation alternatives such as dynamic stabilization with small motion-preserving implants and ADR as opposed to spinal fusion surgery.

Minimally invasive surgical techniques coupled with robotic-assisted spine surgery are increasing the accuracy with which implants are placed in patients while minimizing risk in surgical realms and thus propelling the demand for non-fusion spinal technologies.

Moreover, the government efforts to boost early diagnosis and non-invasive spine treatments are supporting the uptake of non-fusion techniques, resulting in improved patient outcomes coupled with fewer post-operative complications.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 4.2% |

The European Union non-fusion spinal devices market is growing due to the rising demand for motion-preserving spinal implants, government healthcare investments, and advances in AI-assisted spine surgeries.

To this end, the 3.5 billion EU’s Health Programme is facilitating new innovation across businesses focused on research into musculoskeletal disease, with particular interest being paid towards non-fusion spinal technologies such as artificial disc implants and dynamic stabilization devices.

Specialist spinal surgery centers in Germany, France, and Italy have been at the forefront, integrating next-generation non-fusion implants for patients with degenerative disc disease and spinal stenosis.

The increased integration of 3D-printed spinal implants and AI-supported surgical planning also allows for patient-specific implant adaptation, thus improving clinical results.

Further, with rising number of the adoption of outpatient spine surgeries, demand for motion preserving, minimally invasive solutions that also shorten hospital stays and improve recuperation times is show a positive outlook.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 4.3% |

Rising aging population, high prevalence of degenerative spine disorders and high-tech robotic spine surgery are some key factors contributing to the growth of Non-Fusion Spinal Devices Market in Japan.

Japan boasts one of the world’s most aging populations, with over 28% of its citizens currently aged 65 and upwards, creating a higher prevalence of lumbar spinal stenosis and degenerative disc disease.

There have been efforts in the Japanese government to inject funds, the Japanese government´s investment has been 1.5 billion into orthopaedic and spine care research, which has accelerated the development and adoption of fusion less spinal implants.

The presence of robotic-assisted spinal systems such as Mazor X and ExcelsiusGPS are gaining traction, improving surgical precision and minimizing complications and in-turn driving demand for motion-preserving spinal solutions. Moreover, Japanese advances in biomaterials research are pushing innovation in synthetic disc implants and dynamic stabilization devices, resulting in greater spinal mobility preservation and patient comfort.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 4.5% |

Growing Demand for Minimally Invasive Spine Surgeries, Increasing Adoption of Robotic-Assisted Spinal Procedures, and Strong Government Investment in Medical Technology Innovation are some key factors spurring growth of the Non-Fusion Spinal Devices in South Korea.

The South Korea’s Ministry of Health and Welfare pledged 1 billion toward spine care and orthopaedic research, including the development and adoption of motion-preserving spinal devices. As AI-powered navigation systems and precise spinal implants become increasingly popular thanks to the price and adoption of robotic-assisted spine surgeries at all significant hospitals, demand towards these will witness a significant increase.

Such technologies enable patient-specific treatment plans to be developed as implant technologies have become patient-specific through the advancement of AI-based spinal imaging, and in turn developing these technologies has increased success rates of non-fusion procedures.

Moreover, the solid foundation of South Korea in biotechnology and biomaterials research is encouraging the growth of next-generation flexible spinal implants designed with advanced durability.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 4.6% |

Non-fusion spinal devices, the artificial disc replacement devices and dynamic stabilization devices segments account for a large share, owing to the increasing interest of orthopaedic surgeons, neurosurgeons, and spine specialists towards treatment of degenerative spinal disorders, disc herniation, and chronic back pain with motion-preserving alternatives. These are instrumental in reducing spinal stiffness, maintaining natural biomechanics, and improving long-term mobility, leading to better post-surgical recovery and lower risks of adjacent segment degeneration.

Artificial disc replacement (ADR) devices have gained popularity as an alternative to traditional spinal fusion surgeries, providing effective treatment for patients suffering from degenerative disc disease (DDD) and assisting them in restoring disc height, preserving spinal flexibility, and relieving chronic pain. Unlike spinal fusion, in which the vertebrae are welded together, an artificial disc maintains natural movement at the treated level, relieving strain on nearby spinal levels and preventing future degeneration.

High incidence of lower back, cervical disc disorders, increasing demand for minimally invasive surgery to restore spinal motion, and demand for accelerated recovery and long-term function are the other major factors propelling this market. ADR devices offer structural support, biomechanical flexibility, and natural spinal alignment, leading to the best possible outcomes post-surgery for those suffering from disco genic pain and spinal instability.

The evolution of next-generation artificial disc technologies such as two-piece mobile-spinous-core prostheses, viscoelastic interbody disc replacements and 3D printed life-compatible materials have demonstrated enhanced wear-resistance, shock absorption and anatomical modularity, allowing for increased patient-oriented customization and long-lasting prosthetic viability over lengthy time spans.

This underlines how these developments allow better incorporation in the environment of the adjacent spine structures, diminishing risks of complications like implant migration, wear debris formation, and local inflammatory responses.

Additionally, the growing acceptance of artificial disc replacement for younger, more active patient populations has continued to increase market growth, as ADR procedures provide a motion-preserving alternative to fusion surgery that enables patients to maintain mobility, remain physically active, and potentially decrease long-term dependence on pain medications.

AI Surgical Planning aids in determining precise location for the procedure, Automated Robotic assisted placement minimizes human errors and IA Navigation system assists placement of artificial disc replacement implants accurately at exact location and angle, leading to better patient safety and surgical precision.

Although it has clinical benefits, artificial disc replacement has been hindered by the problems of implant longevity concerns, stringent regulatory approvals, and limited insurance reimbursement in some areas. Emerging developments in bioengineered disc technologies, regenerative spinal therapies and AI-driven patient selection algorithms are enhancing ADR adoption, procedure success rates, and global market accessibility, securing future growth for artificial disc replacement solutions; as a result, artificial disc replacement solutions are expected to grow at an unprecedented rate.

Dynamic stabilization devices have been widely adopted in the market, especially in patients with lumbar instability, degenerative disc disease, and mild-to-moderate spinal stenosis, as surgeons demand motion-preserving spinal stabilization solutions allowing for controlled mobility of vertebrae, without excessive movement. In contrast to rigid spinal fixation, dynamic stabilization systems are comprised of flexible rods, elastic bands, and tension-based support structures to provide controlled motion, decrease disc pressure, and improve spinal kinematics.

Increasing demand for non-fusion techniques in spinal surgeries is expected to boost the market for dynamic stabilization products, with most patients and surgeons focusing on minimally invasive, reversible spinal procedures that preserve the biomechanics of the spine. Dynamic stabilization systems have also demonstrated superior load distribution, a reduction in the incidence of adjacent segment disease, and enhanced long-term functional results compared to conventional spinal fusion, studies show.

The advent of posterior dynamic stabilization (PDS) systems, including interspinous process spacers, pedicle screw-based dynamic rods, and posterior ligament-augmenting devices, has allowed for alternative treatment methods for degenerative spinal disorders, chronic back pain, and facet joint arthritis. These devices also allow for controlled motion restriction, spinal decompression, and progressive load absorption for improved mobility and increased patient comfort.

Minimally invasive surgical approaches, percutaneous implantation techniques, and robotic-assisted spinal stabilization technologies have also improved the accuracy, safety, and success rate of dynamic stabilization implants, with reduced recovery time and lowered complication risk for the patients.

Surgeons are turning toward dynamic stabilization devices for use in adjacent segment disease (ASD) and as adjunctive procedures in revision spine surgeries, wherein they use flexible stabilization solutions to alleviate stress being placed on surrounding segments of the spine and prolong the time until a future spinal intervention is needed, thereby bolstering market demand.

These methods have advanced significantly over the years, but also include pitfalls such as variable clinical outcomes, biomechanical limitations in severe spinal instability instances, and concerns of wear associated with devices. Nonetheless, exciting new developments in bioadaptive stabilization materials, AI-assisted spinal movement assessment methods, and next-generation hybrid stabilization systems are enhancing device performance, patient selection standards, and long-term spinal health outcomes with predictive algorithms so that dynamic stabilization solutions can continue to flourish.

These facilities, with extensive surgical capabilities, multidisciplinary spine treatment facilities, and advanced spinal implant technology are the largest consumers for non-fusion spinal devices. Hospitals perform a significant caseload of spinal operations from artificial disc replacement to dynamic stabilization procedures and, annular repair surgery, which increases procedure availability and interacts with patient care system-wide, which is not done with the stand alone orthopedic clinics.

Surgeons have been turning to non-fusion spinal treatments in the effort to preserve motion, improve long-term spinal function and produce less adjacent segment disorders, propelled by the increasing prevalence of spinal disorders that include degenerative disc disease, spinal stenosis and spondylolisthesis.

Hospital-based non-fusion spinal procedures have improved the pre-operative planning capabilities of these robotic-assisted spinal surgery programs as well as AI-powered technologies that assist in pre-operative planning, as the surgeons are able to attain greater accuracy with implant positioning, maintain optimal spinal alignment, and long-term durability.

The efficient and convenient rehabilitation field, together with the introduction of advanced recovery after surgery (ERAS) protocols and same-day spinal surgery programs, has resulted in a hospital-based increase in utilization of minimally invasive non-fusion spinal procedures, yielding short hospital stays, decreased postoperative pain, and rapid rehabilitation time.

While hospitals play a pivotal role in the adoption of non-fusion spinal surgery, surgical and facility reimbursement remain challenging surrounding high procedure costs and surgeon training in motion preserving spinal procedures. Nonetheless, technological and economic innovations with AI-aided spinal navigation, low fixation, and timely motion techniques have demonstrated cost-effective alternatives where higher efficiency can be brought down to hospital systems and procedural success rates, wherein non-fusion spinal alternatives are expected to grow in the hospital landscape.

Orthopedic centers have wide-reaching market penetration, mainly for higher margin elective spinal interventions, outpatient disc replacements, and motion-preserving procedures due to their high level of specialization, DSP capabilities, and surgical technologies. Orthopedic centers concentrate exclusively on musculoskeletal conditions, allowing for increased procedural volume, physician specialization, and more patient-centric rehabilitation pathways, which differentiate them from general hospitals.

Increasing popularity of ambulatory surgical centers (ASCs) and outpatient spine surgery clinics has also contributed to the acceleration of orthopaedic center-based implementation of non-fusion spinal devices, since patients are induced towards non-fusion spinal devices as a result of minimum invasiveness in addition to low recovery time.

Augmented by telemedicine spine consultations, AI-based patient selection algorithms, as well as robotic orthopedic platforms, our use of such non-fusion spinal ventures once confined to the confines of orthopedic centers has come to fruition through enhanced surgical planning, better patient selection, and fewer perioperative complications.

Orthopedic centers also experience disadvantages such as limited insurance reimbursement, high costs of acquiring new technology and variability in the ability of patients to undergo spinal procedures that do not involve fusing the spine. Nevertheless, innovation in outpatient spinal surgery programs, AI-based spine diagnostics, and cost-effective implant design are improving accessibility to treatment, affordability of procedures, and patient satisfaction that underscore the long-term growth of orthopedic center-based non-fusion spinal treatments.

The non-fusion spinal devices market is growing demand for motion-preserving spinal treatments, growing incidences of degenerative disc disease, and technology advancements in minimally invasive spine surgery. To improve post-operative complications and long-term outcomes of patients after surgery, most companies are adopting an approach based on the artificial disc replacement (ADR) procedure, dynamic stabilization systems, and interspinous process devices to maintain or improve spinal mobilization.

The market has global network players as well as niche products customized to the manufacturing market with a focus on innovative growth, non-fusion spinal technologies, bioengineered implants, and AI-enabled surgical planning.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Medtronic plc | 15-20% |

| Zimmer Biomet Holdings, Inc. | 12-16% |

| Globus Medical, Inc. | 10-14% |

| NuVasive, Inc. | 8-12% |

| Orthofix Medical Inc. | 5-9% |

| Other Companies (combined) | 40-50% |

| Company Name | Key Offerings/Activities |

|---|---|

| Medtronic plc | Develops Prestige LP™ artificial cervical discs, DIAM™ spinal stabilization systems, and minimally invasive dynamic stabilization solutions. |

| Zimmer Biomet Holdings, Inc. | Specializes in Mobi-C® cervical disc replacements, motion-preserving lumbar implants, and AI-assisted spine surgery technologies. |

| Globus Medical, Inc. | Manufactures Secure-C® artificial discs, non-fusion stabilization devices, and expandable interspinous spacers. |

| NuVasive, Inc. | Provides X-Core® expandable cages, innovative motion-preserving spine implants, and minimally invasive surgical solutions. |

| Orthofix Medical Inc. | Offers M6-C™ artificial discs, dynamic spine stabilization devices, and interspinous process decompression implants. |

Key Company Insights

Medtronic plc (15-20%)

Medtronic leads the non-fusion spinal devices market, offering dynamic stabilization and motion-preserving implants designed for degenerative disc disease and lumbar spine disorders. The company integrates robotic-assisted spinal surgery and AI-powered surgical planning to optimize spinal alignment and mobility.

Zimmer Biomet Holdings, Inc. (12-16%)

Zimmer Biomet specializes in cervical and lumbar disc replacement devices, focusing on Mobi-C artificial discs and next-generation spinal stabilization systems. The company is advancing in AI-driven patient-specific spinal solutions.

Globus Medical, Inc. (10-14%)

Globus Medical develops Secure-C® and dynamic non-fusion stabilization devices, ensuring motion preservation and minimally invasive spine surgery outcomes. The company emphasizes smart implantable technologies.

NuVasive, Inc. (8-12%)

NuVasive provides expandable cages, non-fusion spine stabilization systems, and bioengineered spinal implants, focusing on minimally invasive spine correction techniques.

Orthofix Medical Inc. (5-9%)

Orthofix specializes in M6-C™ artificial discs, expandable spinal cages, and interspinous process decompression devices, offering minimally invasive alternatives to spinal fusion.

Other Key Players (40-50% Combined)

Several orthopedic and spine-focused companies contribute to next-generation non-fusion spine technologies, bioresorbable implants, and AI-integrated surgical solutions. These include:

The overall market size for Non-Fusion Spinal Devices Market was USD 4.7 Billion in 2025.

The Non-Fusion Spinal Devices Market is expected to reach USD 7.1 Billion in 2035.

The demand for non-fusion spinal devices will grow due to the rising prevalence of spinal disorders, increasing preference for motion-preserving treatments, advancements in minimally invasive spine surgery, and the growing geriatric population, driving the need for effective and flexible spinal solutions.

The top 5 countries which drives the development of Non-Fusion Spinal Devices Market are United States, UK, European Union, Japan and South Korea.

Artificial Disc Replacement Devices and Dynamic Stabilization Devices Drive Market to command significant share over the assessment period.

Protein Diagnostics Market Share, Size and Forecast 2025 to 2035

CGRP Inhibitors Market Trends - Growth, Demand & Forecast 2025 to 2035

Indolent Systemic Mastocytosis treatment Market Insights: Size, Trends & Forecast 2025 to 2035

Intraoperative Fluorescence Imaging Market Report - Demand, Trends & Industry Forecast 2025 to 2035

Lung Cancer PCR Panel Market Trends, Growth, Demand & Forecast 2025 to 2035

Polymyxin Resistance Testing Market Trends – Innovations & Growth 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.