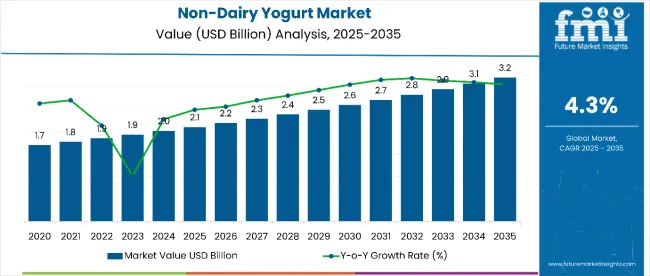

The global non-dairy yogurt market is projected to grow from USD 2.1 billion in 2025 to approximately USD 3.2 billion by 2035, recording an absolute increase of USD 1.1 billion over the forecast period. This translates into a total growth of 52.4%, with the market forecast to expand at a compound annual growth rate (CAGR) of 4.3% between 2025 and 2035.

The overall market size is expected to grow by nearly 1.52X during the same period, supported by increasing consumer awareness about plant-based diets, rising demand for dairy alternatives, and growing focus on lactose-free and allergen-free products.

Between 2025 and 2030, the non-dairy yogurt market is projected to expand from USD 2.1 billion to USD 2.7 billion, resulting in a value increase of USD 0.6 billion, which represents 54.5% of the total forecast growth for the decade. This phase of growth will be shaped by rising consumer awareness about plant-based nutrition benefits, increasing demand for sustainable and environmentally friendly food options, and growing penetration of premium non-dairy products in emerging markets. Food and beverage brands are expanding their non-dairy product portfolios to address the growing demand for multifunctional plant-based solutions.

Non-Dairy Yogurt Market Key Takeaways

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 2.1 billion |

| Forecast Value in (2035F) | USD 3.2 billion |

| Forecast CAGR (2025 to 2035) | 4.3% |

From 2030 to 2035, the market is forecast to grow from USD 2.7 billion to USD 3.2 billion, adding another USD 0.5 billion, which constitutes 45.5% of the overall ten-year expansion. This period is expected to be characterized by expansion of online retail channels, integration of advanced fermentation technologies in formulations, and development of personalized nutrition solutions. The growing adoption of clean label trends and health-conscious consumer preferences will drive demand for premium non-dairy yogurt products with enhanced probiotic benefits and improved taste profiles.

Between 2020 and 2025, the non-dairy yogurt market experienced robust expansion, driven by increasing consumer focus on plant-based diets and growing awareness of lactose intolerance and dairy allergies. The market developed as food brands recognized the need for effective dairy alternatives to address health concerns, environmental sustainability, and ethical consumption. Social media influence and nutritionist recommendations began emphasizing the importance of plant-based proteins in daily dietary routines for maintaining digestive health and overall wellness.

Market expansion is being supported by the increasing consumer awareness about the health benefits of plant-based diets and the corresponding demand for effective dairy alternatives. Modern consumers are increasingly focused on dietary choices that can address lactose intolerance, reduce environmental impact, and support sustainable food systems. Non-dairy yogurt's proven benefits in providing probiotics, plant proteins, and digestive support makes it a preferred choice in health-conscious dietary formulations.

The growing emphasis on clean label and natural ingredients is driving demand for non-dairy yogurt products derived from organic sources such as almonds, oats, and coconuts. Consumer preference for multifunctional products that combine probiotic benefits with nutritional value and taste satisfaction is creating opportunities for innovative formulations. The rising influence of social media wellness trends and nutritionist recommendations is also contributing to increased product adoption across different age groups and dietary preferences.

The market is segmented by source, nature, sales channel, flavor, form, and region. By source, the market is divided into soy, almond, coconut, oat, rice, pea, and others. Based on nature, the market is categorized into organic and conventional. In terms of sales channel, the market is segmented into B2B (HoReCa & other food services) and B2C (modern grocery retailers, hypermarkets/supermarkets, convenience stores, specialty stores, online retailers, wholesalers, other retail forms).

By flavor, the market is divided into plain/unflavored and flavored. By form, the market is classified into drinkable and spoonable. Regionally, the market is divided into North America, Latin America, Western Europe, Eastern Europe, Balkans & Baltic, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and Middle East & Africa.

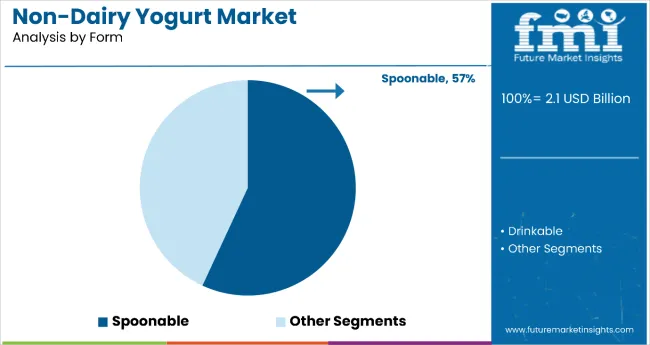

The spoonable form is projected to account for 57% of the non-dairy yogurt market in 2025, reaffirming its position as the category's preferred format. Consumers increasingly favor spoonable varieties for their traditional yogurt experience and versatility in consumption patterns. Spoonable non-dairy yogurt's familiar format provides consumers with customizable portion control and compatibility with various food pairings such as granola, fruits, and nuts, making them particularly appealing for breakfast and snack applications.

This segment forms the foundation of most product positioning, as it represents the most recognizable and consumer-friendly format of non-dairy yogurt consumption. Retailer preferences and shelf visibility continue to strengthen the dominance of spoonable varieties in traditional retail settings. With consumer eating habits maintaining preference for traditional yogurt consumption experiences, spoonable format aligns with both convenience and familiar usage patterns. Its broad appeal across demographics ensures sustained dominance, making it the central growth driver of non-dairy yogurt market demand.

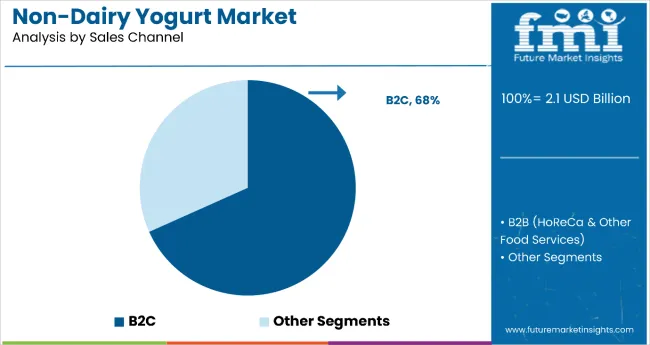

B2C channels are projected to represent 68% of non-dairy yogurt market demand in 2025, underscoring their role as the preferred distribution method for reaching end consumers. Consumers gravitate toward B2C channels for their accessibility, product variety, and ability to compare different brands and formulations, maximizing the reach of non-dairy yogurt products. Positioned as convenient shopping destinations, B2C channels offer both traditional retail benefits, such as physical product examination, and modern conveniences, including online ordering and home delivery.

The segment is supported by the rising popularity of modern grocery retail and online shopping platforms, where non-dairy yogurt products play a central role in health and wellness categories. Additionally, retailers are increasingly dedicating shelf space to plant-based alternatives like non-dairy yogurt, often positioning them alongside traditional dairy products, enhancing accessibility and justifying premium price points. As health-conscious consumers prioritize convenience and product variety, B2C channels will continue to dominate distribution, reinforcing their essential positioning within the non-dairy yogurt market ecosystem.

The non-dairy yogurt market is advancing rapidly due to increasing consumer awareness about plant-based nutrition and growing demand for dairy-free alternatives. However, the market faces challenges including higher production costs compared to dairy yogurt, raw material price volatility, and taste and texture preferences that favor traditional dairy products. Innovation in fermentation technologies and sustainable ingredient sourcing continue to influence product development and market expansion patterns.

Expansion of E-commerce and Direct-to-Consumer Channels

The growing adoption of e-commerce platforms is enabling brands to reach consumers directly and provide personalized nutrition recommendations. Online channels offer convenience, detailed nutritional information, and customer reviews that influence purchasing decisions. Social media marketing and influencer partnerships are driving brand awareness and product adoption, particularly among younger demographics who prefer online shopping experiences and value plant-based lifestyle choices.

Integration of Advanced Fermentation Technologies and Probiotic Formulations

Modern non-dairy yogurt manufacturers are incorporating advanced fermentation systems such as plant-based cultures, enhanced probiotic strains, and improved stabilization technologies to enhance product quality and nutritional benefits. These technologies improve the taste and texture of non-dairy alternatives while extending product shelf life and providing better digestive health benefits. Advanced formulation techniques also enable combination products that deliver multiple nutritional benefits in single servings.

| Country | CAGR (2025 to 2035) |

|---|---|

| India | 5.3% |

| China | 5.1% |

| South Korea | 4.9% |

| Australia | 4.8% |

| Japan | 4.6% |

| Canada | 4.5% |

| Germany | 4.2% |

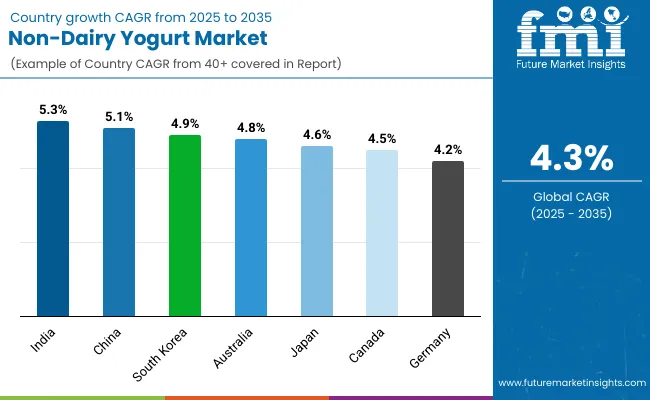

The non-dairy yogurt market is experiencing robust growth globally, with India leading at a 5.3% CAGR through 2035, driven by high lactose intolerance rates, growing health consciousness, and increasing penetration of plant-based food brands. China follows closely at 5.1%, supported by strong e-commerce infrastructure, urbanization trends, and increasing demand for health-oriented food products.

South Korea shows steady growth at 4.9%, emphasizing premium quality formulations and advanced food innovation technologies. Australia records 4.8%, focusing on environmental awareness and premium plant-based products. Japan shows 4.6% growth, prioritizing traditional fermentation expertise and health-focused consumer preferences. Canada demonstrates 4.5% growth, emphasizing government support for plant-based foods and clean label manufacturing practices. Germany demonstrates 4.2% growth, emphasizing organic ingredients and clean label manufacturing practices.

The report covers an in-depth analysis of 40+ countries; seven top-performing countries are highlighted below.

Revenue from non-dairy yogurt in China is projected to exhibit strong growth with a CAGR of 5.1% through 2035, driven by rapid adoption of plant-based diets among younger consumers and increasing influence of health and wellness trends. The country's expanding middle class and growing awareness of lactose intolerance are creating significant demand for premium non-dairy alternatives. Major international and domestic food brands are establishing comprehensive distribution networks to serve the growing population of health-conscious consumers across tier-1 and tier-2 cities.

Revenue from non-dairy yogurt in India is expanding at a CAGR of 5.1%, supported by cultural familiarity with plant-based diets, high lactose intolerance rates, and rising health consciousness. The country's young demographic profile and increasing exposure to global nutrition trends are driving demand for effective dairy alternatives. International food brands and domestic manufacturers are establishing distribution channels to serve the growing demand for affordable and nutritious plant-based products.

Demand for non-dairy yogurt in the USA is projected to grow at a CAGR of 4.0%, supported by consumer preference for plant-based products and health-focused dietary choices. American consumers are increasingly focused on ingredient transparency, nutritional benefits, and sustainable food practices. The market is characterized by strong demand for premium formulations that combine multiple plant proteins with enhanced probiotic benefits.

Revenue from non-dairy yogurt in South Korea is projected to grow at a CAGR of 4.9% through 2035, driven by the country's strong focus on food innovation, premium product positioning, and consumer preference for technologically advanced formulations. Korean consumers consistently demand high-quality, functionally enhanced products that deliver superior taste and nutritional benefits while maintaining food safety standards.

Revenue from non-dairy yogurt in Japan is projected to grow at a CAGR of 4.6% through 2035, supported by the country's deep understanding of fermentation processes and commitment to food quality excellence. Japanese consumers value traditional production methods, ingredient purity, and proven health benefits, positioning non-dairy yogurt as an extension of their cultural appreciation for fermented foods.

Revenue from non-dairy yogurt in Australia is projected to grow at a CAGR of 4.8% through 2035, supported by the country's strong emphasis on environmental protection, health optimization, and premium food experiences. Australian consumers prioritize sustainable sourcing, local ingredients, and proven health benefits, making non-dairy yogurt a trusted choice in the health-conscious food segment.

Revenue from non-dairy yogurt in Germany is projected to grow at a CAGR of 4.2% through 2035, driven by the country's strong focus on food science, organic product positioning, and consumer preference for clinically validated formulations. German consumers consistently demand high-quality, environmentally responsible products that deliver proven nutritional benefits while maintaining taste satisfaction.

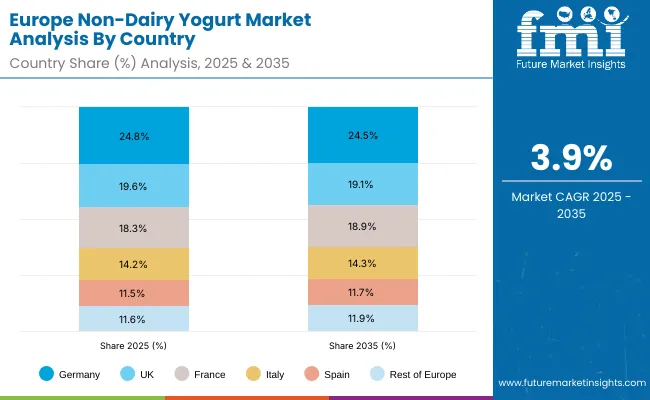

The non-dairy yogurt market in Europe is projected to grow from USD 0.72 billion in 2025 to USD 1.05 billion by 2035, registering a CAGR of 3.9% over the forecast period. Germany will remain the largest market, holding 24.8% in 2025 and easing slightly to 24.5% by 2035, supported by strong demand for organic and clean-label formulations. France follows with 19.6% in 2025, moderating to 19.1% by 2035, driven by premium product adoption and fermentation expertise.

The United Kingdom is expected to hold 18.3% in 2025, rising to 18.9% by 2035, led by ingredient-transparency trends and retailer support for plant-based ranges. Italy remains steady at 14.2% in 2025 and 14.3% in 2035, backed by growing acceptance of plant-based options.

Spain is projected at 11.5% in 2025, edging to 11.7% by 2035, supported by sustainability and snacking trends. The Rest of Western Europe (Nordic, BENELUX and other smaller markets) accounts for 11.6% in 2025, increasing to 11.9% by 2035, reflecting rising plant-based awareness and expanding retail access.

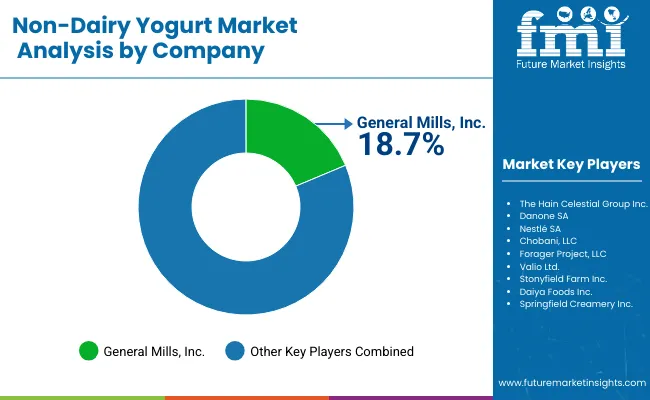

The non-dairy yogurt market is characterized by competition among established food and beverage companies, specialty plant-based brands, and emerging clean label players. Companies are investing in advanced fermentation technologies, sustainable ingredient sourcing, premium packaging, and digital marketing strategies to deliver effective, appealing, and accessible plant-based dairy alternatives. Brand positioning, product innovation, and distribution expansion are central to strengthening product portfolios and market presence.

General Mills, USA-based, leads the market with significant global value share, offering diverse non-dairy yogurt formulations with a focus on taste optimization and nutritional benefits. Danone, France, provides comprehensive plant-based product ranges with emphasis on probiotic enhancement and sustainable sourcing. Nestlé, Switzerland, delivers science-backed formulations with focus on ingredient quality and consumer education. Chobani, USA, focuses on premium positioning that combines traditional yogurt expertise with plant-based innovation.

The Hain Celestial Group and Forager Project, both operating in North America, provide specialized organic non-dairy products across multiple price points and distribution channels. Valio, Finland, emphasizes natural fermentation technologies and Nordic ingredient heritage. Stonyfield Farm, USA, offers organic certified products with environmental sustainability positioning. Daiya Foods and Springfield Creamery provide targeted solutions with focus on specific dietary requirements and taste preferences.

The success of non-dairy yogurt, driven by plant-based diets, lactose intolerance prevalence, and ESG-linked food reformulation, will not only expand healthier eating options but also strengthen sustainable food systems. It will consolidate emerging markets as hubs for plant-based ingredient supply while aligning advanced economies with clean-label, climate-smart dairy alternatives. This calls for a concerted effort by all stakeholders: governments, industry bodies, suppliers, OEMs, and investors. Each can be a crucial enabler in preparing the market for its next phase of growth.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 2.1 Billion |

| Source | Soy, Almond, Coconut, Oat, Rice, Pea, Others |

| Nature | Organic, Conventional |

| Sales Channel | B2B (HoReCa & Other Food Services), B2C (Modern Grocery Retailers, Hypermarkets/Supermarkets, Convenience Stores, Specialty Stores, Online Retailers, Wholesalers, Other Retail Forms) |

| Flavor | Plain/Unflavored, Flavored |

| Form | Drinkable, Spoonable |

| Regions Covered | North America, Latin America, Western Europe, Eastern Europe, Balkans & Baltic, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, Middle East & Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, India, Brazil, Australia and 40+ countries |

| Key Companies Profiled | General Mills, Danone, Nestlé, Chobani, The Hain Celestial Group, Forager Project, Valio, Stonyfield Farm, Daiya Foods, and Springfield Creamery |

| Additional Attributes | Dollar sales by source type and concentration level, regional demand trends, competitive landscape, buyer preferences for organic versus conventional products, integration with clean-label/health-focused positioning, innovations in fermentation technology, probiotic enhancement, and sustainable sourcing practices |

The industry is poised to reach USD 2.1 billion in 2025.

The industry is projected to register USD 3.2 billion by 2035.

Almond-based yogurts are among the most widely used products due to their creamy texture and nutritional benefits.

India, slated to grow at a 5.1% CAGR during the study period, is poised for the fastest growth in the Industry.

Key companies in the industry include General Mills, Inc., Danone SA, Nestlé SA, Chobani, LLC, The Hain Celestial Group Inc., Forager Project, LLC, Valio Ltd., Stonyfield Farm Inc., Daiya Foods Inc., and Springfield Creamery Inc.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Demand for Non-Dairy Yogurt in EU Size and Share Forecast Outlook 2025 to 2035

Yogurt Powder Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Yogurt Dips Market Size, Growth, and Forecast for 2025 to 2035

Yogurt Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Yogurt Maker Market – Trends, Growth & Forecast 2025 to 2035

Yogurt Packaging Market Trends – Growth & Demand Forecast 2025 to 2035

Yogurt And Probiotic Drink Market Analysis by Product Type, Source Type, and Region Through 2035

A2 Yogurt Market Trends – Growth, Demand & Innovations

Dry Yogurt Market Outlook - Growth, Demand & Forecast 2025 to 2035

Greek Yogurt Market Size and Share Forecast Outlook 2025 to 2035

Vegan Yogurt Market Size, Growth, and Forecast for 2025 to 2035

Japan Yogurt Powder Market Analysis by Product Type, Flavor, Nature, Application, End-Use, and Distribution Channel Through 2035

Frozen Yogurt Market Size and Share Forecast Outlook 2025 to 2035

Citrus Yogurt Market Insights – Flavor Trends & Consumer Demand 2025 to 2035

Analysis and Growth Projections for Savory Yogurt Market

Non-GMO yogurt Market Analysis by Product Type, By End use, By Distribution Channel of the and End User Through 2035

Flavored Yogurt Market Analysis by Form, Flavor, End Use and Distribution Channel Through 2035

Drinkable Yogurt Market Size and Share Forecast Outlook 2025 to 2035

Probiotic Yogurt Market Analysis - Size, Share & Forecast 2025 to 2035

Plant-based Yogurt Market Analysis - Size, Share, and Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA