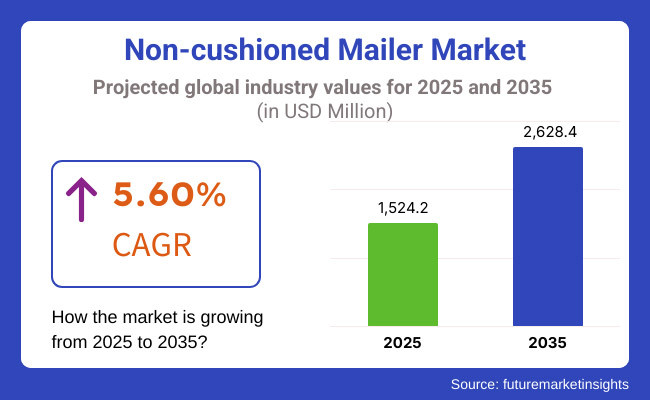

The global non-cushioned mailer market is projected to propel with a CAGR of 5.60% over the forecast period 2025 to 2035, which contributed to the boom of non-cushioned mailer market to USD 1,524.2 million by 2025 through sales of e-Commerce. With sustainable solutions, it is estimated that the industry will reach USD 2,628.4 million by 2035.

Unpadded mailers are increasingly used in e-commerce, fashion and cosmetics, and several other industries, by virtue of the cost- and space-savings that can be found when shipping such goods. Their development is also influenced by many sustainability trends.

As businesses increasingly request more sustainable and efficient packaging, the demand for non-cushioned mailers will also grow steadily. Industry leaders are using the latest environmentally friendly materials to enhance the durability of recyclable packaging materials.

The government is also advocating stricter regulations and motivating the usage of cleaner and advanced packaging solutions. E-commerce is gaining momentum due to the growing demand for secure and convenient home delivery, indicating that the growth of the non-cushioned mailer industry is closely tied to the expansion of online retail.

Explore FMI!

Book a free demo

The segment for non-cushioned mailers will likely be highly lucrative between 2020 and 2024, mainly due to the e-commerce boom and increased demand for sustainable packaging. Brands understood the need for lightweight and sustainable solutions, and they introduced innovative mailers, which also proved to be cost-effective and environmentally friendly.

With more consumers and businesses fixated on waste reduction, recyclable and biodegradable options had become a standard, making non-cushioned mailers the obvious and responsible solution for industries from fashion to electronics.

In 2025 to 2035, the industry will really be growing because sustainability will be deeply ingrained in business practices. With the continued growth of online shopping, companies will increasingly turn to non-cushioned mailers as a cost-effective and environmentally conscious packaging solution.

New technology will streamline production, making them even more eco-friendly, affordable, and functional. This evolution will provide a way forward in developing improved packaging strategies for businesses to meet consumer demand while being considerate of the sustainable development agenda.

Mailers, a crucial part of brands’ sustainability journeys, will achieve critical mass from 2025 to 2035. While peel and seal envelopes are the most recognized as being the best shipping supplies, seal and peel envelopes offer a more versatile, waste-free, and protected shipping solution.

More packaging companies will align with the global shift toward sustainable solutions. These mailers won’t just align with consumer expectations; they’ll help companies differentiate themselves when it comes to being green, as mailers have been shown to be as effective as they are efficient.

| Key Drivers | Key Restraints |

|---|---|

| Surge in e-commerce | Fluctuating raw material costs |

| Consumer shift towards sustainability | Competition from alternative packaging |

| Demand for lightweight packaging solutions | Increased regulatory pressure |

| Eco-friendly material innovations | Higher production costs |

| Focus on reducing carbon footprints | Durability concerns compared to cushioned options |

Impact of Key Drivers

| Key Drivers | Impact Level |

|---|---|

| Surge in e-commerce | High |

| Consumer shift towards sustainability | High |

| Demand for lightweight packaging solutions | Medium |

| Eco-friendly material innovations | Medium |

| Focus on reducing carbon footprints | High |

| Customization and branding opportunities | medium |

Impact of Key Restraints

| Key Restraints | Impact Level |

|---|---|

| Fluctuating raw material costs | Medium |

| Competition from alternative packaging | High |

| Increased regulatory pressure | Medium |

| Higher production costs | Medium |

| Durability concerns compared to cushioned options | Medium |

| Supply chain disruptions | Low |

Various materials are employed to address diverse packaging requirements and help to divide the non-cushioned mailers sector into several products. Polyethylene mailers are utilized extensively in postal and e-commerce applications and are marked by their lightweight, moisture resistance, and affordability, which is expected to drive the polyethylene mailer industry.

As consumers become increasingly conscious of their carbon footprint, Kraft paper mailers are gaining popularity as a greener and biodegradable option. Their metallic foil lining also offers added moisture and tampering protection, which makes them an appropriate option for high-value packages. Polypropylene mailers are most recognized for their maximum strength and tear resistance, making them a durable option for shipping non-fragile items in the non-cushioned mailer category.

Solid paperboard makes corrugated mailers stronger for shipping sensitive materials. Material type used imparts cost, durability, and environmental impact of the mailer, thus giving rise to higher demand in many industries from e-commerce and postal to special verticals such as healthcare and food packaging.

The end-use application segments the market for global non-cushioned mailers, Postal operations also consume these mailers on a large scale for bulk deliveries of parcels and documents, as they are light, efficient, and economical in terms of cost. It is primarily driven by retail and e-commerce because the companies require to send their apparels, electronics, and miscellaneous merchandise using hardy and eco-friendly mailing mediums.

Shipping medicines, medical devices, and sensitive documents requires the use of tamper-proof non-cushioned mailers that offer secure and durable packaging. Another category is eco-friendly mailers, which, according to the most popular report, are used by many apparel and fashion brands, such as Kraft paper-made and polyethylene mailers, allowing them to combine sustainability strategies with reliable deliveries.

In food & beverages, these mailers are adopted to ship dry food, meal kits, and specialty items, which often require moisture-resistant materials such as polypropylene and metallic foil. Thanks to sustainability efforts and cost efficiency, non-cushioned mailer use is quickly becoming a staple of modern logistics in many industries.

In the USA, the industry for non-cushioned mailers is also set for robust growth as e-commerce continues its relentless march forward with an estimated growth rate of 4.30% in 2025. The demand for cost-effective and eco-friendly packaging solutions will rise as sustainability becomes a key priority for businesses.

The increasing awareness of environmental issues among consumers will force businesses to use recyclable, biodegradable, and lightweight non-cushioned mailers. Moreover, stricter environmental regulations along with a national drive for sustainable packaging solutions would accelerate the industry demand. Companies will continue to shake things out in terms of packaging innovation that keeps brands in the forefront but meets sustainability objectives, making the USA an industry leader in the field.

Forecasts predict steady growth in the Canadian non-cushioned mailer industry between 2025 and 2035. This demand will be fueled by the country's thriving e-commerce sector, especially in areas such as Ontario and British Columbia, because packaging that is low-cost and eco-friendly is needed.

Businesses will start adopting recyclable, paper-based mailers as Canadian consumers put eco-friendly products first. Government-led sustainability policies and rising awareness of packaging waste will increase the business case for non-cushioned mailers. Innovations in packaging materials to appeal to eco-conscious, cost-effective shipping options will continue to benefit the Canadian sector.

Between 2025 and 2035, the UK may witness the growth of a non-polyethylene mailer that is likely to register a CAGR of 4.0%. The UK consumer market is shifting toward eco-friendly, recyclable mailers as customers demand brands become eco-conscious.

Non-cushioned mailers will be more in line with business sustainability goals, as the government is focused on plastics and packaged waste, aligning with the government's focus on reducing plastic packaging waste in business practices. As industries such as fashion, cosmetics, and electronics continue to thrive, the demand for cost-effective and lightweight packaging solutions will intensify, positioning the UK as a crucial hub for non-cushioned mailers.

E-commerce and sustainability drive demand for non-cushioned mailers in France, a steadily growing trend. The rising demand from French customers for sustainable and recyclable materials will drive the trend for non-cushioned mailers, especially in fashion, beauty, and electronics. Companies will adopt packaging solutions that comply with the increasingly stringent sustainability regulations enforced by the French government.

Furthermore, the development of recyclable or non-cushioned materials such as biodegradable plastics and recycled papers will further support the use of these eco-friendly packaging to drive the growth of this industry over the coming years.

The market in Germany is estimated to grow at a CAGR of 5.20% during the forecast period 2025 to 2035. We expect the German non-cushioned mailer industry to grow at a considerable rate. The nation is steadfast in its drive toward environmental sustainability and circular economy principles, and such initiatives will compel businesses to adopt eco-packaging solutions like recyclable and biodegradable mailers.

E-commerce is booming, and so is the demand for lightweight, affordable, and sustainable packaging solutions. In addition, Germany has strict rules that encourage reducing packaging waste. Such policies will lead to more businesses using non-cushioned mailers in this country. Furthermore, new packaging materials and better recycling infrastructure will further accelerate industry growth in Germany during the forecast period.

The upturn in the non-cushioned mailer industry of South Korea may be a result of the e-commerce industry that is flourishing at the time and extending between 2025 and 2035, increasing the need for non-plastic and sustainable package solutions. With South Korean consumers becoming increasingly aware of environmental issues, companies are switching to eco-friendly, recyclable mailers.

Businesses are encouraged to adopt these sustainable packaging solutions as part of their green initiatives. The government will push the businesses to opt for non-cushioned mailers as an effort to go green. With industries like fashion, electronics, and beauty booming, the need for inexpensive, environmentally friendly packaging will fuel industry growth in South Korea.

During the forecast period, Japan is anticipated to capture a CAGR of 3.90% with growth in the e-commerce industry and rising demand for sustainable packaging to shape the industry's future. Japanese consumers are very sensitive to environmental problems, leading companies to shift to recyclable, lightweight, eco-friendly mailers.

As the government has called for the minimization of packaging waste, eco-friendly materials will always be a focus for Japanese brands. Japan will need new innovations in environmentally friendly packaging, and advancements in logistics, such as efficient supply chain management and sustainable shipping solutions, will gain traction. This will increase the demand for non-cushioned mailers, making the country a major market for the product during the predicted time.

In China, the non-cushioned mailer sector is projected to grow rapidly between 2025 and 2035, fueled by the Asian nation’s sizeable e-commerce sector and growing consumer preference for sustainable packaging with a CAGR of 6.30%. With pushing for sustainability and waste reduction, businesses will seek eco-friendly package solutions such as recyclable or non-cushioned mailers.

Government initiatives promoting sustainability and reducing packaging waste will accelerate industry expansion. China's e-commerce industry, especially in tier-one cities such as Beijing and Shanghai, will keep the country at the forefront of the non-cushioned mailers industry during the forecast period.

The non-cushioned mailer market in India is projected to witness steady growth from 2025 to 2035, driven by the booming e-commerce industry, which is likely to register a CAGR of 6.80%. With online shopping becoming more prevalent nationwide, there will be an increase in demand for affordable, lightweight, and environmentally friendly packaging solutions.

Rising awareness regarding environmental hazards among Indian consumers will lead businesses to switch to recyclable and biodegradable non-cushioned mailers. The government pushes for sustainability, and initiatives aimed at reducing packaging waste will drive additional industry adoption. The e-commerce and retail sectors are swelling, which will make India a key industry for non-cushioned mailers in the assessment duration.

The industry is highly consolidated, with top-tier companies holding close to 90% of the overall share for non-cushioned mailers. The industry is more consolidated than fragmented. Prominent players have built a strong reputation for their extensive reach, innovative drive, and readiness for environment-friendly solutions.

Smaller players exist, but they typically concentrate on more specialized niches. These players lead the industry because they can best meet this demand, which drives industry growth.

Some of the key players operating in the industries are Smurfit Kappa, Sealed Air, International Paper, STORA ENSO, etc. In 2024, these companies built on this commitment by releasing new, eco-friendly packaging solutions. Smurfit Kappa has focused on other aspects of sustainability beyond just manufacturing, but this does not necessarily make their products more sustainable.

Sealed Air has made outstanding strides in enhancing on-site sustainability practices and designing more eco-friendly technologies and processes. The industry launched this initiative in the first half of 2024, in response to the growing industry demand for sustainable packaging solutions.

The non-cushioned mailers are trending, as they are needed overall by companies looking for cost-effective packaging solutions that are environmentally friendly, save space in transit, and suit sustainability initiatives.

Non-cushioned mailers are also becoming common across multiple verticals, such as e-commerce, clothing, cosmetics, and footwear, because they are low in weight, space-efficient, and environmentally friendly.

One of the major advantages of non-cushioned mailers is that this type of mailer generally is manufactured using recyclable materials, which enables reducing wastage and providing an eco-friendly alternative to conventional packing options.

New and notable advancements include recyclables, multi-use mailers, and innovations in material technology that help protect the product more effectively.

Polyethylene, Kraft Paper, Metallic Foil, Polypropylene, Bubble-lined, Corrugated

Postal Services, E-commerce and Retail, Healthcare and Pharmaceuticals, Apparel and Fashion, Food & Beverages

North America, Europe, Latin America, Asia Pacific, Middle East & Africa

BOPP Film Market Analysis by Thickness, Packaging Format, and End-use Industry Through 2025 to 2035

Korea Tape Dispenser Market Analysis by Material, Product Type, Technology, End Use, and Region through 2025 to 2035

Japan Heavy-duty Corrugated Packaging Market Analysis based on Product Type, Board type, Capacity, End use and City through 2025 to 2035

Corrugated Board Market Analysis by Material and Application Through 2035

Waterproof Packaging Market Trends - Demand & Industry Forecast 2025 to 2035

Thermochromic Labels Market Insights - Innovations & Growth 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.