Moderately consolidated, the global Non-Alcoholic Malt Beverages Market is headed by leading beverage giants, regional malt drink specialists, and a few with emerging functional beverage brands. The top multinational companies in the sector, namely, Anheuser-Busch InBev, Heineken N.V., and Carlsberg Group control 45% of the entire market share enjoyed with aged brewing skills coupled with profound distribution networks and adequate brand attachment on the market.

Other types are mostly included in the soft drinks and FMCG behemoths such as Coca-Cola, PepsiCo, and Suntory Holdings, contributing about 30%. They leverage their marketing and retail supremacy for entry into the malt category of soft drinks. 25% of the consumer base is made up of regional and specialized brands in malt beverage that include names such as Asahi Group, Kirin Holdings, and Molson Coors.

They focus on localized affinities, functional health benefits, and emerging markets. Out of the global total 55% is controlled by the top 5 companies, indicating a competitive yet moderately consolidated market that drives competitive pressures like brand loyalty, innovation in flavor profiles, and premiumization.

Explore FMI!

Book a free demo

| Market Structure | Top Multinationals |

|---|---|

| Industry Share (%) | 45% |

| Key Companies | Anheuser-Busch InBev, Heineken N.V., Carlsberg Group |

| Market Structure | Soft Drink & FMCG Leaders |

|---|---|

| Industry Share (%) | 30% |

| Key Companies | Coca-Cola Company, PepsiCo, Suntory Holdings |

| Market Structure | Regional & Specialty Brands |

|---|---|

| Industry Share (%) | 25% |

| Key Companies | Asahi Group, Kirin Holdings, Molson Coors Beverage Company, Diageo plc |

The market for nonalcoholic malt beverages is moderately consolidated, with malt obligations dominated by brewing giants, while soft drink manufacturers and regional brands are driving innovation and improvement of malt-based soft drinks and functional beverages.

The primary type of malt beers (40%) target consumers who require an alcohol-free production with a beer-like taste. Heineken and Anheuser-Busch lead in this field with their 0.0% alcohol malt beverages. Malt-based soft drinks (30%) grow very fast particularly in Middle East and Latin America, as brands of PepsiCo, Suntory Holdings, and so on are launching flavored malt beverages there. Malt extracts (20%) are widely used in functional drinks and nutritional formulations, where Carlsberg and Molson Coors have offerings. The Others (10%) are energy-infused malt beverages and sports recovery drinks, where new formulations are being developed by Kirin Holdings and Diageo plc.

Preferred packaging format is convenient and long lasting, which is Cans (40%) along with premium canned malt beverages led by Heineken and Carlsberg. Bottles (35%) remain the most common formats for premium malt beverages and most traditional markets, with more investments made by Anheuser-Busch and Diageo into glass bottle packaging for premium positioning. Pouches (15%) start gaining popularity in emerging markets, where economical, single-serve malt beverages are marketed by PepsiCo and Suntory Holdings. Others (10%): keg and tetra pack packaging meant for food service and on-the-go consumption.

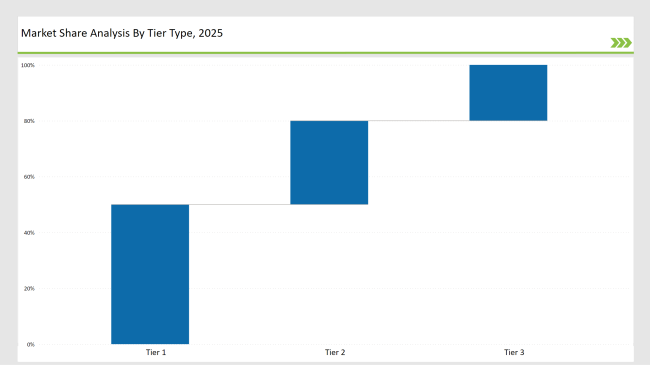

| By Tier Type | Tier 1 |

|---|---|

| Market Share (%) | 50% |

| Example of Key Players | Anheuser-Busch InBev, Heineken N.V., Carlsberg Group |

| By Tier Type | Tier 2 |

|---|---|

| Market Share (%) | 30% |

| Example of Key Players | Coca-Cola Company, PepsiCo, Suntory Holdings |

| By Tier Type | Tier 3 |

|---|---|

| Market Share (%) | 20% |

| Example of Key Players | Asahi Group, Kirin Holdings, Molson Coors, Diageo plc |

| Brand | Key Focus |

|---|---|

| Anheuser-Busch InBev | Expanded Budweiser Zero and Stella Artois 0.0 to new markets. |

| Heineken N.V. | Focused on premium malt beverages with craft brewing techniques. |

| Carlsberg Group | Developed functional malt-based electrolyte sports drinks. |

| Coca-Cola Company | Launched nutrient-fortified malt soft drinks for Middle Eastern markets. |

| PepsiCo, Inc. | Expanded Mountain Dew Malt line with fruity flavors. |

| Diageo plc | Introduced herbal-infused malt beverages with functional benefits. |

| Asahi Group Holdings | Developed low-calorie and sugar-free malt beverages. |

| Kirin Holdings Company | Created Japanese green tea and malt fusion drinks. |

| Molson Coors Beverage Co. | Expanded alcohol-free craft malt drink portfolio. |

| Suntory Holdings Limited | Strengthened distribution of premium malt beverages in Asia. |

The demand for high-end craft-type malt beverages is set to grow in Europe and North America, where consumers demand premium, small-batch products. Barrel-aged, specialty-brewed, organic malt beverages will be grown by Heineken and Carlsberg for the benefit of affluence and health-conscious consumers.

Vitamin, probiotic, electrolyte, and plant-based protein-enriched malt beverages will see definite growth. Distillers such as PepsiCo and Coca-Cola are likely to pioneer the path to fortified malt-based soft drinks, whereas Diageo and Kirin Holdings will concentrate on herbal and botanical-infused functional beverages.

The trend for biodegradable, lightweight, and plastic-free packaging is expected to be adopted by companies. BPA-free cans and plant-based bottles are likely to find traction under this category. Asahi and Suntory Holdings are investing towards carbon-neutral production, and Molson Coors is working on the fully recyclable malt drink packaging.

E-commerce and supply channels through direct-to-consumer subscription models will add to the mix of malt beverage sales, especially among millennial and Gen-Z consumers. Companies like Coca-Cola and Heineken will harness customizable offerings online, exclusive flavors e-commerce, and digital engagement strategies to drive brand loyalty.

Top companies include Anheuser-Busch InBev, Heineken, Carlsberg, Coca-Cola, and PepsiCo, leading both malt beer and malt-based soft drinks.

The industry is shifting toward premiumization, functional health drinks, and sustainability-focused innovations.

Supermarkets and e-commerce platforms are driving retail growth, while bars and restaurants are expanding on-premises consumption.

Brands are infusing malt drinks with plant-based protein, vitamins, and minerals to cater to wellness-focused consumers.

Companies are introducing BPA-free cans, biodegradable bottles, and resealable pouches to improve sustainability.

Expect continued premiumization, functional innovation, and expansion into sustainable and health-focused categories.

USA Bubble Tea Market Analysis from 2025 to 2035

Food Testing Services Market Trends - Growth & Industry Forecast 2025 to 2035

USA Dehydrated Onions Market Insights – Size, Trends & Forecast 2025-2035

Latin America Dehydrated Onions Market Outlook – Demand, Share & Forecast 2025-2035

Europe Dehydrated Onions Market Analysis – Growth, Trends & Forecast 2025-2035

ASEAN Dehydrated Onions Market Trends – Size, Demand & Forecast 2025-2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.