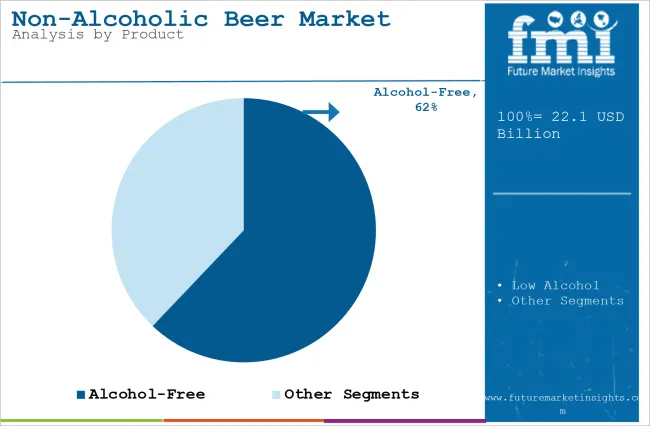

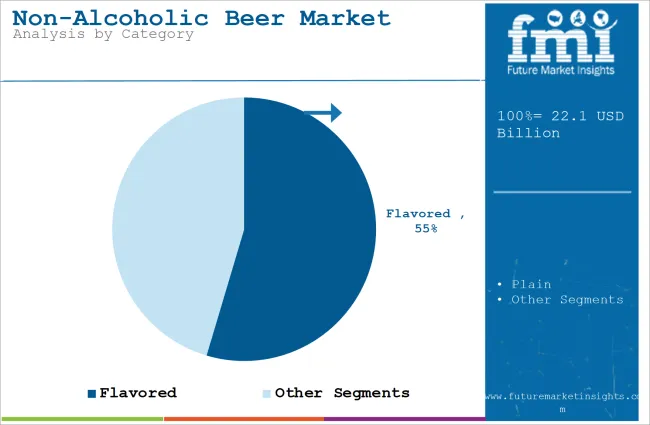

The global non-alcoholic beer market is projected to grow from USD 20.5 billion in 2025 to USD 43.9 billion by 2035, registering a CAGR of 7.9%. Rising health awareness, shifting drinking habits, and the rise of lifestyle-oriented consumer segments are expected to fuel sustained growth over the next decade. Alcohol-free variants are set to dominate product preferences, accounting for over 62% of total sales, while flavored formats are becoming the preferred category for variety-seeking consumers.

| Attributes | Description |

|---|---|

| Estimated Market Value (2025) | USD 20.5 billion |

| Projected Market Value (2035) | USD 43.9 billion |

| Value-based CAGR (2025 to 2035) | 7.9% |

In urban markets, younger generations particularly millennials and Gen Z are actively seeking beer alternatives that offer the same mouthfeel and flavor but without alcohol. Breweries, both large and craft-based, are responding by launching products that deliver on sensory experience while aligning with wellness and social moderation values. DTC (direct-to-consumer) channels and supermarket sales are becoming key distribution avenues, especially in North America and Western Europe.

This growth outlook is also being shaped by flavor innovation, the zero-proof movement, and expanding shelf space for premium non-alcoholic beer variants in both online and offline retail. Manufacturers are introducing exotic infusions and emphasizing eco-conscious brewing techniques to attract health-aware consumers. At the same time, regulatory leniency for non-alcoholic beverages in online retail is creating opportunities for newer brands to scale quickly without legacy distribution hurdles.

The below table presents a comparative assessment of the variation in CAGR over six months for the base year (2024) and current year (2025) for the global target product industry.

This analysis reveals crucial shifts in business performance and indicates revenue realization patterns, thus providing stakeholders with a better vision of the domain growth trajectory over the year. The first half of the year, or H1, spans from January to June. The second half, H2, includes the months from July to December.

| Particular | Value CAGR |

|---|---|

| H1 (2024 to 2034) | 2.8% |

| H2 (2024 to 2034) | 4.8% |

| H1 (2025 to 2035) | 6.0% |

| H2 (2025 to 2035) | 7.9% |

The above table presents the expected CAGR for the global target product sales growth over several semi-annual periods spanning from 2025 to 2035. In the first half (H1) of the decade from 2024 to 2034, the business is predicted to surge at a CAGR of 2.8%, followed by a slightly higher growth rate of 4.8% in the second half (H2) of the same decade.

Moving into the subsequent period, from H1 2025 to H2 2035, the CAGR is projected to increase slightly to 6% in the first half and remain relatively moderate at 7.9% in the second half. In the first half (H1) the sales witnessed a decrease of 35 BPS while in the second half (H2), the target sales witnessed an increase of 42 BPS

The global non-alcoholic beer market has been segmented and analyzed across key parameters including:

Alcohol-free non-alcoholic beer is projected to dominate the product type segment in 2025, holding a substantial 62.1% share of global sales. This segment is expected to register steady demand, driven by growing health consciousness and a cultural shift toward alcohol moderation.

Flavored non-alcoholic beer is set to lead the category segment in 2025, accounting for 54.6% of global sales. The rising demand for variety and experimentation in taste has fueled the growth of this segment, especially among younger consumers.

Malted grains are projected to dominate the material segment in 2025, capturing approximately 48% of the total market share. Their core role in delivering the foundational taste, color, and body of non-alcoholic beer has cemented their position as the preferred ingredient.

Supermarkets are expected to remain the dominant sales channel for non-alcoholic beer in 2025, accounting for over 42% of global market share. Their widespread presence, extensive shelf space, and growing focus on health-oriented product lines have made them the primary point of sale.

Expanding artisanal and craft beer options in urban areas appeals to the consumers for the target product

The increasing trend of artisanal and craft no-alcoholic beer is uplift the sales of target product across the globe due to increasing urbanization like in the metro cities. This craft beer is attracting consumers due to its top quality, and uniqueness in the flavor as the traditional one without any alcohol content.

Some of the traditional beer comes in a taste that is not much accepted by consumers due to its bitterness, so craft beer comes into the picture where taste and other sensory parameters are controlled during the processing of fermentation with the ingredients.

Craft breweries and microbreweries are always popular for their commitment to quality ingredients, innovative brewing techniques, and unique flavor profiles. This brewery used the same principles in the development of target products which are similar in the taste, aroma, and mouthfeel of traditional craft beer.

These microbrewers continue their experimentation with in-house beer brewing with several ingredients. They also introduced a variety of non-alcoholic beers such as ale, stout, lager, etc.

In the many metro cities across the globe, craft beer manufacturers or microbreweries are increasing and many of these are entering into the target product due to the response of consumers for non-alcoholic malt beverages. These microbreweries are small in operation and focus on the quality of the final product.

Availability of unique and exotic flavors in the target product surges the sales

Traditionally target product options were limited in terms of variety and flavours. They were mimicking the flavors of standard lagers or pale ales. However, nowadays the taste preferences of consumers for target product have changed, and looking for different varieties of beer flavors.

This trend is increasing the target product sales by the growing number of end-use consumers who are always ready to experiment with new non-alcoholic beer flavors. Companies such as Daffodils Beverages have launched target products in various assorted flavors available at the e-commerce platform link Amazon.

Non-alcoholic beers with exotic flavors such as Malt, Mint, Ginger, Cranberry, Cranberry Sugar-Free, Peach, and Strawberry are becoming widely popular due to their sweetening and refreshing taste. As consumers become more exposed to different cuisines and ingredients through travel, media, and dining experiences, their palates are becoming more adventurous and open to trying flavors from around the world.

This trend is likely to continue as more breweries recognize the potential of flavor innovation to drive growth and differentiation in the increasingly competitive non-alcoholic beer industry.

The increasing trend of zero-proof movement across the globe surges the sales for target product

“Zero-Proof Movement” refers to the focus on the reduction or elimination of alcohol consumption for a temporary time or a permanent one without losing the sensory part of traditional alcoholic beverages. This proof in term zero-proof is used in the alcoholic industry which refers to the alcohol content in the beverage. Therefore, zero-proof drinks do not contain alcohol.

This movement is reshaping the non-alcoholic beer sales across the globe. As the movement gains traction, the target product is increasingly becoming acceptable and desirable for non-alcoholic beverages such as beers by the widespread demographic groups in several social gatherings, celebrations, and casual outings.

The main reason to surge the target product is growing awareness of the consumers regarding the health impact of alcohol. This shift is partly driven by a greater understanding of the negative effects of alcohol on physical and mental health, such as liver damage, impaired cognitive function, and the risk of addiction.

Growth in online Direct to Consumer (DTC) channels is making non-alcoholic beer more accessible, especially in niche markets

Manufacturing and selling any alcoholic beverages or products require special license and approval from the authority in any country and had to pay extra taxes on those products.

However, the manufacturing or selling of beverages that do not contain alcohol such as non-alcoholic beers need not pay any taxes and requires no other special license or approval from the legal authority. Due to this fact, the target product is listed and sold on many online e-commerce sites.

The availability of target products on the direct-to-consumer (DTC) channel gave a boost to non-alcoholic beer sales across the globe. This opens up the opportunity for the key brand to reshape the target product via consumers where they browse, discover, select, purchase, and enjoy non-alcoholic beers of global brands that are difficult to find on the traditional retail channel.

The convenience of online shopping with the delivery at doorstep without much effort led to the growth of the target product through the online direct-to-consumer channel. In some regions of the globe where non-alcoholic beers are not readily available at the physical stores due to limited demand from the consumers, online DTC comes into the picture.

The Availability of non-alcoholic beverages at bars and restaurants led to the growth of the target product

Several bars and restaurants are adding non-alcoholic beverages such as beers to their menus directly impacting the growth of the target product sales across the globe. The increasing consumer demand and preferences for non-alcoholic beverages have led to this shift. As these products become more normal in dining and drinking establishments. Due to the alcohol-free nature of the products it breaks the barriers and becomes a choice for consumers in the social gathering.

Earlier, restaurants and bars tend to keep only alcoholic beverages in their stock or shelves. This fact made it very difficult for the non-drinkers of alcohol who were limited to only intake of soft drinks, water, or fruit mocktails leaving them unsatisfied.

However, the growing popularity, demand, and development of non-alcoholic beer tend to increase the variety of beverages at restaurants and bars for non-drinkers of alcohol. These target products are also available in the college canteen or at any other place due to the nature of being alcohol-free.

From a business perspective, the inclusion of non-alcoholic beers on menus also opens up new revenue streams. These products appeal to a wide range of customers, including those who might not have ordered a drink otherwise. Additionally, non-alcoholic beers can be marketed as premium, artisanal products, allowing establishments to charge competitive prices and enhance their overall profitability.

The global Non-alcoholic beer industry has many big players such as Big Drop Brewing Co., Anheuser-Busch InBev, Heineken N.V., Bernard Family Brewery Inc., Moscow Brewing Company, Carlsberg A/S, Suntory Beer, and many more comprised a significant share of the global sales including in Tier 1 of the industry structure.

These tier 1 companies hold around 40-45% of the global revenue share. These companies have numerous manufacturing facilities that distinguish themselves based on production capacity, patented product formulation with diverse flavors for the final product and process, and widespread distribution networks across the globe that allow them to manufacture and supply their products worldwide.

They maintain rigorous quality checks across the processing line and throughout the supply chain and reduce costs due to advanced manufacturing technology with high efficiency. These big players often engage in partnership and collaboration to develop solutions that meet specific consumer needs and industry trends.

Tier 2 comprises companies such as mid-tier manufacturing firms with a significant revenue share that are operating in specific and limited geographic locations. These tier 2 companies hold around 20-25% of the global revenue share. Tier 2 companies equipped with processing plants and involved in private labeling with sound knowledge of the target product and industry.

These companies formed strategic partnerships with other companies to expand their reach beyond their limit. Companies like Erdinger Weibbrau, Arpanoosh CO, Krombacher Braueri, Daffodils Beverages, etc come under the tier 2 structure.

Tier 3 structure comprises a local company that operates on a small scale and has limitations based on their product type with the distribution and supply chain network. They operate with a local presence and serve a niche demand space.

Such players focus on product quality with traditional artisanal processing methods or technology and customer satisfaction rather than commercialization. Tier 3 companies hold around 15-20% of the global revenue share.

The United States is projected to remain a dominant force in the global non-alcoholic beer market, expected to grow at a CAGR of 7.1% from 2025 to 2035. Growth is supported by shifting consumer behavior favoring alcohol moderation and health-conscious choices. Craft breweries and major brands are launching zero-alcohol versions, and non-alcoholic beer is now a common fixture in restaurants, bars, and college campuses.

Germany follows closely, with a projected CAGR of 6.8%, driven by the country’s strong brewing heritage and high acceptance of alcohol-free variants that preserve the traditional beer experience. Advanced brewing technology and product quality reinforce Germany’s leadership in both volume and variety. The UK market is expected to grow at 6.5% CAGR, fueled by increasing availability of flavored and hybrid options and a sharp rise in online DTC sales. The government’s push for sustainable parenting and reduced alcohol consumption supports this trend.

| Countries | CAGR (2025 to 2035) |

|---|---|

| The USA | 7.1% |

| UK | 6.5% |

| France | 6.3% |

| Germany | 6.8% |

| Japan | 2.8% |

The United States non-alcoholic beer market is expected to expand at a CAGR of 7.1% from 2025 to 2035, driven by a cultural shift toward mindful drinking and health-conscious choices. Consumers are increasingly opting for alcohol-free beverages that align with wellness goals without compromising on taste. Major breweries such as Anheuser-Busch and emerging craft players are expanding their zero-alcohol portfolios to cater to this growing demand. Availability in restaurants, bars, and college campuses is increasing, while supermarkets and DTC platforms are enhancing accessibility.

Sales of non-alcoholic beer in UK are projected to grow at a CAGR of 6.5% between 2025 and 2035. Rising consumer interest in alcohol-free alternatives is driven by health awareness, sustainability values, and an expanding range of flavorful options. Hybrid and reusable packaging formats are also gaining popularity. Online platforms and subscription services are becoming central to purchase behavior, especially among young families and urban professionals.

France’s non-alcoholic beer sales are expected to grow at a CAGR of 6.3% from 2025 to 2035. Consumers are gravitating toward organic, skin-sensitive, and low-calorie beverage options. Flavored alcohol-free beers with botanical and fruit infusions are especially popular among younger demographics. The segment is witnessing growth in both retail and horeca (hotel/restaurant/café) channels as consumer perceptions of non-alcoholic beverages evolve.

Germany is forecasted to register a CAGR of 6.8% from 2025 to 2035. The country's robust brewing tradition and consumer trust in beer quality are being translated into high acceptance of alcohol-free formats. Non-alcoholic beer is commonly consumed alongside meals, during travel, and in professional settings. Local brands are leading innovation in taste fidelity and brewing technology, supported by the growth of artisanal and private label offerings.

Japan’s non-alcoholic beer market is set to grow at a CAGR of 2.8% from 2025 to 2035. Despite demographic challenges like a declining birth rate, the market is buoyed by premiumization trends and innovation in ultra-thin, breathable packaging and night-use applications. Domestic giants like Asahi and Kirin are actively developing near-beer experiences tailored to mature consumers seeking taste without intoxication.

The non-alcoholic beer market is characterized by a blend of global brewing giants and agile craft producers, with innovation, flavor expansion, and sensory replication at the core of competitive strategy. Tier 1 players such as Anheuser-Busch InBev, Heineken N.V., and Carlsberg Group are aggressively scaling their alcohol-free portfolios, leveraging established distribution networks and brand equity to penetrate both mature and emerging markets. These companies are investing in advanced brewing technologies like limited fermentation and vacuum distillation to maintain flavor integrity while keeping alcohol levels below 0.5% ABV.

Tier 2 manufacturers, including Erdinger Weibbrau, Krombacher, and Daffodils Beverages, are focused on regional dominance with strong product differentiation. Many of these firms are adopting direct-to-consumer models and experimenting with exotic infusions to gain niche appeal. Localized marketing and partnerships with online retailers are also helping expand visibility.

Tier 3 players-typically smaller, local brewers and startups-are emphasizing clean-label, handcrafted positioning and tapping into rising consumer demand for regional authenticity. While their distribution reach remains limited, they contribute meaningfully to flavor innovation and sustainable packaging experimentation.

Across all tiers, R&D investments are geared toward enhancing mouthfeel, improving shelf life, and incorporating botanicals and functional ingredients. Product collaborations, sports sponsorships, and social marketing campaigns continue to be key branding tactics for improving consumer engagement and brand recall.

Non-alcoholic Beer Industry News

| Report Attributes | Details |

|---|---|

| Market Size (2025) | USD 20.5 billion |

| Projected Market Size (2035) | USD 43.9 billion |

| CAGR (2025 to 2035) | 7.9% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | Revenue in USD billion; Volume in million liters |

| Product Types Analyzed | Alcohol-Free, Low Alcohol |

| Category Segments Analyzed | Plain, Flavored |

| Material Types Analyzed | Malted Grains, Hops, Yeasts, Enzymes, Others |

| Sales Channels Analyzed | Convenience Stores, Liquor Stores, Supermarkets, Restaurants & Bars, Online Stores |

| End-Use Segments Analyzed | Individuals, Restaurants, Bars, Supermarkets, Online Retailers |

| Application Segments Analyzed | Health & Wellness, Social Occasions, Religious Reasons |

| Regions Covered | North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, Middle East & Africa |

| Key Countries Covered | United States, Canada, Brazil, UK, Germany, France, China, Japan, India, South Korea, GCC Countries and 40+ countries |

| Key Players Included | Anheuser-Busch InBev, Heineken N.V., Carlsberg Group, Asahi, Kirin, Suntory, Big Drop Brewing, Athletic Brewing, Erdinger |

| Additional Attributes | Market share by segment, innovation trends, regulatory overview, clean-label preferences, e-commerce penetration |

This segment is further categorized into Alcohol-free, Low Alcohol

This segment is further categorized into plain and flavored

This segment is further categorized into Malted Grains, Hops, Yeasts, Enzymes, Others

This segment is further categorized into Convenience Stores, Liquor Stores, Supermarkets, Restaurants & Bars, Online Stores

Industry analysis has been carried out in key countries of North America, Latin America, Europe, East Asia, South Asia, Oceania, and the Middle East & Africa.

The global non-alcoholic beer market is valued at USD 20.5 billion in 2025.

The market is projected to reach USD 43.9 billion by 2035.

Alcohol-Free segment leads with a 62.1% market share in 2025.

Germany is expected to be the fastest-growing market with an 8.2% CAGR during 2025–2035.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Beer Fermenter Market Size and Share Forecast Outlook 2025 to 2035

Beer Stabilizers Market Size and Share Forecast Outlook 2025 to 2035

Beer Bottles Market Size and Share Forecast Outlook 2025 to 2035

Beer Dispensers Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Beer Pasteurization Equipment Market Size and Share Forecast Outlook 2025 to 2035

Beer Glass Chillers Market Size and Share Forecast Outlook 2025 to 2035

Beer Packaging Market Size, Share & Forecast 2025 to 2035

Beer Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Beer Keg System Market Forecast & Outlook for 2025 to 2035

Beer Dispensing Machine Market Trends - Growth, Demand & Analysis 2025 to 2035

Beer Line Cooling System Market Trend Analysis Based on System, Application, and End-Use, and Region 2025 to 2035

Beer Line Cleaning Kit Market Trend Analysis Based on Product, End-User, Type, and Region 2025 to 2035

Beer Filter System Market insights by Equipment Type, Type, Filtration Process, Application, and Region 2025 to 2035

Beer Bottling Kit Market Insights by Equipment, Application, Mode of Operation, Distribution Channel, and Region 2025 to 2035

Market Share Insights for Beer Bottles Providers

Assessing Beer Canning Machines Market Share & Industry Trends

Competitive Overview of Beer Glassware Market Share

Beer Brewing Machine Market

Beer Cans Market

Root Beer Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA