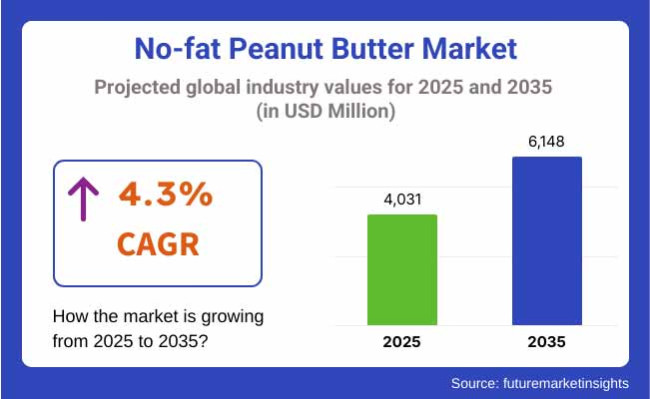

No-fat peanut butter market will observe the highest growth during 2025 to 2035 because the demand for healthy food is increasing from consumers. The market will be USD 4,031 million in 2025 and USD 6,148 million in 2035 with a compound annual growth rate (CAGR) of 4.3% for the forecast period.

There are certain factors which drive the market's growth. Indeed, emerging consumer groups concerned with health are in need of no-extra-fats high-protein food. Health-oriented consumers, heart-oriented consumers, and physically active fitness-oriented consumers are leading the demand for no-fat peanut butter.

Brand names like PBfit and Better'n Peanut Butter introduced new products of no-fat peanut butter with additional natural sweeteners and plant-proteins, for instance. But there are producers that are careful about mouthfeel and taste problems and continue to produce no-fat peanut butter spreads that retain the luxurious creaminess of the full-fat peanut butter without sacrificing any category in the way of nutritional content.

Market segments into uses and formats of no-fat peanut butter. Most frequent formats found in the market include powder type, spread type, and snack type. No-fat peanut butter powder foods such as PB2 are also utilized as smoothies, baking, and protein shakes due to the convenience of blending and shelf life.

Spread form is shelf form for customers who love original peanut butter but require a healthier alternative free from hydrogenated fat and oils. No-fat peanut butter energy balls and protein bars are stock items in the convenience nutrition line.

No-fat peanut butter has the greatest application in sport nutrition, confectionery application, dietetic food, and health foods. Among these, the most successful sector is sport nutrition where sport professionals and bodybuilders are willing to utilize peanut butter because of its high-protein, low-fat energy source composition. No-fat peanut butter is utilized for targeting confectionery firms to produce protein-rich chocolates and bread products for healthy indulgence.

No-fat peanut butter is dominated by North America with the bulk of the immense population base taking up physical well-being and health-consciousness and therefore taking particular interest in body-building culture. Veg foods and functional foods too have been immensely sought after in America and Canada, and no-fat peanut butter has also become very popular as a high-protein diet ingredient.

Brand leaders such as PBfit, Crazy Richard's, and Jif introduced new products with added fibre and natural sweeteners to take advantage of the natural nutrition consumer trend. Clean-label food innovation also compels businesses to cut out artificial additives, and organic and natural no-fat peanut butter products consequently became trendy in bulk.

Europe dominates the no-fat peanut butter market with the United Kingdom, Germany, and France at the forefront. Increased protein-snack food and plant food intake in the region prompted MyProtein and Pip & Nut to launch no-fat peanut butter.

Furthermore, European consumers are able to have an alternative of peanut butter compared to other native spreads like Nutella due to the nutritional advantage of protein with reduced sugar levels. EU food labelling regulation and health claims also makes cleaner ingredients and improved nutrition appealing, or brands genuine.

Asia-Pacific will be the growth leader for no-fat peanut butter due to heightened health consciousness, urbanization, and growing middle-class. Other countries like China, India, and Japan are also witnessing growing demand for fitness and weight control leading to the sale of no-fat peanut butter as a protein supplement food. Pintola and India's.

The Butternut Co. introduced lower-calorie, higher-protein peanut butter to the nation's consumers' minds as that, however, continues, functional foods demand in Japan and South Korean protein-rich snack foods craze drive the aggressive growth of the market. But the effort to convince the consumers that the benefit of no-fat peanut butter over peanut pastes is one worth paying for is a fundamental failure of the marketplace.

Challenge

Taste and Texture Problems

The biggest issue with the no-fat peanut butter category is providing smoothness and nut flavour that the consumer has come to associate with peanut butter. In the absence of fat, the product dries out and is less spreadable, a lower-quality product. The manufacturers are addressing this issue by making a commitment to new processing technology and natural binders such as tapioca starch and pea protein that provide texture without unsightly fat.

Opportunity

Expansion in Functional Foods

Functional foods trend presents a positive opportunity for the no-fat peanut butter market. The customers are becoming more demanding in seeking healthier food that contains fibre, probiotics, and adaptogens.

The brands are designing peanut butter brands that contain omega-3s, collagen, and plant protein as value-added nutritional ingredients. Additionally, food science technology is aiding in developing new taste-flavour flavours, such as honey and cinnamon taste-flavour no-fat peanut butter, to make it appealing to additional consumers.

The no-fat peanut butter market grew between 2020 to 2024 through increased global well-being and well-being. The top-rated markets at that time were plant-based foods, fitness trends, and weight-loss diet. Competition lagged behind them with better labels, organic products, and protein-focused peanut butter alternatives. Flavor and texture were consumers' greatest challenges, and additional R&D expenditure therefore had to be incurred.

Looking ahead to 2025 to 2035, sustainability, clean-label foods, and functional benefits will be the directions in the marketplace. Green packaging, non-GMO ingredients, and plant-based fortifications will be the realm of companies to satisfy future consumer requirements.

Increasing consumer demand for convenient, protein-filled snacks will drive innovation in peanut butter-filled bars, bites, and spreads, driving further marketplace growth. As customers become more and more used to and comfortable with no-fat peanut butter, the industry will expand exponentially within the next decade.

Market Shifts: A Comparative Analysis 2020 to 2024 vs. 2025 to 2035

| Market Shift | 2020 to 2024 |

|---|---|

| Regulatory Landscape | Governments imposed labelling regulations to bring transparency to sugar content and additives in no-fat peanut butter. Health organizations pushed for lower sodium and artificial ingredients. |

| Technological Advancements | Innovations in processing reduced oil levels without compromising texture. Producers experimented with stabilizers to increase shelf life without compromising taste. |

| Consumer Preferences | Healthy consumers drove demand for no-fat peanut butter, but concerns over added sugars and artificial ingredients held back widespread adoption. |

| Retail & Distribution Trends | Specialty food stores and supermarkets were principal channels of distribution. Diet segments on online stores grew more slowly, especially in the post-pandemic period. |

| Ingredients & Formulation | Manufacturers applied starches, gums, and artificial thickeners to replicate classic peanut butter texture. Maltodextrin and aspartame sweeteners were most prevalent in Diet segments. |

| Sustainability Practices | Peanut farming practices that were sustainable were most in evidence. Plastic containers, however, most dominated packaging. |

| Market Growth Drivers | Rising obesity rates and health issues led to demand for no-fat peanut butter. However, issues with taste and consistency restricted growth in Diet segments at a slow pace. |

| Market Shift | 2025 to 2035 |

|---|---|

| Regulatory Landscape | Tighter food labelling and health laws require more transparent ingredient declaration and fewer artificial preservatives. Governments promote natural sweeteners and fortified versions to increase nutritional content. |

| Technological Advancements | Sophisticated food processing methods improve texture and taste without artificial stabilizers. New cold-pressed and enzymatic extraction processes allow for the preservation of natural peanut protein while maintaining zero fat. |

| Consumer Preferences | Increased consumer awareness of plant-based diets and clean labels drives demand. Organic and protein-fortified products are preferred, influencing product innovation and differentiation. |

| Retail & Distribution Trends | Direct-to-consumer (DTC) sales increase through company-owned websites and social media channels. Subscription services and personalized flavours increase consumer interest. |

| Ingredients & Formulation | Reformulation tendencies lean towards natural replacements like date paste and monk fruit for sweetness. Protein and fibre enrichment increase market attractiveness to fitness enthusiasts. |

| Sustainability Practices | Adoption of biodegradable and recyclable packaging increases. Brands highlight carbon-neutral manufacturing and sustainably sourced peanuts to appeal to environmentally aware consumers. |

| Market Growth Drivers | Functional food trend-driven expansion, increased demand for higher protein, and growing vegan and lactose-intolerant consumer base. Companies innovate with nutrient-rich formulations to reach a wider audience. |

The USA no-fat peanut butter industry is changing for the better with increasing significance of healthy eating and plant-based diets. Regimen exercisers who are considering alternatives to high-fat spreads are making increasing demands. The target of the formulators is to reduce artificial ingredients and employ natural ones as part of an ambition to embrace the clean-label trend.

Functional foods such as added fibre and probiotics will lead product innovation over the next several years. The digital platform is leading the way, with direct-to-consumer sales becoming increasingly popular through specialty subscription packs and personalized flavour profiles.

Growing Demand for Functional Spreads: The USA peanut butter market and nutrient-enriched peanut butter varieties command a greater market share. Low-calorie and protein-fortified spreads are the latest trends, particularly among health-conscious gym enthusiasts. Almond-peanut mix spreads are also experimented with by companies to cater to various diet needs.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 4.2% |

The UK no-fat peanut butter market is expanding due to the fact that consumers put greater importance on healthy breakfast and snack food. Retailers selling a range of products have organic and clean-label products, which prompts brands to eliminate artificial ingredients. The shift from sugar is supported by regulatory focus, and the use of natural sweeteners is increasingly accepted in the market.

Sustainability is a matter of utmost significance, and companies move towards sustainable packaging. Allergen-free and peanut-free spreads become trendy as food sensitivities increase. British food manufacturers have been making bold claims about sustainability, and it is having an effect on packaging. Biodegradable pouches and glass jars reign supreme over plastic packaging, which is a sign of the shift towards sustainable trends.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 3.8% |

EU no-fat peanut butter market is dominated by stringent food safety and labelling regulations. The top countries to drive demand based on high demand for organic and plant-based foods are Germany, France, and the Netherlands. Businesses are required to comply with sugar reduction regulations, thereby driving innovation in natural sweeteners.

The plant revolution deeply affects product innovation, and pea protein, flaxseed, and omega-3 enriched spreads grow popular. The functional food trend also creates a demand for spreads enhancing gut health and energy metabolism. The European Union's plant-based food market is at the forefront of nut butter innovation for healthier consumption. Firms prioritize organic certification and nutritional density to appeal to health-conscious consumers.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union | 4.1% |

Japan's low-fat peanut butter market is gradually picking up pace with rising demand for low-calorie, high-protein foods. Consumers want naturally processed, clean-label spreads and manufacturers therefore employ natural thickeners such as konjac fibre. This is aligned with Japan's functional foods and longevity trend.

Urban lifestyle convenient packaging choices such as single serving pouches are ideal for the busy urban consumer. Moreover, peanut cultivation by communities eliminates dependence on imports, making supply chain predictability better. Japanese consumption of functional foods drives more vigorous demand for fat-free add-ins of probiotic, prebiotic, and immunity factor-enriched peanut butter.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 3.9% |

South Korea's no-fat peanut butter market is expanding with rising health-conscious population and growing protein consumption trend. Young people and athletes are driving demand with high-protein, low-fat food demand.

Local brands also are utilizing new ingredients such as black sesame and collagen to give nutritional enhancements. The impact of K-beauty on nutrition also is contributing to the business, as beauty-focused nut butter launches are gaining traction. South Korean beauty food market intersects with the functional peanut butter product category. Antioxidant- and collagen-fortified spreads become leading choices among consumers looking for end-to-end well-being solutions.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 4.0% |

Smooth and spreadable no-fat creamy peanut butter has a wide market share because it meets the demands of consumers who want to enjoy a smooth and spreadable product. Health-conscious consumers, parents, and bodybuilders prefer to utilize creamy peanut butter because it can be used straight away in smoothies, protein shakes, and baked products. Brand names like PB2 and Crazy Richard's have already taken advantage of such a market with highly ground peanut butter with strong flavour without employing fats.

Growing usage of vegetable meals has also helped drive demand for no-fat crunchy peanut butter as a high protein food in food preparation. Fat-free crunchy peanut butter is on an expansion wave with consumers still looking for products with a crunchier bite. Healthy snackers and enthusiasts prefer the combination because it can be utilized to add crunch to yogurt parfaits, oatmeal, and toast.

High-end brands have introduced products that have peanut pieces in them to cater to the demand for extra crunch from the consumers. The category is most preferred by consumers who enjoy eating peanut butter as a spread or straight as a snack.

Jars continue to be the top package choice in the no-fat peanut butter market with convenience, recyclability, and increased pack size. Household consumers choose jars because they allow for effortless scooping and effortless long-term storage.

The majority of the large brands offer glass and plastic jars, and many companies are making the change to environment-friendly and BPA-free packaging to accommodate consumers who are concerned about the environment. The product is a supermarket and grocery store retailer staple with assured perpetual demand.

Squeeze bottle peanut butter is also becoming increasingly popular among consumers who prefer mess-free eating on pancakes, waffles, and toast. Fitness clubs have come up with easy-squeeze peanut butter bottles, which are perfect for consumption immediately before or after exercise.

Stand-up pouches are also becoming popular as a package type, particularly for single-serve packs. Working professionals and sports persons prefer this type of packaging for the consumption of no-fat peanut butter without any use of utensils.

The B2C market is also boiling and customers are purchasing greater volume of no-fat peanut butter from every retailing channel. Hypermarkets and supermarkets remain the strongest selling channels, with broad selection of flavours and pack sizes. Specialist health food shops and organics food shops also have been facing growing demand as these shops carry specialty shoppers who require clean-label and non-GMO peanut butter.

Online shopping has taken root with companies using e-commerce sites such as Amazon, Thrive Market, and consumer-direct sites to reach more buyers. Even peanut butter can now be bought by subscription, allowing health-oriented consumers to get their best-loved products on a regular basis.

Natural flavour chocolate no-fat peanut butter is also in big demand as health-food conscious shoppers also desire alternatives and healthier options of classic chocolate spread. Healthy-conscious, gym-ridden shoppers enjoy this version a guilt-free treat to appease sweet tooth without sacrificing protein quality.

Category leaders led the way with natural cocoa and sugar alternatives to deliver best taste without compromising nutritional integrity. The category keeps expanding as shoppers shift to plant-based and high-protein dessert alternatives.

No-fat peanut butter is a market with region and worldwide players due to customer demand for health, ingredient innovation, and extension of the product. Dominant manufacturers in the market rule through their extensive networks of distribution, product quality, and name recognition.

The manufacturers are willing to spend money on organic, all-natural formulation and clean-labels in response to rising demand for healthy foods from customers. The established names segment and the new entrants segment make up the industry, propelling the innovation and determining the drivers of industry growth.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| The J.M. Smucker Company | 15-20% |

| Hormel Foods Corporation | 12-16% |

| Kraft Heinz Company | 10-14% |

| Conagra Brands, Inc. | 6-10% |

| Once Again Nut Butter | 4-8% |

| Other Companies (combined) | 40-50% |

| Company Name | Key Offerings/Activities |

|---|---|

| The J.M. Smucker Company | Offers Skippy and Jif peanut butter products that are no-fat, with the emphasis being on the flavour and texture. Expands its products with organic and sugar-free additions continually. |

| Hormel Foods Corporation | Manufactures no-fat peanut butter under the Skippy brand, highlighting protein-rich formulas with no artificial preservatives. |

| Kraft Heinz Company | Produces no-fat peanut butter under the Planters brand name, using high-tech processing methods to preserve taste and spreadability. |

| Conagra Brands, Inc. | Markets Peter Pan no-fat peanut butter using non-GMO ingredients, appealing to the health-oriented and fitness consumer markets. |

| Once Again Nut Butter | Excels at all-natural and organic no-fat peanut butter and leads with sustainable sourcing and fair trade. |

Key Company Insights

The J.M. Smucker Company (15-20%)

The J.M. Smucker Company dominates no-fat peanut butter with Jif and Skippy brands having several no-fat and low-fat peanut butter products. It dominates taste and consistency improvement and healthy consumer need fulfillment. J.M. Smucker conducts shelf life improvement and packaging ease research by matured distribution facilities in North America and the world.

Hormel Foods Corporation (12-16%)

Hormel Foods Corporation, producer of Skippy peanut butter, has achieved significant market share by introducing no-fat and low-fat versions without diluting the brand's characteristic creamy texture. Hormel is marketing its peanut butter vigorously as a plant protein food for bodybuilders and health-food shoppers. The company is marketing eco-friendly packaging as part of its initiatives towards green causes aggressively as well.

Kraft Heinz Company (10-14%)

Planters is owned by Kraft Heinz, which produces no-fat peanut butter with the goal of preserving the nutty flavour without oil. Kraft Heinz invests in processing technology for enhanced spreadability and product consistency. Kraft Heinz leverages its wide global distribution and big-box retailer relationships to establish Planters as a name household brand among peanut butter consumers.

Conagra Brands, Inc. (6-10%)

Conagra Brands markets Peter Pan no-fat peanut butter on the natural sweetness and non-GMO platforms. The company continues to find new formulation innovation, such as the addition of protein and fibre enhancers, in order to continue building out the nutrition content of the product. Peter Pan has been resonating with consumers seeking clean-label, health-conscious spreads.

Once Again Nut Butter (4-8%)

Once Again Nut Butter is a niche company that specializes in selling no-fat all-natural peanut butter organic. It buys peanuts from fair trade and sustainable organic operations, which attracts consumers concerned about nature. It keeps customers loyal through low ingredient numbers and small-batch.

Other Large Players (Combined 40-50%)

Other companies supply the no-fat peanut butter segment, such as new lines and value-added price points. They are also vital to break into the market and maximize consumer access to healthy peanut butter. Key players include:

The overall market size for no-fat peanut butter market was USD 4,031 million in 2025.

The no-fat peanut butter market is expected to reach USD 6,148 million in 2035.

The increasing consumer preference for healthier food alternatives, rising awareness about low-fat diets, and growing demand for plant-based protein sources fuel the no-fat peanut butter market during the forecast period.

The top 5 countries which drive the development of no-fat peanut butter market are USA, UK, Canada, Germany, and Australia.

On the basis of distribution channel, supermarkets and hypermarkets to command significant share over the forecast period.

Explore Similar Insights

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA