The global No-Fat Cake Market is poised for steady growth from 2025 to 2035, stimulated by growing demand from consumers for healthier dessert foods. No-fat cakes, popular with those with weight loss and overall well-being concerns, are becoming increasingly popular with low calorie levels and wholesome ingredients.

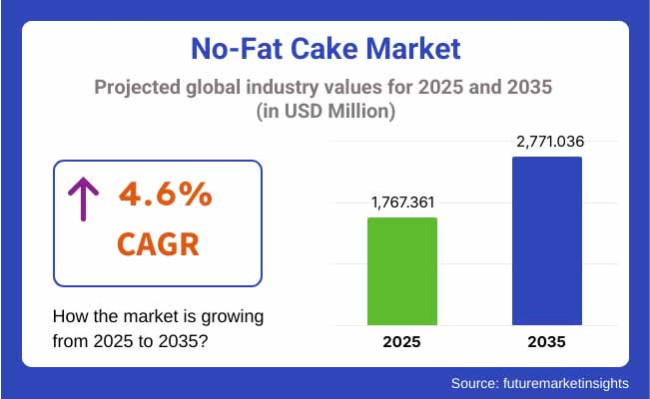

The market is projected to surpass USD 2771.036 Million by 2035, growing at a CAGR of 4.6% during the forecast period.

Growing incidence of lifestyle diseases like diabetes and obesity is stimulating demand for fat-free bakery foods. Expansion in the market is also facilitated by advances in food processing technology and increasing demand for plant-based and alternative ingredient solutions.

North America remains a key market for no-fat cakes. Market growth has been driven by a growing concern for health and the rise of diet-related diseases in China, which have made consumers more aware of what they put in their mouths.

To address consumers' new needs, local bakeries in United States are making and selling functional, low-fat products-evidenced by a thorough infrastructure of food production complexes already engulfing the industry. The new spread of specialty health food stores, supermarkets, convenience shops and e-commerce creates convenient channels for the public.

And yet it is also here that ground-breaking techniques such as natural fat substitutes for no-fat cake send sales soaring up to new heights: anywhere from the housewife's kitchen at home in Japan, all the way out through supermarket chains throughout North America, Europe-indeed global continent by continent--more and more consumers have come to know and enjoy these delicious treats Rising awareness of clean-label and organic ingredients further fuels demand.

Europe is the major share of the no-fat cake market. This is attributed to an increasing attention on dietary wellness and sustainability. Lead countries include Germany, France and the United Kingdom which benefit from strong regulatory frameworks that promote reduced fat food products.

The presence of famous bakery brands and growing demand for vegan and plant-based no-fat cakes add to market expansion in Europe. Europeans display an increasing demand for bakery formulations free from artificial additives, preservatives and unhealthy fats. Thereby driving innovation in this area as well as satisfying their own culinary appetites.

The Asia-Pacific region is expected to experience the fastest growth in the no-fat cake market. This rise will be driven by rapid urbanization, rising disposable incomes and alterations of consumer preferences towards lighter foods overall. Many countries in the region such as China, Japan and India are witnessing healthy growth of healthier baked goods brought on by Western dietary trends.

On-line shopping in the region speeds the sale of no-fat bakery products. And, finally, the increasing awareness that company's creative products have to be both culturally adjusted firms up investment in independent modern no-fat cake manufacturers. A concurrent growth in both sectors combined should see significant market expansion over these coming four years.

Challenge

Limited Market Awareness and Consumer Perception

Limited consumer awareness of the No-Fat Cake Market and doubts about hippie tastes and textures means that the industry faces a tough uphill climb. Many people think fat-free goods suffer in quality or taste-A perception that presents sizable obstacles for producers.

High Production Costs and Ingredient Sourcing

To make no-fat cakes which are genuinely tasty and satisfying, one needs high-quality alternatives to such essential ingredients as natural emulsifiers and sugar substitutes. However, these specialty flourishes increase the company's operating costs, drastically reducing its profitability.

Opportunity

Rising Health and Wellness Trends

The increasing consumer preference for healthy food offers an opportunity to the No-Fat Cake Market. Greater knowledge of obesity, heart disease and other health risks has boosted demand in the bakery industry.

Innovation in Food Technology and Ingredient Development

Technological advances in food production and ingredient formulation are enabling manufacturers to contrive taste and texture in no-fat cakes as never before. Developments in the creation of plant-based fat substitutes and the era for functional ingredients lie ahead offer more variety to consumers while making them even healthy

During 2020 to 2024, the No-Fat Cake Market made moderate progress thanks largely to the increasingly health-conscious eating habits that are sweeping our society. At the same time, people now show more interest in low-calorie baked goods. However, issues of consumer perception and high production costs held the market back.

During 2025 to 2035, the market is likely to continue expanding in the light of progressive formulations of production and such important factors as marketing. We believe that demand for clean-label ingredients, improved flavour profile with plant-based alternatives, and on-the-go convenience will increase. Apart from this, the emergence of new e-commerce platforms as well as direct-to customer through mail order--will be vital for future expansion of our market.

Market Shifts: A Comparative Analysis 2020 to 2024 vs. 2025 to 2035.

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Growing focus on labeling and nutritional transparency |

| Market Demand | Niche consumer base interested in diet-specific baked goods |

| Industry Adoption | Limited presence in mainstream bakery products |

| Supply Chain and Sourcing | Dependence on high-cost specialty ingredients |

| Market Competition | Few specialized brands and health-focused bakeries |

| Market Growth Drivers | Health-conscious consumers and diet trends |

| Sustainability and Energy Efficiency | Minimal focus on sustainable production practices |

| Integration of Digital Innovations | Limited online presence and marketing |

| Advancements in Product Design | Focus on reducing fat while maintaining texture |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Stricter guidelines on sugar and artificial ingredient use |

| Market Demand | Wider acceptance due to improved taste and ingredient innovation |

| Industry Adoption | Expansion into major retail stores and bakery chains |

| Supply Chain and Sourcing | Improved ingredient sourcing and cost-effective alternatives |

| Market Competition | Entry of major bakery brands and private-label products |

| Market Growth Drivers | Innovation in taste, texture, and natural ingredient development |

| Sustainability and Energy Efficiency | Adoption of eco-friendly packaging and sustainable ingredient sourcing |

| Integration of Digital Innovations | Growth in e-commerce sales and digital advertising strategies |

| Advancements in Product Design | Introduction of plant-based and clean-label fat substitutes |

Increasing health consciousness and a rise in the craving for low-calorie sweets are the reasons why the no-fat cake market in the USA is thriving. With a move toward healthier alternatives, consumers are hefting no-fat cakes from groceries into their shopping baskets and slurping up sugar-free (and healthy) soft drinks.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 4.4% |

In the UK, In the UK, obesity and heart disease have become lifestyle diseases on account of this, while peoples demand for no-fat cakes as a dessert is on the increase. Vegan and health-conscious consumers need something with indulgence that won't shock them later not to mention clog their arteries.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 4.5% |

With rising demand for low fat cakes across the European Union and tighter food regulations, the no-fat cake market here is on fire. It is no longer unusual to find countries like Germany and France taking a lead in providing healthier dessert options.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union | 4.7% |

South Korea the current popularity of no-fat cakes has boosted South Korea's healthier eating habits. E-commerce platforms are thus growing and K-health trends also encourage market expansion.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 4.8% |

The organic segment is growing significantly in the mitochondrial DNA market, because consumers are increasingly conscious and preger to undeveloped product. Organic alternatives are based on natural ingredients, processed without the addition of artificial such as preservatives or colouring agents; they are therefore fantastic foods for health-conscious individuals.

Since mitochondrial damage is also associated with diseases like metabolic disorders and continuing state illness, consumers buy Organic products to avoid potential toxic agents. Instead, they are seeking to further increase their general well-being. The rise of clean-label and non-GMO products provides further support for the growth of organic section.

Furthermore, both regulatory enforcement bodies and certifying agencies are promoting adoption of organic goods by setting down strict requirements for purity and sustainability. Organic alternatives may be costly compared to conventional solutions, their perceived health benefits and environmental sustainability level sometimes bring that very weight. As consumers are now focusing on being healthy and living better, it is expected that the organic segment will grow rapidly in this market.

In spite of the increasing demand for organic options, the conventional segment continues to hold the leading position in the market for mitochondrial DNA. Conventional products, such as pharmaceutical medication and supplements, are available everywhere and cheaper than organic options. They are produced on a mass scale through standardized processing mechanisms, promoting identical quality and affordability across a large customer base.

Also, traditional products are subject to extensive testing and regulatory clearance, and thus prove to be a reliable option for healthcare professionals and scientists. Organic products find favour in niche segments, whereas traditional treatments and diagnostic solutions remain the first preference for mitochondrial disease management because of their ready availability and cheaper production.

Finally, continuous research and development in drug formulations and mitochondrial-targeted therapy is likely to continue to augment the traditional segment. As affordability and accessibility continue to play a central role in healthcare decision-making, traditional products will continue to be important in responding to mitochondrial-related health issues.

Bakeries and pastry shops became a prominent supplier of mitochondrial DNA early, a fact clearly demonstrated by health-conscious pastries, biscuits and pill form supplements. Many bakeries have joined the medley of functional food ingredients market, incorporated into their products anti-oxidants, omega-3 fatty acids and possibly the essential vitamins needed by ones mitochondria for good health.

For the ultimate in convenience, functional breads, energy bars, and enriched pastries have begun to grab market ground as people look for increasingly easy ways of eating well. Also, organically-sourced or gluten-free offerings cater directly to the needs of those who must live without certain foods or those suffering from specific nutritional supportive disorders such as mitochondrial diseases. As bakery and pastry shops follow suit with health-conscious products, this sales channel will have an increasing impact on the mitochondrial DNA market.

Confectionery shops tap into the mitochondrial health trend with chocolates, gummies and candy infused by producers that promote cellular energy production. Dark chocolate rich in flavonoids, gummies enriched with many vitamins and herbal-adsorbed sweets are the best choices for customers who want tasty function.

With a growing understanding of the connection between diet and mitochondrial function, more and more confectionery brands are introducing superfoods, adaptor-gens and other mitochondrial boosting nutrients to their product line up. More consumers of Eat Well Grocery products are known to appreciate enjoyable health options by incorporating this branch into the management chain.

The no-fat cake market is witnessing a consistent growth as health-oriented consumers more and more look towards low-calorie and fat-free dessert products. Increasing knowledge about the correct way of eating and the rise in demand for guilt-free indulgence are fueling market growth.

Market Share Analysis by Key Players & Manufacturers

| Company/Organization Name | Estimated Market Share (%) |

|---|---|

| Hostess Brands | 15-20% |

| Grupo Bimbo | 12-17% |

| McKee Foods Corporation | 10-15% |

| Flowers Foods | 8-12% |

| Mondelez International | 6-10% |

| Other Manufacturers | 30-40% |

| Company/Organization Name | Key Offerings/Activities |

|---|---|

| Hostess Brands | Wide range of fat-free cakes and snack cakes. |

| Grupo Bimbo | Low-calorie and sugar-free cakes for health-conscious consumers. |

| McKee Foods Corporation | Specializes in whole-grain and no-fat dessert products. |

| Flowers Foods | Offers no-fat bakery items with natural ingredients. |

| Mondelez International | Produces reduced-fat and no-fat cake options for global markets. |

Key Market Insights

Hostess Brands (15-20%)

A leading player in the market, Hostess Brands provides a variety of fat-free snack cakes, catering to consumers seeking healthier alternatives.

Grupo Bimbo (12-17%)

Grupo Bimbo focuses on producing fat-free cakes with natural and nutritious ingredients, expanding its presence in the global market.

McKee Foods Corporation (10-15%)

McKee Foods specializes in whole-grain and low-fat baked goods, targeting the health-conscious segment.

Flowers Foods (8-12%)

Flowers Foods provides an assortment of no-fat bakery products made with high-quality ingredients.

Mondelez International (6-10%)

Mondelez offers reduced-fat and fat-free cakes, meeting the demand for healthier sweet treats worldwide.

Other Key Players (30-40% Combined)

Several other manufacturers contribute to the no-fat cake market, including:

The overall market size for No-fat Cake market was USD 1767.361 Million in 2025.

The No-fat Cake market is expected to reach USD 2771.036 Million in 2035.

The no-fat cake market will be driven by increasing health consciousness, demand for organic and clean-label products, rising online sales, and growing preference for healthier dessert alternatives in bakeries, restaurants, and households.

The top 5 countries which drives the development of No-fat Cake market are USA, European Union, Japan, South Korea and UK

Organic Products demand supplier to command significant share over the assessment period.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Cake Enzyme Market Size and Share Forecast Outlook 2025 to 2035

Cake Base Discs Market Size and Share Forecast Outlook 2025 to 2035

Competitive Overview of Cake Base Discs Companies

Cake Boxes Market from 2025 to 2035

Cake Concentrate Market

Cupcake Box Market Size and Share Forecast Outlook 2025 to 2035

Cupcake Liner Market Size and Share Forecast Outlook 2025 to 2035

Cupcake Containers Market Size and Share Forecast Outlook 2025 to 2035

Cupcake Wrappers Market Size and Share Forecast Outlook 2025 to 2035

Competitive Landscape of Cupcake Wrappers Manufacturers

Cupcake Tray Machines Market

Rice Cake Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Teaseed Cake Market – Trends & Forecast 2025 to 2035

Instant Cake Gel Market

Instant Cake Emulsifier Market

Aerating Cake Emulsifier Market

Activated Cake Emulsifier Market Size and Share Forecast Outlook 2025 to 2035

Market Share Breakdown of Activated Cake Emulsifier Suppliers

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA