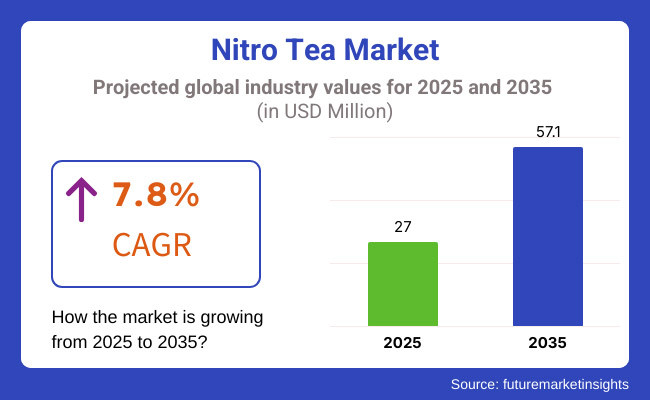

The demand for global Nitro Tea market is expected to be valued at USD 27.00 Million in 2025, forecasted at a CAGR of 7.8% to have an estimated value of USD 57.10 Million from 2025 to 2035. From 2020 to 2025 a CAGR of 7.4% was registered for the market.

The widespread acceptance of nitrogen-infused beverages is helping the nitro tea market. Customers are getting something new from these drinks. The marketing campaigns attempts to highlight the health advantages of nitro drinks-such as their low levels of sugar and acidity-also add to their allure.

Since tea is one of the most consumed beverages worldwide tea products that contain nitrogen have a lot of room to grow. As a result, the market share of nitro-infused beverages is increasing for tea. An increase in the number of customers choosing brew options is helping the industry. It’s said that nitrogen complements brew options. As a result, consumers are favoring options like cold brew nitro tea and nitro brew.

Overall the beverage industry is experiencing the ready-to-drink trend. Ready-to-drink beverage varieties are growing in popularity due to consumer demand for on-the-go drinks and increasingly hectic lifestyles. Thus, tea that is ready to drink is becoming more popular. Nitro tea that is ready to drink is also benefiting from this surge in demand.

As a result, stakeholders are spending more money on the products ready-to-drink varieties. Customers also give nitrogen-infused tea high marks for adaptability to various flavors.

Those with a nitrogen inclination are also being exposed to a wide variety of flavors even as traditional tea makers experiment with different flavors. Chocolate vanilla and mango are just a few of the flavors that are becoming popular.

Therefore, flavored nitro tea presents investors with a promising growth path. However, there are some issues that affect manufacturers. The industry is severely hampered by a lack of knowledge about the drinks. Investment is also challenging due to the difficulty in obtaining nitrogen.

Awareness in Health is Driving the Market Growth

The market for nitro-infused tea has been significantly shaped by health and wellness trends which have increased consumer demand for natural functional beverages that provide both health and hydration advantages.

Drinks that enhance their general health in addition to tasting good are becoming more and more popular among consumers. Furthermore, for those who are concerned about their health and want to make better decisions nitro-infused tea provides a tasty and refreshing substitute for sugary soft drinks and artificially flavored beverages.

During the period 2020 to 2024, the sales grew at a CAGR of 7.4%, and it is predicted to continue to grow at a CAGR of 7.8% during the forecast period of 2025 to 2035.

As the pandemic continued to rage the focus was on healthy beverages. People were clamoring for tea and coffee as they spent more time at home. Customers were also able to try different drinks because of the time savings. Consequently, the nitro tea industry thrived during the historical era. In comparison to the historical period the industry is anticipated to grow more slowly during the forecast period.

The limited availability of the drink in some regions of the world and the existence of substitutes are the causes of the industrys sluggish adoption. For investors however, there are numerous opportunities. Due to the e-commerce boom many manufacturers have expanded their operations online.

E-commerce websites have assisted in bridging the gap between suppliers and customers as the availability of nitro drinks is a concern in some places. It is anticipated that ongoing health trends will also influence industry expansion. Many people who are concerned about their health find it difficult to give up tea. Nitro tea is becoming a viable choice for them.

Tier 1 companies comprises industry leaders acquiring an 80% share in the global business market. These leaders are distinguished by their extensive product portfolio and high production capacity. These industry leaders stand out due to their broad geographic reach, in-depth knowledge of manufacturing and reconditioning across various formats and strong customer base.

They offer a variety of services and manufacturing with the newest technology while adhering to legal requirements for the best quality.

Tier 2 companies comprises of mid-size players having a presence in some regions and highly influencing the local commerce and has a market share of 10%. These are distinguished by their robust global presence and solid business acumen. These industry participants may not have cutting-edge technology or a broad global reach but they do have good technology and guarantee regulatory compliance.

Tier 3 companies comprises mostly of small-scale businesses serving niche economies and serving at the local presence having a market share of 10%. Due to their notable focus on meeting local needs these businesses are categorized as belonging to the tier 3 share segment, they are minor players with a constrained geographic scope.

As an unorganized ecosystem Tier 3 in this context refers to a sector that in contrast to its organized competitors, lacks extensive structure and formalization.

The following table shows the forecasted growth rates of the significant three geographies revenues. USA, UK and Japan come under the exhibit of high consumption, recording CAGRs of 6.4%, 6.5% and 8.2%, respectively, through 2035.

| Countries | CAGR, 2025 to 2035 |

|---|---|

| United States | 6.4% |

| UK | 6.5% |

| Japan | 8.2% |

Throughout the evaluation period the USA industry is expected to grow at a CAGR of 6.4%. The nitro tea market is positively impacted by the widespread coffee shop culture in the United States. Numerous small-scale coffee and tea businesses support the national industry. Nitro tea is also widely distributed by tea chains like Boba Guys. The USA will therefore continue to be a major players pocket.

The market for nitrogen-infused tea in Japan is expected to grow at a notable 8.2% CAGR over the next several years. estimated duration. The Japanese market is anticipated to grow because of its enormous growth potential. considerably in the upcoming years.

Market participants have been growing their businesses by taking advantage of this opportunity. footprint in this location. Although it is still small in comparison to other markets the Japanese market is expanding gradually. infused with nitrogen.

In Japan the tea is referred to as nitro tea and is becoming more and more well-liked by consumers who are looking for healthier options. for fresh and distinctive frozen beverage options that contain nitrogen. The younger generation is especially fond of this trend customers who are captivated by the novelty of tea with nitrogen and its eye-catching appearance.

The industry is expected to continue growing at a compound annual growth rate (CAGR) of 6.5% in the UK. A number of things including the rising demand for tea are to blame for this. The third-highest tea consumption in the world is reportedly found in the United Kingdom. The nations tea drinkers particularly the younger generation are also open to trying new things. Therefore, there is a benefit to the nitro tea market in the UK.

| Segment | Value Share (2025) |

|---|---|

| Nitro Ginger Ale Green Tea (Product Type) | 70% |

The market share of nitro ginger ale green tea was 70% in 2025. Green tea has gained popularity because of its health benefits as well as the refreshments it offers. Many people think that combining nitrogen and green tea combines the best aspects of both. Infusing nitro into green tea enhances its health benefits. Additionally, the final beverage has a distinct flavor.

| Segment | Value Share (2025) |

|---|---|

| Speciality Tea Stores (Distribution Channel) | 48% |

In 2025 specialty tea retailers held a 48% market share. Many tea connoisseurs who are eager to try out new tea varieties and flavors can be found in specialty tea shops. Thus, nitro tea can be easily distributed through specialty tea shops.

Market participants view developing novel flavors as essential. Another tactic used to reach more customers is to offer the product at a competitive price. The nitro tea industry is highly competitive due to the rapid influx of new players brought about by the internet boom.

Leading companies are creating new iterations in an effort to draw in more and more customers. Similarly, businesses are increasingly using tactics like partnerships distribution agreements mergers and collaborations.

To appeal to environmentally conscious consumers a number of businesses are concentrating on using visually appealing and environmentally friendly packaging. Players are using social media platforms as essential marketing tools to reach a wider audience worldwide.

The market is expected to grow at a CAGR of 7.8% throughout the forecast period.

By 2035, the sales value is expected to be worth USD 57.10 Million.

Demand for good health is increasing demand for Nitro Tea.

North America is expected to dominate the global consumption.

Some of the key players in manufacturing include and Rise Brewing Co., East Forged and more.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Nitrogen Tester Market Size and Share Forecast Outlook 2025 to 2035

Nitrogen Fertilizer Additives Market Size and Share Forecast Outlook 2025 to 2035

Nitroglycerin Market Size and Share Forecast Outlook 2025 to 2035

Nitrogen Gas Based Air Separation Unit Market Size and Share Forecast Outlook 2025 to 2035

Nitromethane Market Size and Share Forecast Outlook 2025 to 2035

Nitrogenated Coffee Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Nitrogen Flushing Machine Market Report – Trends, Size & Forecast 2025-2035

Nitrogen Gas Springs Market

Nitrogenous Fertilizer Market

2-Nitrothiophene Market Growth – Trends & Forecast 2025 to 2035

Di Nitro Toluene Market - Trends & Forecast 2025 to 2035

1,8-Dinitroanthraquinone Market Size and Share Forecast Outlook 2025 to 2035

China Nitrogen Gas Spring Market Report - Trends, Growth & Forecast 2025 to 2035

Leading Providers & Market Share in China Nitrogen Gas Springs

Liquid Nitrogen Purge Systems Market Size and Share Forecast Outlook 2025 to 2035

3,5-Dinitroaniline Market Growth – Trends & Forecast 2025 to 2035

Medical Nitroglycerin Sprays Market - Demand, Innovations & Forecast 2025 to 2035

Sodium 3-Nitrobenzenesulfonate Market Size and Share Forecast Outlook 2025 to 2035

Charging Nitrogen Gas Systems Market Size and Share Forecast Outlook 2025 to 2035

Nonprotein Nitrogen Market Insights - Livestock Nutrition & Industry Demand 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA