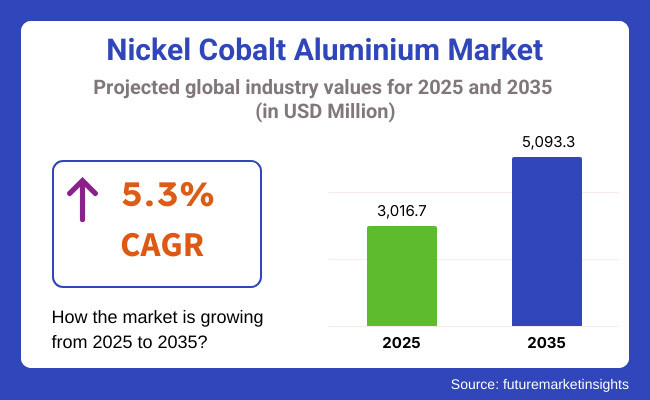

According to Future Market Insights, the global Nickel Cobalt Aluminium industry is expected to be valued at USD 3,016.7 million by 2025 and reach USD 5,093.3 million by 2035. The industry is projected to increase at a 5.3% compound annual growth rate (CAGR), during the forecast period. The growing need for lightweight materials in the automotive and aerospace sectors is fueling the demand of these materials, aiding industry growth.

In 2024, the Nickel Cobalt Aluminium industry witnessed steady growth, led by growing demand for light-weight and high-performance materials in electric vehicles (EVs) and aerospace uses. Advances in battery chemistry and growing EV production helped drive expansion significantly. Moreover, sustainability efforts promoted the implementation of effective recycling systems, guaranteeing stable raw material availability.

The industry is poised for expansion in 2025, driven by rapid EV adoption, government subsidies, and improvements in energy storage technology. The manufacturers of batteries are likely to maximize production efficiency, driving the performance of next-generation lithium-ion batteries. Increasing investment in clean material sourcing and recycling technologies will also fuel industry growth, cementing its position in the global energy transition.

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| EV Boom & Battery Demand: Fast growth in electric vehicle manufacturing drove demand for high-performance battery materials. | Advanced Battery Technology: Broader acceptance of solid-state and high energy density batteries for increasing industry development. |

| Raw Material Restraints: Geopolitical tensions and supply chain disruptions affected nickel and cobalt supply. | Supply Chain Localization: High investment in local sourcing and new battery chemistries to decrease reliance. |

| Sustainability Efforts: Recycling initiatives gained traction, though large-scale efficiency remained a challenge to address. | Circular Economy Strengthening: Enhanced recycling facilities and regulatory requirements to promote material recycling. |

| Investment Boom: Governments and leading producers increased investment in battery R&D. | Production Scale-Up: Gigafactory expansions and technology partnerships to significantly boost material production. |

The Nickel Cobalt Aluminium (NCA) sector falls under the category of battery materials and smart materials industry, primarily boosted by the surging demand from electric vehicles (EV), energy preserving devices, and aeronautic applications.

In addition, the global NCA business is firmly shaped by the major factors, including geopolitical forces, energy transition, and supply chain circumstances. Governments across the globe are encouraging the shift towards adopting clean energy and e-mobility, leading to rising demand for smart and high-functioning battery material.

Moreover, countries like China, the EU, and the USA are dominating the industry by making extensive investments in EV infrastructure as well as indigenous material sourcing to eradicate the dependency on fluctuating supply chains.

Raw material price volatility is a main concern since nickel and cobalt mining is localized in a limited number of countries such as Indonesia, the DRC, and Australia. Initiatives to develop alternative battery chemistries and enhance recycling efficiency are underway, alleviating supply risks.

Moreover, increasing capital investment in gigafactories and advances in solid-state batteries technologies will propel long-term growth. Firms are turning to sustainable sourcing and local production to mitigate economic uncertainty and regulatory change to make industries resilient through 2035.

Nickel Cobalt Aluminium (NCA) materials are of varying purity, which determines their performance in different industries. Advanced applications like electric vehicle batteries and aerospace equipment favor high-purity NCA of over 99%.

Its excellent conductivity, stability, and energy efficiency make it an essential option for future lithium-ion and solid-state batteries. With increasing demand for high-performance energy storage systems, manufacturers will concentrate on optimizing production methods to achieve higher purity levels.

Lower purity NCA, less than 99%, is used in industrial applications demanding low-cost offerings with average performance levels. The industry enjoys growth with growing material handling systems, wireless sensors, and power tools where affordability overrides ultra-high efficiency. Progress in material processing and recycling will enhance the applicability of lower-purity versions.

Other purity grades serve specialized sectors where a compromise of performance and cost is needed. Such materials are used in special applications in niche segments like renewable energy storage and industrial automation, where advancing technology will open up new possibilities for tailored composition.

The transportation sector will be heavily depended on NCA materials as they are lightweight and high-functioning batteries. The surge in the manufacturing of electric vehicles will eventually give rise to the supply of raw materials as businesses will opt for reliable and long-lasting batterie, that also adhere to the recycling programs.

The adoption of NCA alloys in aerospace sector will elevate and improve the fuel efficiency, strengthening the aircraft structures overall. Furthermore, the rising commercial air traffic and defense modernization will propel the industry demand for heat-resistant and light-weight materials.

Consumer goods will use NCA in smartphones, laptops, and wearables, offering improved battery life and smaller dimensions. Improved battery technology will further enhance energy efficiency.

NCA batteries will be used by defense and military applications in communication systems, portable devices, and surveillance equipment. Increased energy storage will enable mission-critical operations and autonomous defense systems.

Energy storage using renewable energy will rely on NCA for effective grid storage and interfacing with solar and wind energy. Industrial automation will use NCA in robots, sensors, and manufacturing equipment, offering a consistent power supply for automated applications.

Medical equipment like pacemakers and implantable defibrillators will get benefit from NCA’s long-lasting compact batteries. Furthermore, power tools will also implement NCA for their high-functioning properties, fast charging, and better working ability.

The United States will be the leading authority in the NCA sector, boosted by rapidly rising factories of electric vehicle manufacturing and battery. Regulatory framework supporting domestic battery production and cutting the reliance on international supply with further shape the industry landscape.

Additionally, the country’s Inflation Reduction Act and clean energy policy will propel investment in sustainable material supply and recycling. The leading automakers and battery manufacturers will shift towards high-functioning application to comply with the rising energy efficiency demands.

Moreover, solid-state energy technology, backed by the smart R &D will contribute to the industrial demand. FMI believes that the USA industry will closely follow the pace of global growth, with a CAGR of 5.1% as evidenced by consistent investment and innovation in energy storage technology.

India's NCA industry will see steep growth with the nation speeding up its transition to electric mobility. Government subsidies through the Faster Adoption and Manufacturing of Electric Vehicles (FAME) effort will advance the indigenous production of batteries. Rising demand for two and three-wheelers EVs will allow battery producers to enhance and expand capacities, integrated specially with high-energy-density applications.

Furthermore, India’s rising solar energy industry will offer opportunities for grid storage solutions that are incorporated with NCA applications. Additionally, the rising number of investments in manufacturing facilities and technology collaborations will flourish industry expansion. FMI opines that India's industry will witness a strong CAGR of 5.7%, underpinned by growing EV penetration and clean energy policies.

China will remain the leading player in the global NCA industry, due to its huge supply chain, government-supported EV policies, and technological prowess in battery innovation. The aggressive move by the country toward electric mobility, underpinned by subsidies and a strategized manufacturing base, will create strong demand for high-performance battery materials.

The leading business of China in batteries will make large investments in new-generation technologies such as cobalt-free alternatives and high-nickel chemistries, achieving cost and efficiency optimization.

Strategic partnerships with African and Indonesian raw material suppliers will provide stable input supply. Recycling efforts will accelerate as China enhances its circular economy framework. FMI research discovered that China will have a 5.4% CAGR, reflecting its stability in battery production and energy storage technologies.

The UK industry for NCA materials will grow as the nation develops net-zero greenhouse gas emission goals and green transition. The ban on internal combustion engine vehicles in 2035 will spur mass adoption of EV batteries made with NCA materials. British car manufacturers will invest in domestic battery gigafactories to reduce imports. Innovation schemes backed by government will fund next-gen battery R&D, such as improved recycling technologies and energy-dense cathode materials.

In addition, the aerospace sector's transition to fuel-efficient planes will also provide additional opportunities for NCA applications. FMI believes that the UK industry will witness constant CAGR growth of 5.0% with the support of regulatory policies and industry-driven innovations.

Germany will be the top country in the European NCA industry, spurred on by its leading position in the manufacturing of vehicles and robust demand for industrial batteries. Germany's engineering efforts of manufacturing high-performance electric vehicles and hybrid cars will boost the utilization of NCA-based battery chemistry. Automotive companies will prioritize research on high-nickel cathodes to develop energy storage capability while lessening the reliance on cobalt.

Government-supported sustainability programs will drive battery recycling in line with Germany's circular economy strategy. In addition, the need for industrial automation and robotics will drive NCA adoption in energy storage applications. FMI believes that Germany's industry will post a robust CAGR of 5.2% with the help of innovation in its automotive electrification and industrial energy solution.

South Korea's NCA industry will flourish as a result of its dominance in lithium-ion battery production and technology. With key battery giants calling the country home, it will lead the charge in high-energy-density materials and future-generation solid-state batteries. Investment in green cathode production and local raw material collaborations will improve supply chain resilience.

The government's green energy plan will further promote the use of NCA materials in renewable energy storage technologies. South Korea's growing defense electronics industry will also drive demand for high-power and lightweight battery technologies. FMI believes that South Korea's industry will register a remarkable 5.3% CAGR, driven by battery technology and clean energy initiatives.

Japan's NCA sector will experience consistent growth, driven by its leadership in advanced battery tech and automotive electrification. Japanese automakers will make investments in high-nickel cathode chemistries to engineer ultra-efficient EV batteries.

Strategic emphasis of the country on hydrogen fuel cells will be supplemented by NCA-based energy storage solutions to provide varied applications across transport and industrial sectors. Stricter regulatory laws and policies in favor of recycling and sustainability of batteries will frame long-term industry growth.

Japan's consumer electronics industry will also drive demand as compact high-capacity batteries are crucial in next-generation products. FMI believes that Japan's industry will portray a steady CAGR of 5.1%, owing to its focus on technological innovation and green energy solutions.

France's NCA industry will grow as the country bolsters its electric mobility efforts and energy storage capacities. The government's carbon emissions cutback pledge will fuel investment in EV battery production and high-performing cathode materials. OEMs and battery manufacturers will push for the expansion of domestic gigafactories, improving energy security, and lowering dependence on foreign raw materials.

In addition, France's robust aerospace industry will generate demand for lightweight, high-temperature-resistant alloys utilized in aircraft systems. Grid-scale energy storage solutions will become popular with the rise in renewable power uptake. FMI believes that France's industry will register CAGR of 5.0% based on policy initiatives and developments in material efficiency.

Italy's NCA sector will increase as the nation invests in clean battery manufacturing and electric car infrastructure. Both foreign and domestic car manufacturers will target high-density-energy materials for the next-gen EV batteries. Italy's production sector will fuel the demand for industrial automation technology that uses NCA-based energy storage solutions. Increased smart grid initiatives will motivate high-end battery adoption for integration of renewable sources of energy.

In addition, the need for small and robust batteries in medical equipment and power tools will further broad the industry. FMI believes that Italy's industry will achieve moderate but consistent CAGR of 4.9%, driven by diversified end-use applications and transformative energy policies.

Australia and New Zealand will see significant growth in the NCA industry due to their rich mineral reserves and growing interest in clean energy storage. The mining sector in Australia will lead the way in providing high-grade nickel and cobalt for global battery production. Government-sponsored projects will encourage domestic battery manufacturing and investments in refining technologies.

New Zealand's renewable energy industry will propel demand for grid storage products, incorporating NCA batteries into solar and wind power systems. With electric mobility picking up pace, the demand for high-performance automotive and industrial batteries will increase. According to FMI analysis, the Australia-New Zealand industry will witness a 5.2% CAGR, fueled by availability of resources and clean energy revolutions.

Future Market Insights carried out a comprehensive survey among major stakeholders such as battery producers, automotive companies, aerospace engineers, and material providers to evaluate the changing scenario of Nickel Cobalt Aluminium (NCA) materials. The survey showed that more than 70% of industry experts are focusing on the production of high-nickel cathode chemistries to improve energy density and battery performance.

Respondents indicated an accelerating demand for sustainable material sourcing, a strong drive toward closed-loop recycling systems in order to decrease reliance on raw material imports. Furthermore, stakeholders have increasingly voiced worries regarding supply chain uncertainty, leading companies to invest in regional manufacturing hubs and strategic alliances in order to hedge risks.

Another key finding emphasized growing demand for NCA-based energy storage applications outside electric vehicles, especially in grid-scale storage and industrial automation. Market leaders anticipate huge investments in future battery technologies, including solid-state batteries, to overcome performance issues and lifespan concerns. The survey also reflected that more than 60% of the respondents expect regulatory backing and government incentives to play a pivotal role in driving industry growth.

Government Regulations

| Countries | Regulations & Certifications |

|---|---|

| United States | The Inflation Reduction Act incentivizes local battery manufacturing and EV uptake. The Environmental Protection Agency (EPA) has tough recycling and disposal standards for battery components. Energy storage systems must carry the UL 1973 certification. |

| India | The FAME II policy provides incentives for EV uptake, increasing NCA demand. The Bureau of Indian Standards (BIS) requires lithium-ion battery safety compliance in vehicles and electronics. |

| China | Government support is provided to EV battery production through subsidies, and tighter environmental regulations govern raw material extraction. The China Compulsory Certification (CCC) is necessary for battery safety certificates. |

| United Kingdom | The UK Battery Strategy promotes domestic battery production, and the rules of Brexit influence material supply. CE marking is necessary for battery-powered appliances. |

| Germany | The European Battery Regulation compels sustainability and responsible sourcing. The VDE certification is needed for energy storage systems. |

| South Korea | The nation's Green New Deal encourages battery recycling and innovation. KC certification guarantees conformity with efficiency and safety standards. |

| Japan | The Japanese government funds next-generation battery R&D as part of its Green Growth Strategy. PSE certification is required for battery-powered consumer devices. |

| France | The French EV and battery policy is aligned with the EU Green Deal to ensure sustainable battery manufacturing. Batteries need CE marking and adherence to EU safety legislation. |

| Italy | Government incentives support EV battery manufacturing and recycling programs. Firms are required to comply with EU REACH standards for material safety. |

| Australia-New Zealand | Australia's Critical Minerals Strategy backs domestic nickel and cobalt mining. New Zealand's clean energy policies promote the use of batteries for grid storage. AS/NZS standards govern battery safety. |

The new Nickel Cobalt Aluminium (NCA) industry, with its changing dynamics, offers unique prospects for companies that value innovation and supply chain agility. Localized manufacturing and material processing will be the key, particularly with governments imposing strict regulations on the import of raw materials.

Firms need to invest in local processing plants, particularly India and the US, where governments are announcing incentives to stem the dependence on foreign suppliers. Strategic acquisitions of midstream processing firms will yield long-term cost stability and regulatory benefits.

Another upcoming development is AI-based battery diagnostics and predictive maintenance. As NCA batteries are increasingly being used in EVs, aerospace, and grid storage applications, smart monitoring systems can be integrated to increase battery life and efficiency.

Firms should collaborate with AI and IoT companies to create real-time analytics for optimizing performance. Moreover, solid-state battery technology with NCA materials would recast the future of energy storage with greater capacity and improved safety. Companies investing in hybrid cathode technologies combining NCA with lithium-manganese or silicon-based anodes will be at the forefront for long-term industry dominance.

The Nickel Cobalt Aluminium (NCA) battery industry is moderately concentrated, with major players such as Panasonic, Samsung SDI, and LG Chem controlling the industry. These players compete on the basis of innovation, strategic alliances, and international expansion to retain their industry share.

Leading companies emphasize improving battery performance through research and development to enhance energy density and lower costs. They form partnerships with carmakers to obtain long-term supply contracts, guaranteeing stable demand. Geographical growth in emerging markets is also on the agenda, seeking to leverage the increasing adoption of electric vehicles globally.

Early in 2024, PT Vale Indonesia Tbk signed a definitive cooperation deal with Zhejiang Huayou Cobalt Co. Ltd and PT Huali Nickel Indonesia to build a High-Pressure Acid Leach (HPAL) refinery. The plant is set to yield 60,000 tons of nickel and around 5,000 tons of cobalt every year as mixed hydroxide precipitate (MHP), which can then be further refined for battery production.

Moreover, the battery minerals industry has witnessed massive mergers and acquisitions. Significantly, top deals globally have transformed the competitive landscape, demonstrating a strategic shift towards securing critical mineral supplies needed for NCA battery manufacturing. These advances highlight the companies’ efforts to obtain raw materials and increase production capacities to keep pace with growing demand for NCA batteries across numerous applications.

Market Share Analysis

Umicore: ~20-25%

A leading global player in battery materials, including NCA cathodes.

Sumitomo Metal Mining Co., Ltd.: ~15-20%

A major supplier of NCA materials, particularly for the electric vehicle (EV) industry.

LG Chem: ~10-12%

A significant player in the EV battery market, producing NCA materials for its battery divisions.

Panasonic Corporation: ~8-10%

Known for its partnership with Tesla, Panasonic is a major consumer and producer of NCA materials.

Targray Technology International Inc.: ~5-8%

A leading supplier of advanced battery materials, including NCA.

Nichia Corporation: ~5-7%

A key player in the battery materials industry, with a focus on high-performance cathodes.

Other Players: ~20-25%

Includes smaller regional players and niche companies specializing in NCA materials.

Rising demand for high-performance batteries in electric vehicles, aerospace, and energy storage, along with advancements in high-nickel cathode chemistries, are accelerating industry expansion.

Manufacturers are investing in regional processing facilities, securing long-term raw material agreements, and developing closed-loop recycling systems to reduce dependency on volatile cobalt and nickel supplies.

Incentives for domestic battery manufacturing, stricter environmental regulations, and sustainability mandates are pushing companies to innovate and localize production.

Advancements in solid-state battery integration, AI-driven battery management systems, and hybrid cathode formulations are enhancing energy density, lifespan, and safety.

NCA-based batteries are expanding into aerospace, industrial automation, grid storage, and medical devices, where high energy density and lightweight properties are essential.

Table 01: Global Market Volume (Tons) and Value (US$ Million) Forecast by Purity Type, 2018 to 2033

Table 02: Global Market Volume (Tons) and Value (US$ Million) Forecast by End Use Industry, 2018 to 2033

Table 03: Global Market Volume (Tons) and Value (US$ Million) Forecast by Region, 2018 to 2033

Table 04: North America Market Volume (Tons) and Value (US$ Million) Forecast by Country, 2018 to 2033

Table 05: North America Market Volume (Tons) and Value (US$ Million) Forecast by Active Ingredient Type, 2018 to 2033

Table 06: North America Market Volume (Tons) and Value (US$ Million) Forecast by End Use Industry, 2018 to 2033

Table 07: Latin America Market Volume (Tons) and Value (US$ Million) Forecast by Country, 2018 to 2033

Table 08: Latin America Market Volume (Tons) and Value (US$ Million) Forecast by Purity Type, 2018 to 2033

Table 09: Latin America Market Volume (Tons) and Value (US$ Million) Forecast by End Use Industry, 2018 to 2033

Table 10: Western Europe Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 11: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 12: Western Europe Market Volume (Tons) and Value (US$ Million) Forecast by Purity Type, 2018 to 2033

Table 13: Western Europe Market Volume (Tons) and Value (US$ Million) Forecast by End Use Industry, 2018 to 2033

Table 14: Eastern Europe Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 15: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 16: Eastern Europe Market Volume (Tons) and Value (US$ Million) Forecast by Purity Type, 2018 to 2033

Table 17: Eastern Europe Market Volume (Tons) and Value (US$ Million) Forecast by End Use Industry, 2018 to 2033

Table 18: East Asia Market Volume (Tons)and Value (US$ Million) Forecast by Country, 2018 to 2033

Table 19: East Asia Market Volume (Tons) and Value (US$ Million) Forecast by Purity Type, 2018 to 2033

Table 16: East Asia Market Volume (Tons) and Value (US$ Million) Forecast by End Use Industry, 2018 to 2033

Table 20: SAP Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 21: SAP Market Volume (Tons) and Value (US$ Million) Forecast by Purity Type, 2018 to 2033

Table 22: SAP Market Volume (Tons) and Value (US$ Million) Forecast by End Use Industry, 2018 to 2033

Table 23: MEA Market Volume (Tons) and Value (US$ Million) Forecast by Country, 2018 to 2033

Table 24: MEA Market Volume (Tons) and Value (US$ Million) Forecast by Purity Type, 2018 to 2033

Table 25: MEA Market Volume (Tons) and Value (US$ Million) Forecast by End Use Industry, 2018 to 2033

Figure 01: Global Market Historical, Current, and Forecast Volume (Tons), 2018 to 2033

Figure 02: Global Market Historical, Current, and Forecast Value (US$ Million), 2018 to 2033

Figure 03: Global Market Incremental $ Opportunity (US$ Million), 2018 to 2033

Figure 04: Global Market Share and BPS Analysis by Purity Type to 2023 and 2033

Figure 05: Global Market Y-o-Y Growth Projections by Purity Type, 2023 to 2033

Figure 06: Global Market Attractiveness by Purity Type, 2023 to 2033

Figure 07: Global Market Absolute $ Opportunity by >99% Segment, 2018 to 2033

Figure 08: Global Market Absolute $ Opportunity by <99% Segment, 2018 to 2033

Figure 09: Global Market Absolute $ Opportunity by Others Segment, 2018 to 2033

Figure 10: Global Market Share and BPS Analysis by End Use Industry to 2023 and 2033

Figure 11: Global Market Y-o-Y Growth Projections by End Use Industry, 2023 to 2033

Figure 12: Global Market Attractiveness by End Use Industry, 2023 to 2033

Figure 13: Global Market Absolute $ Opportunity by Automotive Segment, 2018 to 2033

Figure 14: Global Market Absolute $ Opportunity by Aerospace Segment, 2018 to 2033

Figure 15: Global Market Absolute $ Opportunity by Electronics Segment, 2018 to 2033

Figure 16: Global Market Absolute $ Opportunity by Defense and Military Segment, 2018 to 2033

Figure 17: Global Market Absolute $ Opportunity by Renewable Energy Segment, 2018 to 2033

Figure 18: Global Market Absolute $ Opportunity by Industrial Automation Segment, 2018 to 2033

Figure 19: Global Market Absolute $ Opportunity by Medical Devices Segment, 2018 to 2033

Figure 20: Global Market Absolute $ Opportunity by Power Tools Segment, 2018 to 2033

Figure 21: Global Market Absolute $ Opportunity by Others Segment, 2018 to 2033

Figure 22: Global Market Share and BPS Analysis by Region to 2023 and 2033

Figure 23: Global Market Y-o-Y Growth Projections by Region, 2023 to 2033

Figure 24: Global Market Attractiveness by Region, 2023 to 2033

Figure 25: Global Market Absolute $ Opportunity by North America Region, 2018 to 2033

Figure 26: Global Market Absolute $ Opportunity by Latin America Region, 2018 to 2033

Figure 27: Global Market Absolute $ Opportunity by Western Europe Region, 2018 to 2033

Figure 28: Global Market Absolute $ Opportunity by Eastern Europe Region, 2018 to 2033

Figure 29: Global Market Absolute $ Opportunity by East Asia Region, 2018 to 2033

Figure 30: Global Market Absolute $ Opportunity by SAP Region, 2018 to 2033

Figure 31: Global Market Absolute $ Opportunity by MEA Region, 2018 to 2033

Figure 32: North America Market Share and BPS Analysis by Country to 2023 and 2033

Figure 33: North America Market Y-o-Y Growth Projections by Country, 2023 to 2033

Figure 34: North America Market Attractiveness by Country, 2023 to 2033

Figure 35: North America Market Share and BPS Analysis by Purity Type to 2023 and 2033

Figure 36: North America Market Y-o-Y Growth Projections by Purity Type, 2023 to 2033

Figure 37: North America Market Attractiveness by Purity Type, 2023 to 2033

Figure 38: North America Market Share and BPS Analysis by End Use Industry to 2023 and 2033

Figure 39: North America Market Y-o-Y Growth Projections by End Use Industry, 2023 to 2033

Figure 40: North America Market Attractiveness by End Use Industry, 2023 to 2033

Figure 41: Latin America Market Share and BPS Analysis by Country to 2023 and 2033

Figure 42: Latin America Market Y-o-Y Growth Projections by Country, 2023 to 2033

Figure 43: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 44: Latin America Market Share and BPS Analysis by Purity Type to 2023 and 2033

Figure 45: Latin America Market Y-o-Y Growth Projections by Purity Type, 2023 to 2033

Figure 46: Latin America Market Attractiveness by Purity Type, 2023 to 2033

Figure 47: Latin America Market Share and BPS Analysis by End Use Industry to 2023 and 2033

Figure 48: Latin America Market Y-o-Y Growth Projections by End Use Industry, 2023 to 2033

Figure 49: Latin America Market Attractiveness by End Use Industry, 2023 to 2033

Figure 50: Western Europe Market Share and BPS Analysis by Country to 2023 and 2033

Figure 51: Western Europe Market Y-o-Y Growth Projections by Country, 2023 to 2033

Figure 52: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 53: Western Europe Market Share and BPS Analysis by Purity Type to 2023 and 2033

Figure 54: Western Europe Market Y-o-Y Growth Projections by Purity Type, 2023 to 2033

Figure 55: Western Europe Market Attractiveness by Purity Type, 2023 to 2033

Figure 56: Western Europe Market Share and BPS Analysis by End Use Industry to 2023 and 2033

Figure 57: Western Europe Market Y-o-Y Growth Projections by End Use Industry, 2023 to 2033

Figure 58: Western Europe Market Attractiveness by End Use Industry, 2023 to 2033

Figure 59: Eastern Europe Market Y-o-Y Growth Projections by Country, 2023 to 2033

Figure 60: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 61: Eastern Europe Market Share and BPS Analysis by Purity Type to 2023 and 2033

Figure 62: Eastern Europe Market Y-o-Y Growth Projections by Purity Type, 2023 to 2033

Figure 63: Eastern Europe Market Attractiveness by Purity Type, 2023 to 2033

Figure 64: Eastern Europe Market Share and BPS Analysis by End Use Industry to 2023 and 2033

Figure 65: Eastern Europe Market Y-o-Y Growth Projections by End Use Industry, 2023 to 2033

Figure 66: Eastern Europe Market Attractiveness by End Use Industry, 2023 to 2033

Figure 67: East Asia Market Share and BPS Analysis by Country to 2023 and 2033

Figure 68: East Asia Market Y-o-Y Growth Projections by Country, 2023 to 2033

Figure 69: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 70: East Asia Market Share and BPS Analysis by Purity Type to 2023 and 2033

Figure 71: East Asia Market Y-o-Y Growth Projections by Purity Type, 2023 to 2033

Figure 72: East Asia Market Attractiveness by Purity Type, 2023 to 2033

Figure 73: East Asia Market Share and BPS Analysis by End Use Industry to 2023 and 2033

Figure 74: East Asia Market Y-o-Y Growth Projections by End Use Industry, 2023 to 2033

Figure 75: East Asia Market Attractiveness by End Use Industry, 2023 to 2033

Figure 76: SAP Market Share and BPS Analysis by Country to 2023 and 2033

Figure 77: SAP Market Y-o-Y Growth Projections by Country, 2023 to 2033

Figure 78: SAP Market Attractiveness by Country, 2023 to 2033

Figure 79: SAP Market Share and BPS Analysis by Purity Type to 2023 and 2033

Figure 80: SAP Market Y-o-Y Growth Projections by Purity Type, 2023 to 2033

Figure 81: SAP Market Attractiveness by Purity Type, 2023 to 2033

Figure 82: SAP Market Share and BPS Analysis by End Use Industry to 2023 and 2033

Figure 83: SAP Market Y-o-Y Growth Projections by End Use Industry, 2023 to 2033

Figure 84: SAP Market Attractiveness by End Use Industry, 2023 to 2033

Figure 85: MEA Market Share and BPS Analysis by Country to 2023 and 2033

Figure 86: MEA Market Y-o-Y Growth Projections by Country, 2023 to 2033

Figure 87: MEA Market Attractiveness by Country, 2023 to 2033

Figure 88: MEA Market Share and BPS Analysis by Purity Type to 2023 and 2033

Figure 89: MEA Market Y-o-Y Growth Projections by Purity Type, 2023 to 2033

Figure 90: MEA Market Attractiveness by Purity Type, 2023 to 2033

Figure 91: MEA Market Share and BPS Analysis by End Use Industry to 2023 and 2033

Figure 92: MEA Market Y-o-Y Growth Projections by End Use Industry, 2023 to 2033

Figure 93: MEA Market Attractiveness by End Use Industry, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Nickel Sulfate Market Size and Share Forecast Outlook 2025 to 2035

Nickel Mining Market Size and Share Forecast Outlook 2025 to 2035

Nickel Superalloy Market Size and Share Forecast Outlook 2025 to 2035

Nickel Niobium Market Size and Share Forecast Outlook 2025 to 2035

Nickel Carbonate Market Size and Share Forecast Outlook 2025 to 2035

Nickel Acetate Market Size and Share Forecast Outlook 2025 to 2035

Nickel Nitrate Hexahydrate Market

Nickel Alloy Market

Nickel Cobalt Manganese (NCM) Market Trend Analysis Based on Product, End-Use, and Region 2025 to 2035

Aluminum-Nickel Catalyst Market Size and Share Forecast Outlook 2025 to 2035

Cobalt Resinate Market Size and Share Forecast Outlook 2025 to 2035

Cobalt Carbonate Market

Tire Cobalt Salt Adhesive Market Size and Share Forecast Outlook 2025 to 2035

Lithium Cobalt Oxide Market Size and Share Forecast Outlook 2025 to 2035

Aluminium Foil Zipper Pouch Market Size and Share Forecast Outlook 2025 to 2035

Aluminium Profiles for Solar Panel Market Size and Share Forecast Outlook 2025 to 2035

Aluminium Fishing Boat Market Size and Share Forecast Outlook 2025 to 2035

Aluminium Ammonium Sulphate Market Analysis – Size, Share, and Forecast Outlook 2025 to 2035

Aluminium Foil Seal Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Aluminium Chloride Market Analysis - Size, Share & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA