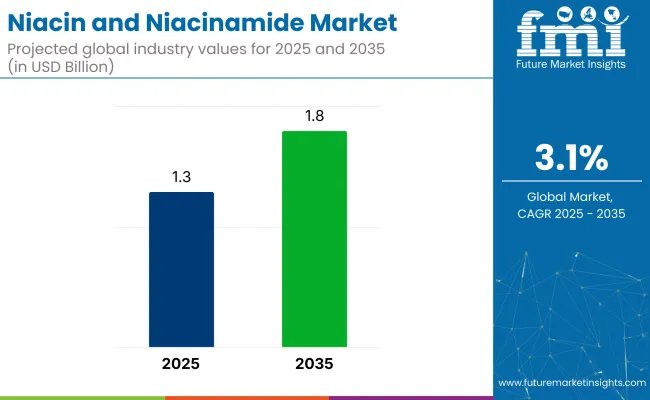

The global niacin and niacinamide market is expected to witness steady growth from USD 1.3 billion in 2025 to USD 1.8 billion in 2035 with a CAGR of 3.1%. These compounds are used extensively in a variety of formulations, such as dietary supplements, topical creams, and oral tablets, thus broadening their scope of application.

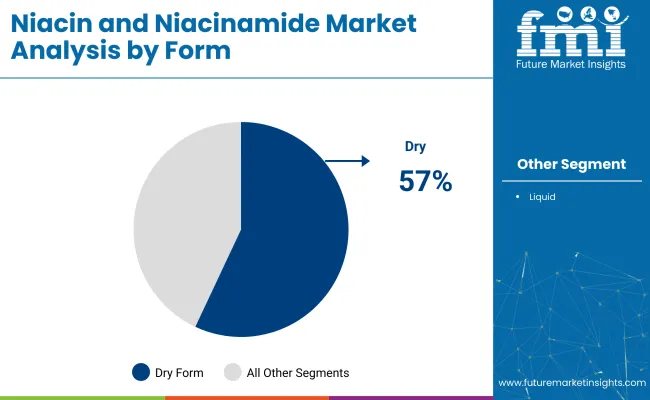

The dry form currently leads the product form segment, commanding approximately 57% of the industry share in 2024. This preference is attributed to its longer shelf life, ease of handling, and broad applicability across the pharmaceutical and food industries.

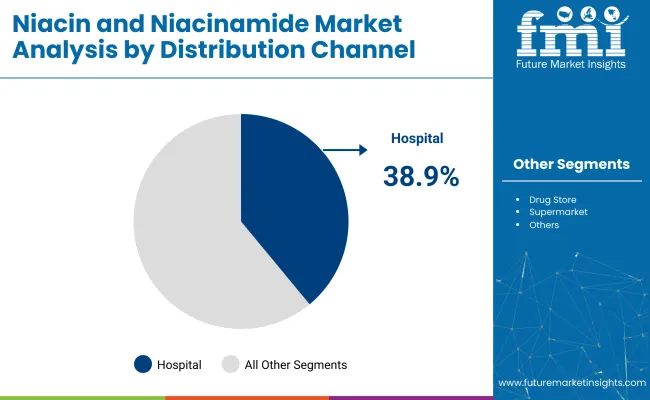

Liquid forms, such as solutions and creams, serve specialized purposes in cosmetics and other targeted applications. The distribution of niacin and niacinamide products is predominantly driven by hospital pharmacies and drug stores, which held a 38.9% industry share.

These channels are favored for their regulatory compliance and reliable healthcare networks. Hypermarkets and supermarkets also play a significant role in extending consumer reach as secondary distribution channels.

Demand has seen a rise in Asia Pacific. India and China are high-growth markets, driven by growing consumer awareness about skincare and nutrition, as well as expanding healthcare infrastructure.

Leading companies in the industry are focusing on innovation, such as sustainable sourcing and advanced manufacturing technologies, to meet the rising demand. Regulatory agencies worldwide continue to prioritize product safety and efficacy, ensuring the continued growth of the industry.

Emerging trends indicate an increasing preference for clean-label and naturally derived ingredients, further accelerating industry expansion.

The overall industry outlook remains positive, with rising consumer demand and expanding applications fueling growth. As ChromaDex's former CEO Frank Jaksch noted, the potential of niacinamide derivatives, including nicotinamide riboside (NR), extends beyond traditional uses into functional foods and medical products.

The industry is segmented by form and distribution channel, with dry form leading the form segment due to stability and convenience. Hospital pharmacies dominate distribution because of strict regulations. Growth is supported by rising demand in pharmaceutical and cosmetic applications globally.

Dry form dominates the industry, holding approximately 57% of the total industry share.

Hospital pharmacies and drug stores held the largest share of approximately 38.9% in 2024, driven by stringent regulations ensuring product quality and safety.

These channels are trusted by healthcare professionals for dispensing niacin and niacinamide, particularly in therapeutic contexts such as vitamin deficiency treatment and skin disorder management.

The industry growth is owing to the rising demand in pharmaceuticals and cosmetics, supported by health benefits and expanding applications. However, high regulatory barriers and raw material price fluctuations restrain growth. Rising clean-label trends and biotechnological innovations present significant opportunities, while sustainability challenges persist.

Rising Demand in Pharmaceuticals and Cosmetics

The primary driver fueling the industry is the growing recognition of their therapeutic and cosmetic benefits. Niacinamide, known for its anti-inflammatory and skin barrier-repair properties, is widely incorporated in skincare products, fueling demand from the cosmetics sector.

Meanwhile, pharmaceutical applications, including treatment for pellagra and cholesterol management, continue to expand as awareness of vitamin B3’s health benefits grows globally. Increasing consumer focus on preventive healthcare and wellness supplements also boosts consumption.

Regulatory Barriers and Raw Material Price Volatility

Industry growth faces significant restraints from stringent regulatory requirements and raw material price volatility. Regulatory bodies enforce strict safety, efficacy, and labeling standards for niacin and niacinamide products, especially those used therapeutically.

This creates entry barriers for smaller manufacturers and delays product launches. Additionally, fluctuating prices of raw materials, particularly due to dependence on petrochemical-derived intermediates, impact production costs and profitability. Supply chain disruptions exacerbate these price instabilities.

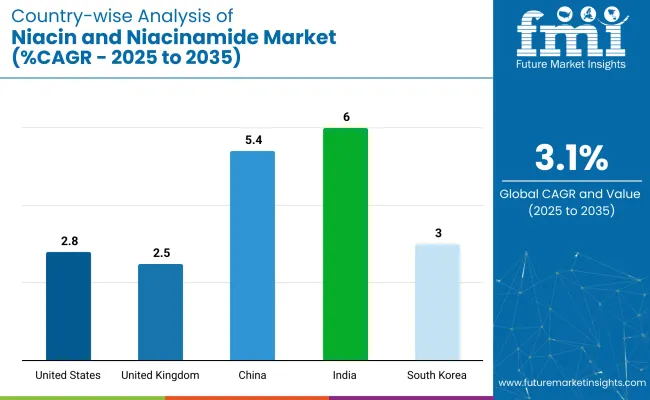

The industry varies across countries due to differences in healthcare infrastructure, regulatory environment, and consumer awareness. The United States leads with strong pharmaceutical demand. China and India show rapid growth driven by expanding healthcare access. The UK and South Korea reflect mature industries with high product innovation and adoption.

| Countries | CAGR (2025-2035) |

|---|---|

| United States | 2.8% |

| United Kingdom | 2.5% |

| China | 5.4% |

| India | 6% |

| South Korea | 3% |

The industry growth in the United States is expected to sustain a moderate CAGR of 2.8%, supported by continuous product innovation and increasing focus on preventive healthcare.

The industry growth in the United Kingdom is moderate with a CAGR of approximately 2.5%, with regulatory compliance and consumer demand for efficacy driving product development and industry penetration.

The industry in China is projected to register a strong CAGR of 5.4%, driven by urbanization and rising health consciousness.

The industry in India is projected to grow at a CAGR of 6% over the coming decade, driven by improving healthcare access, rising disposable incomes, and growing awareness about nutrition and skincare.

The continued innovation and growing wellness trends in South Korea support steady industry expansion at a CAGR of 3%.

Dominant players such as Lonza Group AG, Koninklijke DSM N.V., and Merck KGaA lead the industry with extensive product portfolios, strong R&D capabilities, and robust distribution networks across pharmaceuticals, nutraceuticals, and cosmeceuticals. Key players including BASF SE, Evonik Industries AG, and Jubilant Life Sciences Limited offer specialized formulations catering to specific applications and regional markets. Emerging players, such as Vertellus Specialties Inc. and Fagron NV, focus on innovative delivery systems and cost-effective solutions, expanding their presence in the global industry.

Recent Industry News

In 2025, Jubilant Ingrevia Limited inaugurated a cutting-edge cGMP-compliant manufacturing facility in Bharuch, Gujarat, India. The plant focuses on high-purity niacinamide production for food and cosmetics, strengthening Jubilant’s global supply chain and supporting increasing demand driven by health trends.

| Report Attributes | Details |

|---|---|

| Industry Size (2025E) | USD 1.3 billion |

| Projected Industry Size (2035F) | USD 1.8 billion |

| CAGR (2025-2035) | 3.1% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD billion for value and tons for volume |

| Form Segments Analyzed | Dry, Liquid |

| Distribution Channel Segments | Hospital Pharmacies & Drug Stores, Hypermarkets & Supermarkets, Others |

| Regions Covered | North America; Latin America; Western Europe; South Asia & Pacific; East Asia; Middle East & Africa |

| Countries Covered | United States, Canada, Mexico, Brazil, Argentina, Germany, France, United Kingdom, Italy, Spain, Netherlands, China, India, Japan, South Korea, Australia, GCC Countries, South Africa |

| Key Players Influencing Industry | Lonza Group AG, Koninklijke DSM N.V., Bactolac Pharmaceutical Inc., Merck KGaA, BASF SE, Foodchem International Corporation, Evonik Industries AG, Jubilant Life Sciences Limited, Vertellus Specialties Inc., Fagron NV |

| Additional Attributes | Dollar sales by form and distribution channel, Trends in cosmetic and pharmaceutical applications, Regulatory impacts on vitamin B3 derivatives, Growth in nutraceutical and skincare sectors, Regional consumer preferences and supply chain dynamics |

By form, the industry is segmented into dry and liquid.

By distribution channel, the industry is segmented into hospital pharmacies, drug stores, hypermarkets and supermarkets, and others.

The industry is segmented into North America, Latin America, Western Europe, South Asia and Pacific, East Asia, and the Middle East and Africa.

The industry is expected to reach an industry size of USD 1.3 billion in 2025.

The industry is projected to grow to USD 1.8 billion by 2035, reflecting a steady growth trajectory.

The industry is expected to grow at a CAGR of 3.1% from 2025 to 2035.

The dry form of niacin and niacinamide holds the largest industry share at 57%.

India is the fastest-growing industry, with a CAGR of 6%.

Explore Similar Insights

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA