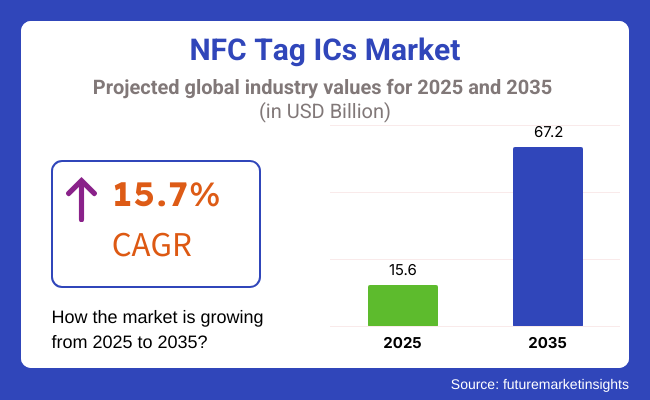

The NFC Tag ICs market is anticipated to hit USD 15.6 billion in 2025 while the projection of the increase to USD 67.2 billion by 2035. The demand growth is the most due to the continuing advancement in digital connectivity and more pervasive use of automation. With enterprises quickly integrating your science and technology, connected with NFC tag and IC technology, they are registering more and more use in consumer electronics, retail, healthcare, and enterprise security verticals.

The flourishing digital economy, adding to that, the IoT, automation and smart devices investments rise are the main reasons for the market's upturn. One other factor is the growing trend of companies opting for contactless payments over cash transactions, which has resulted in an increase in demand for systems that are associated with NFC in the retail industry and banking sector, marking the utter market for growth over decades.

Companies started using NFC tags, to interact with their customers, identify the customers' products, and promote marketing schemes via the NFC tag, thus becoming a key element to the present and future business paradigm.

The usage of AI-powered NFC in medical areas, for instance, to monitor patients or control smart home environments is another factor that the market must consider. The NFC tag ICs are expected to be mainstream in the field of money transfer that is untethered, thus their place in the smart ecosystems will definitely rise up during the years to come.

The idea of going cashless is now a trend with the retail and banking sectors incorporating mobile wallets and tap-to-pay as the traditional channels. The future of the NFC development in areas Tag ICs market will be a result of the use of new security instruments like biometric checks and blockchain contracts, where customers will be free to offer and receive high-level security Internet transactions.

Wearable payment gadgets such as smartwatches and rings are most likely to propel market development further. In contrast, the combination of NFC and proper technology in IoT is a breakthrough in IT operations for real-time monitoring, predictive maintenance, and logistics automation, thus providing the opportunity for higher productivity among firms.

Security also moved up the level from entry-keys to a much more sophisticated identity verification through biometric authentication, coupled with AI-driven fraud prevention. This software leap is essential in keeping secure digital transactions and making more robust authentication mechanisms both in the public and private sectors. On the other hand, NFC technology is being widely used in the medical field for tracking patients, drug management, and attendance monitoring of workers through automation.

Explore FMI!

Book a free demo

From 2020 to 2024, the NFC tags market grew as contactless payments came into play. Packaging improved in quality as well. The COVID-19 pandemic hastened adoption in retail and healthcare, as companies looked for touch-free interactions. Improvements in chip technology allowed for greater security, better data storage, and increased communication speeds.

Retailers and logistics firms started using NFC tags for tracking products and customer interaction, while transport smart ticketing applications picked up. Installation costs were high and posed incompatibility concerns with existing systems in some areas, though.

2025 to 2035 will see advancements in NFC technology with AI personalization, low-power chips, and increased deployment in IoT networks. NFC tags can be verified using biometric, and this can improve security for banking and would also provide a better control for access. Flexible and print-friendly NFC tags are transforming smart packaging. Blockchain integration will provide end-to-end product authentication and anti-counterfeiting solutions. Reduced costs and interoperability will facilitate NFC adoption in various industries like automotive, health, and smart cities.

Global NFC Tag ICs Trends: 2020 to 2024 vs. 2025 to 2035

| 2020 to 2024 (Past Trends) | 2025 to 2035 (Future Trends) |

|---|---|

| Major application in mobile phones, tablet computers, and laptops for peer-to-peer short-distance data sharing (up to 10 cm). | Rolling out to wearables, home appliances, and industrial Internet of Things to enable interoperable connectivity within various ecosystems. |

| Widespread application in contactless transactions, where banks provide NFC-card-capable bank cards and smart phones gain more traction. | Joint use of digital wallets and biometric Near Field Communication-based authentications eliminating card dependency. |

| Advertising and retail industry applied NFC tags to engage customers, verify brands, and interactive promotions. | Artificial intelligence-driven smart retail solutions will incorporate NFC for auto-purchase, personalized offers, and supply chain monitoring. |

| NFC security and door access applications were deployed in office suites, hotels, and public establishments. | Emergence of new security features through the use of blockchain for authentications, safe NFC transactions, and biometric management. |

| Scarce uses in medicine and workforce management, with niche deployments for asset tracking and patient identification. | Huge expansion of healthcare, making intelligent patient management, electronic patient records, and NFC-based medicine management possible. NFC will also be used for staff management with self-service staff attendance, access, and HR operations. |

| Straightforward product verification and anti-counterfeiting was implemented through the use of NFC tags in brand products and medication. | Traceability in supply chains will get a boost using NFC tags with real-time monitoring, fraud, and source traceability across diverse industries. |

| Moderate R&D expenditure on NFC tech, as the industry concentrated on standardization and security enhancements. | NFC miniaturization, low-power semiconductors, and long-range performance will receive increased investment for R&D to expand applications in industries. |

| NFC tags were predominantly passive (externally reader-powered), with restricted ability. | Mass markets for high-communication capability long-life active and semi-active NFC tags will emerge. |

| Public knowledge and uptake were increasing but divided to particular sectors. | NFC will be propelled into mainstream in non-payment applications by smart city, automotive, and logistics use cases. |

| NFC technology was viewed as an add-on convenience and not essential. | NFC will be a facilitator of digital transformation as one of the leading drivers of more efficient, secure communication among industries. |

Global supply shortages of chips have had a huge effect on the availability of their NFC tag ICs, with lead times extending and prices going up. Now many NFC chips have backlog orders of 30-40 weeks, which means suppliers cannot meet demand. Supply constraints around semiconductor components have added to costs, with manufacturers focused on high-margin customers and limiting stock to smaller purchasers.

Production is hampered by raw material constraints. Limited manufacturing output due to ongoing shortages of silicon wafers and packaging substrates is further compounded by foundries increasing wafer prices by 3-20% to manage supply chain circumstantiality. Even passive components, such as capacitors and antennas, are experiencing extended lead times, further stalling overall production. Higher energy and metal costs in recent years have added another factor for pricing pressure across the semiconductor industry.

Chipmakers’ margins are squeezed by low-cost applications of NFC such as transit cards and event passes. Since these market segments require tags priced at mere cents, suppliers are forced to focus on low-cost chip designs and tiered product offerings to keep profitable in a high-volume playing field.

| Technology Trend | Details |

|---|---|

| Tamper-proof & Blockchain-based NFC Tags | For validating authenticity and secure verification methods for luxury items and pharmaceuticals, as well as supply chain verification. |

| Ultra-Low-Power NFC Tags | Superb battery-less NFC appliance by using harvesting technology. Perfect for IoT, smart labels, and wearables. |

| Multi-function NFC Chips | Merges NFC with RFID, Bluetooth Low Energy (BLE) and UHF allowing for more versatile implementations of logistics, access control and smart pay. |

The overall market for NFC Tag ICs is chiefly dominated by high-memory designs (greater than 10,000 bytes), with increasing data storage needs in many applications fueling adoption globally. With the NFC technology being used in applications such as cashless payments, digital authentication, industrial automation, and smart commerce, the demand for real-time data access and the need for secure encryption is soaring.

Advancements in contactless technologies driven by the convergence of IoT, AI and blockchain are cementing high-memory NFC Tag ICs as the linchpin of future solutions. These tags will enable innovations in connected ecosystems, leading the way towards effortless and safe interactions.

Accounting for the growing worldwide market of NFC Tag IC with the medium memory (1,000 to 10, 000-bite)-the next level with 60% of total growth, as it offers optimal storage capacity and cost-effectiveness without compromising on versatility. These tags are suitable for moderate data storage applications like contactless payments, asset tracking, and event ticketing and inventory management.

More businesses are also adopting NFC-enabled solutions, and medium-memory tags can easily be integrated into IoT ecosystem, smart packaging and retail operations for real-time data access and improved customer benefit. They offer an affordable compromise over higher end, higher memory options yet still provide adequate encryption and data processing capabilities, making them an appealing option for a mid-tier application.

Increasing usage of medium-memory NFC Tag ICs is driven by expanding applications in IoT and smart automation technologies, requiring secure and reliable data processing. Health care, logistics and hospitality are just some of the industries expected to unleash their NFC use cases thanks to these tags.

Device pairing applications account for the largest share in the NFC Tag ICs market as we use this NFC Tag IC in most of the device pairing where the device can be unlocked using a Bluetooth interface paired with the NFC-enabled smartphone and other NFC-enabled devices such as smart gate entries and smart IoT devices. These applications provide secure and error-free experiences and therefore are imperative for consumers as well as enterprises.

Device-to-device communication represents the biggest market share, though peer-to-peer (P2P) applications are few and far between, as Bluetooth and Wi-Fi Direct technology offer faster transmission rates. The NFC-enabled device pairing is projected to continue to drive market growth as industries and consumers become more cashless and smart systems become more common.

Payment applications are the most significant reason for the NFC Tag ICs market since contactless payment solutions, mobile wallets as well as mobile banking are being widely adopted globally. They have become the preferred option for consumers and businesses, offering secure, seamless, and instant transaction capabilities.

With the world now moving towards a cashless economy, NFC-enabled payment systems are proving to be a necessity. The increasing consumerization of technology, together with consumer demand for convenience and security, has generated a flurry of activity from mobile payment platforms, including Apple Pay, Google Pay, and Samsung Pay, to integrate NFC Tag ICs into their solutions and provide consumers with fast and secure transactions.

The USA is at the forefront of contactless payment acceptance using NFC technology on mobile wallets like Apple Pay, Google Pay, and Samsung Pay. The payment sector is also putting a lot of money into NFC credit/debit cards so that payments become safer and faster. Touchless payment via NFC has even made it to retail.

Growth Factors

| Key Factors | Details |

|---|---|

| Contactless Payments | Widespread adoption of NFC-based mobile wallets and cards. |

| Expansion in Retail & Smart Packaging | NFC-enabled product authentication and customer engagement. |

| Increased IoT Adoption | NFC tags integrated with smart home and industrial IoT solutions. |

| High Demand in Healthcare | NFC use in patient tracking, medication management, and hospital assets. |

The UK has embraced the NFC technology in retail to supply chain management and the customer experience. Tesco and Sainsbury's are setting the pace using NFC-enabled intelligent shelves and touch-sensitive digital display posters. Contactless payment is widespread in the United Kingdom, which has been inspired by the ambition of the government to create a cashless society.

Growth Factors

| Key Factors | Details |

|---|---|

| Rapid Digital Payment Adoption | Vigor push for retail and transport cashless transactions. |

| Growth in Secure Identification & Access Control | NFC-enabled ID badges and security cards on the rise. |

| Expanding Smart Packaging & Anti-Counterfeiting Measures | Application of NFC in luxury products, drugs, and foodstuffs. |

| Rising Popularity of NFC-enabled Wearables | Smartwatches and fitness bands with NFC for payment and connectivity. |

China is a leader in NFC-based systems, applying the technology in the control of smart homes, public transport, and mobile payments. Consumer electronics make use of NFC tags to provide effortless pairing. Mobile payment giants WeChat Pay and Alipay popularized NFC transactions, and cashless transactions.

Growth Factors

| Key Factors | Details |

|---|---|

| Strong Government Push for Digital Payments | Extensive application of NFC in Alipay, WeChat Pay, and public transportation. |

| Growth in Smart Cities & Public Services | NFC application in e-governance, transport cards, and public safety infrastructures. |

| Expansion in Retail & E-Commerce | NFC-based product tracing and customer engagement solutions. |

| Increasing Smartphone & IoT Device Production | Local manufacturers integrating NFC chips into a wide range of consumer electronics. |

Germany's automotive industry is among the largest drivers of NFC adoption. Large automobile companies like BMW, Volkswagen, and Mercedes-Benz are embedding NFC in vehicles for keyless entry, car environment personalization, and secure car-to-car communication. NFC-based technology authentication is gaining popularity for electric vehicle charging points so that electric vehicle owners can pay contactless and conveniently.

Growth Factors

| Key Factors | Details |

|---|---|

| Rising Demand in Automotive Industry | NFC used in keyless entry, infotainment devices, and vehicle authentication. |

| Growth in Industrial IoT (IIoT) Applications | NFC implementation in smart factories for equipment tracking and inventory management. |

| Increasing Use in Healthcare & Pharmaceuticals | NFC-enabled drug verification and patient tracking. |

| Expansion of Digital Access Control & Security | NFC tags placed on office workstations, public spaces, and home security systems. |

In rural and semi-urban locations. Digital India that has been kicked off with goading from the government has prompted banks and digital technology firms to introduce NFC-enabled RuPay cards and tap-and-pay on UPI. Spread of low-cost NFC-capable feature phones is also driving adoption of contactless payments among street vendors and small merchants.

Growth Factors

| Key Factors | Details |

|---|---|

| Growing Digital Payment Ecosystem | Increasing NFC-enabled payment adoption through UPI and mobile wallets. |

| Expansion of Smart Retail Solutions | NFC technology used in interactive advertising and customer loyalty programs. |

| Government Push for Smart Cities | NFC applications in public transport, digital identity, and municipal services. |

| Affordable Smartphone Penetration | Rise in NFC-enabled budget smartphones expanding market reach. |

Japan led by introducing NFC-equipped public transport in the shape of smart intelligent cards like Suica, Pasmo, and ICOCA to simplify train, bus, and metro line travel. Outside of transport, NFC finds its way into day-to-day living, from vending machines to ticketing booths popular throughout retail, hospitality, and entertainment sectors.

Growth Factors

| Key Factors | Details |

|---|---|

| Advanced Public Transit Systems | NFC-powered Suica, Pasmo, and other contactless travel solutions. |

| High Adoption in Consumer Electronics | Smartphones, gaming consoles, and cameras integrating NFC features. |

| Growth in Retail Automation | Use of NFC for seamless self-checkout and interactive shopping experiences. |

| Strong Demand for NFC in Healthcare | Hospitals adopting NFC tags for medical record access and patient tracking. |

The NFC tag IC market is a scene of intense competition between the major players wanting to cash in on the increasing demand for contactless communication technologies. The major companies in this domain include NXP Semiconductors, STMicroelectronics, Panasonic, Broadcom, Qualcomm, Nokia, Identiv, Sony, and MediaTek. These companies engage in developing and supplying NFC tag ICs for several applications, including mobile payments, access control, and data exchange.

NXP Semiconductors

With approximately 35% market share led by mobile payment, automotive, and secure access control solutions.

Broadcom Inc.

It is a leading United States entity that has approximately 15% market share in wireless semiconductor solutions for consumer products, smartphones, and wearables.

Qualcomm Technologies, Inc.

Holds a market share of 12% owing to its development in wireless communication and NFC implementation with 5G.

STMicroelectronics

10% market share holds a position of top vendor for NFC tag ICs to automobile and industrial application markets with solutions of high-performance and reliability.

Texas Instruments

Maintains a market share of 8%, is famous for high-reliability NFC transceivers used for access control, payment, as well as for industrial automation.

Infineon Technologies AG

Being Germany-based, it maintains 7% market share of the total market share and has monopolistic hold on the market for secure NFC transaction and authentication products. Infineon finds the most suitable usage in financial transactions and government identities where high security NFC controllers cannot be redirected.

The Successful Start-Up Culture of the NFC Industry

While incumbents rule, startups are disrupting at breakneck speeds and building niches with next-generation solutions for security, IoT connectivity, and consumer engagement. The startup ecosystem is rife with new entrants disrupting industry giants by building affordable, scalable, and agile NFC solutions across industries.

Identiv, Inc.

Based in the USA, it is a leader in secure identification solutions, focusing primarily on the healthcare, retail, and logistics sectors. Its contactless authentication products are picking up pace in hospitals, warehouses, and electronic payment networks.

Thinfilm Electronics ASA

A Norwegian start-up firm is shaking the market with its printed NFC tags, with its main focus on product authentication, digital brand interaction, and supply chain transparency.

Blue Bite

It is a border of consumer interaction with NFC. It facilitates the interaction of consumers and brands online through digital coupons, smart packaging, and loyalty cards.

Dolphin RFID

An Indian firm is developing RFID and NFC-based inventory management, asset tracking, and supply chain logistics solutions to assist business organizations in optimizing supply chain management.

Wiliot

An Israeli firm is sending shockwaves with battery-free sensors that support NFC and Bluetooth features and revolutionized real-time supply chain monitoring in a novel manner.

The market for NFC is witnessing increased technical developments with businesses actively investing in product innovation and security features in an attempt to chase a lead. Contactless payment methods are part of the priority interest as the need for accelerated, secured, and frictionless payment is rising across the globe. Security is another field that is in gigantic demand for topmost priority as companies are tending towards data encryption, authentication feature, and anti-fraud feature to make NFC-based payment an easy stroll.

The convergence of NFC with IoT and cloud computing post-AI is today a strategic necessity, allowing organizations to create connected systems that re-imagine automation, efficiency, and interconnectivity in various sectors. The trend is being most prominently observed in smart home automation, industrial IoT, and healthcare, where the use of NFC is being utilized to automate and secure.

Retail and online retail is also another sector to be targeted where firms are using NFC-enabled interactive packaging to engage with customers. NFC-enabled smart labels are driving real-time product information, authenticity verification, and customer personalization. The firms are leveraging the technology for customer loyalty promotion and digital innovation for brick-and-mortar stores.

The global market will grow from USD 15.6 billion in 2025 to USD 67.2 billion in 2035 with a compound annual growth rate (CAGR) of 15.7% during the forecast period.

The market is driven by increasing adoption of contactless payments, growth in IoT, advances in security features, increasing healthcare and retail use cases, and continuous innovation in NFC chip technology.

Retail, payment, healthcare, supply chain, and the automobile industry will have the highest uptake, with NFC enabling smart shopping, secure payments, patient location tracking, instant tracking of shipments, and smart car entry.

The Asia-Pacific region is expected to spearhead rapid digitalization, and North America and Asia-Pacific collectively accounted for 67% market share in 2025.

The leaders are NXP Semiconductors with 35% share, Broadcom Inc. with 15%, Qualcomm Technologies with 12%, STMicroelectronics with 10%, Texas Instruments with 8%, and Infineon Technologies with 7%.

The market is categorized based on memory capacity, including high memory (more than 10,000 bytes), medium memory (1,000 to 10,000 bytes), and low memory (less than 1,000 bytes).

The type of connection segmentation involves people-to-people (peer-to-peer) and people-to-devices (device pairing), both defining the manner in which the technology facilitates the interactions.

Smart posters, payment, marketing strategies, information exchange, delivery of digital content, social networks, games, and authentication uses are various applications fueling market adoption.

The market is widespread across various sectors, including BFSI, media & entertainment, retail, hospitality, healthcare, and other sectors using the technology for increased interconnectivity and security.

Regional segmentation highlights the presence and growth of the market in North America, Latin America, Western Europe, Eastern Europe, South Asia and the Pacific, East Asia, and the Middle East and Africa.

Remote Construction Market Analysis by Component, Application, End-use Industry and Region Through 2035

Security Inspection Market Insights – Trends & Forecast 2025 to 2035

Procurement as a Service Market Trends – Growth & Forecast 2025 to 2035

Massive Open Online Course Market Analysis – Growth, Trends & Forecast 2025 to 2035

Tactical Radios Market Analysis by Type, Application, and Region Through 2025 to 2035

Healthcare Virtual Assistants Market Analysis by Product, End User and Region Through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.