The next generation packaging industry is changing the approach to sustainability, consumer interaction, and product protection of brands. Companies are moving toward smart, active, and eco-friendly packaging options that deliver increased freshness, lower waste, and enhanced supply chain transparency. As demand for greener options grows, companies are adding smart sensors, QR coding, and biodegradable material to meet regulatory and environmental objectives.

Manufacturers are making investments in AI-based quality control, Internet of Things-enabled packaging, and self-healing barrier coatings to improve efficiency and product longevity. The sector is shifting towards circular economy paradigms that guarantee lower carbon footprints and better recycling systems. Active and smart packaging demand is expanding exponentially in industries like food & beverages, pharmaceuticals, personal care, and logistics.

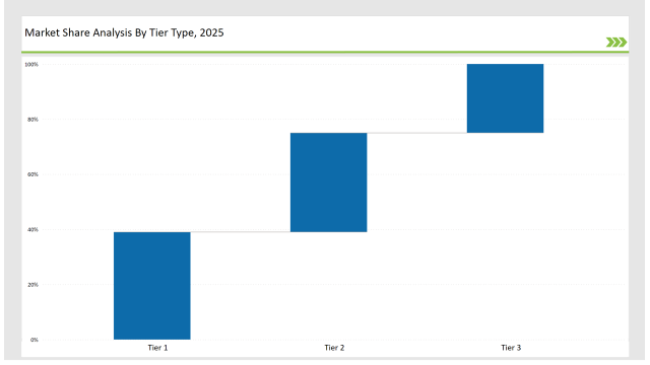

Tier 1 players like Amcor, Sealed Air, and Tetra Pak control 39% of the market with their dominance in smart packaging innovation, large R&D investments, and partnerships with worldwide brands.

Tier 2 players like Stora Enso, Avery Dennison, and Huhtamaki control 36% of the market through their cost-efficient, high-performance, and smart packaging solutions for numerous industries.

Tier 3 consists of regional and niche players specializing in bio-based materials, smart packaging applications, and AI-driven supply chain tracking, holding 25% of the market. These companies focus on localized production, innovation, and sustainability-driven designs.

Explore FMI!

Book a free demo

Global Market Share by Key Players 2025

| Category | Market Share (%) |

|---|---|

| Top 3 (Amcor, Sealed Air, Tetra Pak) | 20% |

| Rest of Top 5 (Stora Enso, Avery Dennison) | 11% |

| Next 5 of Top 10 (Huhtamaki, WestRock, Coveris, Smurfit Kappa, Multivac) | 8% |

The next generation packaging industry serves multiple sectors where sustainability, real-time monitoring, and consumer engagement are essential. Companies are developing innovative packaging solutions that integrate smart sensors, sustainable materials, and digital tracking.

Manufacturers are optimizing next generation packaging with biodegradable materials, active barrier technologies, and intelligent tracking systems.

Sustainability and smart technology are driving the next generation packaging industry. Companies are integrating AI-powered material optimization, self-healing barrier coatings, and blockchain-backed traceability to enhance product longevity, reduce food waste, and improve recycling rates. Businesses are developing smart labels that enable consumers to access product history and authenticity verification. Manufacturers are expanding closed-loop production models to support waste-free packaging solutions. Additionally, firms are optimizing lightweight packaging to lower transportation costs and emissions.

Year-on-Year Leaders

Technology suppliers should focus on automation, digital tracking, and sustainable materials to support the evolving next generation packaging market. Collaborating with FMCG brands and pharmaceutical firms will accelerate adoption.

| Tier Type | Example of Key Players |

|---|---|

| Tier 1 | Amcor, Sealed Air, Tetra Pak |

| Tier 2 | Stora Enso, Avery Dennison, Huhtamaki |

| Tier 3 | WestRock, Coveris, Smurfit Kappa, Multivac |

Leading manufacturers are advancing next generation packaging technology with AI-powered quality control, smart labels, and high-barrier recyclable materials.

| Manufacturer | Latest Developments |

|---|---|

| Amcor | Launched recyclable smart packaging with freshness indicators in March 2024. |

| Sealed Air | Developed AI-driven self-healing barrier films in April 2024. |

| Tetra Pak | Expanded interactive consumer engagement packaging in May 2024. |

| Stora Enso | Released fiber-based active packaging solutions in June 2024. |

| Avery Dennison | Strengthened RFID-enabled traceability packaging in July 2024. |

| Huhtamaki | Introduced compostable packaging with high-barrier coatings in August 2024. |

| Multivac | Pioneered AI-driven automated inspection systems in September 2024. |

The next generation packaging market is evolving as companies invest in sustainable materials, AI-powered automation, and intelligent tracking technologies.

The industry will continue integrating AI-driven packaging solutions, blockchain-backed traceability, and high-barrier sustainable materials. Manufacturers will refine smart labels with real-time freshness tracking. Businesses will expand interactive packaging with augmented reality features. Companies will develop biodegradable films with extended shelf-life capabilities. Smart packaging will enable end-to-end supply chain monitoring. Additionally, firms will optimize AI-powered material selection for enhanced recyclability.

Leading players include Amcor, Sealed Air, Tetra Pak, Stora Enso, Avery Dennison, Huhtamaki, and Multivac.

The top 3 players collectively control 20% of the global market.

The market shows medium concentration, with top players holding 39%.

Key drivers include sustainability, automation, smart tracking, and active packaging solutions.

Nitrogen Flushing Machine Market Analysis by Automatic and Semi-Automatic Through 2035

Pan Liner Market Analysis by Polyethylene (PE), Nylon, Polypropylene, Polyester, Polytetrafluoroethylene (PTFE) and Biodegradable Plastics Through 2035

Perfume Filling Machine Market Analysis by Automatic Perfume Filling Machines and Manual Perfume Filling Machines Through 2035

Molded Pulp Packaging Machines Market Analysis - Growth & Forecast 2025 to 2035

Packaging Tensioner Market Analysis - Growth & Forecast 2025 to 2035

Packaging Films Market Analysis by Product Type, Material Type and End Use Through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.