The Neutron Detectors Market is valued at USD 2.0 billion in 2025. As per FMI's analysis, the Neutron Detectors Industry will grow at a CAGR of 11.9% and reach USD 6.5 billion by 2035. In 2024, the neutron detectors market saw significant advancements, driven by the increased demand for radiation monitoring and nuclear safety.

Specifically, the industry witnessed a notable surge in demand from the defense and security sectors, particularly in response to heightened concerns about nuclear security and the proliferation of radiological materials.

Additionally, technological improvements in neutron detector materials, such as the development of more efficient scintillator crystals and advanced semiconductor detectors, helped boost performance, reducing both cost and operational limitations. Simultaneously, regulatory frameworks have increasingly mandated real-time monitoring of nuclear facilities, driving investments in advanced detection technologies

Looking ahead to 2025 and beyond, growth is expected to be driven by continued advancements in detector sensitivity and the increasing use of neutron detectors in healthcare, especially in medical imaging and cancer treatment.

The rising global emphasis on nuclear power as a clean energy source will also provide a long-term growth trajectory for the industry. Moreover, the integration of artificial intelligence and machine learning in neutron detection systems is anticipated to enhance the accuracy and reliability of neutron-based applications.

Industry Value Insights

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 2.0 billion |

| Industry Value (2035F) | USD 6.5 billion |

| CAGR (2025 to 2035) | 11.9% |

Explore FMI!

Book a free demo

The Neutron Detectors Industry is poised for strong growth, driven by increasing demand in nuclear safety, security, and healthcare applications. Advancements in detection technology and the rising focus on nuclear energy will propel industry expansion. Companies investing in cutting-edge materials and AI-integrated systems stand to benefit, while those slow to adopt these innovations may struggle to maintain a competitive edge.

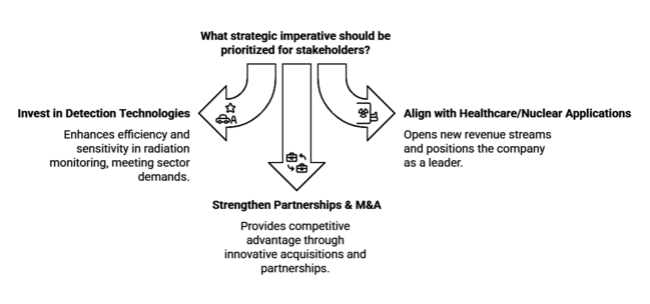

Invest in Advanced Detection Technologies

Executives should prioritize investments in next-generation detector materials, such as high-performance scintillators and semiconductors, to improve efficiency, sensitivity, and cost-effectiveness. Emphasizing R&D in these areas will help meet the growing demand for high-precision radiation monitoring in critical sectors like defense, nuclear energy, and healthcare.

Align with Emerging Applications in Healthcare and Nuclear Energy

Focus on integrating detector technology into emerging applications, particularly in medical imaging and nuclear power plants. As the demand for clean energy grows and healthcare solutions evolve, aligning with these trends will open new revenue streams and position the company as an industry leader.

Strengthen Strategic Partnerships & M&A

Explore partnerships with key players in defense, energy, and healthcare to accelerate access to new industries and applications. Additionally, acquiring smaller, innovative companies with expertise in AI-based detection systems or next-gen materials can provide a competitive advantage and enhance product offerings.

| Risk | Details |

|---|---|

| Technological Obsolescence | Probability: High |

| Regulatory Changes | Probability: Medium |

| Supply Chain Disruptions | Probability: Medium |

| Priority | Immediate Action |

|---|---|

| Enhance Product Innovation | Develop advanced neutron detection systems with improved sensitivity and accuracy. |

| Strengthen Supply Chain Management | Diversify supplier networks to ensure material availability and stability. |

| Expand Sustainable Practices | Introduce eco-friendly materials and optimize energy usage. |

To stay ahead, companies must prioritize significant investments in next-generation neutron detection technologies, focusing on advancements in materials and AI integration to meet rising demands in defense, healthcare, and nuclear energy sectors. This strategic shift will require ramping up R&D efforts, forming strategic alliances, and closely aligning with regulatory trends and industry needs.

The growing adoption of clean nuclear energy and healthcare applications presents lucrative opportunities, and positioning the company as a leader in these areas will be critical for long-term growth. Immediate action will enable firms to differentiate themselves through superior product offerings, establishing a competitive edge that fosters sustained success over the next decade.

Surveyed Q4 2024, n=450 stakeholder participants evenly distributed across manufacturers, distributors, researchers, in the US, Western Europe, Japan, and South Korea

Regional Variance:

High Variance

Convergent and Divergent Perspectives on ROI:

Consensus:

Variance:

Shared Challenges:

Regional Differences:

Manufacturers:

Distributors:

End-Users (Researchers/Industries):

Alignment:

Divergence:

Conclusion: Variance vs. Consensus

| Countries | Policy/Regulation Impact & Mandatory Certifications |

|---|---|

| USA | Stringent radiation safety regulations at federal and state levels (e.g., NRC regulations). Companies need NRC licensing for radiation detectors. |

| UK | Compliant with EU safety and environmental standards post-Brexit. Mandatory CE marking for radiation equipment and adherence to Ionizing Radiation Regulations 2017. |

| France | Compliance with EU safety regulations, including CE marking and radiation protection laws. Requires compliance with the French Nuclear Safety Authority (ASN) for nuclear applications. |

| Germany | Strict EU regulations on environmental safety (e.g., REACH and RoHS). CE marking required, and compliance with Germany’s Federal Office for Radiation Protection (BfS) for nuclear sectors. |

| Italy | Adheres to EU regulations for radiation safety and environmental standards. Requires CE marking and compliance with the Italian National Agency for New Technologies, Energy, and Sustainable Economic Development (ENEA). |

| South Korea | Strong focus on radiation protection laws and environmental standards. Companies must comply with Korean Institute of Nuclear Safety (KINS) regulations and have certifications for nuclear safety. |

| Japan | Strict regulations on radiation safety, requiring compliance with the Nuclear Regulation Authority (NRA). Companies need licenses for radiation detection devices under Japanese safety standards. |

| China | Radiation safety regulations governed by the National Nuclear Safety Administration (NNSA). Mandatory compliance with China’s national standards for radiation protection and detection equipment. |

| Australia-NZ | Requires compliance with local radiation safety standards, including the Australian Radiation Protection and Nuclear Safety Agency (ARPANSA). CE marking is needed for export. |

The lithium large-area neutron detector segment is anticipated to expand at a CAGR of 11.8% from 2025 to 2035. It is expected to maintain its momentum due to increasing demand for advanced detection systems across various industries. The adoption of these detectors in sectors like nuclear power, healthcare, and defense continues to grow, driven by their ability to provide precise measurements in high-radiation environments.

The shift towards larger and more sophisticated detection systems, in response to stricter safety regulations and the need for better monitoring capabilities, is another factor supporting the segment’s growth. With the ongoing advancements in technology and increasing demand for high-performance detection systems, the lithium large-area neutron detector industry is projected to remain one of the strongest contributors to the overall industry growth over the next decade.

In terms of application, the nuclear power segment is projected to experience a CAGR of 11.7% from 2025 to 2035. As nuclear energy plays an increasingly important role in the global transition toward cleaner energy sources, the need for accurate and reliable detection systems grows. Neutron detectors are critical for ensuring the safety and efficiency of nuclear power plants, where they are used for monitoring radiation levels and ensuring compliance with stringent safety standards.

The expansion of nuclear power plants globally, coupled with rising regulatory pressures for enhanced safety measures, ensures that the nuclear power application will remain one of the fastest-growing segments in the neutron detector industry in the coming years.

The United States is expected to grow at a 13.2% CAGR between 2025 to 2035, which can be attributed to a well-established technological structure and strong industry verticals, including defense, healthcare, and energy industries. Moreover, the growing focus on nuclear safety and the growth of healthcare technologies based on radiation imaging and cancer treatments are increasing the demand for high-precision detection systems.

Moreover, this industry is also fueled by various regulatory requirements for all industries as well as the surging adoption of automation and AI technologies. Continued investment in R&D and infrastructure in the USA will fill the gaps with innovation, as well as industry expansion.

China is forecasted to maintain a 12.8% compound annual growth rate (CAGR) driven by its rapid technological advancements and its ever-growing nuclear energy development. As the nation continues to upgrade in industrial and healthcare infrastructures, demand for high-performance detectors grow.

Government policies in China promoting nuclear energy, environmental safety, and healthcare development create a favourable environment for the industry. Moreover, China's essential industrial base along with increasing investments in scientific research and development, has made the country key growth hub for radiation detection technologies, which in turn, makes China an attractive industry for global players.

South Korea, is projected to grow at an 11.5% CAGR between 2025 and 2035, is being driven by tech infrastructure within healthcare as well as nuclear energy developments. A South Korean company with a prominent role in developing nuclear detection systems for both industrial and healthcare use massive investments made by the country in AI, robotics, and automation also serve to improve operational efficiency and safety across sectors.

In addition to this, high-quality detection technologies are being encouraged by South Korea’s regulatory landscape, resulting in a solid radiation detection and safety systems industry, with robust industrial and healthcare demand prospects.

France will grow with an 11.0% CAGR during the forecast period with strong nuclear energy and strong commitment towards sustainable future. Due to the country's sizable dependency on nuclear power as one of its key energy sources, there will always be a need for radiation detection systems to ensure safety and adherence to regulations.

Moreover, sustainability and green technologies are high on the agenda in the country, which promotes the demand & development of eco-friendly detection solutions. Detection technologies would also benefit from France's development of its healthcare sector, particularly with regard to cancer treatment and diagnostic imaging. This industrial and healthcare demand sets France up for continued growth in the industry.

The UK is projected to grow at a 10.8% CAGR from 2025 to 2035, driven by its focus on nuclear energy safety, healthcare innovation, and regulatory compliance. The UK has stringent safety standards, particularly in its nuclear and healthcare sectors, driving demand for precise and reliable detection systems.

As the healthcare sector embraces more advanced imaging and radiation therapies, the need for sophisticated detection systems increases. The UK’s commitment to sustainability, coupled with a favourable regulatory environment, ensures continued industry growth, making it a key player in the global radiation detection industry.

Germany is projected to grow at 10.5% CAGR from 2025 to 2035 due to its leadership position in the European nuclear energy sector and its efforts to promote environmental sustainability. As a leading producer of nuclear energy in Europe, advancements in detection systems are a necessary part of operational safety amidst high regulatory standards in Germany.

Moreover, the country's push to lower its carbon footprint through green energy projects fuels the need for eco-friendly and energy-saving technologies. The growth of detection technologies in Germany is also reinforced by the concentration of technological innovation in healthcare which drives the industry growth

Japan is forecasted to experience a 9.7% CAGR from 2025 to 2035, reflecting its unique focus on maintaining nuclear safety and its cautious approach to adopting advanced technologies. Japan's reliance on nuclear energy, combined with the government’s strict regulations, creates a steady demand for radiation detection systems.

However, Japan’s industry growth is somewhat tempered by its slower adoption of cutting-edge technologies, such as AI-powered detection systems, due to cost concerns and the relatively smaller scale of operations compared to other countries. Japan’s regulatory environment ensures consistent demand for high-quality and reliable detection solutions in nuclear and healthcare sectors.

Italy is anticipated to grow at a CAGR of 8.9% from 2025 to 2035 owing to the necessity of radiation detection technologies within its healthcare sector and its increasing focus on nuclear safety. Although Italy's nuclear energy sector is small, the demand for radiation detection remains strong due to its use in nuclear medicine, radiation imaging, and cancer therapies.

Considering the improvement in healthcare facilities in Italy along with sustainability aspect and compliance of the established rules would be optimal to prefer the detection technologies. But Italy’s industry is further restricted by its relatively incremental pace of industrial development relative to other territories.

Australia and New Zealand are projected to grow at a 7.5% CAGR from 2025 to 2035, driven by their smaller but growing healthcare and nuclear sectors. While not as large as other global industries, both countries are investing in healthcare technologies, including radiation-based diagnostic tools, which will drive demand for advanced detection systems.

In the nuclear sector, Australia is increasingly focusing on safe and sustainable energy practices, which will contribute to the growth of detection technologies in this field. However, the industry is relatively smaller in scale, and growth may be impacted by the pace of regulatory adoption and technological innovation.

The neutron detectors industry can be classified as concentrated. This is due to the dominance of a few large players, such as Mirion Technologies, Thermo Fisher Scientific, and Kromek Group, which hold a significant share. These companies have established strong reputations in providing high-performance solutions for nuclear safety, defense, healthcare, and environmental monitoring.

However, there are also several smaller companies, such as Symetrica and Rhombus Power, focusing on niche applications, which adds some degree of fragmentation. Overall, the industry is primarily concentrated, with a few key players driving the majority of the growth, while smaller firms target specialized or emerging areas.

Mirion Technologies (~22-26%)

A leading provider of radiation detection solutions, Mirion Technologies focuses on environmental monitoring detectors with enhanced sensitivity for a variety of applications, including nuclear power and safety.

Thermo Fisher Scientific (~18-22%)

Thermo Fisher Scientific offers high-efficiency neutron detectors tailored for use in nuclear plants and healthcare settings, providing reliable real-time radiation measurements with enhanced resolution.

Kromek Group (~12-15%)

Kromek Group specializes in neutron-based diagnostics and is expanding into the medical imaging sector, providing advanced radiation detection technology for both clinical and industrial applications.

Arktis Radiation Detectors (~10-12%)

Arktis focuses on high-performance directional neutron detection systems, with applications primarily in the defense sector, ensuring security through advanced radiation monitoring technologies.

Proportional Technologies (~8-10%)

Known for pioneering helium-3 alternative technologies, Proportional Technologies leads in providing advanced neutron detection systems using cost-effective and safer alternatives to helium-3.

Leidos (~7-9%)

Leidos is a key player in government contracts for nuclear security systems, providing cutting-edge neutron detection and radiation monitoring solutions for national defense and nuclear safety.

Photonis (~5-7%)

Photonis develops compact neutron detectors, with a focus on space applications, offering high-precision radiation measurement tools for satellites and space exploration.

Symetrica (~4-6%)

Symetrica specializes in portable radiation detection systems powered by AI, enhancing the analysis of neutron and gamma radiation for use in security and emergency response scenarios.

Rhombus Power (~3-5%)

Rhombus Power is advancing AI and machine learning-enhanced radiation monitoring technologies, focusing on critical infrastructure monitoring and providing cutting-edge solutions for industries in need of robust detection systems.

Silverside Detectors (~2-4%)

Silverside Detectors focuses on niche applications, providing ultra-low-background detection systems ideal for specialized scientific and environmental research requiring high sensitivity in low radiation environments.

The demand for neutron detectors is driven by increasing safety regulations, technological advancements, and the need for accurate radiation monitoring in nuclear, defense, healthcare, and environmental sectors.

The industryis expected to grow steadily, fueled by advancements in nuclear safety, defense, healthcare applications, and environmental monitoring, with strong expansion projected through 2035.

Key players in the neutron detectors industry include Thermo Fisher Scientific, Mirion Technologies, Lanthan Biosciences, RADEX, Fluke Corporation, Canberra (A subsidiary of Mirion Technologies), Leidos, Qualtrex, ORTEC (A subsidiary of AMETEK), Harshaw Tracer.

The nuclear safety application segment is expected to continue dominating the industry, driven by stringent regulations and the need for advanced radiation detection systems in nuclear power plants.

The neutron detectors industry is expected to reach a value of USD 6.5 billion by 2035, reflecting robust growth over the next decade.

The industry is divided into Lithium large-area neutron detectors, fast neutron detectors, scintillation neutron detectors, semiconductor neutron detectors.

It is segmented into nuclear power, aerospace & defense, urban detection networks, and others.

The landscape is studied across North America, Latin America, Western Europe, Eastern Europe, South Asia and Pacific, East Asia, and Middle East and Africa.

Marine Selective Catalytic Reduction Systems Market Growth – Trends & Forecast 2025 to 2035

LASER Light Cables Market Growth – Trends & Forecast 2025 to 2035

Automatic Fire Suppression System Market Growth - Trends & Forecast 2025 to 2035

Wagon Tipplers Market Growth - Trends & Forecast 2025 to 2035

Binoculars and Mounting Solutions Market Growth - Trends & Forecast 2025 to 2035

Aviation Test Equipment Market Growth - Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.