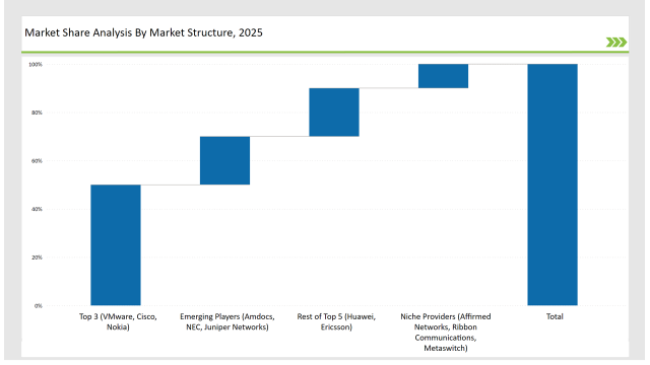

The Network Function Virtualization (NFV) market is growing rapidly as telecom operators, cloud providers and enterprises embrace virtualization to increase efficiencies, lower costs and enhance agility in network operations. VMware, Cisco, and Nokia account for a market share of almost 50% among leading vendors driven by leveraging cloud-native architectures, AI-driven network automation, and multi-access edge computing to meet the demands of service provider networks for NFV adoption.

The rest of the top five vendors -Huawei and Ericsson - collectively have 20% power, purposefully devoting themselves to 5G network slicing, open-source NFV and integrated service orchestration. 20% by emerging players like Amdocs, NEC, and Juniper Networks who fit the cloud driven network automation space well and have integrated into SD-WAN seamlessly. This remaining 10% making up for niche providers such as Affirmed Networks, Ribbon Communications and Met switch to fulfil specific requirements in mobile core virtualization, security, and VoIP optimization.

Explore FMI!

Book a free demo

| Category | Industry Share (%) |

|---|---|

| Top 3 (VMware, Cisco, Nokia) | 50% |

| Rest of Top 5 (Huawei, Ericsson) | 20% |

| Emerging Players (Amdocs, NEC, Juniper Networks) | 20% |

| Niche Providers (Affirmed Networks, Ribbon Communications, Metaswitch) | 10% |

The market for NFV is moderately concentrated, with more than 60% of share held by top 10 vendors. The larger vendors are major players, and mid-sized ones are the primary innovators for virtualization of telecom and enterprises.

Solution

The NFV Solution segment dominates with a 60% market share, driven by increased demand for virtualized network functions (VNFs) and cloud-native orchestration. VMware and Nokia lead this space by delivering robust NFV infrastructures that support automated network provisioning, real-time analytics, and edge computing optimizations.

Cisco enhances cloud-based SD-WAN and security solutions to further strengthen NFV adoption. With growing 5G deployments, NFV solutions integrating AI-based optimization and traffic routing will see rapid expansion.

Services

The NFV Services segment accounts for 40% of the market, including consulting, integration, and managed services. Ericsson and Huawei lead by offering full-service NFV deployments, including cloud orchestration, managed SDN/NFV solutions, and 5G core virtualization. As enterprises adopt NFV to enhance operational efficiency, demand for service-driven implementations will surge, particularly for security-focused NFV deployments and AI-powered monitoring solutions.

Small Enterprises

Small enterprises hold a 15% market share, primarily adopting NFV for cost reduction and network flexibility. Solutions tailored for small-scale SD-WAN deployments and cloud-based VNFs see increased adoption, with players like Juniper Networks and Affirmed Networks offering lightweight NFV implementations.

Medium Enterprises

Medium enterprises account for 30% of the NFV market, leveraging virtualized networks for scalable remote operations, cybersecurity, and network management. Vendors like Cisco and NEC provide cost-efficient, modular NFV solutions with managed service options to help mid-sized firms optimize network functions.

Large Enterprises

Large enterprises dominate the NFV market with a 55% share, adopting NFV to support cloud-native workloads, hybrid networks, and data-intensive applications. VMware and Nokia lead in enterprise-scale NFV adoption, offering cloud-based infrastructure and AI-driven network analytics to ensure high-performance networking across global operations.

Service Providers

Telecom operators and cloud service providers hold a 50% share, leveraging NFV for 5G deployments, software-defined networking (SDN), and automated network slicing. Huawei and Ericsson dominate this segment, enhancing mobile core virtualization and carrier-grade SD-WAN for seamless service delivery.

Data Centers

Data center operators account for 30% of NFV adoption, utilizing virtualized networking to scale infrastructure, improve automation, and reduce operational costs. VMware and Juniper Networks lead in NFV-driven data center virtualization, integrating SDN and security for optimized cloud networking.

Enterprises

Corporate enterprises contribute 20% to NFV adoption, deploying NFV for enhanced security, compliance, and operational agility. Cisco and Amdocs drive enterprise NFV adoption by integrating hybrid cloud networking and real-time network monitoring for large-scale businesses.

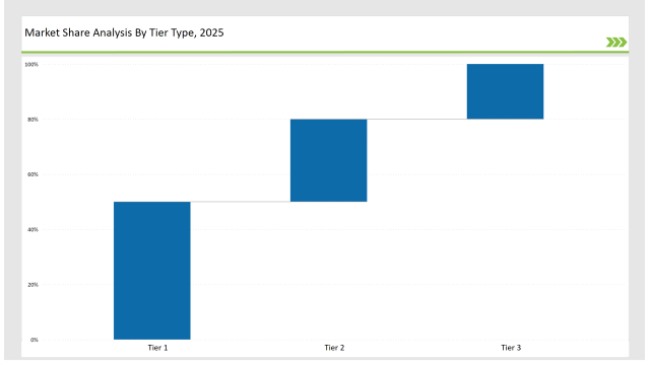

| Tier | Tier 1 |

|---|---|

| Vendors | VMware, Cisco, Nokia |

| Consolidated Market Share (%) | 50% |

| Tier | Tier 2 |

|---|---|

| Vendors | Huawei, Ericsson, Amdocs |

| Consolidated Market Share (%) | 30% |

| Tier | Tier 3 |

|---|---|

| Vendors | NEC, Juniper Networks, Affirmed Networks, Ribbon Communications, Metaswitch |

| Consolidated Market Share (%) | 20% |

| Vendor | Key Focus |

|---|---|

| VMware | Advances AI-powered NFV automation and cloud-native networking. |

| Cisco | Strengthens security integrations for SD-WAN and NFV deployments. |

| Nokia | Develops cloud-native NFV solutions with 5G optimization. |

| Huawei | Enhances edge computing and AI-driven NFV orchestration. |

| Ericsson | Expands AI-based security and automated NFV risk detection. |

| Juniper Networks | Innovates SD-WAN and NFV-driven cloud networking. |

| Amdocs | Focuses on telecom-focused NFV service automation. |

Vendors must refine AI-driven NFV orchestration to optimize network performance, integrating predictive analytics to detect and mitigate potential failures. Automating NFV service management through machine learning will enable businesses to streamline operations and enhance security monitoring.

As global 5G deployments accelerate, telecom operators and enterprises will prioritize NFV-driven network slicing and cloud-native security enhancements. Strengthening partnerships with cloud providers and SD-WAN vendors will be crucial for NFV market expansion.

Leading vendors VMware, Cisco, and Nokia hold 50% of the market.

Emerging players Amdocs, NEC, and Juniper Networks hold 20% of the market.

Niche providers Affirmed Networks, Ribbon Communications, and Metaswitch hold 10% of the market.

The top five vendors (VMware, Cisco, Nokia, Huawei, and Ericsson) control 70% of the market.

Market concentration in 2025 is categorized as medium, with the top 10 players controlling 60% to 70% of the market.

Catenary Infrastructure Inspection Market Insights - Demand & Forecast 2025 to 2035

Category Management Software Market Analysis - Trends & Forecast 2025 to 2035

DC Power Systems Market Trends - Growth, Demand & Forecast 2025 to 2035

Switching Mode Power Supply Market - Growth & Forecast 2025 to 2035

Safety Mirrors Market - Growth & Forecast 2025 to 2035

Heat Interface Unit Market Analysis - Size, Demand & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.