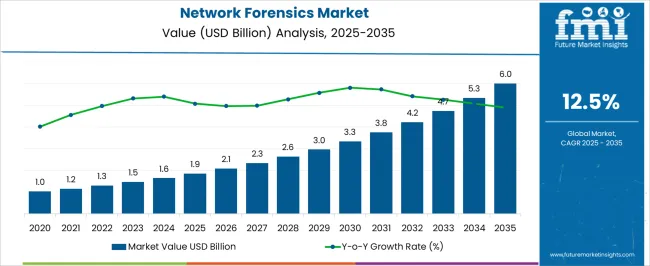

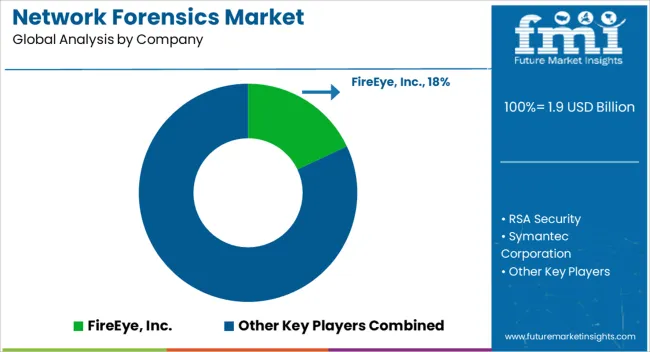

The Network Forensics Market is estimated to be valued at USD 1.9 billion in 2025 and is projected to reach USD 6.0 billion by 2035, registering a compound annual growth rate (CAGR) of 12.5% over the forecast period.

| Metric | Value |

|---|---|

| Network Forensics Market Estimated Value in (2025E) | USD 1.9 billion |

| Network Forensics Market Forecast Value in (2035F) | USD 6.0 billion |

| Forecast CAGR (2025 to 2035) | 12.5% |

The network forensics market is evolving rapidly due to escalating cyber threats, complex network architectures, and the growing need for real-time incident detection and response. Enterprises across various sectors are prioritizing forensic visibility to strengthen their cybersecurity posture and meet compliance mandates.

Increased digital transformation, cloud migration, and hybrid IT environments have heightened the demand for advanced threat monitoring, breach analysis, and audit trail reconstruction capabilities. Organizations are integrating network forensics into their broader security operations strategies to enhance investigative capabilities post-incident.

Rising government initiatives on data protection, along with the proliferation of sophisticated ransomware and zero-day exploits, are expected to further accelerate market expansion. Looking ahead, innovation in AI-powered anomaly detection and deeper integration with Security Information and Event Management (SIEM) platforms are likely to shape the future landscape of this market.

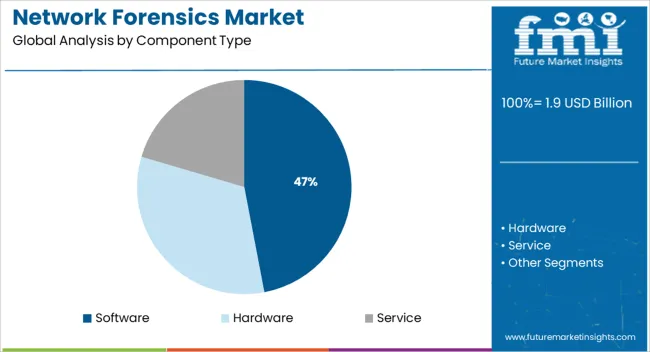

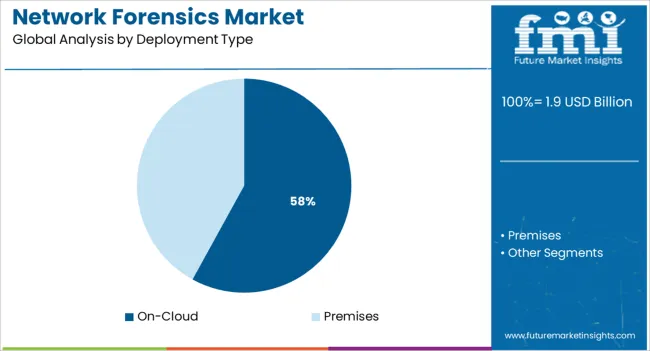

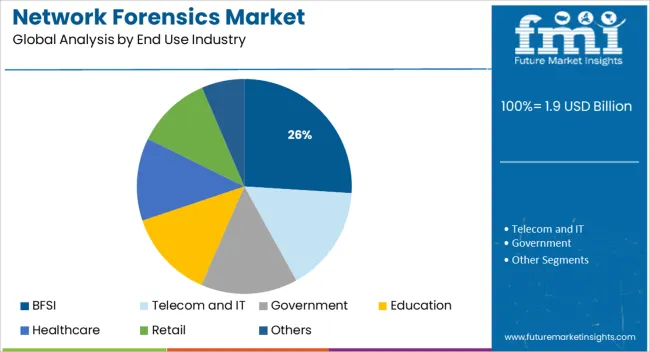

The market is segmented by Component Type, Deployment Type, and End Use Industry and region. By Component Type, the market is divided into Software, Hardware, and Service. In terms of Deployment Type, the market is classified into On-Cloud and Premises. Based on End Use Industry, the market is segmented into BFSI, Telecom and IT, Government, Education, Healthcare, Retail, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Software solutions are expected to account for 47.0% of the total market share in 2025, making them the dominant component in the network forensics market. Their leadership is being driven by the ability to perform deep packet inspection, traffic pattern analysis, and correlation across multiple network layers in real time.

The software's scalability, ease of updates, and compatibility with evolving network environments have made it indispensable for enterprises adapting to distributed infrastructure. Customizable dashboards, automated alerting systems, and integration with incident response workflows have further supported adoption.

As threats become more dynamic, software-based forensic tools are being favored for their adaptability, modularity, and support for continuous monitoring without the need for additional hardware.

On-cloud deployment is projected to hold 58.0% of the market share in 2025, emerging as the leading model for network forensics solutions. This trend is being shaped by enterprises moving toward cloud-native infrastructure and seeking scalable, cost-efficient, and remotely accessible security tools.

Cloud-based forensic platforms enable centralized data storage, rapid log correlation, and enhanced collaboration among incident response teams. The flexibility to scale resources during peak network activity, along with built-in redundancy and backup capabilities, has increased preference for cloud deployment.

Furthermore, ongoing developments in cloud security compliance and data encryption technologies are addressing concerns around data sovereignty and privacy, making cloud the deployment model of choice across multiple verticals.

The BFSI sector is forecast to lead the network forensics market with a 26.0% revenue share in 2025. This dominance is attributed to the industry's high exposure to cyber threats, regulatory scrutiny, and the critical need for real-time threat detection and response.

Financial institutions are under constant pressure to protect sensitive customer data, ensure transaction integrity, and maintain uninterrupted digital services. Network forensics tools are being deployed to monitor internal and external traffic, identify insider threats, and support compliance with frameworks such as PCI-DSS, SOX, and GDPR.

The increasing adoption of online banking, mobile payments, and cloud-based financial platforms has further elevated the importance of comprehensive forensic visibility. As financial firms prioritize cyber resilience and fraud prevention, investment in network forensic capabilities is expected to remain strong.

Due to the increase in network complexity in the Asia Pacific, organizations are forced to deploy network forensic solutions in order to protect from the rising threat landscape. It is expected that the Asia Pacific region will hold the largest market share during the forecast period due to its advanced and rapid adoption of emerging technologies in the market.

During the forecast period, the Asia Pacific region is predicted to grow at the fastest rate, as it has experienced rapid and advanced adoption of new technologies over the past few years. According to the forecast, India and China will enjoy the highest growth rates with a CAGR of 16.3%. This will be closely followed by Japan which is expected to grow by 10.5% CAGR during the period of forecasting.

Due to the increasing number of cybersecurity threats and cybercrimes in India, it is expected that market demand for network forensics will rise in the future. This region is home to a large number of SMEs, which provide significant opportunities for employment in the area. These factors will fuel the growth of the network forensics market in the region.

A rapid increase in the use of digital applications in the banking sector, as well as the increasing use of digital payment methods, may provide certain opportunities in the near future. The amount of potential the market has to offer is demonstrated by the use of network management solutions to improve business operations.

Researchers are focusing on developing new techniques to determine the network activity of users. The network introduces new digital devices with diverse functionalities and different protocols, such as smart televisions and play stations. This latest generation of devices requires the development of network forensics models and frameworks corresponding to them. In order to meet the current technological challenges, it is necessary to develop and improve the existing forensic technology to make it more efficient and sophisticated.

By continent/region, Asia has the highest percentage of internet users, accounting for 51.8 % of all users in 2024. Due to various technological improvements, network traffic is expected to increase even more in the next few years.

The investigation process becomes laborious when there is a lot of data traffic and complicated systems to analyze in order to have a better understanding of the systems. In the future years, the network forensics market will be driven by the rising requirement to protect networks from advanced assaults and reduce network crimes.

Network forensics aids businesses in capturing, recording, and analyzing network data in order to conduct investigations and respond to incidents. Organizations all around the world have begun to adopt network forensics systems in order to detect network activity and identify potential threats.

When it comes to network forensics investigations, investigators must have the necessary technical skills and understanding to capture, process, store, and analyze evidence. There is a demand for educated network forensics professionals for this meaningful examination of digital evidence, which is currently behind in the market and is projected to be the primary factor limiting network forensics market growth.

In order to address significant vulnerabilities with faster mitigation, threat detection, and response capabilities, network forensics investigators are adding AI, machine learning, and analytics principles into their solutions. Advances in technology, such as AI and machine learning, are helping to turn the tide against vulnerabilities.

Network security systems based on AI and machine learning assist enterprises in providing complete security features to their network infrastructure. As AI approaches are used for learning and reasoning, they are exceptionally capable of learning and solving complicated computational problems.

AI systems have achieved great advances in performing increasingly complicated computational tasks, using ML as the basic technology, and network forensics investigators can advance ANN in pattern recognition.

While investigating the most complicated network attacks, network forensics investigators face a variety of problems. To prepare for digital evidence, the detectives must collect data from throughout the company's networks relevant to network offenses.

Due to the challenges of obtaining large amounts of data for inquiry, network forensics investigators face a range of technical hurdles. Traditional forensics solutions have significant limitations that make collecting digital evidence challenging.

The network forensics market is segmented into components, deployment types, end-use industries, and regions.

According to FMI, by components, software holds the largest share in the network forensic market, with an anticipated CAGR of 12.3%. The growing relevance of identifying unauthorized access and discovering the source of security assaults, as well as the continuous focus on reducing IT network downtime across various enterprises, are likely to fuel the expansion of the worldwide network forensics market.

On-Premises have the highest potential in the network forensics market, with an expected CAGR of 9.2% during the forecast period. The widespread use of personal devices by businesses in this sector is to blame for the rise in network intrusions and crimes. IT service providers are now adopting network forensics solutions for investigations to maintain the safety of network infrastructure and technological innovation.

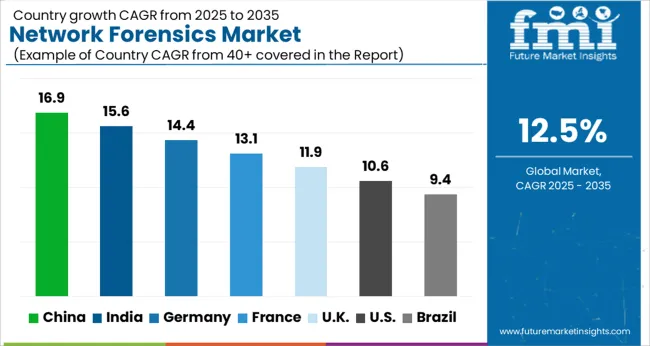

| Regions | CAGR (2025 to 2035) |

|---|---|

| China | 16.9% |

| India | 15.6% |

| Germany | 14.4% |

| France | 13.1% |

| United Kingdom | 11.9% |

| United States | 10.6% |

| Brazil | 9.4% |

Due to the presence of prominent network forensics players in the region and increasing investment in network forensics infrastructure by organizations across various industries, North America is expected to dominate the global network forensics market with a projected market value of USD 2 billion.

With the rise in network complexities, the threat landscape in the Asia Pacific region is changing at an alarming rate, pushing enterprises to employ network forensics solutions. China, Singapore, India, and the rest of the Asia Pacific countries are part of the region.

Many SMEs exist in this region, providing significant employment prospects. Asia Pacific has seen rapid and advanced adoption of new technologies, and it is predicted to grow at the fastest rate during the forecast period.

The region is pushing hard to make the most of its IT infrastructure, allowing businesses to adopt cutting-edge technologies. However, reasons such as the growing mobile workforce, increasing company complexity, and the uncontrolled nature of the internet are projected to encourage such SMEs to become more mobile.

Network forensics market players are taking advantage of the opportunities prevailing in the market by training and up-skilling their staff. Non-traditional job prospects who can make an immediate impact on the industry are predicted to be opportunistic for the network forensics market, according to key participants.

Players in the network forensics market are primarily focused on the creation of creative and efficient goods. The findings illustrate how rivals are capitalizing on the potential in the network forensics market.

The following are some of the most recent advancements in the network forensics market:

The global network forensics market is estimated to be valued at USD 1.9 billion in 2025.

The market size for the network forensics market is projected to reach USD 6.0 billion by 2035.

The network forensics market is expected to grow at a 12.5% CAGR between 2025 and 2035.

The key product types in network forensics market are software, hardware and service.

In terms of deployment type, on-cloud segment to command 58.0% share in the network forensics market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Network Simulator Software Market Size and Share Forecast Outlook 2025 to 2035

Network Connectivity Tester Market Size and Share Forecast Outlook 2025 to 2035

Network Analyzers Market Size and Share Forecast Outlook 2025 to 2035

Network as a Service (NaaS) Market Size and Share Forecast Outlook 2025 to 2035

Network Analytics Market Size and Share Forecast Outlook 2025 to 2035

Network Devices Market Size and Share Forecast Outlook 2025 to 2035

Network Sandboxing Market Size and Share Forecast Outlook 2025 to 2035

Network Access Control (NAC) Market Size and Share Forecast Outlook 2025 to 2035

Network Monitoring Market Size and Share Forecast Outlook 2025 to 2035

Network Encryption Market Size and Share Forecast Outlook 2025 to 2035

Network Packet Broker Market Size and Share Forecast Outlook 2025 to 2035

Network Traffic Analytics Market Size and Share Forecast Outlook 2025 to 2035

Network Function Virtualization (NFV) Market Size and Share Forecast Outlook 2025 to 2035

Network Cable Tester Market Size and Share Forecast Outlook 2025 to 2035

Network Point-of-Care Glucose Testing Market Size and Share Forecast Outlook 2025 to 2035

Network Telemetry Market Size and Share Forecast Outlook 2025 to 2035

Network Security Policy Management Market Size and Share Forecast Outlook 2025 to 2035

Network Probe Market Size and Share Forecast Outlook 2025 to 2035

Network Traffic Analysis Solutions Market Size and Share Forecast Outlook 2025 to 2035

Network Slicing Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA