The neovascular AMD treatment industry is valued at USD 3.3 billion in 2025. As per FMI's analysis, the industrywill grow at a CAGR of 5% and reach USD 5.38 billion by 2035.

In 2024, the neovascular or angiogenic age-related macular degeneration (NAMD) treatment industryexperienced notable advances in drug formulations and delivery systems. The regulatory approval of longer-acting anti-VEGF therapies minimized the frequency of injections, alleviating a significant patient concern and enhancing compliance.

Biosimilars entered major markets, introducing price competition and increasing accessibility to a wider patient population. North America and Europe continued to lead the adoption of innovative therapies, thanks to robust regulatory backing and well-established healthcare infrastructure. The Asia-Pacific region saw increasing investments in ophthalmic treatment, with governments and private entities developing research and treatment centers.

According to the analysis, the approval of cell and gene therapies could revolutionize treatment by providing one-time solutions rather than requiring lifelong management. Moreover, advancements in sustained-release drug delivery will further minimize the burden of treatment.

Moreover, the research anticipates that increased funding in ophthalmic research will hasten advances in targeted therapies, enhancing their effectiveness and lowering side effects. As universal healthcare systems place greater emphasis on early diagnosis and intervention, players need to comply with changing regulatory regimes and reimbursement policies to optimize industrypenetration and patient benefits.

Industry Forecast Table

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 3.3 billion |

| Industry Value (2035F) | USD 5.38 billion |

| CAGR (2025 to 2035) | 5% |

Explore FMI!

Book a free demo

The treatment industryfor angiogenic age-related macular degeneration is poised for sustained growth fueled by improvements in long-acting anti-VEGF therapeutics and increasing use of biosimilars.

Pharmaceutical companies that invest in gene and cell therapies have much to benefit from, with legacy drug companies that depend on dated treatment paradigms potentially facing pricing pressures. It also expects growth in aging global populations and rising healthcare spending to maintain demand, driving the industryto USD 5.38 billion by 2035.

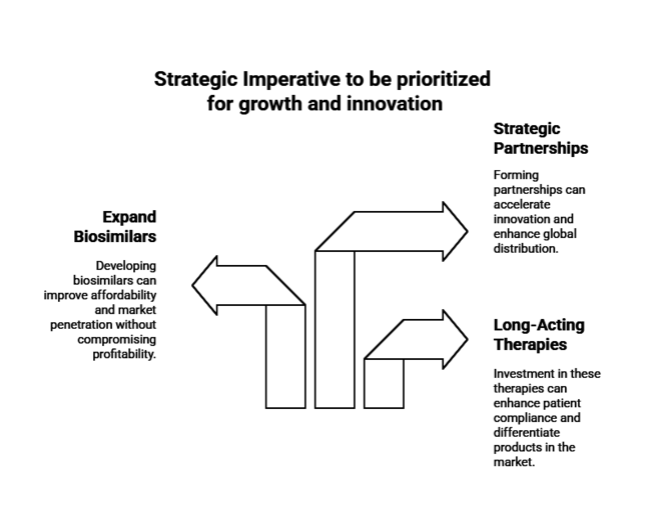

Prioritize Long-Acting and Next-Generation Therapies

Pharmaceutical manufacturers need to step up investment in long-duration anti-VEGF drugs, gene therapies, and cell-based treatments to improve patient compliance and stand out from the competition.

Expand industryaccess through biosimilars.

FMI analysis revealed that capitalizing on biosimilar development has the potential to enhance affordability and industrypenetration, especially in cost-sensitive industries, while ensuring wider adoption without affecting profitability.

Strengthening Strategic Partnerships for Distribution and R&D

Partnerships with biotech companies, research centers, and healthcare providers will be the key to faster innovation, regulatory clearances, and maximizing global distribution networks.

| Risk | Probability & Impact |

|---|---|

| Regulatory Delays in Approvals | High Probability - High Impact |

| Pricing Pressure from Biosimilars | Medium Probability - High Impact |

| Supply Chain Disruptions | Low Probability - Medium Impact |

| Priority | Immediate Action |

|---|---|

| Accelerate Gene Therapy Trials | Secure regulatory fast-track approvals and expand clinical studies |

| Strengthen Biosimilar Strategy | Establish pricing models and engage with payers for reimbursement negotiations |

| Expand Global Industry Access | Forge partnerships in emerging industrie s to enhance distribution and affordability |

To stay ahead, companies need to lead innovation, increase affordability, and go global to achieve industrydominance in the upcoming industryfor treating neovascular age-related macular degeneration. Research by FMI indicates that firms should accelerate next-generation therapies, particularly gene and cell-based therapies, and optimize biosimilar strategies to capture price-sensitive industries.Engaging with regulators, making strategic R&D investments, and strengthening industryaccess efforts should take precedence in the next 12 months to consolidate competitive positioning and foster long-term growth.

Treatment Affordability and Accessibility:

Regional Difference:

Converging Trends:

Consensus:

Regional Variances:

Important Challenges:

Regional Differences:

Manufacturers:

Healthcare Providers:

Global Alignment:

Regional Focus Areas:

High Consensus:

Key Variances:

Strategic Insight:

| Countries | Regulatory Impact & Certification Requirements |

|---|---|

| United States | Anti-VEGF and gene therapeutics are regulated by the FDA under the Biologics Control Act. The Biosimilar User Fee Act ( BsUFA ) streamlines biosimilar approvals; Medicare pricing negotiations have implications for reimbursement. |

| United Kingdom | Post- Brexit , the MHRA handles drug approvals and follows (broadly) similar rules to the EU, but with a streamlined conditional approval route. Anhad | (London) They are evaluated for NHS adoption in terms of their cost-effectiveness by the National Institute for Health and Care Excellence (NICE). |

| France | On the other hand, ANSM, a French health authority modeled after the EU-EMA, strictly controls prices through CEPS (the Economic Committee for Healthcare Products), which results in a low adoption rate of high-cost therapies. |

| Germany | As mandated by Germany's AMNOG law, the Federal Joint Committee (G-BA) is required to conduct thorough cost-benefit assessments that impact reimbursement rates for novel therapies. Incentive schemes promote biosimilar access. |

| Italy | Although AIFA gets the final say, all new drug reimbursements must be approved by regional health authorities. Industry access to high-cost biologics is driven by rigid price negotiations. |

| South Korea | The Ministry of Food and Drug Safety (MFDS) regulates biologics and has accelerated approval pathways for domestic companies. Unlike premium therapies, the national health insurance system encourages the use of biosimilars |

| Japan | Biologics must undergo stringent safety trials before receiving approval from the PMDA (Pharmaceuticals and Medical Devices Agency). Government policies promote the use of more affordable treatment options, which negatively impacts the adoption of premium gene therapy. |

| China | The National Medical Products Administration (NMPA) accelerates the review of innovative medicines via its priority review system but requires local clinical trials to be performed. High-end therapy growth slowed due to price caps imposed by the government. |

| India | The Central Drugs Standard Control Organization's (CDSCO) tracks WHO biosimilar guidelines but mandates local clinical trials of foreign drugs. Drugs that are under price control through the Drug Price Control Order (DPCO) do not allow charging a premium for treatment. |

The industry for neovascular age-related macular degeneration treatments by drug type is anticipated to grow at a CAGR of 5.4% during the period 2025 to 2035. Aflibercept and ranibizumab are still the leading therapies because of their proven efficacy and widespread use.Aflibercept is expanding its industry share due to its longer dosing interval, which reduces patient burden. Faricimab is the most rapidly growing segment, driven by dual-pathway inhibition, with longer treatment intervals.

Although bevacizumab is widely used off-label due to cost benefits, it faces regulatory and reimbursement issues. Brolucizumab penetration is moderate due to early safety issues but will bounce back with enhanced physician confidence. Long-acting versions and biosimilar formulations of ranibizumab and aflibercept will further fuel industry growth, especially in cost-sensitive industries.

Wet AMD dominates treatment sales, accounting for nearly 90%, due to its aggressive progression and need for frequent interventions. However, innovations in Dry AMD treatment are expected to drive gradual industry expansion in this segment. Although dry AMD is an underpenetrated industry, new therapies in complement inhibition are opening up new avenues.

The emergence of new therapies like pegcetacoplan and gene therapy for dry AMD will disrupt the industry, but reimbursement continues to be a challenge. The wet AMD segment will maintain its grip, whereas treatments for dry AMD will witness a slow but consistent pick-up, particularly in high-income economies with an aging population.

The industry for treating neovascular age-related macular degeneration by age category is projected to grow at a CAGR of 5.3% during 2025 to 2035. The 60-to-80-year age group represents the largest segment, as AMD prevalence is highest within this population. The early detection and campaigns have enhanced the diagnosis rate, resulting in early intervention.

The over-80 segment is growing more slowly because of lower treatment compliance and increased mortality. The less-than-60 segment, while currently a niche industry, will also increase because genetic and lifestyle influences cause disease to develop earlier. Outreach to diagnose early and customized treatment protocols for the elderly population will be key to maintaining growth.

The treatment industry for angiogenicage-related macular degeneration based on gender is projected to grow at a CAGR of 5.1% during the period 2025-2035. Females represent a larger patient base due to their higher life expectancy and increased risk of AMD among postmenopausal women. Hormonal variation and genetic influence are responsible for the increased burden in women and thus, subsequently, the greater demand for treatment.

Male patients have greater rates of adherence to anti-VEGF therapy, which determines long-term treatment results. While gender-specific prevalence patterns will persist, individualized treatment approaches that address compliance factors will enhance therapy effectiveness.

The treatment industry for neovascular age-related macular degeneration by disease stage is anticipated to grow at a CAGR of 5.5% during 2025 to 2035. Late-stage AMD generates the highest demand for treatment because of irreversible vision loss, necessitating aggressive intervention. Intermediate-stage AMD is turning out to be an important growth sector with rising use of early intervention techniques to slow down the progression.

Early-stage AMD has limited existing treatments, but pipeline advancements in neuroprotection and anti-inflammatory therapies may change industry dynamics. Investment in early-stage treatments and patient awareness initiatives will be key to disease burden reduction and addressable industry growth.

The distribution channel industry for the treatment of neovascular age-related macular degeneration is projected to grow at a CAGR of 5.6% from 2025 to 2035. Hospital pharmacies lead because they dispense high-cost biologics under specialist care. Specialty pharmacies are increasing fast, serving long-term patient management and direct-to-patient delivery models.

Online pharmacies, though still a small niche, are expanding due to the rise of digital prescriptions and home delivery services. The streamlined supply chain approaches and increased insurance coverage of specialty and online pharmacy distribution will improve patients' access to treatments.

In the United States, the industry for treating neovascular age-related macular degeneration is projected to grow with a CAGR of 5.6% from 2025 to 2035. The USA is the biggest industry due to its high healthcare expenditure and early embracement of innovative treatments. According to FMI analysis, biosimilars are gaining popularity because of medicare cost pressures, whereas premium therapies such as gene and long-acting treatments are confronted with reimbursement challenges.

The FDA's fast-track approvals support innovation, while the Inflation Reduction Act (IRA) may impact pricing and reimbursement policies. The manufacturers need to emphasize long-term cost-saving advantages to gain payer approvals. Additionally, they should broaden clinical trials for new delivery mechanisms to alleviate patient burden from multiple injections.

In the United Kingdom, the industry for treating neovascular age-related macular degeneration is projected to grow at a CAGR of 4.8% between 2025 and 2035. NHS reimbursement and MHRA regulations form the UK industry. FMI analysis expects that NICE prefers cost-effectiveness, with preference for biosimilars and restriction on the adoption of high-cost therapy.

Long-acting therapies are receiving interest, subject to the fact that they cut down on clinical visits. Post-Brexit regulatory flexibility may accelerate drug approvals. It is also suggested that manufacturers must align pricing strategies with NHS funding constraints while leveraging real-world evidence to demonstrate treatment efficiency.

France's industry for the treatment of neovascular age-related macular degeneration is estimated to grow at a CAGR of 4.5% from 2025 to 2035. EU regulatory norms govern France, where ANSM and CEPS manage drug approvals and enforce strict price controls. Biosimilars are becoming more prevalent, and cost-effectiveness testing is being done on premium treatments. Public healthcare accounts for reimbursements, with restricted penetration of high-cost drugs. Obtaining approvals primarily depends on patient outcome data and strategic pricing.

Germany's industry for neovascular age-related macular degeneration treatment is anticipated to grow at a CAGR of 5.0% from 2025 to 2035. AMNOG price negotiations and robust biosimilar uptake support Germany's industry. G-BA requirements for cost-benefit analysis affect reimbursement rates. Sustained-release therapies are gaining popularity, provided they demonstrate cost savings. Manufacturers need to maximize industry access strategies, focusing on real-world cost savings.

In Italy, neovascular age-related macular degeneration treatment is predicted to grow in its industry by 4.2% CAGR between the periods of 2025 to 2035. In Italy, drug approvals are regulated by AIFA, while regional health organizations manage reimbursement.

The FMI analysis observed a growth in high-priced treatments and biosimilars due to pricing negotiation limits. Growing awareness drives and government efforts in favor of early diagnosis will drive treatment penetration. Firms need to form regional alliances to overcome reimbursement challenges and highlight real-world evidence to support premium pricing.

In South Korea, the treatment industry for neovascular age-related macular degeneration is forecast to grow at a CAGR of 4.6% during the period 2025 to 2035. Biologics are regulated by the Ministry of Food and Drug Safety (MFDS), and government insurance encourages cost-saving options.

Surge in biosimilars, while regulatory and cost hurdles hinder advanced gene therapies. With an increasing elderly population and increased healthcare expenditures, there is growing demand for novel treatments. The firms need to align with local regulatory frameworks, show long-term cost-effectiveness, and partner with local healthcare providers to ensure adoption.

In Japan, the industry for neovascular age-related macular degeneration treatment is anticipated to grow at a CAGR of 4.0% during the period from 2025 to 2035. Stringent approval mechanisms are enforced by the Pharmaceuticals and Medical Devices Agency (PMDA), with a bias toward cost-effective drugs and biosimilars.

Premium biologics face difficulties with reimbursement owing to government-based price controls and biennially mandated price cuts. Despite Japan’s aging population, adoption of expensive therapies remains low due to conservative prescribing habits and patient reluctance toward frequent injections.

The industry for neovascular age-related macular degeneration treatment in China is estimated to grow at a CAGR of 5.4% from 2025 to 2035. The National Medical Products Administration (NMPA) has initiated fast-track approvals for new drugs but has strict local clinical trial mandates, hindering the foreign brands' entry.

NRDL-imposed pricing caps restrict premium therapy growth, whereas local biosimilars experience high take-up due to cost benefits. Urban hospitals are the most dominant in treatment access, and rural penetration is low, thus leaving an unmet opportunity for affordable AMD treatments.

In India, the industry for treating neovascular age-related macular degeneration is projected to grow at a CAGR of 5.2% from 2025 to 2035. The Central Drugs Standard Control Organization (CDSCO) adheres to WHO biosimilar guidelines, and the Drug Price Control Order (DPCO) has strict price controls on essential drugs, which affect the pricing of anti-VEGF therapies. FMI forecasts assume affordability to continue as the top issue, leading to widespread biosimilar use versus originator biologics.

The presence of local pharmaceutical firms producing cost-effective substitutes has brought about deeper penetration in urban communities, though rural access still poses a problem on account of inadequate ophthalmology infrastructure. Firms investing in tier-2 and tier-3 city outreach initiatives and mobile eye clinics will gain a competitive edge by bridging the access gap and enhancing patient awareness about early AMD intervention.

Pricing, innovation, strategic partnerships and collaboration, and geographical expansion will fuel the competitive dynamics of angiogenicage-related macular degeneration treatment. Heavyweights like Roche, Novartis, Regeneron, and Bayer lean into extended dosing intervals to help differentiate premium therapies from competing on price against biosimilars.

However, currently, the key players are focusing on dual-action biologics and gene therapies R&D.Moreover, strategic options to expand availability in price-sensitive industries and considers partnerships with local pharmaceutical companies and healthcare practitioners as key to improving access. Additionally, licensing deals and acquisitions are accelerating entry into the industry, especially in the Asia-Pacific, where the demand for low-priced treatment is rising.

Industry Share Analysis

Regeneron Pharmaceuticals

Industry Share: ~35-40%

The product comes with robust clinical evidence, indications for expansion, and a pass-through of its blockbuster medicine Eylea (aflibercept) to command the industry.

Roche (Genentech)

Industry Share: ~25-30%

It maintains a significant industry share alongside Lucentis (ranibizumab) and emerging products such as Vabysmo (faricimab), which is making a slight comeback due to its extended dosage profile.

Novartis

Industry Share: ~15 to 20%

Rely on Beovu (brolucizumab) despite safety problems while putting money into next-gen treatments like iptacopan for geographic atrophy.

Bayer

Industry Share: ~10-15%

Bayer, in collaboration with Regeneron, is conducting trials on a high-dose version of aflibercept to assess its potential for extending treatment intervals.

Apellis Pharmaceuticals

Industry Share: ~5-10%

Making progress with Syfovre (pegcetacoplan), the first-ever approved treatment for geographic atrophy, a complication of late-stage AMD.

Alcon (purchased Aerie Pharmaceuticals in 2022)

Industry Share: ~5%

The company is currently working on sustained-delivery innovations, albeit with a relatively modest share of the industry in comparison to the leaders.

Key factors driving adoption of treatment include the rising elderly population, growing incidence of eye disorders, and advancements in biologics.

The industry is expected to grow steadily due to increasing patient awareness, improved reimbursement policies, and the emergence of long-acting therapies.

The leading manufacturers include F. Hoffmann-La Roche AG, Bausch + Lomb, Novartis AG, Pfizer Inc., Allergan Plc., Acucela Inc., Santen Pharmaceuticals Co., Ophthotech Corporation, Alimera Sciences Inc., GSK plc., Regeneron Pharmaceuticals Inc., Bayer AG, RXi Pharmaceuticals Inc.

Aflibercept is likely to continue to be a dominant player due to its long dosing schedules and its clinician preference among several physicians.

Sustained investment in advanced treatment options will drive the industry to a projected valuation of USD 5.38 billion by 2035.

the industry is segmented into ranibizumab, aflibercept, bevacizumab, brolucizumab and faricimab.

it is bifurcated into dry AMD and wet AMD.

it is segmented into less than 60, between 60 to 80 and more than 80.

it is bifurcated into male and female.

it segmented as early-stage AMD, intermediate AMD and late-stage AMD.

it is fragmented into hospital pharmacy, specialty pharmacy and online pharmacy.

the industry is studied across North America, Latin America, Europe, East Asia, South Asia, Oceania, Middle East & Africa.

Protein Diagnostics Market Share, Size and Forecast 2025 to 2035

Intraoperative Fluorescence Imaging Market Report - Demand, Trends & Industry Forecast 2025 to 2035

Lung Cancer PCR Panel Market Trends, Growth, Demand & Forecast 2025 to 2035

Polymyxin Resistance Testing Market Trends – Innovations & Growth 2025 to 2035

Procalcitonin (PCT) Assay Market Analysis by Component, Type, and Region - Forecast for 2025 to 2035

Cardiovascular Diagnostics Market Report- Trends & Innovations 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.