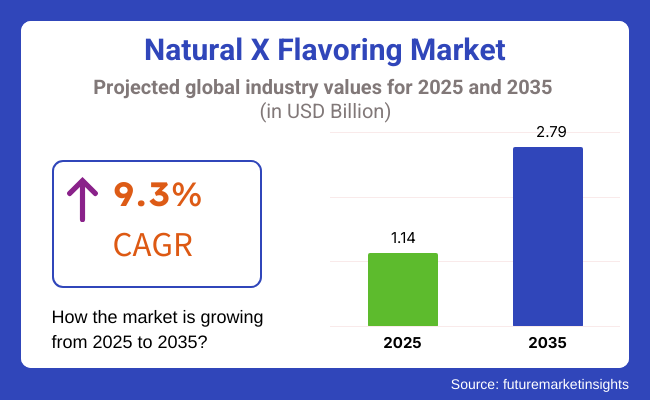

The natural X flavoring market is expected to witness a remarkable surge in demand, with a projected worth of USD 1.14 billion by 2025. The total industry will see a CAGR of 9.3% during the projection period from 2025 to 2035. By 2035, the net valuation of this particular industry is expected to be USD 2.79 billion.

Natural X flavoring, which is sourced from plants and organic sources, is increasing in prominence as a result of the constant rise in consumer demand for clean-label and natural food components. As the health-conscious population turns its back on additives and synthetic flavors, food and beverage manufacturers strive to blend natural X flavor into their product formulas.

By reason of the growing insistence on genuineness, transparency, and sustainability in food production, the notion is becoming the norm. The expansion of the anti-X flavor supplement industry is mainly a consequence of plant botanical X flavor use in the different beverages, dairy, confectionery, and bakery sectors.

Since consumers are demanding more enjoyable flavors, the manufacturers are innovating by combining different asingle-source extracts, fruit concentrates, and plant-derived herbal essences to produce new and versatile flavors. Furthermore, the support of regulations in favor of natural food components is speeding up the use of natural X flavoring in various global markets.

The stability, solubility, and shelf life of natural X flavoring have improved a lot, thus making it more suitable for mass production of food. Suppliers of raw materials are also investing in the R&D departments with the view of fabricating quality, stabilizer-free, and adaptable flavor agents that satisfy the needs of different manufacturers in the food and beverage sector.

At the same time, the industry is faced with issues like higher production costs and supply chain glitches that are related to discovering natural raw materials. Changes in the seasonal availability of raw ingredients and local variations in raw material quality can also lead to decreased productivity. In addition, the need for manufacturers to ensure flavor profile consistency while at the same time complying with set regulatory standards results in complexity.

Nevertheless, it is a busy industry for expansion. The newly introduced plant-based and functional food products are going to be a favorable path for natural X flavoring. The increase in consumer awareness about organic and non-GMO ingredients is a catalyst in the demand for natural flavors in the health-centric food formulations.

On top of that, the increasing trend of e-commerce and direct-to-consumer channels not only makes the sourcing of natural X flavoring easier but also introduces it to a higher number of customers globally, thereby contributing to the industry stabilizing.

Explore FMI!

Book a free demo

The industry is experiencing strong growth due to swelling demand for clean-label, plant-based, and organic ingredients. People are looking aggressively for natural flavoring solutions that free them from artificial additives and preservatives.

Natural X flavoring in the food and beverage sector is extensively applied in beverages, confectionery, dairy, and bakery to flavor with clean-label transparency. Natural flavoring is coming into syrups and medicines in the pharmaceutical industry to make it more palatable without using artificial chemicals.

Natural X flavoring employed in lip balm, oral hygiene, and perfumes is being utilized by the cosmetics and personal care industry to benefit from the tendency towards chemical-free and green beauty. Natural X flavoring is being utilized by dietary supplements to impart a more enhanced taste to protein powders, vitamins, and functional foods. With a growing emphasis on sustainability and well-being, corporations are focusing on organic, non-GMO, and sustainably sourced ingredients that align with changing consumer demands.

The period between 2020 and 2024 witnessed strong growth in the industry as consumer demand for natural, clean-label ingredients was on the rise. Growing health awareness of the ill effects of artificial additives led food and beverage companies to re-position their products using natural flavoring ingredients.

Transition from plant-based and organic ingredients served to propel industry demand for natural X flavorings across segments of beverages, dairy, confectionery, and processed foods. Natural and organic labeling support came from regulations as well, strengthening industry uptake. But high manufacturing costs, logistics issues, as well as natural ingredient unavailability, posed risks to scalability and profitability.

Between 2025 and 2035, the industry will expand extremely rapidly as technology increases methods of extraction and stability and intensity of flavor. Flavor profiling and blending of natural ingredients will be made more effective by AI and bioengineering.

Sustainability will remain prominent with producers adopting sustainable sourcing and production practices. Increasing demand for functional foods and personalized nutrition among consumers will propel innovation in flavor personalization.

Regulatory agencies should impose stricter measures for natural labeling and ingredient visibility, raising the demand for stringent compliance. Blockchain-based tracing of supply chain and product authentication is likely to gain momentum to maintain consumer trust and product quality.

Comparative Market Shift Analysis 2020 to 2024 vs. 2025 to 2035

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Movement towards clean-label, natural ingredients fueled by wellness awareness | Growing demand for functional, tailored flavors with health benefits |

| Consistent growth as a result of clean-label trends and reformulation of processed foods | Faster growth fueled by technological advancements and sustainable manufacturing |

| Early advancements in natural flavor extraction and formulation | AI-based flavor profiling and bioengineering for improved flavor blends |

| Natural and organic labeling support | Tighter standards for natural labeling and greater ingredient transparency |

| Focus on natural and plant-based ingredients | Green sourcing, carbon-free manufacturing, and enhanced traceability |

| High cost of production and supply constraints | Regulatory requirements and need to drive sustainability metrics |

| Beverages, dairy, confectionery, and processed foods | Growth into plant-based alternatives, functional food, and health-oriented products |

The industry is flourishing due to the major factors such as increase in consumer preference for clean-label and plant-based ingredients in food and beverages. However, compliance with the strict regulatory frameworks related to the ingredient sourcing, labeling accuracy, and the health claims can be challenging. Companies are required to comply with the global food safety regulations and ensure transparency to keep their consumer trust.

Production consistency has been negatively affected by supply chain disruptions, including the availability of raw material, the impacts of climate change, and geopolitical tensions. The industry's reliance on natural resources makes it susceptible to the yield variations of crops and the effects of the environment. To manage these threats effectively, businesses are encouraged to implement multipronged sourcing strategies and adopt environmentally friendly farming techniques.

Industry competition with man-made flavors and other natural extractions is the other disadvantage that has to do with pricing as well as differentiating. Unique compositions, patented extraction processes, and additional application uses are all that companies should strive for as they concentrate on health and taste attributes at once.

Economic fluctuations and changes in consumer preferences related to food can directly influence the demand for high-end natural flavoring products. However, in order to grow sustainably, companies should channel resources into research and product development, broaden distribution networks, and use digital marketing tools to get in touch with consumers and to familiarize the general public with their brand in a tough business setting.

Based on form, the industry is expected to be dominated by the liquid segment, which holds approximately 57.4% of the industry share in 2025. The food & beverage, pharmaceuticals, and cosmetics industries are major consumers of liquid natural Flavoring, owing to its ease of mixing, high solubility, and flavor retention.

Liquid flavors are more easily dispersed into products (beverages, dairy, sauces, and syrup, e.g.) and, as such, allow for greater integrity of the products in keeping flavors and use common applications in this section.

Players such as Firmenich, Givaudan, and Symrise are developing natural extraction technologies to enhance their stability and authenticity. The other factor driving the growth of this segment is the key demand for clean-label, organic, and non-GMO products, specifically in ready-to-drink (RTD) beverages and plant-based dairy substitutes.

Based on the form of ingredient, the natural flavoring segmentation is divided into powdered, liquid, and oil natural flavoring, out of which powdered natural Flavoring is expected to account for 42.6% of the industry share by 2025. It will continue to grow steadily due to longer shelf-life, ease of storage, and ability to dose accurate quantities.

In terms of moisture control aspects, it is widely used in bakery, confectionery, nutraceuticals, and dry seasoning blends. This has led to the development of powdered flavoring solutions from innovative companies like Kerry Group, Sensient Technologies, and Takasago International Corporation to cater to an expanding functional foods and dietary supplements industry.

The growing popularity of sports nutrition and meal replacement products is boosting the demand for powdered flavor extracts. As consumers increasingly favor natural, organic, and sustainably sourced flavors, strong demand is expected across both the liquid and powder segments in multiple industries, including food and beverage, pharmaceuticals, and cosmetics.

Based on the type of flavoring in the industry, vanilla will lead with a share of 24.5% in 2025 growing demand for natural vanilla in the bakery, confectionery, dairy, and beverage industries. Restrictions on using synthetic vanilla and a growing preference for clean-label products are pushing companies to use more natural vanilla extracts and oleoresins.

Nielsen-Massey and other major players, like Symrise and Givaudan, are increasingly investing in sustainable vanilla from Madagascar and Uganda as demand continues to grow internationally. Expansion of the plant-based and premium dairy segment is the windfall that needs to nurture the quest for natural vanilla flavors across such applications, including ice creams, yogurt, and flavored protein shakes.

The lemon flavoring segment is anticipated to hold 21.3% of the industry share in 2025 in terms of revenue owing to the surging inclination for flavoring in beverages, bakery, and savory food formulations. From detox drinks to flavored water and health supplements, with their refreshing taste profile and functional properties, natural lemon extracts and oils are emerging as effective ingredient choices for RTD beverages.

As a result, other manufacturers, including the likes of Kerry Group, Dohler, and Firmenich, are also branching into the production of cold-pressed and steam-distilled lemon flavoring to meet the demand for organic, non-GMO, and preservative-free flavoring solutions.

The growing adoption of immunity-boosting products and functional tea using lemon-based flavors is also driving greater industry expansion. In the aftermath of consumers shifting to genuine, natural, and sustainably sourced flavors, both vanilla and lemon will remain used in the changing natural flavoring area.

| Countries | Estimated CAGR (2025 to 2035) |

|---|---|

| USA | 5.6% |

| UK | 4.8% |

| France | 4.5% |

| Germany | 5% |

| Italy | 4.2% |

| South Korea | 6.1% |

| Japan | 4.7% |

| China | 6.8% |

| Australia | 4.3% |

| New Zealand | 4% |

The USA industry is expected to grow at a 5.6% CAGR from 2025 through 2035. Growth is driven by consumer interest in clean-label foods and plant-based alternatives. The food and beverage industry in the USA enthusiastically utilizes natural flavors to appeal to health-conscious consumers. McCormick & Company and Givaudan are expanding their portfolios of natural ingredients with a focus on organic and sustainable origins.

Innovation in the USA industry also stems from the growing trend of functional drinks with botanical extracts and natural sweeteners. The demand for products that are free from non-GMO, allergens, and artificial additives compels flavor makers to develop solutions conforming to regulatory standards. Beyond Meat and Impossible Foods brands employ natural flavoring to enhance plant-based substitutes as the world continues to move towards sustainable food production.

The UK industry is forecasted to increase at a CAGR of 4.8% during the period from 2025 to 2035. The increasing popularity of organic and ethically sourced ingredients is behind the growing industry size. Customers prefer food items with clear labels, and this drives companies to adopt natural botanical extracts over artificial flavoring. Tate & Lyle and Synergy Flavors are some of the companies that invest heavily in R&D to enhance the authenticity of flavor without the use of synthesized additives.

The expansion of alcohol-free beverages and plant-based dairy alternatives also drives the UK industry. With strict regulation of synthetic additives, brands explore fermentation-based natural flavor solutions to ensure optimum product appeal. Low-sugar and functional beverages, particularly soft drinks and herbal infusions, are trends that offer opportunities for natural flavor innovation.

France's industry for natural X flavoring is likely to grow at a 4.5% CAGR between 2025 and 2035. France possesses a strong cuisine and culinary culture and believes in the incorporation of natural extracts and essential oils in food and beverage products. French companies such as Robertet Group and Mane are leading players in innovation concerning botanical and citrus flavors, bolstered by consumer demand for clean-label and craft products.

The push towards gourmet and organic foods is fueling the use of fruit, spice, and herb-based natural flavoring. The growing organic food industry, particularly in dairy, baked foods, and beverages, reinforces the move towards non-synthetic flavor solutions. Additionally, France's robust perfumery and cosmetics industry integrates natural aromatic extracts, further increasing the industry's scope.

Germany's industry will develop a 5% CAGR during the period from 2025 to 2035. The country is a trendsetter for sustainable food innovation with high demand for organic, allergen-free, and plant-based flavors. Symrise and Wild Flavors lead by innovating pre-emptive fermented and enzyme-based flavoring solutions to combat the rising demand for natural umami and fruit extracts for packaged food.

Germany's stringent food safety regulations encourage the replacement of artificial flavoring agents with certified organic and natural flavor enhancers. Growth in the plant-based meat and dairy-free drink industry drives the adoption of fermented and yeast-based flavor enhancers. In addition, the trend for functional drinks and immunity-driven drinks fuels the demand for botanical-infused flavors, and thus Germany is a significant industry for health-focused innovation.

Italy's industry is expected to develop at a CAGR of 4.2% from 2025 to 2035. Italy possesses a robust food culture with a penchant for handcrafted and natural ingredients, leading to a high demand for spice, citrus, and herbal-based flavoring solutions. Natural extracts used in food and drinks are the core business of companies like FlavourArt.

With the strong Italian coffee and wine culture, natural flavors play an important role in strengthening beverages, sweets, and baked goods. Natural flavoring in gelato as well as in dairy desserts is becoming more prominent with clean-label and organic fueling consumer demand. In addition, Italy's booming organic wine industry blends natural flavors of botanicals and fermented isolates.

South Korea's industry is poised to grow vigorously at a CAGR of 6.1% from 2025 to 2035. Increased consumer interest in functional and fermented beverages like kombucha and traditional teas drives the adoption of natural extracts and botanical infusions. Players like CJ CheilJedang and Daesang focus on developing fermentation-derived flavor solutions amidst clean-label consumer trends.

The expansion of the K-beauty industry also propels the rising use of natural flavoring and perfumes in nutraceuticals and cosmetics. Additionally, growing interest in plant-based Korean cuisine, such as vegan kimchi and soy-based alternative dishes, fuels demand for non-artificial, high umami flavor profiles.

Japan's industry is expected to grow at a CAGR of 4.7% in the years 2025 to 2035. Japan's long-standing focus on umami and fermentation flavors positions a demand for natural flavoring in food and beverage uses. The industry leaders are T. Hasegawa and Takasago, which lead traditional and new-age botanical flavor development.

The expansion of functional foods and drinks, particularly gut wellness foods and beverages, drives the demand for naturally fermented flavoring ingredients derived from miso, kombu, and sake lees. Japan's tea culture, including matcha and hojicha-based beverages, also employs natural, low-processing flavor solutions for enhanced authenticity.

China's industry will develop at a rapid pace during 2025 to 2035 at a CAGR of 6.8%. Urban life and health-conscious consumer behavior are major drivers of demand for plant-based, herbal, and fruit-based flavoring alternatives. Domestic Industry players like Angel Yeast focus on fermentation-based plant and functional food flavor enhancers.

The industry of traditional Chinese medicine (TCM) uses natural flavors in health drinks and dietary supplements, promoting growth in the industry. Furthermore, the rapid expansion of herbal beverages and dairy alternatives offers floral and spice-infused natural flavoring innovation new routes.

Industry in Australia will develop a CAGR of 4.3% through 2025 to 2035. There is demand for organic, Indigenous plant flavors, such as the one made by Taste Australia in terms of eucalyptus, lemon myrtle, and wattleseed extracts.

The organic movement and clean-label trend propel the innovation of natural flavor in functional drinks, dairy substitutes, and alternative meat. Besides, the booming craft brewing business in Australia utilizes locally sourced natural flavors, which further highlights the focus on minimally processed, sustainable ingredients.

New Zealand's industry is anticipated to grow at a CAGR of 4% from 2025 to 2035. Natural flavoring in value dairy products, led by the dairy industry, is a high-priority innovation area. Fonterra is in the lead for natural flavoring in value dairy products.

Manuka honey-enhanced flavors drive expansion in the honey and herbal supplement segment. New Zealand's focus on organic food production is also supportive of indigenous botanical extracts in functional beverages and plant-based foods.

The industry for natural X flavoring is expected to be highly booming, mainly due to increased consumer demand for cleaner, plant-based, and less processed food ingredients. Rising demand for authentic, natural, and health-beneficial flavors has propelled companies to focus more on enhancing their flavor solutions through botanical extracts, essential oils, and fermentation-based flavor development for more appealing use across all kinds of foods, drinks, and nutraceuticals.

Leading players such as Givaudan, Symrise, Firmenich, Kerry Group, and International Flavors & Fragrances (IFF) dominate the industry, thereby offering their customized natural flavoring solutions to suit the different industry sectors.

New entrants, as a niche segment in this industry, are focusing on innovative methods employed to extract their organic-certified ingredients and sustainable sourcing as ways of meeting evolving consumer demands. Key offerings include fruit-derived, spice-based, floral, and herbal flavors, with increasing applications in dairy alternatives, plant-based meats, functional beverages, and confectionery.

Companies are using high extraction technologies, enzymatic bioconversion, and AI-flavor modeling to create one-of-a-kind clean-label taste profiles. Actions based on regulatory frameworks favoring the inclusion of natural ingredients, the advent of technology relating to flavor enhancement, and emerging trends toward transparency in food labeling have resulted in transforming the industry.

North America and Europe lead in terms of the use of natural flavors, while Asia-Pacific is growing due to rising disposable incomes and changing personal consumption patterns. Strategic watersheds affecting competition include the sourcing of sustainable ingredients, investment into R&D for developing new flavors and forging alliances with food and beverage manufacturers.

Other companies are also going ahead to widen their spectrum of geographical reach and direct-to-consumer sales channels to establish stronger industry positioning. With this, they will also be able to cater to the ever-rising demand for clean-label, natural flavor solutions in the consumer markets.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Givaudan | 18-22% |

| Firmenich | 14-18% |

| Symrise AG | 10-14% |

| International Flavors & Fragrances (IFF) | 8-12% |

| Kerry Group | 6-10% |

| Other Players (Combined) | 25-35% |

| Company Name | Key Offerings & Market Focus |

|---|---|

| Givaudan | Specializes in plant-based and fruit-derived natural flavors, leveraging AI-driven innovation and sustainable sourcing. |

| Firmenich | Develops botanical extracts and clean-label flavor solutions, integrating fermentation-based production for enhanced authenticity. |

| Symrise AG | Focuses on natural citrus, vanilla, and herbal flavorings, using green chemistry and CO2 extraction technologies. |

| IFF (International Flavors & Fragrances) | Leading in bio-based and fermented natural flavors, offering customized solutions for food and beverages. |

| Kerry Group | Provides natural taste modulation systems and organic flavor extracts, emphasizing sustainability and clean-label trends. |

Key Company Insights

Givaudan (18-22%)

Leading in natural flavors, Givaudan invests in biotechnology and AI flavor profiling that increasingly extends into plant-based and sustainable ingredients.

Firmenich (14-18%)

Botanical expertise in which the firm is awesome, Firmenich is moving fermentation into flavor production and replacing traditional extraction methods with fermentation-based ones.

Symrise AG (10-14%)

Strong in citrus, vanilla, and herbal flavor extracts, Symrise focuses on eco-friendly extraction and advanced ingredients from upcycling.

IFF (8-12%)

The pioneer has fermented and bioengineered approaches for natural flavors. It collaborates with food and beverage brands to develop their innovative clean-label formulations.

Kerry Group (6-10%)

Kerry is one of the main innovators in natural taste solutions, developing advanced sensory technologies and sustainable ingredient sourcing.

The industry is expected to generate USD 1.14 billion in revenue by 2025.

The industry is projected to reach USD 2.79 billion by 2035, growing at a CAGR of 9.3%.

Key players include Givaudan, Firmenich, Symrise AG, International Flavors & Fragrances (IFF), Kerry Group, Takasago International Corporation, Sensient Technologies, Mane, Robertet Group, and T. Hasegawa.

North America and Europe, driven by rising demand for organic, non-GMO, and naturally derived flavoring agents in food, beverages, and personal care products.

Essential oils and plant extracts dominate due to their versatility, strong consumer appeal, and extensive applications in bakery, confectionery, dairy, and functional beverages.

By form, the industry is classified as liquid and powder.

By end user, the industry is classified as food and beverage processing industry, bakery products (including confectionery, fondants and dry mixes, desserts, chocolates, cakes and pastries), beverages, others (such as sauces, spreads & dressing, syrups), dairy products (including yogurt, milk, ice creams, and others).

By flavors, the industry is classified as vanilla, lemon, lime, orange, apple, apricot, orchard, peach, pear, black currant, blueberry, cherry, raspberry, and others (such as passion fruit, banana).

By region, the industry is divided as North America, Latin America, Europe, East Asia, South Asia, Oceania, and Middle East and Africa.

Moringa Extract Market Analysis by Product Type, Form, End Use, Distribution Channel and by Region from 2025 to 2035

NFC Juice Market Analysis by Product Type, Product Claim, End-Use Application and by Region from 2025 To 2035

United States Plant-Based Meal Kits Market Analysis by Product Type, Format, Sales Channel - Growth, Trends and Forecast from 2025 to 2035

Vanillic Acid Market Analysis by Purity, Application, and Region - Growth, Trends, and Forecast from 2025 to 2035

United States Pet Food Market Analysis by Nature, Product Type, Source, Pet Type, Packaging, Distribution Channel - Growth, Trends and Forecast from 2025 to 2035

Organic Gummy Worms Market Analysis by Flavors, Distribution Channel and Region from 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.