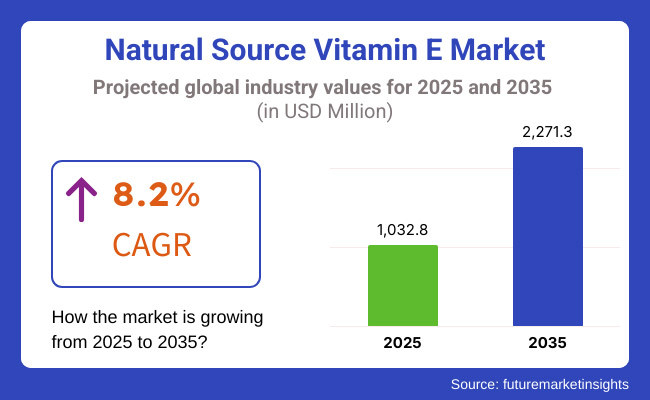

The Natural Source Vitamin E market is estimated to be worth USD 1,032.8 million in 2025 and is projected to reach a value of USD 2,271.3 million by 2035, expanding at a CAGR of 8.2% over the assessment period of 2025 to 2035.

The applications of natural vitamin E has continuously risen over the last decade due to global changes in demand focusing on natural plant ingredients and due to positive effects of the compound. With consumers beginning to understand the significance of maintaining their health and the benefits of antioxidant, the sector for natural vitamin E for diverse industries has increased tremendously

Companies in this category have realized the great opportunity and have therefore not waited to be compelled to implement measures of enhancing their positions in the arena. Among the focus areas, the development of capacities for increasing production volumes in response to the increasing demand has been actively pursued.

Several key players like BASF, ADM, DSM Nutritional Products have made strategic enhancements to its production capacities and facilities to provide supply with consistency in its quality. These investments also clearly indicate how the manufacturers are willing and have the capacity to deliver on the need of the sphere while enhancing their position as key players in the globe.

In addition to the capacity enhancement, the manufacturers have also been actively focusing on product differentiation. They have been developing natural vitamin E based products of different forms and hoping consumers’ increasing concern on health. Here, these companies have correctly placed as the answer to the new needs of consumers and markets, as stimulants in diverse applications across the dietary supplement and personal care product sectors, functional foods and beverages.

Furthermore, awareness of more functional and nutritional ingredients is thereby another crucial factor for the industry. People specifically look for that product that meets their preset criteria for taste and convenience and at the same time impacts their health positively. Due to the human body presumed benefits as an antioxidant and as a complementary medicine, manufacturers have sought to lay their claims to it by creating new product lines.

Moreover, the consumer’s demand towards natural products has play an important role of driving sector. With the trend towards clean label and plant based products, more and more consumers prefer natural over synthetic types. This has put pressure on manufacturers to source their products in such ways that will be more environmentally friendly through enhancing the natural aspect of the products creating an even stronger sphere which will continue to grow.

With the increasing global concern toward preventive healthcare, natural wellness, and consumption of natural products the demand of the natural products sector will increase in the long run. Intensified investments, product development, and arena positioning by manufacturers and producers have thus put the industry’s future on the right course and strategically placed it to be a major player within the context of a booming health and wellness industry.

Explore FMI!

Book a free demo

The below table presents a comparative assessment of the variation in CAGR over six months for the base year (2024) and current year (2025) for the global industry. This analysis reveals crucial shifts in performance and indicates revenue realization patterns, thus providing stakeholders with a better vision of the growth trajectory over the year. The first half of the year, or H1, spans from January to June. The second half, H2, includes the months from July to December.

| Particular | Value CAGR |

|---|---|

| H1 2024 | 7.8% (2024 to 2034) |

| H2 2024 | 8.2% (2024 to 2034) |

| H1 2025 | 8% (2025 to 2035) |

| H2 2025 | 8.3% (2025 to 2035) |

The global industry's predicted compound annual growth rate (CAGR) over a semi-annual period from 2025 to 2035 is shown in the above table. The business is anticipated to grow at a CAGR of 7.8% in the first half (H1) of 2024 and then slightly faster at 8.2% in the second half (H2) of the same year. The CAGR is anticipated to decrease somewhat to 8% in the first half of 2025 and continues to grow at 8.3% in the second half. The industry saw a decline of 35 basis points in the first half (H1 2025) and an increase of 46 basis points in the second half (H2 2025).

Rising Demand of Antioxidants and increasing health concerns elevating the sales

Advance insight into the role of antioxidants in overall well-being has induced rampant surge in consumer demand for products high in such compounds as vitamin E. The upper-hand shift in consumer preferences has spurred the need for more concerted attention toward developing and marketing of natural, antioxidant-oriented products to reach an increasingly health-conscious target sector.

The increasing enlightenment of the public to the inclusion of antioxidants in their daily lives has compelled an industrial race: industries compete for the newest brands along with features they would regard as capable of meeting changes of the very core desires and needs anticipated from thereof by thousands by virtue of natural ingredients.

Manufacturers focus on regulatory standards and high quality products

Following protocols set by regulatory authorities and ensuring high quality in their products emerged as the core differentiators in that highly competitive landscape. It has been recognized by manufacturers that their ultimate goal should be to in still trust and credibility about the products they marketise with the help of an array of rigorous testing and certification procedures so that they can thus sell assurance of purity, safety, and transparency, which, according to industry conditions, are increasingly valuable as accountability and transparency have become issues in terms of purchasing decisions.

Placing this value on regulatory compliance and quality has created a strategic imperative for the many manufacturers to position themselves as good partners among their target audiences.

Skyrocketing expenditure on skin care products leveraging business landscape

The high expenditure is on skin care products currently creating a significant marketing chance for producers to deploy the various proven benefits of ingredients such as vitamin E. It is thus, hands down, the best compound that can be expected to moisten, protect and improve the skin, making it greatly looked for in a number of encompassing applications.

This trend has unlocked the ways for upscaling and revolution, as manufacturers developing targeted skin care products with infusion to meet the rising demand and crave of health conscious population finding naturally sourced high quality formulations for their skin care routine.

Infusion of Vitamin E in animal feed and pet food bolstering the growth

As far as the animal product business landscape is concerned, the addition of vitamin E into animal or even pet foods is regarded as one of the newest strategies. The use reinforces general animal well-being and provides an economic advantage to the manufacturers who service the ever growing demand for value added pet and livestock products.

This trend is indicative of the changing paradigm in animal product business where the focus is more on making animal health and nutrition better for household and agricultural animals which is aligned with what pet owners and livestock producers seek to achieve for the health and longevity of their animals.

Consumer shift towards specific nutritional products and awareness about wellbeing

The sphere has been growing due to the increasing popularity of health and wellness products among consumers. As a result, companies are coming up with new and specialized skin care products to meet the needs of health-conscious consumers who are looking care for routines. natural The and consumer’s effective are products paying for more their attention skin to their nutritional needs and what products are good or bad for them. This change in attitude has caused an increase in the demand for specific nutritional products that contain vitamin E.

Thus, manufacturers are developing products that aim at particular health issues and are aimed at the changing preferences of health-conscious consumers, thus making these companies the go-to companies for optimal health and wellness. Through this, these companies have been able to establish themselves as leaders.

Plant based solutions by key manufacturers attracting the end user industries

The large players in the industry have noticed the growing trend of plant-based solutions and are now investing a lot of their resources in developing new products that use the benefits of plant-based ingredients such as vitamin E.

This focus on plant-based products also helps the company to capture the growing consumer demand for environmentally conscious and ethically sourced products and makes these companies leaders in the sustainable and eco-friendly product business landscape.

By accepting plant-based alternatives, companies are able to meet the changing needs of health-conscious consumers who are looking for natural, plant-based products that support their health and the environment.

Consequently, the sphere has been growing stable in recent years that are clearly illustrated by sales figures denoting the rising popularity of plant-sourced compounds. It has had a growth trend in between 2020 to 2024 Campaigns on preventive nutrition have been fashioned, there is a shift of consumers towards natural products, and awareness of the health benefits of Vitamin E has been on the rise.

Forecasting into the future, the industries anticipate the same trend and the arena will be stronger in the period of 2025 to 2035. Such long-term view is well supported by the consistent consumer preference for functional, nutrient dense foods and by the increased manufacturing capacities and R & D thrust to create path-breaking solutions to address the emerging global health conscious consumer base.

Tier 1 companies comprise industry leaders with revenue of above USD 30 million capturing a significant share of 50% to 60% in the global business landscape. High production capacity and a wide product portfolio characterize these leaders. These leaders are distinguished by their extensive expertise in manufacturing and reconditioning across multiple packaging formats and a broad geographical reach, underpinned by a robust consumer base.

They provide a wide range of series including reconditioning, recycling, and manufacturing utilizing the latest technology and meeting the regulatory standards providing the highest quality. Prominent companies within tier 1 include Koninklijke DSM N.V., Penta International Corporation NOW Foods BASF SE Riken Vitamin Co., Ltd. and few others.

Tier 2 companies include mid-size players with revenue of USD 10 to 30 million having a presence in specific regions and highly influencing the local commerce. These are characterized by a strong presence overseas and strong business knowledge.

These players in the arena have good technology and ensure regulatory compliance but may not have advanced technology and wide global reach. Prominent companies in tier 2 include A to Z Nutrition International Inc. Yasho Industries Pacific Rainbow International, Inc. Zhejiang NHU Company Ltd. Parchem Fine & Specialty Chemicals Shandong Tianli Pharmaceutical Co., Ltd..

Tier 3 includes the majority of small-scale companies operating at the local presence and serving niche economies having revenue below USD 10 million. These companies are notably oriented towards fulfilling local demands and are consequently classified within the tier 3 share segment.

They are small-scale players and have limited geographical reach. Tier 3, within this context, is recognized as an unorganized ecosystem, denoting a sector characterized by a lack of extensive structure and formalization when compared to organized competitors.

The following table shows the estimated growth rates of the top three countries. USA, Germany and China are set to exhibit high consumption, and CAGRs of 5.2%, 6.7% and 9.1% respectively, through 2035.

| Countries | CAGR, 2024 to 2034 |

|---|---|

| United States | 5.2% |

| Germany | 6.7% |

| China | 9.1% |

The American people are the largest consumers in the world due to the Americans’ great number, their preference for healthy nutrition, availability of vitamin E containing products, including foods and supplements and due to the trends towards prevention methods and natural products and remedies.

The USA is well-known for its active consumers with constantly increasing demand in the spheres of nutraceuticals, focusing on dietary supplements, personal care products, foods, and beverage that provide health and wellness benefits for the consumers.

This is further supported by the growing knowledge on the health benefits attributed to the consumption that has seen the vitamin E find its way in many consumer goods that are used in preventing heath complications and enhancing overall well-being.

Currently, Germany ranks second in the global consumption of natural source vitamin E. This is because the country population has aged, and the society is looking for natural products to preventing ailments making products to be popular. The Germany market share of natural vitamin E is significantly high mainly due to the high consumers’ demand for quality supplements that are safe and effective.

While health consciousness and the implementation of natural plant compounds to broader wellness have been factors in propelling the industry growth, an important driver has also been the increasing trend toward sustainability and engagement of old-age natural solutions in the later years.

Currently, China ranks in the third position among the major consumers of natural source vitamin E. The above factors advanced by China’s growing economy, expanding middle class, and enhancing health awareness also promote the steadily rising demand for natural and high-quality nutritional substances.

Combined with the Chinese authorities’ expectation to improve public health as well as increasing popularity of traditional Chinese medicine, China is a strategic sphere for manufacturers and suppliers. With the advancing local health awareness and China’s consumers paying more attention to preventive healthcare service and natural ingredients’ efficacy, this product sector maintains its rapid development and sustained growth, in sync with the clients’ transforming demands and requirements.

| Segment | Value Share (2024) |

|---|---|

| Tocopherols (Type) | 62.7% |

The fact that tocopherols occupy a significant share in the vitamin E from natural source is due to namesakes’ recognition and existing positive evidence about its effectiveness. Due to its prevalence and frequent research, tocopherols form the backbone of vitamin E as accepted by the consumers, physicians, and producers.

Its benefits in terms of antioxidant activities and other health benefits like the function of maintaining cardiac health as well as immune system strength has made it applicable in nutritional supplements and health care products.

The non-PVC resin technology and recognizance of tocopherols as natural vitamin E source has made them taken preference by the mainstream consumer in relation to quality naturally occurring stereoisomers making the tocopherols the laddering business landscape.

| Segment | Value Share (2024) |

|---|---|

| Dietary supplements (Application) | 42.5% |

High usage of in the dietary supplements sphere can be attributed to the fact that this compound is a well-recognized antioxidant that is also related to other aspects of health. People today want to maintain good health, and they now learn that the most effective way is to engage in preventive measures and use natural products enriched for improved consumption.

Thorough investigations carried out so far on the efficacy especially in supporting the health of cardiovascular system, immune system and skin integrity have put lot of emphasis as a natural health nutrient wealthy enough to give optimal health support to health conscious individuals. Businessmen have not been left behind in this regard, advancing new improved high quality supplements that meet the increasing consumers’ demand of natural and effective product that can easily blend with the other wellness and fitness practices.

The natural source ingredient industry is more or less fragmented because various prominent manufacturers are seeking to gain a bigger share. In order to survive and maintain competitive edge, various approaches have been made by companies. One key area is product innovation, through presenting new differentiated products which reflect changing consumer demand. Other types are also evacuation of capacity and strategic alliances, which enable the manufacturers to address the increasing demand and enhance their supply chains as well.

There has been great focus on sustainability and transparency which has increased concerns on purchasing sustainably and ethically sourced ingredients. Promotion and advertising communicate the distinctive characteristics and added values of natural products in inducing consumer loyalty among health conscious consumers. Manufacturers constantly change and focus on the trend and invest in the competitive advantage in this emerging and fluid industry segment.

Throughout the forecast period, the sales are expected to grow at a CAGR of 8.2%.

By 2035, the sales value is expected to be worth USD 2,271.3 Million.

Increased demand for dietary supplements is expected to boost sales.

Asia-Pacific is expected to dominate the global consumption.

Key players includes ADM, BASF, Royal DSM, Cargill, Isochem, COFCO Tech Bioengineering, American River Nutrition, and Beijing Gingko Group and few others.

By type industry has been categorised into Tocopherols and Tocotrienols.

By Application sector has been segmented as Food & Beverages, Dietary supplements, personal care & Cosmetics and others

Industry analysis has been carried out in key countries of North America, Latin America, Europe, Middle East and Africa, East Asia, South Asia, and Oceania

Comprehensive Analysis of Pet Dietary Supplement Market by Pet Type, by Product Type, By Application, and Region through 2035

Latin America Mezcal Market Analysis by Product type, Source, Form, Application, Type, and Distribution channel and Country through 2035

USA Meal Replacement Products Industry Analysis from 2025 to 2035

UK Meal Replacement Products Industry Analysis from 2025 to 2035

USA Lactic Acid Industry Analysis from 2025 to 2035

UK Lactic Acid Industry Analysis from 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.