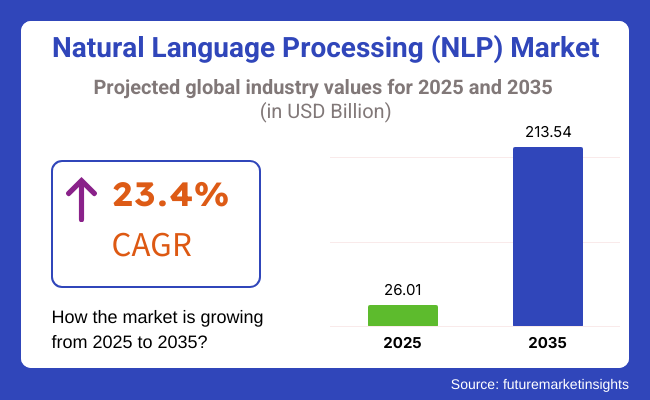

The Natural Language Processing (NLP) market will grow exponentially between 2025 and 2035, fueled by the growing adoption of AI-driven conversational systems, machine learning-enabled text analytics, and improvements in speech recognition technology. The industry is projected to reach USD 26.01 billion in 2025 and expand to USD 213.54 billion by 2035, reflecting a compound annual growth rate (CAGR) of 23.4% during the forecast period.

With the rising demand for chatbots, AI-driven customer service automation, and real-time sentiment analysis, NLP solutions are becoming integral to business intelligence, healthcare diagnostics, and financial analytics. The intersection of LLMs, voice AI assistants, and multilingual NLP capabilities is increasingly enhancing human-computer interaction across various industries. In addition, the increase in deep learning, contextual AI, and edge-based NLP processing is also boosting the growth.

Along with that, increased growth in rates is fueled by the expansion of AI-facilitated content generation, auto-document handling, and specialized NLP applications. Companies increasingly apply NLP to prevent fraud, meet compliance regulations, and achieve a hyper-personalized customer experience.

It is expected that Auto coding will have 24.1% of the share in 2025, driven by the increasing adoption of these AI-powered automation tools for text categorization, data annotation, medical coding, and more. The increase of unstructured data across various industries, including healthcare, finance, and legal services, is driving the demand for efficient solutions for auto coding.

The most recognized arena of auto-coding usage is in the healthcare sector, where it is successfully applied to improve clinical documentation improvement (CDI), accelerate medical billing as well as regulatory adherence (ICD-10, CPT codes, etc.). Companies such as 3M, Optum, and Nuance Communications have already adopted AI-driven auto-coding software to solve various internal challenges by increasing accuracy and reducing administrative effort.

Enterprises are also embedding auto coding into their customer service and content management platforms for tagging, classification, and retrieval of large text datasets. The ability of AI models to improve contextual understanding and accuracy will encourage the continued growth of auto-coding adoption across different domains, ensuring efficiency and scalability.

Text analytics is forecast to account for 31.8% of the share by 2025, in part driven by the growing prominence of big data, sentiment analysis, and AI and deep learning-accelerated insights in business intelligence. Organizations across industries, from retail to finance to marketing, are pursuing text analytics to improve customer sentiment, detect fraud, and optimize content strategy.

With enterprises increasingly interested in harnessing actionable insights from an array of structured and unstructured data sources, from emails and social media to chatbot interactions, the demand for natural language processing (NLP) and machine learning-based text analytics continues to rise.

The leading players like IBM Watson, SAS, and Microsoft Azure Cognitive Services, are upgrading their Natural Language Processing models to develop better contextual understanding, Entity Recognition, and intent analysis.

In 2025, the rule-based segment will account for 22.5% of the share, as it is more structured in its approach to text processing and classification. In a review of such frameworks, the understanding is that strict rule-based systems are best suited for certain fundamental roles like healthcare coding, legal document review, and compliance reporting, where regulatory compliance and accuracy are critical. They achieve this by parsing text based on pre-established language rules, lexicons, and pattern-matching algorithms.

They will still use rule-based text analysis widely across government, healthcare, finance, and many other sectors (e.g., for automated documentation, fraud detection, and compliance monitoring). Same for a chatbots and virtual assistants as well which are primarily built with a decision making approach for clearing a limited range of queries. However, these systems are limited and scaling while handling vague or unstructured text formats and therefore restrict themselves to advanced structural languages.

Other organizations like SAS, IBM Watson, and Oracle are enhancing rule-based systems with hybrid AI-based developments to improve speed and agility.

In fact, by 2025, the statistical segment would represent the majority of the industry, with enterprises slated to adopt ML and AI-enabled NLP solutions in 40.3% of cases. Statistical techniques, with their use of probabilistic modeling, deep learning algorithms, and big data, are able to detect trends, sense sentiment, and learn which are the most effective ways to make decisions.

Major players in the statistical NLP industry include Google AI, Amazon Web Services (AWS), and Microsoft Azure Cognitive Services, which offer AI-powered text analytics solutions for e-commerce, social media, and customer service automation.

The Natural Language Processing (NLP) Market is undergoing a fast expansion phase that is largely propelled by the widespread acceptance of AI-based chatbots, virtual assistants, sentiment analysis, and voice recognition technologies.

In the healthcare sector, NLP plays a significant role in clinical documentation, medical transcription, and patient data analysis, which requires great accuracy and the fulfillment of obligations concerning data privacy regulations. Retail & e-commerce make use of NLP for tailor-made suggestions, chatbots, and customer sentiment analysis problems that are focused on real-time processing and scalability.

The finance and banking industry features fraud detection, risk assessment, and compliance automation, which are the primary reasons why it demands high security, precise information, and integration capabilities. IT & telecom are the industry areas of the economy that apply NLP to enable automatic customer care, real-time analysis, and text mining, which is the current trend with cost-effectiveness and scalability.

Government & defense applications are the ones that are based on NLP for threat analysis, automated language, and secure communication, with an emphasis on privacy, accuracy, and compliance of information.

| Company | Contract Value (USD Million) |

|---|---|

| Google Cloud | Approximately USD 80 - 90 |

| Microsoft | Approximately USD 70 - 80 |

| IBM Watson | Approximately USD 60 - 70 |

| OpenAI | Approximately USD 90 - 100 |

| Nuance Communications | Approximately USD 50 - 60 |

In 2024 and early 2025, the Natural Language Processing Market witnessed significant momentum as organizations across various sectors increasingly adopt AI-driven language solutions to enhance customer engagement, streamline operations, and extract actionable insights from vast data sets.

Leading companies such as Google Cloud, Microsoft, IBM Watson, OpenAI, and Nuance Communications have secured pivotal contracts and strategic partnerships, underscoring the industry's commitment to driving innovation and integrating cutting-edge NLP technologies into core business processes.

From 2020 to 2024, the NLP market developed rapidly due to AI advancements, chatbots, and content creation through automation. Organizations applied NLP to customer service, business process automation, and language translation in real-time across healthcare, banking, and e-commerce.

Human-like natural language conversations and emotional sentiment analysis became achievable through conversational AI tools such as GPT and BERT. Medical and legal professionals use NLP to process documents and transcribe them. From 2024 onward, efforts focused on reducing bias, improving explainability, and making models more efficient.

2025 to 2035, NLP will advance using explainable AI, multimodal learning, and domain-specific models. Neurosymbolic AI will improve contextual comprehension and reasonableness. Multimodal AI will process text, voice, and vision and energize AR/VR and autonomous machines.

AI assistants will anticipate user intent and perform sophisticated tasks. Federated learning will protect user data and allow for personalization. Quantum computing will speed up training and allow for improved contextual embeddings, transforming advanced language processing and multi-turn conversation.

A Comparative Market Shift Analysis (2020 to 2024 vs. 2025 to 2035)

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Tighter data protection regulations (GDPR, CCPA, AI Ethics Guidelines) necessitated NLP models to incorporate improved data protection, bias elimination, and transparency capabilities. | Decentralized, AI-powered NLP platforms utilize blockchain-based privacy protection, explainable AI (XAI), and regulation-compliant language models to provide ethical, bias-free communication. |

| Transformer architectures (BART, GPT, T5) transformed NLP potential to enable human-like text generation, sentiment analysis, and context knowledge. | Neuromorphic, artificially intelligent NLP technology allows ultra-contextual real-time natural language understanding, self-training, and multimodal intelligence for human-like conversation. |

| Companies use AI-driven chatbots and virtual assistants to enable customer support, workflow automation, and real-time analysis. | AI-powered, intent-based NLP technologies offer hyper-personalized, emotion-sensitive interactions, dynamically changing conversations based on user tone, context, and predictive behavior. |

| Firms used NLP-based low-code/no-code platforms to automate content creation, analytics, and app development. | Self-improving, AI-driven NLP platforms self-generate and optimize low-code processes, providing real-time, natural-language programming and decision-making capabilities. |

| AI-fueled NLP technologies advanced real-time spoken-to-written word translation, defying language obstacles in international communications. | Universal NLP systems powered by AI facilitate hyper-realistic cross-language dialogue, gesture-to-speech translation in real time, and frictionless human-AI communication across cultures. |

| NLP technology for health care enhanced health care documentation, AI conversationalists, and automated diagnosis. | Real-time AI-generations NLP applications scan patient data, predict conditions, and provide context-sensitive clinical decision support for tailored medicine. |

| Smaller, high-speed networks fueled real-time NLP capability for voice interfaces, video conferences, and smart IoT devices. | AI-driven, 6G-based NLP systems offer real-time, context-aware voice AI, facilitating ultra-low-latency, immersive human-AI interaction in the metaverse and digital workplaces. |

| AI-driven NLP models detected phishing attempts, analyzed threats in digital communication, and enhanced cybersecurity automation. | AI-powered, quantum-resistant NLP cybersecurity tools autonomously analyze linguistic patterns, detect deception, and counteract sophisticated AI-generated cyber threats in real-time. |

| Enterprises optimized NLP model training and inference to reduce computational costs and lower environmental impact. | Carbon-conscious, AI-powered NLP models employ energy-frugal algorithms, distributed computing, and intelligent workload optimization for green AI language processing. |

| NLP technologies developed in virtual assistants, autocomplete, and sentiment-guided AI responses. | Self-improving NLP agents deliver live emotional intelligence, adaptive decision-making, and AI-human co-authoring, revolutionizing creative content creation, automation, and user interaction. |

The industry is at risk due to several factors, such as data privacy issues, ethical AI problems, dynamic regulatory frameworks, and expensive computational requirements. With more and more companies turning to artificial intelligence (AI) apps driven by these risks, they have to be solved properly for the sake of scalability, compliance, and responsible AI mutual adoption.

Data security and privacy are the two major concerns. The inability to protect the privacy of customers is a major reason why many businesses found it so hard to trust NLP models grasping external data from sources like customer interactions, medical records, and financial documents. Besides, improper encryption and access control are the main things that businesses need to address to avoid data breaches and noncompliance with rules concerning data privacy like that of GDPR, CCPA, and HIPAA.

Another problem with cyberspace prejudices and moral artificial intelligence has also been raised. For example, NLP programs sorted through nasty or unfiltered data can produce discriminatory, misleading, or even insulting sentences.

This is particularly important in fields like healthcare, hiring, and customer service, on which unbiased decision-making is heavily reliant. Despite this, companies are to take steps such as budget realignment in favor of mitigation strategies, fairness audits, and imposing rigorous governance on AI so that they realize fewer reputational and legal risks.

The exorbitant computational expenses of executing NLP models are yet another hurdle. Training and fine-tuning massive language models are not cheap, involving the use of costly hardware, cloud storage, and power-consuming resources. Lack of cost-effective AI infrastructure, inefficient model designs, and not having scalable cloud systems in place are some of the key issues businesses are struggling with in addressing these costs effectively.

| Country | CAGR (2025 to 2035) |

|---|---|

| The USA | 12.5% |

| The UK | 12.1% |

| European Union (EU) | 12.3% |

| Japan | 11.9% |

| South Korea | 12.7% |

The Natural Language Processing (NLP) market in the USA is expanding at a rapid rate with the increasing adoption of AI, the rising need for automated customer service, and improvements in deep learning models. Organizations deploy NLP-based chatbots, AI-based sentiment analysis, and real-time speech recognition to enhance user interaction and productivity.

The National Science Foundation (NSF) and tech leaders invest in big data language models, document processing using artificial intelligence, and real-time translation of languages in order to drive automation and access.

Voice command assistant innovations, fraud detection based on artificial intelligence, and smart transcription services enhance growth even more. Google, Microsoft, and OpenAI develop text analytics using artificial intelligence, multilingual NLP solutions, and real-time conversational AI to enable business communication and decision-making.

FMI is of the opinion that the USA market is slated to grow at 12.5% CAGR during the study period.

Growth Factors in the USA

| Key Drivers | Details |

|---|---|

| AI Adoption | Companies in chatbots, sentiment analysis, and voice recognition use NLP. |

| Government & Private Investments | NSF and tech leaders invest in big-data AI models and document processing. |

| Business Applications | Smart transcription, fraud detection with AI, and multilingual NLP services drive growth. |

The UK NLP industry is growing monstrously on the shoulders of increasing funds for AI research, intelligent automation implementation, and an increase in the expansion of NLP in financial services and healthcare. AI-enabled virtual assistants, intelligent data analysis, and customer sentiment analysis in real-time help firms improve business effectiveness. Responsible usage of NLP is encouraged in the UK via the AI Strategy and policy interventions.

Live voice processing via AI and conversational AI supporting multiple languages are increasing their use across industries. Such firms spend money on AI-driven chatbots, NLP-driven legal document examination, and AI-driven knowledge management systems to optimize enterprise automation.

FMI is of the opinion that the UK is slated to grow at 12.1% CAGR during the study period.

Growth Drivers in the UK

| Key Drivers | Details |

|---|---|

| AI Research Spending | Government and private entities fund AI research and NLP solutions. |

| Adoption of Automation | NLP enhances customer service, finance, and healthcare processes. |

| Support of Regulations | AI policies ensure the safe and ethical use of NLP. |

NLP in the EU market is growing rapidly with EU-level AI investment strategies, increased adoption of machine learning-based NLP models, and rising demand for automation of text analytics.

The EU Digital Strategy and GDPR govern secure and ethical NLP deployments. Germany, France, and the Netherlands are at the forefront of multilingual AI translation, AI-driven knowledge discovery, and real-time voice analysis.

AI-powered automated customer services, NLP-driven fraud detection, and compliance management software are fueling growth. SAP, Siemens, and Orange invest in intelligent text processing, AI-driven knowledge extraction, and real-time speech recognition for business automation and decision-making.

FMI is of the opinion that the EU is slated to grow at 12.3% CAGR during the study period.

Growth Drivers in the EU

| Key Drivers | Details |

|---|---|

| AI Investment Policies | European countries are emphasizing AI investments and research. |

| Data Security Regulations | GDPR impacting ethical NLP implementations. |

| Industry-Specific NLP Applications | Finance, health, and compliance monitoring growth. |

NLP in Japan is developing rapidly with government-sponsored AI projects, booming uses of AI-powered voice assistants, and expansion of NLP robotics and healthcare solutions. Intelligent automation, multilingual AI models, and deep learning are Japan's focal points that create new horizons for NLP solutions.

Investment by the Ministry of Internal Affairs and Communications (MIC) is made in real-time AI-transcription services, sentiment analysis using NLP, and language learning platforms powered by AI. Voice recognition for autonomous systems, AI document summarization, and AI compliance monitoring go mainstream.

Fujitsu, Sony, and NTT Communications of Japan lead in AI-driven text analysis, deep learning-based NLP, and voice-enabling AI to deliver best-in-class business intelligence and automation.

FMI is of the opinion that Japan is slated to grow at 11.9% CAGR during the study period.

Drivers of Growth in Japan

| Key Drivers | Details |

|---|---|

| Government-Backed AI Initiatives | MIC invests in sentiment analysis and AI-powered transcription. |

| Healthcare & Robotics Industry | NLP enables automation in the healthcare and robotics industry. |

| Speech-Enabling AI | Speech recognition powered by AI fuels business and consumer use. |

South Korea's NLP industry growth is gaining traction on the strength of nationwide AI research spending, surging demand for AI-powered customer service automation, and changing NLP-powered content moderation. South Korea's focus on AI-powered translation services and smart voice recognition fuels adoption. The Ministry of Science and ICT (MSIT) promotes AI-powered language processing, real-time speech-to-text analysis, and NLP-powered sentiment analysis.

AI-driven legal document processing, voice-secured security authentication, and intelligent contract automation redefine business. Samsung Electronics, LG AI Research, and Naver, some of South Korea's leading companies, are investing in deep learning-driven NLP, AI-driven content generation, and multi-language voice recognition to drive innovation in automated communication and data insights.

FMI is of the opinion that South Korea is slated to grow at 12.7% CAGR during the study period.

Growth Drivers in South Korea

| Key Drivers | Details |

|---|---|

| AI Research Expenditure | Government and private investment fund AI-driven NLP innovation. |

| Content Moderation & Security | AI facilitates fraud detection and document processing. |

| Multilingual AI Growth | Speech recognition and translation are driven by AI-supported expansion. |

The natural language processing (NLP) market is growing as businesses adopt customer service solutions fueled by AI in automation technology and content analysis. The increasing proliferation of chatbots, virtual assistants, speech recognition, and text analytics in industries such as healthcare, finance, e-commerce, and media are further propelling the growth of NLP markets.

Market giants like Google, Microsoft, IBM, OpenAI, and Amazon use large-scale language models, cloud-based NLP solutions, and AI-powered analytics platforms to capture a larger market share. Meanwhile, startups and niche providers are increasing their competitive intensity because of their application-specific and real-time sentiment analysis and domain-trained AI models.

The rapid evolution of the market is driven by advances in deep learning, transformer-based architectures (of which the most well-known examples include GPT and BERT), and multimodal AI, developing language understanding and contextual awareness. The increasing popularity of multilingual NLP and ethical AI is shaping the industry's future direction.

Increased AI automation, impending regulations about data privacy, and the development of bias-free language models are the major strategic factors affecting the industry. Companies are building differentiation through AI-driven personalization and scalable cloud NLP applications and including them in enterprise software ecosystems, and this will continue to provide innovation and dynamic competition.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Google AI (Alphabet) | 20-25% |

| Microsoft Corporation | 15-20% |

| IBM Watson | 12-16% |

| Amazon Web Services (AWS) | 10-14% |

| OpenAI | 6-10% |

| Other Companies (combined) | 20-30% |

| Company Name | Key Offerings/Activities |

|---|---|

| Google AI (Alphabet) | Develop advanced NLP models like BERT and Gemini for search, chatbots, and voice recognition. |

| Microsoft Corporation | Provides AI-powered language models through Azure Cognitive Services and OpenAI integration. |

| IBM Watson | Specializes in enterprise-grade NLP, AI-driven insights, and conversational AI solutions. |

| Amazon Web Services (AWS) | Innovates in cloud-based NLP tools for voice, text analytics, and AI chatbots. |

| OpenAI | Leads in generative AI with NLP-driven models like GPT for automated text generation and virtual assistants. |

Key Company Insights

Google AI (Alphabet) (20-25%)

Cutting-edge models like BERT, Gemini, and LaMDA have made Google a giant in research on artificial intelligence for applications in search, translation, and conversation.

Microsoft Corporation (15-20%)

Microsoft is thus redefining language processing with Azure AI and its collaboration with OpenAI for scalable language services, exclusively AI-enabled, for enterprises.

Watson Intelligent (12-16%)

It has natural language understanding capabilities, AI-based text analytics, and NLP solutions for sectors like healthcare and finance that target enterprises.

Amazon Web Services (AWS) (10-14%)

AWS is revolutionizing the NLP arena through Cloud-based AI tools with real-time voice recognition, sentiment analysis, and text analytics, among other offerings for the companies.

OpenAI (6-10%)

OpenAI is enabling organizations to tap the full force of these powerful NLP capabilities through automation, content creation, and virtual assistant models such as GPT.

Other Key Players (20-30% Combined)

The market is segmented into Auto Coding, Text Analytics, Optical Character Recognition (OCR), Interactive Voice Response, Pattern & Image Recognition, and Speech Analytics.

The market includes rule-based, statistical, and hybrid models.

The market is categorized into Integration Services, Consulting Services, and Maintenance Services.

The market comprises on-premises and on-demand deployment models.

The market covers sentiment analysis, data extraction, risk and threat detection, automatic summarization, content management, language scoring, and others (portfolio monitoring, HR and Recruiting, and Branding and Advertising).

The market spans the healthcare sector, public sector, retail sector, media & entertainment, manufacturing, and other sectors.

The market is distributed across North America, Latin America, Western Europe, Eastern Europe, Asia Pacific excluding Japan (APEJ), Japan, and the Middle East & Africa.

The industry is slated to reach USD 26.01 billion in 2025.

The industry is predicted to reach a size of USD 213.54 billion by 2035.

Key companies include Google AI (Alphabet), Microsoft Corporation, IBM Watson, Amazon Web Services (AWS), OpenAI, Meta AI, SAP SE, Nuance Communications, Hugging Face, and Cohere.

South Korea, driven by advancements in AI-powered language models and increasing adoption in enterprises, is expected to record the highest CAGR of 12.7% during the forecast period.

Statistical Natural Language Processing models are among the most widely used in the industry.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Value (US$ Million) Forecast by Technology, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 4: Global Market Value (US$ Million) Forecast by Service, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Deployment Model, 2018 to 2033

Table 6: Global Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 7: Global Market Value (US$ Million) Forecast by Vertical, 2018 to 2033

Table 8: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Technology, 2018 to 2033

Table 10: North America Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Service, 2018 to 2033

Table 12: North America Market Value (US$ Million) Forecast by Deployment Model, 2018 to 2033

Table 13: North America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 14: North America Market Value (US$ Million) Forecast by Vertical, 2018 to 2033

Table 15: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 16: Latin America Market Value (US$ Million) Forecast by Technology, 2018 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 18: Latin America Market Value (US$ Million) Forecast by Service, 2018 to 2033

Table 19: Latin America Market Value (US$ Million) Forecast by Deployment Model, 2018 to 2033

Table 20: Latin America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 21: Latin America Market Value (US$ Million) Forecast by Vertical, 2018 to 2033

Table 22: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 23: Western Europe Market Value (US$ Million) Forecast by Technology, 2018 to 2033

Table 24: Western Europe Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 25: Western Europe Market Value (US$ Million) Forecast by Service, 2018 to 2033

Table 26: Western Europe Market Value (US$ Million) Forecast by Deployment Model, 2018 to 2033

Table 27: Western Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 28: Western Europe Market Value (US$ Million) Forecast by Vertical, 2018 to 2033

Table 29: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 30: Eastern Europe Market Value (US$ Million) Forecast by Technology, 2018 to 2033

Table 31: Eastern Europe Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 32: Eastern Europe Market Value (US$ Million) Forecast by Service, 2018 to 2033

Table 33: Eastern Europe Market Value (US$ Million) Forecast by Deployment Model, 2018 to 2033

Table 34: Eastern Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 35: Eastern Europe Market Value (US$ Million) Forecast by Vertical, 2018 to 2033

Table 36: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 37: South Asia and Pacific Market Value (US$ Million) Forecast by Technology, 2018 to 2033

Table 38: South Asia and Pacific Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 39: South Asia and Pacific Market Value (US$ Million) Forecast by Service, 2018 to 2033

Table 40: South Asia and Pacific Market Value (US$ Million) Forecast by Deployment Model, 2018 to 2033

Table 41: South Asia and Pacific Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 42: South Asia and Pacific Market Value (US$ Million) Forecast by Vertical, 2018 to 2033

Table 43: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 44: East Asia Market Value (US$ Million) Forecast by Technology, 2018 to 2033

Table 45: East Asia Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 46: East Asia Market Value (US$ Million) Forecast by Service, 2018 to 2033

Table 47: East Asia Market Value (US$ Million) Forecast by Deployment Model, 2018 to 2033

Table 48: East Asia Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 49: East Asia Market Value (US$ Million) Forecast by Vertical, 2018 to 2033

Table 50: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 51: Middle East and Africa Market Value (US$ Million) Forecast by Technology, 2018 to 2033

Table 52: Middle East and Africa Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 53: Middle East and Africa Market Value (US$ Million) Forecast by Service, 2018 to 2033

Table 54: Middle East and Africa Market Value (US$ Million) Forecast by Deployment Model, 2018 to 2033

Table 55: Middle East and Africa Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 56: Middle East and Africa Market Value (US$ Million) Forecast by Vertical, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Technology, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Type, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Service, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Deployment Model, 2023 to 2033

Figure 5: Global Market Value (US$ Million) by Application, 2023 to 2033

Figure 6: Global Market Value (US$ Million) by Vertical, 2023 to 2033

Figure 7: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 8: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 9: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 10: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 11: Global Market Value (US$ Million) Analysis by Technology, 2018 to 2033

Figure 12: Global Market Value Share (%) and BPS Analysis by Technology, 2023 to 2033

Figure 13: Global Market Y-o-Y Growth (%) Projections by Technology, 2023 to 2033

Figure 14: Global Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 15: Global Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 16: Global Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 17: Global Market Value (US$ Million) Analysis by Service, 2018 to 2033

Figure 18: Global Market Value Share (%) and BPS Analysis by Service, 2023 to 2033

Figure 19: Global Market Y-o-Y Growth (%) Projections by Service, 2023 to 2033

Figure 20: Global Market Value (US$ Million) Analysis by Deployment Model, 2018 to 2033

Figure 21: Global Market Value Share (%) and BPS Analysis by Deployment Model, 2023 to 2033

Figure 22: Global Market Y-o-Y Growth (%) Projections by Deployment Model, 2023 to 2033

Figure 23: Global Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 24: Global Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 25: Global Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 26: Global Market Value (US$ Million) Analysis by Vertical, 2018 to 2033

Figure 27: Global Market Value Share (%) and BPS Analysis by Vertical, 2023 to 2033

Figure 28: Global Market Y-o-Y Growth (%) Projections by Vertical, 2023 to 2033

Figure 29: Global Market Attractiveness by Technology, 2023 to 2033

Figure 30: Global Market Attractiveness by Type, 2023 to 2033

Figure 31: Global Market Attractiveness by Service, 2023 to 2033

Figure 32: Global Market Attractiveness by Deployment Model, 2023 to 2033

Figure 33: Global Market Attractiveness by Application, 2023 to 2033

Figure 34: Global Market Attractiveness by Vertical, 2023 to 2033

Figure 35: Global Market Attractiveness by Region, 2023 to 2033

Figure 36: North America Market Value (US$ Million) by Technology, 2023 to 2033

Figure 37: North America Market Value (US$ Million) by Type, 2023 to 2033

Figure 38: North America Market Value (US$ Million) by Service, 2023 to 2033

Figure 39: North America Market Value (US$ Million) by Deployment Model, 2023 to 2033

Figure 40: North America Market Value (US$ Million) by Application, 2023 to 2033

Figure 41: North America Market Value (US$ Million) by Vertical, 2023 to 2033

Figure 42: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 43: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 44: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 45: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 46: North America Market Value (US$ Million) Analysis by Technology, 2018 to 2033

Figure 47: North America Market Value Share (%) and BPS Analysis by Technology, 2023 to 2033

Figure 48: North America Market Y-o-Y Growth (%) Projections by Technology, 2023 to 2033

Figure 49: North America Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 50: North America Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 51: North America Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 52: North America Market Value (US$ Million) Analysis by Service, 2018 to 2033

Figure 53: North America Market Value Share (%) and BPS Analysis by Service, 2023 to 2033

Figure 54: North America Market Y-o-Y Growth (%) Projections by Service, 2023 to 2033

Figure 55: North America Market Value (US$ Million) Analysis by Deployment Model, 2018 to 2033

Figure 56: North America Market Value Share (%) and BPS Analysis by Deployment Model, 2023 to 2033

Figure 57: North America Market Y-o-Y Growth (%) Projections by Deployment Model, 2023 to 2033

Figure 58: North America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 59: North America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 60: North America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 61: North America Market Value (US$ Million) Analysis by Vertical, 2018 to 2033

Figure 62: North America Market Value Share (%) and BPS Analysis by Vertical, 2023 to 2033

Figure 63: North America Market Y-o-Y Growth (%) Projections by Vertical, 2023 to 2033

Figure 64: North America Market Attractiveness by Technology, 2023 to 2033

Figure 65: North America Market Attractiveness by Type, 2023 to 2033

Figure 66: North America Market Attractiveness by Service, 2023 to 2033

Figure 67: North America Market Attractiveness by Deployment Model, 2023 to 2033

Figure 68: North America Market Attractiveness by Application, 2023 to 2033

Figure 69: North America Market Attractiveness by Vertical, 2023 to 2033

Figure 70: North America Market Attractiveness by Country, 2023 to 2033

Figure 71: Latin America Market Value (US$ Million) by Technology, 2023 to 2033

Figure 72: Latin America Market Value (US$ Million) by Type, 2023 to 2033

Figure 73: Latin America Market Value (US$ Million) by Service, 2023 to 2033

Figure 74: Latin America Market Value (US$ Million) by Deployment Model, 2023 to 2033

Figure 75: Latin America Market Value (US$ Million) by Application, 2023 to 2033

Figure 76: Latin America Market Value (US$ Million) by Vertical, 2023 to 2033

Figure 77: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 78: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 79: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 80: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 81: Latin America Market Value (US$ Million) Analysis by Technology, 2018 to 2033

Figure 82: Latin America Market Value Share (%) and BPS Analysis by Technology, 2023 to 2033

Figure 83: Latin America Market Y-o-Y Growth (%) Projections by Technology, 2023 to 2033

Figure 84: Latin America Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 85: Latin America Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 86: Latin America Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 87: Latin America Market Value (US$ Million) Analysis by Service, 2018 to 2033

Figure 88: Latin America Market Value Share (%) and BPS Analysis by Service, 2023 to 2033

Figure 89: Latin America Market Y-o-Y Growth (%) Projections by Service, 2023 to 2033

Figure 90: Latin America Market Value (US$ Million) Analysis by Deployment Model, 2018 to 2033

Figure 91: Latin America Market Value Share (%) and BPS Analysis by Deployment Model, 2023 to 2033

Figure 92: Latin America Market Y-o-Y Growth (%) Projections by Deployment Model, 2023 to 2033

Figure 93: Latin America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 94: Latin America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 95: Latin America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 96: Latin America Market Value (US$ Million) Analysis by Vertical, 2018 to 2033

Figure 97: Latin America Market Value Share (%) and BPS Analysis by Vertical, 2023 to 2033

Figure 98: Latin America Market Y-o-Y Growth (%) Projections by Vertical, 2023 to 2033

Figure 99: Latin America Market Attractiveness by Technology, 2023 to 2033

Figure 100: Latin America Market Attractiveness by Type, 2023 to 2033

Figure 101: Latin America Market Attractiveness by Service, 2023 to 2033

Figure 102: Latin America Market Attractiveness by Deployment Model, 2023 to 2033

Figure 103: Latin America Market Attractiveness by Application, 2023 to 2033

Figure 104: Latin America Market Attractiveness by Vertical, 2023 to 2033

Figure 105: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 106: Western Europe Market Value (US$ Million) by Technology, 2023 to 2033

Figure 107: Western Europe Market Value (US$ Million) by Type, 2023 to 2033

Figure 108: Western Europe Market Value (US$ Million) by Service, 2023 to 2033

Figure 109: Western Europe Market Value (US$ Million) by Deployment Model, 2023 to 2033

Figure 110: Western Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 111: Western Europe Market Value (US$ Million) by Vertical, 2023 to 2033

Figure 112: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 113: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 114: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 115: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 116: Western Europe Market Value (US$ Million) Analysis by Technology, 2018 to 2033

Figure 117: Western Europe Market Value Share (%) and BPS Analysis by Technology, 2023 to 2033

Figure 118: Western Europe Market Y-o-Y Growth (%) Projections by Technology, 2023 to 2033

Figure 119: Western Europe Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 120: Western Europe Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 121: Western Europe Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 122: Western Europe Market Value (US$ Million) Analysis by Service, 2018 to 2033

Figure 123: Western Europe Market Value Share (%) and BPS Analysis by Service, 2023 to 2033

Figure 124: Western Europe Market Y-o-Y Growth (%) Projections by Service, 2023 to 2033

Figure 125: Western Europe Market Value (US$ Million) Analysis by Deployment Model, 2018 to 2033

Figure 126: Western Europe Market Value Share (%) and BPS Analysis by Deployment Model, 2023 to 2033

Figure 127: Western Europe Market Y-o-Y Growth (%) Projections by Deployment Model, 2023 to 2033

Figure 128: Western Europe Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 129: Western Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 130: Western Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 131: Western Europe Market Value (US$ Million) Analysis by Vertical, 2018 to 2033

Figure 132: Western Europe Market Value Share (%) and BPS Analysis by Vertical, 2023 to 2033

Figure 133: Western Europe Market Y-o-Y Growth (%) Projections by Vertical, 2023 to 2033

Figure 134: Western Europe Market Attractiveness by Technology, 2023 to 2033

Figure 135: Western Europe Market Attractiveness by Type, 2023 to 2033

Figure 136: Western Europe Market Attractiveness by Service, 2023 to 2033

Figure 137: Western Europe Market Attractiveness by Deployment Model, 2023 to 2033

Figure 138: Western Europe Market Attractiveness by Application, 2023 to 2033

Figure 139: Western Europe Market Attractiveness by Vertical, 2023 to 2033

Figure 140: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 141: Eastern Europe Market Value (US$ Million) by Technology, 2023 to 2033

Figure 142: Eastern Europe Market Value (US$ Million) by Type, 2023 to 2033

Figure 143: Eastern Europe Market Value (US$ Million) by Service, 2023 to 2033

Figure 144: Eastern Europe Market Value (US$ Million) by Deployment Model, 2023 to 2033

Figure 145: Eastern Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 146: Eastern Europe Market Value (US$ Million) by Vertical, 2023 to 2033

Figure 147: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 148: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 149: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 150: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 151: Eastern Europe Market Value (US$ Million) Analysis by Technology, 2018 to 2033

Figure 152: Eastern Europe Market Value Share (%) and BPS Analysis by Technology, 2023 to 2033

Figure 153: Eastern Europe Market Y-o-Y Growth (%) Projections by Technology, 2023 to 2033

Figure 154: Eastern Europe Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 155: Eastern Europe Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 156: Eastern Europe Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 157: Eastern Europe Market Value (US$ Million) Analysis by Service, 2018 to 2033

Figure 158: Eastern Europe Market Value Share (%) and BPS Analysis by Service, 2023 to 2033

Figure 159: Eastern Europe Market Y-o-Y Growth (%) Projections by Service, 2023 to 2033

Figure 160: Eastern Europe Market Value (US$ Million) Analysis by Deployment Model, 2018 to 2033

Figure 161: Eastern Europe Market Value Share (%) and BPS Analysis by Deployment Model, 2023 to 2033

Figure 162: Eastern Europe Market Y-o-Y Growth (%) Projections by Deployment Model, 2023 to 2033

Figure 163: Eastern Europe Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 164: Eastern Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 165: Eastern Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 166: Eastern Europe Market Value (US$ Million) Analysis by Vertical, 2018 to 2033

Figure 167: Eastern Europe Market Value Share (%) and BPS Analysis by Vertical, 2023 to 2033

Figure 168: Eastern Europe Market Y-o-Y Growth (%) Projections by Vertical, 2023 to 2033

Figure 169: Eastern Europe Market Attractiveness by Technology, 2023 to 2033

Figure 170: Eastern Europe Market Attractiveness by Type, 2023 to 2033

Figure 171: Eastern Europe Market Attractiveness by Service, 2023 to 2033

Figure 172: Eastern Europe Market Attractiveness by Deployment Model, 2023 to 2033

Figure 173: Eastern Europe Market Attractiveness by Application, 2023 to 2033

Figure 174: Eastern Europe Market Attractiveness by Vertical, 2023 to 2033

Figure 175: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 176: South Asia and Pacific Market Value (US$ Million) by Technology, 2023 to 2033

Figure 177: South Asia and Pacific Market Value (US$ Million) by Type, 2023 to 2033

Figure 178: South Asia and Pacific Market Value (US$ Million) by Service, 2023 to 2033

Figure 179: South Asia and Pacific Market Value (US$ Million) by Deployment Model, 2023 to 2033

Figure 180: South Asia and Pacific Market Value (US$ Million) by Application, 2023 to 2033

Figure 181: South Asia and Pacific Market Value (US$ Million) by Vertical, 2023 to 2033

Figure 182: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 183: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 184: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 185: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 186: South Asia and Pacific Market Value (US$ Million) Analysis by Technology, 2018 to 2033

Figure 187: South Asia and Pacific Market Value Share (%) and BPS Analysis by Technology, 2023 to 2033

Figure 188: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Technology, 2023 to 2033

Figure 189: South Asia and Pacific Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 190: South Asia and Pacific Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 191: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 192: South Asia and Pacific Market Value (US$ Million) Analysis by Service, 2018 to 2033

Figure 193: South Asia and Pacific Market Value Share (%) and BPS Analysis by Service, 2023 to 2033

Figure 194: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Service, 2023 to 2033

Figure 195: South Asia and Pacific Market Value (US$ Million) Analysis by Deployment Model, 2018 to 2033

Figure 196: South Asia and Pacific Market Value Share (%) and BPS Analysis by Deployment Model, 2023 to 2033

Figure 197: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Deployment Model, 2023 to 2033

Figure 198: South Asia and Pacific Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 199: South Asia and Pacific Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 200: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 201: South Asia and Pacific Market Value (US$ Million) Analysis by Vertical, 2018 to 2033

Figure 202: South Asia and Pacific Market Value Share (%) and BPS Analysis by Vertical, 2023 to 2033

Figure 203: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Vertical, 2023 to 2033

Figure 204: South Asia and Pacific Market Attractiveness by Technology, 2023 to 2033

Figure 205: South Asia and Pacific Market Attractiveness by Type, 2023 to 2033

Figure 206: South Asia and Pacific Market Attractiveness by Service, 2023 to 2033

Figure 207: South Asia and Pacific Market Attractiveness by Deployment Model, 2023 to 2033

Figure 208: South Asia and Pacific Market Attractiveness by Application, 2023 to 2033

Figure 209: South Asia and Pacific Market Attractiveness by Vertical, 2023 to 2033

Figure 210: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 211: East Asia Market Value (US$ Million) by Technology, 2023 to 2033

Figure 212: East Asia Market Value (US$ Million) by Type, 2023 to 2033

Figure 213: East Asia Market Value (US$ Million) by Service, 2023 to 2033

Figure 214: East Asia Market Value (US$ Million) by Deployment Model, 2023 to 2033

Figure 215: East Asia Market Value (US$ Million) by Application, 2023 to 2033

Figure 216: East Asia Market Value (US$ Million) by Vertical, 2023 to 2033

Figure 217: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 218: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 219: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 220: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 221: East Asia Market Value (US$ Million) Analysis by Technology, 2018 to 2033

Figure 222: East Asia Market Value Share (%) and BPS Analysis by Technology, 2023 to 2033

Figure 223: East Asia Market Y-o-Y Growth (%) Projections by Technology, 2023 to 2033

Figure 224: East Asia Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 225: East Asia Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 226: East Asia Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 227: East Asia Market Value (US$ Million) Analysis by Service, 2018 to 2033

Figure 228: East Asia Market Value Share (%) and BPS Analysis by Service, 2023 to 2033

Figure 229: East Asia Market Y-o-Y Growth (%) Projections by Service, 2023 to 2033

Figure 230: East Asia Market Value (US$ Million) Analysis by Deployment Model, 2018 to 2033

Figure 231: East Asia Market Value Share (%) and BPS Analysis by Deployment Model, 2023 to 2033

Figure 232: East Asia Market Y-o-Y Growth (%) Projections by Deployment Model, 2023 to 2033

Figure 233: East Asia Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 234: East Asia Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 235: East Asia Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 236: East Asia Market Value (US$ Million) Analysis by Vertical, 2018 to 2033

Figure 237: East Asia Market Value Share (%) and BPS Analysis by Vertical, 2023 to 2033

Figure 238: East Asia Market Y-o-Y Growth (%) Projections by Vertical, 2023 to 2033

Figure 239: East Asia Market Attractiveness by Technology, 2023 to 2033

Figure 240: East Asia Market Attractiveness by Type, 2023 to 2033

Figure 241: East Asia Market Attractiveness by Service, 2023 to 2033

Figure 242: East Asia Market Attractiveness by Deployment Model, 2023 to 2033

Figure 243: East Asia Market Attractiveness by Application, 2023 to 2033

Figure 244: East Asia Market Attractiveness by Vertical, 2023 to 2033

Figure 245: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 246: Middle East and Africa Market Value (US$ Million) by Technology, 2023 to 2033

Figure 247: Middle East and Africa Market Value (US$ Million) by Type, 2023 to 2033

Figure 248: Middle East and Africa Market Value (US$ Million) by Service, 2023 to 2033

Figure 249: Middle East and Africa Market Value (US$ Million) by Deployment Model, 2023 to 2033

Figure 250: Middle East and Africa Market Value (US$ Million) by Application, 2023 to 2033

Figure 251: Middle East and Africa Market Value (US$ Million) by Vertical, 2023 to 2033

Figure 252: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 253: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 254: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 255: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 256: Middle East and Africa Market Value (US$ Million) Analysis by Technology, 2018 to 2033

Figure 257: Middle East and Africa Market Value Share (%) and BPS Analysis by Technology, 2023 to 2033

Figure 258: Middle East and Africa Market Y-o-Y Growth (%) Projections by Technology, 2023 to 2033

Figure 259: Middle East and Africa Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 260: Middle East and Africa Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 261: Middle East and Africa Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 262: Middle East and Africa Market Value (US$ Million) Analysis by Service, 2018 to 2033

Figure 263: Middle East and Africa Market Value Share (%) and BPS Analysis by Service, 2023 to 2033

Figure 264: Middle East and Africa Market Y-o-Y Growth (%) Projections by Service, 2023 to 2033

Figure 265: Middle East and Africa Market Value (US$ Million) Analysis by Deployment Model, 2018 to 2033

Figure 266: Middle East and Africa Market Value Share (%) and BPS Analysis by Deployment Model, 2023 to 2033

Figure 267: Middle East and Africa Market Y-o-Y Growth (%) Projections by Deployment Model, 2023 to 2033

Figure 268: Middle East and Africa Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 269: Middle East and Africa Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 270: Middle East and Africa Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 271: Middle East and Africa Market Value (US$ Million) Analysis by Vertical, 2018 to 2033

Figure 272: Middle East and Africa Market Value Share (%) and BPS Analysis by Vertical, 2023 to 2033

Figure 273: Middle East and Africa Market Y-o-Y Growth (%) Projections by Vertical, 2023 to 2033

Figure 274: Middle East and Africa Market Attractiveness by Technology, 2023 to 2033

Figure 275: Middle East and Africa Market Attractiveness by Type, 2023 to 2033

Figure 276: Middle East and Africa Market Attractiveness by Service, 2023 to 2033

Figure 277: Middle East and Africa Market Attractiveness by Deployment Model, 2023 to 2033

Figure 278: Middle East and Africa Market Attractiveness by Application, 2023 to 2033

Figure 279: Middle East and Africa Market Attractiveness by Vertical, 2023 to 2033

Figure 280: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Natural Language Processing in Finance Market Size and Share Forecast Outlook 2025 to 2035

Healthcare Natural Language Processing (NLP) Market Insights – Trends & Growth Forecast 2025 to 2035

Natural Antioxidant Market Size and Share Forecast Outlook 2025 to 2035

Natural Disaster Detection IoT Market Forecast Outlook 2025 to 2035

Natural Cosmetic Color Market Size and Share Forecast Outlook 2025 to 2035

Natural Food Preservatives Market Size and Share Forecast Outlook 2025 to 2035

Natural Polymer Market Size and Share Forecast Outlook 2025 to 2035

Natural Gas Analyzers Market Size and Share Forecast Outlook 2025 to 2035

Natural Mineral Oil Coolant Market Size and Share Forecast Outlook 2025 to 2035

Natural Synthetic Cytokinin (Anti-zeatin Riboside) Market Size and Share Forecast Outlook 2025 to 2035

Natural Food Flavors Market Size and Share Forecast Outlook 2025 to 2035

Natural Silicone Alternative Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Natural Skincare Preservatives Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Natural Surfactant Market Size and Share Forecast Outlook 2025 to 2035

Natural Bitterness Blockers Market Analysis - Size And Share Forecast Outlook 2025 To 2035

Naturally Fermented Food Market Size and Share Forecast Outlook 2025 to 2035

Natural Refrigerants Market Size and Share Forecast Outlook 2025 to 2035

Natural Ferulic Acid Market Size and Share Forecast Outlook 2025 to 2035

Natural Vitamin E Product Market Size and Share Forecast Outlook 2025 to 2035

Natural Oil Polyols NOP Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA