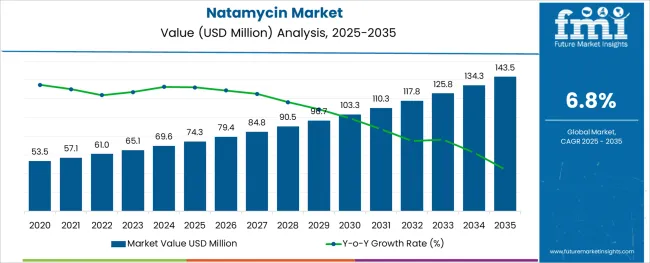

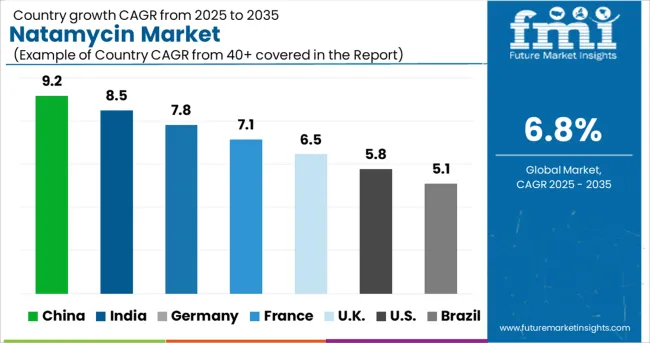

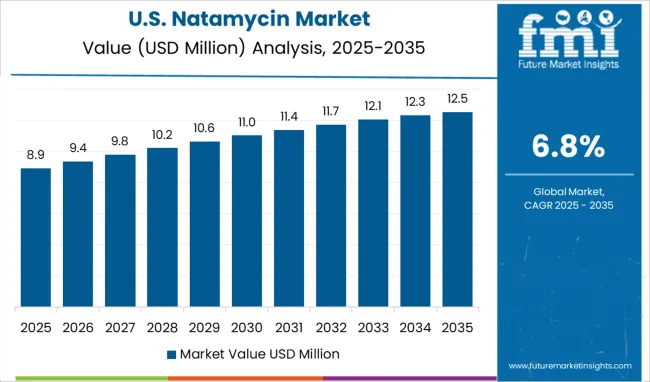

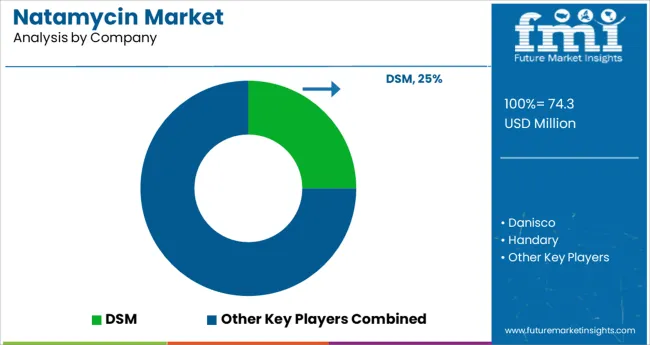

The Natamycin Market is estimated to be valued at USD 74.3 million in 2025 and is projected to reach USD 143.5 million by 2035, registering a compound annual growth rate (CAGR) of 6.8% over the forecast period.

The natamycin market is progressing steadily as increasing demand for natural food preservatives, regulatory approval of clean-label ingredients, and growing awareness of fungal contamination risks drive its adoption. Rising consumer preference for minimally processed and chemical-free food products has positioned natamycin as a favored antifungal agent in various applications.

Industry initiatives to replace synthetic preservatives with natural alternatives have also influenced manufacturers to integrate natamycin into their formulations. Technological advancements in production processes and improved cost efficiencies have further enhanced accessibility and scalability, ensuring wider reach across diverse geographies.

Future growth is expected to be supported by sustained investment in food safety standards, innovation in formulation technologies, and the expansion of distribution networks, which are collectively paving the way for deeper penetration and higher adoption of natamycin across industries.

The market is segmented by Form and Application and region. By Form, the market is divided into Powder and Liquid. In terms of Application, the market is classified into Food and Beverage, Pharmaceuticals, Nutraceuticals, Cosmetics & Personal Care, Pet Food, and Animal Feed. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The market is segmented by Form and Application and region. By Form, the market is divided into Powder and Liquid. In terms of Application, the market is classified into Food and Beverage, Pharmaceuticals, Nutraceuticals, Cosmetics & Personal Care, Pet Food, and Animal Feed. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

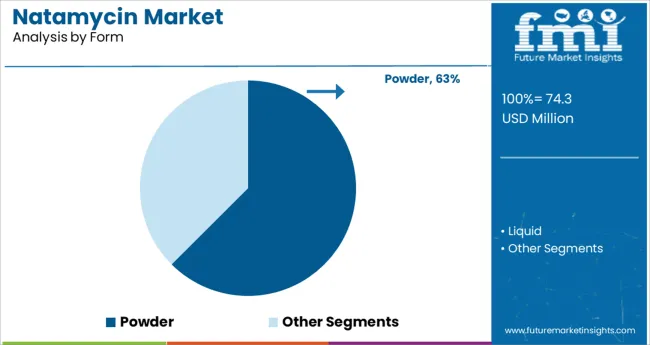

When segmented by form, the powder segment is expected to account for 62.5% of the total market revenue in 2025, maintaining its position as the leading segment. This dominance is attributed to the longer shelf life, ease of handling, and superior stability of the powdered form compared to liquid alternatives.

Manufacturing processes have favored the powder format due to its compatibility with various food systems and its ability to maintain efficacy during storage and distribution. The ability to blend seamlessly into dry mixes and its lower transportation costs have also contributed to its preference among producers.

Operational advantages such as reduced wastage and precise dosing have reinforced the appeal of powder, establishing it as the most viable form for large-scale production and diverse industrial use.

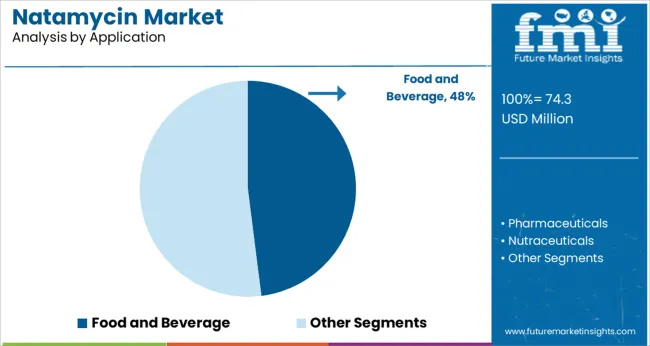

In terms of application, the food and beverage segment is projected to hold 48.0% of the market revenue in 2025, emerging as the top segment. This leadership is driven by stringent food safety regulations and rising consumer awareness about natural preservation methods in packaged foods, dairy, and beverages.

Natamycin has become integral to extending shelf life and preventing spoilage in high-risk food categories while maintaining clean-label appeal. The segment has been supported by increased adoption in bakery products, cheese, and ready-to-eat meals, where maintaining texture and flavor integrity is critical.

Operational efficiencies achieved through reduced product recalls and enhanced brand reputation have further strengthened the position of natamycin within the food and beverage industry, reinforcing its leadership in the market.

According to Future Market Insights’ latest analysis, the global demand for natamycin is projected to surge at a robust CAGR of 6.8% between 2025 and 2035, in comparison to the 5.4% CAGR registered during the historical period from 2020 to 2024.

Increasing usage of natamycin across diverse industries including pharmaceutical and food & beverage is a key factor spurring growth in the global market for natamycin.

Natamycin is a natural antimicrobial preservative used to prevent the growth of fungi, bacteria, and other microbes in food products. It has been used as an additive in foods for decades and has seen increased demand over the years due to its superior safety profile compared to other additives.

Demand for natamycin is expected to grow at a healthy pace during the next ten years owing to the growing need for preventing food wastage, increasing consumer spending on processed food products, rising application of natamycin in food products such as cheese, bakeries, and processed meat,

Besides this, the rising usage of natamycin as an antifungal medication to treat several fungal infections around the eye will create lucrative opportunities for natamycin manufacturers during the next ten years.

Rising Inclination Towards Clean Label Foods to Positively Impact Natamycin Industry

The trend towards clean-label foods has been growing steadily in recent years, driven by consumer demand for natural ingredients and more transparency on food labels. This shift is having a significant effect on the natamycin market, as manufacturers seek out more natural preservatives to replace synthetic ones.

Natamycin is a naturally-occurring preservative derived from the fermentation of Streptomyces bacteria. It is commonly used in processed foods such as cheese, yogurt, and other dairy products to extend shelf life and guard against spoilage from mold or bacteria.

However, the demand for clean-label foods has made it increasingly difficult for manufacturers to use natamycin due to its synthetically produced status.

As a result, many companies have turned towards more natural preservatives such as vinegar or citrus extracts which are perceived as safer options by health-conscious consumers. This may limit the market expansion to some extent.

Rising Usage in Topical Ophthalmic Drugs to Boost Natamycin Sales in the USA Through 2035

The USA's natamycin market is a quickly changing landscape that has seen an increase in demand due to its medical and food safety applications.

Natamycin, an antifungal agent, is widely used as a preservative in products such as cheese and processed meats. As the world increasingly moves towards healthier diets, demand for natamycin has been growing significantly over the past few years across the USA

The increasing prevalence of fungal infections, maturing population, and rising health consciousness among consumers are some of the key factors driving the USA's natamycin industry.

In addition to its use in food products, natamycin is also being used increasingly as a topical drug to treat skin and eye infections caused by fungi. This has led to increased demand for this product from hospitals and pharmacists across the USA and the trend is expected to further escalate amid rising cases of fungal diseases.

Escalating Research and Development Activities Making the UK a Promising Market

Recently, Europe, spearheaded by the UK, has emerged as a leading producer of natamycin due to its commitment to research and development of this important product.

The primary reason why Europe is becoming a leader in natamycin production is its commitment to long-term investments in research and development activities.

For example, European businesses are investing heavily in ways to increase the efficiency of their production processes and make them more cost-effective. Additionally, they are looking into new technologies that can help reduce waste while still delivering quality natamycin.

Another key factor that is expected to propel natamycin demand across the UK is the rising production and consumption of packaged food products with longer shelf life.

Consumers in the UK seek convenient foods that stay fresh for longer and contain natural ingredients. As a result, food manufacturers are using preservatives like natamycin.

Demand Remains High for Powdered Natamycin

Based on form, the global market for natamycin is segmented into powder and liquid. Among these, the powder segment currently holds the largest market and is expected to retain its dominance during the forecast period. This is due to rising end-user preference for powdered natamycin over other forms.

The use of natamycin powder is advantageous from a cost perspective as it often comes at a lower price than other forms. Additionally, its shelf life is longer than that of liquid or suspension forms which makes it more convenient for food manufacturers to stock up on the powder form for longer-term use.

This allows them to better manage their inventory levels and reduce wastage costs.

Food and Beverage to Remains the Most Profitable Application

Natamycin is a natural antibiotic that can be used in the food and beverage industries. It inhibits the growth of bacteria, yeast, and mold. It is not harmful to humans or pets, and it does not produce any adverse effects on food. As a result, it has become one of the widely used natural preservatives in the food & beverage sector.

Natamycin is extensively used in food products such as sausages, cheese, bakery items, processed meat, fruits & vegetables, beverages, and others for preventing the growth of bacteria and other microorganisms. Hence, it extends the shelf life of products and reduces food wastage.

Growing demand for packaging food products with longer shelf life along with the rising need for reducing food wastage is playing a key role in boosting natamycin sales and the trend is expected to continue during the next ten years.

The global market for natamycin is quite competitive due to the vast number of producers that operate in this space. The major businesses are making significant investments in Research and Development, which is anticipated to accelerate the expansion of the industry as a whole over the coming years.

Additionally, during the projected period, market participants should benefit significantly from the increased focus on diversifying product portfolios and the rise in mergers and acquisitions.

Recent Developments:

| Attribute | Details |

|---|---|

| Estimated Market Size (2025) | USD 74.3 million |

| Projected Market Size (2035) | USD 143.5 million |

| Anticipated Growth Rate (2025 to 2035) | 6.8% CAGR |

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2024 |

| Market Analysis | million for Value and Million. Sq. M. for Volume |

| Key Regions Covered | North America; Latin America; Europe; East Asia; South Asia; and the Middle East & Africa |

| Key Countries Covered | USA, Brazil, Mexico, Germany, UK, China, India, Japan, Australia, and GCC Countries |

| Key Segments Covered | Form, Application, and Region |

| Key Companies Profiled | DSM; Danisco; Handary; VGP; Silver-Elephant; AMTECH BIOTECH; Lanzhou Weiri; Zhengzhou New Frey; Langfang Meihua; Beijing Oriental Rada; Chihon; Jiaozuo Join care; Pucheng Life come |

| Report Coverage | Market Forecast, Company Share Analysis, Competition Intelligence, Drivers, Restraints, Opportunities and Threats Analysis, Market Dynamics and Challenges, and Strategic Growth Initiatives |

The global natamycin market is estimated to be valued at USD 74.3 million in 2025.

It is projected to reach USD 143.5 million by 2035.

The market is expected to grow at a 6.8% CAGR between 2025 and 2035.

The key product types are powder and liquid.

food and beverage segment is expected to dominate with a 48.0% industry share in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA