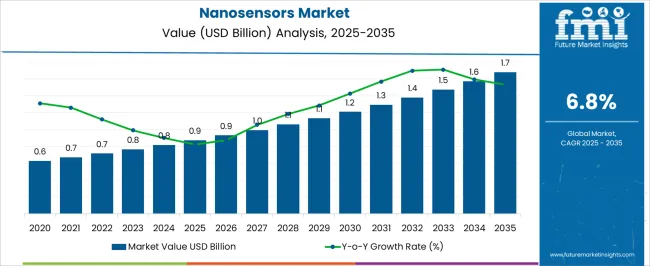

The Nanosensors Market is estimated to be valued at USD 0.9 billion in 2025 and is projected to reach USD 1.7 billion by 2035, registering a compound annual growth rate (CAGR) of 6.8% over the forecast period.

| Metric | Value |

|---|---|

| Nanosensors Market Estimated Value in (2025 E) | USD 0.9 billion |

| Nanosensors Market Forecast Value in (2035 F) | USD 1.7 billion |

| Forecast CAGR (2025 to 2035) | 6.8% |

The nanosensors market is progressing rapidly, driven by advancements in nanotechnology and increasing integration of nanoscale sensing devices across industrial and healthcare applications. Industry publications and R&D updates have emphasized the value of nanosensors in delivering high sensitivity, low power consumption, and miniaturized designs suitable for next-generation electronics, medical diagnostics, and environmental monitoring.

Continuous funding from government agencies and private investors for nanoscience research has strengthened innovation pipelines, particularly in materials science and fabrication techniques. Additionally, the adoption of nanosensors in electronics and biomedical fields has been supported by their ability to detect chemical, physical, and biological changes at the molecular level with unmatched precision.

The market outlook is further enhanced by strategic collaborations between academic institutions and technology developers, which have accelerated commercialization timelines. Future demand is expected to be shaped by expanding applications in IoT devices, wearable health monitors, and smart manufacturing systems, with growth anchored in chemical nanosensors, electronics applications, and molecular self-assembly technologies.

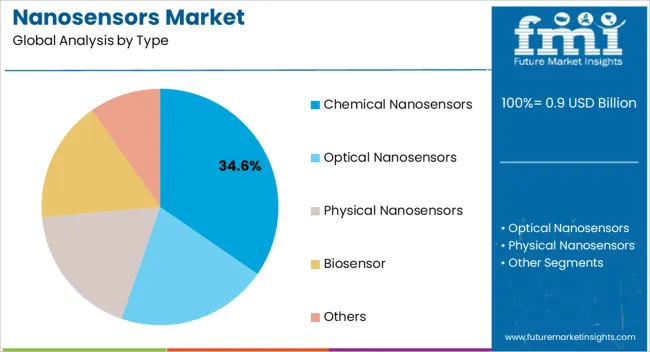

The Chemical Nanosensors segment is projected to hold 34.60% of the nanosensors market revenue in 2025, maintaining its lead within type categories. This segment’s prominence has been driven by its critical role in detecting gases, toxins, and other chemical analytes with extremely high sensitivity.

Researchers and industry reports have highlighted that chemical nanosensors are increasingly used in healthcare diagnostics, environmental safety monitoring, and industrial process control, where early detection of chemical changes is vital. The ability of these nanosensors to deliver real-time, accurate readings at the molecular level has enhanced their adoption in multiple fields.

Continuous innovation in nanomaterials, including carbon nanotubes and graphene, has further boosted their performance, reliability, and miniaturization. As regulatory bodies tighten monitoring requirements for pollution control and workplace safety, the use of chemical nanosensors is expected to remain central to the market’s growth.

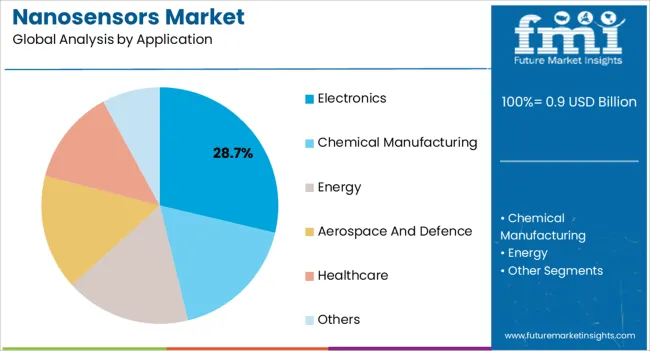

The Electronics segment is projected to contribute 28.70% of the nanosensors market revenue in 2025, securing its position as the leading application area. Growth of this segment has been supported by the rapid miniaturization of electronic devices and the demand for ultra-sensitive sensors in consumer and industrial electronics.

Nanosensors have been integrated into electronic circuits to improve device efficiency, enable advanced functionalities, and reduce energy consumption. Reports from semiconductor research groups have noted that nanosensors are increasingly incorporated into microchips, IoT devices, and wearable technologies, where their compact size and high responsiveness are critical.

The consumer electronics industry has also accelerated adoption through applications in smartphones, laptops, and smart home devices. With continuous investment in nanoelectronics and the convergence of AI and IoT technologies, the Electronics segment is expected to retain its market leadership, driven by demand for smarter, more efficient devices.

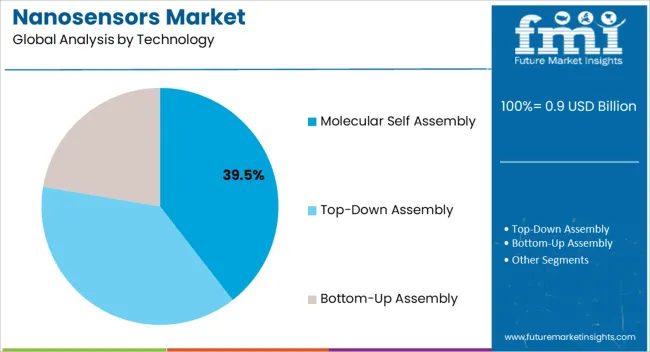

The Molecular Self-Assembly segment is projected to account for 39.50% of the nanosensors market revenue in 2025, establishing itself as the dominant technology. Growth in this segment has been fueled by the scalability and precision offered by molecular self-assembly techniques in fabricating nanosensors.

Industry journals and scientific reports have highlighted that molecular self-assembly allows nanosensors to be produced with consistent patterns and functionalities at lower costs compared to traditional lithography-based methods. The ability to engineer nanoscale materials with tailored properties has made this technology highly attractive for large-scale manufacturing in electronics, healthcare, and environmental monitoring.

Moreover, the process is energy-efficient and aligns with sustainable manufacturing practices, further strengthening its appeal. As nanosensor applications diversify, molecular self-assembly is expected to remain the preferred technology, offering flexibility, cost-effectiveness, and reliability in high-volume production.

Top-down and Bottom-Up are the key types of nanosensor production technology. Top-down techniques which involve miniaturizing existing patterns are beneficial in several ways, especially in long-range order and macroscale dimensions. However, they become more difficult when applied in nanoscale dimensions. Also, the involvement of planar technology means difficulty in constructing 3-dimensional objects that are difficult to construct. The final product can also suffer from imperfections in surface structure.

The bottom-up approach involves the usage of physical and chemical forces to assemble structures from smaller basic units in an almost atom-for-atom form of building molecular structure. Bottom-up techniques are beneficial, especially in short-range order in nanoscale dimensions. This technique, however, is still in the emerging stages. The integration of both is an emerging field of interest as nanotechnology looks at new techniques.

Nanosensors and nanotechnology, in general, showcase the massive potential for various applications in the defense sector. For example, Nanosensors can be used to detect harmful substances, such as toxic gases and explosives, based on a mass-based identification. Another application for nanotechnology lies in military apparel and gears. Nanophotonic technology harnesses nanosensors that sense optic changes in response to the target stimuli. This can be helpful when informing those in the line of defense when parts of their gear or themselves are at risk or exposed to danger. Bionanosensor technology can also be harnessed to collect and analyze health-related data, which can be vital in monitoring soldiers.

Use in aerospace is also driving demand for Nanosensors. Sensors are important in aircraft and are vital for measuring various indicators, such as fuel levels, external conditions, and performance updates. Nanosensors, when integrated into these sensor systems, can benefit the systems with improvements in sensitivity and reduction of weight.

Both these factors are vital to aircraft designers since smaller and lightweight sensors mean that more sensors can be used, improving safety and ensuring optimal usage of craft parts without compromising on the lightweight of their aircraft and the benefits lightweight has on fuel usage and efficiency. Also, these Nanosensors can be used in monitoring and camera systems owing to their broader electromagnetic spectrum bandwidth, so the sensing can occur even in bad climates and low visibility situations.

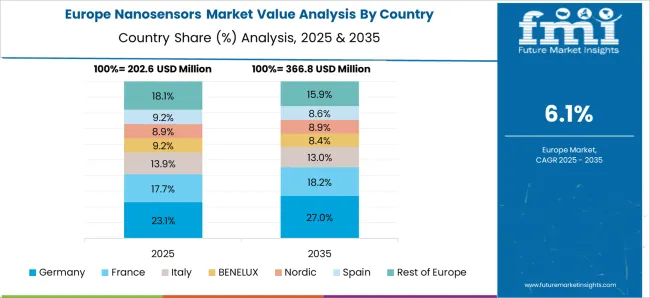

The nanosensors market in Europe is expected to witness a CAGR of 6%, with a forecasted valuation of USD 0.6 million at a CAGR of 7.7%. The market in the United Kingdom witnessed a CAGR of 9.8% from 2020 to 2025, and it is forecasted to reach a valuation of USD 1.7 million by 2035.

In 2025, Ireland’s Causeway Sensors, a diagnostics company that developed Nanosensors to detect early-stage cancer and other diseases, announced that they had raised USD 18 million in investment, as well as a USD 3.9 million grant it received as part of the Smart NNI group that raised approximately USD 50 million from the government agency. Causeway is in the developmental stage for a Nanosensors platform, which is intended to have the ability to integrate directly with a bioreactor.

In 2024, Israel’s NonoVation announced that the European Union had awarded them a USD 0.8 million Grant under the Horizon 2024 EIC Accelerator Program. The grant award is to be used for the further development of their nanosensor-based product, SenseGuard. The device has CE certification and is intended as a continuous monitoring system for respiratory concerns. In 2024, the European Innovation Council also provided a USD 5.9 million investment in NonoVation.

The United States to be the country with the largest contribution to demand in the forecast period

The United States is a key market for nanosensors, having witnessed a CAGR of 10.5%, with an absolute dollar opportunity of USD 200.5 million and a forecasted market size of USD 759.4 million at a CAGR of 7.7%. Significant research funding and grant allocation is the key driver for demand in the United States

In September 2024, Nanobiofab announced that they had been awarded a grant from the Defence Health Agency’s SBIR program. The grant amounts to USD 250,000 and will be used to further research. The proposal submitted was for an Inkjet-assisted nano-printing sensing platform.

Under the National Institute of Food and Science, there are 4 key grant programs that fund nanotechnology-related projects, with research on their use in the detection of contaminants like pathogens and allergens being the key concern.

In August 2024, the NIH or National Institutes of Health’s NIGMS or National Institute of General Medical Sciences awarded funding of USD 1.96 million to a City College of New York biomedical engineer as part of the MIRA ESI or Maximizing Investigator’s Research Award for Early Stage Investigators program. The funding has to be used to create implantable novel Nanosensors of the fluorescent type to study cytokine signaling in chronic diseases.

Healthcare is the top application of Nanosensors, having witnessed a CAGR of 9.4% and a forecasted CAGR of 6.3%. Rapid, sensitive, and accurate detections are vital to diagnostic medicine. The early detection of conditions is essential since many problems have symptoms that do not start showing observable signs until the condition has progressed to stages that can prove to be hard to treat. Currently, a key form of the use of nanosensors in the diagnostics field is for immediate diagnostics of conditions through techniques such as real-time monitoring.

One example of this is through the use of QDs or Quantum Dots, which can be used as photoluminescent nanosensors to detect chemicals and even tumors. Quantum dots have been the topic of a large volume of current research. Nanosensors can also be used in IV lines as silicon nanowires. They can detect biomarkers that would allow their monitoring over time to sense any abnormalities and thus help analyze organ health over time. They can also be used to monitor for contamination in organ implants, with embedded implants that can detect contaminations over time through continuous monitoring.

At present, nanosensor providers are focused on research and development to understand possible applications for the use of their products across various industries and applications. The key companies operating include Affymetrix Inc., Agilent Technologies Inc., Altair Nanotechnologies Inc., Bayer AG, BioCrystal Ltd., Biosensors International Group Ltd., Debiotech S.A., Diabetech, Kleindiek Nanotechnik GmbH, Micro-Tech Scientific Incorporated, Nanomix Inc, Nano Detection Technologies Inc., Spectra Fluidics, Fischer Scientific

Some of the recent developments in Nanosensors are as follows :

The global nanosensors market is estimated to be valued at USD 0.9 billion in 2025.

The market size for the nanosensors market is projected to reach USD 1.7 billion by 2035.

The nanosensors market is expected to grow at a 6.8% CAGR between 2025 and 2035.

The key product types in nanosensors market are chemical nanosensors, optical nanosensors, physical nanosensors, biosensor and others.

In terms of application, electronics segment to command 28.7% share in the nanosensors market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA