Global n-ethyl-2-pyrrolidone (NEP) market is anticipated to grow steadily with its usage increasing as consumption goes up with usage as a high-performance solvent in electronics, petrochemicals, pharmaceuticals, and agrochemicals.

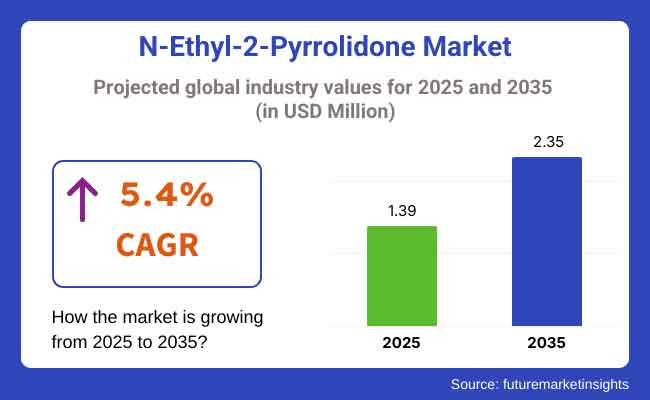

The solvent capability of NEP to dissolve an extremely broad spectrum of polymers and active ingredients makes it an extremely versatile ingredient used in semiconductor processing, surface coatings, and drug manufacturing. The NEP market worldwide is anticipated to be around USD 1.39 million in 2025. It is likely to increase to USD 2.35 million in 2035, at a rate of compound annual growth rate (CAGR) of 5.4%.

Demand for NEP is sustained in lithium-ion battery, printed circuit board (PCB) cleaning, and polymer processing. Its role as a lower-toxicity alternative to N-Methyl-2-pyrrolidone (NMP), especially where solvent regulations are tighter, is promoting substitution in some applications but at risk with NEP's own toxicology.

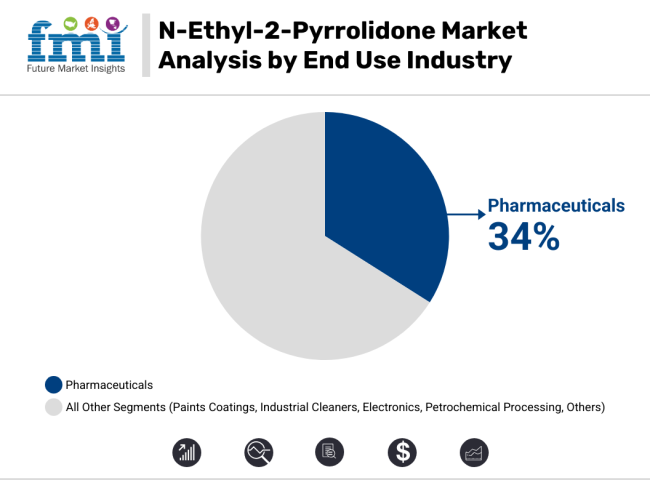

The pharma sector is anticipated to dominate the N-Ethyl-2-Pyrrolidone (NEP) market by 2025 with a significant share of 34% globally. NEP is in tremendous demand with the industry because of its considerable solubility and stability and thus finds usage as a significant solvent of high purity utilized in medicine preparations such as injectibles and skin medicaments.

The product is applied in the production of Active Pharmaceutical Ingredients (APIs) within regions such as North America and East Asia where it is significant to be complying with Good Manufacturing Practices (GMP) rules. Drug exports by Indian parties are more reliant on NEP for production which is aimed for use in making anti-inflammatory as well as antifungal medication.

Despite rising environmental concerns and control requirements, NEP has high demand since it can meet the stringent requirements of the pharmaceutical industry. Its versatility across a broad spectrum of uses and capability to ensure potency and purity of drugs make NEP a backbone of the process of drug manufacture, resulting in its solid market foundation.

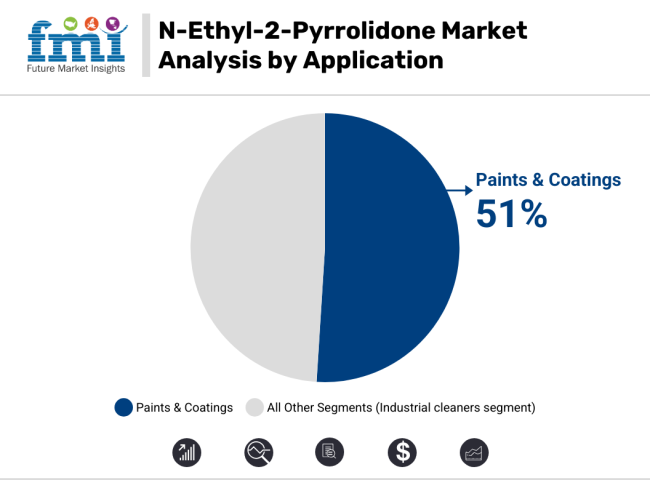

The paints and coatings industry is expected to grow moderately in the NEP market, accounting for only 51% of the overall market in 2025. NEP has traditionally been valued for its capacity to break down resins and improve surface finish of the coatings, and thus it is a good solvent for use in industrial paint formulations.

But tighter environmental regulations in North America and Europe are compelling a movement towards greener and more environmentally friendly options. For example, one of Germany's leading producers of industrial paint recently substituted NEP with solvents derived from bio-materials to meet EU REACH standards.

Expanding this trend towards green chemistry will be eroding NEP's market share in the coatings and paints segment in the next forecast period. Because producers are being subjected to more pressure to minimize their footprint on the environment, the transition to cleaner and greener solvents is bound to become more prominent, hence driving NEP's future demand in this use.

North America is adequately covered, primarily on the strength of high-value uses in electronics, semiconductor, and agrochemicals. The USA market is moving away from the application of NEP as a substitute for NMP in controlled environments of pharmaceuticals and microelectronics production despite growing regulatory focus by the EPA.

Europe is also moving slowly because of tight chemical safety rules under REACH, which has categorized NEP as a substance of concern. Limited and specific applications remain in specialty chemical production and surface coating. Specialty-grade high-purity grades of NEP are made by low-volume producers in Germany and France for pharmaceutical intermediates.

Asia-Pacific dominates the market for NEP, with China, Japan, South Korea, and India following, where massive electronics, petrochemical, and pharmaceutical industries depend on NEP as a main solvent. Ongoing demand especially in China is due to goliath-scale battery production factories, while South Korea uses NEP in semiconductor fabs for wafer stripping and cleaning.

Health Risks, Regulatory Restrictions, and Availability of Substitutes

The most significant challenge to NEP is its reprotoxic rating, which restricts its uses in consumer-exposure or unventilated applications. EU and USA regulators are tightening control over its uses, affecting long-term sustainability in sensitive applications. Green solvents or lower-toxicity amides are some alternative technologies appearing as viable alternatives in segments cleared by regulation.

High-Purity Demand in Electronics, Solvent Replacement, and Battery Boom

In spite of such issues, high-purity grades of NEP are still in demand for use in semiconductor production, high-performance coatings, and pharmaceutical synthesis. NEP's high boiling point, thermal stability, and high solvency make it a preferred option where others fail. Furthermore, the increasing global production of electric vehicles presents a safe alternative for NEP usage in battery slurry formulation and electrode coating processes.

NEP consumption fluctuated between 2020 and 2024 with regulatory updates and pandemic-induced supply chain disruptions in drugs. While demand was cut back by some producers based on estimates of health hazards, demand gained momentum in the Asia-Pacific market, especially in electronics and energy storage applications. NEP increased usage in new lithium-sulphur battery R&D and OLED material.

During 2025 to 2035, NEP will likely remain a niche solvent application, mainly in heavily regulated uses. Advances in capture-and-reuse technology, worker exposure assessment, and low-toxicity blend formulations will allow for extended application in advanced manufacturing. But to make that work, manufacturers will need to achieve a balance of performance benefits against considerations of compliance with regulation and environmental stewardship, possibly hybrids that blend NEP with biodegradable or bio-based cosolvents.

Market Shifts: A Comparative Analysis 2020 to 2024 vs. 2025 to 2035

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Subject to REACH registration in the EU and monitored for toxicity in industrial applications. |

| Consumer Trends | Demand driven by its performance as a solvent in electronics, petrochemicals, and agrochemicals. |

| Industry Adoption | Widespread use in semiconductor cleaning, herbicide formulations, and coatings. |

| Supply Chain and Sourcing | Raw material reliance on butyrolactone and ethylamine; localized production in Asia and Europe. |

| Market Competition | Dominated by BASF, Ashland, and Mitsubishi Chemical with capacity focused on industrial-grade NEP. |

| Market Growth Drivers | Growth tied to agrochemical demand, solvent performance, and industrial cleaning requirements. |

| Sustainability and Environmental Impact | Growing concerns over toxicity led to substitution in consumer-facing coatings and cleaners. |

| Integration of Smart Technologies | Use in precision solvent applications for microelectronics manufacturing. |

| Advancements in Equipment Design | Batch reactors with standard solvent recovery units. |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Tighter global regulations on reproductive toxicity and increased pressure for safer solvent substitutes in electronics and pharma. |

| Consumer Trends | Shift toward safer alternatives in consumer-facing industries; retained demand in high-purity industrial and battery sectors. |

| Industry Adoption | Growing presence in lithium-ion battery production and niche uses in specialty coatings and high-performance plastics. |

| Supply Chain and Sourcing | Move toward vertical integration by battery material manufacturers and diversification of sourcing routes to avoid regulatory risks. |

| Market Competition | Entry of regional specialty chemical players offering high-purity NEP variants tailored for energy storage and advanced electronics. |

| Market Growth Drivers | Propelled by demand from the electric vehicle sector, semiconductor advancements, and expansion of energy storage systems. |

| Sustainability and Environmental Impact | Transition to closed-loop solvent systems, adoption of green chemistry practices, and regulatory-compliant NEP alternatives in R&D. |

| Integration of Smart Technologies | Integrated into digitalized process lines in semiconductor fabs with real-time solvent recovery monitoring and automated handling. |

| Advancements in Equipment Design | Development of enclosed, solvent-recycling systems in chemical processing lines and AI-driven purity monitoring in NEP production. |

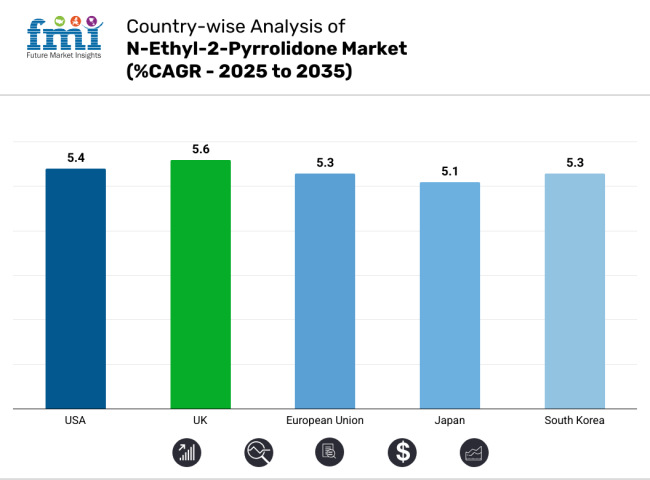

In the USA, NEP demand continues in niche markets like precision cleaning for electronics and lithium battery production, particularly for EV manufacturers. However, heightened scrutiny by EPA over reproductive toxicity is pressuring chemical firms to innovate with safe handling and closed-loop systems. Specialty chemical companies are offering high-purity NEP for tech sector applications, offsetting regulatory constraints in mainstream uses.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 5.4% |

The UK market is gradually phasing out NEP in consumer and agrochemical applications due to post-Brexit alignment with REACH-like controls. However, high-value electronics and niche pharma manufacturing still use NEP for its solvency strength. Academic R&D and cleanroom chemical suppliers continue procuring NEP for complex synthesis and electronics-grade cleaning applications.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 5.6% |

Strict regulations under REACH have significantly curbed NEP use in mass-market formulations. However, demand remains in semiconductor hubs in Germany and France, where cleanroom-grade solvents are required. Specialty solvent players are now investing in greener synthesis methods to meet ongoing demand from chip fabs and pharma intermediates while ensuring compliance.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 5.3% |

Japanese manufacturers continue to use NEP in highly controlled environments, especially in the production of photoresists and advanced materials for chipmaking. Companies like JSR and Sumitomo Chemical rely on ultrapure solvents like NEP for high-performance applications. Sustainability efforts focus on closed solvent systems and solvent reclaim technologies without impacting performance.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 5.1% |

South Korea’s rapidly expanding semiconductor and battery manufacturing sectors are the main users of NEP. With major companies like Samsung and LG Chem investing in vertical supply chains, local suppliers are scaling up production of electronics-grade NEP. Regulations continue to tighten, but industrial demand for precision solvents keeps the market resilient.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 5.3% |

The n-ethyl-2-pyrrolidone (NEP) market is growing slowly on account of its international demand in various industries like electronics, pharmaceuticals, and agriculture. Its use as an all-around solvent and intermediate renders it inevitable for production on a large scale, from semiconductors to medicines and crop protection chemicals.

On this account, market leaders are increasing investments in boosting production capacity, product quality, and strategic alliances. These projects seek to stake out their competitive strength and take the market leadership role in the expanding NEP market driven by the booming demand for productive, multi-function chemical solutions.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| BASF SE | 20-25% |

| Ashland Holdings Inc. | 15-20% |

| Evonik Industries AG | 10-15% |

| Eastman Chemical Company | 8-12% |

| Wacker Chemie AG | 5-10% |

| Other Companies (combined) | 20-30% |

| Company Name | Key Offerings/Activities |

|---|---|

| BASF SE | In 2024, expanded NEP production capacity in Asia to meet growing regional demand. In 2025, introduced high-purity NEP grades tailored for the electronics industry. |

| Ashland Holdings Inc. | In 2024, launched a sustainable NEP production initiative focusing on green chemistry principles. In 2025, formed strategic alliances with pharmaceutical companies to enhance solvent applications. |

| Evonik Industries AG | In 2024, developed customized NEP solutions for agrochemical formulations. In 2025, invested in R&D to improve NEP's efficacy in high-performance coatings. |

| Eastman Chemical Co. | In 2024, introduced NEP variants with reduced environmental impact. In 2025, expanded distribution networks in emerging markets to capture new growth opportunities. |

| Wacker Chemie AG | In 2024, focused on enhancing NEP purity levels for sensitive applications. In 2025, collaborated with personal care brands to develop NEP-based formulations. |

Key Company Insights

BASF SE (20-25%)

BASF leads the NEP market with massive production capacities and high-purity product focus, particularly to address the stringent requirements of the electronics sector.

Ashland Holdings Inc. (15-20%)

Ashland is committed to green production of NEPs, in line with global green chemistry trends and strengthening ties with pharmaceutical companies to broaden application areas.

Evonik Industries AG (10-15%)

Evonik leads in tailor-made NEP solutions for the agrochemical sector, leveraging R&D investments to maximize product performance across various formulations.

Eastman Chemical Company (8-12%)

Eastman excels in NEP variants for sustainable applications and is growing increasingly in emerging countries to reach new consumers.

Wacker Chemie AG (5-10%)

Wacker excels in high-purity NEP for delicate applications and cooperates with brands of personal care to create products based on NEP.

Other Key Players (20-30% Combined)

The overall market size for n-ethyl-2-pyrrolidone market was USD 1.39 million in 2025.

The n-ethyl-2-pyrrolidone market is expected to reach USD 2.35 million in 2035.

The increasing use of n-ethyl-2-pyrrolidone as a solvent in lithium-ion battery manufacturing, electronics, and agrochemicals fuels the market during the forecast period.

The top 5 countries which drive the development of n-ethyl-2-pyrrolidone market are China, South Korea, Japan, United States, and Germany.

On the basis of application, paints and coatings industry to command significant share over the forecast period.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA