The musical instrument market is booming as musicians, hobbyists, and professionals are seeking quality instruments, digital integration, and sustainable craftsmanship. With the rising trend of online learning, home recording, and digital music production, demand is observed in all types of instruments. Companies focusing on sound quality, durability, smart technology, and affordability are ruling the industry.

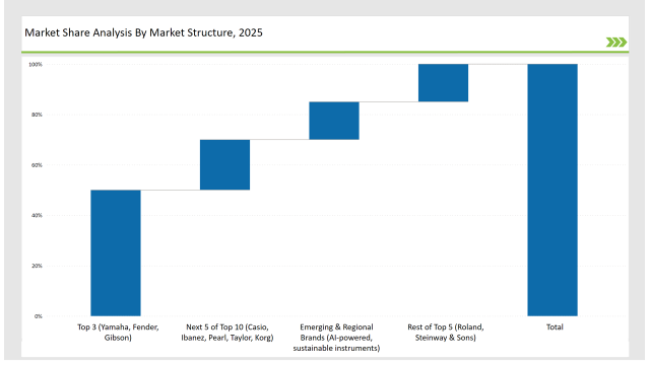

The market leaders, Yamaha, Fender, and Gibson, occupy 50% of the market share by leveraging strong brand heritage, leading-edge manufacturing, and digital instrument innovation. Independent and regional manufacturers account for 30% with handcrafted, boutique, and custom-built instruments. Emerging startups focusing on AI-powered sound customization, smart learning features, and eco-friendly materials contribute to 20% of the market.

Explore FMI!

Book a free demo

| Market Segment | Industry Share (%) |

|---|---|

| Top 3 (Yamaha, Fender, Gibson) | 50% |

| Rest of Top 5 (Roland, Steinway & Sons) | 15% |

| Next 5 of Top 10 (Casio, Ibanez, Pearl, Taylor, Korg) | 20% |

| Emerging & Regional Brands (AI-powered, sustainable instruments) | 15% |

| Market Concentration | Assessment |

|---|---|

| High (More than 60% by top players) | Medium |

| Medium (40 to 60% by top 10 players) | High |

| Low (Less than 30% by top players) | Low |

E-commerce & Direct-to-Consumer Sales dominate with 60%, as digital-first retailers and online tutorials drive instrument purchases. Music Retail Chains & Physical Stores hold 20%, catering to musicians who prefer hands-on instrument testing. Professional & Studio Equipment Suppliers account for 15%, targeting professional musicians and recording studios. Subscription-Based Instrument Rentals & Leasing make up 5%, appealing to students and temporary users.

String Instruments such as Guitar, Violins, Basses, and Ukuleles at 40% due to their popularity in all types of music. Keyboards & Digital Pianos by 30%, targeting both beginner and professional usage for music producers. Percussion & Drum Kits by 20%, helping deliver live performances and recording sessions. AI-Powered & Smart Instruments - 10%, gaining versatility by embracing digital music and extensive learning enhancement.

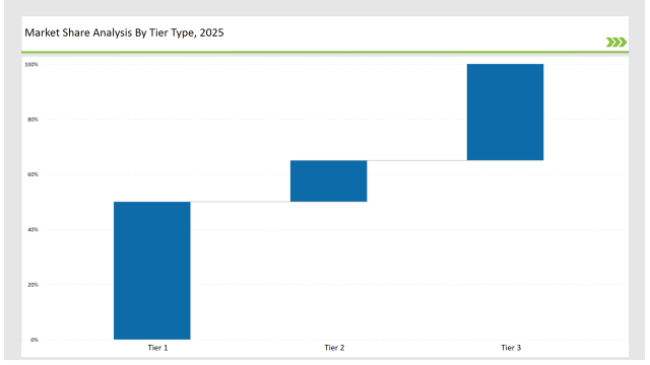

As customer preferences evolved, market leaders and new entrants made strategic choices that transformed the musical instrument industry.

| Tier Type | Tier 1 |

|---|---|

| Example of Key Players | Yamaha, Fender, Gibson |

| Market Share (%) | 50% |

| Tier Type | Tier 2 |

|---|---|

| Example of Key Players | Roland, Steinway & Sons |

| Market Share (%) | 15% |

| Tier Type | Tier 3 |

|---|---|

| Example of Key Players | Casio, Ibanez, Pearl, Taylor, Korg |

| Market Share (%) | 35% |

| Brand | Key Focus Areas |

|---|---|

| Yamaha | AI-powered music learning & digital instrument expansion |

| Fender | Bluetooth-integrated smart guitars & effects |

| Gibson | Sustainable tonewood sourcing & classic reissues |

| Roland | High-end electronic drums & digital pianos |

| Emerging Brands | Portable AI-enhanced smart instruments |

The musical instrument market is changing. Its focus will shift towards technology, accessibility, and sustainability. Smarter and more connected instruments for musicians are a demand of the future, while brands will gain dominance with AI-powered learning, eco-friendly materials, and digital production tools. Online music education and home recording are changing purchasing trends as well.

Subscription-based rentals and digital learning integration are becoming standard. More musicians are prioritizing hybrid instruments that blend acoustic authenticity with digital convenience. Additionally, boutique brands emphasizing craftsmanship and customization are gaining traction among professional and amateur musicians alike. With innovation and sustainability at the forefront, the future of the musical instrument market is tech-enabled, eco-conscious, and designed for both modern and traditional musicians.

Leading players such as Yamaha, Fender, and Gibson collectively hold around 50% of the market.

Online sales represent approximately 60% of the market, driven by digital learning and instrument customization.

These solutions account for about 10% of the market, with projected growth in music technology innovation.

Sustainable instruments hold around 15% of the market, with rising consumer demand for ethical craftsmanship.

High for companies controlling 50%+, medium for 30% to 50%, and low for those under 30%.

Porcelain Tableware Market Trends - Growth & Demand Forecast 2025 to 2035

Toothpaste Market Trends - Growth, Sales & Forecast 2025 to 2035

Snus Market Growth - Demand, Sales & Forecast 2025 to 2035

Sparkling Bottled Water Market Growth - Demand & Trends 2025 to 2035

Luxury Fine Jewellery Market Growth - Trends & Forecast 2025 to 2035

Sneaker Boots Market Insights - Size & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.