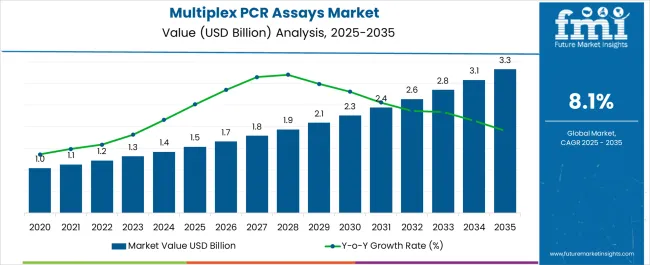

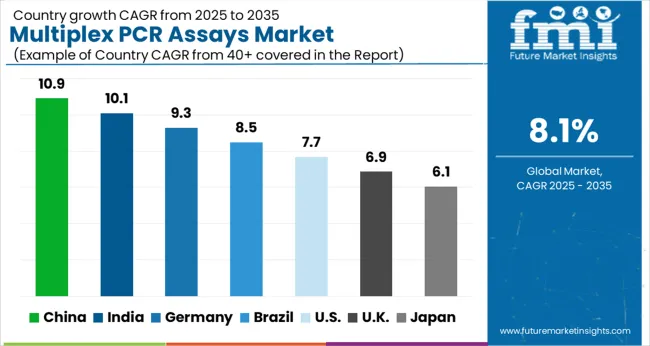

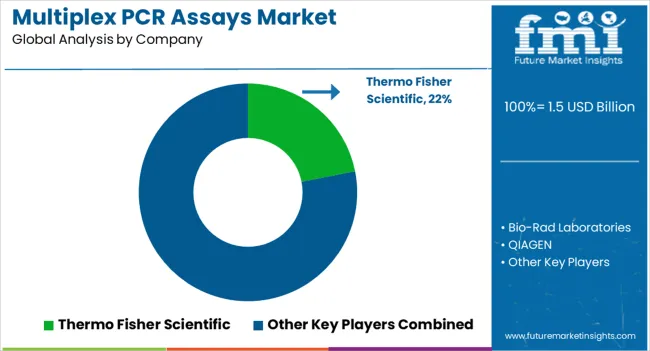

The Multiplex PCR Assays Market is estimated to be valued at USD 1.5 billion in 2025 and is projected to reach USD 3.3 billion by 2035, registering a compound annual growth rate (CAGR) of 8.1% over the forecast period.

| Metric | Value |

|---|---|

| Multiplex PCR Assays Market Estimated Value in (2025 E) | USD 1.5 billion |

| Multiplex PCR Assays Market Forecast Value in (2035 F) | USD 3.3 billion |

| Forecast CAGR (2025 to 2035) | 8.1% |

The multiplex PCR assays market is advancing rapidly as the demand for precise, high throughput, and cost efficient diagnostic solutions continues to rise across healthcare systems worldwide. Growing prevalence of infectious diseases, cancer, and genetic disorders is increasing reliance on multiplex assays that can simultaneously detect multiple targets in a single test, thereby reducing turnaround time and resource consumption.

Ongoing innovations in assay design, automation, and integration with next generation sequencing are further strengthening their role in both clinical and research applications. Additionally, the increasing use of molecular diagnostics in personalized medicine and routine disease surveillance is accelerating adoption.

Regulatory support for advanced diagnostic techniques and expanding investments from healthcare providers in molecular testing infrastructure are creating strong growth opportunities. The outlook remains positive as multiplex PCR assays are expected to play a pivotal role in strengthening diagnostic efficiency and improving patient outcomes.

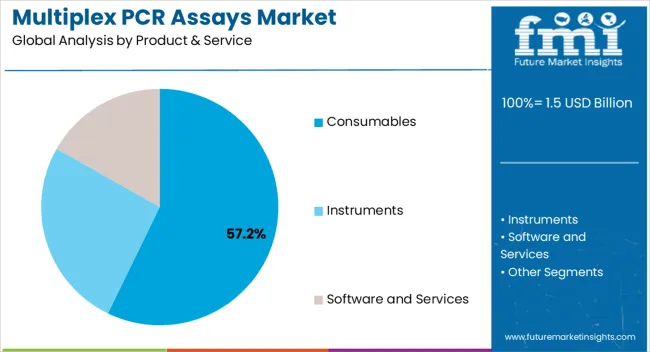

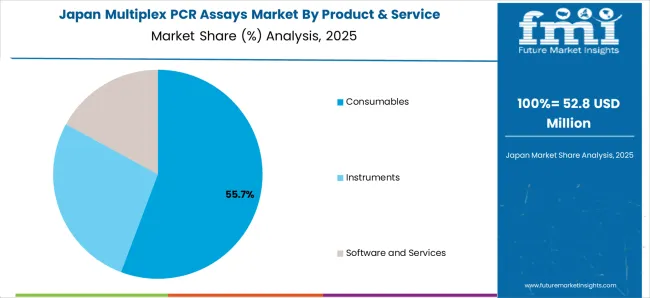

The consumables segment is projected to account for 57.20% of total revenue by 2025 within the product and service category, making it the dominant contributor. This growth is attributed to the recurring nature of consumable demand including reagents, kits, and assay plates that are required for continuous laboratory operations.

Rising adoption of molecular diagnostic testing in hospitals, diagnostic centers, and research facilities has amplified the need for reliable consumables. Moreover, consumables enable flexible use across multiple platforms, driving consistent purchases and ensuring steady revenue flow for suppliers.

As testing volumes continue to grow, the dependency on consumables is expected to sustain their leading share in the market.

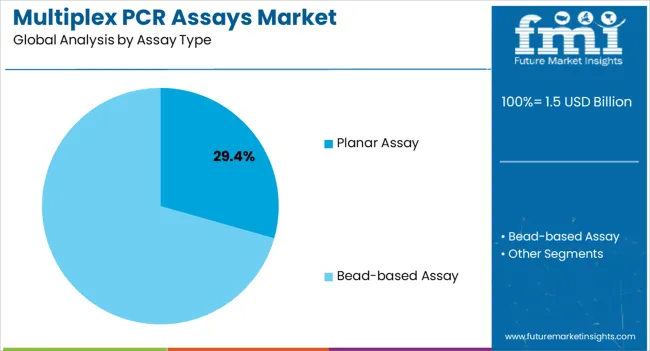

The planar assay type segment is expected to contribute 29.40% of total revenue by 2025 within the assay type category, positioning it as a significant growth area. The preference for planar assays is supported by their ability to accommodate multiplexing on compact surfaces, ensuring high throughput and cost effectiveness.

Their compatibility with a wide range of biomarkers and capacity for precise detection have encouraged adoption across research and diagnostic laboratories. Furthermore, continuous advancements in microarray technologies and improvements in assay sensitivity are enhancing the clinical relevance of planar assays.

This combination of scalability, efficiency, and accuracy is strengthening the position of planar assays in the multiplex PCR assays market.

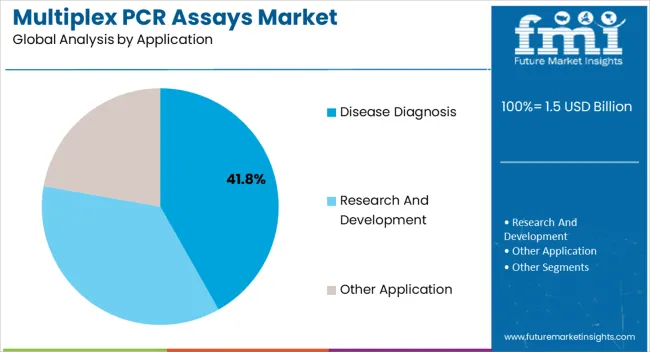

The disease diagnosis application segment is anticipated to account for 41.80% of total revenue by 2025, positioning it as the leading application area. This dominance is being driven by the growing need for early detection and accurate monitoring of infectious diseases, genetic conditions, and cancer.

The ability of multiplex PCR assays to deliver comprehensive diagnostic information from minimal sample volumes has made them indispensable in clinical workflows. Additionally, rising healthcare expenditure, expanding hospital infrastructure, and public health initiatives aimed at reducing disease burden are reinforcing adoption.

As a result, disease diagnosis remains the primary driver of market demand, ensuring consistent growth for multiplex PCR assays in clinical practice.

From 2020 to 2025, the global multiplex PCR assays market experienced a CAGR of 7.8%, reaching a market size of USD 1.5.3 billion in 2025.3.

Multiplex PCR assays play a vital role in diagnostic applications, particularly in infectious disease testing. The need for rapid and accurate detection of multiple pathogens in a single test is driving the demand for multiplex PCR assays.

With the increasing prevalence of infectious diseases, such as respiratory infections, sexually transmitted infections, and hospital-acquired infections, the demand for multiplex PCR assays is expected to grow.

Future Forecast for Multiplex PCR Assays Industry:

Looking ahead, the global multiplex PCR assays market is expected to rise at a CAGR of 8.5% from 2025.3 to 203.33.3. During the forecast period, the market size is expected to reach USD 3.3.0 billion by 203.33.3.

Point-of-care (POC) and decentralized testing are gaining prominence in healthcare. Multiplex PCR assays offer the potential for on-site, rapid, and accurate diagnosis in settings such as clinics, emergency departments, and resource-limited areas. The demand for multiplex PCR assays in POC and decentralized testing is expected to increase as the focus on accessible and timely diagnostics grows.

| Country | The United States |

|---|---|

| Market Size (USD Million) by End of Forecast Period (2035) | USD 3.3 million |

| CAGR % 2025 to End of Forecast (2035) | 7.1% |

The multiplex PCR assays market in the United States is expected to reach a market size of USD 3.3 billion by 2035, expanding at a CAGR of 7.1%.

The USA has a substantial burden of infectious diseases, including respiratory infections, sexually transmitted infections, and healthcare-associated infections. The increasing demand for accurate and comprehensive infectious disease testing is driving the growth of the multiplex PCR assays market in the USA

| Country | The United Kingdom |

|---|---|

| Market Size (USD Million) by End of Forecast Period (2035) | USD 146.9 million |

| CAGR % 2025 to End of Forecast (2035) | 8.7% |

The multiplex PCR assays market in the United Kingdom is expected to reach a market value of USD 146.9 billion, expanding at a CAGR of 8.7% during the forecast period. The UK has a strong research and development landscape, with renowned academic institutions, biotechnology companies, and pharmaceutical companies actively engaged in life sciences research.

Multiplex PCR assays are widely utilized in research laboratories for their ability to detect multiple targets simultaneously. The expanding research and development activities across diverse fields, such as genomics, oncology, and infectious diseases, are driving the demand for multiplex PCR assays in the UK.

| Country | China |

|---|---|

| Market Size (USD billion) by End of Forecast Period (2035) | USD 188.7 billion |

| CAGR % 2025 to End of Forecast (2035) | 6.6% |

The multiplex PCR assays market in China is anticipated to reach a market size of USD 188.7 billion by the end of 2035, growing at a CAGR of 6.6% throughout the forecast period. China has faced several epidemics and disease outbreaks in the past, which has heightened the focus on epidemic and disease control measures.

Multiplex PCR assays play a critical role in rapid and accurate diagnosis, surveillance, and control of infectious diseases. The emphasis on epidemic and disease control drives the demand for multiplex PCR assays as essential tools in public health initiatives.

| Country | Japan |

|---|---|

| Market Size (USD billion) by End of Forecast Period (2035) | USD 115.0 billion |

| CAGR % 2025 to End of Forecast (2035) | 7.0% |

The multiplex PCR assays market in Japan is estimated to reach a market size of USD 115.0 billion by 2035, expected to thrive at a CAGR of 7.0%. Japan has made significant investments in healthcare infrastructure and technology, leading to advancements in diagnostics and molecular testing.

The country has witnessed improvements in laboratory facilities, research capabilities, and access to advanced diagnostic technologies. These developments create a favorable environment for the adoption of multiplex PCR assays in Japan.

| Country | South Korea |

|---|---|

| Market Size (USD billion) by End of Forecast Period (2035) | USD 51.9 billion |

| CAGR % 2025 to End of Forecast (2035) | 4.7% |

The multiplex PCR assays market in South Korea is expected to reach a market size of USD 51.9 billion, expanding at a CAGR of 4.7% during the forecast period. South Korea’s biotechnology and pharmaceutical industries have been growing rapidly in recent years. The country has made significant investments in research and development, fostering innovation in life sciences. Multiplex PCR assays find applications in various research and clinical areas, making them valuable tools for biotech and pharma companies. The expansion of these industries fuels the demand for multiplex PCR assays in South Korea.

Instrument segment dominated the multiplex PCR assays market with a market share of 53.5% in 2025. Instruments typically have a longer lifespan compared to consumables. Once purchased, instruments can be used for several years with proper maintenance and calibration.

In contrast, consumables such as PCR reagents, primers, probes, and plates are required for each assay and need to be replenished regularly. The lower replacement frequency of instruments compared to consumables contributes to their dominance in the market.

Based on assay type, planar assay segment has dominated the category withholding the significant share of the market at around 64.5% at the end of 2025. Planar assays offer the ability to simultaneously detect and analyze multiple targets in a single assay. They enable the parallel detection of multiple DNA or RNA sequences, gene mutations, or protein markers in a high-throughput manner.

This multiplexing capability is crucial for applications that require the simultaneous analysis of multiple targets, such as genotyping, mutation screening, gene expression profiling, and pathogen detection.

By application, research and development segment is expected to continue leading the market over a CAGR of 9.2% throughout the projected timeframe. Multiplex PCR assays simplify experimental workflows in research and development.

By consolidating multiple targets into a single assay, researchers can reduce the number of experimental steps, including DNA extraction, PCR setup, and sample handling. This streamlining of workflows minimizes the risk of errors, improves reproducibility, and enhances overall experimental efficiency.

The biopharmaceutical companies have led the multiplex PCR assays market as the leading end user with the market share of 40.7% in 2025. Biopharmaceutical companies are engaged in the research and development of new drugs and therapies.

Multiplex PCR assays play a crucial role in the early stages of drug discovery by enabling the simultaneous analysis of multiple genes, biomarkers, or mutations associated with diseases or drug responses. These assays help in identifying potential drug targets, characterizing patient populations, and assessing the efficacy and safety of candidate drugs.

The multiplex PCR assays industry includes several key players that are actively involved in the development, manufacturing, and distribution of multiplex PCR assay products. Manufacturers are heavily investing in the research and developments activities to come up with novel products in the industry.

Key Strategies Used by the Participants

Product & Service Innovation

Key players continuously invest in research and development to introduce innovative products. They strive to develop assays with improved sensitivity, specificity, accuracy, and ease of use.

Strategic Partnerships and Collaborations

Key players often form strategic partnerships and collaborations with other companies, research institutions, and healthcare organizations. These partnerships can lead to knowledge sharing, joint product development, and expanded market reach.

Expansion into Emerging Markets

Expanding into emerging markets with growing healthcare infrastructure and rising demand for multiplex PCR assays allows companies to tap into new opportunities and gain a competitive edge.

Mergers and Acquisitions

Companies in the market may engage in mergers or acquisitions to streamline their product portfolio, obtain new technologies, enter new market niches, and gain access to novel products or intellectual property.

Key Developments in the Multiplex PCR Assays Market:

In June 2024, Bio-Rad confirmed its agreement with Seegene to supply molecular testing services in the USA market.

The global multiplex PCR assays market is estimated to be valued at USD 1.5 billion in 2025.

The market size for the multiplex PCR assays market is projected to reach USD 3.3 billion by 2035.

The multiplex PCR assays market is expected to grow at a 8.1% CAGR between 2025 and 2035.

The key product types in multiplex PCR assays market are consumables, instruments and software and services.

In terms of assay type, planar assay segment to command 29.4% share in the multiplex PCR assays market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Multiplex Molecular Diagnostics Market Size and Share Forecast Outlook 2025 to 2035

Multiplex Biomarker Imaging Market – Size, Share & Forecast 2024-2034

Multiplex Assay Market

Syndromic Multiplex Diagnostic Market

Wavelength Division Multiplexing (WDM) Equipment Market Analysis - Size, Growth, and Forecast 2025 to 2035

PCR Tire Building Machine Market Size and Share Forecast Outlook 2025 to 2035

PCR Plastic Packaging Market Size and Share Forecast Outlook 2025 to 2035

PCR Plate Sealer Market Size and Share Forecast Outlook 2025 to 2035

Breaking Down PCR Films Market Share & Industry Positioning

PCR Films Market Analysis by PET, PS, PVC Through 2035

PCR Bottles Market Growth - Demand, Innovations & Outlook 2024 to 2034

PCR Pouches Market

qPCR Instruments Market Analysis - Growth, Trends & Forecast 2025 to 2035

RT-PCR Kits Market Growth - Trends & Forecast 2023 to 2035

1-Step RT-PCR Kits Market Size and Share Forecast Outlook 2025 to 2035

Real-Time PCR Systems Market Growth – Trends & Forecast 2025 to 2035

Lung Cancer PCR Panel Market Trends, Growth, Demand & Forecast 2025 to 2035

Global One Step RT-qPCR Kits Market Analysis – Size, Share & Forecast 2024-2034

Cartridges for RT-PCR Automatic Systems Market

Mycobacterium Tuberculosis PCR Detection Kits Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA