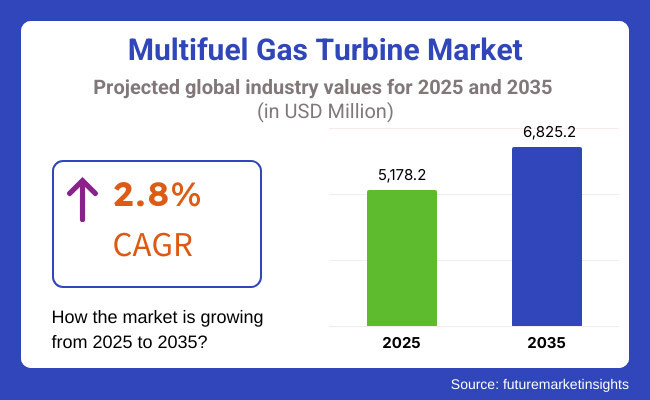

The Multifuel Gas Turbine Market is projected to grow from USD 5,178.2 million in 2025 to USD 6,825.2 million by 2035, reflecting a CAGR of 2.8% over the forecast period. This growth is driven by the increasing demand for flexible and efficient power generation solutions, especially in regions focusing on energy security and transition to low-carbon technologies.

Multifuel gas turbines, capable of operating on natural gas, diesel, biofuels, and hydrogen blends, are gaining traction in power generation, industrial applications, and emergency backup systems. The rising integration of renewable energy sources, coupled with the need for grid stability and backup power, is further fueling market expansion.

The market is continuing to experience robust expansion as a result of the necessity of dependable electricity generation utilizing various fuel sources. Multihued gas turbines are the key players in the process of reducing carbon emissions due to their ability to work with different fuels and their compatibility with hydrogen and biofuels. These systems provide not only gas turbines but also support low carbon renewable energy sources such as wind and solar, thus, further pushing the market.

The turbines are receiving the benefits of higher efficiency, digital control systems, and AI-driven predictive maintenance, which increases the reliability and decrease the cost of the systems.

Innovation in hydrogen (H2) energy solutions, carbon capture technologies, and government electrification through incentives are supporting the trend for the replacement of traditional fuels with the most advanced multi-fuel turbines. On the other hand, the progresses in decentralized power generation including combined heat and power (CHP) applications and offshore gas turbine deployment constitute the principal engine for the market expansion.

Explore FMI!

Book a free demo

The expansion of the North American market is attributable to the increasing investments directly into the construction of natural gas power facilities, hydrogen co-firing projects, and grid reliability initiatives. The USA and Canada have turned existing turbine fleets in both countries on to a low-carbon fuel pathway through machine learning, virtual reality, and diagnostic maintenance tools they link through smart digital twin technology.

Hydrogen-ready turbines, carbon capture integration, and advanced CHP systems are receiving government support, which is accelerating the shift to cleaner energy sources. Nevertheless, difficulties like the uncertainties in regulations, infrastructure costs, and the variation in fuel prices may influence development.

The multi fuel gas turbine business in European markets is mainly driven by decarburization policies, renewable energy expansion, and energy security concerns. The Green Deal and hydrogen strategy of the European Union are spurring the growth of hydrogen-capable turbines that help in fossil fuel dependency reduction. Countries like Germany, the UK, and France are investing in hybrid power plants, CHP systems, and grid balancing technologies to ensure energy stability.

However, the situation is exacerbated by the introduction of carbon taxes, regulatory barriers, and competition from battery storage technologies. The integration of AI-driven efficiency enhancements, waste heat recovery, and low-emission turbine models is expected to accelerate market growth.

The region is characterized as one of the fastest-growing markets which is mainly due to urbanization, industrialization, and the rising demand for electricity. Countries such as China, India, and Japan are on the road to constructing more gas-based power plants in a bid to minimize coal consumption while integrating energy storage that is renewable.

Governments are driving projects aimed at LNG infrastructure, hydrogen co-firing, and grid resilience thus helping in the increased penetration of the market. Nevertheless, the region mostly grapples with issues such as fuel supply logistics, dependency on imports, and excessive infrastructure costs. The deployment of distributed energy systems, CHP technologies, and efficient turbine aero derivative units on the increase will be key in the development of the market within the region.

The market of the Middle East & Africa (MEA) is benefiting from the progress in gas-fired power plants, industrial electrification, and mini-grid solutions. Gulf nations, including Saudi Arabia and UAE are the ones who utilize not only natural gas but also hydrogen fuels in their turbines with an aim to diversifying the energy mix and also net-zero targets.

Nigeria and South Africa in Africa, have invested in gas turbine track micro grids as well as energy access projects to support electrification. However, the region is dealing with issues such as geopolitical instability, sporadic fuel availability, and stagnated technology progress. The increased use of portable gas turbine units and the integration of hybrid renewables will be effective in the mitigation of these hurdles.

The evolution of the gas market in Latin America is attributed directly to the ongoing construction of natural gas infrastructure, industrial development, and strategic energy reforms. Brazil, Mexico, and Argentina are prominent players focusing on combined-cycle act plants, CHP systems, and LNG imports as routes to energy security. A blend of gas from other sources hydrogen in with the gas turbine of the future is another inventive technique that the Latin American region is analyzing to reach the sustainability vision.

Nonetheless, I doubt if the recent developments due to economic crises, regulatory inconsistency, and limited technology investment could be such a big blow to the response of society. Contrariwise, the win-win solution for the extension of both the energy companies and the mechanical technology suppliers in making projects that are low emission and efficient will be the main factor for the long-term market growth.

Challenges

The issue of high Infrastructure and Operational Costs

Typically, the installation of multi fuel gas turbines requires quite a bit amount of real capital upfront, particularly for the fans of hydrogen-compatible ones, carbon capture-integrated ones, and CHP systems. The financial resources in developing countries are limited leading to a situation where the substantial turbine adoption becomes challenging. Also, transportation costs for fuel, ongoing costs for maintenance, and expenses on the infrastructure changes all add up to the overall high cost of ownership.

Turbine operators are commanded to purchase expensive components such as advanced cooling systems, emissions control technologies, digital automation, etc., to carry on providing desired outputs. Government grants and funding mechanisms, though they mitigate some of the costs, are not enough because there is still the issue of the cost of instability, price variations of fuel, and the high price of procurement which still are central to the problem of cost-conscious consumers.

The lack of clarity in regulations and fuel supply constraints

The gas turbine multi fuel is typically affected by the stiffening of discharge regulations, carbon-cutting taxes, and the turnover in government policies e.g. renewable vs gas-based energy plants. Nations are enthusiastic about the idea of promoting cleaner energy solutions, thus this is influencing the economic performance of the gas sector in the long run. The power plant operators are faced with the fuel supply constraints, which include LNG dependency for imports, limitations of biofuel production, and lack of hydrogen.

In addition, the price fluctuations for gas and synthetic fuels in the market can influence the operational costs and profitability of the project. Achieving the target of net-zero emissions-states require progress in technology, easy access to low-emission fuels, and infrastructural up-gradation therefore, it is tough for companies to switch over without enormous capital and no clear policy direction.

Energy Storage and Renewable Energy Competition

The gas turbine market, in terms of multi fuels, confronts stiff rivalry from the fast uptake of renewables like wind, solar, and hydroelectric power. Battery energy storage systems (BESS) are making strides in both lowering peak loads and ancillary services due to their decreasing dependence on gas-powered generation. As the price of renewable energy declines further, politicians and utilities will shift their focus to the more direct carbon-free alternatives.

This trend will in turn curtail the growth of gas turbines. Although turbines present an advantage of flexibility and the ability to ramp up quickly, their position on the market gets hindered by the development of energy storage systems that are ever more efficient in providing grid stability without emissions.

Opportunities

Hydrogen and Biofuel-Compatible Gas Turbines Advancement

The very invention of biofuel-ready and hydrogen gas turbines is primarily a way of offsetting the emission of greenhouse gases while at the same time having the flexibility of the fuel mix. Various corporations are channeling funds toward the development of innovative rotor technologies that are compatible with renewable, gases such as waste products, and blends of ammonia.

Combining fuels, the advancements in combustion efficiency, and hydrogen-based technologies is paving the way for pollutant-free gas turbines. Governments backing hydrogen-driven economies will create an edge for manufacturers who produce environmentally friendly, flexible-burning turbines. Addition of power systems with renewables like wind and solar and industries with low carbon dioxide technology will be a proactive approach to grow the business.

Distributed Energy and Hybrid Power Systems Growth

Hybrid power systems are becoming one of the predominant drivers of multi fuel gas turbines in off-grid power generation, micro grids, and industrial combined heat and power (CHP) applications. The hybrid gas-renewable energy plants that incorporate a combination of solar, wind, and gas have become critical in ensuring grid stability as well as peak power availability.

Many plants and remote areas use active turbines to continue their work when renewable energy drops. The merger of AI-powered predictive maintenance and digital automation, the gas turbines, gradually become more efficient, and adjustable and thus, create supportive conditions for energy security, decentralized grids, and reliable back power at global levels.

Investment in AI-Powered Monitoring and Efficiency Optimization

Gas turbine efficiency and reliability optimization is being transformed through the adoption of AI-powered analytics, digital twin technology, and real-time turbine diagnostics. These technologies facilitate predictive maintenance, which ensures that plants are running optimally and saves operating costs. Machine learning algorithms run automated optimizations for turbine performance, which optimizes fuel consumption, emissions control, and thermal efficiency.

The remote monitoring minimizes the operation lifespan of the plant as it allows for automated adjustments. The digitalization process that power plants and industries adopt with "smart-grid" infrastructure will expect AI-driven turbines to make tremendous operational savings, increase the flexibility of the power plant, and create stable energy. The latest digital technologies are enabling gas turbines to become more competitive and flexible for future energy markets.

Multi fuel gas turbine marketed has suddenly reached the highest point since its takeover of 2020 to 2024. It can be explained by the need for flexible energy generation and a higher security of energy. The strategic shift towards lower carbon sources program entails the industrial and public utilities' promotion of gas turbines which has been realized through the ability to work on various fuels thus including hydrogen and synthetic fuels.

The market is also responded to both the evolving environmental regulations and the ever-present pressure to decarbonize. Between the years 2025 and 2035, hydrogen ignition research, carbon capture integration, & digital monitoring will be the key features in reshaping the sector.

Market Comparison Analysis:

The multi fuel gas turbine market has experienced substantial growth from 2020 to 2024, driven by the increasing demand for flexible power generation, energy security concerns, and the transition toward lower-carbon fuels. Industries and utilities have increasingly adopted multi fuel gas turbines due to their ability to operate on a variety of fuel sources, including natural gas, hydrogen, and synthetic fuels.

The market has also been shaped by evolving environmental regulations and the push for decarburization.Looking ahead to 2025-2035, advancements in hydrogen combustion, carbon capture integration, and digital monitoring will redefine the sector.

| Market Shift | 2020 to 2024 |

|---|---|

| Regulatory Landscape | Governments promoted natural gas as a bridge fuel with moderate carbon emission targets. |

| Technological Advancements | Development of turbines with dual-fuel capability, enhanced efficiency, and lower NOx emissions. |

| Industry-Specific Demand | Growth in power generation, industrial cogeneration, and backup energy systems. |

| Sustainability & Circular Economy | Initial adoption of cleaner fuels and improvements in turbine efficiency. |

| Production & Supply Chain | Increased investment in turbine manufacturing and fuel supply infrastructure. |

| Market Growth Drivers | Rising energy demand, grid reliability concerns, and flexible fuel capabilities. |

| Market Shift | 2025 to 2035 |

|---|---|

| Regulatory Landscape | Stricter mandates for low-carbon fuels, hydrogen blending, and carbon capture implementation. |

| Technological Advancements | Widespread adoption of hydrogen-ready turbines, AI-driven optimization, and integration with energy storage. |

| Industry-Specific Demand | Expansion into hybrid renewable-energy systems, hydrogen production, and decentralized power generation. |

| Sustainability & Circular Economy | Strong focus on net-zero emissions, carbon-neutral fuel alternatives, and enhanced turbine recycling programs. |

| Production & Supply Chain | Localization of production, AI-driven supply chain optimization, and advancements in fuel flexibility. |

| Market Growth Drivers | Surge in green hydrogen adoption, enhanced grid resilience, and government incentives for cleaner technologies. |

The growth of the United States Multif uel Gas Turbine market is continuous owing to the inclination of the nation on the energy resilience, grid reliability and emissions reduction issues. The transition from coal to natural gas as a fuel, and the adjustment of solar and wind energy for grid backup are the two main reasons to push the demand for flexible gas turbines.

The newly designed and redone grid-powered plants that use hydrogen-blending technologies are also the drivers which nullity drive the market. Even the increased generation of decentralized power, energy recovery of the industries, and deployment of the Armed Forces are factors that expand the use of multi fuel machines. The hardware and software upgrades of power stations also fuel the need for efficient and flexible turbines.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 2.9% |

The United Kingdom Multifuel Gas Turbine Market is expanding due to the country’s focus on decarbonization, energy security, and hydrogen integration. With offshore wind and solar power capacity growing rapidly, gas turbines are increasingly used as backup power sources to ensure grid stability.

The UK government’s push for low-carbon and hydrogen-ready gas turbines is driving investments in next-generation energy solutions. The country’s industrial sector and CHP plants are also adopting multifuel turbines to enhance fuel flexibility and efficiency.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 2.6% |

The European Union Multifuel Gas Turbine Market is growing due to the region’s energy transition policies, hydrogen economy development, and focus on grid reliability. The EU’s Fit for 55 package and Repower plan are encouraging investment in hydrogen-ready gas turbines as part of the strategy to reduce dependence on imported fossil fuels.

Countries like Germany, France, and Italy are upgrading power infrastructure, integrating renewables with flexible gas turbines to enhance grid stability. Additionally, industrial applications in refineries, chemical plants, and district heating are driving adoption.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union | 2.7% |

The China Multifuel Gas Turbine Market is expanding rapidly due to the country’s focus on power infrastructure development, industrial energy efficiency, and clean energy transition. While coal remains dominant, China is investing heavily in natural gas power plants and hydrogen-capable turbines to reduce emissions.

The government’s push for energy diversification and peak load balancing in major cities is driving demand for multifuel gas turbines. Additionally, the industrial sector, including petrochemicals and manufacturing, is adopting CHP systems to enhance energy efficiency.

| Country | CAGR (2025 to 2035) |

|---|---|

| China | 3.0% |

The Japan Multifuel Gas Turbine Market is growing due to the country’s focus on energy security, hydrogen adoption, and grid resilience. Following the Fukushima disaster, Japan has prioritized natural gas and hydrogen-blended turbines as part of its energy mix. The government’s Green Growth Strategy encourages investment in hydrogen-compatible gas turbines, supporting carbon neutrality goals.

Additionally, industrial and commercial CHP systems are driving demand for multifuel turbines to improve energy efficiency and reliability.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 2.5% |

The South Korea Multifuel Gas Turbine Market is expanding due to government initiatives in energy transition, hydrogen infrastructure, and industrial efficiency. South Korea’s Hydrogen Economy Roadmap is driving investments in hydrogen-capable gas turbines for power generation and industrial applications. The country’s semiconductor and manufacturing industries are increasing demand for CHP systems to enhance operational efficiency.

Additionally, South Korea’s shift toward cleaner energy sources is promoting the replacement of older power plants with low-emission gas turbines.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 2.8% |

Low Output (Below 100 MW) Segment Leads with Demand for Decentralized Power Generation

the gas turbines of low output (or <100 MW) currently dominate the market, accounting for a large share of the market. The main applications are the distributed power generation, backup power, and microgrid applications. The preference of the gases of these turbines is vast in the sectors as they are reliable and fuel-efficient in remote locations, small industrial facilities, and emergency power systems where grid access is minimal or unstable.

Furthermore, low-output turbines are often utilized as peaking power plants alongside renewable energy sources to provide grid stability when fluctuations happen in sources alike wind and solar. Moreover, the increasing amount of capital being routed to the establishment of small modular power plants and waste-to-energy projects are influencing the use of these turbines in residential, commercial, and public infrastructure sites.

Medium Output (100 MW - 300 MW) Segment Gains Momentum with Industrial and Utility-Scale Applications

The medium output (100 MW - 300 MW) segment is marking its rise with increased application in industrial power generation and combined heat and power (CHP) systems. The turbines are flexible and cost-efficient and are an excellent solution for manufacturing sectors dealing with steel and chemicals and large production plants that require a stable power supply.

They are also used in medium-sized energy-generating units and utility grids, where they are the optimal choice being flexible and energy-efficient. In a world where energy efficiency and clean power generation are at the forefront, medium-output gas turbines are grasping the attention more and more with their application in hybrid projects that include natural gas, hydrogen, and renewables.

Heavy Output (Above 300 MW) Segment Expands with Rising Demand for Large-Scale Power Plants

The heavy output (above 300 MW) category is predominantly represented in the power plants constructed by large companies, gas & oil operations, and paired cycle power plants (CCGT). These turbines are essential for secure base-load electricity production, thus power plants gain stability and can then distribute that increased energy to cities and industrial areas.

In this sustainable energy era, heavy-duty turbines offer multifuel options for gas- and hydrogen-based electricity production, allowing the gradual shift from coal to gas. The large-scale power stations based on gas and oil and the construction of new energy plants in the region are also leading the segment to grow, especially in the Asia Pacific area and the Middle East.

Energy & Power Sector Drives Market Growth with Demand for Grid Stability

The energy & power sector continues to be the largest demand driver for multi fuel gas turbines. The prime reasons for their large scale application is mainly owing to their role in grid balancing, as peak-load power supply, and renewable energy integration.

Alongside technological development, the global transition to low-carbon energy solutions is powered by the increasing use of gas turbines in hybrid power plants, which co-fire natural gas, hydrogen, and synthetic fuels, while simultaneously advancing decarburization goals. The collaboration of gas turbines, operating in the combined-cycle mode, is soaring since these types circuits are better in energy saving and less gassy than the traditional wood-burning steam plant.

Public Infrastructure Segment Gains Traction with Urbanization and Smart City Initiatives

The public infrastructure sector is confronting the mass deployment of gas turbines in municipal heating systems, power plants, and even in cases of emergency power backup. The public programs that encourage the building of smart cities with energy resilience are the ones that are sources of investments for co-generation plants that supply power and heat to hospitals, schools, water-treatment facilities, city buildings, etc.

Air traffic, railroads, and military power applications are seeing gas turbine involvement as their pivotal role in the whole project that is to ensure power supply without interruption for the vital part infrastructure.

Residential & Commercial Sectors See Steady Growth with Decentralized Energy Systems

Residential and commercial sections are experiencing convenience heavily brought by the upsurge in the requirement for decentralized power systems and co-generation (CHP) systems.

In the areas where the power grid is less reliable or frequently becomes dysfunctional, multi fuel gas turbines are utilized as dependable sources of backup power for homes, office buildings, data centers, and retail spaces. Furthermore, the shift towards energy efficiency is one of the factors that urban planners consider in the adoption of micro turbines for residential and commercial buildings.

Industrial Sector Expands Adoption with Focus on Energy Efficiency and Cost Savings

Industries like steel, cement, chemicals, and paper & pulp are the main users of hydrocarbon mixing together with using it in production and in process heating. Switching options between natural gas, diesel, and biofuels turns such turbines into ideal solutions for factories that consume a lot of energy and want reliable and cheap energy sources.

Along with the stricter carbon emission rules, many manufacturers are now using gas for their CHP systems that gradually withdraw from coal, cut operational costs, and boost energy efficiency.

Oil & Gas Industry Remains a Key Market with Demand for Off-Grid and Offshore Power Generation

The oil and gas segment is taking advantage of mult ifuel gas turbines for shoestring budgets and for mobile energy sources at far off offshore places. Gas turbines are the best match in unfavorable conditions at isolated, offshore sites due to their high reliability rate, fuel flexibility, and less maintenance to be performed.

The surge in the up surgence of gas flaring recovery schemes and gas-to-power projects is fortifying the gas turbine penetration, as oil producers hunt for avenues to get rid of waste and cash-in on excess gas resources. Also, as the industry turns towards hydrogen and carbon capture solutions, multi-fuel turbines are expected to play a vital role in the low-carbon energy transition strategies.

The Multifuel Gas Turbine Market has been on the upswing due to shriveling demand for power generation that lacks flexibility, efficiency, and low-emission. These turbines which come with the capacity to function on natural gas, diesel, hydrogen, syngas, and biofuels not only diversify energy supplies but also improve energy security that makes them a perfect fit for power plants, industrial facilities, and offshore platforms.

The primary driver for the adoption of turbines is the increasing emphasis on carbon reduction, the integration of renewables, and grid stability. The dominant players in the market are targeting the development of the hydrogen-ready turbines, digital monitoring, and hybrid fuel solutions to improve efficiency and environmental emissions reduction. The technological breakthroughs in smart diagnostics and AI-driven performance optimization also contribute significantly to the overall market growth.

The global Multifuel Gas Turbine market is projected to reach USD 5,178.2 million by the end of 2025.

The market is anticipated to grow at a CAGR of 2.8% over the forecast period.

By 2035, the Multifuel Gas Turbine market is expected to reach USD 6,825.2 million.

The power generation segment is expected to dominate due to the increasing adoption of multifuel turbines for flexible and efficient electricity generation.

Key players in the Multifuel Gas Turbine market include General Electric, Siemens Energy, Mitsubishi Power, Kawasaki Heavy Industries, and Ansaldo Energia.

Diaphragm Coupling Market Growth - Trends & Forecast 2025 to 2035

HID Ballast Market Growth - Trends & Forecast 2025 to 2035

Fluid Conveyance Systems Market Growth - Trends & Forecast 2025 to 2035

GCC Magnetic Separator Market Outlook – Growth, Trends & Forecast 2025-2035

United Kingdom Magnetic Separator Market Analysis – Size, Share & Forecast 2025-2035

Glass Door Merchandisers Market Growth - Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.