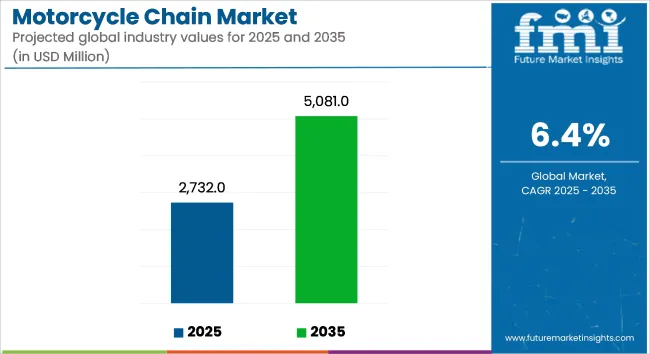

The global motorcycle chain market is estimated at USD 2,732 million in 2025 and is projected to reach USD 5,081 million by 2035, reflecting a CAGR of 6.4% over the forecast period.

Demand is being supported by increased motorcycle production in Asia-Pacific markets, particularly in India, China, and select Southeast Asian countries. Chains with integrated O-ring and X-ring sealing technologies were introduced to improve lubrication retention and reduce wear in dusty and wet riding conditions. These features have been preferred in sport, adventure, and off-road motorcycles. Standard roller chains have continued to be used in commuter-class motorcycles due to cost considerations.

Heavy-duty chain designs incorporating heat-treated steel and nickel plating have been produced to enhance tensile strength and extend replacement intervals. In 2024, lightweight alloy chain prototypes were cited in Chinese patent CN201802814U, which described innovations aimed at reducing mass without compromising load-bearing strength.

Sealed chains have remained the dominant choice in premium and performance-oriented models in North America and Europe. Their use has been associated with reduced maintenance frequency and improved longevity, aligning with recreational and touring applications.

Chain-sprocket replacement kits have been supplied in the aftermarket to facilitate full drivetrain restoration. These kits often include pre-matched components to ensure alignment and tension compatibility during service operations. Tools for chain adjustment and lubrication have also been bundled with premium repair kits to support ease of installation.

Pricing trends have been influenced by fluctuations in steel and alloy input costs. Lightweight chains have been positioned to offer secondary cost advantages by lowering shipping weight and reducing rolling resistance.

Digital platforms have provided instructional content on correct chain tensioning and alignment procedures. Video guides and torque specifications have been made available to improve installation accuracy.

Compliance with global standards such as ISO 8840 has been maintained across production lines, ensuring interchangeability and adherence to defined mechanical tolerances. Warranty terms have continued to require periodic inspection and servicing of chain-sprocket assemblies.

With consistent growth in motorcycle ownership and sustained interest in performance applications, demand for durable and efficient chain systems is expected to remain stable through 2035. Innovation in materials and sealing technologies is anticipated to play a key role in future product development.

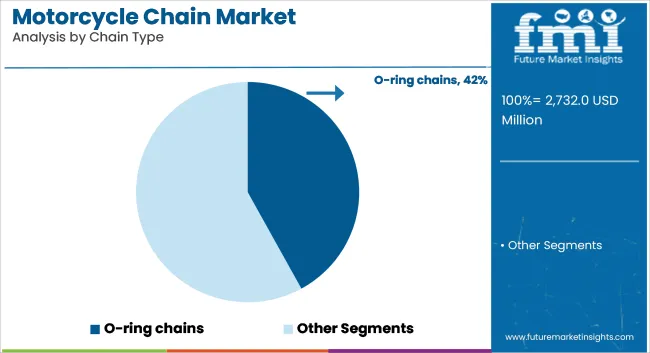

O-ring chains are estimated to account for approximately 42% of the global motorcycle chain market in 2025 and are projected to grow at a CAGR of 6.6% through 2035. These chains offer improved sealing, reduced friction, and longer service life compared to standard ring chains, making them suitable for motorcycles operating under varied load and terrain conditions. In 2025, OEMs and aftermarket suppliers favor O-ring chains for their balance of durability and affordability across mid-range and entry-level sport motorcycles.

Continuous improvements in sealing compounds and heat-treated steel link designs contribute to enhanced performance and reduced wear. As riders prioritize low-maintenance drivetrains, O-ring chains continue to gain preference in both urban commuting and touring segments, particularly in Asia-Pacific and European markets.

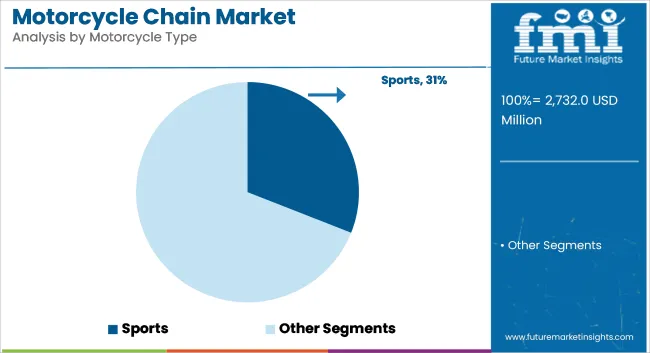

Sports motorcycles are projected to account for 31% of the global motorcycle chain demand in 2025 and are expected to grow at a CAGR of 6.7% through 2035. This segment drives chain adoption through the need for high-speed torque transmission, superior wear resistance, and low chain slack under dynamic riding conditions. Chains used in sports motorcycles are typically subjected to aggressive acceleration, gear shifts, and high RPM operations, prompting demand for precision-engineered links and seals.

Manufacturers focus on developing lightweight, high-tensile chain systems with advanced coatings to reduce friction and extend service intervals. Growth is supported by expanding middleweight and premium sport motorcycle sales in India, Southeast Asia, Europe, and Latin America, where performance, safety, and aftermarket customization trends continue to evolve.

Durability Issues and High Maintenance Costs

The motorcycle chain market faces multiple difficulties because of chain deterioration along with regular lubrication tasks and costly maintenance procedures. A traditional roller chain shows damage from friction while operators need to keep up with periodic cleaning and lubrication work along with tension adjustments to achieve peak output. Harsh weather factors combined with dust, moisture and extreme temperatures continue to shorten the life span of chains.

Heavy-duty motorcycles with performance-driven requirements need premium-grade chains that raise ownership expenses for motorcycle enthusiasts. The main obstacle stands at improving chain longevity and cutting maintenance needs while retaining operational excellence.

Advancements in Materials and Smart Chain Technologies

Self-lubricating and high-tensile strength along with corrosion-resistant motorcycle chains show considerable potential for the market because of their rising market acceptance. Sealed O-ring and X-ring chains along with carbon-reinforced alloys and low-friction coatings increase product lifespan and decrease care needs.

Modern smart chain monitoring systems and embedded sensors with AI-enabled wear detection capabilities make it possible for riders to monitor their chain performance in real time. The rising electric motorcycle market creates a need for lightweight chains that operate quietly with high efficiency thus expanding the market potential.

The United States motorcycle chain market is exhibiting steady growth led by an increase in demand for high-performing motorcycles, growth in recreational biking activities, and developments in motorcycles technology. As adventure touring and off-road biking gain popularity the demand for strong and durable motorcycle chain is rising.

The growth of the motorcycle customization and aftermarket modification business are also expected to drive the demand for performance-enhanced chains, including O-ring and X-ring chains. Fast forward, with the arrival of electric motorcycles, manufacturers have been focusing on lightweight, low-maintenance chain solutions. Market growth is further supported by the presence of leading motorcycle manufacturers and robust aftermarket distribution networks.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 6.5% |

In the UK, the motorcycle chain market is growing because of the surging interest in motorcycle sports, touring, and urban commute. Demand for high-performance chains is being fuelled by the increasing two-wheeler fleet across the country and rising adoption of premium motorcycles.

The changing rules on vehicle emissions in the vehicle space have spurred a transition to lightweight, fuel-efficient motorcycles, which has contributed to the sales of low-friction and wear-resistant chains. Moreover, motorcycle rental and sharing services are driving demand for high-durability chain systems that reduce maintenance costs and improve performance.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 6.3% |

As high-end motorcycles place a premium on chain properties, demand for these materials is robust, while growth in urban mobility solutions and expanding motorcycle transmission technology are also contributing to the growth of the EU motorcycle chain market. Germany, France and Italy are the dominant market leaders in the region with their strong motorcycle manufacturing industry and high consumer demand for touring and sports motorcycles.

This has led to manufacturers developing sealed, self-lubricating motorcycle chains, owing to increasing consumer preference toward low-maintenance and corrosion-resistant chains. Furthermore, European Union (EU) initiatives to promote sustainable mobility are leading to demand for lightweight and energy-efficient motorcycles, which in turn is creating demand for innovative chain solutions. The increasing aftermarket and replacement parts sector also contributes to the growth of the market.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union | 6.5% |

The growth of the Japan motorcycle chain market is propelled by its well-established motorcycle manufacturing industry, advancements in technology, and growing demand for efficient motorcycle components. Well, the continuous demand for qualitative chains is provided due to the presence of major motorcycles manufacturers like Honda, Yamaha, and Suzuki.

The market for electric motorcycles and hybrid two-wheelers is also forcing manufacturers into manufacturing low-noise, lightweight chain alternatives. In addition, Japan has produced heat-treated and self-lubricating chains, thanks to its precision engineering and advanced materials expertise, providing superior durability and performance. Increasing use of urban commuter motorcycles along with delivery bikes is also driving the demand in the market.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 6.4% |

The South Korea motorcycle chain market is growing as a result of rising fuel-efficient two-wheelers, growing motorcycle export, and rising demand for sports and touring 2-wheelers. The presence of strong industry participants in the country, such as motorcycle and aftermarket parts manufacturers, is driving steady market growth.

As motorcycles become increasingly popular for delivery services and in urban areas, the demand for low-maintenance, high durability chain has been on the rise. In addition, governmental incentives for electric two-wheelers have motivated producers to supply energy-efficient transmission, such as space-saving motorcycle chains with lowered friction and extended lifespans.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 6.4% |

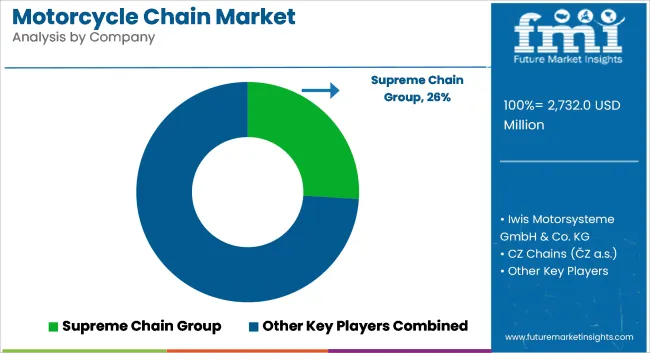

The motorcycle chain market is a competitive market with the demand for chains which are durable, high in performance, and light in weight for motorcycles used in commuting, racing, and off-road applications. These chains, vital for the power transmission system, provide the connection between the engine and the rear wheel.

The major players emphasize use of advanced material, self-lubricating, and high-tensile strength designs to drive performance and durability. Global automotive component suppliers and aftermarket suppliers for everything from commuter bikes to high-performance racing machines are part of the aftermarket motorcycle chain market, alongside specialized motorcycle chain manufacturers.

Other Key Players

Several other companies contribute to the motorcycle chain market with performance-focused, budget-friendly, and specialized chains:

| Report Attributes | Details |

|---|---|

| Current Total Market Size (2025) | USD 2,732 million |

| Projected Market Size (2035) | USD 5,081 million |

| CAGR (2025 to 2035) | 6.4% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD million for value and million units for volume |

| Chain Types Analyzed (Segment 1) | Standard Ring Chain, O-ring Chain, X-ring Chain |

| Motorcycle Types Analyzed (Segment 2) | Standard, Sports, Touring, Cruiser, Off-road, Others |

| Engine Capacities Analyzed (Segment 3) | Up to 150 CC, 150-300 CC, 300-500 CC, Above 500 CC |

| Sales Channels Analyzed (Segment 4) | OEM, Aftermarket |

| Regions Covered | North America; Latin America; Western Europe; Eastern Europe; South Asia and Pacific; East Asia; Middle East & Africa |

| Countries Covered | United States, Canada, Mexico, Brazil, Argentina, Germany, France, United Kingdom, Italy, Spain, Netherlands, China, India, Japan, South Korea, ANZ, GCC Countries, South Africa |

| Key Players influencing the Motorcycle Chain Market | Daido Kogyo Co., Ltd. (D.I.D), Renthal Ltd, RK Japan, Tsubakimoto Chain Co., Sunstar Engineering America, Regina Catene Calibrate S.p.A, Rockman, Rombo, BikeMaster, Enuma Chain Mfg. Co., Ltd. |

| Additional Attributes | Dollar sales by chain type (standard, O-ring, X-ring), Dollar sales by motorcycle category (sports, off-road, touring), OEM vs aftermarket chain demand patterns, Chain innovations in wear resistance and lubrication, Expansion in high-displacement engine segments, Demand surge in emerging motorcycle markets and mobility ecosystems |

| Customization and Pricing | Customization and Pricing Available on Request |

The overall market size for the motorcycle chain market was USD 2,732 million in 2025.

The motorcycle chain market is expected to reach USD 5,081 million in 2035.

The increasing production of motorcycles, rising demand for high-performance and durable chains, and growing preference for advanced chain lubrication technologies fuel the motorcycle chain market during the forecast period.

The top 5 countries driving the development of the motorcycle chain market are the USA, UK, European Union, Japan, and South Korea.

O-Ring Chain and Sports Motorcycle lead market growth to command a significant share over the assessment period.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Motorcycle Chain Sprocket Market Analysis - Size, Share, and Forecast 2025 to 2035

Motorcycle Drive Chain Market Size and Share Forecast Outlook 2025 to 2035

Motorcycle Fuel Hoses Market Size and Share Forecast Outlook 2025 to 2035

Motorcycle Wheels Market Size and Share Forecast Outlook 2025 to 2035

Motorcycle Airbag Jacket Market Size and Share Forecast Outlook 2025 to 2035

Motorcycle Helmet Market Size and Share Forecast Outlook 2025 to 2035

Motorcycle Diagnostic Scan Tools Market Size and Share Forecast Outlook 2025 to 2035

Motorcycle Suspension System Market Growth - Trends & Forecast 2025 to 2035

Motorcycle Lead Acid Battery Market - Trends & Forecast 2025 to 2035

Motorcycle Boots Market Analysis - Size, Share, and Forecast 2025 to 2035

Market Share Insights for Motorcycle Boots Providers

Motorcycle Horn Market Analysis - Size, Share, and Forecast 2024 to 2034

Motorcycle Headlight Bracket Market Growth – Trends & Forecast 2024-2034

Motorcycle Exhaust Mounting Brackets Market

Motorcycle Side Box Market

Motorcycle Hub Motor Market

Motorcycle Sensors Market

Motorcycle Shock Absorbers Market

Motorcycle Start Stop Systems Market

Motorcycle Lighting Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA