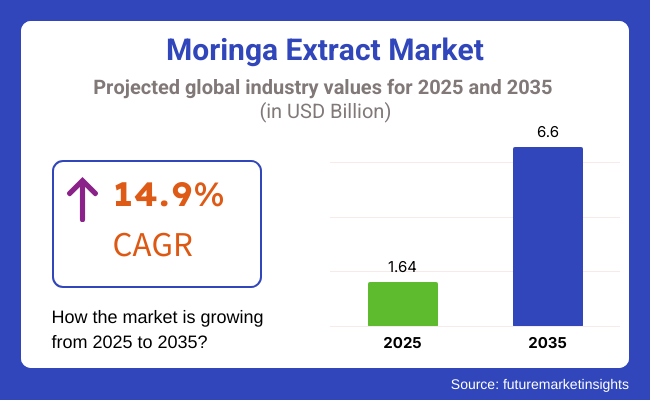

The demand for moringa extract is likely to increase, with an estimated value of USD 1.64 billion in 2025. Moreover, the CAGR is likely to grow at 14.9% during forecast of 2025 and 2035. By 2035 the industry is expected to net a valuation of USD 6.6 billion.

Moringa is extracted from the highly nutritious leaves, seeds and pods of the moringa tree, has recently become very popular due to its various health advantages. Due to its antioxidant, anti-inflammatory and the fact that moringa extract contains much nutrition, it is frequently used in supplements, functional foods, and cosmetics. The increasing consumer preference for plant-based and natural ingredients have been the determinant factor that fuels the pace of the industry.

The sector is buoyed especially by the general public’s increasing knowledge of moringa's health benefits such as promoting immune health, bettering digestion, and boosting energy levels. Conversely, as customers opt for clean-label and sustainable-sourced elements, the demand for organic and non-GMO moringa products rises.

This includes the rising moringa interests in the pharmaceutical and nutraceutical sectors, besides, which further leads to the company's growth. It is already an established trend in the superfood and herbal supplement sectors, evidenced by its penetration into the global industry.

The producers are now including this plant in capsules, powders, teas, and fortified drinks so they can reach a larger clientele that are health-focused. Moringa being a plant that is completely vegan as well as a plant that is rich in nutrients is what makes veganism as well as plant diets quicker to promote industry growth.

Though, the industry is really facing some problems such as supply chain constraints and the raising costs of raw materials. Quality and efficacy of it among several others are very challenging to the producers because of the heterogeneous nature of the agricultural environment which is a factor that depends on the area of production. Also, the fact that there is limited public knowledge in some areas may be a hurdle in the way of the company's growth.

Nonetheless, the industry is on the verge of attaining significant growth. The huge demand for herbal skincare and haircare/healthcare is bringing new business opportunities for the cosmetics industry in which can be used.

Moreover, continuous research and development initiatives are believed to be the catalysts that would lead to the discovery of new, innovative uses of moringa for preventing diseases and promoting overall well-being. One of the most interesting nodal points in the industry is its readiness for considerable expansion in the near future, propelled by the ever-growing consumer preference for natural and functional ingredients.

Explore FMI!

Book a free demo

The industry is growing strongly as a result of heightened consumer interest in natural superfoods and plant-based healthcare solutions. Being rich in antioxidants, vitamins, and essential amino acids, it finds extensive applications in food, beverages, pharmaceuticals, cosmetics, and dietary supplements.

In the food and beverage industry it is incorporated in functional drinks, energy bars, and health powders due to mounting demand for plant-based nutrition. The pharmaceutical industry utilizes its antimicrobial and anti-inflammatory properties and incorporates it as a chief component in herbal preparations and supplements.

The beauty industry combines moringa in skin and hair care formulas, enhancing moisturizing and anti-aging benefits. The animal feed industry, on the other hand, is embracing moringa due to its high protein value and immuno stimulating effects.

Due to increasing consumer demand for organic and sustainable inputs, manufacturers are emphasizing clean-label, non-GMO, and sustainably sourced moringa products to satisfy health-aware customers.

Between 2020 and 2024, the industry experienced significant growth as a result of increasing consumer demand for health benefits associated with natural and nutrient-rich ingredients. Industry growth came on the back of rising demand for natural and organic supplements and a move towards plant-based products.

However, concerns such as regulation compliance and sustainable sourcing needed to be undertaken cautiously by manufacturers. Before the period from 2025 to 2035, the industry will continue to grow. Technological advancements in extraction processes will improve yield and purity, thereby making it cost-effective and more desirable for widespread applications.

The food and beverage sector is expected to expand the application of it, especially in the development of functional foods and beverages, due to their high nutritional value. Focus on sustainability and green responsibility will also promote innovation in environmentally friendly harvesting and processing technologies. Regulation matters and a high amount of research required to reach complete knowledge about the prospects of it can be limiting for industry expansion.

Comparative Market Shift Analysis 2020 to 2024 vs. 2025 to 2035

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Increasing demand for natural and nutrient-dense ingredients | Growing demand for functional foods and beverages with moringa extracts |

| Industry expansion led by dietary supplements and personal care products | Additional expansion with major contributions from the food and beverage sector |

| Early up-take of extraction technologies | Improved extraction processes enhancing yield and purity |

| New guidelines for natural product use | Increased regulations for sustainable sourcing and environmental conservation |

| Maturity of sustainable sourcing practices | Adoption of thoroughgoing sustainability and traceability practices |

| Primarily in supplements and personal care | Expansion into functional foods, beverages, and pharmaceuticals |

The industry is witnessing growth due to the increasing preference of consumers for natural health supplements and functional foods. But the regulatory issues related to organic certification, labeling correctness, and health claims create compliance risks. Firms should follow international food and supplement rules to keep the trust of consumers and have access to the industry.

Supply chain vulnerabilities occur due to the excessive reliance on specific agricultural regions, climate change effect, or quality control failure, all of which can lead to production volatility. Seasonal changes and potential contamination risks in the source regions could lead to supply shortages and price fluctuations.

Consumer awareness and industry education are still the main challenges. Even though moringa is a plant that contains many valuable nutrients, some people may reject its consumption because they are not well informed of its use or effectiveness.

Hence, companies need to conduct focused marketing campaigns, clinical research, and be as transparent as possible with the information on their products in order to increase trust in consumers which in turn would facilitate entering the industry.

Economic recessions and changing health trends might affect the demand for moringa-based goods. Hence, to maintain their growth in the longer term, the companies need to ensure the consumption of their products is affordable, and be innovative and sustainable while making use of the opportunities that lie in functional foods, cosmetics, and pharmaceutical applications.

Due to its stronger nutritional value and antioxidant properties, moringa leaf extract is expected to dominate the industry with an industry share of 63.5% in 2025. Palta is rich in vitamins (A, C, and E), polyphenols, and essential amino acids and is commonly incorporated in dietary supplements, functional foods, and herbal medicines. Rising consumer preference for plant-based nutrition is propelling the demand.

Trailblazers like Kuli Kuli, Organic India, and Moringa Source are already building their product portfolios around it. The rising consumption of moringa-related superfood powders and capsules, especially in North America and Europe, is also expected to drive industry demand.

Thanks to its antimicrobial, anti-inflammatory, and skin-repairing attributes, Moringa extract is also gaining ground for an industry share of 36.5% in 2025. This product is widely used in the cosmetic, pharmaceutical, and water purification industries. The rise in the demand for moringa seed oil in the formulation of skincare products for anti-aging and hydration is the major factor contributing to the growth of this segment.

Companies such as Aayuritz Phytonutrients and Green Virgin Products are using advanced extraction techniques to increase the purity and potency of moringa seed oil. Its antibacterial properties further research is driving its applications in the pharmaceuticals. With scientific validation and consumer awareness, both moringa leaf and seed extracts are forecasted to grow rapidly across end-use sections.

Due to its ability to be easily mixed into various formulations such as smoothies, capsules, teas, and functional foods50, Moringa powder is anticipated to exhibit the largest share of 68.3% in the global industry by 2025. Between the high protein, fiber, vitamins, and the like, its composition makes it an ideal choice for health-conscious individuals, athletes, and vegans.

Moringa powder-infused products from Kuli Kuli and Organic India, as well as other superfood brands, are coming up with cool new food. Another factor contributing to the growth of the industry for moringa powder in terms of demand across North America and Europe during the forecast period is the increasing acceptance of dietary supplements as a nutrition trend, including plant-based and clean-label products in North America and Europe.

Liquid moringa extract is also growing increasingly popular, with an expected 31.7% of the marketplace by 2025 (for herbal tonics, cosmetics formulations, sports, and energy drinks). Cosmeceuticals are dependent on these compounds because of their high bioavailability as well as rapid absorption capacity.

Wellness drinks and organic skincare formulations demand high-quality liquid moringa extracts, so some companies, like Aayuritz Phytonutrients, Green Virgin Products, etc., have already begun producing them. The increasing need for functional beverages that contain herbal and plant-based extracts is expected to experience tremendous growth in this segment in the coming years.

Extracts of moringa, both in powder expectancy & and in fluid form, will again create an important part of the growing health & wellness industry due to consumers increasingly searching for natural & and nutrient-rich items.

| Countries | CAGR (2025 to 2035) |

|---|---|

| USA | 6.8% |

| UK | 5.2% |

| France | 5.5% |

| Germany | 5.8% |

| Italy | 5.1% |

| South Korea | 6.3% |

| Japan | 6% |

| China | 7.4% |

| Australia | 5.7% |

| New Zealand | 5% |

The USA industry will witness a CAGR of 6.8% between 2025 and 2035. The demand for organic and natural products is seeing a boom, thereby driving the use of moringa in dietary supplements, functional foods, and cosmetics. High disposable income and rising wellness trends are driving demand. Industry leaders like Kuli Kuli and Organic India have solidified their position by promoting sustainable agriculture and superior quality moringa products.

Broad-based channels of distribution, including e-commerce, chain food stores, and specialty health food stores, support the USA industry. Growth has also been driven by innovation in the guise of moringa-enhanced energy beverages and protein powder. Moreover, growing health consciousness in terms of plant-based nutrition and the vegan subculture has led to a greater number of consumers embracing moringa as a superfood.

The industry is growing because people are increasingly using herbal supplements. UK-based brand Aduna has made moringa a household name with massive publicity campaigns. Natural and plant-based products have picked up considerably as the trend is toward preventive care and clean-label solutions.

Retail popularity and expansion of direct-to-consumer brands have made availability more widespread, with moringa products now retailed by leading health stores and online. Moringa tea, in keeping with the UK's strong tea culture, is also gaining traction in the industry. Favorable regulatory support for natural supplements has also driven the industry's innovation.

The industry is anticipated to grow at a CAGR of 5.5% from 2025 to 2035. Organic and ethically certified products are what the French consumer prefers; thus, naturally, would prefer moringa-based wellness products, skincare, and supplements. Arkopharma and Nutrisanté are a few of the companies that have incorporated moringa into their herbal product offerings, keeping in mind its health implications.

The increasing number of organic- and vegan-driven consumers has contributed to the increase in the application of moringa in plant-based food and beverage products. The French cosmetics industry also applies moringa today, integrated into anti-aging and moisturizer products due to its antioxidant properties. Increasing knowledge of plant-based ingredients gives moringa a competitive advantage in this sector.

Germany's industry is likely to grow at a CAGR of 5.8%. The intense demand for natural and herbal products in the nation contributes to this growth. Leading German nutraceutical companies such as Salus Haus and BioPräp are incorporating moringa into herbal supplements, leveraging its strong nutrition potential.

Increased demand for organic and bio-certified food has seen moringa emerge as the major constituent in herbal teas, plant protein powder, and energy bars. Additionally, the focus on fair trade and sustainable sourcing in the country helps keep the use of ethically sourced moringa. Consumers' belief in certified organic foods provides a good platform for moringa-based products.

The industry for moringa extract is predicted to register a 5.1% CAGR from 2025 to 2035. Italians place importance on health and natural medicine, and therefore the herbal supplement and functional food industry has expanded. Italian businesses like Erboristeria Magentina have been able to create product lines with the addition of moringa in herbal mixes.

Moringa is becoming more and more popular in Italy's cosmetics industry, with firms producing moringa-based skin and hair products. Mediterranean diet's plant food utilization is replicated in the utilization of moringa as a component of diet-driven consumption of health. The diffusion of organic food culture has also increased the demand for moringa in Italy.

The industry is likely to grow at a CAGR of 6.3%. South Korea's established skincare industry has embraced moringa due to its antioxidant and anti-inflammatory properties, and thus, it is used in K-beauty products. Innisfree and The Face Shop are famous companies that have incorporated moringa products.

Moringa functional foods and beverages are quickly catching on due to South Korea's strong health-focused culture. Increasing demand for traditional herbal medicines and nutraceuticals has driven moringa usage in wellness drinks and superfood powders and further fueled industry growth.

The industry is predicted to record a CAGR of 6%, is driven by the historical use of herbal medicine in Japan. Suntory and Morinaga are some of the popular Japanese brands that have launched moringa-flavored functional beverages and health supplements among health-conscious consumers.

Japan's aging population is also one of the reasons moringa is gaining popularity due to its anti-aging and immunity-boosting effects. Moringa is also incorporated in green teas and matcha-flavored drinks since, with the Japanese, thick nutrient-dense traditional beverages are also the preferred choice.

China is likely to register the highest growth at a CAGR of 7.4%. The country's focus on traditional health care and herbal remedies has created immense demand for moringa goods. Industry giants such as By-Health and Tong Ren Tang are making a push towards herbal products and moringa supplements.

Middle-class population expansion and growing disposable incomes have propelled the demand for premium natural health products. Moringa is also catching pace in the food functional space, with fortified beverages and herbal tonics gaining ground among health-conscious consumers.

The industry is likely to expand at a CAGR of 5.7%. Consumers are realizing their way to superfood and organic foods, and moringa is emerging as the product of choice for dietary supplements. Nutra Organics and other companies have found it profitable to include moringa in wellness products and superfood formulas.

Growing demands for plant protein and plant-based supplements have spurred the utilization of moringa in nutrition and health. Besides this, Australia's stringent organic certification level provides high-quality products for marketing, leading to customer confidence that the products marketed are genuine.

The industry is likely to grow at a CAGR of 5% during the forecast period. A focus on sustainable and organic product focus in New Zealand has driven up the availability of products centered around moringa. One of the companies that have availed themselves of the rising demand for natural health products is Matakana SuperFoods.

The increased need for herbal tea and natural boosters of the immune system has been driving the profile of moringa in the health foods industry. Also, New Zealand's thriving organic farming industry guarantees a healthy environment for local cultivation and production of high-quality moringa products.

The industry is experiencing rapid growth due to increasing consumer awareness of superfoods and the rising demand for plant-based supplements. Moringa extract is incorporated into fortified foods, dietary supplements, personal care products, and medicines, thanks to its high nutritional value and antioxidant properties that may offer various health benefits.

Major players include Kuli Kuli Inc., Organic India, Moringa Initiative Ltd., Grenera Nutrients, and Moringa Farms, excelling in the industry for sustainable sourcing, organic certifications, and diverse products, and the advancement of start-up and niche players offering new formulations such as moringa-infused drinks, powders as well as skin care solutions.

This group of consumers is focusing on the expanding wellness-conscious consumer segment. Products mainly include moringa leaf extract, moringa seed extract, and oil-based formulations with applications in immune-boosting supplements, herbal teas, and clean-label personal care products. Companies invest in high-potency extraction processes to maintain bioactive ingredients while improving efficacy.

Industry evolution is driven by an increase in the demand for nutrition extracted from plants, certifications in sustainability, and increasing applications in nutraceuticals and formulations in skin care. Asia Pacific, especially India and the Philippines, is a key supplier of raw moringa for North America and Europe, two of the most prominent markets in terms of consumption in the world's major superfood consumer regions.

Strategic factors influencing competition include sustainable farming initiatives, activity vertical integration for quality control, and more distribution through e-commerce and health specialty stores. Such combinations enable companies to partner with wellness brands, diversify their product portfolios, and introduce scientific research to develop their positions competitively for future industry growth opportunities.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Kuli Kuli, Inc. | 18-22% |

| Organic India Pvt. Ltd. | 14-18% |

| Moringa Initiative Ltd. | 10-14% |

| Grenera Nutrients Pvt. Ltd. | 8-12% |

| Moringa Farms Inc. | 6-10% |

| Other Players (Combined) | 25-35% |

| Company Name | Key Offerings & Market Focus |

|---|---|

| Kuli Kuli, Inc. | Top organic moringa powder and extract supplier with an emphasis on sustainable sourcing and functional nutrition. |

| Organic India Pvt. Ltd. | Expert in moringa wellness products, with an emphasis on organic agriculture and Ayurvedic health solutions. |

| Moringa Initiative Ltd. | Specializes in high-quality moringa extracts for foods and beverages, tapping into African moringa farm networks. |

| Grenera Nutrients Pvt. Ltd. | World-class, high-quality moringa leaf and seed extract that caters to nutraceutical and dietary supplements. |

| Moringa Farms Inc. | Pure moringa supplements are available to health-conscious consumers and holistic wellness brands. |

Key Company Insights

Kuli Kuli, Inc. (18-22%)

Exporting moringa-based top genetics is preferred by smallholder farmers for fair-trade sourcing, then venturing into retail and functional beverages.

Organic India Pvt. Ltd. (14-18%)

Well-rooted in organic as well as Ayurvedic health markets, integrating it into herbal teas and supplements.

Moringa Initiative Ltd. (10-14%)

Major supplier of African-derived it for high-potency formulations in food, health, and cosmetics industries.

Grenera Nutrients Pvt. Ltd. (8-12%)

Expand in niche bulk solutions for dietary supplements and functional foods in B2B supply of it.

Moringa Farms Inc. (6-10%)

Explores direct marketing of moringa extracts for integral nutrition and plant-based well-being.

The industry is expected to generate USD 1.64 billion in revenue by 2025.

The industry is projected to reach USD 6.6 billion by 2035, growing at a CAGR of 14.9%.

Key players include Kuli Kuli, Inc., Organic India Pvt. Ltd., Moringa Initiative Ltd., Grenera Nutrients Pvt. Ltd., Moringa Farms Inc., Sunfood Superfoods, Ancient Greenfields Pvt. Ltd., H&C Herbal Ingredients, Earth Expo Company, and BioNutrition Inc.

North America and Asia-Pacific, driven by growing awareness of moringa's health benefits, rising demand for organic supplements, and increasing use in functional foods and cosmetics.

Moringa leaf extract dominates due to its high nutritional content, antioxidant properties, and widespread application in dietary supplements, herbal teas, and skincare products.

By product type, the industry is classified as leaf extract, seed extract, bark extract, and root extract.

By form, the industry classified as powder, liquid, and capsules/tablets.

By end use, the industry classified as food and beverages, dietary supplements, cosmetics and personal care, pharmaceuticals, and animal feed.

By distribution channel, the industry classified as hypermarkets/supermarkets, convenience stores, pharmacy & health stores, specialty stores, independent small groceries, online retailing, and others.

By region, the industry divided as North America, Latin America, Europe, East Asia, South Asia, Oceania, and Middle East & Africa.

Aquafeed Enzymes Market Analysis by Enzyme Type, Form, Aquatic Animal, and Region Through 2035

Cattle Nutrition Market Analysis by Cattle Type, Nutrition Type, Application, Life Stage Through 2025 to 2035

Calorie Supplements Market Analysis by Form, Packaging, Flavor, Sales Channel and Region Through 2025 to 2035

Chickpea Milk Market Analysis by Category, Flavor and End Use Through 2025 to 2035

Coconut Butter Market Analysis by End-use Application Sales Channel Through 2025 to 2035

Hydrotreated Vegetable Oil Market Analysis by Type and Application Through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.