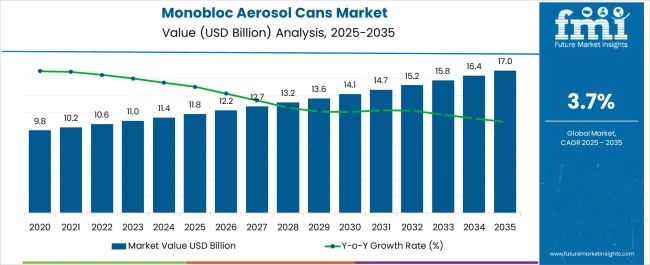

The Monobloc Aerosol Cans Market is estimated to be valued at USD 11.8 billion in 2025 and is projected to reach USD 17.0 billion by 2035, registering a compound annual growth rate (CAGR) of 3.7% over the forecast period.

| Metric | Value |

|---|---|

| Monobloc Aerosol Cans Market Estimated Value in (2025 E) | USD 11.8 billion |

| Monobloc Aerosol Cans Market Forecast Value in (2035 F) | USD 17.0 billion |

| Forecast CAGR (2025 to 2035) | 3.7% |

The monobloc aerosol cans market is undergoing notable advancement, led by sustainability mandates, performance packaging requirements, and growing application in high-demand consumer categories. Demand is rising for lightweight, recyclable metal containers that ensure safe and pressurized dispensing, particularly across sectors such as personal care, pharmaceuticals, and household products.

Regulatory focus on reducing plastic packaging waste has encouraged brand owners to shift to aluminum-based monobloc formats, valued for their barrier properties, aesthetic appeal, and compatibility with compressed gases and propellants. Manufacturing innovation, including impact extrusion and digital printing capabilities, has enabled greater customization and rapid design iteration.

As consumer-facing industries seek packaging that delivers both functionality and branding, the market is expected to benefit from continuous product launches and regional expansion of filling operations. Long-term growth will be supported by aluminum circularity programs, enhanced recycling infrastructure, and increased awareness of low-VOC and environmentally safer propellant systems.

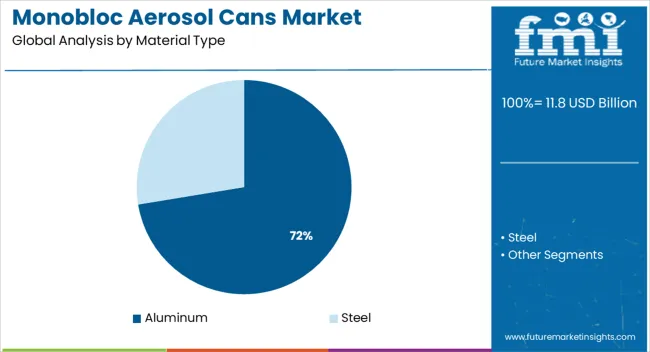

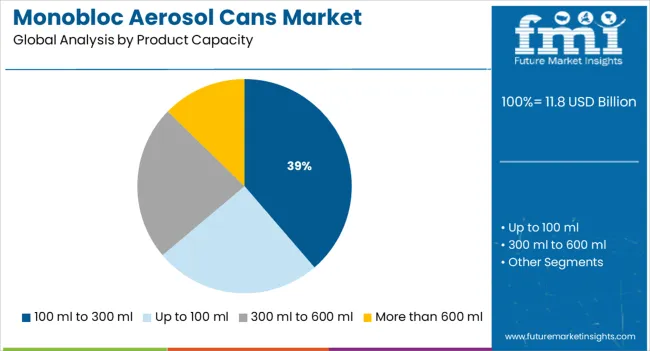

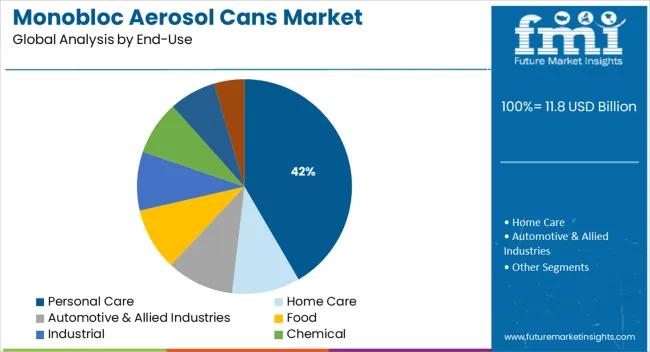

The market is segmented by Material Type, Product Capacity, and End-Use and region. By Material Type, the market is divided into Aluminum and Steel. In terms of Product Capacity, the market is classified into 100 ml to 300 ml, Up to 100 ml, 300 ml to 600 ml, and More than 600 ml. Based on End-Use, the market is segmented into Personal Care, Home Care, Automotive & Allied Industries, Food, Industrial, Chemical, Pharmaceutical, and Insecticides and Pesticides. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Aluminum is projected to dominate the monobloc aerosol cans market in 2025, contributing 72.4% of total revenue. This leading position is being supported by aluminum’s high strength-to-weight ratio, corrosion resistance, and infinite recyclability, making it a preferred choice among environmentally responsible manufacturers.

The material’s compatibility with high-speed extrusion processes and its ability to withstand internal pressure fluctuations without deformation have ensured its consistent use across hygiene, medical, and cosmetic applications. As regulatory focus intensifies on eliminating single-use plastics and improving carbon footprints, aluminum monobloc cans are increasingly being prioritized in brand sustainability roadmaps.

The material’s ability to support both matte and high-gloss finishes also enhances shelf appeal, aligning with premiumization trends across packaging sectors.

The 100 ml to 300 ml segment is expected to account for 38.7% of the total market revenue in 2025, ranking it as the most demanded product capacity range. Its popularity is being driven by rising consumer preference for portable, travel-friendly aerosol packaging that offers sufficient volume without contributing to bulk.

This capacity range strikes a balance between affordability and product lifespan, making it ideal for frequent-use items such as deodorants, hairsprays, and medical sprays. Brands favor this format for limited edition runs and promotional SKUs, as it supports quick turnover and manageable logistics.

Additionally, regional restrictions on maximum carry-on liquid volumes have solidified this segment’s relevance in both domestic and international travel settings.

The personal care industry is forecast to lead the market with 41.6% share of total revenue in 2025, affirming its position as the primary end-use segment for monobloc aerosol cans. Growth in this segment is being driven by increased consumption of products such as hair styling sprays, deodorants, dry shampoos, and shaving foams.

Monobloc aerosol cans offer tamper-resistance, precise dispensing, and superior product preservation attributes highly valued in the personal care category. Consumer expectations for hygienic, durable, and visually attractive packaging continue to drive demand, especially in premium and gender-specific product lines.

Additionally, the ability to support air-powered and low-VOC propellant systems has made monobloc cans a more sustainable choice, aligning with eco-labeling initiatives and clean beauty standards adopted by global brands.

Brands often opt for atmospheric or dip-tube pumps before airless technology becomes available. A low-pressure area is created in front of the product inside the bottle at the pump intake when a dip-tube pump, also known as an atomizer or spray pump, is activated. Low pressure causes air behind the product to flow forward, pushing it forward and into the pump.

While there are two distinct kinds of airless monobloc aerosol cans systems, the airless piston system is by far the most common. For easier product dispensing, airless piston systems incorporate a moulded piston within the bottle. There is an inherent vacuum in airless systems. That suction is kept going thanks to the piston.

The pouch airless method has recently gained traction and, as a result, has cornered a sizable share of the airless industry. A pouching system consists of a stiff bottle housing a soft pouch equipped with an airless pump. In order to prevent air from entering the pouch after the substance has been evacuated, the pouch contracts.

Almost all extruded aluminium monobloc aerosol cans and bottles are presently produced from raw aluminium slugs using impact extrusion. Because of development in metal technology by Ball Corp., extruded aluminium monobloc aerosol cans can now be made from recycled aluminium. The resulting metal alloy is stronger, and more lightweight containers can be made (by as much as 10%) without compromising on safety.

For the Carolina Herrera fragrance collection, the Ardagh Group designed a tinplate three-piece monobloc aerosol cans. The de-bossing mechanism in the aerosol can is intricate.

To complement the understated hues of the ornamentation, this dramatic embossed addition has been added, and a transparent cap shows off the reflective dome and matching actuator. The de-bossing function was custom-made for this endeavour, necessitating adjustments to the manufacturing assembly lines.

Aerosol cans are widely used for the packaging of the variety of liquid products under specified pressure in different end-use industries such as cosmetics & personal care, automotive, home care, and other industries. However, the aerosol cans find its significant application for the packaging of deodorants in the personal care industry.

The aerosol cans are used to suspend fine particles of any liquid in smoke, gas, mist, or smog form. Aerosol cans made up of a single piece of metal is called monobloc aerosol cans. Monobloc aerosol can is a very efficient packaging solution and maintain the integrity of the product packed inside it. It is an ideal packaging and dispensing product.

The monobloc aerosol cans are increasingly becoming popular for the packaging application of a wide variety of products in toiletries, automotive, home care, insecticides, and personal care industry.

Monobloc aerosol cans are generally made up of aluminum material due to its highly recyclable properties. It could be justified by the fact that the processing of recycled aluminum takes 95% less energy than that of energy used in the processing of virgin aluminum material.

However, some factors which need to be considered while designing a monobloc aerosol cans are leak proof, unbreakable, high-pressure resistance, corrosion resistance, heat resistance, and light & air proof characteristics. Monobloc aerosol cans are available in the variety of capacities and could also be customized according to the requirement of brand owners.

Demand for monobloc aerosol cans is increasing at a much faster rate than before due to the increasing consumer inclination towards personal hygiene products such as deodorants. Also, the increase in demand for home care products such as insect sprays, room fresheners, etc. is also driving the demand for the monobloc aerosol cans in the global market.

However, the demand for this product is also expected to grow with the introduction of new features and the latest innovation in the product which will also create new application prospects for the monobloc aerosol cans. Some of the restraints present in the market is the threat of substitute products or the introduction of new alternative packaging solution which might hamper the growth of this market in near future.

Another challenge in this market is the collection of the monobloc aerosol cans for recycling purpose. Existing companies in the monobloc aerosol cans market could focus on expanding their market presence through expansion or acquisition & merger strategy. There are significant opportunities available for contract manufacturing of monobloc aerosol cans in the emerging coutries.

Some of the key players in the Monobloc Aerosol Cans market are Pioneer Group, Tecnocap S.p.A., The Metlac Group, Ball Corporation, ATP Group, ALUCON Public Co. Ltd., Girnar Group, LINHARDT GmbH & Co.KG, Alumatic Cans Pvt. Ltd., and HAYK Industries.

The Monobloc Aerosol Cans market report is a compilation of first-hand information, qualitative and quantitative assessment by industry analysts, inputs from industry experts and industry participants across the value chain.

The Monobloc Aerosol Cans market report provides in-depth analysis of parent market trends, macroeconomic indicators and governing factors along with market attractiveness as per segments. The Monobloc Aerosol Cans market report also maps the qualitative impact of various market factors on market segments and geographies.

The global monobloc aerosol cans market is estimated to be valued at USD 11.8 billion in 2025.

The market size for the monobloc aerosol cans market is projected to reach USD 17.0 billion by 2035.

The monobloc aerosol cans market is expected to grow at a 3.7% CAGR between 2025 and 2035.

The key product types in monobloc aerosol cans market are aluminum and steel.

In terms of product capacity, 100 ml to 300 ml segment to command 38.7% share in the monobloc aerosol cans market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Aerosol Cap Market Size and Share Forecast Outlook 2025 to 2035

Aerosol Packaging Market Size and Share Forecast Outlook 2025 to 2035

Aerosol Printing And Graphics Market Size and Share Forecast Outlook 2025 to 2035

Aerosol Market Size and Share Forecast Outlook 2025 to 2035

Aerosol Filling Machines Market Size and Share Forecast Outlook 2025 to 2035

Aerosol Propellants Market Size and Share Forecast Outlook 2025 to 2035

Market Leaders & Share in the Aerosol Packaging Industry

Analyzing Aerosol Cap Market Share & Industry Leaders

Market Share Breakdown of Aerosol Valves Industry

Market Share Breakdown of Aerosol Printing and Graphics

Market Share Insights of Aerosol Actuators Product Providers

Aerosol Valves Market Growth and Trends 2025 to 2035

Aerosol Sprayers Market

Aerosol Dispensing Systems Market

Non-Aerosol Overcaps Market Size and Share Forecast Outlook 2025 to 2035

VCI Aerosol Market

Metal Aerosol Can Market Size and Share Forecast Outlook 2025 to 2035

Metal Aerosol Packaging Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Plastic Aerosol Packaging Market

Aluminum Aerosol Cans Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA