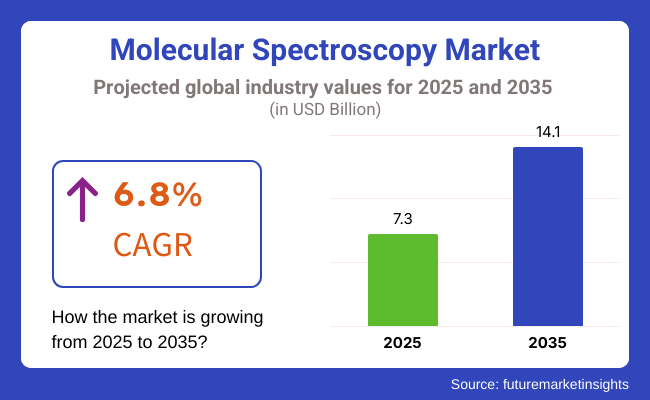

The global molecular spectroscopy market is estimated to be valued at USD 7.3 billion in 2025 and is projected to reach USD 14.1 billion by 2035, registering a compound annual growth rate (CAGR) of 6.8% over the forecast period.

The market is expanding rapidly, driven by growing adoption across pharmaceutical, environmental, food safety, and materials research sectors. Increasing regulatory stringency for quality control in drug manufacturing, food analysis, and industrial processing is elevating the demand for precise, high-throughput molecular analysis platforms.

Biopharmaceutical companies are integrating spectroscopy for real-time monitoring during continuous manufacturing processes, ensuring product consistency and regulatory compliance. Simultaneously, emerging clinical diagnostic applications such as metabolomics and biomarker discovery are expanding the market’s footprint.

Leading manufacturers such as Thermo Fisher Scientific, Bruker Corporation, Agilent Technologies, PerkinElmer, and Shimadzu are actively expanding their molecular spectroscopy portfolios through platform innovation, cloud-based analytics, and global partnerships. Key drivers include growing demand for GMP-compliant real-time analytics, process analytical technologies (PAT), and miniaturized portable spectroscopy systems for field-based applications. At Pittcon 2025, HORIBA launched Veloci system and PoliSpectra Rapid Raman Plate Reader (RPR).

“The pharmaceutical industry is increasingly using fluorescence spectroscopy, as a Process Analytical Technology (PAT) for manufacturing control. A-TEEM provides similar information to mass spectrometry and chromatography, but faster and easier, typically no consumables, while like any optical technique is easily implemented,” said Andrew Whitley, Vice President, HORIBA Life Science Business. These launches strengthen positioning for manufacturers in GMP-regulated pharmaceutical and biotechnology labs, offering scalable solutions that adapt to both R&D and manufacturing workflows.

North America leads the molecular spectroscopy market, underpinned by strong pharmaceutical manufacturing, advanced materials research, and environmental monitoring programs. The FDA’s continued emphasis on real-time release testing (RTRT) and process analytical technologies (PAT) has accelerated spectroscopy adoption in biopharmaceutical manufacturing. Strategic collaborations between major manufacturers and academic centers are advancing applications in clinical diagnostics and nanomaterials characterization.

Europe is witnessing accelerated growth driven by regulatory harmonization under EMA and EFSA standards, alongside growing biopharmaceutical production and food safety initiatives. Europe’s multi-sector demand diversification is positioning the region for strong mid-to-long-term growth in both clinical and industrial molecular spectroscopy segments.

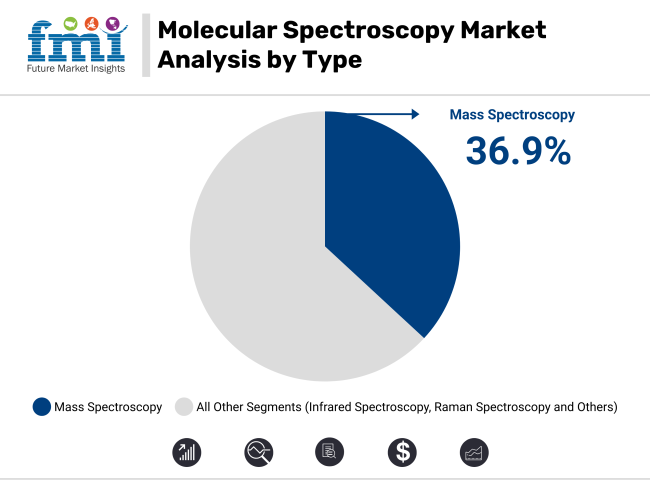

In 2025, mass spectroscopy is expected to capture 36.9% of the revenue share in the molecular spectroscopy market. This dominance is attributed to its high sensitivity, precision, and versatility in molecular analysis, making it essential in various applications, including proteomics, metabolomics, and environmental analysis. Mass spectroscopy provides detailed molecular information, enabling researchers to identify and quantify compounds with high accuracy.

Its ability to analyze complex mixtures and perform high-throughput screening has made it the preferred technology in pharmaceuticals, biotechnology, and environmental testing. Additionally, advancements in mass spectrometry technology, such as improved resolution and faster data acquisition, have further expanded its applications and made it more accessible to a broader range of industries.

The growing demand for molecular analysis in drug development, clinical research, and environmental monitoring has further fueled the growth of mass spectroscopy, solidifying its position as the leading technology in the market.

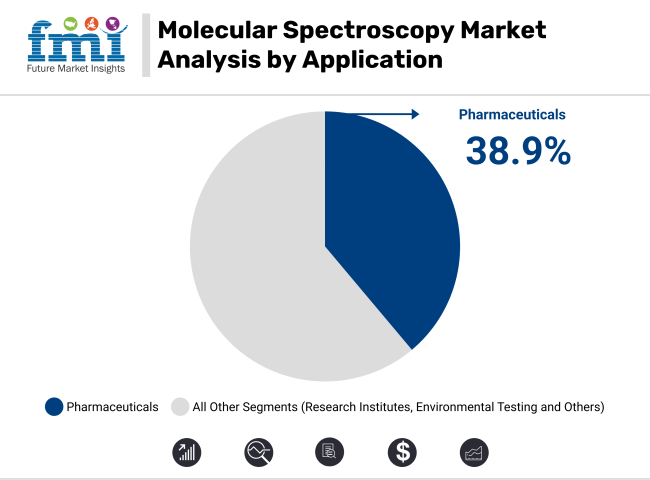

In 2025, pharmaceutical applications are projected to account for 38.9% of the total revenue share in the molecular spectroscopy market. This segment's leadership is driven by the critical role molecular spectroscopy plays in drug discovery, development, and quality control in the pharmaceutical industry. Spectroscopic techniques, such as IR, NMR, and UV-Vis spectroscopy, are widely used to analyze the chemical structure, composition, and stability of pharmaceutical compounds.

The growth of the pharmaceutical applications segment has been fueled by the increasing need for precise, non-destructive testing methods during drug formulation and manufacturing. Additionally, the growing emphasis on personalized medicine and the need for regulatory-compliant drug testing have contributed to the expanding use of molecular spectroscopy in the pharmaceutical sector.

Molecular Spectroscopy: Intricate Instruments and High Price Tags

The challenge faced in the Molecular Spectroscopy Market include high cost and complexity of spectroscopic instrumentation. Research laboratories, pharmaceutical companies, and academic institutions often find molecular spectroscopy tools to be expensive; tools such as nuclear magnetic resonance (NMR), infrared (IR), and Raman spectroscopy. Such devices have complex hardware that requires specialized domain knowledge for effective operation, calibration and results interpretation resulting in a steep learning curve for practitioners.

Moreover, interfaces with current lab systems and meeting regulatory requirements create additional challenges. These challenges can be mitigated if manufacturers design affordable, user-friendly spectroscopic solutions with automated analysis capabilities for seamless integration. Wider adoption and relief in terms of operational complexities will also be reached through improved training programs, AI-based spectral interpretation, and modular spectroscopic systems.

Technological Advancements and Expanding Applications

The expanding use of molecular spectroscopy in the pharmaceutical, biotechnology, environmental monitoring, and food safety industries creates lucrative market opportunities. This pushes the efficiency and accuracy of molecular analysis forward through advances in miniaturized spectrometers, AI-powered spectral analysis, and high-throughput screening techniques. The need for quick, portable spectroscopic tools for field work in industries such as agriculture, forensics and chemical processing is also driving innovation.

In addition to that, molecular spectroscopy is one of the important techniques underlying each of personalized medicine, drug discovery, and quality control processes. Investments in AI-powered spectroscopy, the establishment of cloud-based spectral databases, and software-enabled automation for spectroscopic workflows will also give all of these companies a competitive edge. Interest in green chemistry is also being driven by sustainability initiatives, with spectroscopy playing a key role in monitoring the environmentally-friendly synthesis of chemical compounds and reduction of waste.

Strong investments in pharmaceutical research, biotechnology developments and stringent regulatory configuration for quality control, are supporting leading to make United States molecular spectroscopy market the largest worldwide. Key players in the market for spectroscopy instruments, including Thermo Fisher Scientific, Agilent Technologies, and Bruker Corporation, promote consistent technology development.

Modern pharmaceutical and biotechnology industries are the largest consumers of molecular spectroscopy techniques such as NMR, Raman and mass spectrometry for drug development, biomarker discovery and quality control. Drug safety testing requires extensive analytical testing by the USA Food and Drug Administration (FDA), leading to a surge in demand for accurate analytical methods of identification in spectroscopy methods.

The environmental end-use market is another major driver, with spectroscopy being employed for water quality monitoring, air pollution analysis and hazardous substance detection. Moreover, their growing emphasis, like personalized medicine and genomics, is expected to drive the infrared and Raman spectroscopy market for molecular diagnostics.

Driven by ongoing research in advanced spectroscopy techniques and eminent regulatory support for analytical testing, USA molecular spectroscopy market is poised to garner additional revenues and witness significant growth over the forecast period.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 7.2% |

The United Kingdom molecular spectroscopy market is driven by increasing investments in life sciences, government initiatives in pharmaceutical R&D, and the expanding applications in food safety and environmental monitoring. Molecular spectroscopy is widely utilised within the UK’s biopharmaceutical sector, which includes AstraZeneca and GlaxoSmithKline (GSK) among its major businesses for drug discovery and quality assurance.

Infrared and Raman spectroscopy are being increasingly embraced corporate fundamental diagnostic tools by the National Health Service and academic research institutions. In addition, the ongoing commitment to environmental sustainability is leading to an increase in the demand for spectroscopy-based air and water quality testing solutions in the UK.

AI-based spectroscopic systems are increasingly being integrated, improving quantitative accuracy and precision in fields such as materials science, forensics and precision medicine. Growth for the molecular spectroscopy market in the UK will be steady with continuing investments in nanotechnology and bioanalytical research.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 6.5% |

The market in European region is driven by stringent regulatory requirements, increased use of advanced analytical techniques in pharma and biotech, and growing focus on environmental protection. Germany, France and the Netherlands leads the spectroscopy research in the world.

The European pharmaceutical and chemical industry with its largest specialized hub in Germany plays a key role in the market of High-Resolution NMR in the field of drug analysis and material characterization (mass spectrometry, UV-Vis spectroscopy, etc.). Upon the EU's strict food safety regulations under EFSA (European Food Safety Authority), molecular spectroscopy is being adopted to detect contaminants, toxins, and adulterants in food products.

Moreover, the EU initiative for climate change mitigation is contributing to the demand for molecular spectroscopy based environment monitoring solutions. Also bolstering market expansion are advancements in quantum-based spectroscopy and AI-driven molecular analysis.

Solid growth is expected in the EU molecular spectroscopy market, supported by robust investments in pharmaceutical research and development, clean energy applications, and quality control in manufacturing.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 6.9% |

The steady growth of the Japan molecular spectroscopy market is attributed to increase in precision medicine, robust pharmaceutical R&D activities, and adoption of artificial intelligence-based analytical instruments. Major users of high-resolution NMR and mass spectrometry for drug development and proteomics research are Japan’s leading biopharmaceutical companies like Takeda and Astellas.

As the population in Japan ages, this is driving the need for diagnostic solutions based on spectroscopy, such as cancer research, biomarker discovery, and clinical testing segment. AI- and automation-enabled integration of spectroscopy is improving the efficiency of real-time molecular analysis and high-throughput screening.

Japan’s semiconductor and electronics industries are also embracing Raman and infrared spectroscopy for material characterization and failure analysis. The combination with ongoing investments in nanotechnology, regenerative medicine, and AI lab automation will position the Japanese molecular spectroscopy market for successful growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 6.7% |

Driving the South Korean molecular spectroscopy market are investments in biotech research, demand for precision diagnostics and adoption of spectroscopy in industrial applications. Positioning South Korea as a leader in analytical instrumentation, AI-enabled research and advanced manufacturing, further increasing demand for spectroscopy solutions for both quality control and material analysis.

These sectors are primarily driven by biopharmaceutical and life sciences industries owing to the application of mass spectrometry and NMR spectroscopy in drug discovery and metabolomics research. Moreover, growing applications of infrared and Raman spectroscopy in material characterization in the expanding semiconductor and nanotechnology sectors are supporting demand.

Strict government initiatives taken up by South Korea towards digital healthcare and lab automation are facilitating the adoption of AI-powered spectroscopy instruments in clinical diagnostics and personalized medicine. The South Korea molecular spectroscopy market is anticipated to grow at a steady pace, due to the continuous advancements in bioanalytical technologies and precision medicine.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 6.8% |

Growing need for advanced analytical techniques in pharmaceuticals, biotechnology, environmental testing, and food safety is driving the molecular spectroscopy market. Upon High-Performance Computing, real-time Data Interpretation, Precision in Automations, the need for AI-based Spectral Analysis, Miniaturized Spectroscopy Devices, and Cloud Analysis are some trends that companies are focusing on.

The market analysis helps in forming a better understanding of the different factors contributing to this market, which is in turn influencing service offerings by global analytical instrumentation providers and specialized spectroscopy manufacturers in the portfolio expansion with new technological developments in Raman spectroscopy, NMR spectroscopy, mass spectrometry, and infrared (IR) spectroscopy.

Thermo Fisher Scientific, Inc. (15-20%)

Thermo Fisher also uses cloud-based AI assisted spectral analysis that leads the molecular spectroscopy market, including FTIR, Raman, and UV-Vis spectroscopy instruments.

Agilent Technologies, Inc.4 (12-16%)

Agilent is focused on NMR spectroscopy, mass spectrometry and fluorescence analysis, enabling the optimization of workflows in pharmaceutical and chemical analysis.

Bruker Corporation (10-14%)

As a leader in life science instrumentation, Bruker offers high-resolution NMR and vibrational spectroscopy solutions that provide high-precision molecular structure identification.

PerkinElmer, Inc. (8-12%)

PerkinElmer develops portable and high throughput spectroscopy instruments for food safety and environmental analysis for rapid screening.

Shimadzu Corporation (5-9%)

Shimadzu builds automated FTIR, NIR, and fluorescence spectroscopy to deliver AI-guided realtime data analysis.

Other Key Players (40-50% Combined)

Several analytical instrumentation companies contribute to next-generation spectroscopy solutions, AI-driven spectral analysis, and miniaturized spectroscopy devices. These include:

The overall market size for Molecular Spectroscopy Market was USD 7.3 Billion in 2025.

The Molecular Spectroscopy Market expected to reach USD 14.1 Billion in 2035.

The demand for the Molecular Spectroscopy Market will be driven by the growing need for precise analytical techniques in pharmaceuticals, environmental testing, and food safety. Advancements in technology and increased applications in research and diagnostics will further support market growth.

The top 5 countries which drives the development of Molecular Spectroscopy Market are USA, UK, Europe Union, Japan and South Korea.

Infrared Spectroscopy and Nuclear Magnetic Resonance (NMR) Spectroscopy Drive Market to command significant share over the assessment period.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 4: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 5: North America Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 6: North America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 7: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 8: Latin America Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 9: Latin America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 10: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 11: Western Europe Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 12: Western Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 13: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 14: Eastern Europe Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 15: Eastern Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 16: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 17: South Asia and Pacific Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 18: South Asia and Pacific Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 19: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 20: East Asia Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 21: East Asia Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 22: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 23: Middle East and Africa Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 24: Middle East and Africa Market Value (US$ Million) Forecast by Application, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Application, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 4: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 5: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 6: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 7: Global Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 8: Global Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 9: Global Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 10: Global Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 11: Global Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 12: Global Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 13: Global Market Attractiveness by Type, 2023 to 2033

Figure 14: Global Market Attractiveness by Application, 2023 to 2033

Figure 15: Global Market Attractiveness by Region, 2023 to 2033

Figure 16: North America Market Value (US$ Million) by Type, 2023 to 2033

Figure 17: North America Market Value (US$ Million) by Application, 2023 to 2033

Figure 18: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 19: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 20: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 21: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 22: North America Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 23: North America Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 24: North America Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 25: North America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 26: North America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 27: North America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 28: North America Market Attractiveness by Type, 2023 to 2033

Figure 29: North America Market Attractiveness by Application, 2023 to 2033

Figure 30: North America Market Attractiveness by Country, 2023 to 2033

Figure 31: Latin America Market Value (US$ Million) by Type, 2023 to 2033

Figure 32: Latin America Market Value (US$ Million) by Application, 2023 to 2033

Figure 33: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 34: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 35: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 36: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 37: Latin America Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 38: Latin America Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 39: Latin America Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 40: Latin America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 41: Latin America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 42: Latin America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 43: Latin America Market Attractiveness by Type, 2023 to 2033

Figure 44: Latin America Market Attractiveness by Application, 2023 to 2033

Figure 45: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 46: Western Europe Market Value (US$ Million) by Type, 2023 to 2033

Figure 47: Western Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 48: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 49: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 50: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 51: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 52: Western Europe Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 53: Western Europe Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 54: Western Europe Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 55: Western Europe Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 56: Western Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 57: Western Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 58: Western Europe Market Attractiveness by Type, 2023 to 2033

Figure 59: Western Europe Market Attractiveness by Application, 2023 to 2033

Figure 60: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 61: Eastern Europe Market Value (US$ Million) by Type, 2023 to 2033

Figure 62: Eastern Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 63: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 64: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 65: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 66: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 67: Eastern Europe Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 68: Eastern Europe Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 69: Eastern Europe Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 70: Eastern Europe Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 71: Eastern Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 72: Eastern Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 73: Eastern Europe Market Attractiveness by Type, 2023 to 2033

Figure 74: Eastern Europe Market Attractiveness by Application, 2023 to 2033

Figure 75: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 76: South Asia and Pacific Market Value (US$ Million) by Type, 2023 to 2033

Figure 77: South Asia and Pacific Market Value (US$ Million) by Application, 2023 to 2033

Figure 78: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 79: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 80: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 81: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 82: South Asia and Pacific Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 83: South Asia and Pacific Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 84: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 85: South Asia and Pacific Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 86: South Asia and Pacific Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 87: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 88: South Asia and Pacific Market Attractiveness by Type, 2023 to 2033

Figure 89: South Asia and Pacific Market Attractiveness by Application, 2023 to 2033

Figure 90: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 91: East Asia Market Value (US$ Million) by Type, 2023 to 2033

Figure 92: East Asia Market Value (US$ Million) by Application, 2023 to 2033

Figure 93: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 94: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 95: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 96: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 97: East Asia Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 98: East Asia Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 99: East Asia Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 100: East Asia Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 101: East Asia Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 102: East Asia Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 103: East Asia Market Attractiveness by Type, 2023 to 2033

Figure 104: East Asia Market Attractiveness by Application, 2023 to 2033

Figure 105: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 106: Middle East and Africa Market Value (US$ Million) by Type, 2023 to 2033

Figure 107: Middle East and Africa Market Value (US$ Million) by Application, 2023 to 2033

Figure 108: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 109: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 110: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 111: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 112: Middle East and Africa Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 113: Middle East and Africa Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 114: Middle East and Africa Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 115: Middle East and Africa Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 116: Middle East and Africa Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 117: Middle East and Africa Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 118: Middle East and Africa Market Attractiveness by Type, 2023 to 2033

Figure 119: Middle East and Africa Market Attractiveness by Application, 2023 to 2033

Figure 120: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Molecular Diagnostic Market Size and Share Forecast Outlook 2025 to 2035

Molecular Respiratory Panels Market Size and Share Forecast Outlook 2025 to 2035

Molecular Diagnostics In Pharmacogenomics Market Size and Share Forecast Outlook 2025 to 2035

Molecular Biomarkers For Cancer Detection Market Size and Share Forecast Outlook 2025 to 2035

Molecular Cytogenetics Market Size and Share Forecast Outlook 2025 to 2035

Molecular Biology Enzymes, Kits & Reagents Market Trends and Forecast 2025 to 2035

Molecular Breast Imaging Market – Trends & Forecast 2025 to 2035

Molecular Quality Controls Market Overview - Trends & Forecast 2025 to 2035

Molecular Imaging Market is segmented by modality type, application and end user from 2025 to 2035

Molecular Microbiology Market

Low Molecular Weight Chondroitin Sulfate Sodium Market Size and Share Forecast Outlook 2025 to 2035

13X Molecular Sieve Activated Powder Market Size and Share Forecast Outlook 2025 to 2035

High Molecular Ammonium Polyphosphate Market Size and Share Forecast Outlook 2025 to 2035

Orthomolecular Medicine Market

Viral Molecular Diagnostics Market Size and Share Forecast Outlook 2025 to 2035

At-home Molecular Testing Market Size and Share Forecast Outlook 2025 to 2035

Automated Molecular Diagnostics Testing System Market Size and Share Forecast Outlook 2025 to 2035

Multiplex Molecular Diagnostics Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Molecular Diagnostics Market Growth - Trends & Forecast 2025 to 2035

Market Share Distribution Among Ultra-High Molecular Weight Polyethylene Manufacturers

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA