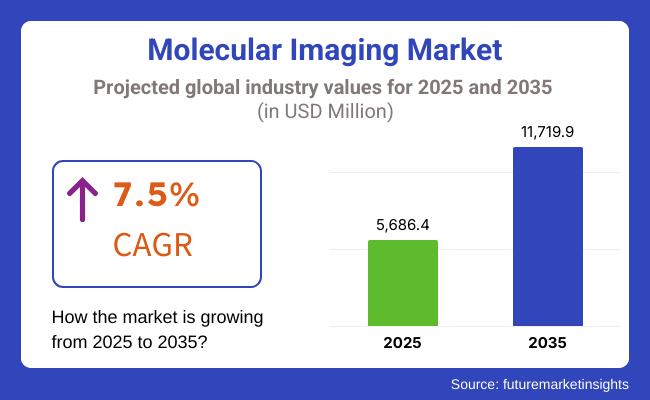

The global market for molecular imaging is forecasted to attain USD 5,686.4 million by 2025, expanding at 7.5% CAGR to reach USD 11,719.9 million by 2035. In 2024, the revenue of molecular imaging was around USD 5,312.3 million.

Molecular imaging, the emerging field in biomedical research, allows visualization, differentiation, and quantitation of various biological processes at the molecular and cellular levels inside a living organism. In contrast to classical microscopic biomedical imaging, molecular imaging targets specific molecular pathways and mechanisms associated with a particular disease found within a living body.

It enables clinical scientists and researchers to study the molecular abnormalities taking place inside the body to carry out early detection of a disease and to optimize medications aiming for disease-related molecular targets.

Nuclear medicine plays a vital role in conducting a molecular imaging process and can be broadly used to treat distinct cancers and related diseases. Nuclear medicine, such as radiopharmaceuticals, is used to diagnose and treat disease or cancer.

Molecular imaging in clinical practice is currently inclined towards hybrid methodologies PET-CT, SPECT-CT, or PET-MR-that profile high-resolution anatomical imaging as opposed to the typical standalone diagnostic and imaging modalities available worldwide, and this is likely to bolster the growth of the molecular imaging market.

It was in the previous period during which such advanced devices were purchased and sold in the marketplace, including the PET-CT, PET-MR, or SPECT-MR advanced devices, for the better and more accurate localization of tracer hot spots in anatomy, providing better diagnosis and therapeutic marshaling.

Expenditure by the government on healthcare facilities, like favorable reimbursement for molecular imaging and treatment, propelled the market's growth. The growing ageing population and the rising incidence of cardiology, neurology and oncology conditions drive the need for different body scans and tissue injuries, affecting the market for molecular imaging.

The positive government policies towards start-up firms like medical device producers and new manufacturing establishments by top manufacturers of developing economies are expected to drive the growth of this market during the forecast period. The growing per capita expenditure on healthcare for quality patient care and for advanced treatments is also expected to drive the growth of the global molecular imaging market.

Explore FMI!

Book a free demo

North America is also anticipated to possess a commanding market share for molecular imaging throughout the forecast period. This supremacy can be put down to a robust healthcare structure, healthy investment in R&D, and a high prevalence of chronic diseases that require advanced diagnostic solutions, thereby fueling this market.

The United States is expected to be a key contributor to this market, mainly because of the presence of some major players in the market and a firm accent on technological innovations. Furthermore, this region is spurred on by promoting early detection and prevention of diseases and personalized medicine.

On the other hand, image equipment costs and procedures may handicap access to molecular imaging modalities for populations with little or no medical insurance. Moreover, the stringent regulatory requirements may easily impose barriers to market entry and hinder the approval of new imaging agents.

Europe is sharing a massive part in the market for molecule imaging, with rising health care spending, an increase in the prevalent segment of aged populaces, and rousing cases of chronic diseases having their roots there. Germany, France, and the United Kingdom lead, with calibrated healthcare systems and involvement in medical research.

The region benefits from the collaboration between academia and industry in new imaging technologies and the development of new radiotracers. However, the huge income gaps in the various European regions will continue to lead to uneven access to advanced imaging modalities. Shameless exploitation of the intricate regulatory structure of the European Union leads to several challenges for the manufacturers.

The Asia-Pacific region is expected to rise quickly during the predicted years for the molecular imaging market. This boom could be attributed to increased investment and development in healthcare infrastructure and increasingly enhanced health awareness and recognition for early detection or diagnosis of disease.

Countries like China, India, and Japan witness a growing prevalence of chronic diseases, which increases the demand for sophisticated diagnostic modalities. The government initiatives toward better healthcare services and research collaborations providing positive results will also support market growth.

However, challenges such as limited access to modern healthcare in rural regions, economic disparities, and immense variability in regulatory frameworks among the nations may restrain the penetration into the market.

Nonetheless, this region presents huge opportunities for growth through value-based partnerships, in-country product development, and educated initiatives to promote the benefits of molecular imaging while overcoming challenges.

Frequent Product Recalls Hampers the Molecular Imaging

Product recall and safety concerns due to the adverse events associated with molecular imaging, including side effects, may hamper the growth of the global molecular imaging market.

The stringent rules and regulations by the USA Food and Drug Administration, such as (FDA) 510 (K) for molecular imaging devices and the European Commission for new product launches and marketing and sales activities may hinder the growth of the global molecular imaging market. The higher price of molecular imaging devices may also become a cost restraint for the global market over the forecast period.

Increasing Focus on Personalized Medicine Expands the Opportunities in the Molecular Imaging Market

Growing attention on personalized medicine presents opportunities for imaging agent design customized to an individual's disease biomarker, with heightened diagnostic specificity and treatment effectiveness.

Technological advancements, including combinations of artificial intelligence and machine learning, are opening doors to innovative possibilities for the analysis and interpretation of images, workflow efficiency, and diagnostic accuracy. Furthermore, increasing numbers of people developing chronic diseases all over the world make necessary more and better diagnostic methods of early recognition with timely treatment.

Partnerships among pharmaceutical, research institutes, and medical device corporations could develop innovative new imaging probes and help further utilize molecular imaging to target areas such as new treatments and targeted drugs. Furthermore, growth in emerging markets and the creation of affordable imaging solutions specific to these markets hold significant growth opportunities.

Advancing Precision Medicine: The Evolving Landscape of Molecular Imaging:

The market has transformed in many ways, with new hybrid recording devices such as PET/MRI and PET/CT improving diagnostic accuracy in early disease identification. Targeted molecular imaging agents, including radiopharmaceuticals, have enhanced diagnosis in oncology, cardiology, and neurology. It also allows individualized therapeutic regimens based on genetics.

The continued placement of molecular imaging in preclinical investigations and clinical trials has only solidified the position of molecular imaging in drug discovery. Improved image processing algorithms enhance digital data interpretation, thus improving patient outcomes.

New trends within molecular imaging have shifted to focusing early on detecting disease-increasingly-or, for many of these cases, cancers and diseases related to the nervous system. Theranostics is the new word for combining a diagnostic procedure and therapy.

AI integration improves the quality of image analysis and, hence, diagnostic performance, while utilizing portable imaging devices expands the accessibility of these technologies for deployable point-of-care use.

The molecular imaging market was predicted to grow between 2020 and 2024 owing to the increased demand for early-stage disease diagnosis due in part to commercialized innovations in imaging agents and a general increase in hybrid system adoption.

For oncology, cardiology, and neurology applications, PET, SPECT, and optical imaging systems gained increasing application as the systems improved disease detection and effective treatment planning. AI-related innovations in image analysis offered further innovative and accurate radiotracers for sophisticated disease diagnostics.

On the downside, equipment costs have proved high, with those most promising potentials equally challenged by regulatory barriers and disruptions in supply chains related to radiopharmaceuticals.

One will witness the market characterized by AI-enabled image processing, improved specificity next-gen tracers, and broader avenues on molecular imaging into personalized medicine during 2025 to 2035. Regulatory agencies will streamline new guidelines around approvals for imaging agents and AI-driven diagnostics.

An increase in investments in theranostics-those combined therapy and diagnostics- will thus contribute to the market's growth. Sustainability efforts would entail a reduction in radioactive wastes and the creation of eco-friendly imaging materials. Localized radiopharmaceutical production and establishing multinational distribution networks would also achieve resilience in the supply chain.

Shifts in the Molecular Imaging Market from 2020 to 2024 and Future Trends (2025 to 2035)

| Category | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Strict FDA and EMA approvals for new tracers and imaging systems; growing emphasis on patient safety. |

| Technological Advancements | Growth of hybrid imaging (PET-CT, PET-MRI), AI-powered image analysis, and development of novel radiotracers. |

| Consumer Demand | Increased adoption in oncology, cardiology, and neurology for early disease detection. |

| Market Growth Drivers | Improved imaging technology increases chronic disease prevalence and health care costs. |

| Sustainability | Limited focus on sustainability; challenges in managing radioactive waste from tracers. |

| Supply Chain Dynamics | Dependence on centralized radiopharmaceutical production; occasional shortages due to supply chain disruptions. |

| Category | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Streamlined regulatory processes for AI-driven diagnostics and next-generation radiotracers. |

| Technological Advancements | Expansion of AI-driven image interpretation, high-resolution molecular imaging, and targeted theranostics. |

| Consumer Demand | Increasingly applied in personalized medicine, regenerative medicine, and treatment by AI-assisted precision diagnostics. |

| Market Growth Drivers | Expansion into emerging markets, increased focus on theranostics, and novel PET and SPECT tracers development. |

| Sustainability | Development of eco-friendly tracers, reduced radiation exposure imaging techniques, and sustainable disposal methods. |

| Supply Chain Dynamics | Diversified radiotracer production, localized manufacturing, and improved global distribution networks. |

Market Outlook

The molecular imaging market is big in the states and astonishing; the growth rate of this development, however, is still very much dependent upon the interesting number of patients suffering from chronic diseases such as cancer and cardiovascular disorders. Better performance in imaging technologies will again make resistant to early disease diagnosis and personalized treatment approaches. However, high costs and varied regulations may hinder market expansion.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 7.2% |

Market Outlook

Germany's molecular imaging market is expanding due to a robust healthcare infrastructure and a strong focus on medical technology innovation. Although the diagnostic imaging and molecular imaging markets in Germany are growing with robust healthcare infrastructure and supporting medical technology innovation, growth could be inhibited by stringent regulatory frameworks and high costs.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| Germany | 7.8% |

Market Outlook

India's molecular imaging market is primed for immense growth, propelled by a growing number of cases of chronic diseases and growing healthcare awareness. Together with an increase in the number of healthcare facilities and the actions taken by the government to improve disease diagnosis, this opens up further market development possibilities. However, the low availability of advanced treatments in rural areas may slow market growth.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| India | 8.6% |

Market Outlook

The incredibly vast molecular imaging market growth in China rests on the larger patient base suffering from chronic diseases and increasing healthcare investment. Focus on improving healthcare access and the rigorous adoption of advanced medical technologies also contribute to the market growth rate.

Nevertheless, there is a disparity across different regions about healthcare delivery quality, especially between urban areas and Congress and rural areas, which might pose huge challenges.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| China | 8.9% |

Market Outlook

Brazil's molecular imaging market is growing on the back of an improved system of healthcare infrastructures and an accompanying increased incidence of chronic diseases.

The shift towards advanced imaging technologies by the majority and the government initiatives to increase healthcare access contribute to the expansion of the market. Economic disparities and regional differences in health may pose obstacles to some extent.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| Brazil | 6.5% |

SPECT Dominates the Market Due to its Advanced Molecular Imaging with Versatility and Cost-Effectiveness

Single Photon Emission Computed Tomography (SPECT) still stands high against molecular imaging because of its cost-effectiveness and versatility. SPECT imaging has extensive applications in cardiology, neurology, and oncology while feeding back information that is helpful in functional and physiological domains.

The growing use of radiopharmaceuticals like Technetium-99m, advances made in SPECT-CT hybrid imaging, and new prospects in quantitative imaging will drive market growth. Moreover, using artificial intelligence for image analysis and enhancement will add to diagnostic accuracy. The other added advantage is the rise of theranostics that supports SPECT in this fast-changing field of molecular imaging.

The Rising Adoption of Hybrid Molecular Imaging due to Enhanced Diagnostic Precision and Clinical Applications

Hybrid imaging systems, such as fusion and other imaging modalities, have become popular. Fusing functional and anatomical information that works to accomplish these sets these systems apart from the normal imaging modalities. In addition to staging and localization of disease, one good use is in oncology, neurology, and cardiovascular imaging by merging metabolic information with high-resolution anatomical information.

The increasing adoption of AI data-driven hybrid imaging platforms, rapid advances in detector technology, and growing opportunities in multimodal imaging in PM are augmenting the future growth of this segment. The wider applications in theranostics and drug research push demand further for hybrid molecular imaging products.

Oncology Dominating the Market with Rising Cancer Prevalence and Precision Medicine Adoption

The field of oncology has received much impetus from the increased incidence of cancer and rising demand for early diagnosis and an accurate assessment of tumors in a global arena. Allowing for visualization of tumorous growth, detection, staging, treatment planning, and assessment, Siemens Molecular Imaging focuses on PET, SPECT, and hybrid PET-CT/MRI systems.

There is rising application of radiopharmaceuticals in cancer imaging, AI-based imaging analytics, and advances in targeted radiotracers for specific cancers, fostering market growth. Theranostic strategies integrating molecular imaging and targeted radiotherapy are also poised to metamorphose destiny in oncology for imaging.

Neurology is an Emerging Segment as it is Expanding its Role in the Early Diagnosis of Neurodegenerative Diseases.

Neurology is on course to become the next high growth platform for the molecular imaging market; a growing incidence of Alzheimer's, Parkinson's disease, epilepsy, and multiple sclerosis is driving that growth. PET/SPECT modalities are seminal in identifying abnormal protein deposits, brain metabolomic profiling, assessing neurodegenerative diseases, and determining functional deficiencies.

Demand for neuroimaging via molecular imaging will be driven by increasing usage of amyloid and tau PET imaging for Alzheimer's diagnosis, along with ongoing development of new radiotracers for neuroinflammation and incorporation into AI-driven image analysis. Moreover, increased use of molecular imaging for drug discovery and pharmaceutical clinical trials will further sustain growth.

The expanding role of molecular imaging in oncology, cardiology, and neurology, the technical development of imaging technology, and the increasing need for early disease diagnosis are contributing factors to the growth of the molecular imaging market. Meanwhile, leading companies in the market are investing in improvements, regulatory approvals, and strategic alliances to secure their market exclusivity.

The market is highly competitive, and medical imaging companies are heavily investing in the next generations' of molecular imaging technologies.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| GE Healthcare | 17.0% |

| Siemens Healthineers | 9.5% |

| Philips Healthcare | 10.0% |

| Bruker Corporation | 2.3% |

| Other Companies (combined) | 61.2% |

| Company Name | GE Healthcare |

|---|---|

| Year | 2025 |

| Key Developments/Activities | The company emphasizes new product launches and up-gradation of existing products and software to expand its product offerings to the end users and revenue generation |

| Company Name | Siemens Healthineers |

|---|---|

| Year | 2024 |

| Key Developments/Activities | The company focuses on consolidation activities and expansion activities to expand its geographical presence across the world to en-cash the growing opportunities in the healthcare IT industry |

| Company Name | Philips Healthcare |

|---|---|

| Year | 2024 |

| Key Developments/Activities | The company focuses on partnerships and collaboration activities to increase the product reach to the end users and to increase the growth in revenue |

| Company Name | Bruker Corporation |

|---|---|

| Year | 2025 |

| Key Developments/Activities | The company emphasizes new product development and up-gradation of the existing devices and software to cater to the increasing demand for molecular imaging and diagnostics industry |

Key Company Insights

GE Healthcare (17.0%)

GE Healthcare leads the molecular imaging market with a strong portfolio of PET, SPECT, and hybrid imaging solutions that integrate AI for enhanced diagnostic accuracy.

Siemens Healthineers (9.5%)

Siemens Healthineers specializes in high-performance molecular imaging technologies, focusing on oncology, neurology, and cardiology applications.

Philips Healthcare (10.0%)

Philips provides advanced hybrid imaging systems with accurate diagnostics, allowing for improved clinical decision-making through AI-driven analytics.

Bruker Corporation (2.3%)

Bruker is recognized for producing high-resolution preclinical imaging systems for drug development and research organizations and pharmaceutical companies.

Beyond the leading companies, several other manufacturers contribute significantly to the market, enhancing product diversity and technological advancements. These include:

The overall market size for molecular imaging market was USD 5,686.4 million in 2025.

The Molecular Imaging Market is expected to reach USD 11,719.9 million in 2035.

The increasing adoption of hybrid imaging systems and novel radiopharmaceuticals is enhancing diagnostic accuracy and expanding clinical applications in molecular imaging.

The top key players that drives the development of molecular imaging market are Becton Dickinson and Company, GE Company, Fujifilm Holdings Corporation, Siemens AG, Koninklijke Philips N.V. and Bruker Corporation

SPECT in modality type of molecular imaging market is expected to command significant share over the assessment period.

Warm Autoimmune Hemolytic Anemia (WAIHA) Treatment Market Analysis by Drug Class, Distribution Channel, and Region through 2035

Atrophic Vaginitis Treatment Market Analysis And Forecast by Diagnosis, Treatment, Therapy Type, Distribution Channel, and Region through 2035

Adrenal Crisis Management Market Analysis and Forecast, By Diagnosis Method, Treatment Method, Distribution Channel, and Region, through 2035

Birch Allergy Treatment Market Analysis by Drug Class, Route of Administration, Distribution Channel and Region: Forecast from 2025 to 2035

Cancer Vaccines Market Analysis by Technology, Treatment Method, Application and Region from 2025 to 2035

Automated Sample Storage Systems Market Growth - Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.