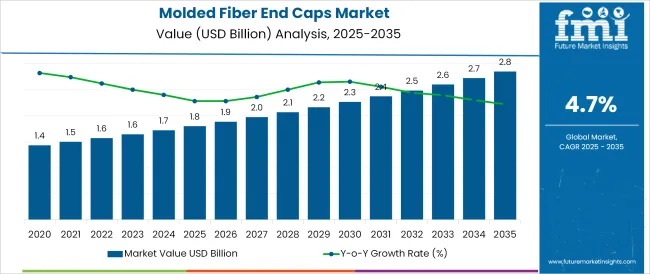

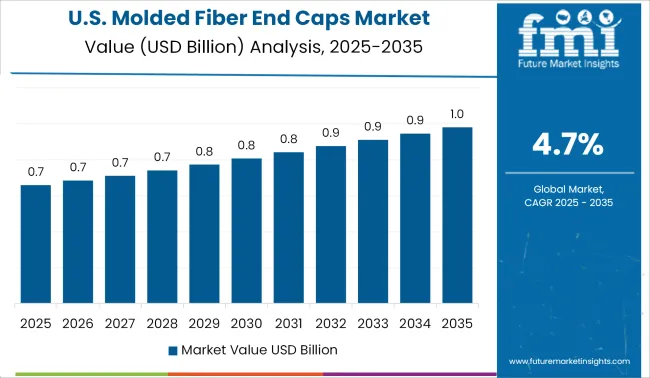

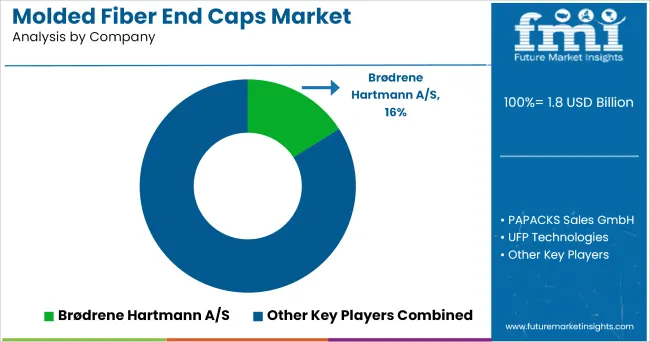

The Molded Fiber End Caps Market is estimated to be valued at USD 1.8 billion in 2025 and is projected to reach USD 2.8 billion by 2035, registering a compound annual growth rate (CAGR) of 4.7% over the forecast period.

The molded fiber end caps market is gaining momentum due to the global transition toward sustainable and recyclable protective packaging materials. Growing pressure to replace expanded polystyrene (EPS) and plastic foams with eco-friendly alternatives is accelerating adoption across various industrial sectors. Molded fiber end caps are gaining favor in electronics, appliances, and food packaging due to their structural integrity, shock absorption capabilities, and compostable nature.

Government regulations targeting single-use plastics and carbon reduction are further influencing procurement practices across supply chains. Technological enhancements in pulp molding equipment, improved tooling precision, and compatibility with automated lines are enabling high-volume production of customized end caps with minimal environmental footprint.

Market participants are increasingly focusing on integrating renewable raw materials, such as wood pulp, and closed-loop recycling systems. As environmental, social, and governance (ESG) criteria continue to shape packaging choices, molded fiber end caps are expected to play a pivotal role in future-ready, circular packaging strategies.

The market is segmented by Source Type, Molded Type, and Application and region. By Source Type, the market is divided into Wood Pulp and Non-wood Pulp. In terms of Molded Type, the market is classified into Transfer, Thick Wall, Thermoformed, and Processed. Based on Application, the market is segmented into Electronics, Food Packaging, Food Service, Healthcare, Industrial, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

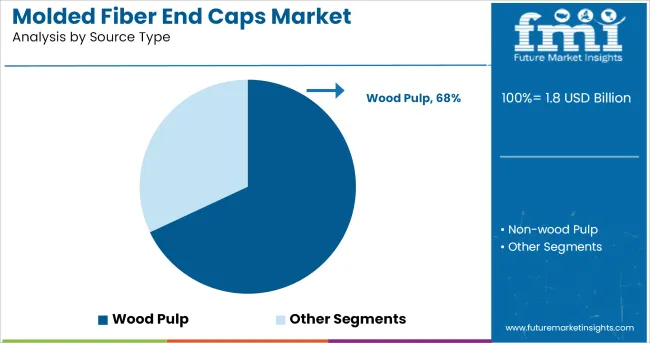

Wood pulp is expected to contribute 68.0% of the total revenue in the molded fiber end caps market by 2025, making it the dominant source type. This leadership is being driven by the abundant availability, renewability, and compostability of wood pulp, which aligns with global demand for low-impact packaging inputs.

Wood pulp's ability to form strong, lightweight, and biodegradable structures without synthetic additives has enhanced its adoption across electronics and consumer goods packaging lines. The compatibility of wood pulp with standard molding equipment supports its scalability and cost-efficiency in industrial production environments.

Furthermore, the improved tensile strength and cushioning performance of advanced pulp grades are increasing its acceptance in protective packaging applications that require durability and product safety during transit. With heightened awareness around plastic reduction and circular material flows, wood pulp continues to be the preferred base for sustainable molded fiber packaging.

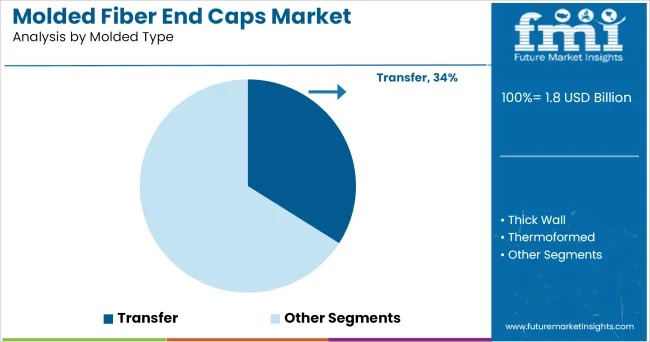

The transfer molded segment is projected to account for 34.0% of total market revenue in 2025, positioning it as the leading molded type in the molded fiber end caps market. This segment's dominance is being supported by its ability to deliver consistent wall thickness, smooth surface finish, and superior dimensional accuracy characteristics critical for precise end-cap packaging applications.

Transfer molding allows for faster cycle times and efficient moisture removal, reducing energy usage and improving product throughput. Its suitability for intricate shapes and sharp edges has increased its adoption in sectors requiring tight product fit and surface contact protection.

Additionally, transfer molded fiber is easier to decorate and customize, which supports branding initiatives in consumer-facing applications. As industries prioritize high-performance, moldable, and aesthetically uniform fiber packaging, the transfer molded process is emerging as a scalable, reliable solution for medium- to high-volume manufacturing environments.

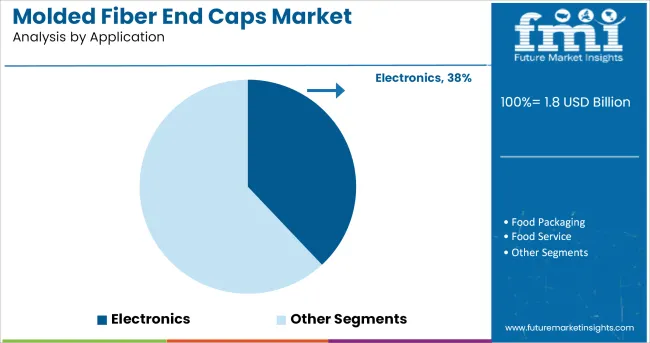

Electronics is projected to hold a 38.0% share of the molded fiber end caps market by 2025, ranking as the leading application segment. This leadership is being driven by increased demand for protective, shock-absorbent, and sustainable packaging solutions for high-value electronic goods.

Molded fiber end caps provide cushioning and rigidity without relying on plastic foams, meeting stringent industry requirements for vibration resistance and static protection. As electronics companies face growing scrutiny over packaging waste and extended producer responsibility, molded fiber solutions are gaining favor for their compostability and ease of recycling.

The lightweight nature of molded fiber also supports reduced freight costs and emissions, further aligning with sustainability targets. Adoption has been accelerated by OEMs and third-party logistics providers that seek standardized, eco-conscious packaging systems that also enhance brand perception and environmental compliance.

Increasing demand for molded fiber end caps from industrial and electrical applications is one of the major factors driving the demand for molded fiber end caps. The molded fiber end caps provide cushioned packaging for the industrial products which helps in securing the product and maintains the product.

Moreover, there has been a rise in demand for fiber end caps owing to its environmental benefits and hence a large number of companies are adopting the molded pulp end caps and edge guards for their interior packaging needs.

On the basis of molded type, the sensor market has been bifurcated in to thick wall, transfer, thermoformed, and processed molded types. Out of which, the transfer molded type segment is anticipated to hold the largest share of the market.

The growth of the segment can be attributed to the high demand in food packaging industry owing to its advantages, such as air permeability and hygroscopic properties, which actually help in extending the shelf life of food products. However, thick wall molded type segment is anticipated to grow at a significant CAGR over the forecast period. The growth of this segment can be attributed to growing demand for packaging of industrial products.

USA happens to be one of the largest markets for molded fiber end caps across the globe. The growth in USA is attributed to the presence of established players such as Genpak LLC, Eco-Products, Pro-Pac Packaging, and UFP Technologies, among others.

Moreover, growing food industry in the USA with increasing restaurants and food service outlets is one of the major factors responsible for rise in demand for fiber end caps. Furthermore, fiber molded end caps are extensively used in the packaging of non-electronic products, such as cosmetics, personal care, and medicines, which is expected to further drive the demand for fiber molded end caps market in the USA during the forecast period.

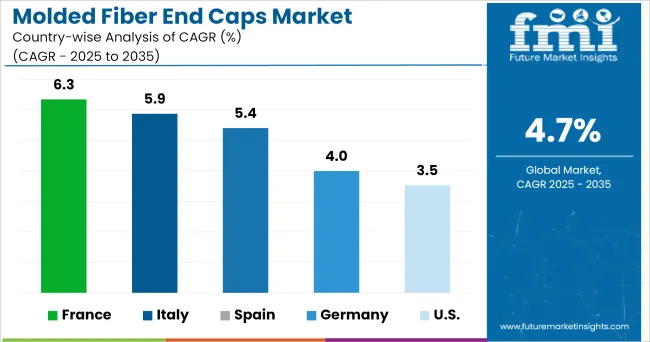

The demand for molded fiber end caps in Europe has been on the rise. The growing disposable income coupled with the growth of e-commerce and food delivery services is one of the major factors responsible for the rise in demand for molded fiber rend caps in the region.

Fiber molded packaging happens to be an environmentally-friendly substitute to expanded polystyrene packaging and others, and also possesses excellent dampening and cushioning properties. Owing to this, a large number of companies are turning towards the adoption of environmentally friendly methods of packaging.

Some of the leading providers of molded fiber end caps include

Companies operating in the market are focused on offering innovative as well environmentally friendly molded fiber end caps for packing. For instance, UFP Technologies is offering protective packaging for Lexmark, an ink-jet printer manufacturer. The packaging comprises of cushions which are placed manually on each end of the plastic-bagged ink-jet printers. The molded fiber cushions act as a means of protective packaging for the printers.

The report is a compilation of first-hand information, qualitative and quantitative assessment by industry analysts, inputs from industry experts and industry participants across the value chain.

The report provides in-depth analysis of parent market trends, macro-economic indicators and governing factors along with market attractiveness as per segments. The report also maps the qualitative impact of various market factors on market segments and geographies.

The global molded fiber end caps market is estimated to be valued at USD 1.8 billion in 2025.

The market size for the molded fiber end caps market is projected to reach USD 2.8 billion by 2035.

The molded fiber end caps market is expected to grow at a 4.7% CAGR between 2025 and 2035.

The key product types in molded fiber end caps market are wood pulp and non-wood pulp.

In terms of molded type, transfer segment to command 34.0% share in the molded fiber end caps market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Molded Wood Pallets Market Forecast and Outlook 2025 to 2035

Molded FRP Grating Market Size and Share Forecast Outlook 2025 to 2035

Molded Foam Market Size and Share Forecast Outlook 2025 to 2035

Molded Pulp Packaging Market Size and Share Forecast Outlook 2025 to 2035

Molded Pulp Basket Market Size and Share Forecast Outlook 2025 to 2035

Molded Underfill Material Market Size and Share Forecast Outlook 2025 to 2035

Molded Pulp Packaging Machines Market Analysis - Growth & Forecast 2025 to 2035

Market Share Breakdown of the Molded Pulp Basket Industry

Competitive Overview of Molded Wood Pallets Market Share

Molded Case Circuit Breaker (MCCB) Market Growth – Trends & Forecast 2023-2033

Molded Interconnect Devices (MID) Market

Molded Fiber Egg Packaging Market Forecast and Outlook 2025 to 2035

Molded Fiber Bowl Market Size and Share Forecast Outlook 2025 to 2035

Molded Fiber Pulp Packaging Industry Analysis in Australia and New Zealand Forecast Outlook 2025 to 2035

Molded Fiber Pulp Packaging Market Size and Share Forecast Outlook 2025 to 2035

Molded Fiber Packaging Market Size and Share Forecast Outlook 2025 to 2035

Molded Fiber Pulp Cap Market Size and Share Forecast Outlook 2025 to 2035

Molded Fiber Pulp Packaging Market Size and Share Forecast Outlook 2025 to 2035

Molded Fiber Cup Market Size and Share Forecast Outlook 2025 to 2035

Molded Fiber Wine Packs Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA