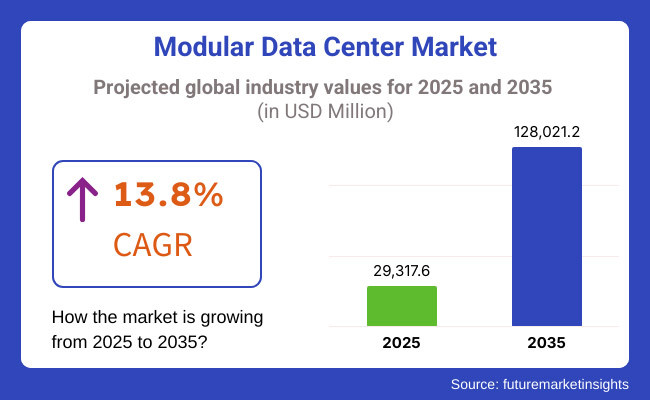

The global Modular Data Center market is projected to grow significantly, from USD 29,317.6 Million in 2025 to USD 128,021.2 Million by 2035 an it is reflecting a strong CAGR of 13.8%.

As organizations are relying more on third-party vendors and partners to provide modular data center infrastructure, managing those risks becomes paramount. With the growth of data, digital capabilities in all the key industries such as BFSI, healthcare, and IT stand and deliver for operational security and compliance. The dependency on third-party providers fuels the demand for effective solutions to help overcome related risk.

Data centers are subject to stringent compliance mandates such as GDPR in Europe and CCPA in California, which focus on data protection and security. Modular data centre solutions offer these automated compliance management tools that help businesses keep pace with ever-changing regulatory requirements easily and prevent them from facing legal penalties as a result of non-compliance. These solutions are essential due to the growing complexities of compliance measures.

Business accelerates digital transformation, modular data centers are the core infrastructure of the cloud, IT infrastructure and edge computing. As third-party integrations become more pervasive, this increasing reliance places demand on superior risk management solutions to ensure any weaknesses in those identifiers do not impact the rest of the system. Secure and compliant deployments are a major driver of growth in this market.

Another area of concern for modular data centers is the rise in cyber threats that makes security a top priority. Therefore organizations need to continuously monitor and assess the risks in real time, to ensure that potential breaches from external vendors can be tracked in real-time. Robust security frameworks make modular data centers resilient against the rising tide of cyber risks.

North America currently accounts for the largest market share, with stringent cybersecurity regulations alongside leading solution providers contributing to this. The modular data center market is also experiencing increased adoption due to a growing digital economy and increasing regulatory scrutiny. India and Australia among countries, which are also seeing growing demand as businesses expand their digital infrastructure and look for enterprise grade data management solutions.

Explore FMI!

Book a free demo

| Company | Schneider Electric |

|---|---|

| Contract/Development Details | Awarded a contract by a cloud service provider to design and deploy modular data centers, enabling rapid scalability, energy efficiency, and reduced deployment times to meet growing data demands. |

| Date | June 2024 |

| Contract Value (USD Million) | Approximately USD 45 |

| Renewal Period | 6 years |

| Company | Huawei Technologies Co., Ltd. |

|---|---|

| Contract/Development Details | Partnered with a telecommunications company to construct modular data centers in emerging markets, focusing on enhancing network infrastructure, reducing latency, and supporting the expansion of digital services. |

| Date | November 2024 |

| Contract Value (USD Million) | Approximately USD 50 |

| Renewal Period | 7 years |

Rising demand for scalable and flexible data center solutions to support cloud computing and edge applications

Increasing adoption of cloud computing and edge applications is fueling growth of scalable, flexible and modular data centers. With most enterprises moving to hybrid and multi-cloud environments, traditional data centers are unable to keep up with the ever-increasing processing and storage requirements. Modular data centers offer a fast-start deployment model, enabling organizations to provision infrastructure as needed without a heavy capital outlay.

As global cloud computing spending is projected to exceed USD 1 trillion by 2026, enterprises and hyperscaler are increasingly adopting modular solutions to ensure agility, cost-efficiency and reliability. With the growing popularity of 5G networks, autonomous vehicles, and IoT devices, demand continues to increase for modular edge data centers, which enable computing to happen closer to the end user, resulting in reduced latency and enhanced performance.

Rising energy efficiency concerns accelerating the shift toward sustainable and green data center solutions

Data center energy consumption poses a significant environmental challenge, driving the continual transition toward modular data centers that are more sustainable and energy efficient. Standard data centers use almost 200 TWh per year of energy, thus generating substantial carbon emissions. With a strict carbon neutrality policy being introduced by governments, organizations are looking for green data center solutions that integrate advanced cooling technologies, renewable energy and energy-efficient hardware.

Modular data centers deliver PUE with less energy waste and more performance. Liquid cooling systems, AI-driven energy management and waste heat recovery are just some of the innovations that are adding to efficiency in these modular deployments.

Demand for modular data centers in telecom and 5G networks to handle increasing data traffic

The telecom sector is installing modular data centers on the back of rising data traffic along with the rapid growth of 5G networks. With the number of connected mobile devices expected to grow to more than 50 billion by 2030, the global mobile data traffic is expected to be 500 exabytes per month, putting pressure on telecom providers to upgrade their infrastructure to accommodate demands for ultra-low latency, high-connectivity, high-speed, low-cost, and real-time processing.

With the use of modular data centers - a repeatable and very space-efficient design - data can easily be deployed next to a cell tower or base station to function at the edge of the network. Modular solutions are becoming more pressing in telecom with the rise of connected devices, smart cities, and autonomous systems.

Challenges in integrating with legacy IT infrastructure, causing deployment delays

Many organizations, particularly in banking, healthcare, and government, still use legacy IT systems that were never built for modular scalability. Traditional systems typically rely on legacy hardware, proprietary software stacks, and rigid network topologies that make it challenging to natively integrate modern modular data center offerings.

Legacy applications cannot operate in a modular environment, which can lead to migration taking place over longer periods of time, disruption of service and inherent costs during the reconfiguration of the workspace.

Moreover, the conventional IT frameworks are not equipped with the needful automation and orchestration capabilities to harness the benefits of modular data centers to its fullest. Operational bottlenecks arise, with enterprises forced to manually reallocate workloads, optimize data streams, and change network configuration settings to ensure seamless integration.

Also, legacy environments can fall short on modern encryption and access controls and real-time monitoring, preferred capabilities in modular data center operation, further exposing the gap in security between old and new systems. These challenges push out deployment timelines, which inhibits organizations from realizing the speed, efficiency, and scalability that modular data centers are meant to deliver.

| Market Shift | 2020 to 2024 |

|---|---|

| Regulatory Landscape | Energy efficiency mandates encouraged adoption of modular data centers. |

| Edge Computing Expansion | Growth in edge computing increased demand for modular data centers. |

| AI & Autonomous Management | AI-powered monitoring improved efficiency and predictive maintenance. |

| Sustainability & Green Energy | Shift towards liquid cooling and renewable energy-powered data centers. |

| Market Growth Drivers | Rising data consumption and cloud expansion boosted modular data center adoption. |

| Market Shift | 2025 to 2035 |

|---|---|

| Regulatory Landscape | AI-powered sustainability compliance frameworks govern data center energy usage. |

| Edge Computing Expansion | AI-driven micro data centers enhance decentralized computing capabilities. |

| AI & Autonomous Management | Self-healing AI-driven data centers dynamically optimize resource allocation. |

| Sustainability & Green Energy | AI-driven cooling systems optimize energy consumption for carbon-neutral operations. |

| Market Growth Drivers | AI-driven edge computing and real-time data analytics fuel future growth. |

Tier 1 vendors are industry leaders with a presence worldwide, and offer complete modular data center solutions in a broad spectrum of industries and applications. They have invested years of time and fortunes in R&D, supply chains, and proven implementations. Prominent Tier 1 vendors include Schneider Electric, Huawei, Dell, Vertiv, and Eaton. By offering end-to-end solutions with a global support network, they lead in the modular data center market.

Tier 2 - Well-known companies with a significant regional presence or niche presence in the modular data centre landscape. While they may not have the same level of global presence as Tier 1 vendors, they are critical to addressing particular market niches and regional needs.

Prominent Tiers 2 providers comprise Rittal, Delta Electronics, STULZ, and Johnson Controls. These companies might be targeting specific niches markets or specific technology areas, which gives these companies an upper hand in competing against big companies by addressing specific customer needs in particular geography.

Tier 3: Smaller or new vendors that provide modular data center solutions more targeted toward a specific market or application, often limited to a regional or local area. These vendors have the potential to build customized solutions that are tailored to their customers' unique needs and requirements.

Though lacking the same level of resources as their Tier 1 or Tier 2 counterparts, Tier 3 vendors bring a measure of diversity to the marketplace through innovative solutions that help mitigate different pain points inherent in the modular data center ecosystem.

The section highlights the CAGRs of countries experiencing growth in the Modular Data Center market, along with the latest advancements contributing to overall market development. Based on current estimates China, India and USA are expected to see steady growth during the forecast period.

| Countries | CAGR from 2025 to 2035 |

|---|---|

| India | 16.8% |

| China | 15.2% |

| Germany | 11.0% |

| Japan | 13.8% |

| United States | 12.3% |

Modular data centers capable of being sited nearer to end-users are benefiting from the rapid 5G roll out across China and an increase in edge computing deployment. China is in the midst of a mobile internet boom and an unparalleled surge of mobile connected devices, with a large population and expanding data consumption fed by AI apps and IoT deployments.

Even low-latency requirements are hard to cater using conventional centralized data centers, thus decentralized and modular solutions seem to be the natural choice to cater such needs. The ambition of the government to broaden the 5G infrastructure all over the country has also resulted in massive investment with the construction of edge computing facilities.

According to estimations, by 2025, China will have more than 30 million 5G base stations in place, and the volume of data generated will far exceed the current network standards, necessitating that the data be processed in situ to avoid stressing data networks. China is anticipated to see substantial growth at a CAGR 15.2% from 2025 to 2035 in the Modular Data Center market.

The Digital India Initiative is transforming the digital infrastructure in the country that will create substantial demand for modular data centers. Broadband penetration, cloud computing adoption, and e-governance are some of the top priorities of the government - making a strong data center ecosystem an infrastructural requirement.

Scaled secure modular data centers are a more cost-effective way to provide capacity than traditional facilities, making them perfect for supporting this national digitization. This urgent need for speed can be justified by rapid growth in the country, with the number of internet users exceeding 900 million and the gradual penetration of online services.

The Indian government has taken initiatives like Data Center Policy, which will help in attracting foreign investment and indigenous data center development to support this growth. For 2023, the government has earmarked USD 12 billion for IT infrastructure development; this includes incentives for data center operators who opt for energy-efficient modular systems. India's Modular Data Center market is growing at a CAGR of 16.8% during the forecast period.

The USA modular data center market is witnessing growth, backed by investments in hyperscale and colocation facilities. Cloud service providers and enterprises that are rapidly scaling their infrastructure to accommodate increasing data processing needs are also opting for modular solutions due to their rapid deployment and operational flexibility.

Modular and energy-efficient data centers are also being cultivated, supported by the USA Government. In addition, over 50% of world hyperscale data centers are situated in the USA and need scalable, pre-fabricated solutions like never before. USA is anticipated to see substantial growth in the Modular Data Center market significantly holds dominant share of 76.6% in 2025.

The section contains information about the leading segments in the industry. By Component, the Services segment is estimated to grow quickly from the period 2025 to 2035. Additionally, by Industry, Finance segment holds dominant share in 2025.

| Component | CAGR (2025 to 2035) |

|---|---|

| Services | 15.2% |

Services segment is expected to grow at a CAGR of 15.2% from the period 2025 to 2035. As companies increasingly depend on third-party expertise in deployment, maintenance, and operational efficiency, demand for services in the modular data center market is growing substantially. Due to rapid scalability, energy efficiency and cost efficiency, organizations are shifting towards a modular data center.

However, companies are looking to professional and managed services to maximize performance and, enable smooth integration with existing infrastructure. These services range from site assessment, installation and real time monitoring to cyber security solutions, ensuring modular data centers operate at optimum efficiency, with minimal downtime.

Governments across the globe are driving digital transformation and infrastructure modernization, which is augmenting the demand for such services. Enough is enough: just a couple weeks ago, a government supported USD 5 billion project was announced to expand datacentre capabilities, focusing on end-to-end support services on modular deployments.

Moreover, looking at stricter data regulations and cybersecurity requirements, there is a growing demand among the businesses for compliance and risk management services to safeguard their operations.

| Industry | Value Share (2025) |

|---|---|

| Finance | 22.3% |

The Finance industry is poised to capture share 22.3% in 2025. The modular data center market for the finance portals sector is anticipated to be the most lucrative owing to the enormous data processing and stringent security requirements. As such, banks, apps for exchanges, and fintech companies are embracing modular data centers as a means to improve digital banking operations, high-frequency trading, and compliance.

And as financial transactions result in tremendous volumes of data being generated, modular solutions can provide a more scalable and cost-effective option for processing and storing that critical financial information securely. Moreover, due to AI-led financial services, digital payments, and blockchain technology, the demand for high-performance computing infrastructure in the finance industry has seen a spike too.

The governments are enacting more robust financial data security policies and promoting digital finance growth. As recently as October 2023, a USD 10 billion government fund was unveiled for modernizing banking infrastructure, with a large portion dedicated to upgrading data center capabilities.

In addition, central banks and regulatory authorities brought forth stern data storage and cybersecurity directives where financial and other institutions were forced to shell out for modular data centers.

The Modular Data Center market is highly competitive, with a presence of numerous large and small players. Companies differentiate themselves in areas like how quickly they can deploy solutions, cost, sustainability and innovation within their cooling technologies and artificial intelligence-driven management solutions.

The increasing demand for edge computing and hyperscale expansion is driving the competition that requires the vendors to have flexible and prefabricated solutions. Moreover, compliance with regulations and green data center initiatives are directing trends in the climate market and presenting opportunities for market participants in regards to being distinguished through eco-friendly and high-performance designs.

Recent Industry Developments in Modular Data Center Market

The Global Modular Data Center industry is projected to witness CAGR of 13.8% between 2025 and 2035.

The Global Modular Data Center industry stood at USD 29,317.6 million in 2025.

The Global Modular Data Center industry is anticipated to reach USD 128,021.2 million by 2035 end.

South Asia & Pacific is set to record the highest CAGR of 15.3% in the assessment period.

The key players operating in the Global Modular Data Center Industry Dell Technologies, Hewlett Packard Enterprise (HPE), Huawei Technologies, Vertiv Group, Eaton, IBM Corporation, Schneider Electric, Cannon Technologies, Rittal GmbH & Co. KG, Baselayer Technology.

In terms of component, the segment is segregated into solution and services.

In terms of Data Center Size, the segment is segregated into Small Data Centre, Mid-Size Data Centre and Large Data Centre.

In terms of Industry, it is distributed into Finance, manufacturing & Resources, Distribution Services, Services, Public Sector and Infrastructure.

A regional analysis has been carried out in key countries of North America, Latin America, East Asia, South Asia & Pacific, Western Europe, Eastern Europe and Middle East and Africa (MEA), and Europe.

Remote Construction Market Analysis by Component, Application, End-use Industry and Region Through 2035

Security Inspection Market Insights – Trends & Forecast 2025 to 2035

Procurement as a Service Market Trends – Growth & Forecast 2025 to 2035

Massive Open Online Course Market Analysis – Growth, Trends & Forecast 2025 to 2035

Tactical Radios Market Analysis by Type, Application, and Region Through 2025 to 2035

Healthcare Virtual Assistants Market Analysis by Product, End User and Region Through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.