The modular construction market will be growing in the predicted years of 2025 to 2035 growing by a significant growth rate owing to the requirement for a cost-effective, time-effective, and sustainable solution for buildings. With several world-leading industries adopting modular construction for residential, commercial, healthcare, and industrial buildings.

The growth of the sector is being driven by urbanization, greater infrastructure investment and improvements in prefabrication technology. And as the demand for sustainable and energy-efficient buildings rises, developers are adopting modular solutions that may save on waste, labour costs and project duration.

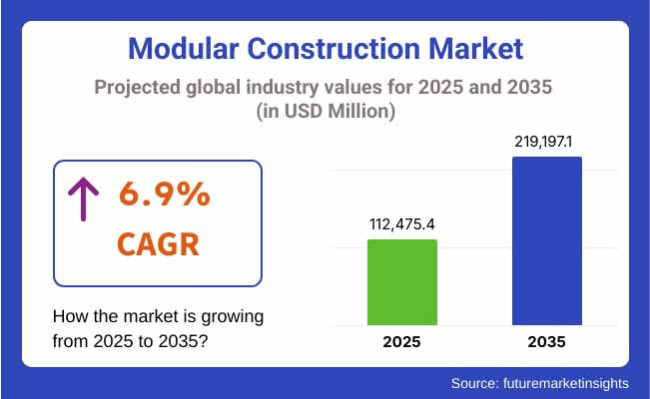

The market is expected to go from USD 112,475.4 Million in 2025 to USD 219,197.1 Million by 2035, at a CAGR of 6.9% for the forecast period. Modular construction is experiencing a renaissance due to advancements in 3D printing, AI-driven design, and digital twin technology, which is making this method of construction more scalable and precise, making it an undeniable solution for affordable housing, disaster relief shelters, green building projects, and more dignity for people around the world.

The United States and Canada are at the forefront of the Modular Construction Market in North America, where there are increasing housing shortages and labour constraints, increasing climate sustainability mandates, which are major driving factors for adoption.

Government incentives for energy-efficient buildings and increasing investments in smart cities and infrastructure projects support the region. Modular techniques are increasingly being adopted by the commercial sector to help reduce project time frames and save costs, especially in hotels, office buildings, and healthcare facilities.

A significant market for modular construction is Europe itself, particularly Germany, the UK and Scandinavia. European Union mandates accelerating green building initiatives and stricter construction waste regulations are driving developers to utilize prefabrication methods. Main growth drivers: Affordable housing projects, school expansions, and healthcare facility upgrades. Nordic countries are increasingly adopting timber modular construction because of their sustainability inclinations.

The modular construction market in Asia-Pacific is the fastest-growing, due to rapid urbanization in countries such as China, India, Japan, and Australia. China and India Governments are promoting affordable housing and smart cites, therefore a rapid growth is seen in modular buildings.

The hospitality and healthcare industries are likewise seeing the benefits of modular construction as they respond to increasing demand for expedited infrastructure delivery. Frequent demand for constructing high-rise modular buildings is due to population density and land constraints in major cities.

Challenge

High Initial Investment and Logistics Complexity

While its high upfront costs result in long-term costs benefits, modular construction comes with an initial capital burden on manufacturing plants, transportation and specialized labour for assembly. The logistics complexity, with on-site logistics, transportation of modular prefabricated elements, and regulatory approvals, also limits widespread adoption.

To overcome these challenges, companies have invested in automation and AI-enabled project management tools, and regional modular factories to streamline manufacturing and reduce logistical forgetfulness.

Opportunity

Growth of Smart and Sustainable Modular Solutions

Smart, technology-enabled modular construction is on the rise, as we see IoT, AI, and BIM (Building Information Modelling) technologies come together to enable accurate design capable of real-time monitoring and efficiency. New growth avenues open up with innovations, including 3D-printed modular units, net-zero energy buildings and circular economy-based prefabrication.

Government institutions and private developers alike that embark on similar eco-friendly modular solutions can become a key player in the development trends of the future.

The modular construction market saw a surge between 2020 and 2024 driven by the need for affordable, quick, and sustainable building solutions.

Advancements in prefabrication techniques, offsite construction and sustainable building materials led to greater efficiency. The commercial sector offices, hotels and retail spaces have also recently seen greater adoption due to cost savings and reduced need for manpower on site. But due to the high cost of an initial investment, transportation challenges, and low design flexibility, these barriers limited widespread development.

Modular construction will encompass AI-optimized design, automation-enabled prefabrication, and sustainable construction materials from 2025 to 2035. Smart modular buildings will also maximize efficiency and sustainability with IoT-enabled energy management systems, self-regulating HVAC solutions, and integrated solar panels.

The types of customization and precision necessary for level-focused gaming will be made possible by 3D printing, robotics-assisted assembly, and digital twin technology. Construction: There will be a prominent focus on new carbon-neutral, recyclable, and bio-based materials, especially with new global green building standards emerging.

Market Shifts: A Comparative Analysis (2020 to 2024 vs. 2025 to 2035)

| Market Shift | 2020 to 2024 |

|---|---|

| Construction Methods | Expansion of off-site prefabrication and volumetric modular units. |

| Technology Integration | Use of BIM (Building Information Modelling) for design efficiency. |

| Sustainability & Materials | Focus on recycled steel, cross-laminated timber (CLT), and energy-efficient materials. |

| Application Expansion | Growth in residential, healthcare, and hospitality sectors. |

| Regulatory Compliance | Compliance with local building codes and fire safety regulations. |

| Market Growth Drivers | Demand fuelled by cost efficiency, rapid deployment, and labour shortages. |

| Market Shift | 2025 to 2035 |

|---|---|

| Construction Methods | Adoption of 3D-printed modules, robotics-assisted assembly, and digital twins. |

| Technology Integration | AI-driven design automation, predictive analytics, and smart modular systems. |

| Sustainability & Materials | Shift toward carbon-neutral, bio-based, and recyclable modular components. |

| Application Expansion | Increased adoption in data centres, educational institutions, and large-scale urban projects. |

| Regulatory Compliance | Standardization of global modular construction codes and green certifications. |

| Market Growth Drivers | Growth driven by smart buildings, sustainability mandates, and automation in construction. |

The United States modular construction market is in a phase of significant growth, propelled by increasing demand for efficient and affordable construction methods. Market drivers include the growing use of prefabricated buildings in commercial, residential, and industrial sectors.

Besides, sustainable building practices and energy efficiency are encouraging framing companies to use modular construction methods due to government rules. Automatic processes and creative materials are the focus of major players in the USA as they work to improve modular building quality and reduce waste.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 6.5% |

In the UK, there are ongoing efforts to increase the adoption of modular construction through government policies aimed at addressing housing affordability and encouraging sustainable construction practices. The rising shortage of skilled workers and surging construction costs have moving developers to embrace modular building methods that provide a quicker turnaround and lower prices. Moreover, adoption of off-site construction and digital modelling technologies are further driving market adoption.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 7.1% |

An increasing emphasis on green building standards and prefabrication techniques is driving the growth of the European modular construction market. Leading the way in modular construction are countries like Germany, France, and the Netherlands, which in their stride have significantly embraced this practice due to factors such as urbanization, energy-efficient building regulations, and government subsidies on integrated housing projects.

Especially the modular offices, hotels, and healthcare facilities are in high demand for the moment, which also influences the market to grow even higher.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 7.2% |

The Japan modular construction market is driven by rapid technological evolution with a strong engineering precision culture. Increasing adoption of modular construction techniques in the country has, therefore, been growing for disaster-resistant and earthquake-proof buildings. Prefabricated homes and prefabricated commercial buildings can withstand extreme weather conditions and offer effective use of space, making them popular among consumers.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 6.8% |

In South Korea the modular construction is growing rapidly driven by escalated urbanization and the government emphasis on sustainable infrastructure initiatives. Costs and speed of deployment drive the increase in modular housing units, commercial spaces, and temporary facilities. Industry 4.0 and trends. It also includes this like leading on digital design technologies and also 3D Print industry which change the game.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 6.9% |

| By Product | Market Share (2025) |

|---|---|

| Relocatable | 53.7% |

The modular construction sector is predominantly driven by demand for relocatable modular structures as various industries look for cost-effective, flexible, & efficient building solutions. These provide a more flexible alternative to traditional construction that allows a business to change location of facilities according to operational considerations. Relocatable buildings are in high demand in the healthcare, education and commercial sector as they need to be expanded rapidly or require temporary infrastructure.

Relocatable modular buildings also can reduce build times, by utilizing prefabricated components that are assembled off-site and shipped to the project for rapid assembly. It helps to lower labour costs as well as smooth out weather delays, which in turn speeds up project completion. These structures also conform to the strictest building codes, making them a suitable option for businesses that want compliance but do not wish to give up on speed or convenience.

The development of modular technology has incorporated designs with energy-efficient provisions, smart automation, and better insulation to enhance the attractiveness of relocatable structures. Moreover, the increasing trend of sustainable and adaptive infrastructure is further enabling new demand for relocatable modular buildings, ensuring their continued dominance in the market.

| By Material | Market Share (2025) |

|---|---|

| Steel | 48.2% |

Both industry-leading companies and new players find themselves entering into this emerging market for steel modular construction. Modular construction employs steel, which increases structural strength; providing resistance against various environmental elements and weather conditions including earthquakes. With many industries increasingly focused on longevity and sustainability, the green modular steel structure is being applied increasingly across numerous industries including commercial, residential and industrial applications.

Steel can bear significantly higher loads, enabling multi-story modular buildings to suit an urban infrastructure project wherein space is optimized. Moreover, steel modular construction aligns with sustainable building practices by allowing material reuse, minimizing waste, and using green coatings for better energy efficiency.

This technology is available in many shapes and sizes, and manufacturers are investing in automation, which aims to provide precision cutting and welding techniques that are integrated with advanced steel fabrication to create modular units that can be more efficient and customizable. Rapid focus on sustainability of building performance coupled with government initiatives favouring sustainable construction is expected to fuel growth of steel modular buildings in global market. Due to changing needs in architectural design and technological improvements, steel modular construction is expected to grow.

The Modular Construction Sector is expanding as a result of rising demand for cost-saving, green, and timely building solutions. Firms are making investments in automation, prefabrication technology, and green materials to improve efficiency and minimize waste in construction.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Sekisui House Ltd. | 15-20% |

| LAING O'ROURKE | 12-16% |

| Red Sea International | 10-14% |

| Skanska | 8-12% |

| Other Companies (combined) | 40-50% |

| Company Name | Key Offerings/Activities |

|---|---|

| Sekisui House Ltd. | In 2024, expanded its modular housing solutions with smart home integration and energy-efficient designs. |

| LAING O'ROURKE | In 2025, invested in AI-driven prefabrication technology to enhance project efficiency and reduce waste. |

| Red Sea International | In 2024, introduced next-generation modular solutions for remote and emergency housing projects. |

| Skanska | In 2025, partnered with sustainability firms to develop carbon-neutral modular construction materials. |

Key Company Insights

Sekisui House Ltd. (15-20%)

Sekisui House leads with advanced prefabrication methods and eco-friendly modular home designs, expanding its presence in urban housing projects.

LAING O'ROURKE (12-16%)

LAING O'ROURKE strengthens its position with AI-driven construction solutions, optimizing modular assembly and logistics.

Red Sea International (10-14%)

Red Sea International focuses on modular housing for remote locations, including workforce accommodations and emergency shelters.

Skanska (8-12%)

Skanska integrates sustainability into modular construction, developing carbon-neutral materials to align with green building initiatives.

Other Key Players (40-50% Combined)

Several companies contribute to market development with specialized modular solutions:

The overall market size for the Modular Construction Market was USD 112,475.4 Million in 2025.

The Modular Construction Market is expected to reach USD 219,197.1 Million in 2035.

The demand is driven by rising urbanization, increasing adoption of cost-effective and time-efficient construction methods, growing focus on sustainable building solutions, advancements in prefabrication technology, and the need for rapid infrastructure development in emerging economies.

The top 5 countries driving market growth are the USA, UK, Europe, Japan and South Korea.

The steel segment is expected to command a significant share over the assessment period.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Units) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 4: Global Market Volume (Units) Forecast by Type, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Material, 2018 to 2033

Table 6: Global Market Volume (Units) Forecast by Material, 2018 to 2033

Table 7: Global Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 8: Global Market Volume (Units) Forecast by Application, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 10: North America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 12: North America Market Volume (Units) Forecast by Type, 2018 to 2033

Table 13: North America Market Value (US$ Million) Forecast by Material, 2018 to 2033

Table 14: North America Market Volume (Units) Forecast by Material, 2018 to 2033

Table 15: North America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 16: North America Market Volume (Units) Forecast by Application, 2018 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 18: Latin America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 19: Latin America Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 20: Latin America Market Volume (Units) Forecast by Type, 2018 to 2033

Table 21: Latin America Market Value (US$ Million) Forecast by Material, 2018 to 2033

Table 22: Latin America Market Volume (Units) Forecast by Material, 2018 to 2033

Table 23: Latin America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 24: Latin America Market Volume (Units) Forecast by Application, 2018 to 2033

Table 25: Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 27: Europe Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 28: Europe Market Volume (Units) Forecast by Type, 2018 to 2033

Table 29: Europe Market Value (US$ Million) Forecast by Material, 2018 to 2033

Table 30: Europe Market Volume (Units) Forecast by Material, 2018 to 2033

Table 31: Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 32: Europe Market Volume (Units) Forecast by Application, 2018 to 2033

Table 33: Asia Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 34: Asia Pacific Market Volume (Units) Forecast by Country, 2018 to 2033

Table 35: Asia Pacific Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 36: Asia Pacific Market Volume (Units) Forecast by Type, 2018 to 2033

Table 37: Asia Pacific Market Value (US$ Million) Forecast by Material, 2018 to 2033

Table 38: Asia Pacific Market Volume (Units) Forecast by Material, 2018 to 2033

Table 39: Asia Pacific Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 40: Asia Pacific Market Volume (Units) Forecast by Application, 2018 to 2033

Table 41: MEA Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 42: MEA Market Volume (Units) Forecast by Country, 2018 to 2033

Table 43: MEA Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 44: MEA Market Volume (Units) Forecast by Type, 2018 to 2033

Table 45: MEA Market Value (US$ Million) Forecast by Material, 2018 to 2033

Table 46: MEA Market Volume (Units) Forecast by Material, 2018 to 2033

Table 47: MEA Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 48: MEA Market Volume (Units) Forecast by Application, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Material, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Application, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 5: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 6: Global Market Volume (Units) Analysis by Region, 2018 to 2033

Figure 7: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 8: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 9: Global Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 10: Global Market Volume (Units) Analysis by Type, 2018 to 2033

Figure 11: Global Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 12: Global Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 13: Global Market Value (US$ Million) Analysis by Material, 2018 to 2033

Figure 14: Global Market Volume (Units) Analysis by Material, 2018 to 2033

Figure 15: Global Market Value Share (%) and BPS Analysis by Material, 2023 to 2033

Figure 16: Global Market Y-o-Y Growth (%) Projections by Material, 2023 to 2033

Figure 17: Global Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 18: Global Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 19: Global Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 20: Global Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 21: Global Market Attractiveness by Type, 2023 to 2033

Figure 22: Global Market Attractiveness by Material, 2023 to 2033

Figure 23: Global Market Attractiveness by Application, 2023 to 2033

Figure 24: Global Market Attractiveness by Region, 2023 to 2033

Figure 25: North America Market Value (US$ Million) by Type, 2023 to 2033

Figure 26: North America Market Value (US$ Million) by Material, 2023 to 2033

Figure 27: North America Market Value (US$ Million) by Application, 2023 to 2033

Figure 28: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 29: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 30: North America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 31: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 32: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 33: North America Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 34: North America Market Volume (Units) Analysis by Type, 2018 to 2033

Figure 35: North America Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 36: North America Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 37: North America Market Value (US$ Million) Analysis by Material, 2018 to 2033

Figure 38: North America Market Volume (Units) Analysis by Material, 2018 to 2033

Figure 39: North America Market Value Share (%) and BPS Analysis by Material, 2023 to 2033

Figure 40: North America Market Y-o-Y Growth (%) Projections by Material, 2023 to 2033

Figure 41: North America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 42: North America Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 43: North America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 44: North America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 45: North America Market Attractiveness by Type, 2023 to 2033

Figure 46: North America Market Attractiveness by Material, 2023 to 2033

Figure 47: North America Market Attractiveness by Application, 2023 to 2033

Figure 48: North America Market Attractiveness by Country, 2023 to 2033

Figure 49: Latin America Market Value (US$ Million) by Type, 2023 to 2033

Figure 50: Latin America Market Value (US$ Million) by Material, 2023 to 2033

Figure 51: Latin America Market Value (US$ Million) by Application, 2023 to 2033

Figure 52: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 53: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 54: Latin America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 55: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 57: Latin America Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 58: Latin America Market Volume (Units) Analysis by Type, 2018 to 2033

Figure 59: Latin America Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 60: Latin America Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 61: Latin America Market Value (US$ Million) Analysis by Material, 2018 to 2033

Figure 62: Latin America Market Volume (Units) Analysis by Material, 2018 to 2033

Figure 63: Latin America Market Value Share (%) and BPS Analysis by Material, 2023 to 2033

Figure 64: Latin America Market Y-o-Y Growth (%) Projections by Material, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 66: Latin America Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 67: Latin America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 68: Latin America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 69: Latin America Market Attractiveness by Type, 2023 to 2033

Figure 70: Latin America Market Attractiveness by Material, 2023 to 2033

Figure 71: Latin America Market Attractiveness by Application, 2023 to 2033

Figure 72: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 73: Europe Market Value (US$ Million) by Type, 2023 to 2033

Figure 74: Europe Market Value (US$ Million) by Material, 2023 to 2033

Figure 75: Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 76: Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 77: Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 78: Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 79: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 80: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 81: Europe Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 82: Europe Market Volume (Units) Analysis by Type, 2018 to 2033

Figure 83: Europe Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 84: Europe Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 85: Europe Market Value (US$ Million) Analysis by Material, 2018 to 2033

Figure 86: Europe Market Volume (Units) Analysis by Material, 2018 to 2033

Figure 87: Europe Market Value Share (%) and BPS Analysis by Material, 2023 to 2033

Figure 88: Europe Market Y-o-Y Growth (%) Projections by Material, 2023 to 2033

Figure 89: Europe Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 90: Europe Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 91: Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 92: Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 93: Europe Market Attractiveness by Type, 2023 to 2033

Figure 94: Europe Market Attractiveness by Material, 2023 to 2033

Figure 95: Europe Market Attractiveness by Application, 2023 to 2033

Figure 96: Europe Market Attractiveness by Country, 2023 to 2033

Figure 97: Asia Pacific Market Value (US$ Million) by Type, 2023 to 2033

Figure 98: Asia Pacific Market Value (US$ Million) by Material, 2023 to 2033

Figure 99: Asia Pacific Market Value (US$ Million) by Application, 2023 to 2033

Figure 100: Asia Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 101: Asia Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 102: Asia Pacific Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 103: Asia Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 104: Asia Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 105: Asia Pacific Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 106: Asia Pacific Market Volume (Units) Analysis by Type, 2018 to 2033

Figure 107: Asia Pacific Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 108: Asia Pacific Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 109: Asia Pacific Market Value (US$ Million) Analysis by Material, 2018 to 2033

Figure 110: Asia Pacific Market Volume (Units) Analysis by Material, 2018 to 2033

Figure 111: Asia Pacific Market Value Share (%) and BPS Analysis by Material, 2023 to 2033

Figure 112: Asia Pacific Market Y-o-Y Growth (%) Projections by Material, 2023 to 2033

Figure 113: Asia Pacific Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 114: Asia Pacific Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 115: Asia Pacific Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 116: Asia Pacific Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 117: Asia Pacific Market Attractiveness by Type, 2023 to 2033

Figure 118: Asia Pacific Market Attractiveness by Material, 2023 to 2033

Figure 119: Asia Pacific Market Attractiveness by Application, 2023 to 2033

Figure 120: Asia Pacific Market Attractiveness by Country, 2023 to 2033

Figure 121: MEA Market Value (US$ Million) by Type, 2023 to 2033

Figure 122: MEA Market Value (US$ Million) by Material, 2023 to 2033

Figure 123: MEA Market Value (US$ Million) by Application, 2023 to 2033

Figure 124: MEA Market Value (US$ Million) by Country, 2023 to 2033

Figure 125: MEA Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 126: MEA Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 127: MEA Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 128: MEA Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 129: MEA Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 130: MEA Market Volume (Units) Analysis by Type, 2018 to 2033

Figure 131: MEA Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 132: MEA Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 133: MEA Market Value (US$ Million) Analysis by Material, 2018 to 2033

Figure 134: MEA Market Volume (Units) Analysis by Material, 2018 to 2033

Figure 135: MEA Market Value Share (%) and BPS Analysis by Material, 2023 to 2033

Figure 136: MEA Market Y-o-Y Growth (%) Projections by Material, 2023 to 2033

Figure 137: MEA Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 138: MEA Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 139: MEA Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 140: MEA Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 141: MEA Market Attractiveness by Type, 2023 to 2033

Figure 142: MEA Market Attractiveness by Material, 2023 to 2033

Figure 143: MEA Market Attractiveness by Application, 2023 to 2033

Figure 144: MEA Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Modular & Prefabricated Construction Market Size and Share Forecast Outlook 2025 to 2035

Modular Rotary Table Market Size and Share Forecast Outlook 2025 to 2035

Modularised Emulsion Plant Market Size and Share Forecast Outlook 2025 to 2035

Modular Palletizer Cells Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Modular Self-Contained Aisle and Racking Systems Market Size and Share Forecast Outlook 2025 to 2035

Modular Flooring Market Size and Share Forecast Outlook 2025 to 2035

Modular Furniture Market Size and Share Forecast Outlook 2025 to 2035

Modular Fitness Furniture Market Size and Share Forecast Outlook 2025 to 2035

Modular Chillers Market Size and Share Forecast Outlook 2025 to 2035

Modular Kitchen Baskets Market Size and Share Forecast Outlook 2025 to 2035

Modular Data Center Market Analysis - Size, Share, and Forecast 2025 to 2035

Modular Instrumentation Platform Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Modular UPS Market Growth - Trends & Forecast 2025 to 2035

Modular Energy Control System Market Growth – Trends & Forecast 2025 to 2035

Modular Instruments Market Growth – Trends & Forecast 2025 to 2035

Modular Trailer Market Growth – Trends & Forecast 2024-2034

Modular Substation Market Analysis – Growth & Demand 2024-2034

Modular Robotics Market Growth – Trends & Forecast 2024-2034

Modular Plating Systems Market

Modular Conveyor System Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA