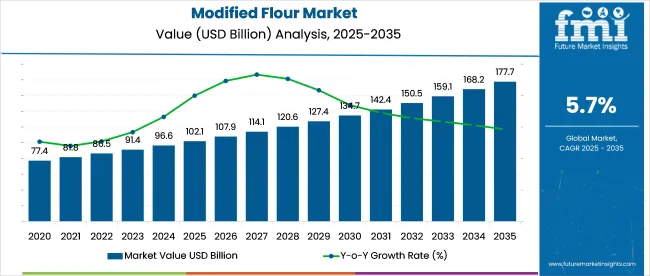

The modified flour market is estimated to be worth USD 102.1 billion in 2025, increasing to USD 177.7 billion by 2035, at an approximate CAGR of 5.7%. Growth is being shaped by rising demand for functional, gluten-free, and enzyme-treated flours that offer improved texture, shelf life, and nutritional benefits.

| Metric | Value |

|---|---|

| Industry Value (2025) | USD 102.1 billion |

| Forecast Value (2035) | USD 177.7 billion |

| Global CAGR (2025 to 2035) | 5.7% |

Powdered and physical-modification formats are being favored due to their processing flexibility, while chemical and enzymatic variants are being adopted for clean-label and performance-driven applications. It is argued that manufacturers investing in microencapsulation, precision fermentation, and AI-enabled formulation will outperform generic millers.

In 2025, Cargill introduced its latest portfolio of modified starches and functional flour blends at the AAHAR trade event in India, highlighting its commitment to delivering ingredient solutions tailored to modern food processing needs. These innovations, including dent corn-based modified starches, are designed to enhance texture, improve stability, and optimize production costs across bakery, snack, and convenience food applications.

The modified flour marketholds a specialized share within its parent markets. In the flour market, it accounts for about 5-7%, as it is a niche segment. Within the food ingredients market, the share is approximately 2-3%, due to its functional use in various food products.

In the baking ingredients market, modified flour represents 6-8%, essential for specific applications like gluten-free and low-carb baking. In the processed food market, its share is around 3-5%, used in convenience foods. In the health and wellness food market, the share is about 2-3%, supporting healthier food options.

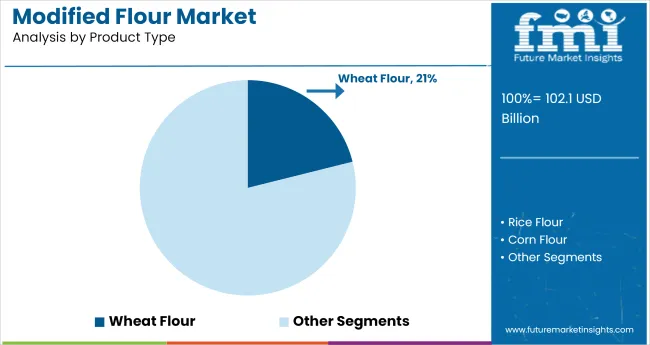

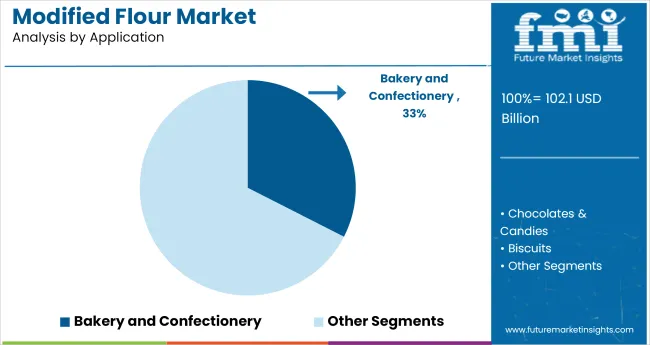

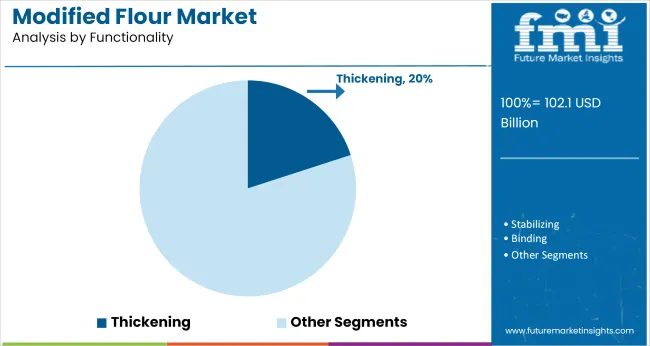

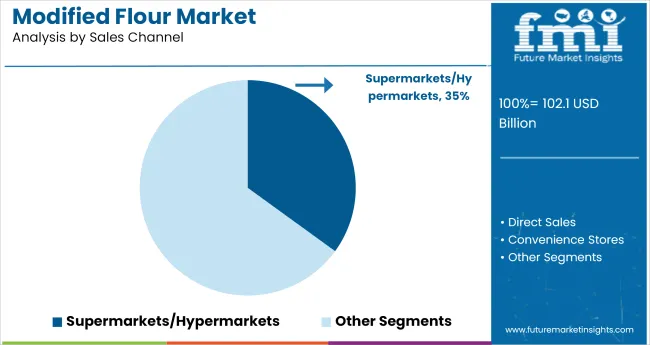

The modified flour market in 2025 will be driven by wheat flour with a 21.1% market share, bakery and confectionery applications capturing 32.5%, thickening functionality at 20%, and supermarkets/hypermarkets leading the sales channel with 35% market share.

Wheat flour is expected to account for 21.1% of the market share in the modified flour segment by 2025. As a versatile and widely used flour, wheat flour remains the cornerstone for various food applications, especially in bakery products.

Its adaptability in formulations, ease of modification for specific functionality, and widespread availability make it the most popular choice in the modified flour market. The growing demand for customized flour with enhanced properties in food processing applications is also driving the continued dominance of wheat flour.

The bakery and confectionery sector is projected to capture 32.5% of the market share in 2025. Modified flour plays a critical role in the production of various baked goods and confectionery products, where texture, taste, and shelf life are crucial.

With the rising consumer demand for high-quality baked goods, the demand for specialized flours, such as those modified for improved texture, moisture retention, and dough stability, is growing. Bakery applications, including bread, cakes, and pastries, account for the majority of modified flour usage in the food industry, further strengthening this segment’s leading position.

Thickening functionality is expected to capture 20% of the market share in 2025, driven by the need for modified flours that enhance the texture and consistency of sauces, gravies, soups, and other culinary products. The ability to provide smooth and consistent viscosity makes thickening agents critical in both food and industrial applications.

As consumers demand more convenience, processed food products utilizing modified flour for thickening purposes continue to rise. This trend, combined with the growing focus on clean-label ingredients, is driving the demand for flours that can deliver high-performance thickening properties without compromising on quality.

Supermarkets and hypermarkets are projected to capture 35% of the modified flour market share in 2025, making them the leading sales channel. These retail giants offer easy access to a wide range of modified flour products for both consumer use and industrial applications.

The growing trend of home baking and increasing consumer awareness of functional food ingredients further supports the dominance of supermarkets and hypermarkets. Their ability to offer large quantities, product variety, and convenience continues to make them the preferred point of sale for modified flour.

The modified flour market is expanding due to rising demand for health-conscious and gluten-free food products. However, challenges such as fluctuating raw material prices and production barriers, including limited access to consistent quality ingredients, are limiting broader market growth, particularly for smaller manufacturers.

Rising Demand for Health-Conscious and Gluten-Free Products

The modified flour market is driven by the increasing preference for health-conscious and gluten-free food options. As consumers become more aware of their dietary needs, demand for modified flours, such as those made from legumes, rice, and sorghum, has risen.

These flours offer enhanced nutritional value and better texture for gluten-free products like bread, snacks, and bakery items. The shift towards healthier eating, combined with dietary restrictions, continues to propel the market forward, making modified flour a preferred choice for many consumers.

Raw Material Price Instability and Production Barriers

Despite market growth, the modified flour market faces challenges due to fluctuating raw material costs and production barriers. Prices for key ingredients like legumes, grains, and specialty crops can fluctuate based on weather conditions, agricultural output, and global market trends.

These price changes can affect production costs, leading to price volatility for modified flour products. Additionally, complex production processes and limited access to consistent quality raw materials further restrict large-scale production and availability, especially for smaller manufacturers and emerging market players.

| Countries | CAGR (2025 to 2035) |

|---|---|

| United States | 3.1% |

| India | 6.3% |

| China | 5.9% |

| Germany | 3.9% |

| Japan | 5.5% |

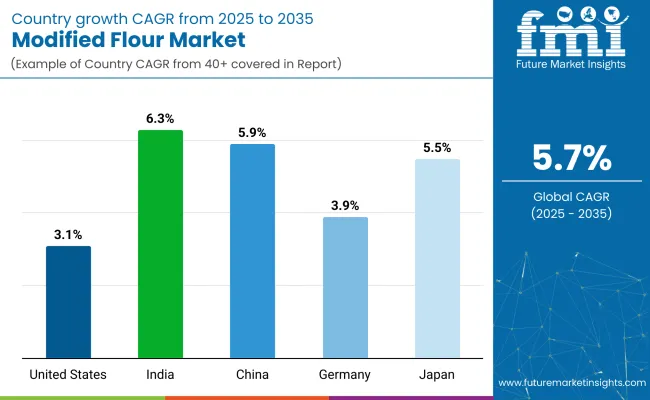

Global modified flour market demand is projected to rise at a 5.7% CAGR from 2025 to 2035. Of the five profiled markets out of 40 covered, India leads at 6.3%, followed by China at 5.9%, and Japan at 5.5%, while the United States posts 3.1% and Germany records 3.9%.

These rates translate to a growth premium of +10% for India, +3% for China, and -32% for the United States versus the baseline, while Germany and Japan show more moderate growth. Divergence reflects local catalysts: increasing demand for functional, health-oriented food ingredients in India and China, while slower growth in the United States and Germany is driven by market maturity and established usage in the food processing industry.

The modified flour market in the United States is forecasted to grow at a 3.1% CAGR from 2025 to 2035. Growth remains tied to demand from foodservice and processed snack categories, with particular focus on thickening agents and gluten-replacement functions.

Manufacturers are targeting clean-label applications, including ready meals, gravies, and bakery mixes, using pregelatinized and enzyme-modified variants. While large-scale adoption persists across institutional and industrial kitchens, consumer-facing growth remains tempered by labeling skepticism and shifting flour substitution trends. Applications in frozen meal stabilization and low-carb bakery formulations are seeing incremental growth due to private label innovation and ingredient consolidation strategies.

India’s modified flour market is projected to expand at a 6.3% CAGR from 2025 to 2035. The food manufacturing sector continues to adopt modified flour for improving texture, water retention, and shelf life in products such as instant mixes, snacks, and frozen parathas. Domestic processors are incorporating heat-treated and acid-modified flours to improve frying properties and reduce oil uptake.

Packaged food growth across Tier 2 cities is strengthening commercial demand, with multinational food brands localizing product lines to suit Indian taste profiles. Export demand for ready-to-cook products is also contributing to flour modification innovation using native grains.

China’s modified flour market is expected to grow at a CAGR of 5.9% between 2025 and 2035. Food ingredient manufacturers use modified flour as stabilizers and viscosity enhancers across sauces, desserts, and noodle-based frozen meals. Multinational firms and regional players continue to expand coating and binding applications within snack coatings and processed meats.

Regulatory clarity around food-grade modifiers has allowed broader usage across packaged and convenience food categories. With online grocery formats rising, demand has shifted toward ambient-stable, rehydratable foods that rely heavily on modified flour properties. Export-oriented food factories have also upgraded quality protocols to meet international compliance for flour additives.

Germany’s modified flour market is projected to grow at a CAGR of 3.9% from 2025 to 2035. Growth is underpinned by industrial bakery demand, with controlled starch modifications used to enhance dough stability and extend shelf life in frozen and gluten-free breads. Modified flours are incorporated into convenience products such as sauces, ready-to-eat soups, and dairy-alternative beverages.

German ingredient companies are investing in enzymatic and physical flour treatment methods, avoiding chemical modifications due to EU labeling restrictions. Bio-based starch modifiers using native grains like rye and spelt are being integrated to meet formulation flexibility and processing resilience.

Japan’s modified flour market is forecast to grow at a 5.5% CAGR through 2035. Consumer-facing segments rely on modified flour for thickening, binding, and freeze-thaw stability across frozen desserts, instant soups, and ready meals. Japanese processors favor high-performance flour alternatives derived from sweet potatoes and rice, responding to texture-focused consumer preferences.

Modified flour is integrated in smaller batch formulations such as convenience store bento items and cold-prep noodle kits. Due to stringent consumer expectations on mouthfeel and visual consistency, refinements in cross-linked and oxidized flour usage are central to innovation.

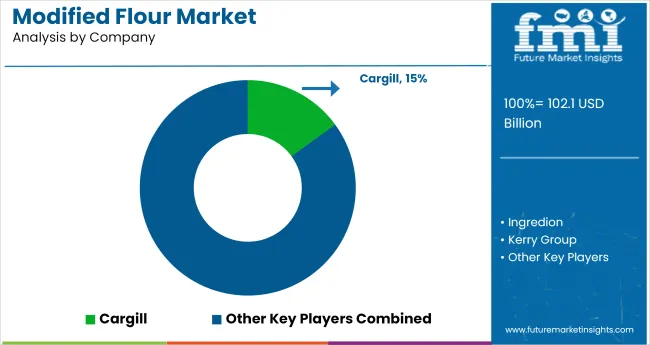

The global modified flour market is led by Cargill, Incorporated, holding a significant share of approximately 15%.Cargill's extensive portfolio includes modified flours derived from various sources such as wheat, corn, and tapioca, catering to diverse applications in the food and beverage industry.

The company's commitment to innovation and quality has solidified its leadership position in the market.Cargill's strategic initiatives, including research and development investments and global expansion, have further strengthened its market presence.The company's focus on meeting the evolving demands of consumers and food manufacturers has contributed to its sustained growth in the modified flour sector.

Recent Industry Developments

| Report Attributes | Details |

|---|---|

| Market Size (2025) | USD 102.1 billion |

| Market Value (2035) | USD 177.7 billion |

| Forecast CAGR (2025 to 2035) | 5.7% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD billion for value and million tons for volume |

| Product Type Segmentation | Wheat Flour, Rice Flour, Corn Flour, Potato Flour, Tapioca Flour/Starch, Cassava Flour, Soy Flour, Oat Flour, Chickpea Flour, Others |

| End-Use Segmentation | Bakery and Confectionery, Chocolates & Candies, Biscuits, Cakes, Bread and Bread Products, Dairy Products, Infant Formula/Baby Food, Desserts & Smoothies, Instant Food Products, Beverages Processing |

| Functionality Segmentation | Thickening, Stabilizing, Binding, Texture Modification, Moisture Control, Gel Formation, Gluten Modification, Shelf-life Extension |

| Sales Channel Segmentation | Direct Sales, Supermarket/Hypermarket, Convenience Stores, Discount/Dollar Stores, Grocery Stores, Wholesale Stores, Online Retailing |

| Regions Covered | North America, Latin America, Europe, East Asia, South Asia, Oceania, Middle East & Africa |

| Countries Covered | United States, Canada, Mexico, Brazil, Argentina, Germany, France, United Kingdom, Italy, Spain, Netherlands, China, India, Japan, South Korea, Australia, New Zealand, GCC Countries, South Africa |

| Leading Modified Flour Brands | Cargill, Ingredion, Kerry Group, Tate & Lyle, Roquette, DuPont (now part of International Flavors & Fragrances Inc.), Bunge, Grain Millers, MGP Ingredients, Corbion, AAK, The Scoular Company, SunOpta, AVEBE, RCL Foods, Tereos, Harinera del Valle, Glico Nutrition, Manildra Group |

| Additional Attributes | Dollar sales by product type, end-use, and functionality, rising demand for gluten-free and alternative flour products, growing adoption in the food and beverage sector, expanding distribution through supermarkets and online retail, regional trends in food formulation and product development. |

Product segmentation includes wheat flour, rice flour, corn flour, potato flour, tapioca flour/starch, cassava flour, soy flour, oat flour, chickpea flour, and others.

End-use categories comprise bakery and confectionery, chocolates & candies, biscuits, cakes, bread and bread products, dairy products, infant formula/baby food, desserts & smoothies, instant food products, and beverages processing.

Functional attributes include thickening, stabilizing, binding, texture modification, moisture control, gel formation, gluten modification, and shelf-life extension.

Sales channels include direct sales, supermarket/hypermarket, convenience stores, discount/dollar stores, grocery stores, wholesale stores, and online retailing.

Regional analysis includes North America, Latin America, Europe, East Asia, South Asia, Oceania, and the Middle East & Africa.

The projected size of the global modified flour market in 2025 is USD 102.1 billion.

The market value of the modified flour market in 2035 is USD 177.7 billion, with a CAGR of 5.7%.

Bakery and confectionery applications dominate the modified flour market with a 32.5% market share.

India will experience the fastest growth in the modified flour market with a CAGR of 6.3% from 2025 to 2035.

The leading company in the modified flour market is Cargill, Incorporated, with a 15% market share.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Modified Soya Flour Market Size and Share Forecast Outlook 2025 to 2035

Modified Milk Ingredients Market Size and Share Forecast Outlook 2025 to 2035

Modified Atmosphere Packaging Equipment Market Size and Share Forecast Outlook 2025 to 2035

Modified Bitumen Market Size and Share Forecast Outlook 2025 to 2035

Modified Release Formulations Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Modified Starch Market Analysis - Size, Share, and Forecast 2024 to 2034

Modified lecithin Market

DNA-Modified Plant Extracts Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Organo-Modified Bentonite Market Growth - Trends & Forecast 2025 to 2035

Polymer Modified Bitumen Market Growth 2024-2034

Polyether Modified Polysiloxane Market Analysis – Share, Size, and Forecast 2025 to 2035

Competitive Overview of Active and Modified Atmospheric Packaging Companies

Active & Modified Atmospheric Packaging Market Trends & Forecast 2024-2034

Genetically Modified Food Market Analysis by Type, Trait, and Region through 2035

Flour Mixes Market Growth – Specialty Baking & Industry Trends 2025 to 2035

Flour Substitutes Market Analysis by Baked Goods, Noodles, Pastry, Fried Food, Pasta, Bread, Crackers Applications Through 2035

Flour Conditioner Market

Flour Improvers Market

Corn Flour Market Size and Share Forecast Outlook 2025 to 2035

Bean Flour Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA