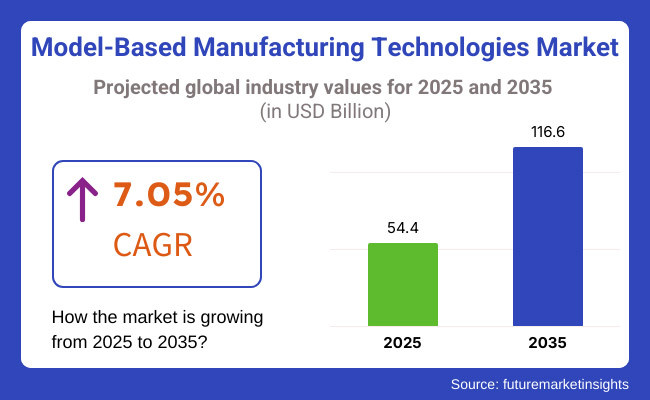

The global model-based manufacturing technologies market is set to register USD 54.4 billion in 2025. The industry is poised to reach 7.05% CAGR from 2025 to 2035, witnessing USD 116.6 billion by 2035.

The model-based manufacturing technologies market refers to the sector focused on employing digital models, simulations, and automation to reduce industrial production cycles. Artificial Intelligence-based analytics, digital twin technics and intelligent factory solutions will allow manufacturers to create, prototype, and manufacture smarter, more efficient and scalable fashion.

The aerospace, automotive, health, and consumer electronics sectors are increasingly adopting model-based manufacturing with the goal of enhancing precision, reducing costs, and offering real-time data-supported decision-making in the context of a rapidly evolving industry landscape.

Increasing dependence upon automation, predictive analysis, and digital simulations is expected to push the demand for model-based manufacturing solutions. Helpful in speeding up the product lifecycle, reducing waste and maximizing efficiencies, AI driven process optimization has also crept into the business process. Understanding the need for application data up to date helps manufacturers predict maintenance needs, increase supply chain functionality and minimize downtime, thus boosting productivity and saving costs through real-time data integration.

Technological advancements are also disrupting the industry; the advent of smart factory, IoT and cloud computing-based data analytics, and advanced simulation software are ensuring easy connectivity provided through manufacturing ecosystems. Digital twins-virtual replicas of real-world production environment-are being deployed to test different scenarios, prototype before building, and ensure product quality while minimizing resource consumption. The technologies are reshaping traditional manufacturing models by enabling automation, predictive maintenance, and process control.

The widespread adoption of industry is accelerating the need for model-based manufacturing for a variety of industries. Such technologies are being used by aerospace and automotive to improve complex production, reduce lead times and assist compliance. Digital modeling is improving the precision of medical device manufacturing in the healthcare sector, while AI-augmented design and rapid prototyping are allowing consumer electronics manufacturers to provide greater product customization.

The industry will continue to expand with ever-evolving automation, real-time monitoring, and AI-based decision-making. Investments in more scalable, affordable and highly efficient production technologies will happen as industries embrace smart manufacturing solutions. We will also see further synergies between model-based systems and cloud, edge AI, and digital twins to enhance manufacturing capabilities, ensuring a future of precision, speed, and flexibility in the industrial production of the future.

Explore FMI!

Book a free demo

The inustry for model-based manufacturing technologies is being revolutionized through the takeoff of Industry 4.0, digital twins, and the automation-based on AI. Model-based system integration is an area of concentration for companies aimed at maximizing productivity, reducing cost, and accommodating stringent regulations. The software industry is concentrating on designing new simulation software, cloud platforms, and AI applications for predictive maintenance and optimization of processes.

The systems integrators are promoting interoperability and continuous communications between previous systems and newly installed technologies. End users, however, in vehicle, aircraft, and electrical devices industry are demanding flexible and affordable solutions for the streamlining of design-to-production workflows.

The quick digital transformation, the rise of smart factories, and the real-time monitoring capacity are the main forces that cause an investment in model-based manufacturing. As companies tend to act on the data-driven decisions, an upsurge in the implementation of AI, IoT, and cloud MES (managing execution systems) is expected, which will consequently bring about a inustry extension.

| Company | Siemens Digital Industries Software |

|---|---|

| Contract/Development Details | Siemens secured a multi-year contract with a leading aerospace manufacturer to implement model-based manufacturing solutions for digital twin integration and real-time production optimization. |

| Date | March 15, 2024 |

| Contract Value (USD Million) | Approximately USD 90 - USD 100 |

| Estimated Renewal Period | 5 years |

| Company | Dassault Systèmes |

|---|---|

| Contract/Development Details | Dassault Systèmes entered into an agreement with a global automotive company to deploy its model-based manufacturing technology, enhancing virtual simulations and predictive maintenance capabilities. |

| Date | July 22, 2024 |

| Contract Value (USD Million) | Approximately USD 80 - USD 90 |

| Estimated Renewal Period | 6 years |

| Company | PTC Inc. |

|---|---|

| Contract/Development Details | PTC expanded its model-based manufacturing portfolio through a strategic partnership with an industrial equipment manufacturer, focusing on IoT-driven production automation and digital thread integration. |

| Date | October 10, 2024 |

| Contract Value (USD Million) | Approximately USD 70 - USD 80 |

| Estimated Renewal Period | 5 years |

| Company | Autodesk Inc. |

|---|---|

| Contract/Development Details | Autodesk announced a collaboration with a top-tier electronics manufacturer to implement AI-powered generative design and model-based manufacturing workflows for high-precision component production. |

| Date | January 5, 2025 |

| Contract Value (USD Million) | Approximately USD 60 - USD 70 |

| Estimated Renewal Period | 4 years |

In 2020 to 2024, the industry for model-based manufacturing technologies was supported by industries' allocation of resources toward automation, digital twins, and real-time data integration to achieve production efficiency. Demand from the aerospace, automotive, and industrial sectors propelled the uptake of Computer-Aided Design (CAD), Computer-Aided Manufacturing (CAM), and Product Lifecycle Management (PLM) systems.

Manufacturers used simulation and predictive analytics to enhance their business processes and reduce production downtime. Cloud-based solutions were getting popular as well, which could facilitate collaboration across the supply chains of the world.

The period 2025 to 2035 will see industry development around AI, machine learning, and edge computing. There are smart factories, where Industry 5.0 would also create opportunities for digital twins or even cyber-physical systems supporting adaptive and self-optimizing production spaces.

Sustainability challenges shall also urge industries toward energy-efficient and waste-reducing manufacturing solutions. The industry will remain in the forefront of digital transformation for industries, along with customization and on-demand production taking center stage.

Comparative Market Shift Analysis (2020 to 2024 vs. 2025 to 2035)

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Governments and industry associations enforced digital thread integration. This made manufacturers adopt MBM to achieve global quality and safety standards. | Automation of regulatory compliance through AI complements MBM, offering real-time data tracking, automated audits, and predictive quality control to counter evolving global manufacturing regulations. |

| Firms used digital twin technology to model manufacturing processes, streamline workflows, and minimize production faults. | Self-learning, AI-fueled digital twins power autonomous manufacturing with real-time decision-making, adaptive process control, and proactive failure prevention. |

| MBM was integrated with real-time feedback loops by manufacturers to maximize production efficiency and facilitate adaptive process optimization. | AI-fueled closed-loop manufacturing systems adjust parameters autonomously, optimize production schedules, and reduce defects through continuous self-learning mechanisms. |

| MBM-based robotics enhanced precision, automation, and human-machine coordination in intelligent factories. | AI-powered, completely autonomous robotic systems use MBM to enable self-calibrating, real-time adaptive manufacturing, minimizing human interaction and maximizing efficiency. |

| Flexible manufacturing, responsive to demand, can be managed through MBM, which is suitable for rapid prototyping and just-in-time production. | AI MBM solutions create flexible, demand-led manufacturing networks able to change production schedules dynamically, based on real-time demand forecasting and supply chain insights. |

| MBM is being adopted in manufacturing for advanced simulations that embody structural, thermal, and fluid dynamics, with an emphasis on engineering quality products. | AI-based multi-physics modeling platforms have revolutionized manufacturing by realizing hyper-accurate fast simulation for advanced materials and next-generation product designs. |

| Firms have moved from the on-premise MBM to cloud-based versions to enhance collaboration through access to data and remote operation. | Real-time collaborative-virtual manufacturing and decentralized production hubs within an AI-enabled multi-cloud MBM ecosystem are breaking the silos and fostering cross-functional teamwork. |

| Maximizing production performance with minimum downtimes was provided by AI-enabled MBM integrating predictive maintenance strategies. | The AI technologies for predictive maintenance automate, in real time, condition monitoring, so that production processes are kept in a near-continuous state of self-optimization with scant downtime. |

| With improvements in supply chain visibility and efficiency through the MBM platforms, waste was minimized and resource allocation maximized. | AI-reactive choreography of supply chains through MBM senses demand in real-time and automates inventory control while providing frictionless supplier collaboration to reduce all delays and inefficiencies. |

The model-based manufacturing (MBM) technologies market is under a number of essential threats, including integration challenges, regulatory compliance, cybersecurity threats, and technological obsolescence. One of the main risks is system integration complexity. A lot of manufacturers are still using legacy systems and basic traditional CAD/CAM software that they are accustomed to, therefore it is difficult to go for the digital model process entirely alone.

Regulatory compliance is also a big risk because sectors like aerospace, automotive, and healthcare manufacturing must comply with stringent manufacturing regulations such as ISO 9001, AS9100, and FDA. Not following the regulations may have legal consequences, lead to supply chain disruption, and even product recalls which in turn can lead to lower profits.

Cybersecurity threats are being discussed more and more as issues in the context of cloud-based and IoT-connected manufacturing technologies. Specifically, model-based manufacturing which is a process that relies on digital twins, real-time data sharing, and AI-driven analytics, is putting companies in a vulnerable position to cyberattacks, data breaches, and intellectual property theft.

Technological obsolescence is also another crucial risk. Continuous investment in R&D and workforce training is necessary since the pace of advancement in AI, machine learning, and additive manufacturing has been very fast. The firms which do not preserve, and embrace the original technology may face the challenge of staying competitive in the industry.

The last impediment, the high costs of implementation and the lack of sufficient return on investment (ROI) have the effect of slowing down the adoption of this technology, especially for small and mid-sized manufacturers. The full transition to automated, model-driven production processes will be possible afterward but first, the manufacturers need to buy software, hardware, and the labor force which will be costly. Hence, cost management becomes a top concern.

Major players, including SAP, Oracle, and Microsoft Dynamics 365, embed AI and IoT features in their ERP systems specifically designed for manufacturing customers, allowing them to enhance inventory management, supply chain integration, and demand forecasting. Ford automotive manufacturing plants minimize scrap using KTKs ERP Powered Insights for Data-Driven Automated Production.

Manufacturing Execution Systems (MES) allow for the real-time control of production in which materials and work-in-progress can be tracked, while PLM software enables the optimization of a product's design over its life cycle and CAD/CAM tools facilitate precision engineering (computer-aided design and computer-aided manufacturing) development. Industry leaders, including PTC, Dassault Systèmes, and Siemens Digital Industries create modeling and simulation AI-powered tools to enhance product quality at the cost of prototyping.

With manufacturers moving toward cloud-based smart factories, cybersecurity consulting and predictive maintenance services are in high demand. Rockwell Automation's security services safeguard connected production systems from cyber threats, promoting dependable and effective manufacturing environments. Model-based manufacturing technologies are advancing rapidly and are powered by AI-driven automation, data analytics, and cloud-based collaboration, confirming their essential role within current industrial ecosystems.

In 2025, automotive was estimated to continue leading the model-based manufacturing technologies market and will play a dominant role in the automotive sector. The reason for this dominance lies in the ever-increasing complexity of vehicle manufacturing, the evolution of electric vehicles (EVs), and ever-stricter compliance requirements.

Automobile manufacturers like Tesla, Toyota, and General Motors are using ERP and PLM software to streamline their manufacturing processes, minimize waste, and improve speed to industry. For instance, Toyota's Smart Factory program helps to coordinate the supply chain and plan production to be efficient through real-time data analytics and AI-based predictive maintenance.

Model-based manufacturing is being rapidly adopted in the electronics and semiconductor industry to address the increasing complexity of chip fabrication and miniaturization. With the growing reliance on high-performance, energy-efficient components, businesses are increasingly using CAD/CAM and MES software that can improve production efficiency and quality control.

Industry leaders such as Intel and TSMC use AI-driven defect detection, real-time data analytics, and automation to optimize wafer fabrication and cleanroom operations. This helps yield rates and lower production downtime and errors in processes. As semiconductor nodes continue to shrink down to 3nm and below, it is critical for semiconductor manufacturers to embrace model-based manufacturing to accelerate innovation, improve the scalability of designs, and remain globally competitive in a rapidly evolving tech landscape.

| Countries | CAGR (2025 to 2035) |

|---|---|

| USA | 9.1% |

| China | 9.7% |

| Germany | 8.5% |

| Japan | 8.8% |

| India | 9.9% |

| Australia | 8.4% |

The USA industry is growing progressively with intelligent manufacturing, digital twin technology, and AI-optimized manufacturing finding applications across sectors.

Businesses are embracing model-based technologies to deliver efficiency improvements, lower operation costs, and improve predictive maintenance. The investment in advanced manufacturing and automation in 2024 was more than USD 10 billion, showing an increasing dependence on digital transformation. Automotive, aerospace, and electronics sectors are shifting towards model-based manufacturing to improve the accuracy of designs and make them production process-oriented.

The USA government is still emphasizing the development of Industry 4.0 technologies, such as cloud-based manufacturing and predictive analytics that further enable industry growth. FMI believes the USA the industry will expand at 9.1% CAGR over the forecast period.

| Growth Drivers in the USA | Information |

|---|---|

| Expansion of Smart Manufacturing and Industry 4.0 | Implementing automated workflow, real-time simulation, and digital twins is on the rise. |

| AI-Based Production Optimizations | AI-based analytics improve process performance and predictive maintenance. |

| Expansion in Aerospace, Automotive, and Electronics | Model-based technologies enhance design flexibility and accuracy. |

China is expanding immensely by adopting smart factory solutions, automation, and AI-based manufacturing solutions. China, the world's manufacturing hub, is investing significantly in digital twins, predictive analytics, and cloud-based manufacturing platforms. Industrial AI and smart manufacturing in 2024 totaled USD 15 billion in China, once again solidifying its leadership in advanced manufacturing.

The automotive, electronics, and heavy machinery industries use model-based simulation tools to improve efficiency in manufacturing and supply chain. FMI forecasts the industry in China to grow at 9.7% CAGR over the forecast period.

| Growth Drivers in China | Information |

|---|---|

| Government Support for Smart Factory Establishment | Manufacturing and automation policies in support of AI. |

| Growing Use of AI and Robots in Manufacturing | Increased adoption of digital twins, robotics-based automation, and predictive analysis. |

| Use in Automotive, Electronics, and Heavy Machinery | Enhanced production quality and supply chain effectiveness. |

Germany is growing well because of the integration of cyber-physical manufacturing systems, digital twins, and real-time automated processes. Germany dominates precision engineering and industrial productivity and invests in green and energy-saving production. Germany's industry and IoT integration commitment drives industries to adopt cloud-based model-based production systems.

| Growth Drivers in Germany | Details |

|---|---|

| Adoption of Digital Twins and Simulation | Improved modeling increases process automation. |

| Sustainable and Energy-Saving Manufacturing | Energy consumption is minimized through model-based methods. |

| Evolution of IoT and Cloud-Based Manufacturing | Enhanced application of cloud computing for manufacturing. |

Japan is growing as businesses adopt predictive maintenance, real-time monitoring, and artificial intelligence automation. Smart factory solutions and digital twins have been driven to the forefront by Japan's high-precision engineering and robotics.

Japan's semiconductor and high-tech manufacturing industries use model-based optimization to gain high-end manufacturing capability with efficiency and quality control. FMI considers that Japan's industry will register 8.8% CAGR during the forecast period.

| Growth Drivers in Japan | Insights |

|---|---|

| Artificial Intelligence in Smart Manufacturing and Robotics | AI-based automation provides maximum efficiency in manufacturing. |

| Semiconductor and Electronics Growth | Model-based optimization enhances accuracy in chip manufacturing. |

| Secure Cloud-Based Manufacturing Platforms | Future SaaS-based digital manufacturing requirements. |

India's industry is growing at an extremely high rate with government-induced industrial automation, IoT investments, and intelligent manufacturing policies.

The 'Make in India' policy has influenced organizations to adopt cost-effective model-based solutions. Auto and aviation industries invest in process improvement by model-based simulation, while SMEs adopt scalable digital manufacturing solutions.

| Growth Drivers in India | Data |

|---|---|

| Government Encouragement towards Digital Manufacturing | Industry 4.0 and automation adoption policies. |

| Growth of Automotive and Aerospace Sectors | Growing application of model-based simulation technologies. |

| Low-cost, Scalable Digital Technologies | SMEs embracing AI-based manufacturing platforms. |

Australia is growing consistently as companies invest in digital manufacturing, AI-based automation, and industrial IoT. Defense, mining, and renewable energy industries embrace model-based predictive analysis and process optimization. The country's emphasis on sustainability and technology development is propelling the adoption of smart manufacturing.

| Growth Drivers in Australia | Data |

|---|---|

| Government Industrial AI Investments | Digitalization and automation policies by the government. |

| Development of Cloud-Based and IoT-Powered Systems | Integrated systems make real-time production smoother. |

| Development of Aerospace, Mining, and Renewable Energy | Increased use of digital twins and smart manufacturing. |

The industry for model-based manufacturing technologies is growing at a rapid pace, primarily due to the advent of industry, digital twin technology, and advanced automation. With an agenda to improve efficiency, lower costs, and raise product quality, the manufacturers are causing a further deterrence of the industry growth by hastening their investment in AI-based analytics, real-time simulations, and cloud-based modeling solutions.

Leading players like Siemens, Dassault Systèmes, PTC, Autodesk, and Hexagon AB are paving the way for innovation through integrated software platforms that cater to virtual prototyping, predictive maintenance, and process optimization. These players are using AI, machine learning, and IoT to develop intelligent manufacturing ecosystems, intensifying the competition.

Emerging startups and niche providers are developing specialized model-based solutions for additive manufacturing, robotics, and supply chain digitalization. Such collaboration with industrial automation firms and ERP providers is enhancing product offerings with end-to-end process control.

Sustainability and data security are playing a major role, with compliance and cybersecurity becoming major differentiators. Thus, firms that are green manufacturing focus on cloud interoperability and have cybersecurity-enhanced digital twins have a competitive edge over others in the fast-evolving landscape.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Siemens AG | 20-25% |

| Dassault Systèmes | 15-20% |

| PTC Inc. | 10-15% |

| Autodesk Inc. | 8-12% |

| Hexagon AB | 5-10% |

| Ansys Inc. | 4-8% |

| Other Companies (combined) | 30-38% |

| Company Name | Key Offerings/Activities |

|---|---|

| Siemens AG | Digital twin solutions, AI-driven manufacturing simulations, and industrial automation. |

| Dassault Systèmes | 3DEXPERIENCE platform for model-based product and manufacturing process design. |

| PTC Inc. | IoT-integrated manufacturing solutions, real-time data analytics, and smart factory applications. |

| Autodesk Inc. | Cloud-based modeling and digital prototyping solutions for industrial manufacturing. |

| Hexagon AB | Smart manufacturing software, digital quality control, and metrology solutions. |

| Ansys Inc. | Simulation-driven manufacturing solutions with AI-powered predictive analytics. |

Key Company Insights

Siemens AG (20-25%)

Siemens is the industry leader in model-based manufacturing technology with its advanced digital twin solutions and AI-powered automation facilities. Industry 4.0, smart factories, and predictive analytics are the focus of their company.

Dassault Systèmes (15-20%)

Dassault Systèmes owns the 3DEXPERIENCE platform. The stages of model-based design or manufacturing involve real-time collaboration and support for virtual factory simulation.

PTC Inc. (10-15%)

PTC is a major player in the world of IoT-oriented manufacturing solutions, such as real-time analytics and smart factory process optimization enhanced with artificial intelligence.

Autodesk Inc. (8-12%)

Autodesk is involved with cloud-based manufacturing modeling, delivering digital prototyping solutions targeted at industrial and consumer product manufacturing.

Hexagon AB (5-10%)

Hexagon offers smart manufacturing software, from digital quality control and metrology applications to driving efficiencies in automated production lines.

Ansys Inc. (4-8%)

Ansys provides simulation-driven manufacturing solutions using AI predictive analytics, the focus of which is to optimize production performance and reduce waste.

Other Key Players (30-38% Combined)

The industry is slated to reach USD 54.4 billion in 2025.

The industry is predicted to reach USD 116.6 billion by 2035.

The key companies in the industry include Oracle Corporation, SAP SE, Dassault Systèmes, Honeywell International, Inc., Siemens Digital Industries Software, Rockwell Automation, Inc., PTC, Ansys Inc., Autodesk, Inc., Aspen Technology, Inc., iBASEt Inc., and Schneider Electric.

India, slated to grow at 9.9% CAGR during the forecast period, is poised for the fastest growth.

It is majorly used by the automotive industry.

By solution, the industry is segmented into software and services.

By deployment, the industry is segmented into cloud and on-premises.

By enterprise size, the industry is segmented into small & medium enterprises (SMEs) and large enterprises.

By industry, the industry is segmented into automotive, electronics & semiconductors, aerospace & defense, oil & gas, healthcare & pharmaceuticals, food & beverages, and others.

Region-wise, the industry is segmented into North America, Latin America, Europe, Asia Pacific, and the Middle East & Africa.

Mid-infrared Lasers Market Analysis - Growth & Trends 2025 to 2035

Multi-Axis Sensors Market Insights - Trends & Forecast 2025 to 2035

Photonic Integrated Circuit & Quantum Computing Market - Trends & Forecast 2025 to 2035

Security Inspection Market Insights – Trends & Forecast 2025 to 2035

Massive Open Online Course Market Analysis – Growth, Trends & Forecast 2025 to 2035

Tactical Radios Market Analysis by Type, Application, and Region Through 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.