Mobile fuel delivery has transformed the approach to accessing fuels for consumers and businesses alike; it offers convenience, safety, and efficiency to refuel anytime. Companies are using app-based platforms, AI-driven logistics, and solutions related to eco-friendly fuel to keep up with the rising demand for hassle-free fueling as a result of growing urbanization and accelerating digital transformation.

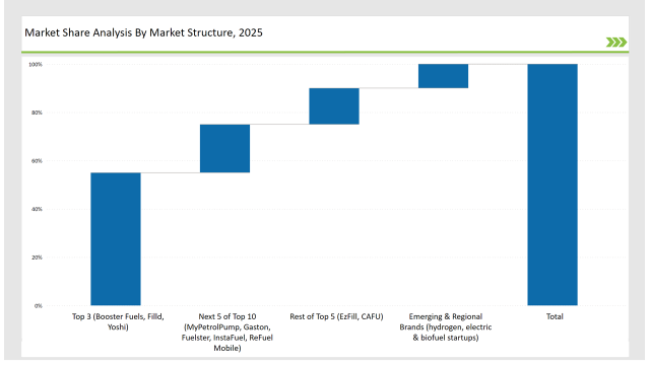

Top players, which include Booster Fuels, Filld, and Yoshi, hold 55% market share owing to their strong technological infrastructure, vast service networks, and high customer retention. The share of regional fuel delivery startups and fleet management solutions is 30%, while that of emerging sustainable and hydrogen fuel delivery companies amounts to 15%.

Explore FMI!

Book a free demo

| Market Segment | Industry Share (%) |

|---|---|

| Top 3 (Booster Fuels, Filld, Yoshi) | 55% |

| Rest of Top 5 (EzFill, CAFU) | 15% |

| Next 5 of Top 10 (MyPetrolPump, Gaston, Fuelster, InstaFuel, ReFuel Mobile) | 20% |

| Emerging & Regional Brands (hydrogen, electric & biofuel startups) | 10% |

The mobile fuel delivery market in 2025 is moderately concentrated, with the top players accounting for 50% to 60% of the total market share. Leading companies such as Booster Fuels, Filld, and Yoshi dominate the segment, while regional startups and specialized B2B fuel solutions add competitive diversity.

This market structure reflects strong brand influence while allowing space for on-demand fuel innovations and eco-friendly fuel alternatives.

There are various sales channels for mobile fuel delivery. App-based services lead the way with 60% of market share since ordering fuel through an app is most convenient for a consumer. Solutions for fleet fueling contribute to 25%, targeting business sectors with large vehicle fleets, wherein refueling would be done with efficiency and as per schedule.

Commercial and industrial fuel delivery stands at 10%, which focuses on construction sites, factories, and maritime operations. Sustainable fuel delivery solutions make up the remaining 5%, with hydrogen and electric vehicle (EV) refueling growing in importance.

The mobile fuel delivery market is segmented into gasoline, diesel, biofuels, and alternative energy refueling. Gasoline delivery leads with 45% of the market, as passenger vehicles remain the primary consumers. Diesel accounts for 30%, catering to commercial fleets, heavy equipment, and long-haul trucking.

Biofuels contribute 15%, as sustainability-conscious businesses opt for greener alternatives. Hydrogen and EV charging services hold 10%, gaining momentum with the rise of clean energy initiatives and regulatory incentives.

The mobile fuel delivery market has made major strides in 2024 with technological innovation, sustainability efforts, and the growth of service networks. Major players include:

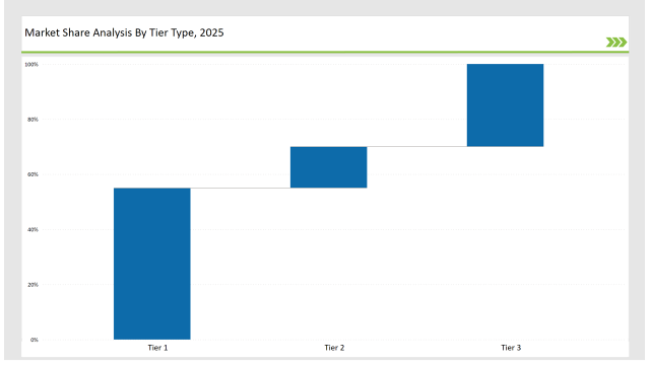

| Tier Type | Tier 1 |

|---|---|

| Example of Key Players | Booster Fuels, Filld, Yoshi |

| Market Share (%) | 55% |

| Tier Type | Tier 2 |

|---|---|

| Example of Key Players | EzFill, CAFU |

| Market Share (%) | 15% |

| Tier Type | Tier 3 |

|---|---|

| Example of Key Players | Regional brands, alternative energy startups |

| Market Share (%) | 30% |

| Brand | Key Focus Areas |

|---|---|

| Booster Fuels | AI-powered fleet fueling & corporate partnerships |

| Filld | Connected vehicle fuel delivery integrations |

| Yoshi | Subscription-based fueling with maintenance add-ons |

| EzFill | Urban expansion & rideshare fleet fueling solutions |

| CAFU | International expansion in emerging markets |

| Emerging Brands | Hydrogen & EV mobile charging solutions |

Mobile fuel delivery is going to grow with sustainable momentum in the coming years due to smart logistics, adoption of alternative energy, and the demand for convenience-based refueling. Brands will invest in growing sustainable fuel solutions, AI-driven route optimization, and connected vehicle integration to improve the customer experience.

As the scenario of urban congestion and environmental regulations evolves, mobile fuel delivery is going to be a vital element in the reduction of emissions, improvement in fleet efficiency, and greener transportation solutions. The future of fuel delivery revolves around technological innovation, digital connectivity, and a commitment to sustainability.

Leading players such as Booster Fuels, Filld, and Yoshi collectively hold around 55% of the market.

Regional fuel delivery companies and fleet-focused services contribute approximately 30% of the market by offering localized and industry-specific solutions.

Startups specializing in hydrogen fuel, EV charging, and biofuel-based mobile delivery hold about 10% of the market.

Private labels from fleet management companies and corporate fuel solutions providers hold around 5% of the market.

High for companies controlling 55%+, medium for 40-55%, and low for those under 30%.

Duck Boots Market Trends - Growth & Industry Outlook 2025 to 2035

Dishwashing Additives Market Growth - Size & Forecast 2025 to 2035

Electric Clothes Drying Hanger Market Trends – Growth & Demand 2025 to 2035

Disinfection Equipment Market Analysis - Trends & Forecast 2025 to 2035

Desert Boots Market Growth - Trends & Demand Forecast 2025 to 2035

Electric Massagers Market – Trends, Growth & Forecast 2025-2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.