The mobile food services industry worldwide will be growing rapidly during 2025 to 2035 as more people are hungry for more convenient grab-and-go food and food trucks and mobile catering are on the rise. Mobile food services from upscale food trucks to temporary pop-up stands are easy to use, less expensive to deploy, and provide menu diversity, and therefore, represent a good substitute for traditional restaurant space. It is underpinned by urbanization, shifting diets, and growing street food cultures in broad parts of the world.

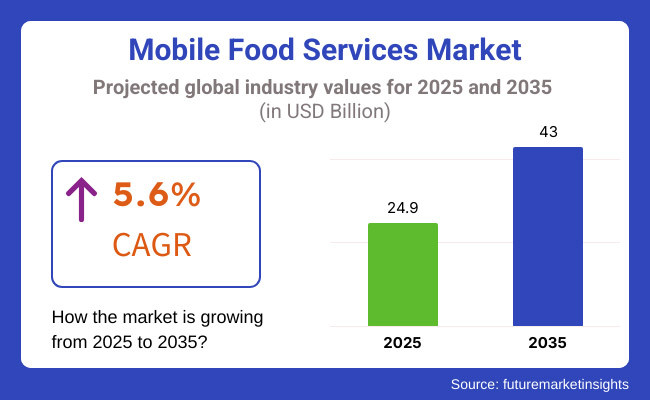

Mobile food services in 2025 were around USD 24.9 Billion. It is expected to grow to USD 43.0 Billion with a CAGR of 5.6% by 2035. It is driven by growing demand for differentiated dining experience, growing consumer spending on eating out, and technological advancements launched by technology like cashless payment and mobile-ordering apps. Green packaging and menu placement of plant-based and health-focused products likewise should continue to be a mainstay of marketplace trends.

Explore FMI!

Book a free demo

The North American continent dominates the mobile food services market, with the United States and Canada holding top positions. The region's highly evolved food truck culture, a consequence of growing numbers of culinary entrepreneurs as well as people's enthusiasm for food variety, has driven the market.

Urban centers such as Austin, New York, and Los Angeles experience highly vibrant mobile food culture through food trucks and street vendors serving everything from global levels of street food to gourmet burgers. Development in market and customer convenience based on increased adoption of location-based services and electronic ordering solutions is also picking up speed.

Europe is set to continue to witness growth in the mobile food services sector as demand for food trucks and mobile kitchens increases in urban centers. The UK, Germany, and France have all adopted street food festivals, food truck parks, and open markets as dining destinations. Eco-friendliness, in the form of consumption of sustainable ingredients and biodegradable packaging, is becoming increasingly accepted throughout the continent.

In addition, the expansion of food vendors to events like concerts, sports, and festivals, along with the demand by consumers for diversified foods with increasing demands for local produce, is going to keep on being responsible for further expanding Europe's market.

Asia-Pacific is poised for maximum growth in the mobile food services market. There is a rich tradition of street food culture in the region and established markets for mobile vendors in markets like China, India, and Thailand. These conventional food services are being upgraded, fueled by rising disposable incomes and urbanization, to propel demand for mobile food.

Increasing use of food ordering applications, travelling, and increasing focus on food safety and sanitation also drive market growth in the region. Increasing numbers of food business operators entering the marketplace and shifting consumer behaviours also see Asia-Pacific as a leading growth segment for mobile food services.

Challenge

Regulatory Compliance and Operational Constraints

Mobile food services market challenges- However, stringent health standards, complications in obtaining licenses, and limitations in operations may hamper the growth of the market. Food trucks, kiosks, and pop-up dining concepts must comply with strict food safety guidelines, zoning laws, and permit requirements, which differ regionally. Furthermore, the lack of physical space for cooking equipment, food storage, and waste disposal can also affect operational efficiency and compliance with hygiene standards.

Mobile food vendors also face challenges from rising fuel costs, unpredictable weather and location restrictions. To turn these challenges into opportunities, businesses can invest in energy-efficient kitchen designs and harness the power of AI for location analytics, as well as digital compliance management systems to optimize and keep up with companies' overall game plan.

Opportunity

Growth in Smart Ordering and Sustainable Mobile Kitchens

The growing demand for convenience, diverse culinary offerings, and sustainable dining experiences create substantial opportunities for the Mobile Food Services Market. Consumers are gravitating toward mobile food vendors that provide contactless payment solutions, the use of A.I.-driven algorithms to personalize orders, and app-based pre-order systems that minimize wait times.

Eco-friendly food trucks powered by renewable energy and biodegradable packaging are also promoting sustainability in the industry. And the partnerships (with smart city programs, ghost kitchens and delivery services) are extending the reach of mobile food businesses. Powering up businesses with digital ordering solutions, eco-friendly food truck technologies, hyper-localized marketing strategies, and other investing infrastructure will empower businesses to gain a competitive edge in this changing industry.

Between 2020 and 2024, steady growth of the mobile food services market has been manifest owing to rising demand for on-the-go food, urbanization and digital food ordering platforms. The mobile POS systems adoption, cashless transactions, and AI-based menu recommendations have increased both customer engagement and operational efficiency.

But meat price volatility, supply chain disruptions and competition from sit-down restaurants dented market stability. In response, businesses optimized food sourcing strategies, adopted cloud kitchen collaborations, and leveraged social media-driven customer engagement.

Looking ahead to 2025 to 2035, the fast food truck sector will witness evolutionary layers of advances in automation, perceived customer experience increases through AI, and sustainable food truck offerings. Mobile food services will be revolutionized by the adoption of robotic food preparation to autonomous food trucks and smart vending units.

Incorporating blockchain for transparency in sourcing ingredients, AI-driven demand forecasting, and real-time location-based marketing will only enable greater efficiency and consumer trust. Automation, sustainability, and digital customer engagement will shape the future of the Mobile Food Services Market for organizations that adapt.

Market Shifts: A Comparative Analysis (2020 to 2024 vs. 2025 to 2035)

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Compliance with health codes and zoning regulations |

| Technological Advancements | Growth in mobile POS systems and cashless transactions |

| Industry Adoption | Increased demand for urban street food and gourmet food trucks |

| Supply Chain and Sourcing | Dependence on traditional food distribution networks |

| Market Competition | Presence of independent food truck operators and franchises |

| Market Growth Drivers | Demand for fast, convenient, and affordable food options |

| Sustainability and Energy Efficiency | Early adoption of biodegradable packaging and low-emission vehicles |

| Integration of Smart Monitoring | Limited use of real-time inventory tracking and digital sales analytics |

| Advancements in Mobile Dining | Traditional food trucks and pop-up dining experiences |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Expansion of AI-driven regulatory compliance, digital licensing, and automated food safety tracking. |

| Technological Advancements | Adoption of autonomous food trucks, AI-powered inventory management, and robotic food preparation. |

| Industry Adoption | Expansion into AI-driven personalized menus, blockchain-based ingredient tracking, and smart vending kiosks. |

| Supply Chain and Sourcing | Shift toward hyper-local sourcing, cloud kitchen partnerships, and sustainable ingredient procurement. |

| Market Competition | Rise of AI-enhanced mobile kitchens, automated food vending systems, and smart city-integrated dining experiences. |

| Market Growth Drivers | Increased investment in smart food service technology, digital customer engagement, and green energy food trucks. |

| Sustainability and Energy Efficiency | Large-scale implementation of solar-powered food trucks, energy-efficient kitchen designs, and zero-waste food operations. |

| Integration of Smart Monitoring | AI-driven predictive food demand analysis, cloud-integrated operational monitoring, and smart customer engagement platforms. |

| Advancements in Mobile Dining | Evolution of fully automated, self-operating food kiosks, AI-curated meal recommendations, and hyper-personalized mobile dining. |

Another great market for mobile food services is the United States, where the food truck trend, pop-up restaurants, and delivery-only kitchens (ghost kitchens) are very popular. The market is spurred by growing on-the-go dining demand and more gourmet street food and cuisines.

Mobile technology is becoming increasingly important in the expansion of mobile foodservice, with food truck businesses using online ordering, mobile payments and location-based marketing to attract customers. Moreover, mobile food vendors are an increasing demand due to the growing trend of food festivals, sports events, and corporate catering.

Food trucks are also becoming more diverse by offering organic, vegan, and local sourcing menu options as healthy dining becomes a trend and the consumer base expands.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 6.1% |

The UK market for mobile food services is expanding steadily as urbanization, changing consumer lifestyles, and a growing demand for quick meal solutions drives the sector. Food trucks and pop-up eateries are thriving, particularly in London, Manchester and Birmingham, where busy professionals hunt for quick and affordable meals.

Healthy and sustainable food options are changing the industry, like vegan, gluten free, organic food trucks. Also, street food markets and weekend food festivals have become the new hot spots, bringing in even greater demand for mobile dining experiences.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 5.7% |

The European mobile food services market is a growing market-food tourism, rising urbanization with high demand for convenience-based dining are all contributing factors. Countries including France, Germany, Italy and Spain are seeing the rise of food trucks, pop-up kitchens and event-based catering companies.

Meanwhile, government support for small-scale food entrepreneurs and relaxed street vending regulations in many EU cities have made it easier than ever for new mobile food businesses to succeed. And, sustainability-minded consumers are fuelling demand for sustainable, locally grown ingredients on food truck menus.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 5.8% |

The mobile food services market in Japan is expanding, driven by urbanisation, hectic lifestyles, and the rising popularity of convenience food. Bento trucks, ramen carts, and specialty dessert vendors continue to thrive, especially in Tokyo, Osaka, and Kyoto.

Fresh produce vending machines are the new trend where even mobile food vendors can automate their business sales. Moreover, food trucks are featuring anime and pop-culture-themed offerings to attract younger consumers and tourists, encouraging market growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 5.9% |

The Korean Road Food is now in high demand between street food culture, K-pop tourism, and high-tech food truck innovations. The country’s night markets and pop-up food festivals are a huge draw for both locals and visitors.

Korean BBQ, fried chicken, and even speciality desserts such as bingsu and hotteok are increasingly making appearances on food trucks. AI-powered food recommendations coupled with automated cooking technology are further enriching the mobile food experience.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 6.0% |

Food trucks and removable containers are the main parties in the mobile food services market on account of urbanization and changing lifestyles as well as the ever-increasing demand from today consumers for fast high-quality food in diverse range. Dynamic food service models are key to retaining accessibility, reducing operational costs, and achieving innovative customer engagement which is crucial for street food businesses and catering entrepreneurs.

As cost effective, sophisticated and culturally varied meal providers, food trucks have become the preferred mobile food service format with high mobility and low overheads. Food trucks being lower in capital investment, highly mobile, and quick in adjusting with market trends, have made them suitable for spaces such as urban areas, festivals, and high-footfall spaces, unlike brick-and-mortar restaurants.

The evolution of the street food and trends toward fusion cuisine and artisanal products combined with the public craving for quick, yet unique food experiences has driven growth within the food truck industry as entrepreneurs and chefs look for a cheaper way to break into the food space. Worldwide, more than 70% of mobile food service businesses use food trucks which guarantees demand for this segment.

The growing prevalence of urban nightlife are complemented by event-driven food that encompass music festivals, sporting events, and cultural gatherings, which drives the market demand up, leading to food trucks being the most preferred choice for large-scale food vending.

This has further accelerated the adoption of AI-powered customer engagement tools with the features of digital menu boards, real-time location tracking, and mobile ordering ensuring more convenience and effortless customer engagement.

This trend also led to the advent of eco-friendly food trucks with solar-powered kitchen systems and biodegradable packaging, which drove the growth of the market, ensuring better sustainability and more alignment with eco-friendly customers.

Better engagement with health-focused consumers has strengthened mixed based with specialized food truck menus, such as meals that are vegan, gluten-free, and organic, in the overall market expansion.

While the food truck segment enjoys low investment costs, operational flexibility and direct consumer interaction, restrictions on wheel location permits, rising fuel prices, and weather-dependent operations are some of the challenges in the segment. But AI-driven business optimization, cloud kitchen integration, and app-based food truck aggregators are emerging innovations that are pushing the envelope on efficiency, profitability, and customer reach - ensuring that food trucks remain a fixture of the market.

Particularly in high-density urban areas, remote locations, and seasonal pop-up dining setups, removable containers have seen strong market adoption as food service providers are investing more heavily in modular, scalable, semi-permanent mobile kitchens. Food trucks are restricted in their kitchen size, equipment and operational stability; By contrast, removable containers enable higher food production volumes and longer serving hours.

The growing demand for flexible and portable food service infrastructure, including semi-permanent dining stations, event-based food courts and outdoor catering installations, has led removable containers to become a more popular option, as restaurant operators look for affordable expansion models. Research shows that over 40% of mobile food businesses in developing markets utilize container-based setups, demonstrating strong demand for this segment.

Moreover, growing ghost kitchen and delivery-only restaurant models with placement of container kitchens in high-demand regions have bolstered market demand for removable variables; establishing a marked preference for the adoption of removable containers for food preparation and fulfilment of orders.

Additional adoption has also been driven by the incorporation of smart kitchen technologies such as automated cooking stations, IoT-enabled food safety monitoring systems and AI-assisted menu optimization driving improved efficiency and food consistency.

Streamlining market progress, the rise of modular kitchen manufacturing with customizable designs, plug-and-play utilities and inclusive energy-efficient systems has attracted food entrepreneurs and chain restaurants demanding fast-market ingress, driving demand for prefabricated or modular kitchen systems.

The increasing use of themed container-based food courts comprising multi-vendor setups, collaborative food hubs, and shared kitchen spaces have reinforced market growth significantly, ensuring improved consumer engagement and diverse dining experiences.

Although removable containers are appealing to end users in terms of scalability, operational efficiency, and cost-effective deployment, their benefits are impeded by the high set-up, logistical complexities, and zoning prohibitions. Yet novel breakthroughs in modular food zone implementation, supply chain management with AI, and app-based container location management are streamlining efficiencies, scalability, and regulatory agility to support stable expansion for removable container-based food services.

The food and beverages segments account for two of the primary market drivers, as mobile food service providers continuously implement new and innovative culinary trends, health-conscious meal options, and premium beverage selections in order to appeal to a wide range of customer demographics.

One of the most lucrative revenue-generating segments for these players has turned out to be food, providing users with a variety of culturally inspired & on-the-go meal offerings. As opposed to conventional sitting restaurants, mobile food services value convenience, quickness, and reasonably priced food, which makes them a favourite for urban commuters, festival-goers, concert-goers, and all types of event participants.

Gourmet-inspired meals at competitive price points (such as Asian fusion, Latin American street tacos, Middle Eastern shawarma, and artisanal sandwiches) have increased adoption of mobile food services, fuelled by demand for global street food in general. Studies show that 80% or more of the mobile food service businesses focus on innovative and specialty foods, naturally creating strong demand for this segment.

Further market development has also been supported by the introduction of health-focused food menus on mobile platforms such as vegan, low-calorie, and food-allergen-free selections that cater to the needs fitness-minded and dietary-restricted consumers.

While offering more options in menu flexibility, cultural diversity, and broad consumer appeal, the food segment also must contend with rising and falling costs of ingredients, regulatory compliance needs for food safety, and evolving trends in consumer diets. Yet, new advances in artificial intelligence-driven menu customization, automated cooking equipment, and smart inventory management systems can help optimize efficiency, food quality, and cost, keeping the mobile food-service industry on its growth trajectory.

A growing mobile food service who is placing their attention on premium, health focused, beverage alternative, the beverage segment has had strong market use case penetration within specialty coffee and craft tea, smoothie and health drink beverage market. This segment, in contrast to mass-market soft drinks, is about freshness, customization, and nutritional benefits, all of which make it sticky to millennial and gen z consumers.

With common options like cold brew coffee, match lattes, fresh-pressed juices and plan-based protein shakes increasing, the popularity of artisanal and gourmet drink offerings has motivated key visibility of mobile drink catering services that increasingly cater to consumers in search of distinct experience-based drinking options.

The beverage category is also in a relatively good spot driven by premium pricing, health-conscious consumption, and a strong profit margin, but it has to contend with competition from coffee chains, seasonality in demand and restraints over ingredient sourcing. On the other hand, rising innovations in AI-driven drink personalisation, smart drink dispensing and block-chain more supply chain transparency are also loading efficiency, product differentiation and customers engagement which impact for growing prevalent mobile drink solutions.

Gourmet street food to on-the-go dining, the need for food and beverage provided in a 'grab-and-go' fashion is expanding the mobile food services market. Restaurants and other food businesses are using AI-driven software for food truck logistics, cloud kitchen integration, contactless ordering systems, etc. to improve customer engagement, operational efficiency and profit. The marketplace consists of international food chains, self-governing food truck owners, and app-driven food service aggregator, each contributing to evolutions in technology like mobile kitchens, e-payment services, and data-driven menu optimization.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Domino’s Pizza Inc. (Mobile & Delivery Services) | 12-16% |

| McDonald’s McDelivery & Mobile Food Trucks | 10-14% |

| Starbucks (Mobile Coffee Services & Food Trucks) | 8-12% |

| Roaming Hunger (Food Truck Aggregator Platform) | 5-9% |

| Kogi BBQ (Independent Gourmet Food Truck Chain) | 3-7% |

| Other Companies & Independent Operators (combined) | 40-50% |

| Company Name | Key Offerings/Activities |

|---|---|

| Domino’s Pizza Inc. | Operates mobile pizza delivery services, AI-driven food truck logistics, and app-based customer engagement tools. |

| McDonald’s McDelivery & Mobile Food Trucks | Specializes in mobile fast food trucks, AI-powered route optimization, and contactless payment solutions. |

| Starbucks (Mobile Coffee Services & Food Trucks) | Provides premium mobile coffee experiences, AI-based demand forecasting, and eco-friendly mobile cafes. |

| Roaming Hunger | Aggregates food truck bookings, mobile catering services, and digital marketing solutions for independent operators. |

| Kogi BBQ | Innovates gourmet food truck dining, social media-driven customer engagement, and premium street food experiences. |

Key Company Insights

Domino’s Pizza Inc. (12-16%)

Domino’s tops the mobile food services segment, providing AI-assisted food truck routing, speedy pizza delivery service, and app-based customer interaction.

McDonald’s McDelivery & Mobile Food Trucks (10-14%)

McDonald’s provides mobile fast-food solutions, driving data-based food truck locations and digital ordering integration

Starbucks (Mobile Coffee Services & Food Trucks) (8-12%)

Starbucks delivers high quality coffee to customers on the move, utilizing AI-powered demand forecasting and sustainable mobile cafes

Roaming Hunger (5-9%)

Roaming Hunger is the nations most trusted and comprehensive food truck booking platform, specializing in providing everything from mobile catering to independent food trucks.

Kogi BBQ (3-7%)

Kogi BBQ is one of the trendsetters of the gourmet food truck phenomenon, adopting a savvy social media marketing campaign and participatory food branding strategy via “influencers” or food bloggers.

Other Key Players (40-50% Combined)

Various food service companies and mobile food ventures help enable the next-gen mobile food experiences, AI-fueled food service logistics, and customer-focused digital interaction. These include:

The overall market size for market mobile food services market was USD 24.9 Billion in 2025.

The market mobile food services market is expected to reach USD 43.0 Billion in 2035.

The demand for the mobile food services market will grow due to increasing consumer preference for convenient and on-the-go meals, rising urbanization, expanding street food culture, advancements in food truck technology, and the growing trend of gourmet and specialty food offerings.

The top 5 countries which drives the development of market mobile food services market are USA, UK, Europe Union, Japan and South Korea.

Food trucks and removable containers drive market to command significant share over the assessment period.

Winning Strategies in Social Media and Destination Market Share Analysis: A Competitive Review

Winning Strategies in the Global Tourism Industry Loyalty Program Sector: A Competitive Review

Winning Strategies in the Global Animal Theme Parks Industry: A Competitive Review

Winning Strategies in the Global Spa Resorts Industry: A Competitive Review

Winning Strategies in the Global Winter Adventures Tourism Industry: A Competitive Review

Surrogacy Tourism Industry – Competitive Analysis and Market Share Outlook

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.