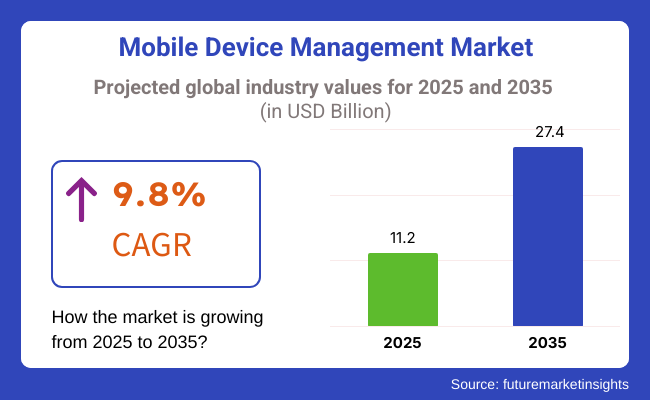

The mobile device management (MDM) market is projected to reach USD 11.2 billion in 2025 and expand to USD 27.4 billion by 2035, reflecting a CAGR of 9.8% during the forecast period. The increasing demand for enterprise mobility solutions, the growing adoption of remote work policies, and advancements in cybersecurity and data protection are driving growth.

Advancements in AI-driven security solutions, predictive analytics, and real-time device monitoring are further expanding industry opportunities. Additionally, the integration of MDM solutions in hybrid cloud environments, edge computing, and enterprise IT ecosystems is enhancing the scope. Strategic investments in R&D, regulatory compliance measures, and collaborations among IT service providers, technology firms, and enterprises are fueling industry expansion.

| Company | Contract Value (USD Million) |

|---|---|

| Sherpa 6, Inc. | USD 1.76 |

| Scalefusion | Approximately USD 5 |

| IBM MaaS360 | Approximately USD 12 |

Between 2020 and 2024, the Mobile Device Management (MDM) market expanded rapidly as organizations prioritized secure and efficient management of mobile endpoints. Businesses adopted cloud-based MDM solutions to enhance security, streamline device provisioning, and enforce corporate policies across remote workforces. The rise of bring-your-own-device (BYOD) policies and hybrid work models accelerated demand for AI-powered security and automation features.

Organizations leveraged AI-driven analytics and automation to monitor mobile device usage, detect security threats, and enforce compliance policies. Integration with endpoint detection and response (EDR) solutions improved threat mitigation and minimized data breaches.

Despite these advancements, companies encountered challenges such as device fragmentation, data privacy concerns, and the increasing complexity of managing a diverse mobile ecosystem. By 2024, service providers introduced zero-trust security models, AI-driven compliance enforcement, and automated remediation to address these challenges.

Looking ahead to 2025 to 2035, the Mobile Device Management market will undergo transformative innovations, including AI-powered self-healing devices, blockchain-enhanced identity management, and predictive analytics for mobile security. Organizations will implement real-time, context-aware security policies, leveraging AI to automate risk detection and response.

Quantum computing will redefine encryption and authentication, ensuring next-generation data security in mobile communications. AI-driven behavioral analytics will enhance anomaly detection, preventing unauthorized access and data leaks.

With the expansion of edge computing and 6G networks, MDM platforms will integrate hyper-intelligent automation, enabling seamless remote device control, proactive maintenance, and ultra-fast security updates. Businesses will adopt digital twins for mobile fleet management, optimizing performance and predicting failures before they occur.

A Comparative Market Shift Analysis (2020 to 2024 vs. 2025 to 2035)

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Enterprises used AI-based tools to monitor mobile devices and automate threat detection. | AI-native MDM solutions predict risks, automatically remediate vulnerabilities, and enhance security postures. |

| Businesses adopted policies to secure employee-owned devices and remote access. | AI-driven zero-trust security dynamically adapts to evolving work environments and device authentication. |

| Organizations implemented zero-trust frameworks to restrict unauthorized access. | AI-powered identity verification ensures continuous authentication and dynamic access control for all mobile endpoints. |

| MDM solutions merged with endpoint security tools to improve threat intelligence. | AI-driven MDM platforms provide real-time risk assessments and automatic response to emerging threats. |

| Companies explored blockchain-based authentication for secure device onboarding. | Decentralized identity solutions provide tamper-proof authentication and seamless cross-platform access control. |

| Organizations upgraded encryption models to meet increasing security demands. | Quantum-safe encryption protocols safeguard mobile communications against future cryptographic threats. |

| Mobile device management adapted to faster network speeds and low-latency connections. | AI-driven edge computing optimizes mobile performance, enabling real-time data processing and automated security updates. |

| Businesses used analytics to track device health and security threats. | AI-powered predictive maintenance extends device lifespan, automates software patches, and ensures optimal performance. |

| Companies optimized mobile management strategies to reduce e-waste. | AI-driven sustainable MDM solutions promote device longevity, energy efficiency, and responsible e-recycling practices. |

| Organizations experimented with digital twins to simulate mobile device performance. | AI-powered digital twins predict hardware failures, optimize device configurations, and enhance mobile ecosystem efficiency. |

The mobile device management (MDM) market in the United States grows rapidly as enterprises implement AI-driven security solutions, remote management tools, and compliance frameworks to enhance mobile workforce productivity. Companies develop advanced MDM platforms to secure corporate data, enforce policy controls, and optimize mobile device performance.

The demand for cloud-based, real-time monitoring and zero-trust security fuels industry expansion. Businesses increasingly leverage AI-powered threat detection, identity access management, and mobile application security to mitigate risks. The rise of remote work and BYOD (Bring Your Own Device) policies further accelerates MDM adoption.

The USA technology, healthcare, and financial sectors integrate MDM solutions to ensure data protection and regulatory compliance. Additionally, government policies encourage businesses to invest in scalable and automated mobile device management technologies.

The increasing adoption of endpoint detection and response (EDR) solutions and AI-driven mobile analytics further propels growth. Companies also implement self-healing device capabilities and automated compliance enforcement to enhance operational efficiency.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 11.0% |

The mobile device management (MDM) market in the United Kingdom expands as businesses implement AI-powered security protocols, mobile application management, and endpoint protection strategies. Companies integrate MDM solutions to enhance remote access security, automate device tracking, and enforce compliance policies. The adoption of 5G-enabled mobile security frameworks and cloud-based endpoint protection solutions strengthens expansion.

The increasing adoption of cybersecurity-as-a-service, zero-trust security models, and automated risk assessment tools drives growth. Additionally, regulatory frameworks supporting GDPR compliance and data protection accelerate the adoption of MDM solutions across industries.

Businesses increasingly deploy AI-driven behavioral analytics and real-time mobile threat intelligence to safeguard corporate networks. The rise of unified endpoint management (UEM) solutions further enhances enterprise mobility strategies.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 10.7% |

The mobile device management (MDM) market in the European Union grows as enterprises deploy AI-enhanced security, real-time device tracking, and encrypted data protection solutions. Countries like Germany, France, and Italy lead the industry by integrating MDM solutions into corporate IT environments, public sectors, and manufacturing industries. Businesses invest in cloud-based MDM platforms, containerized application security, and multi-device endpoint management to optimize mobile security.

The EU enforces strict data privacy and cybersecurity regulations, prompting companies to invest in GDPR-compliant MDM technologies. Additionally, advancements in AI-driven threat detection, secure remote access, and real-time mobile analytics accelerate the adoption of MDM solutions across industries.

The integration of blockchain-based authentication and zero-trust networking further strengthens enterprise security. Companies also implement geofencing and biometric authentication to enhance data protection in mobile environments.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 10.8% |

The Mobile Device Management (MDM) Market in Japan expands as enterprises integrate AI-driven compliance monitoring, secure mobile access, and remote troubleshooting capabilities. Companies develop innovative MDM solutions to enhance corporate mobility, prevent data breaches, and streamline IT operations. The adoption of cloud-native security frameworks, mobile identity verification, and AI-powered threat intelligence fuels industry expansion.

Japan’s focus on cybersecurity, digital transformation, and secure mobile work environments drives the adoption of advanced MDM systems. Additionally, industries such as telecommunications, finance, and e-commerce invest in cloud-based MDM solutions to improve mobile security and operational efficiency.

Businesses implement predictive security analytics and AI-powered mobile endpoint resilience strategies to enhance security posture. The rise of secure enterprise mobility management (EMM) platforms further accelerates market adoption.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 10.9% |

The mobile device management (MDM) market in South Korea grows rapidly as enterprises implement AI-powered mobile security, remote device management, and automated compliance enforcement. The government supports digital security initiatives, accelerating the adoption of MDM platforms across industries. Companies focus on real-time mobile monitoring, AI-driven risk analysis, and blockchain-based mobile authentication to enhance security.

Companies integrate cloud-native endpoint management, AI-powered device monitoring, and multi-layered encryption to optimize mobile security and operational flexibility. Additionally, advancements in 5G connectivity, edge computing, and AI-driven mobile threat analytics further propel growth. The increasing adoption of self-service mobile security dashboards and real-time policy enforcement enhances corporate mobile security strategies.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 11.1% |

The mobile device management (MDM) market experiences rapid growth as enterprises, government organizations, and service providers increasingly adopt mobile security and remote device control solutions. Companies integrate AI-powered device monitoring, real-time policy enforcement, and cloud-based MDM platforms to enhance security, streamline IT management, and improve workforce mobility.

Organizations rely on mobile device management solutions to secure corporate data, enforce compliance policies, and manage employee devices efficiently. Businesses deploy AI-powered endpoint security, automated configuration updates, and real-time device tracking to prevent data breaches and minimize operational disruptions.

The increasing need for hybrid work environments, secure mobile access, and enterprise-wide policy enforcement accelerates the adoption of MDM solutions with AI-powered automated threat detection, remote lock and wipe capabilities, and real-time device analytics. Companies implement zero-trust security models, AI-enhanced user authentication, and cloud-based MDM dashboards to protect sensitive data and improve IT control.

MDM providers enhance capabilities with AI-driven anomaly detection, blockchain-secured device authentication, and automated compliance reporting to ensure regulatory adherence and data protection. The integration of cloud-native MDM platforms, predictive analytics for device health monitoring, and automated software patching strengthens mobile security and operational efficiency.

Despite their advantages, MDM solutions face challenges such as complex multi-device integration, BYOD (Bring Your Own Device) security risks, and evolving cybersecurity threats. However, advancements in AI-powered endpoint management, automated risk assessment, and real-time security policy enforcement address these concerns, ensuring sustained growth.

Banks, healthcare institutions, and retail enterprises use MDM solutions to secure mobile transactions, protect patient data, and improve customer service. Unlike traditional IT security approaches, modern MDM platforms utilize AI-driven mobile threat defense, automated compliance enforcement, and real-time monitoring to enhance security and operational agility.

The push for mobile-first business operations fuels the adoption of MDM solutions for secure enterprise mobility, AI-powered remote access controls, and encrypted data management. Companies integrate AI-driven risk analytics, multi-factor authentication, and geofencing-based security protocols to optimize mobile workforce productivity while minimizing cybersecurity risks.

The deployment of AI-powered malware detection, remote troubleshooting tools, and automated mobile policy management strengthens IT resilience and data protection. Industry leaders invest in cloud-integrated MDM frameworks, AI-driven behavioral analytics, and dynamic threat intelligence to enhance endpoint security and regulatory compliance.

Despite its advantages, MDM adoption faces challenges such as device diversity, managing large-scale deployments, and balancing security with user privacy. However, innovations in AI-powered mobile policy automation, self-healing endpoint security, and real-time risk mitigation continue to improve adoption and scalability.

Educational institutions, government agencies, and manufacturing enterprises implement MDM solutions to improve data security, streamline remote device management, and enhance workforce mobility. AI-powered analytics enable automated policy updates, real-time device tracking, and secure content distribution.

The increasing reliance on remote education, cloud-based public sector operations, and IoT-enabled manufacturing systems accelerates demand for MDM solutions that provide AI-driven policy compliance, real-time vulnerability detection, and automated device quarantine. Companies integrate AI-powered incident response, predictive maintenance for mobile endpoints, and dynamic access controls to improve security and productivity.

The integration of AI-driven mobile access governance, blockchain-secured identity verification, and automated mobile application management strengthens security, compliance, and operational efficiency. Businesses invest in AI-powered risk scoring, cloud-native device monitoring, and automated patch management to optimize IT performance and ensure mobile security.

Despite its importance, MDM adoption in education, government, and manufacturing industries faces challenges such as high deployment costs, evolving security threats, and the complexity of managing diverse device ecosystems. However, advancements in AI-powered device orchestration, real-time security intelligence, and self-learning mobile security frameworks improve scalability and efficiency in enterprise mobility management.

The mobile device management (MDM) market is growing very fast as organizations adopt digital solutions to enhance security, streamline device administration, and improve workforce productivity.

Enterprises are increasingly relying on AI-driven endpoint security, cloud-based device management, and real-time monitoring to optimize enterprise mobility and ensure regulatory compliance. The demand for remote device control, multi-platform integration, and data protection has made MDM very important in IT infrastructure strategies.

Leading players include Microsoft (Intune), VMware (Workspace ONE), IBM Security MaaS360, MobileIron (Ivanti), and BlackBerry UEM. These companies leverage AI-powered automation, zero-trust security models, and advanced analytics to enhance mobile security and management capabilities. Vendors make themselves stand out by focusing on scalability, ease of integration, and comprehensive security frameworks tailored to enterprise needs.

Key Offerings focus on AI-powered threat detection, unified endpoint management, and cross-platform support. Enterprises demand flexible, secure, and automated solutions that reduce IT complexity while ensuring seamless device administration and compliance with security regulations. Cloud-native MDM platforms, real-time analytics, and automated policy enforcement are some noteworthy factors that bring innovation.

Industry evolution is shaped by the increasing adoption of remote and hybrid work models, making mobile security and device management a top priority. Organizations are shifting towards cloud-based MDM solutions, integrating AI-driven automation and advanced encryption to combat cybersecurity threats. The proliferation of IoT and BYOD (Bring Your Own Device) policies further makes it important to come up with better strategies to manage mobile devices.

Several factors affect the market dynamics. There are so many mergers and acquisitions that take place. Companies partner up with each other and make their product stand out from the competition.

Leading companies invest heavily in AI and machine learning to enhance security, improve real-time monitoring, and support zero-trust architectures. The expansion of 5G networks and the rise of edge computing also contribute to market evolution, enabling more sophisticated and scalable MDM solutions.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Microsoft (Intune) | 20-25% |

| VMware (Workspace ONE) | 15-20% |

| IBM Security MaaS360 | 12-17% |

| MobileIron (Ivanti) | 8-12% |

| BlackBerry UEM | 5-9% |

| Other Companies (combined) | 20-30% |

| Company Name | Key Offerings/Activities |

|---|---|

| Microsoft (Intune) | Develops security solutions that can be managed by AI |

| VMware (Workspace ONE) | Provides endpoint management and device analytics by using AI. |

| IBM Security MaaS360 | Has expertise in real-time device monitoring, compliance automation, and AI-enhanced cybersecurity. |

| MobileIron (Ivanti) | Prioritizes zero-trust MDM frameworks, mobile application security, and enterprise data protection. |

| BlackBerry UEM | Offers government-grade mobile security, IoT device management, and AI-powered threat detection. |

Key Company Insights

Other Key Players (20-30% Combined)

The market covers Cloud and On-Premise.

The market includes Device Management, Application Management, Content Management, Service Management, and Security Management.

The market covers Large Enterprises and SMBs.

The market includes Government, Healthcare, Education, BFSI, IT & Telecommunication, Retail, Construction, Transportation & Logistics, Manufacturing, and Media & Entertainment.

The market is segmented into North America, Latin America, Asia Pacific, Middle East & Africa (MEA), and Europe.

The global mobile device management (MDM) industry is projected to witness a CAGR of 9.8% between 2025 and 2035.

The global mobile device management (MDM) industry stood at USD 11.2 billion in 2025.

The global mobile device management (MDM) industry is anticipated to reach USD 27.4 billion by 2035 end.

North America is expected to record the highest CAGR, driven by growing enterprise mobility adoption, remote workforce expansion, and increasing cybersecurity concerns.

The key players operating in the global mobile device management (MDM) industry include VMware Inc., BlackBerry, Microsoft Corporation, MobileIron Inc., Citrix Systems Inc., SAP SE, IBM, SOTI Inc., JAMF, Cisco, and others.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Value (US$ Million) Forecast by Deployment Type, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Solution, 2018 to 2033

Table 4: Global Market Value (US$ Million) Forecast by Business Size, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Vertical, 2018 to 2033

Table 6: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 7: North America Market Value (US$ Million) Forecast by Deployment Type, 2018 to 2033

Table 8: North America Market Value (US$ Million) Forecast by Solution, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Business Size, 2018 to 2033

Table 10: North America Market Value (US$ Million) Forecast by Vertical, 2018 to 2033

Table 11: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 12: Latin America Market Value (US$ Million) Forecast by Deployment Type, 2018 to 2033

Table 13: Latin America Market Value (US$ Million) Forecast by Solution, 2018 to 2033

Table 14: Latin America Market Value (US$ Million) Forecast by Business Size, 2018 to 2033

Table 15: Latin America Market Value (US$ Million) Forecast by Vertical, 2018 to 2033

Table 16: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 17: Western Europe Market Value (US$ Million) Forecast by Deployment Type, 2018 to 2033

Table 18: Western Europe Market Value (US$ Million) Forecast by Solution, 2018 to 2033

Table 19: Western Europe Market Value (US$ Million) Forecast by Business Size, 2018 to 2033

Table 20: Western Europe Market Value (US$ Million) Forecast by Vertical, 2018 to 2033

Table 21: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 22: Eastern Europe Market Value (US$ Million) Forecast by Deployment Type, 2018 to 2033

Table 23: Eastern Europe Market Value (US$ Million) Forecast by Solution, 2018 to 2033

Table 24: Eastern Europe Market Value (US$ Million) Forecast by Business Size, 2018 to 2033

Table 25: Eastern Europe Market Value (US$ Million) Forecast by Vertical, 2018 to 2033

Table 26: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 27: South Asia and Pacific Market Value (US$ Million) Forecast by Deployment Type, 2018 to 2033

Table 28: South Asia and Pacific Market Value (US$ Million) Forecast by Solution, 2018 to 2033

Table 29: South Asia and Pacific Market Value (US$ Million) Forecast by Business Size, 2018 to 2033

Table 30: South Asia and Pacific Market Value (US$ Million) Forecast by Vertical, 2018 to 2033

Table 31: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 32: East Asia Market Value (US$ Million) Forecast by Deployment Type, 2018 to 2033

Table 33: East Asia Market Value (US$ Million) Forecast by Solution, 2018 to 2033

Table 34: East Asia Market Value (US$ Million) Forecast by Business Size, 2018 to 2033

Table 35: East Asia Market Value (US$ Million) Forecast by Vertical, 2018 to 2033

Table 36: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 37: Middle East and Africa Market Value (US$ Million) Forecast by Deployment Type, 2018 to 2033

Table 38: Middle East and Africa Market Value (US$ Million) Forecast by Solution, 2018 to 2033

Table 39: Middle East and Africa Market Value (US$ Million) Forecast by Business Size, 2018 to 2033

Table 40: Middle East and Africa Market Value (US$ Million) Forecast by Vertical, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Deployment Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Solution, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Business Size, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Vertical, 2023 to 2033

Figure 5: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 6: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 7: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 8: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 9: Global Market Value (US$ Million) Analysis by Deployment Type, 2018 to 2033

Figure 10: Global Market Value Share (%) and BPS Analysis by Deployment Type, 2023 to 2033

Figure 11: Global Market Y-o-Y Growth (%) Projections by Deployment Type, 2023 to 2033

Figure 12: Global Market Value (US$ Million) Analysis by Solution, 2018 to 2033

Figure 13: Global Market Value Share (%) and BPS Analysis by Solution, 2023 to 2033

Figure 14: Global Market Y-o-Y Growth (%) Projections by Solution, 2023 to 2033

Figure 15: Global Market Value (US$ Million) Analysis by Business Size, 2018 to 2033

Figure 16: Global Market Value Share (%) and BPS Analysis by Business Size, 2023 to 2033

Figure 17: Global Market Y-o-Y Growth (%) Projections by Business Size, 2023 to 2033

Figure 18: Global Market Value (US$ Million) Analysis by Vertical, 2018 to 2033

Figure 19: Global Market Value Share (%) and BPS Analysis by Vertical, 2023 to 2033

Figure 20: Global Market Y-o-Y Growth (%) Projections by Vertical, 2023 to 2033

Figure 21: Global Market Attractiveness by Deployment Type, 2023 to 2033

Figure 22: Global Market Attractiveness by Solution, 2023 to 2033

Figure 23: Global Market Attractiveness by Business Size, 2023 to 2033

Figure 24: Global Market Attractiveness by Vertical, 2023 to 2033

Figure 25: Global Market Attractiveness by Region, 2023 to 2033

Figure 26: North America Market Value (US$ Million) by Deployment Type, 2023 to 2033

Figure 27: North America Market Value (US$ Million) by Solution, 2023 to 2033

Figure 28: North America Market Value (US$ Million) by Business Size, 2023 to 2033

Figure 29: North America Market Value (US$ Million) by Vertical, 2023 to 2033

Figure 30: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 31: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 32: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 33: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 34: North America Market Value (US$ Million) Analysis by Deployment Type, 2018 to 2033

Figure 35: North America Market Value Share (%) and BPS Analysis by Deployment Type, 2023 to 2033

Figure 36: North America Market Y-o-Y Growth (%) Projections by Deployment Type, 2023 to 2033

Figure 37: North America Market Value (US$ Million) Analysis by Solution, 2018 to 2033

Figure 38: North America Market Value Share (%) and BPS Analysis by Solution, 2023 to 2033

Figure 39: North America Market Y-o-Y Growth (%) Projections by Solution, 2023 to 2033

Figure 40: North America Market Value (US$ Million) Analysis by Business Size, 2018 to 2033

Figure 41: North America Market Value Share (%) and BPS Analysis by Business Size, 2023 to 2033

Figure 42: North America Market Y-o-Y Growth (%) Projections by Business Size, 2023 to 2033

Figure 43: North America Market Value (US$ Million) Analysis by Vertical, 2018 to 2033

Figure 44: North America Market Value Share (%) and BPS Analysis by Vertical, 2023 to 2033

Figure 45: North America Market Y-o-Y Growth (%) Projections by Vertical, 2023 to 2033

Figure 46: North America Market Attractiveness by Deployment Type, 2023 to 2033

Figure 47: North America Market Attractiveness by Solution, 2023 to 2033

Figure 48: North America Market Attractiveness by Business Size, 2023 to 2033

Figure 49: North America Market Attractiveness by Vertical, 2023 to 2033

Figure 50: North America Market Attractiveness by Country, 2023 to 2033

Figure 51: Latin America Market Value (US$ Million) by Deployment Type, 2023 to 2033

Figure 52: Latin America Market Value (US$ Million) by Solution, 2023 to 2033

Figure 53: Latin America Market Value (US$ Million) by Business Size, 2023 to 2033

Figure 54: Latin America Market Value (US$ Million) by Vertical, 2023 to 2033

Figure 55: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 56: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 57: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 58: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 59: Latin America Market Value (US$ Million) Analysis by Deployment Type, 2018 to 2033

Figure 60: Latin America Market Value Share (%) and BPS Analysis by Deployment Type, 2023 to 2033

Figure 61: Latin America Market Y-o-Y Growth (%) Projections by Deployment Type, 2023 to 2033

Figure 62: Latin America Market Value (US$ Million) Analysis by Solution, 2018 to 2033

Figure 63: Latin America Market Value Share (%) and BPS Analysis by Solution, 2023 to 2033

Figure 64: Latin America Market Y-o-Y Growth (%) Projections by Solution, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) Analysis by Business Size, 2018 to 2033

Figure 66: Latin America Market Value Share (%) and BPS Analysis by Business Size, 2023 to 2033

Figure 67: Latin America Market Y-o-Y Growth (%) Projections by Business Size, 2023 to 2033

Figure 68: Latin America Market Value (US$ Million) Analysis by Vertical, 2018 to 2033

Figure 69: Latin America Market Value Share (%) and BPS Analysis by Vertical, 2023 to 2033

Figure 70: Latin America Market Y-o-Y Growth (%) Projections by Vertical, 2023 to 2033

Figure 71: Latin America Market Attractiveness by Deployment Type, 2023 to 2033

Figure 72: Latin America Market Attractiveness by Solution, 2023 to 2033

Figure 73: Latin America Market Attractiveness by Business Size, 2023 to 2033

Figure 74: Latin America Market Attractiveness by Vertical, 2023 to 2033

Figure 75: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 76: Western Europe Market Value (US$ Million) by Deployment Type, 2023 to 2033

Figure 77: Western Europe Market Value (US$ Million) by Solution, 2023 to 2033

Figure 78: Western Europe Market Value (US$ Million) by Business Size, 2023 to 2033

Figure 79: Western Europe Market Value (US$ Million) by Vertical, 2023 to 2033

Figure 80: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 81: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 82: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 83: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 84: Western Europe Market Value (US$ Million) Analysis by Deployment Type, 2018 to 2033

Figure 85: Western Europe Market Value Share (%) and BPS Analysis by Deployment Type, 2023 to 2033

Figure 86: Western Europe Market Y-o-Y Growth (%) Projections by Deployment Type, 2023 to 2033

Figure 87: Western Europe Market Value (US$ Million) Analysis by Solution, 2018 to 2033

Figure 88: Western Europe Market Value Share (%) and BPS Analysis by Solution, 2023 to 2033

Figure 89: Western Europe Market Y-o-Y Growth (%) Projections by Solution, 2023 to 2033

Figure 90: Western Europe Market Value (US$ Million) Analysis by Business Size, 2018 to 2033

Figure 91: Western Europe Market Value Share (%) and BPS Analysis by Business Size, 2023 to 2033

Figure 92: Western Europe Market Y-o-Y Growth (%) Projections by Business Size, 2023 to 2033

Figure 93: Western Europe Market Value (US$ Million) Analysis by Vertical, 2018 to 2033

Figure 94: Western Europe Market Value Share (%) and BPS Analysis by Vertical, 2023 to 2033

Figure 95: Western Europe Market Y-o-Y Growth (%) Projections by Vertical, 2023 to 2033

Figure 96: Western Europe Market Attractiveness by Deployment Type, 2023 to 2033

Figure 97: Western Europe Market Attractiveness by Solution, 2023 to 2033

Figure 98: Western Europe Market Attractiveness by Business Size, 2023 to 2033

Figure 99: Western Europe Market Attractiveness by Vertical, 2023 to 2033

Figure 100: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 101: Eastern Europe Market Value (US$ Million) by Deployment Type, 2023 to 2033

Figure 102: Eastern Europe Market Value (US$ Million) by Solution, 2023 to 2033

Figure 103: Eastern Europe Market Value (US$ Million) by Business Size, 2023 to 2033

Figure 104: Eastern Europe Market Value (US$ Million) by Vertical, 2023 to 2033

Figure 105: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 106: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 107: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 108: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 109: Eastern Europe Market Value (US$ Million) Analysis by Deployment Type, 2018 to 2033

Figure 110: Eastern Europe Market Value Share (%) and BPS Analysis by Deployment Type, 2023 to 2033

Figure 111: Eastern Europe Market Y-o-Y Growth (%) Projections by Deployment Type, 2023 to 2033

Figure 112: Eastern Europe Market Value (US$ Million) Analysis by Solution, 2018 to 2033

Figure 113: Eastern Europe Market Value Share (%) and BPS Analysis by Solution, 2023 to 2033

Figure 114: Eastern Europe Market Y-o-Y Growth (%) Projections by Solution, 2023 to 2033

Figure 115: Eastern Europe Market Value (US$ Million) Analysis by Business Size, 2018 to 2033

Figure 116: Eastern Europe Market Value Share (%) and BPS Analysis by Business Size, 2023 to 2033

Figure 117: Eastern Europe Market Y-o-Y Growth (%) Projections by Business Size, 2023 to 2033

Figure 118: Eastern Europe Market Value (US$ Million) Analysis by Vertical, 2018 to 2033

Figure 119: Eastern Europe Market Value Share (%) and BPS Analysis by Vertical, 2023 to 2033

Figure 120: Eastern Europe Market Y-o-Y Growth (%) Projections by Vertical, 2023 to 2033

Figure 121: Eastern Europe Market Attractiveness by Deployment Type, 2023 to 2033

Figure 122: Eastern Europe Market Attractiveness by Solution, 2023 to 2033

Figure 123: Eastern Europe Market Attractiveness by Business Size, 2023 to 2033

Figure 124: Eastern Europe Market Attractiveness by Vertical, 2023 to 2033

Figure 125: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 126: South Asia and Pacific Market Value (US$ Million) by Deployment Type, 2023 to 2033

Figure 127: South Asia and Pacific Market Value (US$ Million) by Solution, 2023 to 2033

Figure 128: South Asia and Pacific Market Value (US$ Million) by Business Size, 2023 to 2033

Figure 129: South Asia and Pacific Market Value (US$ Million) by Vertical, 2023 to 2033

Figure 130: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 131: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 132: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 133: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 134: South Asia and Pacific Market Value (US$ Million) Analysis by Deployment Type, 2018 to 2033

Figure 135: South Asia and Pacific Market Value Share (%) and BPS Analysis by Deployment Type, 2023 to 2033

Figure 136: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Deployment Type, 2023 to 2033

Figure 137: South Asia and Pacific Market Value (US$ Million) Analysis by Solution, 2018 to 2033

Figure 138: South Asia and Pacific Market Value Share (%) and BPS Analysis by Solution, 2023 to 2033

Figure 139: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Solution, 2023 to 2033

Figure 140: South Asia and Pacific Market Value (US$ Million) Analysis by Business Size, 2018 to 2033

Figure 141: South Asia and Pacific Market Value Share (%) and BPS Analysis by Business Size, 2023 to 2033

Figure 142: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Business Size, 2023 to 2033

Figure 143: South Asia and Pacific Market Value (US$ Million) Analysis by Vertical, 2018 to 2033

Figure 144: South Asia and Pacific Market Value Share (%) and BPS Analysis by Vertical, 2023 to 2033

Figure 145: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Vertical, 2023 to 2033

Figure 146: South Asia and Pacific Market Attractiveness by Deployment Type, 2023 to 2033

Figure 147: South Asia and Pacific Market Attractiveness by Solution, 2023 to 2033

Figure 148: South Asia and Pacific Market Attractiveness by Business Size, 2023 to 2033

Figure 149: South Asia and Pacific Market Attractiveness by Vertical, 2023 to 2033

Figure 150: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 151: East Asia Market Value (US$ Million) by Deployment Type, 2023 to 2033

Figure 152: East Asia Market Value (US$ Million) by Solution, 2023 to 2033

Figure 153: East Asia Market Value (US$ Million) by Business Size, 2023 to 2033

Figure 154: East Asia Market Value (US$ Million) by Vertical, 2023 to 2033

Figure 155: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 156: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 157: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 158: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 159: East Asia Market Value (US$ Million) Analysis by Deployment Type, 2018 to 2033

Figure 160: East Asia Market Value Share (%) and BPS Analysis by Deployment Type, 2023 to 2033

Figure 161: East Asia Market Y-o-Y Growth (%) Projections by Deployment Type, 2023 to 2033

Figure 162: East Asia Market Value (US$ Million) Analysis by Solution, 2018 to 2033

Figure 163: East Asia Market Value Share (%) and BPS Analysis by Solution, 2023 to 2033

Figure 164: East Asia Market Y-o-Y Growth (%) Projections by Solution, 2023 to 2033

Figure 165: East Asia Market Value (US$ Million) Analysis by Business Size, 2018 to 2033

Figure 166: East Asia Market Value Share (%) and BPS Analysis by Business Size, 2023 to 2033

Figure 167: East Asia Market Y-o-Y Growth (%) Projections by Business Size, 2023 to 2033

Figure 168: East Asia Market Value (US$ Million) Analysis by Vertical, 2018 to 2033

Figure 169: East Asia Market Value Share (%) and BPS Analysis by Vertical, 2023 to 2033

Figure 170: East Asia Market Y-o-Y Growth (%) Projections by Vertical, 2023 to 2033

Figure 171: East Asia Market Attractiveness by Deployment Type, 2023 to 2033

Figure 172: East Asia Market Attractiveness by Solution, 2023 to 2033

Figure 173: East Asia Market Attractiveness by Business Size, 2023 to 2033

Figure 174: East Asia Market Attractiveness by Vertical, 2023 to 2033

Figure 175: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 176: Middle East and Africa Market Value (US$ Million) by Deployment Type, 2023 to 2033

Figure 177: Middle East and Africa Market Value (US$ Million) by Solution, 2023 to 2033

Figure 178: Middle East and Africa Market Value (US$ Million) by Business Size, 2023 to 2033

Figure 179: Middle East and Africa Market Value (US$ Million) by Vertical, 2023 to 2033

Figure 180: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 181: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 182: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 183: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 184: Middle East and Africa Market Value (US$ Million) Analysis by Deployment Type, 2018 to 2033

Figure 185: Middle East and Africa Market Value Share (%) and BPS Analysis by Deployment Type, 2023 to 2033

Figure 186: Middle East and Africa Market Y-o-Y Growth (%) Projections by Deployment Type, 2023 to 2033

Figure 187: Middle East and Africa Market Value (US$ Million) Analysis by Solution, 2018 to 2033

Figure 188: Middle East and Africa Market Value Share (%) and BPS Analysis by Solution, 2023 to 2033

Figure 189: Middle East and Africa Market Y-o-Y Growth (%) Projections by Solution, 2023 to 2033

Figure 190: Middle East and Africa Market Value (US$ Million) Analysis by Business Size, 2018 to 2033

Figure 191: Middle East and Africa Market Value Share (%) and BPS Analysis by Business Size, 2023 to 2033

Figure 192: Middle East and Africa Market Y-o-Y Growth (%) Projections by Business Size, 2023 to 2033

Figure 193: Middle East and Africa Market Value (US$ Million) Analysis by Vertical, 2018 to 2033

Figure 194: Middle East and Africa Market Value Share (%) and BPS Analysis by Vertical, 2023 to 2033

Figure 195: Middle East and Africa Market Y-o-Y Growth (%) Projections by Vertical, 2023 to 2033

Figure 196: Middle East and Africa Market Attractiveness by Deployment Type, 2023 to 2033

Figure 197: Middle East and Africa Market Attractiveness by Solution, 2023 to 2033

Figure 198: Middle East and Africa Market Attractiveness by Business Size, 2023 to 2033

Figure 199: Middle East and Africa Market Attractiveness by Vertical, 2023 to 2033

Figure 200: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Mobile ECG Devices Market

Mobile Threat Management Security Software Market Size and Share Forecast Outlook 2025 to 2035

IoT Device Management Market Size and Share Forecast Outlook 2025 to 2035

IoT Device Management Platform Market Size and Share Forecast Outlook 2025 to 2035

Mobile Content Management Market

Mobile Campaign Management Market Size and Share Forecast Outlook 2025 to 2035

Mobile Computing Devices Market Insights – Growth & Forecast 2023-2033

Mobile Healthcare Devices Market Size and Share Forecast Outlook 2025 to 2035

Mobile Point Of Sale Devices (mPOS) Market Size and Share Forecast Outlook 2025 to 2035

Pain Management Devices Market Growth - Trends & Forecast 2025 to 2035

Airway Management Devices Market Growth – Demand & Industry Forecast 2025 to 2035

Digital Mobile X-ray Devices Market Analysis - Growth & Forecast 2024 to 2034

Cardiac Rhythm Management Devices Market Size and Share Forecast Outlook 2025 to 2035

Voice to Text on Mobile Devices Market Size and Share Forecast Outlook 2025 to 2035

Cardiac Monitoring And Cardiac Rhythm Management Devices Market Size and Share Forecast Outlook 2025 to 2035

Mobile Camping Toilet Market Size and Share Forecast Outlook 2025 to 2035

Mobile Phone Screen Underlayer Cushioning Material Market Size and Share Forecast Outlook 2025 to 2035

Mobile Application Store Market Size and Share Forecast Outlook 2025 to 2035

Mobile Money Market Forecast and Outlook 2025 to 2035

Mobile Application Testing Solution Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA