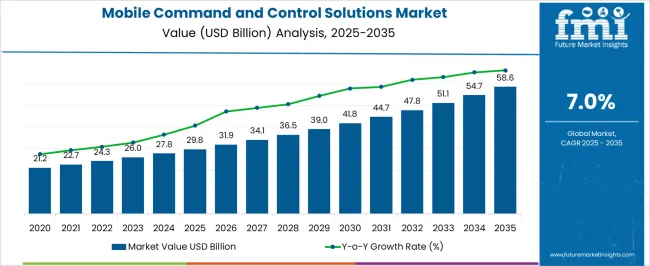

The Mobile Command and Control Solutions Market is estimated to be valued at USD 29.8 billion in 2025 and is projected to reach USD 58.6 billion by 2035, registering a compound annual growth rate (CAGR) of 7.0% over the forecast period.

| Metric | Value |

|---|---|

| Mobile Command and Control Solutions Market Estimated Value in (2025 E) | USD 29.8 billion |

| Mobile Command and Control Solutions Market Forecast Value in (2035 F) | USD 58.6 billion |

| Forecast CAGR (2025 to 2035) | 7.0% |

The mobile command and control solutions market is expanding steadily due to rising defense modernization initiatives, growing demand for real time situational awareness, and the integration of advanced communication technologies in critical operations. The need for secure, mobile, and interoperable platforms has been reinforced by increasing instances of cross border tensions, disaster management requirements, and homeland security operations.

Rapid advancements in satellite communication, AI powered analytics, and ruggedized hardware have supported the development of versatile command centers that can be deployed across diverse terrains and mission types. Investments from defense agencies and public safety organizations are strengthening adoption, while private sector collaborations are accelerating the integration of next generation technologies.

The overall outlook remains positive as governments continue to prioritize resilient and mobile infrastructures that enhance decision making and mission effectiveness.

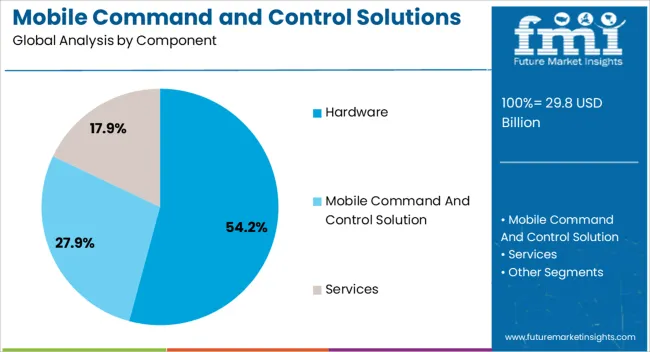

The hardware segment is projected to represent 54.20% of total revenue by 2025 within the component category, establishing itself as the dominant segment. This leadership is attributed to the rising need for ruggedized systems, advanced communication devices, and portable infrastructure capable of withstanding harsh environments.

Hardware forms the foundation of mobile command centers by enabling seamless connectivity, secure data transmission, and real time field coordination. Continuous upgrades in sensors, communication terminals, and power systems are reinforcing reliance on hardware investments.

As operational readiness and durability remain central requirements, the hardware segment continues to account for the largest share within the market.

The global mobile command and control solutions market is expected to witness significant growth during the forecast period, which can be attributed to the increasing adoption of mobile command and control vehicle (MCCV) systems, and the growing need for interoperability between security devices worldwide.

The market is projected to witness significant growth during the forecast period, due to several factors such as maximum speed of response, operational reach and location access, and increasing advantages of UAVs and mobile ground assets.

The increasing mobile command & control centers used in aerospace and defense application to enhance the security of their nations is creating new growth opportunities for mobile command and control solutions market. Thus, to prevent, detect, securing, and responding to crime-prevention activities and managing traffic, an increase in the adoption of mobile command and control solutions has been witnessed by end-users of different verticals across the globe.

Continuous developments and implementation of new technology/solutions such as Next-Gen mobile command and control solutions and converged command and control solutions for various end-users such as military, transportation, infrastructure, and industrial, among others are creating opportunities for growth for the mobile command and control solutions spending.

Advantages and benefits such as operational productivity, faster detection, and improving command and control efficiency, and cost-effective deployment, and real-time visibility, are the primary factors resulting in the high adoption of mobile command and control solutions.

The integration of technologies such as IoT, big data, artificial intelligence, and others can be expected to lead to the development of the mobile command and control solutions market with much more capabilities and improved performance.

The mobile command and control solutions offer a wide range of benefits such as efficient response, convergence, and intelligence, tactical advantage, cost-effective, and visualized command. The reliability of such features drives the demand for the mobile command and control solutions market.

The growing need for modernization of existing military infrastructure for security purposes is expected to fuel growth for the mobile command and control solutions market. The demand for mobile command and control solutions is increasing due to various factors such as remote monitoring, monitoring VIP security, and offering security when needed.

The mobile command and control solutions are easy to deploy mobile surveillance vehicles that are used by paramilitary, police, defense, airports authority, and other security agencies for different applications. Such vehicles are used for the protection of high-security areas, critical infrastructure, public events, and disaster cities.

This mobile command and control vehicle (MCCV) solution can be customized based on the customer's requirements. Such essential factors boost the sales of the mobile command and control solutions market during the forecast period.

The threat landscape continues to grow, mobile command and control solutions providers are not regularly upgrading their software and solutions when it comes to security updates, which could pose a bigger challenge. The restricted development environment, and security testing, among other factors, are expected to restrict the growth of the mobile command and control solutions market over the forecast period.

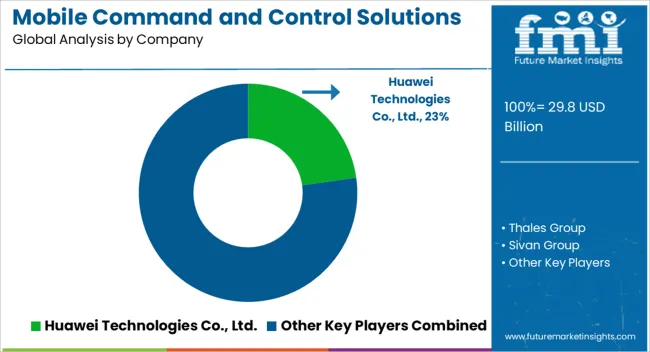

are actively involved in offering mobile command and control solutions and services for different applications.

The introduction of new solution and strategic partnerships are key strategies followed by top players in the Mobile Command and Control Solutions market, to increase their business revenue. Mobile Command and Control Solutions solution and service providers are focusing on innovation in software/services to improve their market shares.

In July 2020, Blue Bear launched mobile command and control system for ground control stations (GCS), geospatial information systems (GIS), recognized air picture, and recognized maritime picture technology, among others.

The company are also partnering with other technology vendors such as security solution provider in the market to drive out more quality and advanced products in the market. It is generally seen to partner with companies who work with the necessary and latest technology, which would benefit the standard product of the company.

In November 2024, Brivo announced strategic partnership with Securitas Electronic Security, Inc., is a security solution provider to deliver its cloud based access control, physical security platform technology to new and existing SES clientele.

The increasing demand for mobile command and control vehicles (MCCV) for homeland security applications has been recently driving the growth of the mobile command and control solutions market. It can support diverse mission-critical applications of security, military, or police forces.

Mobile command and control solutions have been easily deployed at the site of an emergency or at the location that has a potential threat, for complete control of the situation, with the providing seamless 360 monitoring and surveillance. Such applications creating new growth opportunities for the mobile command and control solutions market during the forecast period.

USA is the largest market for mobile command and control solutions, due to the strong presence of mobile command and control software and service provider, in the USA region. This is attributed to the high increase in demand for mobile command and control solutions for various industries such as military and defense, industrial, infrastructure, transportation, aerospace, among others.

Moreover, increasing emphasis on regulating the USA government regarding data integrity and protection is also expected to drive the mobile command and control solutions market in the USA country.

The mobile command and control solutions providers focus on inorganic growth through strategic partnerships and collaborations, to support channel activities and success, commercial excellence, and innovative technology, along with streamlining activities.

There is increasing adoption of advanced technologies/solutions such as integrated command and control solution, the penetration of IoT, the implementation of advanced software, and the establishment of military and defense industries, have resulted to fuel the demand for the mobile command and control solutions market across the South Asia and Pacific region.

Also, the need for enhance incident management and resolution by automating workflows and data retrieval, and increasing investment in Artificial Intelligence (AI) based command and control systems is creating new growth opportunities for the mobile command and control solutions market in the South Asia and Pacific region.

The global mobile command and control solutions market is estimated to be valued at USD 29.8 billion in 2025.

The market size for the mobile command and control solutions market is projected to reach USD 58.6 billion by 2035.

The mobile command and control solutions market is expected to grow at a 7.0% CAGR between 2025 and 2035.

The key product types in mobile command and control solutions market are hardware, mobile command and control solution, services, _system integration, _security consulting and _support & maintenance.

In terms of industry, military segment to command 47.6% share in the mobile command and control solutions market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Mobile Phone Screen Underlayer Cushioning Material Market Size and Share Forecast Outlook 2025 to 2035

Mobile Application Store Market Size and Share Forecast Outlook 2025 to 2035

Mobile Money Market Forecast and Outlook 2025 to 2035

Mobile Application Testing Solution Market Size and Share Forecast Outlook 2025 to 2035

Mobile Cardiac Telemetry System Market Size and Share Forecast Outlook 2025 to 2035

Mobile Robots Market Size and Share Forecast Outlook 2025 to 2035

Mobile Crane Market Size and Share Forecast Outlook 2025 to 2035

Mobile Vascular Imaging Market Size and Share Forecast Outlook 2025 to 2035

Mobile Animal Inhalation Anesthesia Machine Market Size and Share Forecast Outlook 2025 to 2035

Mobile Data Protection Market Size and Share Forecast Outlook 2025 to 2035

Mobile Medical Tablets Market Size and Share Forecast Outlook 2025 to 2035

Mobile WLAN Access Points Market Size and Share Forecast Outlook 2025 to 2035

Mobile Social Networks Market Size and Share Forecast Outlook 2025 to 2035

Mobile Printer Market Size and Share Forecast Outlook 2025 to 2035

Mobile Application Development Platform Market Size and Share Forecast Outlook 2025 to 2035

Mobile Threat Management Security Software Market Size and Share Forecast Outlook 2025 to 2035

Mobile Enterprise Application Development Platform Market Size and Share Forecast Outlook 2025 to 2035

Mobile Analytics Market Size and Share Forecast Outlook 2025 to 2035

Mobile Robotics Software Market Size and Share Forecast Outlook 2025 to 2035

Mobile Notary Public Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA