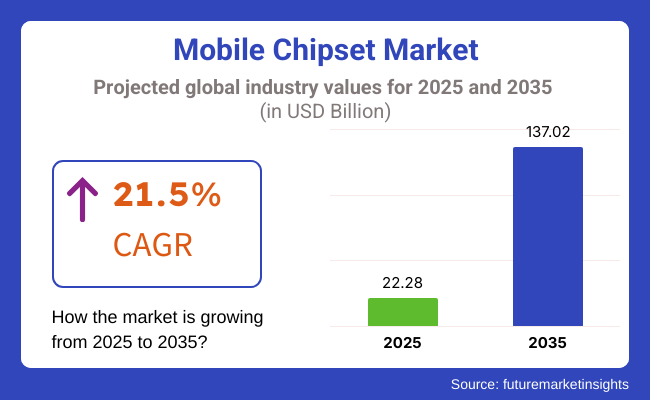

The mobile chipset market is expected to be valued at USD 22.28 billion in 2025 and is poised to expand at a vast scale to USD 137.02 billion by 2035, recording a CAGR of 21.5%, thus becoming a milestone. This is being fueled by continuous advancements in mobile technology, the increased demand for 5 G-enabled devices, and further embedding of AI and advanced technology into the industry. The rising need for high-performance and energy-efficient chipsets for smartphones, tablets, and wearables is encouraging industry growth.

They form the core components of the modern smartphone and seal the deal for smoother connectivity, higher processing speed, and efficient power consumption. The advent of 5G technology opened up access to next-generation mobile chipsets, resulting in an exponential increase in demand for these chips as they accelerate the transfer of data and lower latency.

The demand for high-performance chipsets that can handle advanced computation tasks and still manage battery life has also increased due to AI-based applications, AR, and mobile gaming. Chipset vendors now focus on developing innovative mobile solutions that optimize user experience and device performance, which are in line with evolving and powerful mobile devices.

Some of the drivers responsible for the growth of the industry include: An increasing adoption of 5G technology is another major driver, as it requires greater data transfers and network efficacies, creating more demands on chipsets.

Moreover, the increasing demand for AI-based smartphones with enhanced computational capability is driving developments in chipsets with integrated neural processing units (NPUs). Designing GPUs and processors for better graphics applications is also boosting the industry growth when it comes to mobile gaming and AR usage. Moreover, long-term capital investments in research and development (R&D) for semiconductors, coupled with developments in energy-efficient chip designs, are aiding the industry's development.

Despite high growth opportunities, the industry faces multiple challenges. A recent global shortage of semiconductors has been causing disruptions to the supply chain and, therefore, the manufacturing capacity and price stability. Meanwhile, the costly nature of designing and manufacturing advanced chipsets can be a challenge for smaller industry players.

Geopolitical friction and trade restrictions among the world’s top semiconductor-manufacturing countries also pose a risk to the stability of markets. Moreover, the increasing complexity in the designs of chipsets requires large amounts to be spent on research and development, which could put pressure on profitability for chipset firms.

What the future holds for the industry is determined by not only the latest technology but also the partnerships that the industry players form. This is anticipated to revolutionize the smartphone experience with the emergence of power-efficient AI-powered chipsets, which would offer greater processing performance.

The growing demand for energy-efficient and sustainable chip manufacturing will drive innovation in next-generation semiconductors. In addition, partnerships between chipset manufacturers, cellphone producers, and telecom companies will speed up the adoption of 5G and beyond. The industry will witness unparalleled growth as demand for high-performance mobile devices only seems to rise, shaping the future of connectivity and mobile computing devices.

Sales of high-performance, GPU-equipped smartphones with energy efficiency requirements are powering the industry. Smartphones are the most affected product category as they are mostly inclined towards gaming, AI, and multimedia processing, whereas tablets are the middle ground between power and efficiency and mainly cater to the productivity as well as entertainment needs.

Wearable devices emphasize compact design and low power consumption, and mainly include health monitoring and smart assistant functions. IoT devices are needed in the chipsets that are low-cost and power-efficient with robust connectivity, i.e., for smart home and industrial applications. In cars, the use of features like infotainment, autonomous driving, and vehicle communication is increasing.

The current phase of the mobile-chipset industry includes the burgeoning fabricated generation shift towards 5nm and 3nm, integrated AI accelerators, and data security-enhanced features, which will create new scenarios for both industries' next-gen.

Contract & Deals Analysis

| Company | Contract Value (USD Million) |

|---|---|

| Qualcomm | Approximately USD 100 - USD 120 |

| MediaTek | Approximately USD 80 - USD 90 |

| Samsung Electronics | Approximately USD 90 - USD 100 |

| Apple Inc. | Approximately USD 120 - USD 130 |

| Intel | Approximately USD 70 - USD 80 |

In 2024, the industry witnessed robust adoption fueled by on-device sophisticated processing, 5G associated and in-built AI capabilities in smartphones. Industry leaders such as Qualcomm, MediaTek, Samsung, Apple, and Intel have won humongous orders and strategic deals to drive innovation and meet the growing technological demands of the industry. All these highlight the emphasis of the industry to invest in cutting-edge in order to maintain its competitive advantage in this rapidly evolving global landscape.

During the period between 2020 and 2024, the industry witnessed a paradigm shift with the introduction of AI processing, 5G, and power management design. The introduction of 5G networks increased the need for high-speed chipsets, and Qualcomm, Apple, and MediaTek introduced SoCs with high-speed connectivity that was extremely fast and enhanced AI processing.

Chipsets featured AI-based NPUs for real-time translation, enhanced camera capabilities, and power conservation. High-performance GPUs with ray tracing support enable console-level mobile gaming and AR applications. 5nm and 3nm process technologies improved processing and power efficiency. Global semiconductor shortage and geopolitical tensions also resulted in supply chain disruption as increased investment went into domestic production through moves like the USA CHIPS Act and Europe's semiconductor funding initiatives. 2025 to 2035 will be defined by 6G connectivity, quantum-classical processing, and greener manufacturing.

6G chipsets will provide ultra-low latency, more than 1 Tbps data rates, and real-time holographic communication. Hybrid quantum chipsets will be used for better encryption and AI learning models. Neuromorphic processors will advance contextual AI performance for real-time decision-making. Chipmakers will focus on sustainability with carbon-free production and power-efficient AI cores.

Edge computing integration will facilitate local data processing, decreasing latency and improving privacy. Security will be enhanced with blockchain-based verification and quantum-immune encryption, and high-performance GPUs will support cloud-based and real-time ray-traced gaming.

Comparative Market Shift Analysis 2020 to 2024 vs. 2025 to 2035

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| 5G spectrum allocation, regulation of semiconductor investments | 6G standardization, regulation of quantum-secure chips |

| 5nm to 3nm chip miniaturization, AI-based chipsets | Hybrid quantum chipsets, neuromorphic computing |

| Gaming improvements, AI integration in smartphones | AI-powered mobile assistants, edge computing for IoT |

| AI-powered image processing, real-time translation | Autonomous energy harvesting, self-learning AI chipsets |

| Power consumption reduction, supply chain optimization | Carbon-free chip manufacturing, recyclable chip materials |

| Early AI chip monitoring | Real-time processing improvements, AI-powered predictive maintenance |

| Semiconductor shortage, international supply chain disturbances | Decentralized chip manufacturing, local semiconductor centers |

The industry is expanding with the rising demand for high-performance processors in smartphones, tablets, and IoT devices. High R&D costs and the need to innovate continuously make it expensive for manufacturers. It is necessary to invest in high-end fabrication technologies while keeping cost-effective production to compete.

Worldwide semiconductor shortages and supply chain disruption are a serious threat to chipset manufacturing. Over-reliance on a few manufacturing plants and geopolitical tensions over trade can create supply bottlenecks. Diversification of supplier networks, enhancing local manufacturing, and holding buffers of critical components are the necessary measures to hedge against such threats.

More and more cyberattacks are flooding since chipsets in smartphones mix with AI, 5G, and cloud computing. Flaws in chip architecture can lead to leaks of data, unauthorized access, and the compromise of devices. Robust encryption, secure boot methods, and regular firmware updates must be used to develop robust cybersecurity.

Compliance with regulations and intellectual property rights poses issues on the stability of the industry. Severe government restrictions against selling semiconductors, patent infringement lawsuit cases, and national security are capable of inhibiting industry growth. Institutions face challenges in responding to complicated regulatory regimes, procuring necessary approval, and formulating sound partnerships to prevent disturbance in sales and supply.

Extended technological advancements are also susceptible to obsolescence. The transition to more power-efficient architectures and sophisticated chipsets requires ongoing innovation. Any slowing down in keeping pace with industry trends, such as AI-enabled processing and power-efficient designs, would lead to reduced competitiveness.

Pricing at the 1,200 MHz Segment is expected to lead with an industry share of 38% of the industry in 2025, driven mainly by the wide usage of this segment in entry-level smartphones, IoT devices, and feature phones. These chipsets are low-power and, thus, cheaper than they deliver; it is better for emerging markets where price-sensitive consumers prioritize battery life over performance.

However, because very few semiconductor companies manufacture microcontrollers, companies will hold a monopoly on the microcontroller industry, with affordable, low-power products like the MediaTek Helio A series and UNISOC SC9832E integrated into a wide range of budget smartphones and wearables. With the addition of smart feature phones, especially in regions like Africa and Southeast Asia, there is considerable demand for 800MHz chipsets.

In light of this, the 1.5GHz segment is expected to cap a 62% share of access to the industry in 2025, in the imbued program for greater clock speed for mid-range and low-end smartphones to offer customers much smoother multitasking, faster marathon app processing, and also a high-end gaming experience on their handsets.

As 1.5GHz processors find a good balance of power efficiency and performance, this is why such chipsets are ideal for lower middle and low range 4G and 5G smartphones.

The charge is led by manufacturers like Qualcomm (Snapdragon 4 & 6 series), MediaTek (Helio G & Dimensity series), Samsung (Exynos 850 & 9609) and others. Growing demand for advanced yet low-cost smartphones, especially in India and Latin America, is driving adoption. As smartphone brands emphasize affordable performance, the rapidly expanding 1.5GHz chipset category will ensure its leadership position in the budget and mid-range industry.

By 2025, the Sub-6GHz segment is expected to continue holding the largest industry share at 72%, owing to its extensive usage in the 5G smartphone, IoT devices, and industrial applications. Deploying with continental grease, equipment access, and others. Sub-6GHz frequencies deliver better coverage and power efficiency, so they are the native choice for North American, European, and Asia-Pacific network operators.

Still, the major chip vendors like Qualcomm (Snapdragon 7 & 8 series), MediaTek (Dimensity series), and even Samsung (Exynos 2200 & 2100) have doubled down on Sub-6GHz technology to accelerate widespread 5G deployments at economically and power-efficient price points. India, China, and Brazil, for instance, are focusing on nationwide Sub-6GHz rollouts to support demand in the industry.

The mmWave segment is estimated to preserve 28% of the industry by 2025, growing applications such as ultra-fast 5G networks, premium smartphones, and enterprise solutions. mmWave is used for multi-gigabit speeds with very low latency. However, its high expense and short range have limited its widespread deployments to developed markets like the USA, Japan, and South Korea.

The mmWave ecosystem is maturing, with Qualcomm (Snapdragon X65 & X70 modems) providing key enablers for mmWave in premium devices, automotive connectivity, and private network segments, while Apple (custom 5G modems) is taking charge of adoption in consumer electronics. With telecom operators building out mmWave infrastructure, adoption will be expanding across the board from enterprise to smart cities to high-performance mobile apps. As 5G adoption continues to grow worldwide, the next generation of mobile connectivity will be powered by both Sub-6GHz and mmWave chipsets.

| Countries | CAGR (2025 to 2035) |

|---|---|

| USA | 9.1% |

| UK | 8.6% |

| France | 8.5% |

| Germany | 8.9% |

| Italy | 8.4% |

| South Korea | 9.3% |

| Japan | 8.7% |

| China | 9.5% |

| Australia | 8.2% |

| New Zealand | 8.0% |

The USA industry is gaining momentum with the growth in 5G, AI processors, and the increasing need for performance-focused smartphones. Semiconductor manufacturing within the country is gaining speed with the CHIPS and Science Act, restricting dependence on foreign supply chains. Edge computing and AI-focused mobile applications are leading manufacturers to create energy-efficient and fast processors.

Major players like Qualcomm, Apple, and Intel are investing in custom silicon, cutting-edge lithography, and AI processors to drive efficiency. With further investments in artificial intelligence chipsets and mobile computing technologies, the USA is still at the forefront of the global semiconductor industry.

The UK industry is advancing increasingly on the strength of the 5G rollout, the growth of IoT, and government-sponsored semiconductor R&D programs. Domestic emphasis on AI-based smart devices and cloud applications is driving demand for high-speed, efficient mobile processors.

Strong indigenous companies like ARM Holdings, Imagination Technologies, and Graphcore are at the forefront of CPU architecture innovations. AI accelerator technology and mobile GPU technology. In their wake are foldable phones and AR/VR technologies, and these, too, are creating needs for AI-powered, making the UK a semiconductor hub.

The French industry is changing with developments in future wireless technology, power-saving chips, and AI processing. Government investment in semiconductor research and edge computing is fueling the local sector, driving the growth of AI-based chip architecture.

STMicroelectronics, the best French semiconductor company, is at the forefront of ultra-low-power mobile chipsets and AI mobile computing technologies. The nation's focus on energy-efficient and sustainable chipset manufacturing is transforming the mobile processor industry, with long-term development of the business being made possible.

Germany's industry is booming due to the support of industrial automation technology, AI-based mobile processors, and the development of semiconductor fabrication. Semiconductor fabrication, machine learning acceleration, and AI-powered mobile computing are areas Germany is investing in more and more.

Industry leaders like Infineon Technologies and Bosch are designing next-generation low-power AI chipsets and real-time mobile processing architectures. Increasing adoption of AI-based mobile processors in the automotive industry is also driving industry growth, and Germany is becoming a flagship of semiconductor innovation.

Italy's industry is expanding well, supported by the R&D of semiconductor technology backed by the government, the proliferation of smart devices, and the rising demand for power-efficient computing. High-speed chipsets are being driven by the increasing growth of mobile computing thanks to AI and 5G networking.

Italian chip firms such as STMicroelectronics are spearheading the production of AI-tuned mobile processors and chipsets. Smart wearables, Internet of Things gadgets, and new connectivity solutions are spearheading the chipset industry in the nation with steady growth for the next few years.

South Korea's industry is growing at a breakneck speed, with Samsung and SK Hynix taking the lead. The nation's investments in AI chip design and semiconductor production are leading the pack as far as global mobile processing is concerned.

South Korea's dominance of foldable phones, premium GPUs, and AI mobile apps is driving next-generation chipset demand. The government initiative towards 6G research and AI semiconductors is strengthening the nation's hold on the chipset industry.

The cutting edge of AI chipset R&D, semiconductor miniaturization, and high-performance mobile processing leads Japan's industry. Mobile processing focus optimization in the country is fueling innovation for smartphones, wearables, and automobiles.

Japanese firms like Sony, Renesas, and Toshiba are in charge of developing mini power-saving mobile chipsets that feature enhanced AI processing capabilities. Through its ambitious investments in AI-proof mobile frameworks and edge computing, Japan currently occupies a central role in dictating the future trajectory of AI-capable mobile processing.

China's industry is growing leaps and bounds with massive investment in semiconductor fab, AI processors, and future-proofed mobile connectivity. China's strategic drive to go local for chip manufacturing is fueling the rapid transformation of the chipset industry.

Leading Chinese players Huawei, MediaTek, and SMIC are going all-out for AI-optimized mobile processors and high-performance computing solutions. With continued government encouragement and advancements in AI-specific chip structures, China is turning into a global manufacturing powerhouse of mobile chipsets.

CAGR between 2025 and 2035 is 8.2%. Australia's industry is growing due to increasing smartphone penetration, IoT adoption, and government-sponsored semiconductor research. Australia's emphasis on AI-based mobile computing and power-efficient chip design is fueling the demand for high-performance processors.

Locally based research organizations and technology development firms are at the forefront of AI-facilitated mobile processing technology. As more advanced smartphones and applications supported by edge computing increasingly advance, Australia is placing its semiconductor industry in a position to fund next-generation mobile chipset technology.

New Zealand's industry is growing gradually due to the increasing demand for AI-driven mobile processors and more investment in smart device technology. Green and power-conserving semiconductor solutions are shaping New Zealand's future mobile chipset business.

With improvements in 5G, IoT, and AI-based mobile computing, New Zealand is expected to come up with efficient and quick chips. Digitalization and next-generation connectivity tech, which are focused on by the government, will be a leading cause of long-term semiconductor growth.

The industry for mobile chipsets is growing extremely fast with the technology push for better, faster, and AI-based processors that create the need for greater performance, improved power efficiency, and hassle-free 5G connectivity to address the needs of users. Vendors are always seeking greater performance, improved power efficiency, and flawless 5G connectivity to address the needs of users today. The emphasis on high-end gaming, AI apps, and in-device machine learning is driving chipset design, and vendors are being forced to use bleeding-edge manufacturing techniques as well as sophisticated architecture.

In the competition to remain in business, firms are spending heavily on semiconductor fabrication, AI acceleration, as well as modem integration technology. Chip design advancements in the guise of small transistor nodes and enhanced thermal design are enabling higher-performance but power-conscious processors.

Furthermore, AI-powered computing capabilities are pushing photography, voice recognition, and instant translation further, enhancing the user experience. With increasing numbers of people adopting 5G, even the manufacturers of the chipsets are thinking about developing the modem to make the transition seamless from one network to another.The competitive environment includes high-end semiconductor titans, chipset competitors in

the early stages, and computing technology providers that are leading mobile computing innovations. Customer demands are increasing by the minute, with competing vendors escalating their wars against one another on a daily basis, making the innovation cycles extremely aggressive. With the growing complexity of cellular apps, there will be a huge demand for sophisticated chipsets and future-proof devices, and they will be key drivers of the future of smartphones and connected devices.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Qualcomm | 35-40% |

| MediaTek | 25-30% |

| Apple Inc. | 15-20% |

| Samsung Electronics | 10-14% |

| HiSilicon (Huawei) | 5-9% |

| Other Companies (combined) | 10-20% |

| Company Name | Key Offerings/Activities |

|---|---|

| Qualcomm | Develops Snapdragon processors with integrated 5G modems and AI-powered computing. |

| MediaTek | Specializes in cost-effective, high-performance chipsets for mainstream and premium smartphones. |

| Apple Inc. | Designs proprietary A-series chipsets optimized for seamless iOS integration and battery efficiency. |

| Samsung Electronics | Innovates in Exynos chipsets with AI enhancements and advanced GPU performance. |

| HiSilicon (Huawei) | Focuses on high-security chipsets with advanced AI capabilities for mobile computing. |

Strategic Outlook of Key Companies

Qualcomm (35-40%)

Qualcomm dominates the industry with its industry-leading Snapdragon series, integrating cutting-edge 5G connectivity, AI-powered processing, and superior GPU performance for flagship and mid-range smartphones.

MediaTek (25-30%)

MediaTek is revolutionizing the industry with its Dimensity and Helio chipsets, offering competitive performance, efficient power consumption, and robust connectivity solutions for a broad range of mobile devices.

Apple Inc. (15-20%)

Apple's proprietary A-series chips power its iPhones, delivering unmatched efficiency and processing speeds while optimizing software-hardware integration for a seamless user experience.

Samsung Electronics (10-14%)

Samsung’s Exynos chipsets are designed to enhance gaming performance, AI computation, and 5G integration, making them a competitive alternative in premium and mid-range smartphones.

HiSilicon (Huawei) (5-9%)

Huawei’s HiSilicon Kirin processors focus on security, AI enhancements, and high-performance processing, playing a key role in the brand’s ecosystem of mobile and IoT devices.

Other Key Players (10-20% Combined)

The industry is segmented into 800 MHz, 1.5 GHz, 1.6 GHz-2.5 GHz, and 2.6 GHz-3.5 GHz.

The industry includes Sub-6GHz, mmWave, and a combination of Sub-6GHz + mmWave.

The industry covers 7 nm, 10 nm, and other node types.

IT and telecom, energy and utilities, automotive and transportation, supply chain and logistics, government and public safety, agriculture, and others.

The industry is segmented into North America, Latin America, Western Europe, Eastern Europe, South Asia & Pacific, East Asia, and the Middle East & Africa.

The industry is expected to generate USD 22.28 billion in revenue by 2025.

The industry is projected to reach USD 137.02 billion by 2035, growing at a CAGR of 21.5%.

Key players include Qualcomm, MediaTek, Apple Inc., Samsung Electronics, HiSilicon (Huawei), Unison, Broadcom, Nvidia, Intel, and AMD.

Asia-Pacific, particularly China, South Korea, and Taiwan, due to the presence of major semiconductor manufacturing hubs and rising demand for high-performance mobile processors.

5G chipsets dominate due to their role in enhancing mobile connectivity, improving processing speed, and enabling next-generation smartphone applications.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Units) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Clock Speed, 2018 to 2033

Table 4: Global Market Volume (Units) Forecast by Clock Speed, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Frequency Type, 2018 to 2033

Table 6: Global Market Volume (Units) Forecast by Frequency Type, 2018 to 2033

Table 7: Global Market Value (US$ Million) Forecast by Processing Node Type, 2018 to 2033

Table 8: Global Market Volume (Units) Forecast by Processing Node Type, 2018 to 2033

Table 9: Global Market Value (US$ Million) Forecast by End-user, 2018 to 2033

Table 10: Global Market Volume (Units) Forecast by End-user, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 12: North America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 13: North America Market Value (US$ Million) Forecast by Clock Speed, 2018 to 2033

Table 14: North America Market Volume (Units) Forecast by Clock Speed, 2018 to 2033

Table 15: North America Market Value (US$ Million) Forecast by Frequency Type, 2018 to 2033

Table 16: North America Market Volume (Units) Forecast by Frequency Type, 2018 to 2033

Table 17: North America Market Value (US$ Million) Forecast by Processing Node Type, 2018 to 2033

Table 18: North America Market Volume (Units) Forecast by Processing Node Type, 2018 to 2033

Table 19: North America Market Value (US$ Million) Forecast by End-user, 2018 to 2033

Table 20: North America Market Volume (Units) Forecast by End-user, 2018 to 2033

Table 21: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 22: Latin America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 23: Latin America Market Value (US$ Million) Forecast by Clock Speed, 2018 to 2033

Table 24: Latin America Market Volume (Units) Forecast by Clock Speed, 2018 to 2033

Table 25: Latin America Market Value (US$ Million) Forecast by Frequency Type, 2018 to 2033

Table 26: Latin America Market Volume (Units) Forecast by Frequency Type, 2018 to 2033

Table 27: Latin America Market Value (US$ Million) Forecast by Processing Node Type, 2018 to 2033

Table 28: Latin America Market Volume (Units) Forecast by Processing Node Type, 2018 to 2033

Table 29: Latin America Market Value (US$ Million) Forecast by End-user, 2018 to 2033

Table 30: Latin America Market Volume (Units) Forecast by End-user, 2018 to 2033

Table 31: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 32: Western Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 33: Western Europe Market Value (US$ Million) Forecast by Clock Speed, 2018 to 2033

Table 34: Western Europe Market Volume (Units) Forecast by Clock Speed, 2018 to 2033

Table 35: Western Europe Market Value (US$ Million) Forecast by Frequency Type, 2018 to 2033

Table 36: Western Europe Market Volume (Units) Forecast by Frequency Type, 2018 to 2033

Table 37: Western Europe Market Value (US$ Million) Forecast by Processing Node Type, 2018 to 2033

Table 38: Western Europe Market Volume (Units) Forecast by Processing Node Type, 2018 to 2033

Table 39: Western Europe Market Value (US$ Million) Forecast by End-user, 2018 to 2033

Table 40: Western Europe Market Volume (Units) Forecast by End-user, 2018 to 2033

Table 41: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 42: Eastern Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 43: Eastern Europe Market Value (US$ Million) Forecast by Clock Speed, 2018 to 2033

Table 44: Eastern Europe Market Volume (Units) Forecast by Clock Speed, 2018 to 2033

Table 45: Eastern Europe Market Value (US$ Million) Forecast by Frequency Type, 2018 to 2033

Table 46: Eastern Europe Market Volume (Units) Forecast by Frequency Type, 2018 to 2033

Table 47: Eastern Europe Market Value (US$ Million) Forecast by Processing Node Type, 2018 to 2033

Table 48: Eastern Europe Market Volume (Units) Forecast by Processing Node Type, 2018 to 2033

Table 49: Eastern Europe Market Value (US$ Million) Forecast by End-user, 2018 to 2033

Table 50: Eastern Europe Market Volume (Units) Forecast by End-user, 2018 to 2033

Table 51: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 52: South Asia and Pacific Market Volume (Units) Forecast by Country, 2018 to 2033

Table 53: South Asia and Pacific Market Value (US$ Million) Forecast by Clock Speed, 2018 to 2033

Table 54: South Asia and Pacific Market Volume (Units) Forecast by Clock Speed, 2018 to 2033

Table 55: South Asia and Pacific Market Value (US$ Million) Forecast by Frequency Type, 2018 to 2033

Table 56: South Asia and Pacific Market Volume (Units) Forecast by Frequency Type, 2018 to 2033

Table 57: South Asia and Pacific Market Value (US$ Million) Forecast by Processing Node Type, 2018 to 2033

Table 58: South Asia and Pacific Market Volume (Units) Forecast by Processing Node Type, 2018 to 2033

Table 59: South Asia and Pacific Market Value (US$ Million) Forecast by End-user, 2018 to 2033

Table 60: South Asia and Pacific Market Volume (Units) Forecast by End-user, 2018 to 2033

Table 61: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 62: East Asia Market Volume (Units) Forecast by Country, 2018 to 2033

Table 63: East Asia Market Value (US$ Million) Forecast by Clock Speed, 2018 to 2033

Table 64: East Asia Market Volume (Units) Forecast by Clock Speed, 2018 to 2033

Table 65: East Asia Market Value (US$ Million) Forecast by Frequency Type, 2018 to 2033

Table 66: East Asia Market Volume (Units) Forecast by Frequency Type, 2018 to 2033

Table 67: East Asia Market Value (US$ Million) Forecast by Processing Node Type, 2018 to 2033

Table 68: East Asia Market Volume (Units) Forecast by Processing Node Type, 2018 to 2033

Table 69: East Asia Market Value (US$ Million) Forecast by End-user, 2018 to 2033

Table 70: East Asia Market Volume (Units) Forecast by End-user, 2018 to 2033

Table 71: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 72: Middle East and Africa Market Volume (Units) Forecast by Country, 2018 to 2033

Table 73: Middle East and Africa Market Value (US$ Million) Forecast by Clock Speed, 2018 to 2033

Table 74: Middle East and Africa Market Volume (Units) Forecast by Clock Speed, 2018 to 2033

Table 75: Middle East and Africa Market Value (US$ Million) Forecast by Frequency Type, 2018 to 2033

Table 76: Middle East and Africa Market Volume (Units) Forecast by Frequency Type, 2018 to 2033

Table 77: Middle East and Africa Market Value (US$ Million) Forecast by Processing Node Type, 2018 to 2033

Table 78: Middle East and Africa Market Volume (Units) Forecast by Processing Node Type, 2018 to 2033

Table 79: Middle East and Africa Market Value (US$ Million) Forecast by End-user, 2018 to 2033

Table 80: Middle East and Africa Market Volume (Units) Forecast by End-user, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Clock Speed, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Frequency Type, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Processing Node Type, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by End-user, 2023 to 2033

Figure 5: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 6: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 7: Global Market Volume (Units) Analysis by Region, 2018 to 2033

Figure 8: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 9: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 10: Global Market Value (US$ Million) Analysis by Clock Speed, 2018 to 2033

Figure 11: Global Market Volume (Units) Analysis by Clock Speed, 2018 to 2033

Figure 12: Global Market Value Share (%) and BPS Analysis by Clock Speed, 2023 to 2033

Figure 13: Global Market Y-o-Y Growth (%) Projections by Clock Speed, 2023 to 2033

Figure 14: Global Market Value (US$ Million) Analysis by Frequency Type, 2018 to 2033

Figure 15: Global Market Volume (Units) Analysis by Frequency Type, 2018 to 2033

Figure 16: Global Market Value Share (%) and BPS Analysis by Frequency Type, 2023 to 2033

Figure 17: Global Market Y-o-Y Growth (%) Projections by Frequency Type, 2023 to 2033

Figure 18: Global Market Value (US$ Million) Analysis by Processing Node Type, 2018 to 2033

Figure 19: Global Market Volume (Units) Analysis by Processing Node Type, 2018 to 2033

Figure 20: Global Market Value Share (%) and BPS Analysis by Processing Node Type, 2023 to 2033

Figure 21: Global Market Y-o-Y Growth (%) Projections by Processing Node Type, 2023 to 2033

Figure 22: Global Market Value (US$ Million) Analysis by End-user, 2018 to 2033

Figure 23: Global Market Volume (Units) Analysis by End-user, 2018 to 2033

Figure 24: Global Market Value Share (%) and BPS Analysis by End-user, 2023 to 2033

Figure 25: Global Market Y-o-Y Growth (%) Projections by End-user, 2023 to 2033

Figure 26: Global Market Attractiveness by Clock Speed, 2023 to 2033

Figure 27: Global Market Attractiveness by Frequency Type, 2023 to 2033

Figure 28: Global Market Attractiveness by Processing Node Type, 2023 to 2033

Figure 29: Global Market Attractiveness by End-user, 2023 to 2033

Figure 30: Global Market Attractiveness by Region, 2023 to 2033

Figure 31: North America Market Value (US$ Million) by Clock Speed, 2023 to 2033

Figure 32: North America Market Value (US$ Million) by Frequency Type, 2023 to 2033

Figure 33: North America Market Value (US$ Million) by Processing Node Type, 2023 to 2033

Figure 34: North America Market Value (US$ Million) by End-user, 2023 to 2033

Figure 35: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 36: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 37: North America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 38: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 39: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 40: North America Market Value (US$ Million) Analysis by Clock Speed, 2018 to 2033

Figure 41: North America Market Volume (Units) Analysis by Clock Speed, 2018 to 2033

Figure 42: North America Market Value Share (%) and BPS Analysis by Clock Speed, 2023 to 2033

Figure 43: North America Market Y-o-Y Growth (%) Projections by Clock Speed, 2023 to 2033

Figure 44: North America Market Value (US$ Million) Analysis by Frequency Type, 2018 to 2033

Figure 45: North America Market Volume (Units) Analysis by Frequency Type, 2018 to 2033

Figure 46: North America Market Value Share (%) and BPS Analysis by Frequency Type, 2023 to 2033

Figure 47: North America Market Y-o-Y Growth (%) Projections by Frequency Type, 2023 to 2033

Figure 48: North America Market Value (US$ Million) Analysis by Processing Node Type, 2018 to 2033

Figure 49: North America Market Volume (Units) Analysis by Processing Node Type, 2018 to 2033

Figure 50: North America Market Value Share (%) and BPS Analysis by Processing Node Type, 2023 to 2033

Figure 51: North America Market Y-o-Y Growth (%) Projections by Processing Node Type, 2023 to 2033

Figure 52: North America Market Value (US$ Million) Analysis by End-user, 2018 to 2033

Figure 53: North America Market Volume (Units) Analysis by End-user, 2018 to 2033

Figure 54: North America Market Value Share (%) and BPS Analysis by End-user, 2023 to 2033

Figure 55: North America Market Y-o-Y Growth (%) Projections by End-user, 2023 to 2033

Figure 56: North America Market Attractiveness by Clock Speed, 2023 to 2033

Figure 57: North America Market Attractiveness by Frequency Type, 2023 to 2033

Figure 58: North America Market Attractiveness by Processing Node Type, 2023 to 2033

Figure 59: North America Market Attractiveness by End-user, 2023 to 2033

Figure 60: North America Market Attractiveness by Country, 2023 to 2033

Figure 61: Latin America Market Value (US$ Million) by Clock Speed, 2023 to 2033

Figure 62: Latin America Market Value (US$ Million) by Frequency Type, 2023 to 2033

Figure 63: Latin America Market Value (US$ Million) by Processing Node Type, 2023 to 2033

Figure 64: Latin America Market Value (US$ Million) by End-user, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 66: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 67: Latin America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 68: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 69: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 70: Latin America Market Value (US$ Million) Analysis by Clock Speed, 2018 to 2033

Figure 71: Latin America Market Volume (Units) Analysis by Clock Speed, 2018 to 2033

Figure 72: Latin America Market Value Share (%) and BPS Analysis by Clock Speed, 2023 to 2033

Figure 73: Latin America Market Y-o-Y Growth (%) Projections by Clock Speed, 2023 to 2033

Figure 74: Latin America Market Value (US$ Million) Analysis by Frequency Type, 2018 to 2033

Figure 75: Latin America Market Volume (Units) Analysis by Frequency Type, 2018 to 2033

Figure 76: Latin America Market Value Share (%) and BPS Analysis by Frequency Type, 2023 to 2033

Figure 77: Latin America Market Y-o-Y Growth (%) Projections by Frequency Type, 2023 to 2033

Figure 78: Latin America Market Value (US$ Million) Analysis by Processing Node Type, 2018 to 2033

Figure 79: Latin America Market Volume (Units) Analysis by Processing Node Type, 2018 to 2033

Figure 80: Latin America Market Value Share (%) and BPS Analysis by Processing Node Type, 2023 to 2033

Figure 81: Latin America Market Y-o-Y Growth (%) Projections by Processing Node Type, 2023 to 2033

Figure 82: Latin America Market Value (US$ Million) Analysis by End-user, 2018 to 2033

Figure 83: Latin America Market Volume (Units) Analysis by End-user, 2018 to 2033

Figure 84: Latin America Market Value Share (%) and BPS Analysis by End-user, 2023 to 2033

Figure 85: Latin America Market Y-o-Y Growth (%) Projections by End-user, 2023 to 2033

Figure 86: Latin America Market Attractiveness by Clock Speed, 2023 to 2033

Figure 87: Latin America Market Attractiveness by Frequency Type, 2023 to 2033

Figure 88: Latin America Market Attractiveness by Processing Node Type, 2023 to 2033

Figure 89: Latin America Market Attractiveness by End-user, 2023 to 2033

Figure 90: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 91: Western Europe Market Value (US$ Million) by Clock Speed, 2023 to 2033

Figure 92: Western Europe Market Value (US$ Million) by Frequency Type, 2023 to 2033

Figure 93: Western Europe Market Value (US$ Million) by Processing Node Type, 2023 to 2033

Figure 94: Western Europe Market Value (US$ Million) by End-user, 2023 to 2033

Figure 95: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 96: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 97: Western Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 98: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 99: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 100: Western Europe Market Value (US$ Million) Analysis by Clock Speed, 2018 to 2033

Figure 101: Western Europe Market Volume (Units) Analysis by Clock Speed, 2018 to 2033

Figure 102: Western Europe Market Value Share (%) and BPS Analysis by Clock Speed, 2023 to 2033

Figure 103: Western Europe Market Y-o-Y Growth (%) Projections by Clock Speed, 2023 to 2033

Figure 104: Western Europe Market Value (US$ Million) Analysis by Frequency Type, 2018 to 2033

Figure 105: Western Europe Market Volume (Units) Analysis by Frequency Type, 2018 to 2033

Figure 106: Western Europe Market Value Share (%) and BPS Analysis by Frequency Type, 2023 to 2033

Figure 107: Western Europe Market Y-o-Y Growth (%) Projections by Frequency Type, 2023 to 2033

Figure 108: Western Europe Market Value (US$ Million) Analysis by Processing Node Type, 2018 to 2033

Figure 109: Western Europe Market Volume (Units) Analysis by Processing Node Type, 2018 to 2033

Figure 110: Western Europe Market Value Share (%) and BPS Analysis by Processing Node Type, 2023 to 2033

Figure 111: Western Europe Market Y-o-Y Growth (%) Projections by Processing Node Type, 2023 to 2033

Figure 112: Western Europe Market Value (US$ Million) Analysis by End-user, 2018 to 2033

Figure 113: Western Europe Market Volume (Units) Analysis by End-user, 2018 to 2033

Figure 114: Western Europe Market Value Share (%) and BPS Analysis by End-user, 2023 to 2033

Figure 115: Western Europe Market Y-o-Y Growth (%) Projections by End-user, 2023 to 2033

Figure 116: Western Europe Market Attractiveness by Clock Speed, 2023 to 2033

Figure 117: Western Europe Market Attractiveness by Frequency Type, 2023 to 2033

Figure 118: Western Europe Market Attractiveness by Processing Node Type, 2023 to 2033

Figure 119: Western Europe Market Attractiveness by End-user, 2023 to 2033

Figure 120: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 121: Eastern Europe Market Value (US$ Million) by Clock Speed, 2023 to 2033

Figure 122: Eastern Europe Market Value (US$ Million) by Frequency Type, 2023 to 2033

Figure 123: Eastern Europe Market Value (US$ Million) by Processing Node Type, 2023 to 2033

Figure 124: Eastern Europe Market Value (US$ Million) by End-user, 2023 to 2033

Figure 125: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 126: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 127: Eastern Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 128: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 129: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 130: Eastern Europe Market Value (US$ Million) Analysis by Clock Speed, 2018 to 2033

Figure 131: Eastern Europe Market Volume (Units) Analysis by Clock Speed, 2018 to 2033

Figure 132: Eastern Europe Market Value Share (%) and BPS Analysis by Clock Speed, 2023 to 2033

Figure 133: Eastern Europe Market Y-o-Y Growth (%) Projections by Clock Speed, 2023 to 2033

Figure 134: Eastern Europe Market Value (US$ Million) Analysis by Frequency Type, 2018 to 2033

Figure 135: Eastern Europe Market Volume (Units) Analysis by Frequency Type, 2018 to 2033

Figure 136: Eastern Europe Market Value Share (%) and BPS Analysis by Frequency Type, 2023 to 2033

Figure 137: Eastern Europe Market Y-o-Y Growth (%) Projections by Frequency Type, 2023 to 2033

Figure 138: Eastern Europe Market Value (US$ Million) Analysis by Processing Node Type, 2018 to 2033

Figure 139: Eastern Europe Market Volume (Units) Analysis by Processing Node Type, 2018 to 2033

Figure 140: Eastern Europe Market Value Share (%) and BPS Analysis by Processing Node Type, 2023 to 2033

Figure 141: Eastern Europe Market Y-o-Y Growth (%) Projections by Processing Node Type, 2023 to 2033

Figure 142: Eastern Europe Market Value (US$ Million) Analysis by End-user, 2018 to 2033

Figure 143: Eastern Europe Market Volume (Units) Analysis by End-user, 2018 to 2033

Figure 144: Eastern Europe Market Value Share (%) and BPS Analysis by End-user, 2023 to 2033

Figure 145: Eastern Europe Market Y-o-Y Growth (%) Projections by End-user, 2023 to 2033

Figure 146: Eastern Europe Market Attractiveness by Clock Speed, 2023 to 2033

Figure 147: Eastern Europe Market Attractiveness by Frequency Type, 2023 to 2033

Figure 148: Eastern Europe Market Attractiveness by Processing Node Type, 2023 to 2033

Figure 149: Eastern Europe Market Attractiveness by End-user, 2023 to 2033

Figure 150: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 151: South Asia and Pacific Market Value (US$ Million) by Clock Speed, 2023 to 2033

Figure 152: South Asia and Pacific Market Value (US$ Million) by Frequency Type, 2023 to 2033

Figure 153: South Asia and Pacific Market Value (US$ Million) by Processing Node Type, 2023 to 2033

Figure 154: South Asia and Pacific Market Value (US$ Million) by End-user, 2023 to 2033

Figure 155: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 156: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 157: South Asia and Pacific Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 158: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 159: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 160: South Asia and Pacific Market Value (US$ Million) Analysis by Clock Speed, 2018 to 2033

Figure 161: South Asia and Pacific Market Volume (Units) Analysis by Clock Speed, 2018 to 2033

Figure 162: South Asia and Pacific Market Value Share (%) and BPS Analysis by Clock Speed, 2023 to 2033

Figure 163: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Clock Speed, 2023 to 2033

Figure 164: South Asia and Pacific Market Value (US$ Million) Analysis by Frequency Type, 2018 to 2033

Figure 165: South Asia and Pacific Market Volume (Units) Analysis by Frequency Type, 2018 to 2033

Figure 166: South Asia and Pacific Market Value Share (%) and BPS Analysis by Frequency Type, 2023 to 2033

Figure 167: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Frequency Type, 2023 to 2033

Figure 168: South Asia and Pacific Market Value (US$ Million) Analysis by Processing Node Type, 2018 to 2033

Figure 169: South Asia and Pacific Market Volume (Units) Analysis by Processing Node Type, 2018 to 2033

Figure 170: South Asia and Pacific Market Value Share (%) and BPS Analysis by Processing Node Type, 2023 to 2033

Figure 171: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Processing Node Type, 2023 to 2033

Figure 172: South Asia and Pacific Market Value (US$ Million) Analysis by End-user, 2018 to 2033

Figure 173: South Asia and Pacific Market Volume (Units) Analysis by End-user, 2018 to 2033

Figure 174: South Asia and Pacific Market Value Share (%) and BPS Analysis by End-user, 2023 to 2033

Figure 175: South Asia and Pacific Market Y-o-Y Growth (%) Projections by End-user, 2023 to 2033

Figure 176: South Asia and Pacific Market Attractiveness by Clock Speed, 2023 to 2033

Figure 177: South Asia and Pacific Market Attractiveness by Frequency Type, 2023 to 2033

Figure 178: South Asia and Pacific Market Attractiveness by Processing Node Type, 2023 to 2033

Figure 179: South Asia and Pacific Market Attractiveness by End-user, 2023 to 2033

Figure 180: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 181: East Asia Market Value (US$ Million) by Clock Speed, 2023 to 2033

Figure 182: East Asia Market Value (US$ Million) by Frequency Type, 2023 to 2033

Figure 183: East Asia Market Value (US$ Million) by Processing Node Type, 2023 to 2033

Figure 184: East Asia Market Value (US$ Million) by End-user, 2023 to 2033

Figure 185: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 186: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 187: East Asia Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 188: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 189: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 190: East Asia Market Value (US$ Million) Analysis by Clock Speed, 2018 to 2033

Figure 191: East Asia Market Volume (Units) Analysis by Clock Speed, 2018 to 2033

Figure 192: East Asia Market Value Share (%) and BPS Analysis by Clock Speed, 2023 to 2033

Figure 193: East Asia Market Y-o-Y Growth (%) Projections by Clock Speed, 2023 to 2033

Figure 194: East Asia Market Value (US$ Million) Analysis by Frequency Type, 2018 to 2033

Figure 195: East Asia Market Volume (Units) Analysis by Frequency Type, 2018 to 2033

Figure 196: East Asia Market Value Share (%) and BPS Analysis by Frequency Type, 2023 to 2033

Figure 197: East Asia Market Y-o-Y Growth (%) Projections by Frequency Type, 2023 to 2033

Figure 198: East Asia Market Value (US$ Million) Analysis by Processing Node Type, 2018 to 2033

Figure 199: East Asia Market Volume (Units) Analysis by Processing Node Type, 2018 to 2033

Figure 200: East Asia Market Value Share (%) and BPS Analysis by Processing Node Type, 2023 to 2033

Figure 201: East Asia Market Y-o-Y Growth (%) Projections by Processing Node Type, 2023 to 2033

Figure 202: East Asia Market Value (US$ Million) Analysis by End-user, 2018 to 2033

Figure 203: East Asia Market Volume (Units) Analysis by End-user, 2018 to 2033

Figure 204: East Asia Market Value Share (%) and BPS Analysis by End-user, 2023 to 2033

Figure 205: East Asia Market Y-o-Y Growth (%) Projections by End-user, 2023 to 2033

Figure 206: East Asia Market Attractiveness by Clock Speed, 2023 to 2033

Figure 207: East Asia Market Attractiveness by Frequency Type, 2023 to 2033

Figure 208: East Asia Market Attractiveness by Processing Node Type, 2023 to 2033

Figure 209: East Asia Market Attractiveness by End-user, 2023 to 2033

Figure 210: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 211: Middle East and Africa Market Value (US$ Million) by Clock Speed, 2023 to 2033

Figure 212: Middle East and Africa Market Value (US$ Million) by Frequency Type, 2023 to 2033

Figure 213: Middle East and Africa Market Value (US$ Million) by Processing Node Type, 2023 to 2033

Figure 214: Middle East and Africa Market Value (US$ Million) by End-user, 2023 to 2033

Figure 215: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 216: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 217: Middle East and Africa Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 218: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 219: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 220: Middle East and Africa Market Value (US$ Million) Analysis by Clock Speed, 2018 to 2033

Figure 221: Middle East and Africa Market Volume (Units) Analysis by Clock Speed, 2018 to 2033

Figure 222: Middle East and Africa Market Value Share (%) and BPS Analysis by Clock Speed, 2023 to 2033

Figure 223: Middle East and Africa Market Y-o-Y Growth (%) Projections by Clock Speed, 2023 to 2033

Figure 224: Middle East and Africa Market Value (US$ Million) Analysis by Frequency Type, 2018 to 2033

Figure 225: Middle East and Africa Market Volume (Units) Analysis by Frequency Type, 2018 to 2033

Figure 226: Middle East and Africa Market Value Share (%) and BPS Analysis by Frequency Type, 2023 to 2033

Figure 227: Middle East and Africa Market Y-o-Y Growth (%) Projections by Frequency Type, 2023 to 2033

Figure 228: Middle East and Africa Market Value (US$ Million) Analysis by Processing Node Type, 2018 to 2033

Figure 229: Middle East and Africa Market Volume (Units) Analysis by Processing Node Type, 2018 to 2033

Figure 230: Middle East and Africa Market Value Share (%) and BPS Analysis by Processing Node Type, 2023 to 2033

Figure 231: Middle East and Africa Market Y-o-Y Growth (%) Projections by Processing Node Type, 2023 to 2033

Figure 232: Middle East and Africa Market Value (US$ Million) Analysis by End-user, 2018 to 2033

Figure 233: Middle East and Africa Market Volume (Units) Analysis by End-user, 2018 to 2033

Figure 234: Middle East and Africa Market Value Share (%) and BPS Analysis by End-user, 2023 to 2033

Figure 235: Middle East and Africa Market Y-o-Y Growth (%) Projections by End-user, 2023 to 2033

Figure 236: Middle East and Africa Market Attractiveness by Clock Speed, 2023 to 2033

Figure 237: Middle East and Africa Market Attractiveness by Frequency Type, 2023 to 2033

Figure 238: Middle East and Africa Market Attractiveness by Processing Node Type, 2023 to 2033

Figure 239: Middle East and Africa Market Attractiveness by End-user, 2023 to 2033

Figure 240: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Mobile Phone Screen Underlayer Cushioning Material Market Size and Share Forecast Outlook 2025 to 2035

Mobile Application Store Market Size and Share Forecast Outlook 2025 to 2035

Mobile Money Market Forecast and Outlook 2025 to 2035

Mobile Application Testing Solution Market Size and Share Forecast Outlook 2025 to 2035

Mobile Cardiac Telemetry System Market Size and Share Forecast Outlook 2025 to 2035

Mobile Robots Market Size and Share Forecast Outlook 2025 to 2035

Mobile Crane Market Size and Share Forecast Outlook 2025 to 2035

Mobile Vascular Imaging Market Size and Share Forecast Outlook 2025 to 2035

Mobile Animal Inhalation Anesthesia Machine Market Size and Share Forecast Outlook 2025 to 2035

Mobile Unified Communications and Collaboration (UC&C) Solution Market Size and Share Forecast Outlook 2025 to 2035

Mobile Data Protection Market Size and Share Forecast Outlook 2025 to 2035

Mobile Medical Tablets Market Size and Share Forecast Outlook 2025 to 2035

Mobile WLAN Access Points Market Size and Share Forecast Outlook 2025 to 2035

Mobile Social Networks Market Size and Share Forecast Outlook 2025 to 2035

Mobile Printer Market Size and Share Forecast Outlook 2025 to 2035

Mobile Application Development Platform Market Size and Share Forecast Outlook 2025 to 2035

Mobile Threat Management Security Software Market Size and Share Forecast Outlook 2025 to 2035

Mobile Broadband Infrastructure Market Size and Share Forecast Outlook 2025 to 2035

Mobile Enterprise Application Development Platform Market Size and Share Forecast Outlook 2025 to 2035

Mobile Analytics Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA