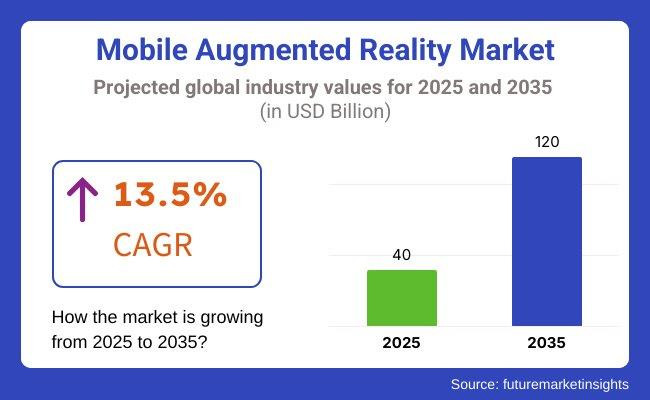

The market will grow to USD 40 billion in 2025 and to USD 120 billion by 2035, with a CAGR of 13.5% during the forecast period. Organizations are implementing AI-powered mobile AR solutions, cloud-based AR platforms, and real-time 3D visualization technologies to drive user interaction and digital experiences. Investments in AR-powered commerce, immersive gaming, and smart city applications will fuel growth.

Companies use mobile augmented reality to maximize user experience, enhance customer relationships, and create interactive digital content in sectors including retail, healthcare, education, and entertainment. The use of AI-powered AR analytics, blockchain-protected digital assets, and IoT-enabled AR applications will optimize real-time interactivity and automation.

Further, the increasing popularity of AR-driven virtual shopping, remote assistance, and interactive learning platforms is driving growth. Firms are leveraging spatial computing, 5G-enabled AR streaming, and AI-powered content personalization to deliver end-to-end and immersive user experiences.

Explore FMI!

Book a free demo

The Mobile Augmented Reality (AR) market is at a super-speed growth phase propelled by the introduction of the new 5G connectivity, AI integration, and AR hardware. In the relevant field of gaming & entertainment, AR is the reason for the addition of realistic conditions and immersion to gaming, with the result that user experience and hardware compatibility became the most important factors for the success of the application.

Retail & e-commerce are utilizing AR technology for applications like virtual try-ons and product visualization, with security, scalability, and seamless integration with existing ones being top priorities.

Similarly, the healthcare field is using AR for surgery assistance and medical training, which demands not only high security and data privacy but also hardware compatibility, which is needed to create frictionless implementation. Education is utilizing AR for fun classes, concentrating on low-cost solutions, scalability, and integration with digital platforms.

Besides, AR is also holding a place within the industrial and manufacturing sectors for maintenance and training purposes, upon which hardware compatibility and security receive emphasis. Companies that are transforming the processes in AR technology are searching for cheap, easily scaled, and firmly secured solutions to problems such as interaction, productivity, and client satisfaction in a variety of industries.

| Company | Contract Value (USD Million) |

|---|---|

| Google and HTC | Approximately USD 240 - 260 |

| Meta Platforms and Essilor Luxottica | Approximately USD 400 - 450 |

| Microsoft and Anduril Industries | Approximately USD 500 - 550 |

In January 2025, Google agreed to acquire a portion of HTC's extended reality unit for approximately USD 240 - 260 million, aiming to bolster its AR hardware offerings. By December 2024, Meta Platforms, in collaboration with EssilorLuxottica, reported sales exceeding one million units of their AR-integrated smart glasses in the EMEA region, valued at approximately USD 400 - 450 million, reflecting significant consumer adoption.

Additionally, in September 2024, Microsoft partnered with Anduril Industries in a contract estimated at USD 500 - 550 million to enhance the USA Army's AR capabilities through the Integrated Visual Augmentation System. These developments underscore the rapid growth and diversification of the Mobile AR Market, with major technology companies investing in hardware acquisitions, consumer wearables, and defense applications to expand their AR portfolios.

Between 2020 and 2024, the mobile AR market developed robustly due to improvements in AR hardware, AI-powered image recognition, and 5G networks. Increasing smartphone penetration and demands for interactive gaming, shopping, and education drove adoption.

The COVID-19 pandemic also spurred AR use for shopping, collaboration, and entertainment. Social media platforms began integrating AR filters, and industries utilized AR for training and data visualization. Businesses concentrated on AI-based rendering and edge computing to improve real-time AR experiences.

Between 2025 and 2035, spatial computing with AI, quantum rendering, and decentralized ecosystems for AR will revolutionize the industry. AI will facilitate scene recognition in real-time, as well as personalized content delivery. Quantum computing will accelerate 3D graphics processing, yielding greater realism.

Blockchain will ensure AR content creation and ownership integrity. AR cloud platforms will enable multi-user environments, whereas AR assistants will offer interactive guidance. BCIs and green AR hardware will fuel immersive, sustainable user experiences as well as smart city integration.

A Comparative Market Shift Analysis (2020 to 2024 vs. 2025 to 2035)

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| More stringent regulations (GDPR, CCPA) necessitated AR apps to improve user data privacy, consent management, and secure spatial mapping. | AI-based, blockchain-protected AR environments provide real-time privacy compliance, decentralized user authentication, and tamper-proof spatial data protection for immersive experiences. |

| AI-based AR apps enhanced object recognition, real-time translation, and gesture controls, making interactivity better. | AI-born, self-improving AR engines support hyper-realistic spatial interactions, predictive environment adaptation, and AI-based augmented decision-making for next-generation mobile applications. |

| Companies incorporated AR for virtual product visualization, increasing customer engagement in fashion, furniture, and cosmetics. | AI-enhanced, real-time AR shopping platforms provide AI-driven hyper-personalized product recommendations, interactive AI avatars, and predictive AR-driven purchasing experiences. |

| Mobile AR apps improved real-time navigation, overlaying directions and points of interest onto real-world environments. | AI-powered, 6G-enabled AR navigation solutions deliver ultra-fast, real-time spatial computing, AI-assisted urban planning, and AR-enhanced predictive mobility solutions. |

| Cloud AR platforms allow spatial content to be coordinated in real-time and thus provide constant, shared AR experiences. | Artificial intelligence-augmented distributed AR cloud architecture allows for the creation of ultra-realistic AI-powered holographic spaces that bring persistent, rich digital overlays of real-world sites. |

| 5G connectivity supported high AR render speeds, reduced latency, and even real-time transmission of high-fidelity AR material. | AI-driven, 6G-powered mobile AR platforms provide ultra-low latency holographic interactions, real-time AI-driven scene reconstruction, and seamless, edge-native AR experiences. |

| AI-enhanced security frameworks protected AR applications against deepfake manipulation, spoofing, and unauthorized tracking. | AI-native, quantum-safe AR security provides real-time anomaly detection, blockchain-enabled user authentication, and AI-driven AR fraud prevention for engaging and secure experiences. |

| Firms tuned AR rendering engines for reduced power usage and better device battery life. | Carbon-aware, AI-powered AR processing optimizes energy consumption dynamically, incorporates green AR cloud computing, and improves sustainable AR content creation. |

| AR mobile apps provide live remote training, interactive learning, and AI-supported healthcare visualization functionalities. | Immersive, AI-enhanced AR learning environments support real-time knowledge transfer, AI-assisted medical diagnosis, and AI-assisted, remote AR surgical assistance. |

| Companies researched blockchain-supported AR content ownership, which protected AR authors' intellectual property rights. | Decentralized, AI-built AR content worlds support real-time smart contract-based licensing, trustless trading of AR assets, and AI-enhanced, cooperative AR world construction. |

The Mobile Augmented Reality (AR) market being a new disruptive technology, currently faces many things such as limitations of technology, fragmentation of the industry, hardware dependency, and evolving regulatory frameworks that are generally the existing threats to businesses. Therefore, risk evaluation of companies dealing with such industry is a necessary step toward their long-term growth and stable operation.

The most concerning thing is hardware dependency. Despite the rapid ascent of AR software, the integration of it comes back to smartphone capabilities, AR glasses, and other wearables. Hardware compatibility problems can paralyze growth, and any lag in the adoption of AR-compatible devices can decelerate the development of the whole sector.

Another challenge of technology development is the main reason for this risk. Real-time image recognition, spatial mapping, and AI-driven AR interactions need high processing power and optimized algorithms. The performance inconsistency of different devices can affect user experience and, thereby, the rate of adoption.

The fragmentation of the industry is also a very serious drawback because there are too many companies developing AR platforms, SDKs, and applications. As a matter of fact, this fragmentation is the cause of the interoperability challenges; for example, the AR content may not work on several devices and be out of the question over other platforms that are, thus hindering mass adoption.

In order to lessen these problems, companies should focus on hardware-agnostic solutions, well-rounded data security measures, industry collaborations, and persistent innovation to attract users' attention and maintain competitiveness among companies.

| Country | CAGR (2025 to 2035) |

|---|---|

| The USA | 12.1% |

| The UK | 11.7% |

| European Union (EU) | 11.9% |

| Japan | 11.8% |

| South Korea | 12.3% |

The USA Mobile Augmented Reality Market is growing significantly as end-users, firms, and application developers adopt AR-based apps across gaming, commerce, and interactive advertising. Organizations develop new mobile AR applications for greater user interactions, transforming virtual shopping and designing engaging brand experiences.

Greater demand for visual recognition powered by AI, real-time navigation, and spatial computing fuels development. The nation's robust tech, entertainment, and e-commerce industries infuse AR to fuel customer experiences and rich digital interactions. Governance policies encourage investment in secure and scalable AR platforms, inviting competition for AR innovation.

FMI is of the opinion that the USA market is slated to grow at 12.1% CAGR during the study period.

Growth Factors in the USA

| Key Drivers | Details |

|---|---|

| Integration with E-commerce | Retailers of a large size utilize AR-powered virtual try-ons and interactive shopping experiences to induce online conversions. |

| Visual Recognition with AI | AR apps leverage object recognition based on AI to enable richer consumer interaction in gaming and commerce. |

| Support from Regulation | Digital policy enhances digital transformation as well as secure AR innovation and drives innovation. |

| 5G connectivity | Faster data transmission speed improves AR performance when used in real-time. |

The UK Mobile Augmented Reality Market grows as businesses embrace AR technology for interactive marketing, education, and healthcare initiatives. Mobile AR-enabled solutions are adopted by businesses to give better user experiences, enable product tests virtually, and provide enhanced real-world experiences.

Higher uptake of AI-based AR, cloud computing, and real-time data visualization drive growth. Government programs encouraging digital innovation also drive the adoption of AR in retail, automotive, and tourism industries.

FMI is of the opinion that the UK market is slated to grow at 11.7% CAGR during the study period.

Growth Factors in the UK

| Key Drivers | Details |

|---|---|

| Interactive Advertising | Companies create AR advertisements to offer interactive customer experiences. |

| Education & Healthcare | Institutions utilize AR for virtual training and simulation in surgery. |

| Cloud Computing | AR applications employ cloud computing for real-time optimization and rendering. |

| Digital Innovation Policies | Government policies stimulate the application of AR across sectors. |

The European Union Market for Mobile Augmented Reality is experiencing quick development as firms adopt AR-enabled navigation, distant learning, and e-commerce buying powers. Germany, France, and Italy dominate the uptake of AR solutions in property, car, and retail markets. Businesses deliver the level of data protection and anonymization requirements that drive investment in GDPR-certified AR solutions. Object recognition based on AI and 5G stimulates velocity to deploy AR.

FMI is of the opinion that the European Union market is slated to grow at 11.9% CAGR during the study period.

Growth Factors in the European Union

| Key Drivers | Details |

|---|---|

| AR-Based Navigation | Businesses embrace AR-based maps and guides for shopping and travel. |

| Remote Assistance | Businesses apply AR to remote technical support and collaboration. |

| GDPR Compliance | Companies invest in secure AR platforms to address privacy regulations. |

| 5G Infrastructure | Fast networks advance AR's real-time feature. |

Japan's Mobile Augmented Reality Market is growing due to AR usage among retail businesses, visual search enabled by artificial intelligence, and live gaming mobile apps. Enterprises have developed innovative AR platforms for digitalization, enhancing customer experiences, and engaging interactive learning.

High-technology innovation efforts and consumerism focused on the digital experience accelerate the adoption of AR in the nation. Entertainment, travel, and smart city projects make significant investments in cloud-enabled AR platforms to enhance user experiences and operational productivity.

FMI is of the opinion that Japan is slated to grow at 11.8% CAGR during the study period.

Growth Factors in Japan

| Key Drivers | Details |

|---|---|

| AR in Gaming | Japanese developers dominate AR-based interactive gaming. |

| Retail Innovation | Companies enhance in-store and online shopping with AR experiences. |

| Smart Cities | City planning integrates AR to navigate, secure, and engage citizens. |

| AI-Powered Search | AR apps use AI to improve consumers' search capability. |

South Korean Augmented Reality Market expands several times as businesses adopt AI-powered AR solutions, immersive entertainment, and intelligent retail solutions. The government genuinely promotes digital transformation, and this is the reason behind the driving adoption of AR among industries.

Companies adopt AR-powered virtual shopping, real-time facial recognition, and AI-powered interactive content for maximum customer engagement. Improvement in 5G infrastructure and edge computing is also the reason behind driving the industry further.

FMI is of the opinion that South Korea is slated to grow at 12.3% CAGR during the study period.

Growth Factors in South Korea

| Key Drivers | Details |

|---|---|

| Interactive Entertainment | AR is integrated into K-pop performances, video games, and content. |

| Smart Retail | Consumers have a better experience with AR capabilities enabled by AI. |

| Government Support | The policy encourages digitalization and the development of AR. |

| 5G and Edge Computing | High-speed networks enable peak AR performance for real-time applications. |

With the increasing need for remotely monitoring IT infrastructure while ensuring cybersecurity measures, the Remote System Management & Monitoring segment in 2025 is expected to contribute to 32.5% of the Managed IT Services Market. With enterprises worldwide adopting hybrid cloud environments, IoT-linked devices, and remote work models, the demand for proactive IT monitoring solutions that ensure smooth operations is driving growth.

However, in the wake of these changes, corporations are being forced to adapt to evolving markets rapidly through cyclical and continuous business transformations. Top names such as IBM, Cisco, HCL Technologies, DXC Technology, etc., are leading the AI-based remote management platforms by providing predictive maintenance functions, automated issue resolution, and cloud-based infrastructure monitoring.

By offering these solutions, organizations can detect vulnerabilities, improve IT performance, and prevent IT system outages before they disrupt operations.

In 2025, Disaster Recovery & Business Continuity Services is expected to hold a share of 20.1% as enterprises aim at attaining cyber resilience, compliance with regulations, and applying mitigation strategies for maximum reduction of risk. As organizations grapple with increasing ransomware attacks, cloud security issues, and regulatory compliance, they are turning to DRaaS, automatic failover systems, and machine learning-powered risk management.

Key vendors, i.e., Microsoft Azure, AWS, Veeam, and Acronis, are investing in real-time data replication, rapid recovery, and automation of disaster recovery plans in order to ensure minimum business downtime. These solutions enable business continuity by safeguarding critical data, facilitating recovery from a cyberattack or disaster, and ensuring compliance with industry regulations.

The telecom & IT sector is predicted to account for 34.8% of the Managed IT Services Market in 2025 due to the increase in acceptance of cloud computing, 5G networks, and AI-driven automation. Telecom operators and IT firms are under growing pressure to handle complex IT infrastructure, cybersecurity threats, and data-intensive operations. Hence, they are investing heavily in remote IT monitoring, managed security services, and cloud-based disaster recovery solutions.

The work of IBM, Accenture, Cognizant, and Tata Consultancy Services (TCS), among others, enables telecom companies to boost network efficiency, optimize IT resilience, and accelerate digital transformation initiatives.

The convergence of blockchain, AI, and cloud-native banking in financial institutions creates a demand for IT services that are secure, scalable, and powered by AI. This demand is only set to increase as the future of digital finance develops. The emergence of fintech, AI-based fraud detection, and cloud-driven financial services is driving demand for managed IT services, especially in areas such as disaster recovery, cybersecurity monitoring, and risk management.

Wipro, Infosys, DXC Technology, and Capgemini are among the companies spearheading secure cloud transfer, AI-driven compliance automation, and IT infrastructure optimization for financial institutions.

The convergence of blockchain, AI, and cloud-native banking in financial institutions creates a demand for IT services that are secure, scalable, and powered by AI. This demand is only set to increase as the future of digital finance develops.

The mobile augmented reality (AR) industry has rapidly emerged since companies started using AR-enabled devices to increase engagement, visualization, and real-life interactions. 5G proliferation, AI-accentuated computer vision, and cloud-based AR content availability all enhance innovation accessibility and scalability across industries.

The biggest players, such as Apple, Google, Microsoft, Niantic, and Snap Inc., dominate the AR scene with AR platforms, wearable AR devices, and AI-infused AR apps. Startups and niche players intensify competition through industry-specific AR solutions, lightweight AR experiences, and AI-based content personalization.

The evolution of the market, which includes real-time AR rendering advancements, LiDAR-based spatial mapping, and WebAR technologies, ensures frictionless and interactive AR experiences in gaming, retail, healthcare, and education, thus incorporating mobile AR into their working for better customer engagement, training simulation, and intuitive commerce.

AR & AI & IoT convergence trends, growing enterprise adoption of AR for remote collaboration, and increasing demand for AR-embedded marketing and e-commerce are shaping the strategic landscape of the industry. Providers are gaining and portraying their uniqueness through scalable AR ecosystems, cloud-based AR content delivery, and AI-powered spatial computing for continued growth and technological advancement.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Google (ARCore) | 20-25% |

| Apple (ARKit) | 15-20% |

| Niantic | 12-17% |

| Snap Inc. (Snap AR) | 8-12% |

| Microsoft (HoloLens Mobile) | 5-9% |

| Other Companies (combined) | 20-30% |

| Company Name | Key Offerings/Activities |

|---|---|

| Google (ARCore) | AI technologies power the tools, along with real-time mapping space for developing AR applications. |

| Apple (ARKit) | Develops AR frameworks for Apple iPhones, immersive AR experiences, and object-recognition capabilities. |

| Niantic | They are specialized in location-based AR gaming and real-time multiplayer AR experiences. |

| Snap Inc. (Snap AR) | Mainly focuses on social AR applications and AI-powered lens filters. |

| Microsoft (HoloLens Mobile) | They provide AR solutions that are mostly oriented towards the enterprise and develop AR collaboration tools. |

Key Company Insights

Google (ARCore) (20-25%)

AI-fueled AR development tools, real-time mapping, and cloud-hosted AR content delivery.

Apple (ARKit) (15-20%)

It uses AI to recognize objects, has immersive AR frameworks, and has effortless iOS integration.

Niantic (12-17%)

Niantic focuses on AI-based location-based AR gaming, real-time multiplayer AR, and advanced geospatial AR technology.

Snap Inc. (Snap AR) (8-12%)

Leads innovation in social AR experiences and AI-driven lens filters

Microsoft (HoloLens Mobile) (5-9%)

Takes AR applications further with enterprise-oriented AR solutions, cloud-based collaboration, and mixed reality tools.

Other Key Players (20-30% Combined)

The industry is slated to reach USD 40 billion in 2025.

The industry is predicted to reach a size of USD 120 billion by 2035.

Key companies include Apple Inc., Google LLC, Qualcomm Technologies, Inc., Samsung Electronics Co. Ltd., Amazon.com, Inc., Intel Corporation, Microsoft Corporation, Magic Leap, Inc., Wikitude GmbH, and others.

South Korea, driven by advancements in 5G connectivity and AR-enabled applications, is expected to record the highest CAGR of 12.3% during the forecast period.

Mobile AR Software and AR Application Platforms are among the most widely used solutions in the industry.

The market covers mobile AR software, mobile AR application platforms, mobile AR SDKs, services, integration & deployment, AR design & development, and support services.

The market includes military, education, healthcare, gaming, media & entertainment, travel & tourism, and others.

The market spans North America, Latin America, Europe, East Asia, and the Middle East & Africa.

Remote Construction Market Analysis by Component, Application, End-use Industry and Region Through 2035

Procurement as a Service Market Trends – Growth & Forecast 2025 to 2035

Massive Open Online Course Market Analysis – Growth, Trends & Forecast 2025 to 2035

Tactical Radios Market Analysis by Type, Application, and Region Through 2025 to 2035

Healthcare Virtual Assistants Market Analysis by Product, End User and Region Through 2035

Microsoft Dynamics Market Trends - Demand & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.