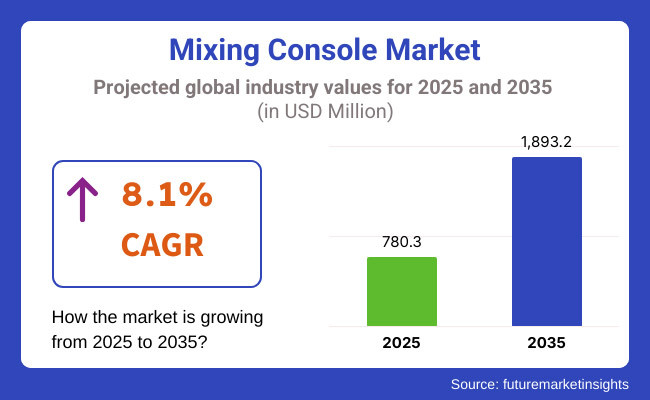

The Mixing Console market is projected to grow significantly, from 780.3 million in 2025 to 1,893.2 million by 2035 an it is reflecting a strong CAGR of 8.1%. The mixer market is expanding rapidly owing to the growing need for quality audio in broadcasting and media outlets, live events, and recording studios.

As content creation continues to lay roots across industries, enthusiasts are digging deep into their pockets with high-end consoles to give them extra sound precision. Due to their real time processing, remote control and flexibility, digital mixing consoles are becoming more commonly used than analog ones, resulting in increasing market adoption of such consoles.

Influence of regulations and industry standards regarding audio quality and broadcasting on the mixing console market Satisfying this quality criterion, broadcasters and production houses need to adapt to the new standards of audio rendering.

This compliance pressure can lead to investments in advanced mixing consoles with built-in features for precise sound management. Moreover, new regulations in various regions are promoting innovation, paving the way for the next generation of efficient and technologically advanced mixing consoles.

AI is revolutionizing the industry with automation, DSP, and remote-controlled mixing solutions on the rise. Digital consoles offer more features, connectivity, and workflow, which is what makes many audio producers prefer this type of console. The adoption of digital mixing consoles is being further driven by their capability to integrate with cloud-based audio solutions and networked systems across a wide range of applications.

With digital mixing consoles increasingly connecting to networks, this trend has led to higher concerns over data security and vulnerabilities in the system. Encryption, secure network protocols, and other such security measures are being integrated by manufacturers to counteract unauthorized access and threats from cyber criminals. This makes security of communication between devices increasingly important for broadcasters, recording studios and live event specialist’s dependent on interconnected audio systems.

The largest market share is held by North America due to the presence of top audio device manufacturers and heavy investment in broadcasting and live event production. In addition, the region's heavy emphasis on technological advancement and compliance with industry standards is also driving the market expansion.

On the other hand, the growing entertainment and media industry in countries such as India and Australia is demanding more professional audio equipment. This is where the manufacturers have a lot of potential with the growing demand for high-quality audio solutions in these emerging markets.

| Company | Yamaha Corporation |

|---|---|

| Contract/Development Details | Secured a contract to supply digital mixing consoles for a series of major international music festivals, aiming to enhance live sound quality and streamline audio management. |

| Date | April 2024 |

| Contract Value (USD million) | Approximately USD 5 |

| Renewal Period | 3 years |

| Company | Allen & Heath |

|---|---|

| Contract/Development Details | Partnered with a national broadcasting company to upgrade their studio equipment with advanced mixing consoles, improving audio production capabilities for television and radio programs |

| Date | August 2024 |

| Contract Value (USD million) | Approximately USD 7 |

| Renewal Period | 5 years |

Rising demand for high-quality audio production in broadcasting, recording studios, and live events

As the consumers and prosumers demand best-in-class sound and sound experiences, demand will remain strong across broadcasting, recording studios, and live action. Broadcasting networks for radio and television are renovating their audio architecture to ensure pristine sound quality when producing for a high-definition or immersive audio format.

Recording studios are looking to advanced mixing console features to satisfy those in the world who expect the best from their audio engineering such as musicians, podcasters, voice-over artists, etc. The live events market is also witnessing better investments in cutting-edge audio equipment to facilitate seamless performances in concerts, corporate events, and theater productions.

As the global economy challenges get all the tougher, governments across the globe also tends to roll their sleeves and get on the entertainment and media industry, realizing how it contributes in a economic growth. In a recent United States-based government initiative, USD 100 million was set aside for the initiative for the development of audio-visual technology, which also includes professional sound technology, to improve local media and live event productions.

Likewise, European regulatory bodies are also demanding higher quality audio delivery for broadcast; to meet such requirements, broadcasters are investing in higher and higher grading mixing consoles. With several nations advocating digital transformation in media, the demand for quality audio solutions will continue to rise, promising audience the best auditory experience in content consumption across all media.

Growing adoption of networked and cloud-based audio solutions

Audio-LAN networking and software have revolutionized the audio management and production sectors in professional facilities. With networking capabilities, digital mixing consoles can integrate with additional audio gear for live performance, as well as remote access and enablement to facilitate collaboration.

As an audio engineer, you want to be able to store, access and process files from anywhere and this is becoming increasingly more intuitive via cloud-based audio solutions for live broadcasting, recording studios and post-production. It also improves workflow efficiency, slashes the dependence on hardware and allows flexible production set-ups, enabling professionals to collaborate easily.

Governments too are pledging to develop certain aspects of their digital infrastructure to boost cloud-based innovations across many industries such as media and entertainment. The UK government, for instance, has just announced a £50 million investment into next-generation digital media technologies to boost cloud-based broadcasting and remote production capabilities.

As the Asia-Pacific region welcomes cloud-based advances with new incentives for digital transformation, South Korea committed USD 200 billion to fuel cloud-based innovations in the entertainment sector. This also means that networked mixing consoles become an integral part of those production environments as businesses increasingly embrace digital audio solutions. Cloud-enabled audio solutions will continue to thrive in the global market as more countries invest in digital media infrastructure.

Rising focus on cybersecurity and encrypted network protocols for digital audio systems

Cybersecurity concerns are on the rise as digital mixing consoles and audio systems become more networked. Cyber threats, including unauthorized access and data breaches, can have a significant impact on broadcasters, live event organizers, and recording studios. Live transmissions are subject to being disrupted, and post-recordings can be tampered with and critical audio data compromised by hackers.

To mitigate these risks, manufacturers are incorporating encrypted network protocols, two-factor authentication and real-time monitoring features into digital audio systems to ensure they remain secure. The total lack of WiFi direct support in professional audio equipment protects them from a possible cyber attack but, at the same time, allows their uninterrupted use.

Governments are also cracking down on regulations regarding cybersecurity, which is hindering the audio and broadcasting industries. The other shoe to drop will be the European Union’s Cyber Resilience Act, which mandates strict security measures for all connected devices, shaking up the professional audio industry in a big way and urging manufacturers to step up the security on digital mixing consoles. In the same vein, the government of the United States allocated 150 million dollars for security upgrades in media and entertainment technology, making sure that digital sound equipment services meet elevated security requirements. As data privacy and cyber threats become more pronounced, audio professionals are looking for secure and encrypted mixing solutions which now more than ever create another layer where advanced cybersecurity aspects should be implemented.

Complex digital interfaces and advanced functionalities require extensive training for operators and sound engineers

Analog/turntable→digital mixing for complex tasks→complex interfaces→a lot of training for operator/sound engineers Instead of physical controls dedicated to each function, as with traditional analog consoles, digital mixing consoles organize many functions into layered menus, touchscreen controls and programmable settings. While this features immense flexibility and customization, it also adds complexity to all professionals whose aim is to work as efficiently as possible through complex workflows.

The challenge is even worse for live sound engineers, who are forced to make quick decisions in real time when making adjustments in performance. Digital consoles have capabilities like automated mixing, multi-track recording, and remote access, but mastering all these features is time-consuming and will take practice.

It would almost certainly create operational disconnects due to many of those who have a decade or longer of analog system experience may not effectively enable the transition to more rapid digital operations, leading to increases in both a trial-for-error model of learning and ultimately higher inefficiencies. Recording studios and broadcasting stations, which frequently have to educate their personnel on software updates, firmware upgrades, and new functionalities, complicate matters.

| Market Shift | 2020 to 2024 |

|---|---|

| Regulatory Landscape | Digital rights management (DRM) regulations influenced professional audio production. |

| Transition to Digital Consoles | Increased adoption of digital mixing consoles over analog alternatives. |

| Live Streaming & Remote Production | Growth in remote and cloud-based audio production tools. |

| Integration with AI & Cloud | AI-assisted mixing and cloud-based audio collaboration tools emerged. |

| Market Growth Drivers | Demand for high-quality audio production in streaming, podcasts, and live events. |

| Market Shift | 2025 to 2035 |

|---|---|

| Regulatory Landscape | AI-driven compliance ensures seamless content licensing and fair use monitoring. |

| Transition to Digital Consoles | AI-powered auto-mixing technology enhances audio production and live sound engineering. |

| Live Streaming & Remote Production | AI-driven real-time sound optimization personalizes user experiences. |

| Integration with AI & Cloud | AI-powered voice synthesis and automated sound design redefine audio engineering. |

| Market Growth Drivers | AI-integrated immersive audio solutions drive next-gen sound innovation. |

The section highlights the CAGRs of countries experiencing growth in the Mixing Console market, along with the latest advancements contributing to overall market development. Based on current estimates China, India and USA are expected to see steady growth during the forecast period.

| Countries | CAGR from 2025 to 2035 |

|---|---|

| India | 11.9% |

| China | 10.7% |

| Germany | 6.3% |

| Japan | 8.2% |

| United States | 7.1% |

China’s entertainment content industry is booming, and there is increasing demand for high-end mixing consoles in recording studios, commercial concerts, and broadcast networks. With film production, music concerts and digital content, the country has become a global hub and high-quality audio production has now become a priority.

With the growing number of large-scale events, including music festivals and a multitude of televised competitions, the demand for advanced digital mixing consoles with enhanced automation and connectivity features heads further upward. Demand for high end audio mixing solutions will continue, primarily driven by the booming gaming and VR sector in China.

China's ruling Communist Party has launched a series of initiatives to help the entertainment and media industry. A government policy in late 2018 to increase cultural exports resulted in a 20% rise in funding of film and television production indirectly fueling demand for professional audio equipment.

In addition, faster 5G adoption in broadcasting in China has also accelerated the shift to digital audio processing, increasing the demand for high-performance mixing consoles used in TV and radio stations. With the growth of the entertainment sector, there will be continued demand for flexible, professional-grade audio mixing devices which will make China an attractive region for producers of such devices.

The increasing number of independent music producers, content creators and podcasters in India are creating strong demand for mixing consoles. As digital streaming services like YouTube, Spotify and local OTT providers continue to gain popularity this means that more artists than ever are investing in their own home studios to produce music, podcasts and video.

That has opened up a whole new level of entry to creators in India thanks to the affordable entry price of digital mixing consoles, coupled with easy (or free) access to music production software. Also, the vast and varied music ecosystem in India including Bollywood, regional film industries and independent music labels is further driving adoption of professional-grade audio equipment.

The media and entertainment industry has been given a number of government incentives. A recent USD 60m national fund to subsidies film and music production has created further incentive for local artists to invest in studio gear - mixing consoles included. Also, the “Digital India” initiative has fueled half the population to have internet and the willingness to consume quality online content, which then need professional audio mixing solutions. with the result that both traditional and new content creators in India are increasingly adopting inexpensive but powerful digital mixing consoles, making the country a high-growth segment of the professional audio equipment market.

The United States is a prominent player in the markets for music, film and broadcasting, making it one of the largest markets for mixing consoles. High-end digital mixing consoles are used by major recording studios, TV networks, and live event production companies to create top-quality audio for music albums, films, concert performances, and sports broadcasts. The growing adoption of immersive audio formats like Dolby Atmos and spatial audio are also pushing forward innovation in digital mixing consoles, with studios and broadcasters seeking increasingly advanced solutions for multi-channel mixing.

There are initiatives within the USA government to support the media and entertainment industry. Recently USD 200 million in new federal funding was announced to upgrade broadcasting infrastructure, including digital audio technologies. Extra regulations were put out by the Federal Communications Commission (FCC) designed to enhance audio quality in digital broadcasting, which encouraged studios and production houses to invest in upgrades to their current mixer. The USA live events industry is also booming, with top-tier music festivals and sports’ events needing complex sound systems. This trend, together with the swift adoption of audio production solutions based on cloud-based technology, is likely to maintain the high demand for advanced mixing consoles in the USA market.

The section contains information about the leading segments in the industry. By Type, the Analog Mixing Console segment is estimated to grow quickly from the period 2025 to 2035. Additionally, by Application, broadcast studios segment hold dominant share in 2025.

| Type | CAGR (2025 to 2035) |

|---|---|

| Analog Mixing Consoles | 9.2% |

The analog mixing console in the audio industry is being fueled by a renaissance of the warm, natural sound quality they offer. Many professional sound engineers, musicians, and producers favor analog consoles because they have more dynamic range with harmonic richness and tactile control. Analog consoles are highly sought after in recording studios, live performances, and broadcast applications due to their organic and authentic tone, which stands in contrast to the sound manipulated through digital mixing console algorithms.

The market for these consoles has expanded due to a rising demand for vintage's particular-style music production featured in an increasing catalog of harvested retro sound sampled from hits back in the day, where warmth and defining character of sound is applied to modern recordings.

Various countries have provided support for traditional audio production methods. Just recently, there was a USD 50 million grant given in the US, a fund dedicated to preserving and promoting analog recording technologies, to help the small and mid-sized studios invest in high-quality analog equipment, mixing consoles etc.

In October 2023 data, the new European regulations to promote high fidelity analog broadcasting have resulted in a 15% boost in demand for analog sound production equipment in public radio stations. With the growing trend of professionals returning to use analog consoles due to their tonal qualities, the market should keep its upward curve and grow as enthusiasts of the sound they can cultivate in booth spaces will be the ones focused on novelty audio fidelity and old source quality.

| Application | Value Share (2025) |

|---|---|

| Broadcast Studios | 34.9% |

Broadcast studios account for a major share of mixing consoles value, because they depend on professional quality audio equipment. Television and radio stations involve mixing consoles that can accommodate complex audio processing, multiple input sources, and continuous live broadcasting. Whether on news channels, sports broadcasting, or entertainment programming, mixing consoles are critical in providing high-fidelity sound with little latency. As broadcasters search for ways to deliver multi-platform content, from traditional TV to video streaming and podcasting, the need for advanced mixing consoles is on the rise again.

The demand for professional audio equipment is also driven by the investments made by several governments across the world in the modernization & up-gradation of broadcasting infrastructure. As part of this initiative, this year, the Indian government announced a USD 145 million project to modernize public broadcasting infrastructure, and there is a growing demand for high-end mixing consoles for the national television and radio networks. Meanwhile, China’s growth of state-funded media channels has led to a year-on-year demand growth of 20 percent for digital and analog mixing consoles. With new technology advancements in broadcast studios, they are enabling high audio solutions to deliver premium sound quality to its audience.

As quality audio production remains a growing necessity for many sectors, the demand for console mixers has been steadily increasing. Top manufacturers emphasize digital innovation, greater connectivity, and a user-friendly interface tailored to both professionals and hobbyists. Competitive Ripe Market with Key Players Investing in Advanced Signal Processing, AI-Powered Automation, and Cloud Integration to Thwart Competition.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Yamaha Corporation | 22-27% |

| Allen & Heath | 15-20% |

| Soundcraft (Harman International) | 12-18% |

| Behringer (Music Tribe) | 8-12% |

| PreSonus Audio Electronics | 6-10% |

| Other Companies (combined) | 25-35% |

| Company Name | Key Offerings/Activities |

|---|---|

| Yamaha Corporation | Offers industry-leading digital and analog mixing consoles for live sound, studio recording, and commercial installations. Focuses on AI-enhanced mixing and cloud-based audio solutions. |

| Allen & Heath | Specializes in high-performance digital and analog mixers, known for their flexibility, reliability, and ease of use in live sound and broadcast applications. |

| Soundcraft (Harman International) | Develops professional-grade digital and analog mixing consoles, integrating Harman's AI-driven sound processing and cloud-based collaboration tools. |

| Behringer (Music Tribe) | Provides budget-friendly yet feature-rich mixing consoles, focusing on digital innovation and accessibility for musicians, podcasters, and small studios. |

| PreSonus Audio Electronics | Innovates in hybrid mixing solutions, combining hardware and software integration with PreSonus Studio One DAW for seamless recording and live production. |

Strategic Outlook

Yamaha Corporation (22-27%)

Yamaha is a dominant player in mixing console with its high-end digital and analog mixers. The CL, QL, and TF series are aimed at live sound, recording, and broadcasting professionals. Further, you can expect to see Yamaha announce AI- assisted mixing, remote control capabilities, cloud-based audio production, and advances in many other intelligent aspects that will both benefit the service provider and the user, further endorsing their leadership position.

Allen & Heath (15-20%)

Allen & Heath is the strong in the pro-audio world, renowned for its solid digital and analog mixers for live production and other professional uses. The company’s dLive and SQ series have intuitive interfaces, flexible routing, and advanced effects processing. Allen & Heath's emphasis is on maximizing workflow efficiency through integration with third party software and hardware.

Soundcraft (Harman International) (12-18%)

Soundcraft is a Harman brand like Sony and Harmon Kardon, and Harman® integrates high-end digital and analog mixers into their professional audio solutions. Its Vi, Si, and Signature series are geared toward touring, broadcast, and studio pros, respectively. Meanwhile, the company also bolsters its consoles with AI-enhanced sound processing and cloud collaboration capabilities, solidifying it as a strong player in the premium space.

Behringer (Music Tribe) (8-12%)

Behringer targets budget-minded users via its low-cost digital and analog mixers. Its X32 and Wing series became widely popular for their advanced DSP processing, intuitive control and high-quality sound. Behringer's cost-effective mixing solutions for musicians, podcasters, and small studios invites evolution.

PreSonus Audio Electronics (6-10%)

PreSonus with their mixture of hybrid hardware and software mixing solutions. Its StudioLive series integrates seamlessly with Studio One DAW, encompassing recording and live performance in one complete workflow. That said, the company does invest in AI driven sound processing and wireless control features.

Other Key Players (25-35% Combined)

Other contributors serving the market include Midas Consoles (Music Tribe), Avid Technology, SSL (Solid State Logic), TASCAM (TEAC Corporation), and Mackie (LOUD Audio, LLC) These brands cater to high-end digital consoles, boutique analog mixers, and other niche applications, including film production, live sound, and home studios. Their innovations propel further adoption in a variety of sonic experiences.

In terms of Type, the segment is segregated into Analog Mixing Console and Digital Mixing Console.

In terms of Sales Channel, the segment is segregated into Direct sales channel and Indirect sales channel.

In terms of Application, it is distributed into Broadcast studios, Broadcast TV, recording studio and Others.

A regional analysis has been carried out in key countries of North America, Latin America, East Asia, South Asia & Pacific, Western Europe, Eastern Europe and Middle East and Africa (MEA), and Europe.

The Global Mixing Console industry is projected to witness CAGR of 8.1% between 2025 and 2035.

The Global Mixing Console industry stood at USD 780.3 million in 2025.

The Global Mixing Console industry is anticipated to reach USD 1,893.2 million by 2035 end.

South Asia & Pacific is set to record the highest CAGR of 10.2% in the assessment period.

The key players operating in the Global Mixing Console Industry Yamaha Corporation, Allen & Heath, Soundcraft (Harman International), Behringer (Music Tribe), PreSonus Audio Electronics, Midas Consoles (Music Tribe), Avid Technology, Inc., SSL (Solid State Logic), TASCAM (TEAC Corporation), Mackie (LOUD Audio, LLC).

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Paint Mixing Market Analysis - Size, Share, and Forecast Outlook for 2025-2035

Vacuum Mixing Devices Market Analysis - Size, Share & Forecast 2025 to 2035

Asphalt Mixing Plants Market Size and Share Forecast Outlook 2025 to 2035

Asphalt Mixing Plant Market Analysis and Opportunity Assessment in India Size and Share Forecast Outlook 2025 to 2035

Thermal Mixing Valves Market Size and Share Forecast Outlook 2025 to 2035

Food-Grade Mixing Tank Market Size and Share Forecast Outlook 2025 to 2035

Thermostatic Mixing Valve Market Size and Share Forecast Outlook 2025 to 2035

Game Consoles Market Size and Share Forecast Outlook 2025 to 2035

Boat Console Market

Gaming Console Market Size and Share Forecast Outlook 2025 to 2035

Automotive Console Box Market

Connected Game Console Market Analysis by Product Type, Application, and Region through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA