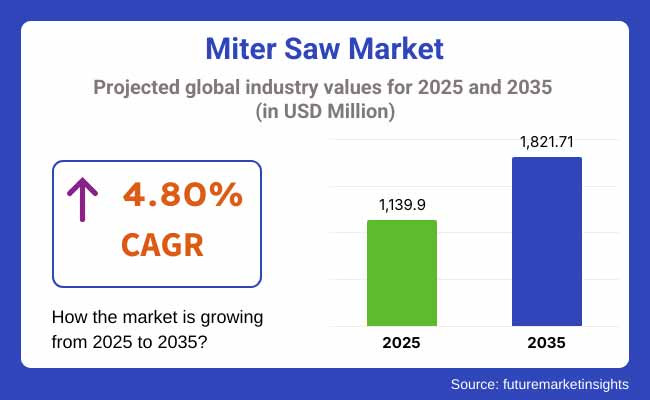

The miter saws industry is anticipated to reach USD 1,139.9 million by 2025 end, progressing at a notable 4.80% CAGR to touch USD 1,821.71 million in 2035.

Growing needs for cordless miter saws are boosting business growth, providing greater mobility and ease of use. Technologies such as LED lights and laser guides are enhancing accuracy, as companies concentrate on lighter, compact designs for professionals and consumers.

In 2024, the miter saw industry evolved with a robust drive towards innovation and efficiency. Cordless versions were the demand leader, providing smooth mobility without compromising on power. Accuracy-improving features, including LED lighting and laser guidance, became de rigueur, revolutionizing precision in woodworking and construction.

Brands aggressively streamlined designs, emphasizing ultra-lightweight, compact designs customized for professionals who operate in confined spaces. Sustainability also became the focus, with brands incorporating energy-efficient mechanisms to meet changing environmental regulations.

With the industry entering 2025, growth is projected to gain traction with the addition of smart, connected technologies. Remote capability and automation are reinventing user demand, fueling a new era of high-output miter saws. In response to rising demand for more intelligent features and environmentally friendly design, manufacturers are reimagining efficiency, making the industry prime for a lively growth cycle.

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Cordless Mobility Revolutionized Workflows - Experts steered clear of corded versions as lithium-ion technology provided longer runtime and power without limitation. Necessity for convenient portability changed tool preferences. | Ultra-Efficient Cordless Technology Reigns - More rapid charging, extended battery life, and power-saving motors will rule. Cordless machines will outgun their corded counterparts, setting new industry standards. |

| Accuracy Became Imperative - Laser guides and LED improvements became the norm, providing highly accurate cutting. Contractors and woodworkers wanted to reduce errors and enhance project flow. | AI-Driven Sensors will Redefine Precision - Smart sensors will provide immediate adjustments to the blades, allowing perfect precision with a minimum of human input. Expert-level cutting will be made universally available through app-controlled calibration. |

| Compact and Light Gain Traction - With the evolving consumer nature, the demand for portable and efficient equipment that would not affect power regardless of the size. | Modular Designs Unleash Versatility - Because of its interchangeable modules and multi-feature functionality, miter saw will become evergreen machines for diversed applications, that will limit the need for extra machineries. |

| Sustainability Became a Competitive Advantage - Manufacturers incorporated energy-efficient motors and recyclable materials, reacting to increasing environmental consciousness and early regulatory pressure. | Tough Eco-Rules Spur Green Innovation - Firms will be compelled to embrace near-zero emissions and sustainable production. Innovative energy-saving technologies will characterize next-generation miter saws. |

| Safety and Dust Control Were the Stars - Increased dust collection and self-parking blade brakes enhanced workplace safety, reducing health hazards in high-exposure situations. | AI-Smart Safety Solutions- Real-time risk detection, self-shutoff modes, and better dust cleaning filters will establish a new safety norm, which provides cleaner and more secure workplaces. |

The miter saw industry functions within the power tools and construction machinery space, which is closely related to infrastructure development, real estate development, and industrialization. Demand will be influenced by global economic change from 2025 to 2035. Rapid urbanization in Asia and North America, fueled by huge construction projects, will fuel demand for precision cutting equipment.

Growing disposable income and growth in the DIY sector will drive consumer-led buying, with industrial take-up exploding as automation and intelligent technology reshape manufacturing practices. Supply chain robustness and raw material stability will be the main issues, with geopolitical forces shaping pricing patterns. Moreover, strict environmental regulations will compel manufacturers to adopt energy-efficient, low-emission technology, transforming production plans.

Through changing sectors, consistent investment in technological advances like AI-driven precision instruments and intelligent integration will fuel long-term growth, setting the industry up for a transformative decade to come.

The miter saw industry is expected to witness huge growth from 2025 to 2035 due to technological advancements and changing user needs. Sliding miter saws are likely to see good growth because of increased flexibility and their capability to work on larger materials. The growth of the construction industry and increased DIY home improvement activities are the reasons behind this trend.

Compound miter saws are expected to increase moderately, providing accuracy in angled cutting, rendering them a necessity for complex woodworking work. The growth in demand for personalized furniture and precise woodwork supports their implementation.

Cordless miter saws are expected to grow largely, fueled by the benefits of mobility and simplicity. The growing popularity of home improvement projects undertaken by individuals and professional construction activities, along with the inherent advantages of cordless technology, drive demand.

On the application front, the home use segment is anticipated to grow at a CAGR of 6.3% during 2025 to 2035, led by the growth in DIY culture and home remodeling activities. The industrial use segment is anticipated to grow at a CAGR of 5.0% during 2025, reaching around USD 543.70 million by 2035. This is due to the growing demand in construction and manufacturing industries.

The commercial applications segment, including small businesses and contractors, is projected to experience consistent growth due to the need for accurate and effective cutting tools in numerous projects.

Similarly, Sliding and cordless miter saws are on the verge of strong growth given their applicability and ease. The home use category is likely to see strong growth, in line with the increasing DIY culture as well as home improvement trends.

The American miter saw industry will grow consistently between 2025 and 2035, fueled by growing construction work and demand for precision cutting tools in commercial woodwork. The surging use of smart and automated saws will improve productivity, especially for big-scale projects. The revival of local manufacturing will drive demand for high-technology power tools, with emphasis on performance and strength.

Home remodelling trends, driven by increasing disposable income, will push DIY and home improvement tool buying into overdrive. Greenness regulations will lead manufacturers to embrace energy-efficient and environmentally friendly models. Digital marketplaces and direct-to-consumer sales will change distribution tactics.

FMI analysis found that the CAGR of the USA industry is approximately 5.2%.

India's miter saw industry is all set for explosive growth, with demand driven by infrastructure growth and a thriving real estate sector. Smart city initiatives and low-cost housing plans will spur widespread uptake of professional cutting equipment. Small-scale woodworking establishments and growing DIY culture will stimulate demand for light and affordable saws.

Producers will emphasize cost effectiveness without sacrificing next-generation features such as laser guidance and dust collectors. Greater workplace safety awareness and precision cutting use in industry are expected to propel demand for highly efficient models. India's position as a manufacturing location of global scope will drive meaningful investment in country-based production capability.

FMI opines that the CAGR of India’s industry is expected to be around 6.1%.

The Chinese miter saw industry share will see significant growth, driven by acceleration in the country's industrialization and domestic manufacturing expansion. Demand for high-precision tools in the automotive, aerospace, and metal fabrication industries will fuel the adoption of premium saws. Increasing labor costs and the drive for automation will spur investments in AI-enabled and smart-controlled saws

As China solidifies its role as a world leader in power tool export, producers will ramp up production capacities to supply both domestic and overseas sectors. Digital sales strategies will be integrated to increase industry penetration in tier-1 and tier-2 cities.

FMI analysis found that the CAGR of China’s industry is projected to be approximately 5.8%.

UK's miter saw industry will be influenced by rising investments in home improvement and interior design styles. A boom in green woodworking projects will propel demand for energy-efficient and precision-driving tools. The commercial segment will experience increased use of smart and automatic saws, boosting productivity in building and metal fabrication sectors.

As the UK consolidates its high-value manufacturing base, next-generation cutting tools will feature prominently in aerospace and defense use. Increased online shopping channels and direct-to-consumer distribution models will transform industry dynamics, bringing premium tools to a wider industry. Increasing need for multi-purpose and space-efficient designs will also continue to drive product innovation.

FMI opines that the CAGR of the UK’s industry is expected to be around 4.5%.

Germany's miter saw industry will flourish on the strength of its expertise in precision engineering and high-quality manufacturing. The solid woodworking and furniture industries in the country will ensure steady demand for sophisticated cutting tools. More automation on production lines will provide opportunities for AI-based and IoT-capable saws. Sustainability will be a top priority, with German producers at the forefront of green tool solutions. The growth in industrial usage, especially automotive and metalworking, will consolidate the industry.

Digitalization will revolutionize sales strategies, with brands relying on AI-powered recommendations to reach professionals and commercial customers. Technological advancement commitment by the country will see power tool performance and efficiency improve continuously.

FMI analysis found that the CAGR of Germany’s industry is projected to be around 4.9%.

South Korea's miter saw industry will grow through the nation's robust tech-driven manufacturing ecosystem. The nation's emphasis on automation and smart factories will drive demand for precision equipment embedded with AI and real-time monitoring systems. Growing use of compact, light designs will meet the demands of urban professionals as well as small-sized businesses. Investments in green technologies will drive manufacturers to come up with ultra-high energy efficiency power tools.

The woodworking sector, spurred by rising exports of premium furniture, will maintain demand for professional-grade saws. Demand will be fueled by the growth of South Korea's aerospace and shipbuilding industries for high-precision metal cutting tools.

FMI opines that the CAGR of South Korea’s industry is expected to be approximately 5.0%.

Japan's miter saw industry will be shaped by its heritage in precision engineering and craftsmanship. Its demand for precision cutting tools will increase as Japan continues to excel in high-quality furniture and building design. Industry automation will necessitate the implementation of AI-saw technology that can self-calibrate and automatically detect errors. The trend towards smaller, multiple-function designs will appeal to professionals working in workshops with limited space.

Sustainability requirements will stimulate investment in recyclable and low-emission tool parts. The expansion of Japan's robotics and advanced manufacturing sectors will propel further industry growth.

FMI analysis found that the CAGR of Japan’s industry is projected to be around 4.7%.

France's miter saw industry will be driven by increasing investments in high-end woodworking and home remodelling activities. The increasing demand for handmade craftsmanship and high-end furniture manufacturing will continue to drive demand for accurate tools.

The nation's stringent safety and environmental regulations will fuel the shift towards energy-efficient and smart-controlled saws. The growth of professional uses in construction, metalworking, and industrial maintenance will fuel industry expansion. The availability of smaller, design-oriented tools will be attractive to both small firms and DYI practitioners.

FMI opines that the CAGR of France’s industry is expected to be approximately 4.6%.

Italy's miter saw industry will be helped by its rich tradition of woodworking and craftsmanship. The growing need for custom furniture and delicate wood detailing will propel professionals to high-precision saws. The steady growth of the construction industry will increase demand for heavy-duty and versatile power tools. Advances in blade technology and cutting efficiency will shape industry developments.

The growth of sustainable design trends will promote the use of green materials and low-energy consumption equipment. Manufacturers will emphasize the integration of traditional craftsmanship with advanced automation, improving efficiency and precision.

FMI analysis found that the CAGR of Italy’s industry is projected to be around 4.8%.

Australia and New Zealand miter saw industry will advance gradually with rising home renovation activities and growth in professional woodworking industries. Demand for all-weather, durable cutting instruments will increase as industries address different climate conditions. The DIY industry will grow as homeowners make investments in small-scale building and creative works. The professional sector will see a jump in demand for high-powered, precision-enhanced saws, especially in flooring and cabinetry uses.

Environmental concerns will drive manufacturers towards energy-efficient motors and recyclable materials. The region's increasing investment in infrastructure and commercial construction will maintain long-term demand for advanced power tools.

FMI opines that the CAGR of Australia and New Zealand’s sector is expected to be approximately 4.9%.

Surveyed Q4 2024, n=450 stakeholder participants, including manufacturers, distributors, professional contractors, DIY enthusiasts, and industrial end-users across North America, Europe, and Asia-Pacific.

Key Priorities of Stakeholders

Regional Variance

Adoption of Advanced Cutting Technologies

Material & Design Preferences

Cost Sensitivity & Pricing Trends

Industry-Specific Challenges

Future Investment Priorities

Regulatory & Policy Impact

Conclusion: Variance vs. Consensus

| Countries | Government Regulations & Certifications Impact |

|---|---|

| United States | OSHA enforces rigorous workplace safety regulations for power tools, compelling manufacturers to incorporate sophisticated safety features. UL and ANSI certifications are necessary for sector access. |

| India | BIS approval is necessary for electrical tools. The "Make in India" policy promotes local manufacturing, impacting pricing and supply chain dynamics. |

| China | CCC (China Compulsory Certification) is compulsory for power tools. Government policies focus on low-emission, energy-efficient tools, compelling greener manufacturing. |

| United Kingdom | CE marking is necessary for product conformity to UK safety and environmental directives. Post-Brexit trade regulations affect import/export operations for miter saw manufacturers. |

| Germany | Strict EU safety directives and TÜV certification standards impose high durability and environmentally friendly production standards, influencing material selection. |

| South Korea | KCS (Korean Certification Safety) approval is obligatory. Government incentives for battery-powered tools promote the transition to cordless miter saws. |

| Japan | PSE (Product Safety Electrical Appliance & Materials) is a necessary certification. Automation and precision tools are encouraged by policies, impacting technological development. |

| France | EU environmental policies, which are strict, favor energy-saving tools. AFNOR certification guarantees adherence to national safety and performance standards. |

| Italy | EU machinery directives and CE marking are necessary. Circular economy legislation encourages sustainable material use and recycling during tool production. |

| Australia-New Zealand | RCM (Regulatory Compliance Mark) certification is a requirement. Government regulations regarding low-noise and low-emission equipment affect product development and imports. |

Stakeholders can leverage technology with the adoption of AI-based precision cutting and intelligent automation to serve high-end professionals. Investment in lightweight yet high-torque cordless versions will resonate with increased demand for mobility in construction and woodworking. Investments into environmentally friendly miter saws with low-emission motors and recyclable components can gain a competitive advantage in Europe and North America, where regulations on sustainability are becoming stringent.

Strategic pricing for the emerging sectors of India and Southeast Asia will fuel penetration, as cost continues to be a major hindrance. Manufacturers need to improve distribution networks through direct-to-consumer (DTC) channels and exclusive arrangements with DIY retailers, providing easy industry access. Customization for industrial uses like metal fabrication and automotive workshops can unlock niche revenue streams.

The miter saw industry is moderately fragmented, with numerous regional players coexisting alongside well-established global producers. This environment promotes competitive pricing as well as ongoing innovation.

Industry leaders compete through technological innovation, strategic alliances, and expansion. They invest in high-end features such as laser cutting and cordless technology to keep up with changing customer needs. Strategic acquisition and merger are used to extend market reach and broaden product portfolios.

In March 2024, MITER Brands made a USD 3.1 billion acquisition of PGT Innovations Inc. The acquisition was to consolidate its position The acquisition is also likely to add variety to MITER's product line and expand its industrial base.

Market Share Analysis

Sliding Miter Saw, Compound Miter Saw, Others

Home Use, Industrial Use, Commercial Use

North America, Latin America, Western Europe, Eastern Europe, South Asia and Pacific, East Asia, Middle East and Africa

Manufacturers are integrating AI-driven precision, cordless mobility, and eco-friendly materials to enhance efficiency and sustainability.

Stricter safety and environmental mandates are driving advancements in dust collection, noise control, and energy-efficient designs.

The rise in professional woodworking, DIY craftsmanship, and smart technology adoption is accelerating the need for precision cutting tools.

Top players are leveraging product innovation, strategic acquisitions, and IoT-enabled features to differentiate and expand their global footprint.

Regulatory shifts favoring low-emission, high-efficiency tools are shaping product development and influencing investment in sustainable technologies.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2019 to 2034

Table 2: Global Market Volume (Units) Forecast by Region, 2019 to 2034

Table 3: Global Market Value (US$ Million) Forecast by Type, 2019 to 2034

Table 4: Global Market Volume (Units) Forecast by Type, 2019 to 2034

Table 5: Global Market Value (US$ Million) Forecast by Application, 2019 to 2034

Table 6: Global Market Volume (Units) Forecast by Application, 2019 to 2034

Table 7: North America Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 8: North America Market Volume (Units) Forecast by Country, 2019 to 2034

Table 9: North America Market Value (US$ Million) Forecast by Type, 2019 to 2034

Table 10: North America Market Volume (Units) Forecast by Type, 2019 to 2034

Table 11: North America Market Value (US$ Million) Forecast by Application, 2019 to 2034

Table 12: North America Market Volume (Units) Forecast by Application, 2019 to 2034

Table 13: Latin America Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 14: Latin America Market Volume (Units) Forecast by Country, 2019 to 2034

Table 15: Latin America Market Value (US$ Million) Forecast by Type, 2019 to 2034

Table 16: Latin America Market Volume (Units) Forecast by Type, 2019 to 2034

Table 17: Latin America Market Value (US$ Million) Forecast by Application, 2019 to 2034

Table 18: Latin America Market Volume (Units) Forecast by Application, 2019 to 2034

Table 19: Western Europe Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 20: Western Europe Market Volume (Units) Forecast by Country, 2019 to 2034

Table 21: Western Europe Market Value (US$ Million) Forecast by Type, 2019 to 2034

Table 22: Western Europe Market Volume (Units) Forecast by Type, 2019 to 2034

Table 23: Western Europe Market Value (US$ Million) Forecast by Application, 2019 to 2034

Table 24: Western Europe Market Volume (Units) Forecast by Application, 2019 to 2034

Table 25: Eastern Europe Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 26: Eastern Europe Market Volume (Units) Forecast by Country, 2019 to 2034

Table 27: Eastern Europe Market Value (US$ Million) Forecast by Type, 2019 to 2034

Table 28: Eastern Europe Market Volume (Units) Forecast by Type, 2019 to 2034

Table 29: Eastern Europe Market Value (US$ Million) Forecast by Application, 2019 to 2034

Table 30: Eastern Europe Market Volume (Units) Forecast by Application, 2019 to 2034

Table 31: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 32: South Asia and Pacific Market Volume (Units) Forecast by Country, 2019 to 2034

Table 33: South Asia and Pacific Market Value (US$ Million) Forecast by Type, 2019 to 2034

Table 34: South Asia and Pacific Market Volume (Units) Forecast by Type, 2019 to 2034

Table 35: South Asia and Pacific Market Value (US$ Million) Forecast by Application, 2019 to 2034

Table 36: South Asia and Pacific Market Volume (Units) Forecast by Application, 2019 to 2034

Table 37: East Asia Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 38: East Asia Market Volume (Units) Forecast by Country, 2019 to 2034

Table 39: East Asia Market Value (US$ Million) Forecast by Type, 2019 to 2034

Table 40: East Asia Market Volume (Units) Forecast by Type, 2019 to 2034

Table 41: East Asia Market Value (US$ Million) Forecast by Application, 2019 to 2034

Table 42: East Asia Market Volume (Units) Forecast by Application, 2019 to 2034

Table 43: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 44: Middle East and Africa Market Volume (Units) Forecast by Country, 2019 to 2034

Table 45: Middle East and Africa Market Value (US$ Million) Forecast by Type, 2019 to 2034

Table 46: Middle East and Africa Market Volume (Units) Forecast by Type, 2019 to 2034

Table 47: Middle East and Africa Market Value (US$ Million) Forecast by Application, 2019 to 2034

Table 48: Middle East and Africa Market Volume (Units) Forecast by Application, 2019 to 2034

Figure 1: Global Market Value (US$ Million) by Type, 2024 to 2034

Figure 2: Global Market Value (US$ Million) by Application, 2024 to 2034

Figure 3: Global Market Value (US$ Million) by Region, 2024 to 2034

Figure 4: Global Market Value (US$ Million) Analysis by Region, 2019 to 2034

Figure 5: Global Market Volume (Units) Analysis by Region, 2019 to 2034

Figure 6: Global Market Value Share (%) and BPS Analysis by Region, 2024 to 2034

Figure 7: Global Market Y-o-Y Growth (%) Projections by Region, 2024 to 2034

Figure 8: Global Market Value (US$ Million) Analysis by Type, 2019 to 2034

Figure 9: Global Market Volume (Units) Analysis by Type, 2019 to 2034

Figure 10: Global Market Value Share (%) and BPS Analysis by Type, 2024 to 2034

Figure 11: Global Market Y-o-Y Growth (%) Projections by Type, 2024 to 2034

Figure 12: Global Market Value (US$ Million) Analysis by Application, 2019 to 2034

Figure 13: Global Market Volume (Units) Analysis by Application, 2019 to 2034

Figure 14: Global Market Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 15: Global Market Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 16: Global Market Attractiveness by Type, 2024 to 2034

Figure 17: Global Market Attractiveness by Application, 2024 to 2034

Figure 18: Global Market Attractiveness by Region, 2024 to 2034

Figure 19: North America Market Value (US$ Million) by Type, 2024 to 2034

Figure 20: North America Market Value (US$ Million) by Application, 2024 to 2034

Figure 21: North America Market Value (US$ Million) by Country, 2024 to 2034

Figure 22: North America Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 23: North America Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 24: North America Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 25: North America Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 26: North America Market Value (US$ Million) Analysis by Type, 2019 to 2034

Figure 27: North America Market Volume (Units) Analysis by Type, 2019 to 2034

Figure 28: North America Market Value Share (%) and BPS Analysis by Type, 2024 to 2034

Figure 29: North America Market Y-o-Y Growth (%) Projections by Type, 2024 to 2034

Figure 30: North America Market Value (US$ Million) Analysis by Application, 2019 to 2034

Figure 31: North America Market Volume (Units) Analysis by Application, 2019 to 2034

Figure 32: North America Market Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 33: North America Market Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 34: North America Market Attractiveness by Type, 2024 to 2034

Figure 35: North America Market Attractiveness by Application, 2024 to 2034

Figure 36: North America Market Attractiveness by Country, 2024 to 2034

Figure 37: Latin America Market Value (US$ Million) by Type, 2024 to 2034

Figure 38: Latin America Market Value (US$ Million) by Application, 2024 to 2034

Figure 39: Latin America Market Value (US$ Million) by Country, 2024 to 2034

Figure 40: Latin America Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 41: Latin America Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 42: Latin America Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 43: Latin America Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 44: Latin America Market Value (US$ Million) Analysis by Type, 2019 to 2034

Figure 45: Latin America Market Volume (Units) Analysis by Type, 2019 to 2034

Figure 46: Latin America Market Value Share (%) and BPS Analysis by Type, 2024 to 2034

Figure 47: Latin America Market Y-o-Y Growth (%) Projections by Type, 2024 to 2034

Figure 48: Latin America Market Value (US$ Million) Analysis by Application, 2019 to 2034

Figure 49: Latin America Market Volume (Units) Analysis by Application, 2019 to 2034

Figure 50: Latin America Market Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 51: Latin America Market Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 52: Latin America Market Attractiveness by Type, 2024 to 2034

Figure 53: Latin America Market Attractiveness by Application, 2024 to 2034

Figure 54: Latin America Market Attractiveness by Country, 2024 to 2034

Figure 55: Western Europe Market Value (US$ Million) by Type, 2024 to 2034

Figure 56: Western Europe Market Value (US$ Million) by Application, 2024 to 2034

Figure 57: Western Europe Market Value (US$ Million) by Country, 2024 to 2034

Figure 58: Western Europe Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 59: Western Europe Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 60: Western Europe Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 61: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 62: Western Europe Market Value (US$ Million) Analysis by Type, 2019 to 2034

Figure 63: Western Europe Market Volume (Units) Analysis by Type, 2019 to 2034

Figure 64: Western Europe Market Value Share (%) and BPS Analysis by Type, 2024 to 2034

Figure 65: Western Europe Market Y-o-Y Growth (%) Projections by Type, 2024 to 2034

Figure 66: Western Europe Market Value (US$ Million) Analysis by Application, 2019 to 2034

Figure 67: Western Europe Market Volume (Units) Analysis by Application, 2019 to 2034

Figure 68: Western Europe Market Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 69: Western Europe Market Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 70: Western Europe Market Attractiveness by Type, 2024 to 2034

Figure 71: Western Europe Market Attractiveness by Application, 2024 to 2034

Figure 72: Western Europe Market Attractiveness by Country, 2024 to 2034

Figure 73: Eastern Europe Market Value (US$ Million) by Type, 2024 to 2034

Figure 74: Eastern Europe Market Value (US$ Million) by Application, 2024 to 2034

Figure 75: Eastern Europe Market Value (US$ Million) by Country, 2024 to 2034

Figure 76: Eastern Europe Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 77: Eastern Europe Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 78: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 79: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 80: Eastern Europe Market Value (US$ Million) Analysis by Type, 2019 to 2034

Figure 81: Eastern Europe Market Volume (Units) Analysis by Type, 2019 to 2034

Figure 82: Eastern Europe Market Value Share (%) and BPS Analysis by Type, 2024 to 2034

Figure 83: Eastern Europe Market Y-o-Y Growth (%) Projections by Type, 2024 to 2034

Figure 84: Eastern Europe Market Value (US$ Million) Analysis by Application, 2019 to 2034

Figure 85: Eastern Europe Market Volume (Units) Analysis by Application, 2019 to 2034

Figure 86: Eastern Europe Market Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 87: Eastern Europe Market Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 88: Eastern Europe Market Attractiveness by Type, 2024 to 2034

Figure 89: Eastern Europe Market Attractiveness by Application, 2024 to 2034

Figure 90: Eastern Europe Market Attractiveness by Country, 2024 to 2034

Figure 91: South Asia and Pacific Market Value (US$ Million) by Type, 2024 to 2034

Figure 92: South Asia and Pacific Market Value (US$ Million) by Application, 2024 to 2034

Figure 93: South Asia and Pacific Market Value (US$ Million) by Country, 2024 to 2034

Figure 94: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 95: South Asia and Pacific Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 96: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 97: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 98: South Asia and Pacific Market Value (US$ Million) Analysis by Type, 2019 to 2034

Figure 99: South Asia and Pacific Market Volume (Units) Analysis by Type, 2019 to 2034

Figure 100: South Asia and Pacific Market Value Share (%) and BPS Analysis by Type, 2024 to 2034

Figure 101: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Type, 2024 to 2034

Figure 102: South Asia and Pacific Market Value (US$ Million) Analysis by Application, 2019 to 2034

Figure 103: South Asia and Pacific Market Volume (Units) Analysis by Application, 2019 to 2034

Figure 104: South Asia and Pacific Market Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 105: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 106: South Asia and Pacific Market Attractiveness by Type, 2024 to 2034

Figure 107: South Asia and Pacific Market Attractiveness by Application, 2024 to 2034

Figure 108: South Asia and Pacific Market Attractiveness by Country, 2024 to 2034

Figure 109: East Asia Market Value (US$ Million) by Type, 2024 to 2034

Figure 110: East Asia Market Value (US$ Million) by Application, 2024 to 2034

Figure 111: East Asia Market Value (US$ Million) by Country, 2024 to 2034

Figure 112: East Asia Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 113: East Asia Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 114: East Asia Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 115: East Asia Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 116: East Asia Market Value (US$ Million) Analysis by Type, 2019 to 2034

Figure 117: East Asia Market Volume (Units) Analysis by Type, 2019 to 2034

Figure 118: East Asia Market Value Share (%) and BPS Analysis by Type, 2024 to 2034

Figure 119: East Asia Market Y-o-Y Growth (%) Projections by Type, 2024 to 2034

Figure 120: East Asia Market Value (US$ Million) Analysis by Application, 2019 to 2034

Figure 121: East Asia Market Volume (Units) Analysis by Application, 2019 to 2034

Figure 122: East Asia Market Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 123: East Asia Market Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 124: East Asia Market Attractiveness by Type, 2024 to 2034

Figure 125: East Asia Market Attractiveness by Application, 2024 to 2034

Figure 126: East Asia Market Attractiveness by Country, 2024 to 2034

Figure 127: Middle East and Africa Market Value (US$ Million) by Type, 2024 to 2034

Figure 128: Middle East and Africa Market Value (US$ Million) by Application, 2024 to 2034

Figure 129: Middle East and Africa Market Value (US$ Million) by Country, 2024 to 2034

Figure 130: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 131: Middle East and Africa Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 132: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 133: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 134: Middle East and Africa Market Value (US$ Million) Analysis by Type, 2019 to 2034

Figure 135: Middle East and Africa Market Volume (Units) Analysis by Type, 2019 to 2034

Figure 136: Middle East and Africa Market Value Share (%) and BPS Analysis by Type, 2024 to 2034

Figure 137: Middle East and Africa Market Y-o-Y Growth (%) Projections by Type, 2024 to 2034

Figure 138: Middle East and Africa Market Value (US$ Million) Analysis by Application, 2019 to 2034

Figure 139: Middle East and Africa Market Volume (Units) Analysis by Application, 2019 to 2034

Figure 140: Middle East and Africa Market Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 141: Middle East and Africa Market Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 142: Middle East and Africa Market Attractiveness by Type, 2024 to 2034

Figure 143: Middle East and Africa Market Attractiveness by Application, 2024 to 2034

Figure 144: Middle East and Africa Market Attractiveness by Country, 2024 to 2034

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Limiter Diodes Market Size and Share Forecast Outlook 2025 to 2035

Road Speed Limiter Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Fault Current Limiters Market Growth - Trends & Forecast 2025 to 2035

SAW Filter Market Size and Share Forecast Outlook 2025 to 2035

Saw Blades Market Size, Share, and Forecast 2025 to 2035

Sawing and Cutting Tools Market Growth, Trends and Forecast from 2025 to 2035

Saw Palmetto Market Analysis by Powder, Whole and others Forms Through 2035

TC-SAW Filter Market

Hacksaw Blades Market Size and Share Forecast Outlook 2025 to 2035

Bandsaw Machines Market Growth - Trends & Forecast 2025 to 2035

Tile Saws Market Size and Share Forecast Outlook 2025 to 2035

Panel Saw Market Size and Share Forecast Outlook 2025 to 2035

Circular Saw Blade Market Forecast and Outlook 2025 to 2035

Concrete Saw Market Growth - Trends & Forecast 2025 to 2035

D-Handle Jigsaw Market Size and Share Forecast Outlook 2025 to 2035

Diamond Wall Saw Market Size and Share Forecast Outlook 2025 to 2035

Orbital Recip Saw Market Size and Share Forecast Outlook 2025 to 2035

Electric Meat Saw Market Size and Share Forecast Outlook 2025 to 2035

Portable Band Saws Market Size and Share Forecast Outlook 2025 to 2035

Stone Cutting Saw Blades Market Analysis & Forecast by Blade Type, Blade Diameter, End User, and Region Forecast Through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA