Mist sprayer pumps industry is growing rapidly as firms focus on precision spraying, sustainability, and user-friendliness. As demand from personal care, household, pharmaceutical, and food business sectors increases, firms are creating innovative products with fine mist technology, leak-proof designs, and eco-friendly materials. Firms are integrating smart dosing systems, ergonomic design, and PCR (post-consumer recycled) plastics to provide improved performance and reduce environmental impact.

Companies are improving mist sprayer pumps using durable materials, artificial intelligence enabled quality assurance, and robotics-driven manufacturing to maximize efficiency. The industry is transitioning to airless, biodegradable, and reusable sprayer pumps to respond to evolving regulatory standards and customer needs.

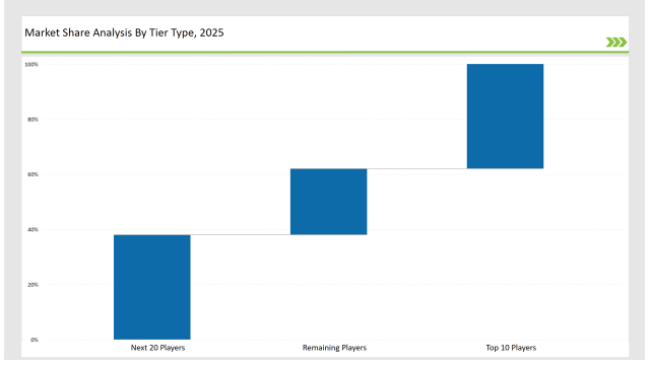

Tier 1 players like Silgan Dispensing, AptarGroup, and Albéa control 38% of the market due to their superiority in green sprayer solutions, precise dispensing technology, and global distribution channels.

Tier 2 companies such as Frapak Packaging, Rieke Packaging, and Berry Global capture 38% of the market with cost-efficient, customizable, and specialty sprayer pumps to suit cosmetic, household, and pharmaceutical application.

Tier 3 consists of regional and niche players with expertise in refillable, airless, and fine-mist sprayer pumps, with 24% market share. They have expertise in localized manufacturing, environmental-friendly innovations, and product differentiation.

| Category | Market Share (%) |

|---|---|

| Top 3 (Silgan Dispensing, AptarGroup, Albéa) | 19% |

| Rest of Top 5 (Frapak Packaging, Rieke Packaging) | 10% |

| Next 5 of Top 10 (Berry Global, RPC Group, Raepak, Z&Z Sprayer, Yuyao Jindiefeng) | 9% |

The mist sprayer pumps business serves industries where accuracy of misting, ease of use, and sustainability are top priorities. Companies are developing solutions that enhance dispensing performance, reduce product wastage, and meet customer requirements. They are developing high-precision actuators with which spray consistency and user control can be enhanced. Further, manufacturers are developing leak-free airless sprayer pumps to prevent product contamination and enhance product shelf life.

Producers are optimizing mist sprayer pumps with better dispensing systems, eco-friendly designs, and smart integration features. Producers are employing ultra-fine mist nozzles to improve the homogeneity of sprays and reduce wastage of liquids. Furthermore, companies are designing high-viscosity sprayers for application with thicker liquids such as serums and disinfectants. Companies are also incorporating smart touchless misting technology to enhance hygiene and reduce cross-contamination risks.

Sustainability and precision dosing are transforming the mist sprayer pumps industry. Companies are adopting AI-driven defect detection, solvent-free coatings, and ergonomic enhancements to improve usability. Businesses are developing ultra-lightweight, high-durability pumps to optimize material use. Manufacturers are introducing smart mist sprayers with embedded sensors for dose control. Additionally, firms are expanding refillable, multi-use sprayer designs to minimize plastic consumption and improve sustainability.

Technology suppliers should focus on automation, smart dispensing technology, and sustainability-driven materials to support the evolving mist sprayer pumps market. Partnering with personal care, pharmaceutical, and homecare brands will drive innovation and market growth.

| Tier Type | Example of Key Players |

|---|---|

| Tier 1 | Silgan Dispensing, AptarGroup, Albéa |

| Tier 2 | Frapak Packaging, Rieke Packaging |

| Tier 3 | Berry Global, RPC Group, Raepak, Z&Z Sprayer, Yuyao Jindiefeng |

Business innovators are making the technology in mist sprayer pumps more innovative with AI-led manufacturing, ergonomically-designed improvements, and smart packaging schemes. Companies are designing ultra-light pumps to curtail plastic usage without sacrificing structural integrity. Besides, companies are incorporating antimicrobial coatings to maintain hygiene and prevent contamination. Organizations are also implementing carbon-reduction molding techniques.

| Manufacturer | Latest Developments |

|---|---|

| Silgan Dispensing | Launched fully recyclable mist sprayers in March 2024. |

| AptarGroup | Developed precision-dose pharmaceutical sprayers in April 2024. |

| Albéa | Expanded ergonomic, leak-proof sprayer pumps in May 2024. |

| Frapak Packaging | Released refillable fine-mist sprayers in June 2024. |

| Rieke Packaging | Strengthened child-resistant and tamper-proof sprayers in July 2024. |

| Berry Global | Introduced lightweight, high-durability sprayers in August 2024. |

| RPC Group | Pioneered airless mist sprayers for premium skincare in September 2024. |

The mist sprayer pumps industry is transforming as businesses invest in eco-friendly materials, AI-based defect detection, and intelligent dispensing solutions. They are incorporating ultra-fine mist technology to enhance spray accuracy and minimize product waste. Manufacturers are also improving ergonomic designs to enhance user experience and product handling. Companies are also using automated assembly methods to enhance production efficiency and ensure high-quality standards.

Manufacturers will continue to evolve AI-driven defect detection, lightest-possible sprayer design, and advanced precision-dosing technology. Companies will expand refillable and biodegradable sprayer solutions to reduce plastic waste. Dose-monitoring and antimicrobial-protected automated mist sprayers will be common industry practice. Automation and predictive analytics will also improve production efficiency, sustainability, and customization. Companies will integrate AI-driven material optimization to reduce raw material waste and enhance recyclability. The manufacturers will also develop energy-saving molding technologies that minimize carbon footprints while maintaining the quality of the products.

Leading players include Silgan Dispensing, AptarGroup, Albéa, Frapak Packaging, Rieke Packaging, Berry Global, and RPC Group.

The top 3 players collectively control 19% of the global market.

The market shows medium concentration, with top players holding 38%.

Key drivers include sustainability, automation, precision dosing, and smart dispensing solutions.

Explore Packaging Consumables and Supplies Insights

View Reports

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.